Korea

-

DATABASE (25)

-

ARTICLES (36)

Crevisse Partners is a South Korean investor and venture builder with an impact focus. Its name stands for “Creative, Visionary and Social Entrepreneurs”. Originally incorporated in 2004, Crevisse claims to be the first impact investor in Korea, even before such terms became commonplace. The company strives to develop businesses in sectors “where the market principle wasn’t working”.Crevisse has internally incubated a number of companies in South Korea, such as reusable drinking cup company BringYourCup, sustainable forestry firm Forest Trust, and fundraising service DONUS. Crevisse Ventures is the company’s dedicated VC arm that manages a $20m fund and a number of blended finance funds through collaborations with government agencies and financial institutions. In particular, Crevisse Ventures focuses on startups that solve problems in four major areas: urban communities; climate and energy; education and welfare; as well as jobs and economic growth.

Crevisse Partners is a South Korean investor and venture builder with an impact focus. Its name stands for “Creative, Visionary and Social Entrepreneurs”. Originally incorporated in 2004, Crevisse claims to be the first impact investor in Korea, even before such terms became commonplace. The company strives to develop businesses in sectors “where the market principle wasn’t working”.Crevisse has internally incubated a number of companies in South Korea, such as reusable drinking cup company BringYourCup, sustainable forestry firm Forest Trust, and fundraising service DONUS. Crevisse Ventures is the company’s dedicated VC arm that manages a $20m fund and a number of blended finance funds through collaborations with government agencies and financial institutions. In particular, Crevisse Ventures focuses on startups that solve problems in four major areas: urban communities; climate and energy; education and welfare; as well as jobs and economic growth.

Dayli Partners is a VC company in South Korea that specializes in biotech and healthcare investments. It is a partner of Korea's TIPS (Tech Incubator Program for Startups) initiative, which aims to find the best startups in the country and help them develop their potential. As of December 2019, it has an AUM total of $170.7m and aims to manage $350m in assets by the end of 2020.

Dayli Partners is a VC company in South Korea that specializes in biotech and healthcare investments. It is a partner of Korea's TIPS (Tech Incubator Program for Startups) initiative, which aims to find the best startups in the country and help them develop their potential. As of December 2019, it has an AUM total of $170.7m and aims to manage $350m in assets by the end of 2020.

Founded in October 1962, Mando Corporation is a South Korean automotive parts manufacturer. It supplies many automobile manufacturers worldwide, including General Motors, Volkswagen, Chrysler, Ford, Nissan, Hyundai, Kia, Suzuki and Chevrolet. With more than 11,000 staff, Mando Corporation produces 4m automotive parts per year, generating annual sales of US$4.74bn in 2018. The company was listed on the Korea Stock Exchange in May 2010; its controlling shareholder is Halla Holdings Corp.

Founded in October 1962, Mando Corporation is a South Korean automotive parts manufacturer. It supplies many automobile manufacturers worldwide, including General Motors, Volkswagen, Chrysler, Ford, Nissan, Hyundai, Kia, Suzuki and Chevrolet. With more than 11,000 staff, Mando Corporation produces 4m automotive parts per year, generating annual sales of US$4.74bn in 2018. The company was listed on the Korea Stock Exchange in May 2010; its controlling shareholder is Halla Holdings Corp.

One Store is a Korean Android app store launched in 2016 as a collaboration between Korea’s three mobile carriers, namely SK Telecom, KT Corp. and LG Uplus Corp., and portal operator Naver, aiming to break into the local applications market, dominated by Google and Apple. It has beaten Apple Store to become the second-biggest app store in South Korea. One Store has also joined hands with Microsoft to expand into overseas markets by 2022.

One Store is a Korean Android app store launched in 2016 as a collaboration between Korea’s three mobile carriers, namely SK Telecom, KT Corp. and LG Uplus Corp., and portal operator Naver, aiming to break into the local applications market, dominated by Google and Apple. It has beaten Apple Store to become the second-biggest app store in South Korea. One Store has also joined hands with Microsoft to expand into overseas markets by 2022.

Shinhan is a Korea-based investment bank that provides commercial and consumer banking-related financial and investment services, aiming to help clients achieve their goals by providing financial products and services that meet the latest trends while delivering high returns. It seeks innovative new solutions using a methodology it calls "creative finance," which it believes will attract more clients, in turn increasing Shinhan’s corporate value and leading to a "virtuous cycle of shared prosperity."

Shinhan is a Korea-based investment bank that provides commercial and consumer banking-related financial and investment services, aiming to help clients achieve their goals by providing financial products and services that meet the latest trends while delivering high returns. It seeks innovative new solutions using a methodology it calls "creative finance," which it believes will attract more clients, in turn increasing Shinhan’s corporate value and leading to a "virtuous cycle of shared prosperity."

Pegasus Tech Ventures (Fenox Venture Capital)

Established in 2011, Fenox Venture Capital (now Pegasus Tech Ventures) is a Silicon Valley-based venture capital firm. It has offices across seven countries, including Japan, Indonesia, and South Korea. Its investment portfolio includes Memebox, Tech in Asia and 99.co. In Indonesia, the firm has invested in HijUp, BrideStory, Jurnal and Alodokter. Other notable investments include Airbnb, 23andMe, and Robinhood.The VC firm is the organizer of the Startup World Cup, a global pitching competition for tech startups that offers a grand prize of $1m in cash investment.

Established in 2011, Fenox Venture Capital (now Pegasus Tech Ventures) is a Silicon Valley-based venture capital firm. It has offices across seven countries, including Japan, Indonesia, and South Korea. Its investment portfolio includes Memebox, Tech in Asia and 99.co. In Indonesia, the firm has invested in HijUp, BrideStory, Jurnal and Alodokter. Other notable investments include Airbnb, 23andMe, and Robinhood.The VC firm is the organizer of the Startup World Cup, a global pitching competition for tech startups that offers a grand prize of $1m in cash investment.

Established in Shanghai in 1992, Greenland Holding Group, also known as Greenland Group, is a state-owned real estate developer. It manages projects in over 100 cities in nine countries, including the US, Australia, Canada, the UK, Germany, Japan, South Korea and Malaysia. It holds assets worth nearly $120bn, and has ranked among Fortune Global 500 for nine consecutive years. The company went public in Shanghai in 2015. Beyond real estate, Greenland has diversified its portfolio by expanding into related sectors, such as retail and transportation.

Established in Shanghai in 1992, Greenland Holding Group, also known as Greenland Group, is a state-owned real estate developer. It manages projects in over 100 cities in nine countries, including the US, Australia, Canada, the UK, Germany, Japan, South Korea and Malaysia. It holds assets worth nearly $120bn, and has ranked among Fortune Global 500 for nine consecutive years. The company went public in Shanghai in 2015. Beyond real estate, Greenland has diversified its portfolio by expanding into related sectors, such as retail and transportation.

Founded by Zhang Guiping, brother of Suning Commerce Group Chairman Zhang Jindong. The Zhang brothers co-founded Suning in 1987 and divided the business in 1999 into Suning Universal, listed as one of the top 20 real estate companies in China, and Suning Commerce, one of the largest appliance retailers in China. The investment conducted by Suning Universal in China mainly focuses on culture and entertainment industry. Suning Universal is expanding to the US, Hong Kong, Singapore, Canada, Australia, France and South Korea, seeking investment opportunities in real estate, entertainment, healthcare, and culture industries.

Founded by Zhang Guiping, brother of Suning Commerce Group Chairman Zhang Jindong. The Zhang brothers co-founded Suning in 1987 and divided the business in 1999 into Suning Universal, listed as one of the top 20 real estate companies in China, and Suning Commerce, one of the largest appliance retailers in China. The investment conducted by Suning Universal in China mainly focuses on culture and entertainment industry. Suning Universal is expanding to the US, Hong Kong, Singapore, Canada, Australia, France and South Korea, seeking investment opportunities in real estate, entertainment, healthcare, and culture industries.

As the Korean conglomerate’s gateway to deep tech startups and innovation, Samsung NEXT covers product development, investment, M&A and partnerships in a single entity to complement Samsung’s hardware business. Outside of South Korea, Samsung NEXT has offices in Berlin, Tel Aviv and in the US in New York, San Francisco, and Silicon Valley. Its portfolio currently includes 55 companies with recent investments including in Series A rounds for Tetrate, Brodmann17 and RapidDeploy, as well as Healthy.io's Series B. It has managed 13 exits to date, including LoopPay, Automated Insights and EyeVerify. The VC was established in 2013.

As the Korean conglomerate’s gateway to deep tech startups and innovation, Samsung NEXT covers product development, investment, M&A and partnerships in a single entity to complement Samsung’s hardware business. Outside of South Korea, Samsung NEXT has offices in Berlin, Tel Aviv and in the US in New York, San Francisco, and Silicon Valley. Its portfolio currently includes 55 companies with recent investments including in Series A rounds for Tetrate, Brodmann17 and RapidDeploy, as well as Healthy.io's Series B. It has managed 13 exits to date, including LoopPay, Automated Insights and EyeVerify. The VC was established in 2013.

Founded in 1994, London-based Hermes GPE is a subsidiary of NYSE-listed Federated Hermes Inc (FHI). The UK limited liability partnership (LLP) is one of the UK’s leading independent investors with $7bn pumped into 260 funds. With a network of over 300 general partners worldwide, the LLP also works with global LPs like BT Pension Scheme, Royal Bank of Scotland and Korea Teachers Credit Union.Hermes started investing in tech startups in 2002 and has provided over $3.7bn worth of co-funding to both tech and non-tech startups via 234 fundraising rounds. Managing assets worth $6bn and international offices in New York and Singapore, sustainability is at the core of its investing portfolio of over 113 startups worldwide. In 2021, recent investments include participation in the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August and May’s $125m Series B round of Paysend, the UK-based card-to-card pioneer and international payments platform.

Founded in 1994, London-based Hermes GPE is a subsidiary of NYSE-listed Federated Hermes Inc (FHI). The UK limited liability partnership (LLP) is one of the UK’s leading independent investors with $7bn pumped into 260 funds. With a network of over 300 general partners worldwide, the LLP also works with global LPs like BT Pension Scheme, Royal Bank of Scotland and Korea Teachers Credit Union.Hermes started investing in tech startups in 2002 and has provided over $3.7bn worth of co-funding to both tech and non-tech startups via 234 fundraising rounds. Managing assets worth $6bn and international offices in New York and Singapore, sustainability is at the core of its investing portfolio of over 113 startups worldwide. In 2021, recent investments include participation in the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August and May’s $125m Series B round of Paysend, the UK-based card-to-card pioneer and international payments platform.

- 1

- 2

TheVentures founders launch Singapore VC to drive deals in Southeast Asia

The Korean Viki co-founders return to Singapore as venture builders and investors, offering South Korean partnerships and “CTO-as-a-service” in Southeast Asia

Alodokter wants personalised healthcare on tap

The Indonesian healthcare startup recently got a US$9 million Series B funding for expansion.

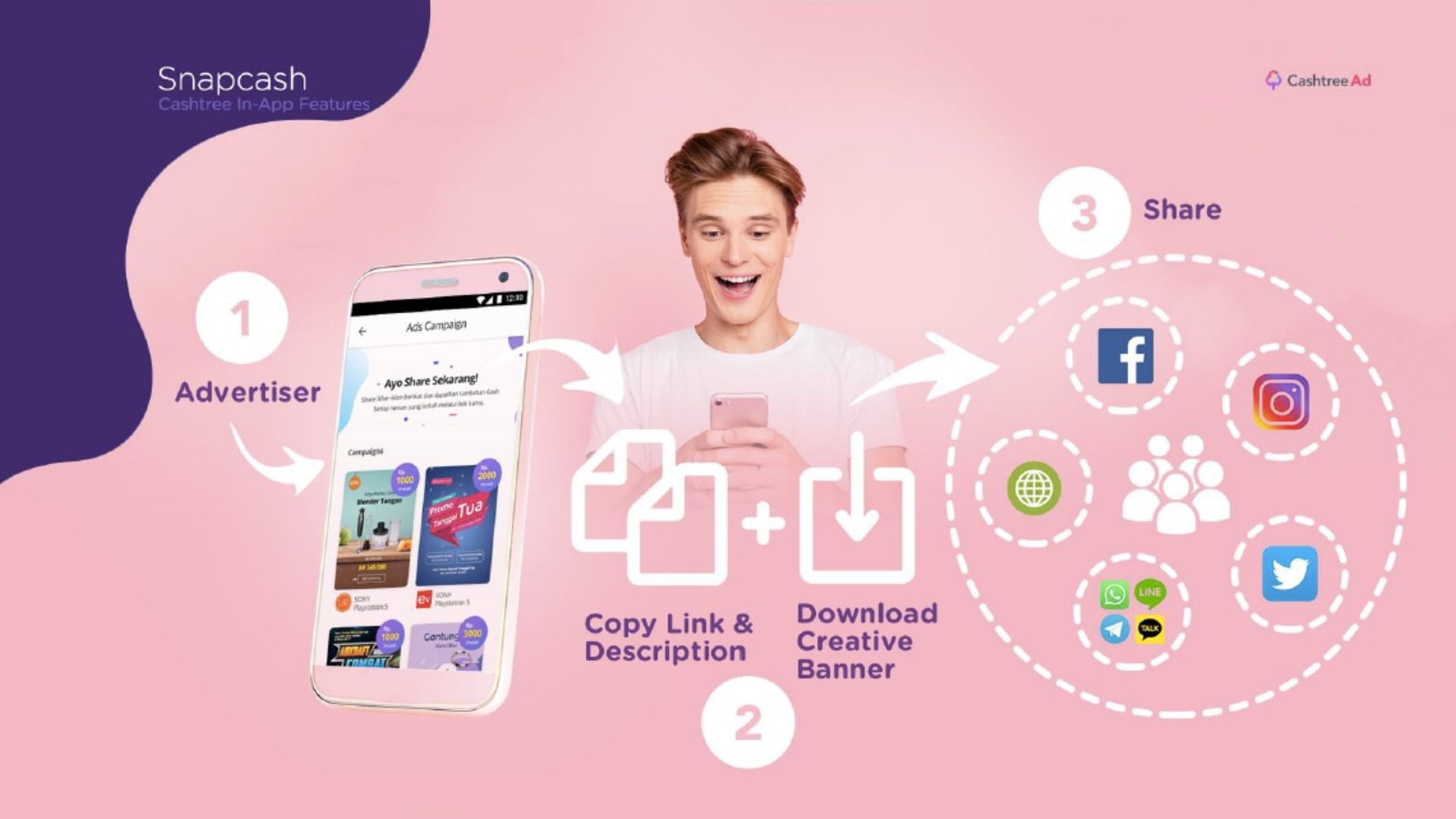

Cashtree combines locksreen ads and rewards-based marketing to help businesses go viral

The Indonesian mobile advertising platform encourages users to share ads on social media and WhatsApp so they go viral

SWITCH Singapore: Investors highlight Vietnam startup ecosystem's potential and resilience

The quality of Vietnam’s local talent remains one of its biggest strengths, but foreign investors also need to be patient and be familiar with the local regulatory landscape

New Food Invest: Challenges of growing an alt-protein startup

Founders of three alt-protein startups in the US share what motivated them to start, their personal experiences growing the businesses, getting funding and finding strategic partners

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

HighPitch 2020: Waste management play Octopus, digital concierge service Izy win Makassar battle

Both startups have scored strong traction despite the weight of Covid-19; they are also expanding and keen to explore new opportunities

Future Food Asia 2021 announces finalists for $100,000 prize

Ten startups from agrifood tech and cleantech sectors will pitch during the five-day conference, are also eligible for two more prizes from sponsors Cargill and Thai Wah

Raising $50m second fund, Indogen Capital seeks more international partners and exits

Cooperation is key to Indogen's investment thesis, as it looks to help more foreign VCs and their portfolio startups find success in Southeast Asia's biggest market

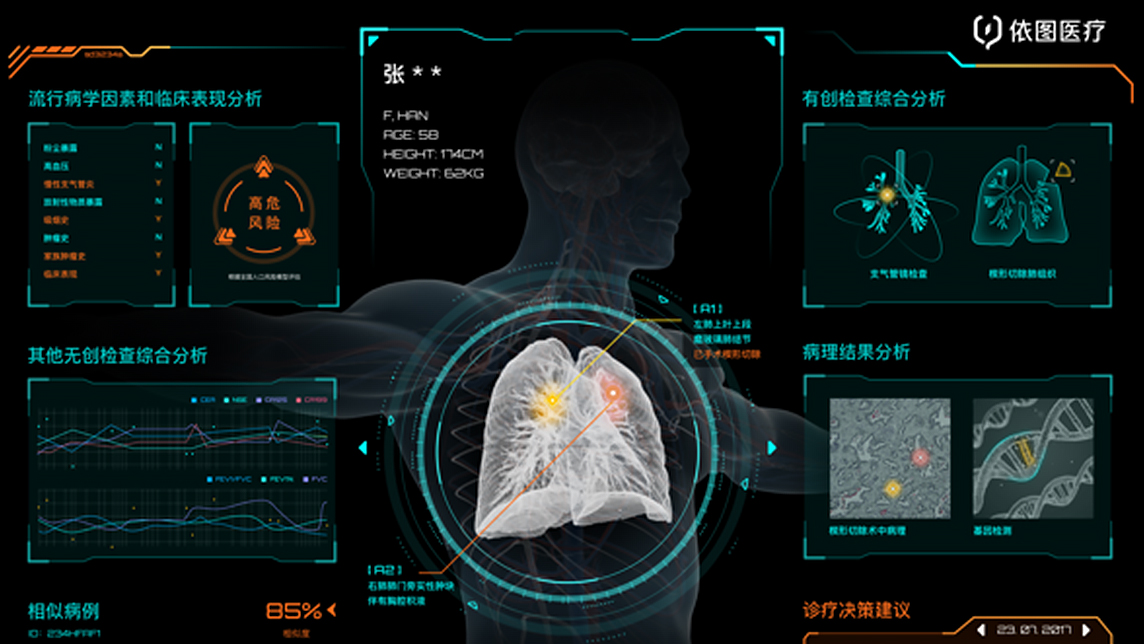

YITU takes smart healthcare to the next level

AI programs developed by this Chinese medtech startup provide more accurate diagnoses by reading medical images in conjunction with patients’ medical records

Zymvol Biomodeling: In the footsteps of Chemistry Nobel Prize winner Frances H. Arnold

Startup founded by scientists helps industries discover and develop enzymes cheaply through computer-driven innovation

This e-retailer uses influencers to sell niche brand cosmetics in high-growth markets

Huajuan Mall is a popular makeup e-mall for young women in smaller Chinese cities, turning little-known local brands into big hits

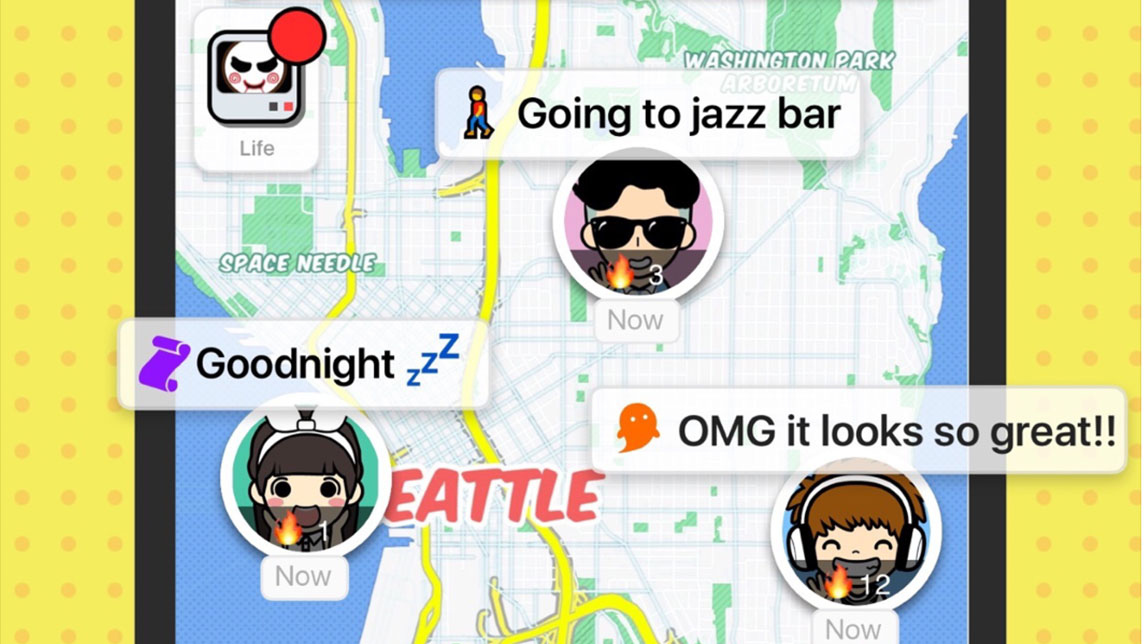

"Spot" your friends, live chat and share music with this social mapping app

Spot, a new challenger to China's WeChat, is using pop-up song lyrics to entice youths to live chat and play games

ZendMoney: Putting cash back into the pockets of Indonesian migrant workers

ZendMoney's unique remittance concept has already helped 90,000 migrant workers send money back home

Bound4Blue taps aeronautical technology for sustainable shipping solutions

Bound4Blue's wind-assisted vessel propulsion saves 40% on fuel costs in a €200bn market; eyes European, Asian expansion

Sorry, we couldn’t find any matches for“Korea”.