ReCircula Solutions

-

DATABASE (158)

-

ARTICLES (275)

Using deep learning, computer vision and NLP, DeepSolutions optimizes the accuracy of CCTV video analytics; builds 3D reconstructions from video for use in multiple verticals.

Using deep learning, computer vision and NLP, DeepSolutions optimizes the accuracy of CCTV video analytics; builds 3D reconstructions from video for use in multiple verticals.

Rising Ventures is a Portuguese seed/early-stage VC firm founded in 2014. Its current portfolio consists of startups that provide B2B tech solutions.

Rising Ventures is a Portuguese seed/early-stage VC firm founded in 2014. Its current portfolio consists of startups that provide B2B tech solutions.

CMO, CPO and co-founder of CrowdDana

Stevanus Iskandar Halim graduated with an associate's degree in Computer Science from Bellevue College in the US and continued to pursue a bachelor's degree at UC Irvine. During his time at university, he developed and monetized games for the iOS platform.After graduating from UCI, he returned to Indonesia and joined Ematic Solutions, an email-based marketing campaign solutions company. After two years, he left the company in 2019 to develop equity crowdfunding platform CrowdDana together with university acquaintance James Wiryadi and Ematic colleague Handison Jaya.

Stevanus Iskandar Halim graduated with an associate's degree in Computer Science from Bellevue College in the US and continued to pursue a bachelor's degree at UC Irvine. During his time at university, he developed and monetized games for the iOS platform.After graduating from UCI, he returned to Indonesia and joined Ematic Solutions, an email-based marketing campaign solutions company. After two years, he left the company in 2019 to develop equity crowdfunding platform CrowdDana together with university acquaintance James Wiryadi and Ematic colleague Handison Jaya.

Co-founder and ex-CTO of GOI

Alberto López Ganan graduated in Informatics from Esteve Terradas i Illa in 2006 and worked as a programmer until 2011 when he decided to become an entrepreneur. While in Barcelona, López co-founded market research firm Meriendacena Producciones in 2011 and iLike IT Solutions in 2012.It was during this period that he met Yaiza Canosa Ferrío and co-founded GOI Travel SL in 2015. He also started fintech Wadify in 2016 that he continues to run but left GOI in May 2018. He also exited Meriendacena Producciones and iLike IT Solutions in 2017 to join Primos NYC Inc as CTO.

Alberto López Ganan graduated in Informatics from Esteve Terradas i Illa in 2006 and worked as a programmer until 2011 when he decided to become an entrepreneur. While in Barcelona, López co-founded market research firm Meriendacena Producciones in 2011 and iLike IT Solutions in 2012.It was during this period that he met Yaiza Canosa Ferrío and co-founded GOI Travel SL in 2015. He also started fintech Wadify in 2016 that he continues to run but left GOI in May 2018. He also exited Meriendacena Producciones and iLike IT Solutions in 2017 to join Primos NYC Inc as CTO.

Co-founder and CMO of Zaask

Kiruba Shankar Eswaran holds a bachelor’s in Engineering from Anna University and an MBA from The Lisbon MBA while on a full merit scholarship. Following that, he was a manager of mobile payments at mobile engagement solutions firm TIMWE.

Kiruba Shankar Eswaran holds a bachelor’s in Engineering from Anna University and an MBA from The Lisbon MBA while on a full merit scholarship. Following that, he was a manager of mobile payments at mobile engagement solutions firm TIMWE.

Co-founder of SmartAHC

Chen Haokai has a bachelor’s degree and a PhD in integrated circuit design from Nanyang Technological University in Singapore. Before co-founding SmartAHC in 2014, he worked as an executive at Marvell Asia, a global supplier of semiconductor solutions.

Chen Haokai has a bachelor’s degree and a PhD in integrated circuit design from Nanyang Technological University in Singapore. Before co-founding SmartAHC in 2014, he worked as an executive at Marvell Asia, a global supplier of semiconductor solutions.

Grupo Cosimet primarily exports metallic components all over Europe. Originally a family business, the group has diversified investments in renewable energy, healthcare and civil engineering; as well as new and emerging technologies.The company participates in key projects like energy storage company SaltX Technology Holding, that trades on Nasdaq First North. Its subsidiary Suncool manufactures solar cooling panels in China. Another investment is Wisekey, a Swiss-based company that develops web-security solutions. The company has also invested in ChainGo, a Spanish blockchain platform that builds logistics solutions for ocean freight.

Grupo Cosimet primarily exports metallic components all over Europe. Originally a family business, the group has diversified investments in renewable energy, healthcare and civil engineering; as well as new and emerging technologies.The company participates in key projects like energy storage company SaltX Technology Holding, that trades on Nasdaq First North. Its subsidiary Suncool manufactures solar cooling panels in China. Another investment is Wisekey, a Swiss-based company that develops web-security solutions. The company has also invested in ChainGo, a Spanish blockchain platform that builds logistics solutions for ocean freight.

Founded in 1995, Digital Garage aims to provide new contexts for businesses by integrating the three technologies of Information (IT), Marketing (MT) and Finance (FT) to create seamless solutions. It has invested in more than 50 companies.

Founded in 1995, Digital Garage aims to provide new contexts for businesses by integrating the three technologies of Information (IT), Marketing (MT) and Finance (FT) to create seamless solutions. It has invested in more than 50 companies.

Formerly known as CrunchFund, Tuesday Capital was founded in 2011 in San Francisco. The VC was rebranded as Tuesday Capital in 2019 and invests in the early stage rounds. Its investment focus includes SaaS, mobile and IT solutions.

Formerly known as CrunchFund, Tuesday Capital was founded in 2011 in San Francisco. The VC was rebranded as Tuesday Capital in 2019 and invests in the early stage rounds. Its investment focus includes SaaS, mobile and IT solutions.

Besides being an investor, Evolution Venture Partners provides effective solutions for VCs and their portfolio companies in looking for a capital raise, a strategic transaction, or in the event that the board decides to wind a company down. Established in 2008, Evolution has invested in the US, Europe and in emerging markets and has a special interest in information security, enterprise software and solutions, consumer products. healthcare and biotechnology.

Besides being an investor, Evolution Venture Partners provides effective solutions for VCs and their portfolio companies in looking for a capital raise, a strategic transaction, or in the event that the board decides to wind a company down. Established in 2008, Evolution has invested in the US, Europe and in emerging markets and has a special interest in information security, enterprise software and solutions, consumer products. healthcare and biotechnology.

Mercy Corps’ Social Venture Fund

Mercy Corps’ Social Venture Fund is a seed and early-stage social impact fund operated by not-for-profit humanitarian organization Mercy Corps. The US-based organization is increasingly moving into tech investments, with key interests in agtech and fintech solutions creating social impact. FinX, a platform designed to accelerate financial inclusion worldwide, was also launched recently. Distributed ledgers, digital assets, cryptocurrencies and other digital financial solutions will be deployed to alleviate poverty in local communities. The fund has invested in 16 companies at the seed stage. Investments in the February 2021 included a pre-seed round for Kenyan healthcare fintech platform ImaliPay. In December 2020, it joined a $5.3m seed round for Colombian remittance tech Valiu.

Mercy Corps’ Social Venture Fund is a seed and early-stage social impact fund operated by not-for-profit humanitarian organization Mercy Corps. The US-based organization is increasingly moving into tech investments, with key interests in agtech and fintech solutions creating social impact. FinX, a platform designed to accelerate financial inclusion worldwide, was also launched recently. Distributed ledgers, digital assets, cryptocurrencies and other digital financial solutions will be deployed to alleviate poverty in local communities. The fund has invested in 16 companies at the seed stage. Investments in the February 2021 included a pre-seed round for Kenyan healthcare fintech platform ImaliPay. In December 2020, it joined a $5.3m seed round for Colombian remittance tech Valiu.

AI- and NLP-powered software accelerating clinical research by structuring relevant patient big data and facilitating clinical data searches, with dramatic improvements of up to 90%.

AI- and NLP-powered software accelerating clinical research by structuring relevant patient big data and facilitating clinical data searches, with dramatic improvements of up to 90%.

Trio.AI’s semantics-based AI interaction system solution enables people to interact with various smart devices or virtual agents using natural language.

Trio.AI’s semantics-based AI interaction system solution enables people to interact with various smart devices or virtual agents using natural language.

Co-founder and CTO of Nodeflux

After graduating from Indonesia’s Institut Teknologi Bogor (ITB) with a degree in Industrial Engineering, Faris Rahman worked as a freelance app developer and project coordinator who built custom HR and accounting solutions for Indonesian companies. Faris also had a stint with multinational firm KBR Inc and started a short-lived venture, Travellist-tour. In 2016, he established computer vision startup Nodeflux.

After graduating from Indonesia’s Institut Teknologi Bogor (ITB) with a degree in Industrial Engineering, Faris Rahman worked as a freelance app developer and project coordinator who built custom HR and accounting solutions for Indonesian companies. Faris also had a stint with multinational firm KBR Inc and started a short-lived venture, Travellist-tour. In 2016, he established computer vision startup Nodeflux.

Circular economy: Discarded goods get a new lease of life in Spain

From e-chargers inside phone booths, recycling chatbots to refurbished stadium seats from Atlético Madrid, the offbeat magic of the circular economy is fast becoming a lucrative business in Spain

Bound4Blue taps aeronautical technology for sustainable shipping solutions

Bound4Blue's wind-assisted vessel propulsion saves 40% on fuel costs in a €200bn market; eyes European, Asian expansion

Cocuus: Industrial-scale solutions to design and print food

This Spanish startup is pioneering industrial-scale 3D food printing using inkjet and laser technology that prints up to 30 times faster with eye-catching food designs

Ecertic Digital Solutions: A Spanish leader in online ID verification

The Spanish biometric tech startup offers online ID verification and tracked document solutions in a US$10 billion market set to double by 2022

Autodrive Solutions: Making driverless vehicles safer with high-precision positioning tech

A Spanish university's research on sophisticated weapons detection technology is being used to prevent accidents in the mobility and transport sectors

Jakarta Smart City seeks startup solutions for life in post-Covid “new normal”

From collaborative working to cyberbullying, these startups will soon work with Indonesia’s first smart city agency

Gago Inc: Satellite data agritech startup ramps up growth with financial sector solutions

Founded by former NASA scientists, Gago began as a data solution to improve China’s traditionally low-yielding and inefficient smallholder-based farming sector

Covid-19 symptoms checker and contact-tracing apps, virtual classrooms and 3D video-conferencing platforms are among the array of solutions for homebound adults and kids

China reverses ban on street vendors to boost economy, sparking new demand for digital solutions

Alibaba, Tencent, Meituan and other tech giants give roadside vendors digital makeover, so they can compete with fast-food chains like McDonald’s, KFC and Pizza Hut

SWITCH Singapore: Race in agrifood tech as a solution to feeding 10bn people

While the potential gains are huge, giving tech solutions to farmers, especially smallholders in developing countries, remains a work in progress

FIWARE Accelerator: More open source ecosystem than accelerator

The European open source initiative to boost smart infrastructures and solutions is calling for new participants to join its unique acceleration ecosystem

SWITCH Singapore 2021: Tapping the $1tn sustainability market in Southeast Asia

Falling costs and simplified deployment of sustainability solutions will help boost adoption, especially in underprivileged communities

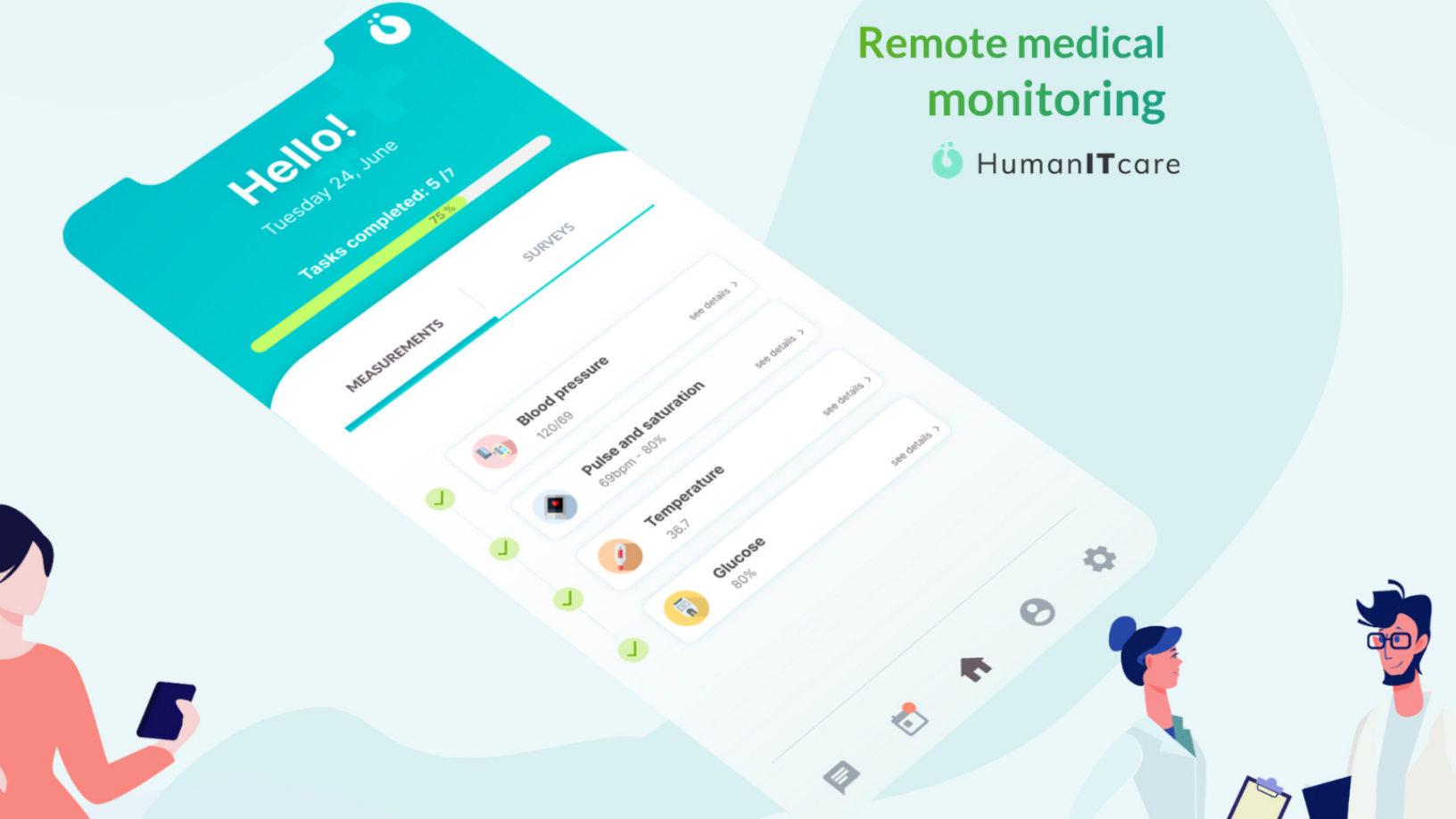

HumanITcare: Covid-19 spurs demand for telemedicine across Spain and beyond

The startup’s revenue is expected to exceed €10m by 2024 due to rapid digital transformation of healthcare services and a growing market for AI-powered medtechs

SWITCH Singapore: Sustainability startups see growing demand from corporates

Sophie’s BioNutrients, Ubiik and Intello Labs also note new trends in technology and supply chain arising from the Covid-19 pandemic, across the food, manufacturing and e-commerce sectors

Haishen Tech: Scan image and find your product in one second

Haishen Tech's AI vending machines will revive unmanned retail economy and tap into growing on-demand consumerism worldwide

Sorry, we couldn’t find any matches for“ReCircula Solutions”.