EV batteries

-

DATABASE (21)

-

ARTICLES (57)

bp ventures is an investment arm of the energy group BP with an annual venture investment budget between $150m and $200m. The group invests in new energy solutions, with over 30 startups’ investments in its portfolio supporting BP’s core business in oil and gas.bp ventures has increasingly invested over the past years in carbon-management technologies, low-carbon products, and advanced mobility through EV charging companies like the Chinese Shanghai PowerShare Tech and the California-based FreeWire Technologies.

bp ventures is an investment arm of the energy group BP with an annual venture investment budget between $150m and $200m. The group invests in new energy solutions, with over 30 startups’ investments in its portfolio supporting BP’s core business in oil and gas.bp ventures has increasingly invested over the past years in carbon-management technologies, low-carbon products, and advanced mobility through EV charging companies like the Chinese Shanghai PowerShare Tech and the California-based FreeWire Technologies.

Samsung Venture Investment, or Samsung Ventures, is the VC investment arm of South Korean diversified conglomerate Samsung Group. It is a separate entity from Samsung NEXT.Samsung Ventures primarily invests in semiconductors, telecommunications tech, software and internet companies, as well as biotechnology and medical companies. The VC is built to support new innovations that can lead to further improvements in Samsung’s existing businesses, which includes smartphones, home appliances, and components like OLED panels and Li-ion batteries.Samsung Ventures has invested in healthcare and wellness tech companies like Indonesia’s telehealth service Alodokter, posture correction device makers Posture360, and Noom, an app for dieting and exercise. In the sensors front, Samsung Ventures has invested in Sense Photonics, a startup creating 3D computer vision based on lidar for industrial and automotive (self-driving) purposes. Besides these companies, Samsung Ventures has also invested in insurtech companies and even gaming companies, such as Pokémon Go developer Niantic.

Samsung Venture Investment, or Samsung Ventures, is the VC investment arm of South Korean diversified conglomerate Samsung Group. It is a separate entity from Samsung NEXT.Samsung Ventures primarily invests in semiconductors, telecommunications tech, software and internet companies, as well as biotechnology and medical companies. The VC is built to support new innovations that can lead to further improvements in Samsung’s existing businesses, which includes smartphones, home appliances, and components like OLED panels and Li-ion batteries.Samsung Ventures has invested in healthcare and wellness tech companies like Indonesia’s telehealth service Alodokter, posture correction device makers Posture360, and Noom, an app for dieting and exercise. In the sensors front, Samsung Ventures has invested in Sense Photonics, a startup creating 3D computer vision based on lidar for industrial and automotive (self-driving) purposes. Besides these companies, Samsung Ventures has also invested in insurtech companies and even gaming companies, such as Pokémon Go developer Niantic.

Established in August 2017, Insignia Ventures Partners is a newly-founded VC by former Sequoia Capital partner Yinglan Tan, a Stanford and Carnegie Mellon alumnus who joined Sequoia in 2012. He had also worked for 3i, Taiwanese AI startup Appier and has been with Indonesia’s Tokopedia since 2014.Starting with maiden funds worth US$120 million, Insignia has invested US$1 million in Indonesia’s B2B platform for the F&B sector Stoqo. Its lead round of US$3.5 million, for co-working spaces EV Hive in September 2017, was joined by Intudo Ventures, Pandu Sjahrir and other prominent angel investors.

Established in August 2017, Insignia Ventures Partners is a newly-founded VC by former Sequoia Capital partner Yinglan Tan, a Stanford and Carnegie Mellon alumnus who joined Sequoia in 2012. He had also worked for 3i, Taiwanese AI startup Appier and has been with Indonesia’s Tokopedia since 2014.Starting with maiden funds worth US$120 million, Insignia has invested US$1 million in Indonesia’s B2B platform for the F&B sector Stoqo. Its lead round of US$3.5 million, for co-working spaces EV Hive in September 2017, was joined by Intudo Ventures, Pandu Sjahrir and other prominent angel investors.

Endeavor Catalyst is part of the global investment company Endeavor. Launched in 2012 and based in New York, it supports the equity funding efforts of Endeavour entrepreneurs with third party investors. Its portfolio investments had a total capital value of over US$100 million and it specializes in mid-stage investments across sectors and different countries, with significant investment in transportation startups to date. In 2020, it participated in the second €12m part of the €23m Series A round of EV charging hardware startup, Wallbox, with an undisclosed investment. Other recent investments in 2020 include in the US$40m Series D round of Egyptian healthtech Vezeeta and in the undisclosed seed round of Turkish fintech Figopara.

Endeavor Catalyst is part of the global investment company Endeavor. Launched in 2012 and based in New York, it supports the equity funding efforts of Endeavour entrepreneurs with third party investors. Its portfolio investments had a total capital value of over US$100 million and it specializes in mid-stage investments across sectors and different countries, with significant investment in transportation startups to date. In 2020, it participated in the second €12m part of the €23m Series A round of EV charging hardware startup, Wallbox, with an undisclosed investment. Other recent investments in 2020 include in the US$40m Series D round of Egyptian healthtech Vezeeta and in the undisclosed seed round of Turkish fintech Figopara.

CEO and co-founder of Scoobic Urban Mobility

Jose María Gómez Marquez started his business career as CEO at Roder Spain from 1986–1994, manufacturing materials used in Expo 1992 in Seville. From 1998–2005, Gómez worked in business development for Climocubierta indoor swimming pool materials company in Seville. Since 1998, Gómez has also been running F1/MotoGP equipment supply company AMG Services as CEO and founder.He completed a master’s in business management in 2006 at San Telmo International Institute in Seville and became the managing partner of Seville-based engineering design company Arquingenia.In 2015, he co-founded Spanish mobility startup Scoobic Urban Mobility and became the CEO of the country’s first three-wheeled EV last-mile delivery logistics provider. He is also CEO of Passion Motorbike Factory.Between 2011 and 2015, Gómez was a director at Morocco-based EURoma Network, a transnational EU organization contributing to the promotion of social inclusion, equal opportunities and the fight against discrimination of the Roma community.

Jose María Gómez Marquez started his business career as CEO at Roder Spain from 1986–1994, manufacturing materials used in Expo 1992 in Seville. From 1998–2005, Gómez worked in business development for Climocubierta indoor swimming pool materials company in Seville. Since 1998, Gómez has also been running F1/MotoGP equipment supply company AMG Services as CEO and founder.He completed a master’s in business management in 2006 at San Telmo International Institute in Seville and became the managing partner of Seville-based engineering design company Arquingenia.In 2015, he co-founded Spanish mobility startup Scoobic Urban Mobility and became the CEO of the country’s first three-wheeled EV last-mile delivery logistics provider. He is also CEO of Passion Motorbike Factory.Between 2011 and 2015, Gómez was a director at Morocco-based EURoma Network, a transnational EU organization contributing to the promotion of social inclusion, equal opportunities and the fight against discrimination of the Roma community.

Aspex Management was founded in 2018 by Hermes Li Ho Kei who was previously the executive MD and Head of Asia Equities at Och-Ziff Capital Management, aka OZ Management. Prior to joining OZ in 2011 Li worked at Goldman, Sachs & Co in Hong Kong.The London School of Economics graduate is now the chief investment officer at Aspex. The Hong Kong firm focuses on equity investments in Pan-Asia, specializing in sectors with long-term market growth potential and companies undergoing structural changes.Aspex led the $64m funding round for South Korean fintech unicorn Toss in August 2019. The P2P money transfer service platform Toss is created by Viva Republica backed by PayPal. Other participants in the round included existing Toss investors Kleiner Perkins, Altos Ventures, Singapore's GIC, Sequoia Capital China, Goodwater Capital and Bessemer Venture Partners.In May 2020, Aspex also invested in another startup Market Kurly, a grocery-delivery service provider that became South Korea’s latest unicorn via the Series E funding round that secured $328m led by DST Global. In July, Aspex also joined the $900m Series C+ funding round of Xpeng Motors, Tesla’s EV rival in China.

Aspex Management was founded in 2018 by Hermes Li Ho Kei who was previously the executive MD and Head of Asia Equities at Och-Ziff Capital Management, aka OZ Management. Prior to joining OZ in 2011 Li worked at Goldman, Sachs & Co in Hong Kong.The London School of Economics graduate is now the chief investment officer at Aspex. The Hong Kong firm focuses on equity investments in Pan-Asia, specializing in sectors with long-term market growth potential and companies undergoing structural changes.Aspex led the $64m funding round for South Korean fintech unicorn Toss in August 2019. The P2P money transfer service platform Toss is created by Viva Republica backed by PayPal. Other participants in the round included existing Toss investors Kleiner Perkins, Altos Ventures, Singapore's GIC, Sequoia Capital China, Goodwater Capital and Bessemer Venture Partners.In May 2020, Aspex also invested in another startup Market Kurly, a grocery-delivery service provider that became South Korea’s latest unicorn via the Series E funding round that secured $328m led by DST Global. In July, Aspex also joined the $900m Series C+ funding round of Xpeng Motors, Tesla’s EV rival in China.

- 1

- 2

Behind Indonesia's recent EV push

EV prices in Indonesia are still high and there are concerns about infrastructure, but serious policymaking and private sector support can boost consumer adoption

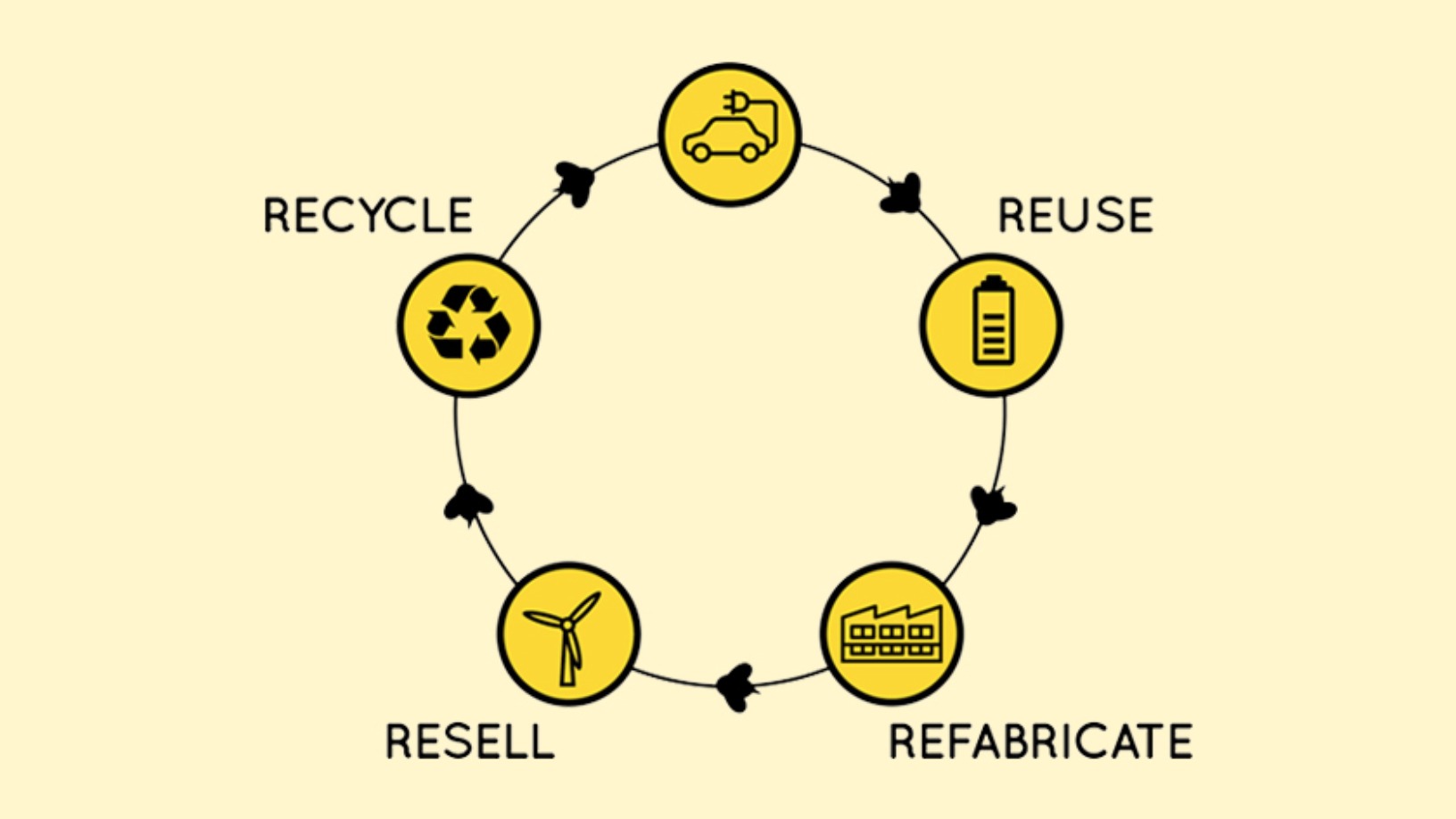

BeePlanet Factory: Recycling EV batteries as a sustainable, profitable business

With 4kWh–200kWh residential and industrial battery packs, the Pamplona-based startup wants to scale its energy storage solutions in the agri-food sector, camping sites and mountain huts

Europe ramps up development of local EV battery sector in race to zero emissions

Startups, automakers jostle or unite to ride the fast-growing EV battery market, as the EU pumps billions into developing its own value chain, to cut reliance on imports

Supercharging and battery swap in race to cut EV charging times in China

Supercharging can slash EV charging times but has technological challenges. Hence battery swapping is on the rise in China, with state support

Oyika wants to help 30,000 Indonesian riders switch to electric motorcycles

With unlimited battery swaps and round-the-clock service, the Singapore startup is targeting ride-hailing and delivery drivers in Indonesia, a market with a growing appetite for electric motorcycles

Botree Cycling: Recovering critical metals from end-of-life batteries

The Beijing-based startup helps clients dismantle and recycle spent lithium batteries on-site, recovering over 90% of rare metals and reducing demand for mineral resources

Subsidy cut has dented sales, but China's EV manufacturers need better products to win over buyers

Eliminating subsidies is a painful must for the sustainability of China’s electric vehicle industry

Chinese EV startups feel the heat as Tesla slashes prices, market subsidies ending

Tesla's recent price cuts and upcoming Shanghai plant for producing cheaper cars are increasing pressure on its Chinese rivals

Scoobic: Nifty electric three-wheelers for last-mile deliveries

Traveling up to 100 km on a single battery charge, Scoobic’s EVs, with delivery capacities of vans, is a sustainable solution to traffic jams and parking restrictions

This EV maker caters to young consumers by making driving easier and more fun

Amongst all the players in China’s EV market, Xpeng Motors still stands out

Place to Plug: Symbiosis in scaling with the electric vehicle sector

Launched commercially just five months ago, EV-charging infrastructure platform Place to Plug has already attracted attention from investors in Silicon Valley and Asia

US non-profit investor New Energy Nexus seeks to kickstart Indonesia’s clean energy sectors

With a “patient capital” approach to investments and a variety of programs, New Energy Nexus hopes to show that startups can lead the way in renewables and smart energy

Warung Pintar: Creating a little place of happiness with smart kiosks

CEO Agung Bezharie Hadinegoro on how Warung Pintar is tapping IoT and other digital tech to unleash the economic potential of Indonesia's traditional street vendors

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

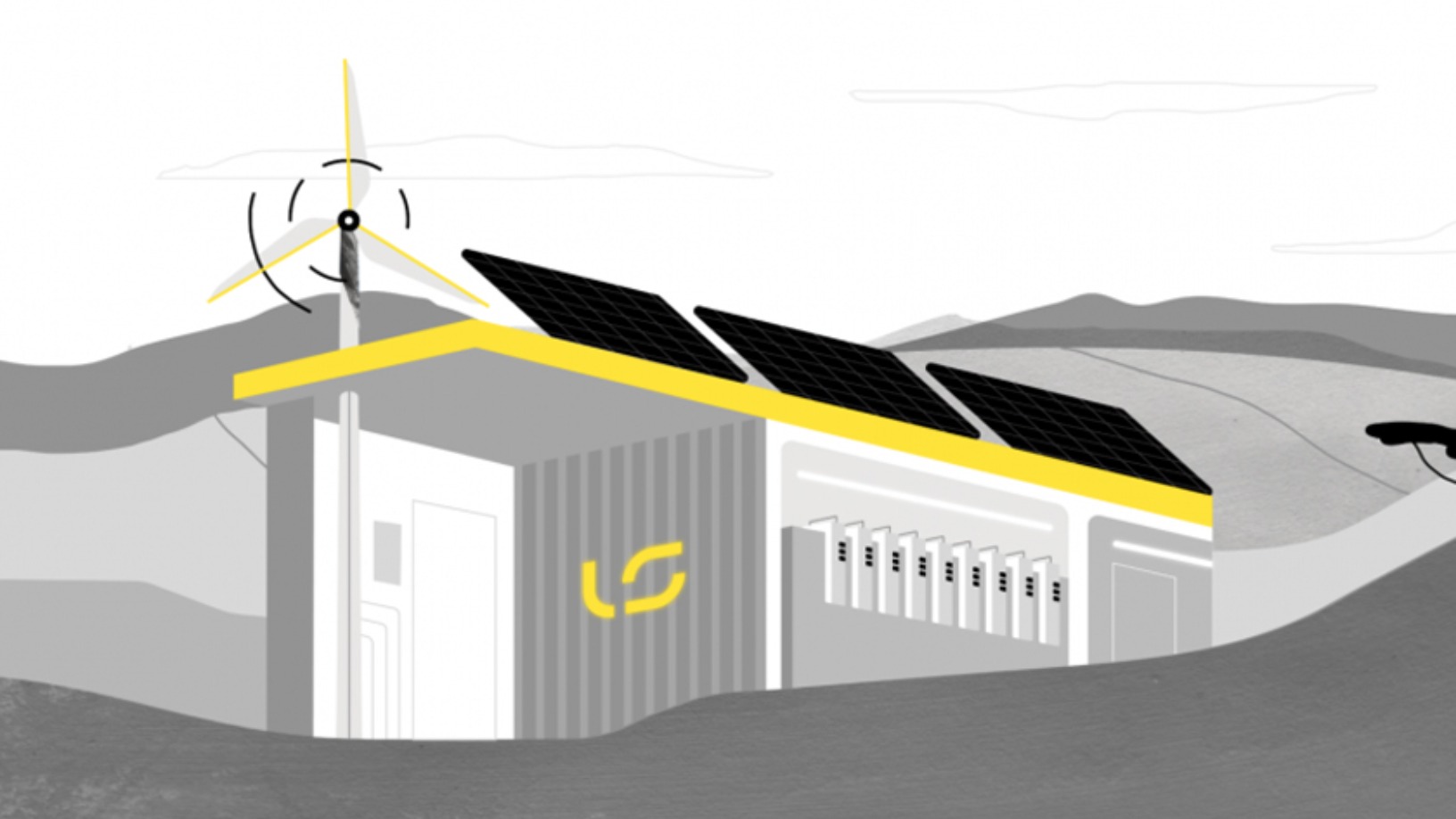

Liquidstar: Bringing decentralized renewable energy to off-grid communities

Using a blockchain-based platform, Liquidstar wants to use smart, modular batteries to power remote, off-grid communities as well as homes, offices and EVs in cities

Sorry, we couldn’t find any matches for“EV batteries”.