UK

-

DATABASE (92)

-

ARTICLES (94)

CFO and Co-founder of Solatom

Raul Villalba Van Dijk is currently an energy management consultant at KPMG Madrid, having spent time in the consulting industry in Spain, South Africa and the UK. Since 2016, he has been CFO and a member of the founding team of Solatom, a startup developing solar concentrators for industrial applications. He graduated with a masters in science specializing in thermal energy systems for solar plants. He also holds an MBA from the London Business School.

Raul Villalba Van Dijk is currently an energy management consultant at KPMG Madrid, having spent time in the consulting industry in Spain, South Africa and the UK. Since 2016, he has been CFO and a member of the founding team of Solatom, a startup developing solar concentrators for industrial applications. He graduated with a masters in science specializing in thermal energy systems for solar plants. He also holds an MBA from the London Business School.

The world’s most valuable fintech firm, Ant Financial Services originated from Alipay, the third-party payments platform under the Alibaba Group. Today, it also runs a money-market fund and an online bank. Ant Financial has more than 450 million active users. It has also expanded into foreign markets, including the US, UK, Germany, Thailand and Australia, and expects more than 60% of its transactions to come from outside China by 2026. It targets to serve 2 billion users then.

The world’s most valuable fintech firm, Ant Financial Services originated from Alipay, the third-party payments platform under the Alibaba Group. Today, it also runs a money-market fund and an online bank. Ant Financial has more than 450 million active users. It has also expanded into foreign markets, including the US, UK, Germany, Thailand and Australia, and expects more than 60% of its transactions to come from outside China by 2026. It targets to serve 2 billion users then.

Carlos Gallardo is an industrial engineer with an MBA from Stanford University. He spent most of his career at the pharmaceutical company Almirall and was promoted through the ranks rapidly holding multiple C-level roles. He became the MD for UK and Ireland for over five years and joined Almirall’s board of directors in 2014.In 2015, he founded CG Health Ventures, a VC firm investing in early-stage digital health companies worldwide. He’s also an active angel investor and advisor for startups developing frontier technologies in the healthcare sector.

Carlos Gallardo is an industrial engineer with an MBA from Stanford University. He spent most of his career at the pharmaceutical company Almirall and was promoted through the ranks rapidly holding multiple C-level roles. He became the MD for UK and Ireland for over five years and joined Almirall’s board of directors in 2014.In 2015, he founded CG Health Ventures, a VC firm investing in early-stage digital health companies worldwide. He’s also an active angel investor and advisor for startups developing frontier technologies in the healthcare sector.

Mustard Seed MAZE is a Lisbon-based VC firm that invests in early-stage startups, primarily in social impact enterprises. Endowed with €40m, the VC has invested in projects dealing with food wastage, human trafficking, postnatal depression and general healthcare.So far, it has managed one exit, with the majority of its portfolio of 20 companies based in Europe. Recent investment rounds include $3m seed funding for Portuguese mesh network tech HypeLabs, €1.15m seed round for Spanish fintech StudentFinance and $12m Series B round for UK-based food waste app Winnow.

Mustard Seed MAZE is a Lisbon-based VC firm that invests in early-stage startups, primarily in social impact enterprises. Endowed with €40m, the VC has invested in projects dealing with food wastage, human trafficking, postnatal depression and general healthcare.So far, it has managed one exit, with the majority of its portfolio of 20 companies based in Europe. Recent investment rounds include $3m seed funding for Portuguese mesh network tech HypeLabs, €1.15m seed round for Spanish fintech StudentFinance and $12m Series B round for UK-based food waste app Winnow.

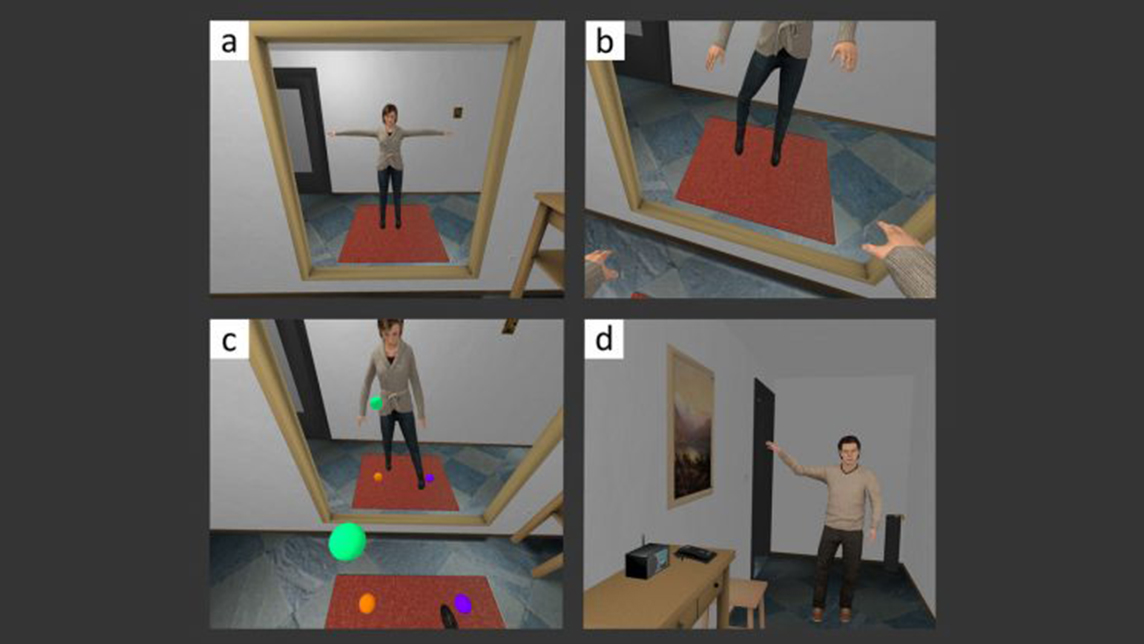

D Moonshots is an investment fund created by Romanian entrepreneur Sacha Dragic, founder of the Superbets online sports betting group. The Cyprus-based investor was founded in 2019 and typically invests €100,000-500,000. To date, the firm has invested in Romanian medtech Medicai’s €500,000 seed round and UK-based soft-skills VR software Bodyswaps’ £470,000 seed funding.

D Moonshots is an investment fund created by Romanian entrepreneur Sacha Dragic, founder of the Superbets online sports betting group. The Cyprus-based investor was founded in 2019 and typically invests €100,000-500,000. To date, the firm has invested in Romanian medtech Medicai’s €500,000 seed round and UK-based soft-skills VR software Bodyswaps’ £470,000 seed funding.

BACKED VC is primarily a seed-stage funder based in London and founded in 2015 that selects its investments based on the founding team rather than on market-based decisions. It typically invests from €0.5m to €2.5m per round and, to date, has invested in 45 startups with two exits so far. Its most recent investments include in the March 2021 £5m Series A round of British legal digitization platform Legl and in the February 2021 £2.7m seed round of UK-based cellular fat producer Hoxton Farms.

BACKED VC is primarily a seed-stage funder based in London and founded in 2015 that selects its investments based on the founding team rather than on market-based decisions. It typically invests from €0.5m to €2.5m per round and, to date, has invested in 45 startups with two exits so far. Its most recent investments include in the March 2021 £5m Series A round of British legal digitization platform Legl and in the February 2021 £2.7m seed round of UK-based cellular fat producer Hoxton Farms.

Established in Shanghai in 1992, Greenland Holding Group, also known as Greenland Group, is a state-owned real estate developer. It manages projects in over 100 cities in nine countries, including the US, Australia, Canada, the UK, Germany, Japan, South Korea and Malaysia. It holds assets worth nearly $120bn, and has ranked among Fortune Global 500 for nine consecutive years. The company went public in Shanghai in 2015. Beyond real estate, Greenland has diversified its portfolio by expanding into related sectors, such as retail and transportation.

Established in Shanghai in 1992, Greenland Holding Group, also known as Greenland Group, is a state-owned real estate developer. It manages projects in over 100 cities in nine countries, including the US, Australia, Canada, the UK, Germany, Japan, South Korea and Malaysia. It holds assets worth nearly $120bn, and has ranked among Fortune Global 500 for nine consecutive years. The company went public in Shanghai in 2015. Beyond real estate, Greenland has diversified its portfolio by expanding into related sectors, such as retail and transportation.

Co-founder, CTO of Sheetgo

Rafael de Alemar Vidal is based in Santa Caterina in Brazil, as the CTO and a co-founder of Sheetgo. He had previously worked for five years as an IT analyst in London UK. He also specialized in Business Information Technology at the South Bank University while in London. After graduating in 2011, he became a Microsoft certified professional in 2013. He returned to Brazil and worked as a systems analyst at Moon Tools and Abramar Construtora. Both companies were co-founded and run by fellow co-founder Yannick Rault van der Vaart.

Rafael de Alemar Vidal is based in Santa Caterina in Brazil, as the CTO and a co-founder of Sheetgo. He had previously worked for five years as an IT analyst in London UK. He also specialized in Business Information Technology at the South Bank University while in London. After graduating in 2011, he became a Microsoft certified professional in 2013. He returned to Brazil and worked as a systems analyst at Moon Tools and Abramar Construtora. Both companies were co-founded and run by fellow co-founder Yannick Rault van der Vaart.

Co-founder, CEO of Polaroo

Marc Rovira is the CEO and co-founder of Spanish household bill manager app Polaroo. In 2017, he joined his brother and a friend to develop the MVP originally known as Widuid. He also co-founded Brainit, an analytical tool for smart devices. He has also worked as a business development and communications manager at space tech Zero2Infinity. He was also a project manager and an engineer. He completed a master's in Entrepreneurship and Innovation at ESADE Business School. He also has a master's in Aerospace, Aeronautical and Astronautical Engineering from the University of Bath, UK.

Marc Rovira is the CEO and co-founder of Spanish household bill manager app Polaroo. In 2017, he joined his brother and a friend to develop the MVP originally known as Widuid. He also co-founded Brainit, an analytical tool for smart devices. He has also worked as a business development and communications manager at space tech Zero2Infinity. He was also a project manager and an engineer. He completed a master's in Entrepreneurship and Innovation at ESADE Business School. He also has a master's in Aerospace, Aeronautical and Astronautical Engineering from the University of Bath, UK.

Founded in 1994, London-based Hermes GPE is a subsidiary of NYSE-listed Federated Hermes Inc (FHI). The UK limited liability partnership (LLP) is one of the UK’s leading independent investors with $7bn pumped into 260 funds. With a network of over 300 general partners worldwide, the LLP also works with global LPs like BT Pension Scheme, Royal Bank of Scotland and Korea Teachers Credit Union.Hermes started investing in tech startups in 2002 and has provided over $3.7bn worth of co-funding to both tech and non-tech startups via 234 fundraising rounds. Managing assets worth $6bn and international offices in New York and Singapore, sustainability is at the core of its investing portfolio of over 113 startups worldwide. In 2021, recent investments include participation in the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August and May’s $125m Series B round of Paysend, the UK-based card-to-card pioneer and international payments platform.

Founded in 1994, London-based Hermes GPE is a subsidiary of NYSE-listed Federated Hermes Inc (FHI). The UK limited liability partnership (LLP) is one of the UK’s leading independent investors with $7bn pumped into 260 funds. With a network of over 300 general partners worldwide, the LLP also works with global LPs like BT Pension Scheme, Royal Bank of Scotland and Korea Teachers Credit Union.Hermes started investing in tech startups in 2002 and has provided over $3.7bn worth of co-funding to both tech and non-tech startups via 234 fundraising rounds. Managing assets worth $6bn and international offices in New York and Singapore, sustainability is at the core of its investing portfolio of over 113 startups worldwide. In 2021, recent investments include participation in the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August and May’s $125m Series B round of Paysend, the UK-based card-to-card pioneer and international payments platform.

Pedro Trinité is the co-founder of ZUVINOVA, a B2B company that owns and operates Transactional Track Record (TTR). The premium online service provides transactional and financial information on Latin American and Iberian markets (M&A, Capital Markets, Project Finance and Acquisition Finance). Before ZUVINOVA, he was a director at Iberpartners and a business consultant for Accenture UK. Trinité received his International MBA degree from IE Business School and his master’s degree in Computer Engineering from Instituto Superior de Informática e Gestão (ISIG). He also attended the Wharton Global Consulting Practicum at the University of Pennsylvania.

Pedro Trinité is the co-founder of ZUVINOVA, a B2B company that owns and operates Transactional Track Record (TTR). The premium online service provides transactional and financial information on Latin American and Iberian markets (M&A, Capital Markets, Project Finance and Acquisition Finance). Before ZUVINOVA, he was a director at Iberpartners and a business consultant for Accenture UK. Trinité received his International MBA degree from IE Business School and his master’s degree in Computer Engineering from Instituto Superior de Informática e Gestão (ISIG). He also attended the Wharton Global Consulting Practicum at the University of Pennsylvania.

UK-based venture capital firm Notion Capital was established in 2009 by SaaS firm MessageLabs founders Stephen Chandler and Jos White. MessageLabs was sold to Symantec for US$700 million the year before. Notion focuses on European enterprise software startups and has about US$350 million under management. The company has invested in 50 startups with a special emphasis on SaaS and Cloud-based applications. It has managed 10 exits to date including Adbrain and NewVoiceMedia. Its recent investments include GoCardless' Series E round, debt financing for DueDil and in Vortexa's Series A round.

UK-based venture capital firm Notion Capital was established in 2009 by SaaS firm MessageLabs founders Stephen Chandler and Jos White. MessageLabs was sold to Symantec for US$700 million the year before. Notion focuses on European enterprise software startups and has about US$350 million under management. The company has invested in 50 startups with a special emphasis on SaaS and Cloud-based applications. It has managed 10 exits to date including Adbrain and NewVoiceMedia. Its recent investments include GoCardless' Series E round, debt financing for DueDil and in Vortexa's Series A round.

Pere Valles is an entrepreneur and angel investor in the Spanish startup ecosystem, sitting on the board of several companies. Valles has been chairman of Spanish digital voting platform Scytl since 2004. In 2018, he was appointed CEO of travel platform Exoticca, which sells long haul touring holidays and has a presence in Spain, France and the UK. He had been a financial director of GlobalNet and a senior manager at KPMG's mergers & acquisitions group in the US.

Pere Valles is an entrepreneur and angel investor in the Spanish startup ecosystem, sitting on the board of several companies. Valles has been chairman of Spanish digital voting platform Scytl since 2004. In 2018, he was appointed CEO of travel platform Exoticca, which sells long haul touring holidays and has a presence in Spain, France and the UK. He had been a financial director of GlobalNet and a senior manager at KPMG's mergers & acquisitions group in the US.

General Atlantic was founded in 1980 as the investment arm of Atlantic Philanthropies, and claims to be the pioneer in growth equity. The US-based company has presence all over the world, including in Indonesia, UK, China, Mexico, and Singapore. As of August 2019, it manages US$35b in assets from global investors. Some major companies that were part of GA's portfolio includes Facebook, Alibaba, Meituan, Saxo Bank, and SEA. Edtech startup Ruangguru is GA's second investment in Indonesia; the first is MAP Boga Adiperkasa, a major F&B and lifestyle conglomerate.

General Atlantic was founded in 1980 as the investment arm of Atlantic Philanthropies, and claims to be the pioneer in growth equity. The US-based company has presence all over the world, including in Indonesia, UK, China, Mexico, and Singapore. As of August 2019, it manages US$35b in assets from global investors. Some major companies that were part of GA's portfolio includes Facebook, Alibaba, Meituan, Saxo Bank, and SEA. Edtech startup Ruangguru is GA's second investment in Indonesia; the first is MAP Boga Adiperkasa, a major F&B and lifestyle conglomerate.

Asabys Partners is a VC firm based in Barcelona and invests mainly in the healthtech and biopharma industries. Backed by Sabadell Bank, the VC now has offices in Spain, UK, Switzerland and Israel. Asabys Partners aims to accelerate technology breakthroughs in the fields of science and medicine by supporting a network of industry experts and talent.Asabys started operations in 2019 and is currently fundraising its first fund, Sabadell Asabys Health Innovation Investments, with a target size of €70m and Banc Sabadell as anchor investor. Main areas of investment include Biopharma, MedTech and Digital Therapeutics.

Asabys Partners is a VC firm based in Barcelona and invests mainly in the healthtech and biopharma industries. Backed by Sabadell Bank, the VC now has offices in Spain, UK, Switzerland and Israel. Asabys Partners aims to accelerate technology breakthroughs in the fields of science and medicine by supporting a network of industry experts and talent.Asabys started operations in 2019 and is currently fundraising its first fund, Sabadell Asabys Health Innovation Investments, with a target size of €70m and Banc Sabadell as anchor investor. Main areas of investment include Biopharma, MedTech and Digital Therapeutics.

Cogo: Tech that helps you cut your real-time carbon footprint through daily choices

Currently operating in New Zealand, Australia and the UK, Cogo is raising $20m to bring its emissions tracking technology to companies and consumers in Asia, Europe and the US

Oceanium: Supporting sustainable seaweed farming

Scottish startup Oceanium has developed a proprietary biorefinery and processing model to create seaweed-based compostable materials, alt-protein ingredients and nutraceuticals for use across industry verticals

Xampla: Making strong, low-cost biodegradable plastic from peas

Inspired by the strength of spider silk, the Cambridge University spinoff has produced a plant-based, completely compostable alternative to microplastics

Chic by Choice: From Forbes' 30 Under 30 to insolvency

Lack of cashflow was the main reason for the demise of Chic by Choice, Europe's leading luxury dress rental e-store

Heura by Foods for Tomorrow: Another new kid on the multibillion-dollar alternative protein market

Already selling in nine countries, Heura’s recent entry into the UK, Europe's largest market for meat substitutes, could prove its biggest test to date

European agritech is the new global focus, as startup investments nearly doubled in 2019

Last year, European agritech surpassed China for the first time in investments received, with openings in multiple subsectors from big data to blockchain

Petit Pli: Origami-inspired clothes that still fit, even after the body has grown

Founded by a young aeronautical engineer, Petit Pli produces stylish, sustainable pleated garments made from recycled plastic that expand up to seven sizes

OLIO: Zero food waste app expands with new product categories, going global

Recent $43m Series B funding will let sustainability app more than triple hiring, add homemade products and household goods to product listings

Checkealos: The UX testing platform helping companies boost conversion, engagement and sales

The Spanish startup aims at US expansion with its 13m-strong tester database and simple, intuitive platform

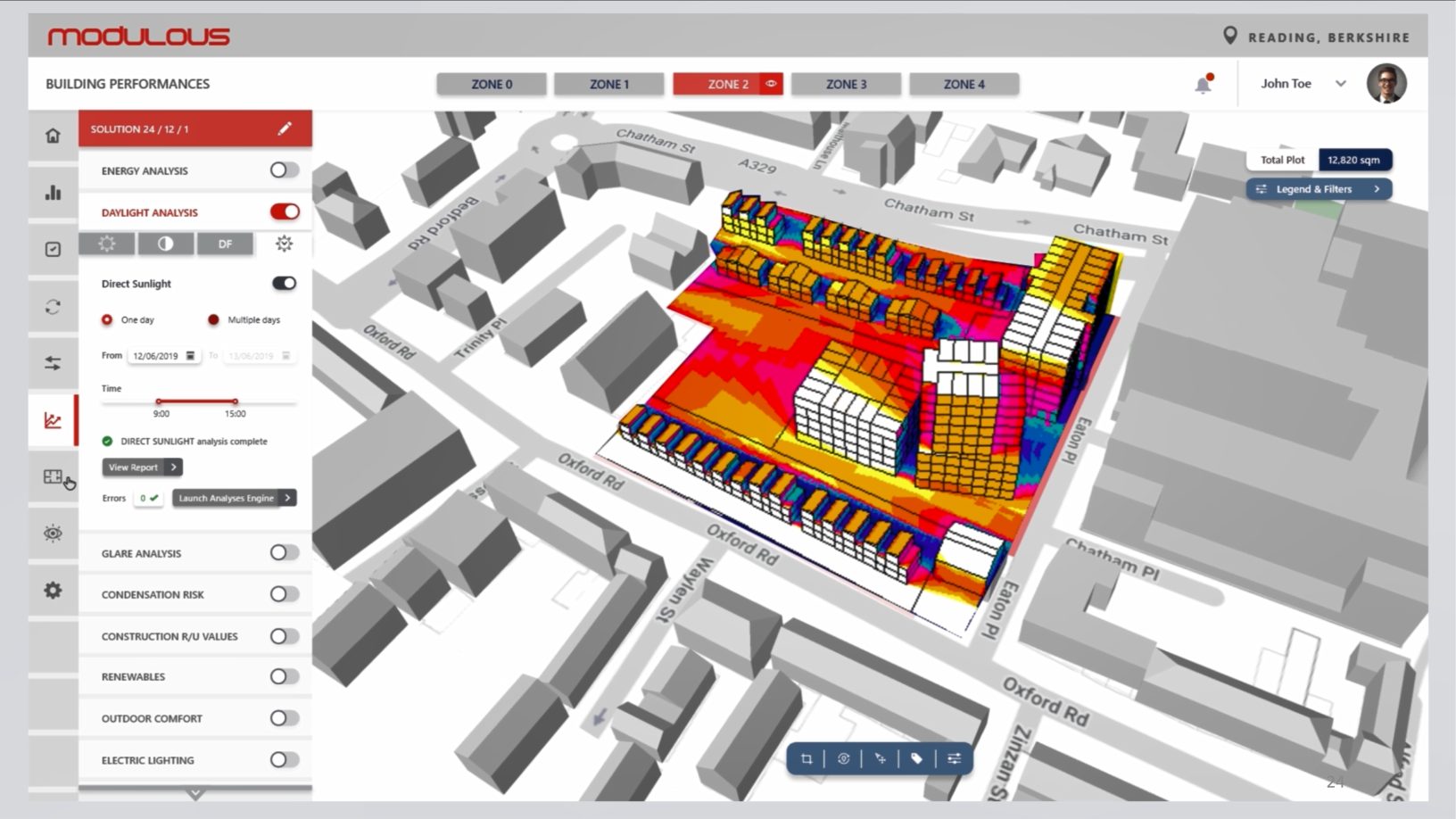

Modulous: End-to-end construction tech to (finally) disrupt the building sector value chain

Construction is among the most lucrative but least disrupted industries globally. UK-based Modulous aims to change this

MIWA Technologies: Reducing food waste and packaging with smart refill vending system

MIWA’s solution lets consumers buy exact refill quantities in personalized containers, eradicating need for single-use plastics throughout the supply chain

Ontruck CTO: How to build, scale technology in the road freight sector

Iterate fast and understand your clients, explains Samuel Fuentes, co-founder and CTO of Ontruck, because "for us, innovation is business as usual”

IsCleanAir targets 2021 revenue to double on Covid-led health security push

IsCleanAir’s water-based air-purifying IoT system reduces air contaminants by more than 90%, and uses 7–10 times less electricity than conventional filter-based systems

Virtual Bodyworks: VR psychotherapy to reduce crime and health issues

Applications created by the Barcelona-based startup could be used to track and influence human behavior

Plant-based eggs (Part II): The foodtech startups to watch

Here’s a shortlist of the foodtech startups to watch in the global vegan egg market

Sorry, we couldn’t find any matches for“UK”.