Green hydrogen

-

DATABASE (22)

-

ARTICLES (88)

Green Innovations is an impact fund that invests in large-scale projects addressing global sustainability challenges, focusing on the agriculture, biotechnology, education, energy, housing and water sectors. It is headed by Angola-based Portuguese businessman Jorge Marques, and linked to Israeli group Mitrelli. Green Innovations took control of Biocant, Portugal’s biggest biotech park, in a privatization move in 2017–2018. Green Innovations's stable of companies includes Green Biotech, created to invest in biotechnology in Portugal, and Green Services Innovations, linked to the exploration of phosphates in Congo.Its recent investments include in the June 2021 $85m Series C round and February 2021 $25m Series B of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution.

Green Innovations is an impact fund that invests in large-scale projects addressing global sustainability challenges, focusing on the agriculture, biotechnology, education, energy, housing and water sectors. It is headed by Angola-based Portuguese businessman Jorge Marques, and linked to Israeli group Mitrelli. Green Innovations took control of Biocant, Portugal’s biggest biotech park, in a privatization move in 2017–2018. Green Innovations's stable of companies includes Green Biotech, created to invest in biotechnology in Portugal, and Green Services Innovations, linked to the exploration of phosphates in Congo.Its recent investments include in the June 2021 $85m Series C round and February 2021 $25m Series B of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution.

Green Monday Ventures is the impact investment arm of Green Monday Group founded by longtime Buddhist David Yeung to produce plant-based meat and operate Hong Kong’s first plant-based concept store.Founded in 2012, the Green Monday movement is a social enterprise aimed at promoting sustainable lifestyle concepts like "green food" to address challenges relating to public health, climate change, food security and animal wellbeing. The Hong Kong-based VC was set up in 2013 to focus on investments in alternative protein companies worldwide.

Green Monday Ventures is the impact investment arm of Green Monday Group founded by longtime Buddhist David Yeung to produce plant-based meat and operate Hong Kong’s first plant-based concept store.Founded in 2012, the Green Monday movement is a social enterprise aimed at promoting sustainable lifestyle concepts like "green food" to address challenges relating to public health, climate change, food security and animal wellbeing. The Hong Kong-based VC was set up in 2013 to focus on investments in alternative protein companies worldwide.

Enagás Emprende, part of the Spanish Transmission System Operator (TS) Enagás, is an investment venture backing and accelerating technology-based startups in their scale-up phase. Its portfolio investment mainly includes companies providing renewable gases, green hydrogen, and biomethane, but also sustainable mobility and energy efficiency. With 50 years of experience in energy infrastructures across Spain, the US, Mexico, Chile, Peru, Albania, Greece and Italy, Enagás provides its portfolio startups with mentoring and expertise acting as investors, clients and industry partners.

Enagás Emprende, part of the Spanish Transmission System Operator (TS) Enagás, is an investment venture backing and accelerating technology-based startups in their scale-up phase. Its portfolio investment mainly includes companies providing renewable gases, green hydrogen, and biomethane, but also sustainable mobility and energy efficiency. With 50 years of experience in energy infrastructures across Spain, the US, Mexico, Chile, Peru, Albania, Greece and Italy, Enagás provides its portfolio startups with mentoring and expertise acting as investors, clients and industry partners.

Los Angeles-based Leonard Green & Partners (LGP) is a PE investment firm with over $50bn of assets under management. Since it was founded in 1989, LGP has invested in over 100 companies in the form of traditional buyouts, going-private transactions, recapitalizations, growth equity, and selective public equity and debt positions.

Los Angeles-based Leonard Green & Partners (LGP) is a PE investment firm with over $50bn of assets under management. Since it was founded in 1989, LGP has invested in over 100 companies in the form of traditional buyouts, going-private transactions, recapitalizations, growth equity, and selective public equity and debt positions.

Green Pine Capital Partners was founded in Shenzhen 1997. The firm has over RMB 16 billion of assets under management. It has invested mainly in biopharmaceuticals, healthcare, new energy, new materials, advanced manufacturing and AI. The company has invested in more than 300 companies, about 60 of which have already gone public or been merged/acquired. Early-stage tech startups account for half of its portfolio.It is headquartered in Shenzhen, with branches in Beijing, Shanghai and Guangzhou.

Green Pine Capital Partners was founded in Shenzhen 1997. The firm has over RMB 16 billion of assets under management. It has invested mainly in biopharmaceuticals, healthcare, new energy, new materials, advanced manufacturing and AI. The company has invested in more than 300 companies, about 60 of which have already gone public or been merged/acquired. Early-stage tech startups account for half of its portfolio.It is headquartered in Shenzhen, with branches in Beijing, Shanghai and Guangzhou.

Green Angel Syndicate (GSA) is an angel investment syndicate fund headquartered in the UK and joined by over 250 members. GSA’s investments are mostly focused on technologies that can tackle climate change and global warming issues. As of December 2020, the firm has, directly and indirectly, contributed to saving more than 20,000 tones of CO2 and increased its emissions savings by 88% throughout the year.The fund has invested over £10m in startups in their early-stage and operating across 10 different sectors. GSA is also behind the EIS Climate Change Fund, a co-investment fund in deals managed by GSA. In 2019, GSA was recognized as the UK Business Angels Association Angel Syndicate of the Year.

Green Angel Syndicate (GSA) is an angel investment syndicate fund headquartered in the UK and joined by over 250 members. GSA’s investments are mostly focused on technologies that can tackle climate change and global warming issues. As of December 2020, the firm has, directly and indirectly, contributed to saving more than 20,000 tones of CO2 and increased its emissions savings by 88% throughout the year.The fund has invested over £10m in startups in their early-stage and operating across 10 different sectors. GSA is also behind the EIS Climate Change Fund, a co-investment fund in deals managed by GSA. In 2019, GSA was recognized as the UK Business Angels Association Angel Syndicate of the Year.

Based in Singapore, GreenMeadows Accelerator (GMA) is a VC firm that provides incubator and accelerator services. GMA mainly invests in advanced manufacturing, engineering and clean/green-tech sectors. Enterprise Singapore Startup Equity SG is its co-investment partner.

Based in Singapore, GreenMeadows Accelerator (GMA) is a VC firm that provides incubator and accelerator services. GMA mainly invests in advanced manufacturing, engineering and clean/green-tech sectors. Enterprise Singapore Startup Equity SG is its co-investment partner.

Co-founder and CEO of Gringgo

Self-styled “professional trash talker” Olivier Pouillon moved from the USA to Bali, Indonesia in 1994, set on a mission to solve the island’s trash problem. In 2011, after years of waste consultancy and NGO work, he founded Bali Recycling, a company that produces upcycled products and promotes “trash-to-cash” programs to locals. (The company has since been renamed KONO Green Living.) In 2014, he and interior designer Febriadi Pratama started an app-based trash collection service, which later became Gringgo.

Self-styled “professional trash talker” Olivier Pouillon moved from the USA to Bali, Indonesia in 1994, set on a mission to solve the island’s trash problem. In 2011, after years of waste consultancy and NGO work, he founded Bali Recycling, a company that produces upcycled products and promotes “trash-to-cash” programs to locals. (The company has since been renamed KONO Green Living.) In 2014, he and interior designer Febriadi Pratama started an app-based trash collection service, which later became Gringgo.

Banking on demand for healthy tea beverages, Changsha's cultural tea house will operate over 200 outlets, offering on-demand deliveries to customers across the city.

Banking on demand for healthy tea beverages, Changsha's cultural tea house will operate over 200 outlets, offering on-demand deliveries to customers across the city.

Co-founder of Narasi TV

Dahlia Citra Buana is a veteran in the journalistic and broadcasting world. After graduating from Universitas Gadjah Mada, Indonesia with a bachelor's degree in Politics, she began her career as a radio host and journalist in 2002, working for KBR68H and Green Radio Jakarta. In 2008 she joined Metro TV, eventually becoming the producer of Mata Najwa, a talk show hosted by well-known anchor Najwa Shihab. Together with Najwa, she established the omni-channel media network Narasi TV in 2017. Dahlia officially left Metro TV in 2018.

Dahlia Citra Buana is a veteran in the journalistic and broadcasting world. After graduating from Universitas Gadjah Mada, Indonesia with a bachelor's degree in Politics, she began her career as a radio host and journalist in 2002, working for KBR68H and Green Radio Jakarta. In 2008 she joined Metro TV, eventually becoming the producer of Mata Najwa, a talk show hosted by well-known anchor Najwa Shihab. Together with Najwa, she established the omni-channel media network Narasi TV in 2017. Dahlia officially left Metro TV in 2018.

COO of NutraSign

Rosa López-Monis is a well-known nutrition, food safety and health specialist in southern Spain. She also holds a master's in Nutrition and Dietetics and a master's in Clinical Analysis. She has published health and nutrition books like Green Detox. Since 2007, the molecular biologist and microscopist has been running her own e-commerce site for Health, Wellness and Fitness Más que Dietas. She joined NutraSign as COO in 2018, applying her food safety knowledge to the company's traceability processes and digital applications.

Rosa López-Monis is a well-known nutrition, food safety and health specialist in southern Spain. She also holds a master's in Nutrition and Dietetics and a master's in Clinical Analysis. She has published health and nutrition books like Green Detox. Since 2007, the molecular biologist and microscopist has been running her own e-commerce site for Health, Wellness and Fitness Más que Dietas. She joined NutraSign as COO in 2018, applying her food safety knowledge to the company's traceability processes and digital applications.

CEO and Co-founder of Play2Speak

Based in Paris, Giuseppe Fantigrossi has an MBA in International Business and Marketing from the Concordia University. The multi-linguist, with four languages under his belt, became the CEO and co-founder of Play2Speak in 2018.As a consultant, with over 10 years of international experience in process improvement and IT integration solution projects, he attained a Lean Six Sigma Black Belt professional qualification in 2013. He has also created a Lean Six Sigma Green Belt full certification program in collaboration with consulting firm Kaizen Way in Paris.

Based in Paris, Giuseppe Fantigrossi has an MBA in International Business and Marketing from the Concordia University. The multi-linguist, with four languages under his belt, became the CEO and co-founder of Play2Speak in 2018.As a consultant, with over 10 years of international experience in process improvement and IT integration solution projects, he attained a Lean Six Sigma Black Belt professional qualification in 2013. He has also created a Lean Six Sigma Green Belt full certification program in collaboration with consulting firm Kaizen Way in Paris.

Hengqin CIMC Readysun Innovation & Entrepreneurship Investment Fund

Hengqin CIMC Readysun Innovation & Entrepreneurship Investment Fund is a VC fund set up by China International Marine Containers (CIMC) and Shenzhen Readysun Investment Group on June 14, 2017. The fund focuses on fast-growing high-end equipment manufacturing and new technology sectors, such as intelligent logistics, industrial automation and robots, industrial internet, green new materials.

Hengqin CIMC Readysun Innovation & Entrepreneurship Investment Fund is a VC fund set up by China International Marine Containers (CIMC) and Shenzhen Readysun Investment Group on June 14, 2017. The fund focuses on fast-growing high-end equipment manufacturing and new technology sectors, such as intelligent logistics, industrial automation and robots, industrial internet, green new materials.

Founded in 1992, Danish state investor Vaekstfonden is a growth fund that has financed more than 9,200 Danish tech and non-tech startups with total funding of 33.8bn Danish krone ($1=6.35DKK, or about €5.8bn), mostly at pre-seed and seed levels. The investor also manages funds from the Danish Ministry of Business, state grants, ordinary loans and green investments. Startup investments are normally carried out in cooperation with other public bodies such as innovation incubators.

Founded in 1992, Danish state investor Vaekstfonden is a growth fund that has financed more than 9,200 Danish tech and non-tech startups with total funding of 33.8bn Danish krone ($1=6.35DKK, or about €5.8bn), mostly at pre-seed and seed levels. The investor also manages funds from the Danish Ministry of Business, state grants, ordinary loans and green investments. Startup investments are normally carried out in cooperation with other public bodies such as innovation incubators.

The biotech will expand its popular range of organic and probiotic treats for dogs and cats with cell-based pet food, planned for launch in 2022.

The biotech will expand its popular range of organic and probiotic treats for dogs and cats with cell-based pet food, planned for launch in 2022.

- 1

- 2

Switch Automation: On-demand, data-driven building management

The Denver-based company kicked off operations in Singapore last year, intends to use the city-state as a spring board to expand in the Asia Pacific

IXON: Preserving food without canning or freezing

Chinese foodtech IXON aims to disrupt global cold chain logistics with its novel food preparation and packaging solution that keeps food fresh at room temperature for years

In a nascent market, one-year-old Starfield has brought its offerings to around 3,000 F&B outlets and generated RMB 10m in revenue

Oceanium: Supporting sustainable seaweed farming

Scottish startup Oceanium has developed a proprietary biorefinery and processing model to create seaweed-based compostable materials, alt-protein ingredients and nutraceuticals for use across industry verticals

Huidu Environmental: Creating a circular economy to ease online retail's parcel waste woes

China's billion-dollar courier industry finds much-needed solution in Huidu's eco-friendly, low-cost boxes and smart recycling system

Biomede: Harnessing plants’ natural attributes to decontaminate soil

The Lyon-based startup says using plants to remove harmful metals from the earth is a sustainable, cost-effective green alternative to decontaminate soil in agricultural or urban environments

Future Food Asia 2021: Regenerative agriculture in Asia

The unique challenges facing regenerative agriculture in Asia require solutions different from those in the West, presenting opportunities for microfinancing and impact investment

Refurbed: Electronics recycling marketplace gets $54m for EU consolidation, overseas expansion

Consumers can reduce their carbon footprints by shifting toward a circular economy, become carbon-neutral by planting one tree with every purchase from Refurbed

MIWA Technologies: Reducing food waste and packaging with smart refill vending system

MIWA’s solution lets consumers buy exact refill quantities in personalized containers, eradicating need for single-use plastics throughout the supply chain

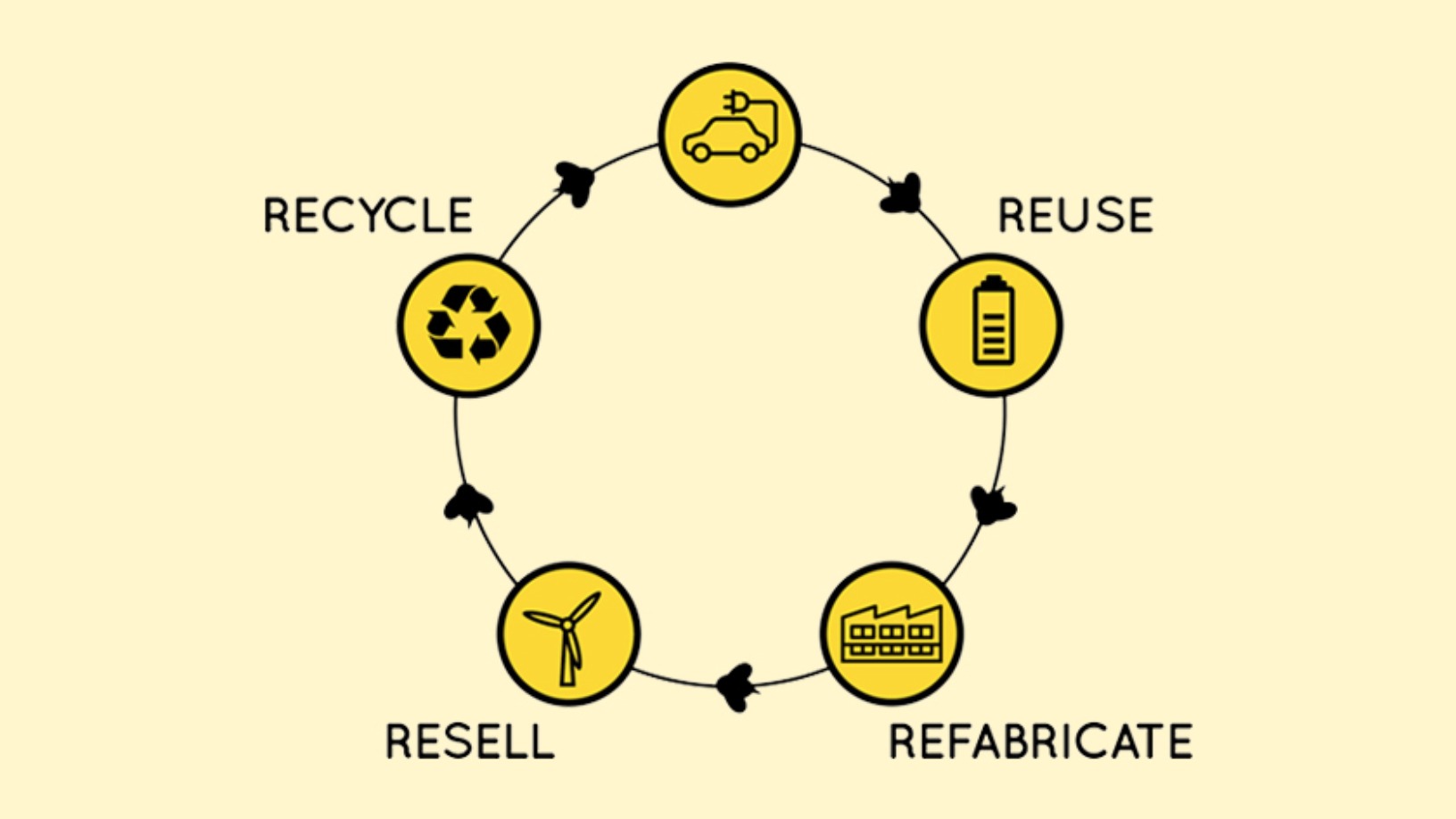

BeePlanet Factory: Recycling EV batteries as a sustainable, profitable business

With 4kWh–200kWh residential and industrial battery packs, the Pamplona-based startup wants to scale its energy storage solutions in the agri-food sector, camping sites and mountain huts

CoRTP: Building sustainable supply chains with returnable packaging

The Shanghai-based startup’s award-winning returnable transit packaging reduced carbon emissions in 2020 by 250,000 tons, and the figure is estimated to reach 8m by 2030

Oscillum: The intelligent label to reduce food waste

The Spanish biotech startup has developed sensors embedded in biodegradable plastic labels to monitor “product freshness” beyond expiration dates, helping consumers to avoid food waste and save money

The B2B platform for greater route efficiency and sustainability in trucking raised €17m despite supply chain disruptions, economic uncertainties during Covid-19

SWORD Health nabs Portugal's second biggest Series A round within one year

SWORD Health's AI-based physiotherapy solution has just clinched $9m from Khosla Ventures and Founders Fund, ringing in a total of $17m in Series A funding

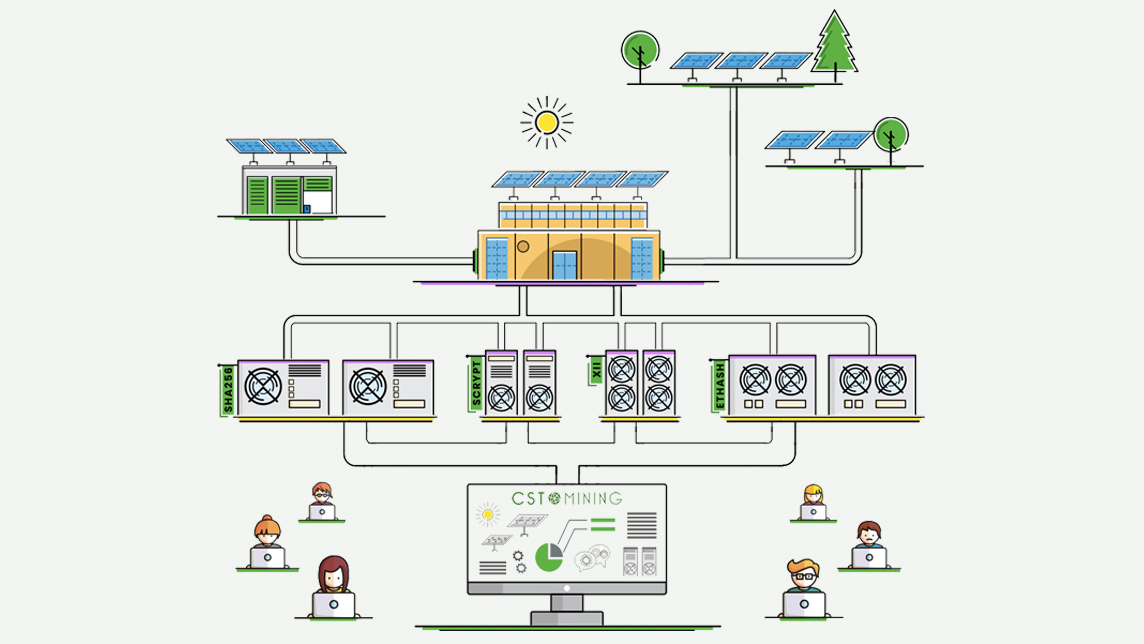

Cryptosolartech: Harnessing solar power to make cryptomining less environmentally harmful

The Spanish startup also sources cheaper electricity for cryptomining. It recently raised €8.85m in a pre-ICO, enabling it to build the world's first solar-powered cryptomining farm

Sorry, we couldn’t find any matches for“Green hydrogen”.