Bayer Growth Ventures

-

DATABASE (425)

-

ARTICLES (466)

Co-founder and CEO of Moka

Haryanto Tanjo graduated with a degree in Industrial Engineering and Operations Research from the University of California Berkeley in 2009. He worked as an associate consultant at Webster Pacific LLC in San Francisco for over two years before attaining an MBA at the UCLA Anderson School of Management USA in 2014. He had previous stints working at Cisco Systems, Bayer and McKinsey & Company. He left McKinsey and eventually teamed up with a software engineer Grady Laksmono to start Moka, a mobile point-of-sale service. He became the CEO of Moka in August 2014.

Haryanto Tanjo graduated with a degree in Industrial Engineering and Operations Research from the University of California Berkeley in 2009. He worked as an associate consultant at Webster Pacific LLC in San Francisco for over two years before attaining an MBA at the UCLA Anderson School of Management USA in 2014. He had previous stints working at Cisco Systems, Bayer and McKinsey & Company. He left McKinsey and eventually teamed up with a software engineer Grady Laksmono to start Moka, a mobile point-of-sale service. He became the CEO of Moka in August 2014.

Vostok New Ventures is a Swedish investment company that invests globally in companies with network effects, founded in 2007. It has a special focus on the areas of real estate, recruitment and job sites, travel and transportation services and general classified ads. It participates in growth-stage companies and has invested in 27 companies, 18 of which as leading investor. Its exits are Avito, Quandoo and Delivery Hero.

Vostok New Ventures is a Swedish investment company that invests globally in companies with network effects, founded in 2007. It has a special focus on the areas of real estate, recruitment and job sites, travel and transportation services and general classified ads. It participates in growth-stage companies and has invested in 27 companies, 18 of which as leading investor. Its exits are Avito, Quandoo and Delivery Hero.

Verizon Ventures is the venture capital arm of Verizon Communications, the US's largest wireless provider, established in 2000. It invests from Series A to IPO. Verizon Ventures has made more than 100 investments to date and managed 20 exits, including healthcare diagnostics company NantHealth and P2P video content service Streamroot. Recent investments include holographic lighting technology company Light Field Lab's US$28m Series A round and AI-powered mass transportation technology company Optibus's US$40m Series B round.

Verizon Ventures is the venture capital arm of Verizon Communications, the US's largest wireless provider, established in 2000. It invests from Series A to IPO. Verizon Ventures has made more than 100 investments to date and managed 20 exits, including healthcare diagnostics company NantHealth and P2P video content service Streamroot. Recent investments include holographic lighting technology company Light Field Lab's US$28m Series A round and AI-powered mass transportation technology company Optibus's US$40m Series B round.

Media Digital Ventures is the first Spanish Cross-Media fund focusing on Media for Equity. It holds multichannel advertising assets across major media sectors. Based in Barcelona, MDV also creates multimedia and advertising campaigns for scaling high-growth startups in return for equity.MDV is co-founded by Gerard Olivé and Miguel Vicente. Both are serial entrepreneurs, investors and co-founders of Antai Venture Builder, Wallapop, Deliberry and Chicplace. Vicente, who exited LetsBonus which he founded in 2009, is also the president of Barcelona Tech City.

Media Digital Ventures is the first Spanish Cross-Media fund focusing on Media for Equity. It holds multichannel advertising assets across major media sectors. Based in Barcelona, MDV also creates multimedia and advertising campaigns for scaling high-growth startups in return for equity.MDV is co-founded by Gerard Olivé and Miguel Vicente. Both are serial entrepreneurs, investors and co-founders of Antai Venture Builder, Wallapop, Deliberry and Chicplace. Vicente, who exited LetsBonus which he founded in 2009, is also the president of Barcelona Tech City.

Big Sur Ventures is a Spanish VC based in Madrid. It was co-founded by Jose Miguel Herrero and Manuel Matés both with extensive international experience in leading technology products and services companies and M&A. The fund invests in companies focused on SaaS, online marketplace and platforms, IT and digital media. Investments range from seed to later growth stage. The VC usually represents the first institutional capital in a company, leading or co-leading the round with capital injection of between €100,000 and €400.000 per round.

Big Sur Ventures is a Spanish VC based in Madrid. It was co-founded by Jose Miguel Herrero and Manuel Matés both with extensive international experience in leading technology products and services companies and M&A. The fund invests in companies focused on SaaS, online marketplace and platforms, IT and digital media. Investments range from seed to later growth stage. The VC usually represents the first institutional capital in a company, leading or co-leading the round with capital injection of between €100,000 and €400.000 per round.

LC Ventures is a Lisbon-based VC specializing in pre-seed and seed investments, mainly in Portugal-based startups and with a focus on promoting regional growth. Established in 2015, it has €11.5m under management in three funds, two which are exclusive to Portuguese startups. It has invested in more than 40 companies to date. Recently it has invested in Botcliq, a blockchain e-marketplace for wild fish trading, and in Finnish cleantech company Solved. It also participated in the €2m Series A round of Portuguese online tech employment agency in March 2020.Its investment portfolio currently includes 32 tech startups, a majority of which are based in Portugal.

LC Ventures is a Lisbon-based VC specializing in pre-seed and seed investments, mainly in Portugal-based startups and with a focus on promoting regional growth. Established in 2015, it has €11.5m under management in three funds, two which are exclusive to Portuguese startups. It has invested in more than 40 companies to date. Recently it has invested in Botcliq, a blockchain e-marketplace for wild fish trading, and in Finnish cleantech company Solved. It also participated in the €2m Series A round of Portuguese online tech employment agency in March 2020.Its investment portfolio currently includes 32 tech startups, a majority of which are based in Portugal.

Former co-founder of Qiscus

Serial entrepreneur Amin Nordin is the co-founder and ex-CEO of Qiscus. He left Qiscus in 2015 to work as the Chief Growth Engineer at marketing agency PaperToaster. In April 2019, he also started working as the Head of Growth at social influencer platform Vybes based in Singapore.After his national service as an army sergeant in Singapore, Amin went to Nanyang Technological Institute and graduated in 2010 with a bachelor's in Mechanical Engineering. He has worked for various companies including a Malaysian Islamic real estate crowdfunding platform Ethis Crowd and creative digital agency 1.618 Pte Ltd in Singapore.

Serial entrepreneur Amin Nordin is the co-founder and ex-CEO of Qiscus. He left Qiscus in 2015 to work as the Chief Growth Engineer at marketing agency PaperToaster. In April 2019, he also started working as the Head of Growth at social influencer platform Vybes based in Singapore.After his national service as an army sergeant in Singapore, Amin went to Nanyang Technological Institute and graduated in 2010 with a bachelor's in Mechanical Engineering. He has worked for various companies including a Malaysian Islamic real estate crowdfunding platform Ethis Crowd and creative digital agency 1.618 Pte Ltd in Singapore.

Kaszek Ventures is an Argentinian VC co-founded in 2011 by Hernan Kazah and Nicolas Szekasy, both hailing from Latin America’s e-commerce success story MercadoLibre. Starting with $95m, the VC made its first investment in Brazilian fintech, Nubank. The VC now has over 159 investments and has managed 21 exits. It mainly focuses on B2C solutions, mobile, healthcare technology, retail and media.The most recent Kaszek investment is in Latin America’s leading crypto platform Bitso, co-leading Bitso’s $62m Series B round with QED Investors. Managing partner Szekasy has also joined Bitso’s board. Existing shareholders Coinbase Ventures and Pantera Capital joined the Bitso round.In 2019, Kaszek raised two new funds securing a total of $600m to invest in later-growth stage companies to tap into Latin America’s rapidly maturing tech ecosystems. The rollout of 4G has also helped to speed up the adoption of new technologies across the region, according to Kazah.

Kaszek Ventures is an Argentinian VC co-founded in 2011 by Hernan Kazah and Nicolas Szekasy, both hailing from Latin America’s e-commerce success story MercadoLibre. Starting with $95m, the VC made its first investment in Brazilian fintech, Nubank. The VC now has over 159 investments and has managed 21 exits. It mainly focuses on B2C solutions, mobile, healthcare technology, retail and media.The most recent Kaszek investment is in Latin America’s leading crypto platform Bitso, co-leading Bitso’s $62m Series B round with QED Investors. Managing partner Szekasy has also joined Bitso’s board. Existing shareholders Coinbase Ventures and Pantera Capital joined the Bitso round.In 2019, Kaszek raised two new funds securing a total of $600m to invest in later-growth stage companies to tap into Latin America’s rapidly maturing tech ecosystems. The rollout of 4G has also helped to speed up the adoption of new technologies across the region, according to Kazah.

Formerly known as Google Ventures, GV is the investment arm of Alphabet Inc. Although Alphabet is its sole limited partner, the VC operates independently from Google. It invests in seed, venture and growth-stage funding rounds with more than 300 companies in its portfolio worth over $5bn. Headquartered in California’s Mountain View, GV has offices in San Francisco, Boston, New York and London. The VC has been actively involved in Silicon Valley’s investment rounds for prominent startups like Uber, Slack, Ripple, Impossible Foods, Lime and Medium.

Formerly known as Google Ventures, GV is the investment arm of Alphabet Inc. Although Alphabet is its sole limited partner, the VC operates independently from Google. It invests in seed, venture and growth-stage funding rounds with more than 300 companies in its portfolio worth over $5bn. Headquartered in California’s Mountain View, GV has offices in San Francisco, Boston, New York and London. The VC has been actively involved in Silicon Valley’s investment rounds for prominent startups like Uber, Slack, Ripple, Impossible Foods, Lime and Medium.

Co-founder of Jimaisong

The former senior executive of b5m.com has designed, developed and operated browser plug-ins. Wang Min led www.b5m.com’s growth to 5 million daily active users, while its e-commerce system also reached over 100 million visits daily.

The former senior executive of b5m.com has designed, developed and operated browser plug-ins. Wang Min led www.b5m.com’s growth to 5 million daily active users, while its e-commerce system also reached over 100 million visits daily.

London-based Sustainability Ventures is one of the UK’s leading early-stage investors in Cleantech. It comprises a group of successful entrepreneurs with a track record in building and investing in high-growth start-ups. It has created Europe’s largest ecosystem for cleantech and sustainability startups, as a business founder and investor, provider of accelerator and support services and provider of shared workspaces. Active since 2011, Sustainability Ventures has raised £250m in total equity funds to date. Its focus is on agritech and food, building technology, circular economy, future energy and mobility. It has established 10 companies, invested in 30 and supported the development of over 250 more enterprises as of 2021 and aims to develop 1,000 sustainable startups by 2025.

London-based Sustainability Ventures is one of the UK’s leading early-stage investors in Cleantech. It comprises a group of successful entrepreneurs with a track record in building and investing in high-growth start-ups. It has created Europe’s largest ecosystem for cleantech and sustainability startups, as a business founder and investor, provider of accelerator and support services and provider of shared workspaces. Active since 2011, Sustainability Ventures has raised £250m in total equity funds to date. Its focus is on agritech and food, building technology, circular economy, future energy and mobility. It has established 10 companies, invested in 30 and supported the development of over 250 more enterprises as of 2021 and aims to develop 1,000 sustainable startups by 2025.

Eight Roads Ventures is the investment arm of Bermuda-based investment management giant Fidelity International Limited, which was founded in 1969. (It was formerly called Fidelity Growth Partners.) Its investment focus includes emerging technology and healthcare companies in North America, Europe and China in their go-to-market stage and early customer traction. It has offices in the UK, China, India and Japan and has seen 42 exits and has invested in over 300 companies to date. It also participates in Series A to D funding rounds and is a major investor in real estate.

Eight Roads Ventures is the investment arm of Bermuda-based investment management giant Fidelity International Limited, which was founded in 1969. (It was formerly called Fidelity Growth Partners.) Its investment focus includes emerging technology and healthcare companies in North America, Europe and China in their go-to-market stage and early customer traction. It has offices in the UK, China, India and Japan and has seen 42 exits and has invested in over 300 companies to date. It also participates in Series A to D funding rounds and is a major investor in real estate.

Openspace Ventures (formerly NSI Ventures)

Originally formed in 2014 as NSI Ventures, Openspace Ventures makes investments in technology companies based in Southeast Asia. Led by Shane Chesson and Hian Goh, Openspace Ventures used to be a part of Northstar Group, a private equity firm primarily invested in the financial services, retail, energy and telecom sectors. In 2018, Chesson and Goh took NSI Ventures independent and rebranded it as Openspace Ventures. They still maintain links with Northstar, with Northstar managing partner Patrick Goh becoming senior advisor to Openspace.

Originally formed in 2014 as NSI Ventures, Openspace Ventures makes investments in technology companies based in Southeast Asia. Led by Shane Chesson and Hian Goh, Openspace Ventures used to be a part of Northstar Group, a private equity firm primarily invested in the financial services, retail, energy and telecom sectors. In 2018, Chesson and Goh took NSI Ventures independent and rebranded it as Openspace Ventures. They still maintain links with Northstar, with Northstar managing partner Patrick Goh becoming senior advisor to Openspace.

Prosperity7 Ventures is the $1bn diversified VC fund of Aramco Ventures, a subsidiary of Aramco, the world's leading integrated energy and chemicals company. The fund's name derives from “Prosperity Well", the 7th oil well drilled in Saudi Arabia and the first to strike oil. Prosperity7 Ventures invests globally, focusing on highly scalable startups in the US and China.

Prosperity7 Ventures is the $1bn diversified VC fund of Aramco Ventures, a subsidiary of Aramco, the world's leading integrated energy and chemicals company. The fund's name derives from “Prosperity Well", the 7th oil well drilled in Saudi Arabia and the first to strike oil. Prosperity7 Ventures invests globally, focusing on highly scalable startups in the US and China.

SC Ventures is the venture capital arm of Standard Chartered Bank. The company serves as a platform from which Standard Chartered can identify innovative technologies in banking and financial services, and invest in the companies that build these technologies and business models. Besides investments, SC Ventures also operates an accelerator program named eXellerator and an internal venture builder unit. As an investor, SC Ventures focuses on Series B+ rounds, with each investment at the $1-5m range.

SC Ventures is the venture capital arm of Standard Chartered Bank. The company serves as a platform from which Standard Chartered can identify innovative technologies in banking and financial services, and invest in the companies that build these technologies and business models. Besides investments, SC Ventures also operates an accelerator program named eXellerator and an internal venture builder unit. As an investor, SC Ventures focuses on Series B+ rounds, with each investment at the $1-5m range.

Bayer Growth Ventures' Paimun Amini: Invest in tech for smarter, more sustainable farming

Corporate venture capital showed up in abundance at Smart Agrifood Malaga, where CompassList spoke with Paimun Amini, Director of Venture Investments for Bayer Growth Ventures (BGV)

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

Future Food Asia: Temasek, Continental Grain on investing in agrifood in Singapore and China

The two heavyweight investors discuss opportunities, needs and how agrifood startups can scale in Asian markets

In-store robots and online doctors serve customers 24/7 at Dingdang Medicine Express

Dingdang also offers cheaper medicines and 28-minute home delivery, thanks to its innovative logistics and partnership models

Xtrem Biotech, an agritech startup from Granada, seeks global expansion

With its research roots in the University of Granada, Xtrem Biotech was named one of the world's most innovative agtech spin-offs by accelerator TERRA Food & AgTech

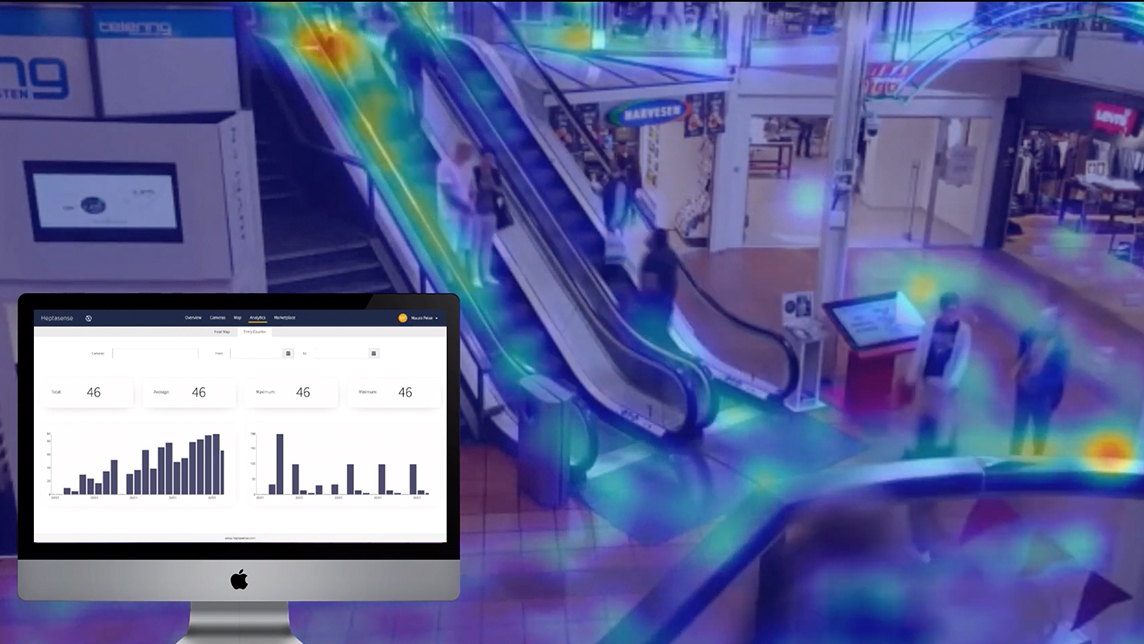

Heptasense wins trust at a time of (lax) global surveillance

There may be some 700 million surveillance cameras running worldwide in today's age of global security threats, yet 98% of them are unmonitored. A Lisbon-based startup is promising real-time response and greater reliability in security tech

Amid Covid-19, contactless smart mailbox startup Mayordomo eyes €75m revenue by 2024

Mayordomo's Smart Point app-locker system helps consumers get the best deals online while minimizing CO2 emissions from multiple vendors’ last-mile deliveries

Backed by pharmas, doctors, medtech startup DyCare is expanding fast across Europe

Its remote musculoskeletal rehabilitation and monitoring system sets to improve rehabilitation outcomes in an overtaxed sector

Housfy leads growth in Spanish proptech

The real estate platform helps clients sell their property without the astronomical agency fees

New Ventures Innovation: Prasetiya Mulya University takes on student entrepreneurship

To prepare a new generation of startup founders, Prasetiya Mulya University combines theoretical education with real-life exposure to the startup world

Beatriz González: Seaya Ventures head and Spanish tech VC trailblazer

From Cabify to Glovo, the only woman to head a Spanish VC firm has backed some of the country’s most successful startups to date

eShop Ventures: A costly spending spree to create the Spanish Amazon

Behind the downfall of one of Spain's most promising startups

Intudo Ventures: Grooming returning overseas talent for an Indonesia-only bet

Combining the experience and networks of foreign-educated Indonesians with local distribution channels, Intudo’s hyperlocal strategy has attracted $200m in managed assets

TroopTravel: Growth opportunities in Big Data corporate travel analytics

International award-winner TroopTravel wants to be the ultimate choice for global travellers.

Science4you cancels IPO amid market jitters, foresees slower growth

Portugal's largest toymaker will continue to focus on international markets, digital boost

Sorry, we couldn’t find any matches for“Bayer Growth Ventures”.