Horizon 2020

-

DATABASE (143)

-

ARTICLES (400)

Listed and based out of London, Standard Chartered Bank, or StanChart, has operations in Asia, Africa and the Middle East. It has about US$60 billion of assets under management, which it hopes to grow to more than US$100 billion by 2020.

Listed and based out of London, Standard Chartered Bank, or StanChart, has operations in Asia, Africa and the Middle East. It has about US$60 billion of assets under management, which it hopes to grow to more than US$100 billion by 2020.

CEO and co-founder of Beyond Leather Materials / Leap

German native Mikael Eydt graduated in economics in 2016 at Erlangen-Nürnberg’s Friedrich-Alexander University. He worked at his family’s hotel company in Germany while studying at university from 2011 to 2016. Eydt also briefly worked in sales for insurance company Debeka and completed his national service as a soldier in Germany. In 2017, Eydt went back to work as a junior manager at family-owned Hotel Eydt in Kirchheim.Currently based in Copenhagen, he is now the CEO and co-founder of Danish alt-leather biotech, Beyond Leather Materials, that produces vegan leather materials from apple waste. He was responsible for the startup’s business development for two years before becoming CEO in July 2020.

German native Mikael Eydt graduated in economics in 2016 at Erlangen-Nürnberg’s Friedrich-Alexander University. He worked at his family’s hotel company in Germany while studying at university from 2011 to 2016. Eydt also briefly worked in sales for insurance company Debeka and completed his national service as a soldier in Germany. In 2017, Eydt went back to work as a junior manager at family-owned Hotel Eydt in Kirchheim.Currently based in Copenhagen, he is now the CEO and co-founder of Danish alt-leather biotech, Beyond Leather Materials, that produces vegan leather materials from apple waste. He was responsible for the startup’s business development for two years before becoming CEO in July 2020.

Endeavor Catalyst is part of the global investment company Endeavor. Launched in 2012 and based in New York, it supports the equity funding efforts of Endeavour entrepreneurs with third party investors. Its portfolio investments had a total capital value of over US$100 million and it specializes in mid-stage investments across sectors and different countries, with significant investment in transportation startups to date. In 2020, it participated in the second €12m part of the €23m Series A round of EV charging hardware startup, Wallbox, with an undisclosed investment. Other recent investments in 2020 include in the US$40m Series D round of Egyptian healthtech Vezeeta and in the undisclosed seed round of Turkish fintech Figopara.

Endeavor Catalyst is part of the global investment company Endeavor. Launched in 2012 and based in New York, it supports the equity funding efforts of Endeavour entrepreneurs with third party investors. Its portfolio investments had a total capital value of over US$100 million and it specializes in mid-stage investments across sectors and different countries, with significant investment in transportation startups to date. In 2020, it participated in the second €12m part of the €23m Series A round of EV charging hardware startup, Wallbox, with an undisclosed investment. Other recent investments in 2020 include in the US$40m Series D round of Egyptian healthtech Vezeeta and in the undisclosed seed round of Turkish fintech Figopara.

Swanlaab Venture Factory is a Spanish-Israeli VC fund founded in 2013 in Israel and in 2017 in Madrid, whose first investment fund totalled €40 million. Within Spain, its portfolio has 11 startups across different B2B verticals. Each startup selected for investment during investment rounds of €2–3 million, receives funds of €500,000 to €1.5 million.Swanlaab's Israeli backer Giza Venture Capital has already achieved more than 40 successful exits and is ranked amongst the top funds worldwide, investing over $600 million since 1992.Its most recent investments include in edtech and multimedia content platform Odilo’s July 2020 $10m undisclosed round and in the €3.5m Series A investment round of sales tech Sales Layer in May 2020.

Swanlaab Venture Factory is a Spanish-Israeli VC fund founded in 2013 in Israel and in 2017 in Madrid, whose first investment fund totalled €40 million. Within Spain, its portfolio has 11 startups across different B2B verticals. Each startup selected for investment during investment rounds of €2–3 million, receives funds of €500,000 to €1.5 million.Swanlaab's Israeli backer Giza Venture Capital has already achieved more than 40 successful exits and is ranked amongst the top funds worldwide, investing over $600 million since 1992.Its most recent investments include in edtech and multimedia content platform Odilo’s July 2020 $10m undisclosed round and in the €3.5m Series A investment round of sales tech Sales Layer in May 2020.

Vesalius Biocapital III is a €70 million fund that invests in medtech, e-health initiatives and drug development in Europe. It was launched in 2017 by Luxembourg-based Vesalius Biocapital, a life sciences venture capital firm founded in 2007. Preceding Vesalius Biocapital III were Vesalius Biocapital I, with €76 million under management and Vesalius Biocapital II, which has €78 million invested; both funds have 11 portfolio companies each.Its recent investments include in Portuguese home physiotherapy tech solution SWORD Health's 2021 $25m Series B and in the 2020 $9m second phase of its Series A round as well as in the 2020 €22m Series B round of German biotech Topas Therapeutics.

Vesalius Biocapital III is a €70 million fund that invests in medtech, e-health initiatives and drug development in Europe. It was launched in 2017 by Luxembourg-based Vesalius Biocapital, a life sciences venture capital firm founded in 2007. Preceding Vesalius Biocapital III were Vesalius Biocapital I, with €76 million under management and Vesalius Biocapital II, which has €78 million invested; both funds have 11 portfolio companies each.Its recent investments include in Portuguese home physiotherapy tech solution SWORD Health's 2021 $25m Series B and in the 2020 $9m second phase of its Series A round as well as in the 2020 €22m Series B round of German biotech Topas Therapeutics.

Founded in 2012, Purple Orange’s objective is to support the transition away from animals in the food chain, supporting early-stage food and biotech companies across the globe with a focus on alternative proteins and cellular agriculture. It currently has 12 startups from different nations in its portfolio. Its most recently disclosed investments have been in the December 2020 pre-seed round of Chinese cultured meat startup CellX and in the November 2020 $500,000 pre-seed round of Swedish plant-based food vending startup VEAT.

Founded in 2012, Purple Orange’s objective is to support the transition away from animals in the food chain, supporting early-stage food and biotech companies across the globe with a focus on alternative proteins and cellular agriculture. It currently has 12 startups from different nations in its portfolio. Its most recently disclosed investments have been in the December 2020 pre-seed round of Chinese cultured meat startup CellX and in the November 2020 $500,000 pre-seed round of Swedish plant-based food vending startup VEAT.

Co-founder and CEO of Kopi Kenangan

Edward Tirtanata is best known for establishing Kopi Kenangan, the popular grab-and-go coffee chain. Prior to that, however, the finance and accounting graduate from Northeastern University, USA, had established Lewis & Carroll, a premium establishment serving artisanal tea. Unfortunately, the brand struggled to grow among Indonesia's budget-conscious youths, who preferred the cheaper bubble tea. Learning from the experience, he decided to eschew the Starbucks-style “third home” retail concept and opted for grab-and-go stalls that are cheaper to establish, but without abandoning the quality of the coffee served. The concept proved to be a hit, and Tirtanata's new venture became a nationwide sensation.Aside from his role as CEO of Kopi Kenangan, Tirtanata is getting more deeply involved in the F&B startup ecosystem. In February 2020, he joined Gojek and startup ecosystem builder Digitaraya in establishing Digitarasa, a new accelerator program for F&B businesses.

Edward Tirtanata is best known for establishing Kopi Kenangan, the popular grab-and-go coffee chain. Prior to that, however, the finance and accounting graduate from Northeastern University, USA, had established Lewis & Carroll, a premium establishment serving artisanal tea. Unfortunately, the brand struggled to grow among Indonesia's budget-conscious youths, who preferred the cheaper bubble tea. Learning from the experience, he decided to eschew the Starbucks-style “third home” retail concept and opted for grab-and-go stalls that are cheaper to establish, but without abandoning the quality of the coffee served. The concept proved to be a hit, and Tirtanata's new venture became a nationwide sensation.Aside from his role as CEO of Kopi Kenangan, Tirtanata is getting more deeply involved in the F&B startup ecosystem. In February 2020, he joined Gojek and startup ecosystem builder Digitaraya in establishing Digitarasa, a new accelerator program for F&B businesses.

Co-founder, CEO of Sea Water Analytics

Javier Colmenarejo is the Spanish co-founder and CEO of Sea Water Analytics, a tourism-focused data aggregator with user app to measure seawater quality. The technology has been in development since 2017, though the company was formally launched in Madrid in April 2020. He has spent more than 15 years as a civil engineer, working in hydraulic and water treatment systems. He currently works on smart city initiatives on the Adapting Cities to Change program in Madrid and he lectures in Big Data, IoT, Data Services and Business in two Madrid institutions. He works part-time at Sea Water Analytics' technical partner Talentum as a blockchain and IoT innovation manager.Colmenarejo holds four master's degrees: in Big Data and Business Analytics from Madrid's School of Industrial Organization (EIO); in Data Science and IoT from Madrid Institute of Things Institute; in Business Administration from The Power MBA; and in civil engineering from the Polytechnic University of Madrid.

Javier Colmenarejo is the Spanish co-founder and CEO of Sea Water Analytics, a tourism-focused data aggregator with user app to measure seawater quality. The technology has been in development since 2017, though the company was formally launched in Madrid in April 2020. He has spent more than 15 years as a civil engineer, working in hydraulic and water treatment systems. He currently works on smart city initiatives on the Adapting Cities to Change program in Madrid and he lectures in Big Data, IoT, Data Services and Business in two Madrid institutions. He works part-time at Sea Water Analytics' technical partner Talentum as a blockchain and IoT innovation manager.Colmenarejo holds four master's degrees: in Big Data and Business Analytics from Madrid's School of Industrial Organization (EIO); in Data Science and IoT from Madrid Institute of Things Institute; in Business Administration from The Power MBA; and in civil engineering from the Polytechnic University of Madrid.

CTO and co-founder of iLoF

Joana Paiva graduated in 2014 with a master’s in biomedical engineering at the University of Coimbra in Portugal. She went on to complete a PhD in physics at the University of Porto in 2019.In 2014, she also worked at INESC Technology and Science for almost five years while completing her PhD thesis: Intelligent Lab on Fiber tools for sensing single-cells and extracellular nano-vesicles. It was her research that led to the founding of medtech startup iLoF.In August 2019, she co-founded iLoF as CTO. The Oxford-Oporto-based startup enables personalized medicine through the use of AI and photonics to create optical fingerprints in a cloud-based library to collate disease biomarkers and biological profiles.Based in Porto, she is also a co-inventor with three patents and 29 scientific publications. She is one of Forbes 30 Under 30 for science and healthcare and was nominated for the EIT Woman Award 2020.

Joana Paiva graduated in 2014 with a master’s in biomedical engineering at the University of Coimbra in Portugal. She went on to complete a PhD in physics at the University of Porto in 2019.In 2014, she also worked at INESC Technology and Science for almost five years while completing her PhD thesis: Intelligent Lab on Fiber tools for sensing single-cells and extracellular nano-vesicles. It was her research that led to the founding of medtech startup iLoF.In August 2019, she co-founded iLoF as CTO. The Oxford-Oporto-based startup enables personalized medicine through the use of AI and photonics to create optical fingerprints in a cloud-based library to collate disease biomarkers and biological profiles.Based in Porto, she is also a co-inventor with three patents and 29 scientific publications. She is one of Forbes 30 Under 30 for science and healthcare and was nominated for the EIT Woman Award 2020.

CEO and co-founder of TurtleTree Labs

Cheese connoisseur, Lin Fengru, was unable to find milk that allowed her to make high-quality cheese. During her search around dairy farms in Asia, she realized that the poor quality of the milk was due to animal hygiene issues and the use of antibiotics and hormones on cows. The lack of quality dairy milk options inspired her to co-found TurtleTree Labs in January 2019 to create milk using stem cells.Lin graduated in information systems management and marketing in 2011 at Singapore Management University (SMU). In 2011, she joined Collis Asia as an account manager and left in 2014 to work at Salesforce in sales and business development. She joined Google Singapore in 2018 and worked as a territory account manager for Google Cloud Platform until June 2019. In 2020, she completed an MIT course in the science and business of biotechnology.

Cheese connoisseur, Lin Fengru, was unable to find milk that allowed her to make high-quality cheese. During her search around dairy farms in Asia, she realized that the poor quality of the milk was due to animal hygiene issues and the use of antibiotics and hormones on cows. The lack of quality dairy milk options inspired her to co-found TurtleTree Labs in January 2019 to create milk using stem cells.Lin graduated in information systems management and marketing in 2011 at Singapore Management University (SMU). In 2011, she joined Collis Asia as an account manager and left in 2014 to work at Salesforce in sales and business development. She joined Google Singapore in 2018 and worked as a territory account manager for Google Cloud Platform until June 2019. In 2020, she completed an MIT course in the science and business of biotechnology.

SoftBank announced its second Vision Fund of about $108bn in July 2019 to invest in technology startups across the world. SoftBank had originally planned to contribute $38bn to the new fund. However, its Vision Fund I was badly affected by the Covid-19 pandemic and losses resulting in lower valuations of its investments in Uber and WeWork.In February 2020, the Japanese conglomerate decided to inject more money into the Vision Fund II before raising new funds from other LPs. With $10bn committed to the second fund by the SoftBank Group, the new fund has now invested in 13 portfolio companies including co-leading the Series C round for XAG in November 2020.

SoftBank announced its second Vision Fund of about $108bn in July 2019 to invest in technology startups across the world. SoftBank had originally planned to contribute $38bn to the new fund. However, its Vision Fund I was badly affected by the Covid-19 pandemic and losses resulting in lower valuations of its investments in Uber and WeWork.In February 2020, the Japanese conglomerate decided to inject more money into the Vision Fund II before raising new funds from other LPs. With $10bn committed to the second fund by the SoftBank Group, the new fund has now invested in 13 portfolio companies including co-leading the Series C round for XAG in November 2020.

Founded in 2015, M25 is an early-stage VC based in Chicago, investing solely in companies headquartered in the US Midwest across tech sectors, almost exclusively at seed stage. It currently has 77 companies in its portfolio and has managed eight exits to date. Its most recent investments include in gaming monetization app Metafy’s $3m seed round in December 2020 and in the $2.7m seed round of mobile online store creation app CASHDROP in August 2020. It invests from $100,000 at the idea stage through to $25m per startup.Im sorry but I dont see that investing in 15 different sectors is actually a focus that is why I put General. it´s mosre like what sectors do they not invest in?

Founded in 2015, M25 is an early-stage VC based in Chicago, investing solely in companies headquartered in the US Midwest across tech sectors, almost exclusively at seed stage. It currently has 77 companies in its portfolio and has managed eight exits to date. Its most recent investments include in gaming monetization app Metafy’s $3m seed round in December 2020 and in the $2.7m seed round of mobile online store creation app CASHDROP in August 2020. It invests from $100,000 at the idea stage through to $25m per startup.Im sorry but I dont see that investing in 15 different sectors is actually a focus that is why I put General. it´s mosre like what sectors do they not invest in?

Based in Amsterdam, BC Begin Capital Limited was established in April 2019 by Alexey Menn as managing partner in Moscow. The VC has invested in five startups. In 2019, it invested in e-grocery food delivery service Samokat that was acquired by Mail.Ru Group.In February 2020, the international firm was lead investor for Finnish fashion marketplace Zadaa, raising €3.5m for its Series A round. Both Begin Capital and Bulgaria’s BrightCap Ventures were lead investors for Woom, raising €2m in May. The two investments are the biggest so far, compared to previous fundraisers for startups like Bulbshare in March 2020.

Based in Amsterdam, BC Begin Capital Limited was established in April 2019 by Alexey Menn as managing partner in Moscow. The VC has invested in five startups. In 2019, it invested in e-grocery food delivery service Samokat that was acquired by Mail.Ru Group.In February 2020, the international firm was lead investor for Finnish fashion marketplace Zadaa, raising €3.5m for its Series A round. Both Begin Capital and Bulgaria’s BrightCap Ventures were lead investors for Woom, raising €2m in May. The two investments are the biggest so far, compared to previous fundraisers for startups like Bulbshare in March 2020.

Established in 2015, Unovis Asset Management is a New York-based investor focussed on the alternative protein sector. It has raised two funds to date, the New Crop Capital Trust and The Alternative Protein Fund. It aims to transform the global food system by investing in solutions that facilitate sustained behavioral change and eliminate the consumption of animal protein products. It partners with entrepreneurs developing innovative plant-based and cultivated replacements to animal products, including meat, seafood, dairy and eggs. It currently has 33 companies in its portfolio and has managed three exits to date including Beyond Meat. Its recent investments include the undisclosed convertible note round of Spanish plant-based meat startup Foods for Tomorrow in May 2020 and in the $28m seed round of US plant-based startup Alpha Foods in February 2020.

Established in 2015, Unovis Asset Management is a New York-based investor focussed on the alternative protein sector. It has raised two funds to date, the New Crop Capital Trust and The Alternative Protein Fund. It aims to transform the global food system by investing in solutions that facilitate sustained behavioral change and eliminate the consumption of animal protein products. It partners with entrepreneurs developing innovative plant-based and cultivated replacements to animal products, including meat, seafood, dairy and eggs. It currently has 33 companies in its portfolio and has managed three exits to date including Beyond Meat. Its recent investments include the undisclosed convertible note round of Spanish plant-based meat startup Foods for Tomorrow in May 2020 and in the $28m seed round of US plant-based startup Alpha Foods in February 2020.

Launched in 2015 in Brussels, EIT Food was established by the not-for-profit European Institute of Innovation & Technology (EIT) and funded by the European Union as an investor and accelerator. Its aim is to support mainly European startups in foodtech areas ranging from traceability to alternative proteins, with sustainability a key deciding factor in the startups it backs from pre-seed to Series-B level. The organization currently has 55 startups in its portfolio, which raised more than €91m in investments in 2020. Its most recent investments include 700,000 Swiss francs (€637,000) in the seed round in January 2021 of Swiss biotech SwissDeCode, a company that applies DNA testing to food traceability. Another investment was the December 2020 €900,000 seed round of Spanish compostable-packaging tech Food Sourcing Specialists.

Launched in 2015 in Brussels, EIT Food was established by the not-for-profit European Institute of Innovation & Technology (EIT) and funded by the European Union as an investor and accelerator. Its aim is to support mainly European startups in foodtech areas ranging from traceability to alternative proteins, with sustainability a key deciding factor in the startups it backs from pre-seed to Series-B level. The organization currently has 55 startups in its portfolio, which raised more than €91m in investments in 2020. Its most recent investments include 700,000 Swiss francs (€637,000) in the seed round in January 2021 of Swiss biotech SwissDeCode, a company that applies DNA testing to food traceability. Another investment was the December 2020 €900,000 seed round of Spanish compostable-packaging tech Food Sourcing Specialists.

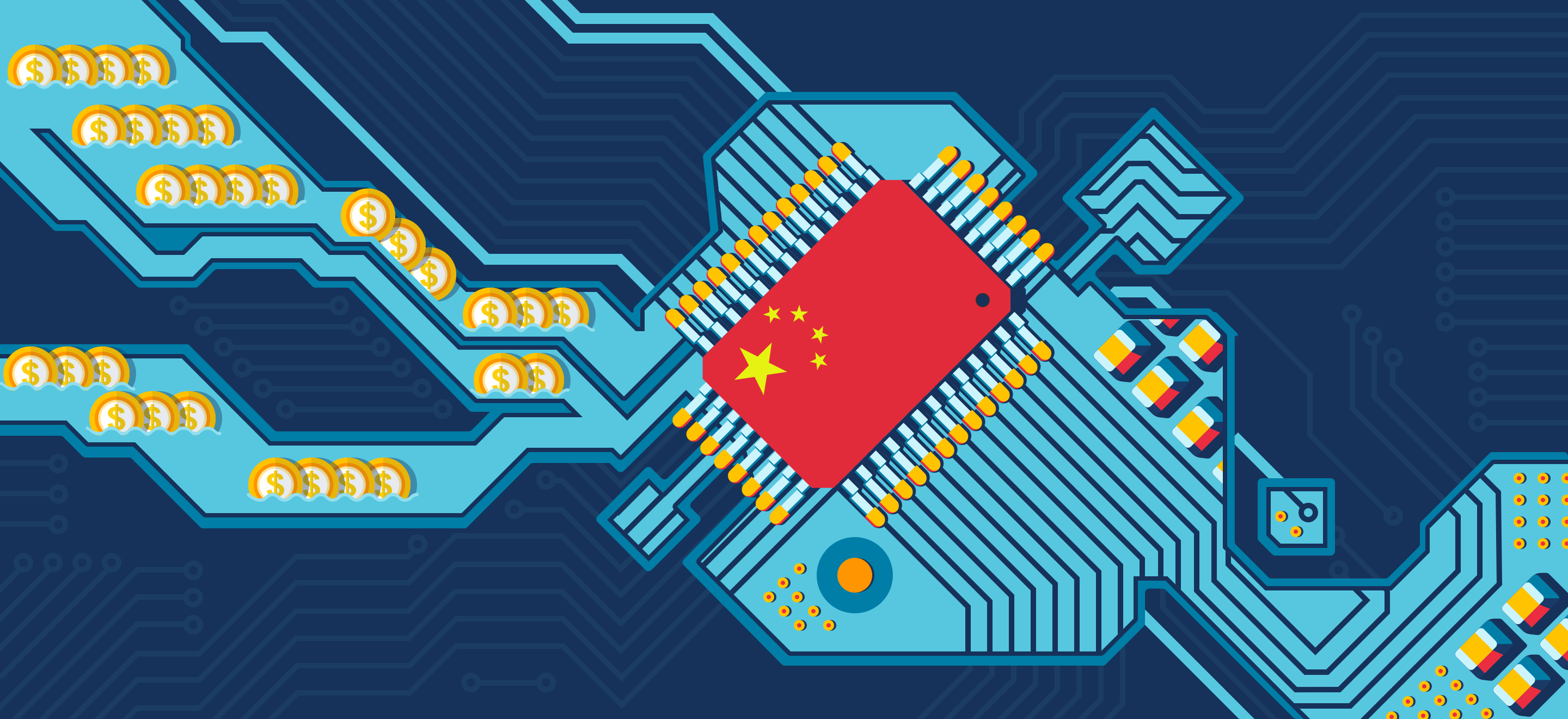

Chinese startups join the race to address chip shortage amid funding boom

Would an overheated semiconductor startup scene and the ability to design cutting-edge chips be enough to help China achieve chip self-sufficiency?

X1 Wind's PivotBuoy: Innovative floating platform to help scale offshore wind energy

With a downwind turbine on its patented single point mooring system, Spanish startup X1 Wind aims to disrupt the market with light, cheaper and easy to install offshore platforms

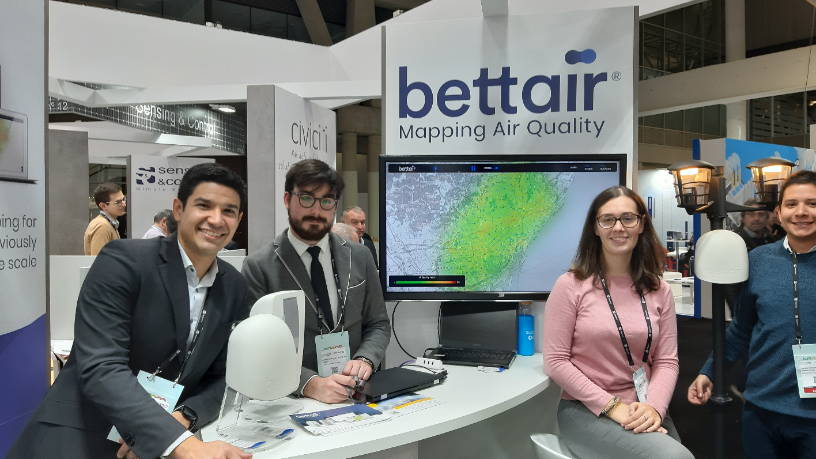

Bettair's air pollution monitoring system for cities promises over 90% accuracy

Combining smart sensors, AI and machine learning, Barcelona-based Bettair has developed a unique, affordable PaaS to accurately measure pollution levels in urban areas

Omniflow gets €2 million boost for its solar-, wind-powered IoT street lights

Thanks to Portugal's Omniflow, renewable energy street lamps doubling up as Wi-Fi hotspots, e-chargers and traffic monitors may soon be ubiquitous street furniture in tomorrow's smart cities

Spain's 3D printing revolution to drive various sectors' growth

From medical splints to meat-free burgers, multimillion-dollar 3D tech hubs are spawning new verticals across Spain

Cubiq Foods: Bioreactor farms producing the food of tomorrow

Growing appetite for meat alternatives expected to fuel demand for Cubiq’s low calorie, Omega 3-enriched lab-grown fats

Neosentec: Open source SaaS helping enterprises create customized AR experiences

Neosentec has created an open source SaaS for businesses to offer customized AR experiences

Xhockware's YouBeep app for speedy checkout, higher customer spending

Besides cutting checkout time to under 1 minute, this in-store shopping app also has other bright ideas: targeted marketing, allergy warnings, even wine-pairing tips

Harnessing its innovative startups, Portugal builds a better cleantech ecosystem

With help from government and private-sector initiatives, Portuguese cleantech startups are playing an ever-increasing role in helping the country meet its energy challenges while cutting harmful greenhouse gases

Circular economy: Discarded goods get a new lease of life in Spain

From e-chargers inside phone booths, recycling chatbots to refurbished stadium seats from Atlético Madrid, the offbeat magic of the circular economy is fast becoming a lucrative business in Spain

New Food Invest: Plant-based cheese, the next investment boom?

With alt-protein startups experiencing a global funding boom, industry experts and investors share their views about emerging trends in diverse food sectors

HighPitch 2020: Goers wins Indonesia's national startup competition

Event ticketing startup Goers gains new revenue streams with pivot to helping leisure spots go online; hotel SaaS Izy and on-demand medical testing service CekLab also in top three

Backed by pharmas, doctors, medtech startup DyCare is expanding fast across Europe

Its remote musculoskeletal rehabilitation and monitoring system sets to improve rehabilitation outcomes in an overtaxed sector

SigmaRail in funding talks, eyes 10-fold surge in revenue

The profitable Madrid-based startup is behind the “Google Maps” for railways to help make trains safer and provide better services

AddVolt: Taking the diesel out of cold-chain transport to make it cleaner, more efficient

The Porto-based startup is winning over the refrigerated goods transportation industry in Europe with the world's first renewable energy plug-in electrical system for the sector

Sorry, we couldn’t find any matches for“Horizon 2020”.