Cleantech Camp

-

DATABASE (22)

-

ARTICLES (17)

Previously known as Incubate Capital Partners, Incubate Fund was founded in 1999 by Tohru Akaura and partners. Focusing on providing early stage funding, its portfolio includes more than 120 companies. It also hosts Incubate Camp, a seed-stage startup acceleration program.

Previously known as Incubate Capital Partners, Incubate Fund was founded in 1999 by Tohru Akaura and partners. Focusing on providing early stage funding, its portfolio includes more than 120 companies. It also hosts Incubate Camp, a seed-stage startup acceleration program.

Established in August 2015 in Beijing, AC Accelerator is a startup incubator. CEO Xu Yong is also the executive director of Angel Camp, China's first non-profit organization that trains angel investors. In addition to funding, AC Accelerator also offers startups resources such as mentors and access to qualified suppliers.

Established in August 2015 in Beijing, AC Accelerator is a startup incubator. CEO Xu Yong is also the executive director of Angel Camp, China's first non-profit organization that trains angel investors. In addition to funding, AC Accelerator also offers startups resources such as mentors and access to qualified suppliers.

Carbonstop claims to be China’s first company providing tools to help enterprises make low-carbon choices by analyzing and managing their carbon footprint.

Carbonstop claims to be China’s first company providing tools to help enterprises make low-carbon choices by analyzing and managing their carbon footprint.

Co-founder of investment and consultancy firm SYSTEMIQ Jeremy Oppenheim invests individually in early-stage cleantech and agritech ventures. He used to be a senior partner at global consultancy McKinsey, where he worked extensively with multilateral development banks, the United Nations and developing nations' governments to set up resource-sustainability projects. From 2013-14, Oppenheim was the program director of the New Climate Economy project, an initiative of the Global Commission on Economy and Climate that identified practical actions and policy options to maximize opportunities associated with climate change. The experience helped propel him into cleantech and agtech investing.

Co-founder of investment and consultancy firm SYSTEMIQ Jeremy Oppenheim invests individually in early-stage cleantech and agritech ventures. He used to be a senior partner at global consultancy McKinsey, where he worked extensively with multilateral development banks, the United Nations and developing nations' governments to set up resource-sustainability projects. From 2013-14, Oppenheim was the program director of the New Climate Economy project, an initiative of the Global Commission on Economy and Climate that identified practical actions and policy options to maximize opportunities associated with climate change. The experience helped propel him into cleantech and agtech investing.

CEO and co-founder of Infinited Fiber

Petri Alava has over 15 years of industry experience in logistics, publishing and waste management. In 1989, he completed a master’s in industrial engineering and started his management career at Finncont Oy, a subsidiary of GWS Group. He went on to work at Rocla Oy in 2001 as managing director of the Rocla Robotruck Group with manufacturing units in Finland and Sweden. He also held senior management roles at Vapo Oy and Kekkilä Oy.In 2015, he became the managing partner of Profon Oy and also co-founded cleantech materials startup Infinited Fiber as CEO. Based in Helsinki, he is also currently chairman of various companies, as well as the CEO of Solid Environmental Technologies.

Petri Alava has over 15 years of industry experience in logistics, publishing and waste management. In 1989, he completed a master’s in industrial engineering and started his management career at Finncont Oy, a subsidiary of GWS Group. He went on to work at Rocla Oy in 2001 as managing director of the Rocla Robotruck Group with manufacturing units in Finland and Sweden. He also held senior management roles at Vapo Oy and Kekkilä Oy.In 2015, he became the managing partner of Profon Oy and also co-founded cleantech materials startup Infinited Fiber as CEO. Based in Helsinki, he is also currently chairman of various companies, as well as the CEO of Solid Environmental Technologies.

Founded in 2007, the Shenzhen-based CDF Capital runs a RMB 4.2 billion PE fund for investments in new materials, new IT, consumer, cleantech and healthcare tech sectors. It has backed over 120 companies to date.

Founded in 2007, the Shenzhen-based CDF Capital runs a RMB 4.2 billion PE fund for investments in new materials, new IT, consumer, cleantech and healthcare tech sectors. It has backed over 120 companies to date.

Started in 2008 by Joe Zhou (Zhou Zhixiong), one of the founders of Kleiner Perkins Caufield & Byers' China fund, Keytone Ventures primarily invests in high-growth companies in the cleantech, media, hi-tech and consumer sectors.

Started in 2008 by Joe Zhou (Zhou Zhixiong), one of the founders of Kleiner Perkins Caufield & Byers' China fund, Keytone Ventures primarily invests in high-growth companies in the cleantech, media, hi-tech and consumer sectors.

CEO and Co-founder of Dipole Tech

Yang Kaikai graduated in 2013, majoring in English Language and Literature at Shanghai Ocean University.In March 2016, she joined Tencent Incubator to work as a marketing and business development manager. She left Tencent in October 2016 and co-founded Energo Labs as COO, responsible for the strategic and global expansion of the company in Asia. In September 2018, Yang also co-founded Dipole Tech, a blockchain-based renewable energy management and trading platform.Yang is co-chair of the Energy Blockchain Leadership Committee and founded the Asian Cleantech Entrepreneurs Community (ACTEC) to connect entrepreneurs focusing on sustainable development and the environment. In 2019, she was nominated as one of 600 entrepreneurs 30 under 30 by the Forbes China.

Yang Kaikai graduated in 2013, majoring in English Language and Literature at Shanghai Ocean University.In March 2016, she joined Tencent Incubator to work as a marketing and business development manager. She left Tencent in October 2016 and co-founded Energo Labs as COO, responsible for the strategic and global expansion of the company in Asia. In September 2018, Yang also co-founded Dipole Tech, a blockchain-based renewable energy management and trading platform.Yang is co-chair of the Energy Blockchain Leadership Committee and founded the Asian Cleantech Entrepreneurs Community (ACTEC) to connect entrepreneurs focusing on sustainable development and the environment. In 2019, she was nominated as one of 600 entrepreneurs 30 under 30 by the Forbes China.

Northern Light Venture Capital

Founded in 2005, NLVC focuses on early and early-growth stage Chinese companies in the TMT, cleantech, healthcare and consumer sectors. It has invested in over 180 companies and manages more than US$1.7 billion spread across four USD-denominated funds and four RMB ones.

Founded in 2005, NLVC focuses on early and early-growth stage Chinese companies in the TMT, cleantech, healthcare and consumer sectors. It has invested in over 180 companies and manages more than US$1.7 billion spread across four USD-denominated funds and four RMB ones.

China Softbank Capital (SBCVC)

Established in 2000 and led by Chauncey Shey (Xue Cunhe), the SoftBank-backed VC/PE firm manages over US$2 billion, focusing on companies in the TMT, cleantech, healthcare, consumer/retail and advanced manufacturing sectors. Notable investments include Alibaba, Focus Media Holding, Wanguo Data, Shenwu Group, GDS, PPLive and Yooli.

Established in 2000 and led by Chauncey Shey (Xue Cunhe), the SoftBank-backed VC/PE firm manages over US$2 billion, focusing on companies in the TMT, cleantech, healthcare, consumer/retail and advanced manufacturing sectors. Notable investments include Alibaba, Focus Media Holding, Wanguo Data, Shenwu Group, GDS, PPLive and Yooli.

London-based Sustainability Ventures is one of the UK’s leading early-stage investors in Cleantech. It comprises a group of successful entrepreneurs with a track record in building and investing in high-growth start-ups. It has created Europe’s largest ecosystem for cleantech and sustainability startups, as a business founder and investor, provider of accelerator and support services and provider of shared workspaces. Active since 2011, Sustainability Ventures has raised £250m in total equity funds to date. Its focus is on agritech and food, building technology, circular economy, future energy and mobility. It has established 10 companies, invested in 30 and supported the development of over 250 more enterprises as of 2021 and aims to develop 1,000 sustainable startups by 2025.

London-based Sustainability Ventures is one of the UK’s leading early-stage investors in Cleantech. It comprises a group of successful entrepreneurs with a track record in building and investing in high-growth start-ups. It has created Europe’s largest ecosystem for cleantech and sustainability startups, as a business founder and investor, provider of accelerator and support services and provider of shared workspaces. Active since 2011, Sustainability Ventures has raised £250m in total equity funds to date. Its focus is on agritech and food, building technology, circular economy, future energy and mobility. It has established 10 companies, invested in 30 and supported the development of over 250 more enterprises as of 2021 and aims to develop 1,000 sustainable startups by 2025.

Fortum Oyj is a Finnish state-owned energy company operating power plants and co-generation plants across the nation. Listed on the NASDAQ OMX Helsinki stock exchange, Fortum is reputed to be Finland’s biggest company in terms of revenue generated in 2020.It is also Europe's third-largest producer of carbon-free electricity and the second-largest producer of nuclear power. Ranked as the fifth largest heat producer globally, Fortum supplies electricity and heating directly to consumers in Finland, Germany, Central Europe, the UK and the Nordic countries.Fortum invested in Finnish cleantech Infinited Fiber, taking up a 4% stake in 2019, to complement the energy company’s biorefining value chain and to improve resource efficiency. The cleantech investee aims to license its biodegradable fiber technology to help industry partners to manufacture innovative materials from textile and industrial waste.

Fortum Oyj is a Finnish state-owned energy company operating power plants and co-generation plants across the nation. Listed on the NASDAQ OMX Helsinki stock exchange, Fortum is reputed to be Finland’s biggest company in terms of revenue generated in 2020.It is also Europe's third-largest producer of carbon-free electricity and the second-largest producer of nuclear power. Ranked as the fifth largest heat producer globally, Fortum supplies electricity and heating directly to consumers in Finland, Germany, Central Europe, the UK and the Nordic countries.Fortum invested in Finnish cleantech Infinited Fiber, taking up a 4% stake in 2019, to complement the energy company’s biorefining value chain and to improve resource efficiency. The cleantech investee aims to license its biodegradable fiber technology to help industry partners to manufacture innovative materials from textile and industrial waste.

Founded in 2007 under the Chinese Fortune 500 company DunAn Group, the investment group manages total fund of RMB 6 billion today, with successful investment in 77 Chinese startups across multiple sectors including healthcare, advanced manufacturing, energy & cleantech, etc. It was nominated for “Top 10 Zhengjiang Investment Group” for seven years in a row and was awarded for “Chinese VC of Best Potential” in 2016 – 2017 by thecapital.com.cn.

Founded in 2007 under the Chinese Fortune 500 company DunAn Group, the investment group manages total fund of RMB 6 billion today, with successful investment in 77 Chinese startups across multiple sectors including healthcare, advanced manufacturing, energy & cleantech, etc. It was nominated for “Top 10 Zhengjiang Investment Group” for seven years in a row and was awarded for “Chinese VC of Best Potential” in 2016 – 2017 by thecapital.com.cn.

With about $2 billion under management, this VC fund invests primarily in early- and growth-stage global companies with substantial businesses in China, namely in the semiconductor, Internet, wireless, new media and cleantech sectors. GSR Ventures has backed Didi, Ele.me, among others, and was involved in the $2.8 billion purchase of an 80% stake in Philips's LED components and automotive business. It has offices in Beijing, Hong Kong and Silicon Valley.

With about $2 billion under management, this VC fund invests primarily in early- and growth-stage global companies with substantial businesses in China, namely in the semiconductor, Internet, wireless, new media and cleantech sectors. GSR Ventures has backed Didi, Ele.me, among others, and was involved in the $2.8 billion purchase of an 80% stake in Philips's LED components and automotive business. It has offices in Beijing, Hong Kong and Silicon Valley.

Established in 2000. With RMB 15 billion under management, Fortune Capital focuses on companies in the TMT, consumer goods & services, modern agriculture and cleantech sectors. It has invested in about 300 startups including Qingke, Hammerhead Sharks, StoreMax and NTS Technology.

Established in 2000. With RMB 15 billion under management, Fortune Capital focuses on companies in the TMT, consumer goods & services, modern agriculture and cleantech sectors. It has invested in about 300 startups including Qingke, Hammerhead Sharks, StoreMax and NTS Technology.

- 1

- 2

Harnessing its innovative startups, Portugal builds a better cleantech ecosystem

With help from government and private-sector initiatives, Portuguese cleantech startups are playing an ever-increasing role in helping the country meet its energy challenges while cutting harmful greenhouse gases

Spain’s 100% renewable energy goal: How its startup ecosystem is rising to the challenge

Energy majors and public entities are backing renewable energy startups in the country's bet on the Green Economy

Already helping over 1,000 corporates like Alibaba and JD.com manage and lower their carbon emissions, Carbonstop is ready to do more when China’s carbon trading starts next year

Viezo: Vibration energy harvesting to power sensors and IoT devices

Disrupting the battery market, Viezo’s proprietary technology, PolyFilm, can also boost operational efficiency and slash maintenance costs of sensors and IoT devices

In China, coding education for children is in demand – but investors are wary

Coding lessons are most wanted by Chinese parents for their kids after English tuition, so hundreds of coding edtech startups have joined the fray

Refurbed: Electronics recycling marketplace gets $54m for EU consolidation, overseas expansion

Consumers can reduce their carbon footprints by shifting toward a circular economy, become carbon-neutral by planting one tree with every purchase from Refurbed

Future Food Asia 2021 announces finalists for $100,000 prize

Ten startups from agrifood tech and cleantech sectors will pitch during the five-day conference, are also eligible for two more prizes from sponsors Cargill and Thai Wah

AddVolt: Taking the diesel out of cold-chain transport to make it cleaner, more efficient

The Porto-based startup is winning over the refrigerated goods transportation industry in Europe with the world's first renewable energy plug-in electrical system for the sector

Oyika wants to help 30,000 Indonesian riders switch to electric motorcycles

With unlimited battery swaps and round-the-clock service, the Singapore startup is targeting ride-hailing and delivery drivers in Indonesia, a market with a growing appetite for electric motorcycles

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

Renewable energy crowdfunding platform Fundeen eyes 2019 profit amid sector boom

The young Spanish startup is eyeing projects worth €220 million by 2023, while cutting CO2 emissions equivalent to 1.3 million Madrid-New York flights

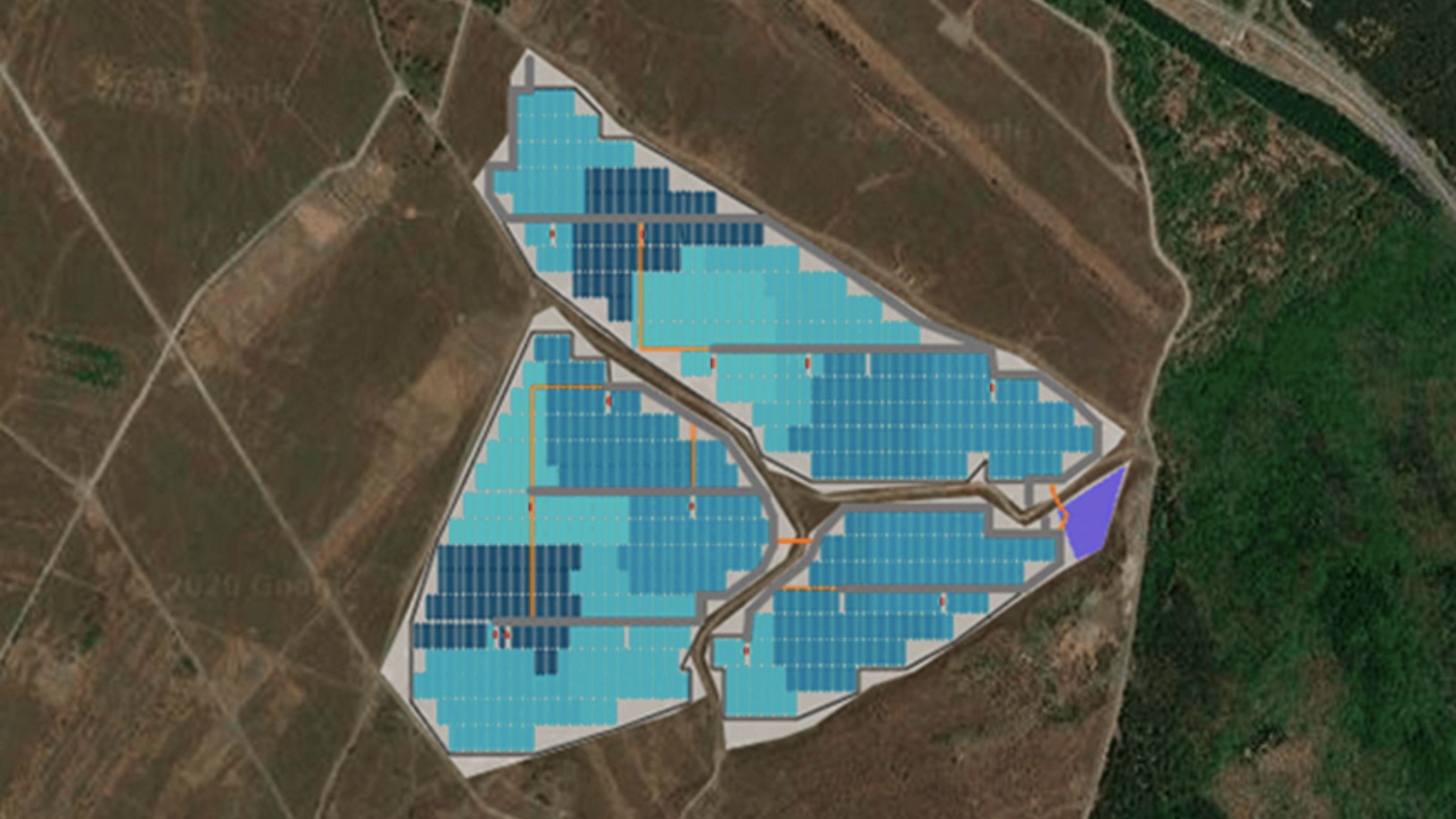

RatedPower: Creating solar power plant designs in minutes

The Spanish startup is helping solar plants expand exponentially worldwide and revolutionizing the sector with its automated software

Xampla: Making strong, low-cost biodegradable plastic from peas

Inspired by the strength of spider silk, the Cambridge University spinoff has produced a plant-based, completely compostable alternative to microplastics

HypeLabs wins bumper US$3m seed funding to democratize connectivity

HypeLab's P2P mesh networking technology enables everyone to communicate within their own networks without needing internet, in cities, remote villages and even in disaster zones

AEInnova: Energy harvester to generate €10 million revenue, plans Series A

A whopping 70% of our energy generated gets lost as waste heat. A Spanish startup has developed innovative solutions to collect the waste heat that industry literally throws away and convert it into electricity

- 1

- 2

Sorry, we couldn’t find any matches for“Cleantech Camp”.