crop protection

-

DATABASE (41)

-

ARTICLES (96)

Clinching China’s largest agritech investment of RMB 1.2bn will help drone-maker XAG compete with key players like DJI to become the market leader.

Clinching China’s largest agritech investment of RMB 1.2bn will help drone-maker XAG compete with key players like DJI to become the market leader.

Co-founder and CTO of Habibi Garden

Irsan Rajamin is a keen gardener and managed to rope in high school friend Dian Prayogi Susanto to develop more efficient crop farming systems using automated technology. The graduate from Sekolah Tinggi Teknologi Telkom (Telkom University) in Bandung is responsible for the agritech’s software development as the CTO and co-founder of Habibi Garden.

Irsan Rajamin is a keen gardener and managed to rope in high school friend Dian Prayogi Susanto to develop more efficient crop farming systems using automated technology. The graduate from Sekolah Tinggi Teknologi Telkom (Telkom University) in Bandung is responsible for the agritech’s software development as the CTO and co-founder of Habibi Garden.

Co-founder and CEO of Habibi Garden

Dian Prayogi Susanto graduated in 2007 from Institut Teknologi Bandung, Indonesia. He had previously worked as lead engineer for Schlumberger. After two failed attempts at entrepreneurship, he met high school friend Irsan Rajamin. The two developed an idea to automate farming through the use of sensors, automatic pumps and analytics. In 2016, their idea manifested into Habibi Garden, an IoT startup that aims to automate farming and solve crop nourishment issues.

Dian Prayogi Susanto graduated in 2007 from Institut Teknologi Bandung, Indonesia. He had previously worked as lead engineer for Schlumberger. After two failed attempts at entrepreneurship, he met high school friend Irsan Rajamin. The two developed an idea to automate farming through the use of sensors, automatic pumps and analytics. In 2016, their idea manifested into Habibi Garden, an IoT startup that aims to automate farming and solve crop nourishment issues.

The GlassWall Syndicate is a US investment group comprising venture capitalists, foundations, trusts, non-profits and individual investors. The VC members include Blue Horizon, Veg Invest and New Crop Capital.The syndicate funds are mostly invested in foodtech companies like Mosa Meat and Beyond Meat that are currently disrupting the traditional global food industry.

The GlassWall Syndicate is a US investment group comprising venture capitalists, foundations, trusts, non-profits and individual investors. The VC members include Blue Horizon, Veg Invest and New Crop Capital.The syndicate funds are mostly invested in foodtech companies like Mosa Meat and Beyond Meat that are currently disrupting the traditional global food industry.

In student recruitment since 2009, with the largest market share in Beijing, Zhiyouwo’s innovative escrow system protects its student clients against nonpayment by crook employers.

In student recruitment since 2009, with the largest market share in Beijing, Zhiyouwo’s innovative escrow system protects its student clients against nonpayment by crook employers.

Co-founder and CEO of Datary

Daniel Jadraque is a trained Civil Engineer who co-founded Datary, a data exchange marketplace, soon after graduating from the Polytechnic University in Madrid. In addition to being Datary's Managing Director, Jadraque is a startup mentor at Google's Madrid Campus and a visiting professor at the Polytechnic University in Madrid. He is also advisor to the BBVA and ING banks for the development of digital products as well as consultant on data flow and data protection to members of the European Commission and its parliament.

Daniel Jadraque is a trained Civil Engineer who co-founded Datary, a data exchange marketplace, soon after graduating from the Polytechnic University in Madrid. In addition to being Datary's Managing Director, Jadraque is a startup mentor at Google's Madrid Campus and a visiting professor at the Polytechnic University in Madrid. He is also advisor to the BBVA and ING banks for the development of digital products as well as consultant on data flow and data protection to members of the European Commission and its parliament.

Archipelago Next is an investor based in Spain’s Canary Islands and owned by prominent local companies. It has a non-sectorial focus on startups based in the archipelago and in Africa and is the Canary Islands’ only venture builder. It currently has 20 startups in its portfolio. Its most recent investments were €520,000 in a seed funding round in 2021 of Valencian accessibility hardware and app for the deaf, Visualfy and €260,000 in the 2021 seed round of AI-powered crop prediction agtech RawData.

Archipelago Next is an investor based in Spain’s Canary Islands and owned by prominent local companies. It has a non-sectorial focus on startups based in the archipelago and in Africa and is the Canary Islands’ only venture builder. It currently has 20 startups in its portfolio. Its most recent investments were €520,000 in a seed funding round in 2021 of Valencian accessibility hardware and app for the deaf, Visualfy and €260,000 in the 2021 seed round of AI-powered crop prediction agtech RawData.

Co-founder & Advisor of Red Points

David Casellas, a graduate of ESADE Law and Business School, is a legaltech expert who built his career in digital businesses.He started his professional career as Digital Business Development Manager at FC Barcelona. In 2012, he co-founded Red Points, a SaaS producing anti-piracy and counterfeit detection technology to protect brands in the digital ecosystem. Since 2017, he has also been Co-founder and Managing Director of Pridatect, the first online platform that allows professionals to offer compliance in General Data Protection Regulation (GDPR) services to their clients.

David Casellas, a graduate of ESADE Law and Business School, is a legaltech expert who built his career in digital businesses.He started his professional career as Digital Business Development Manager at FC Barcelona. In 2012, he co-founded Red Points, a SaaS producing anti-piracy and counterfeit detection technology to protect brands in the digital ecosystem. Since 2017, he has also been Co-founder and Managing Director of Pridatect, the first online platform that allows professionals to offer compliance in General Data Protection Regulation (GDPR) services to their clients.

Tapping into Indonesia’s US$24 billion crowdfunding pool, iGrow’s agribusiness platform aims to help poor farmers to transform underused arable land into sustainable profit-sharing organic micro-farms.

Tapping into Indonesia’s US$24 billion crowdfunding pool, iGrow’s agribusiness platform aims to help poor farmers to transform underused arable land into sustainable profit-sharing organic micro-farms.

Alodokter is rapidly spearheading into Asia’s lucrative healthcare industry with localized medical information portals vetted by doctors.

Alodokter is rapidly spearheading into Asia’s lucrative healthcare industry with localized medical information portals vetted by doctors.

Founded in 2008, Delian Capital focuses on healthcare, TMT, high-end manufacturing, new materials, new energy, and resources utilization in environmental protection, with RMB 2 billion of funds under management.

Founded in 2008, Delian Capital focuses on healthcare, TMT, high-end manufacturing, new materials, new energy, and resources utilization in environmental protection, with RMB 2 billion of funds under management.

Tianxing Capital is a venture capital management company that was founded in 2012. It has invested in over 500 enterprises so far. Its investment focuses are media, healthcare, energy conservation, environmental protection, high-end manufacturing, etc.

Tianxing Capital is a venture capital management company that was founded in 2012. It has invested in over 500 enterprises so far. Its investment focuses are media, healthcare, energy conservation, environmental protection, high-end manufacturing, etc.

Founded in Shenzhen in 2013, Topsailing Capital is mainly involved in venture capital and private equity funding of diverse industry sectors like culture, entertainment, big data, intelligent manufacturing, agriculture, environmental protection and medicine.

Founded in Shenzhen in 2013, Topsailing Capital is mainly involved in venture capital and private equity funding of diverse industry sectors like culture, entertainment, big data, intelligent manufacturing, agriculture, environmental protection and medicine.

Established in September 2016, Chobe Capital is based in Shanghai. The firm is a registered private equity manager, focusing on pre-IPO and VC projects. Chobe Capital mainly invests in various sectors like TMT, biotechnology, consumer products and environmental protection.

Established in September 2016, Chobe Capital is based in Shanghai. The firm is a registered private equity manager, focusing on pre-IPO and VC projects. Chobe Capital mainly invests in various sectors like TMT, biotechnology, consumer products and environmental protection.

Smart Agrifood 2021: SVG Ventures's Hartnett, Land O'Lakes's Bekele on disruption in agrifood chain

How US farming cooperative Land O'Lakes and leading CPG brands are working with famers and tech firms to overcome agritech challenges, transform the whole value chain

Gigacover: Providing a financial safety net for gig workers

Gigacover is eyeing multi-billion-dollar opportunities in income and healthcare protection and financial services for the 150m self-employed workers in Southeast Asia, about half of whom are underbanked

UTW: Drones and big data to help farmers get the most out of their land

Analytics startup UTW also harvests real-time farming information using satellites and sensors, to offer crop yield predictions

Dao Foods: Grooming and betting on China's rising alternative protein startups

How can businesses involve Chinese consumers in the environmental cause, even if it isn’t a priority for them? For that, the impact investor-incubator Dao Foods has got its philosophy-led strategy figured out

Red Points: US$38 million Series C to power US conquest

The Barcelona-based startup is ramping up US sales and deep-tech capabilities for its online brand protection platform

iOLAND: Farm management technology created for and by farmers

Precision farming startup iOLAND provides farmers recommendations based on data collected by its IoT devices and refined by machine learning

Fresh from $13.5m Series A, Indonesian insurtech Qoala takes the long view amid Covid-19

Backed by capital from VCs like Sequoia Capital India, Qoala wants to grow its income channels, team and partnerships as others hold back

Singrow to start selling Singapore-grown strawberries in March, plans $15m Series A this year

Singrow also plans to offer locally grown produce across Southeast Asia, starting with strawberries farmed in energy-efficient greenhouses

Kuorum: a SaaS that enables citizen participation

Kuorum generates citizen engagement webpages in less than a minute to cope with Spain’s mandate of digitalizing administrative procedures by the end of 2020

Promising market, but China’s DTC genetic testing startups have to first overcome a few hurdles

Genetic information is being used for everything from predicting health risks to personalizing exercise and dietary regimes. China represents a huge potential market for direct-to-consumer (DTC) genetic testing

Portugal pumps up to €60m into new initiatives to avert backslide in startup ecosystem

Government funding to ensure the strategically important and social impact startups don't fail, post-Covid

Plant-based eggs (Part II): The foodtech startups to watch

Here’s a shortlist of the foodtech startups to watch in the global vegan egg market

Future Food Asia 2021: Regenerative agriculture in Asia

The unique challenges facing regenerative agriculture in Asia require solutions different from those in the West, presenting opportunities for microfinancing and impact investment

Something positive could come out of the Facebook fallout

Users and startups could learn a lot from the Facebook-Cambridge Analytica scandal. For a start, don’t succumb to apathy

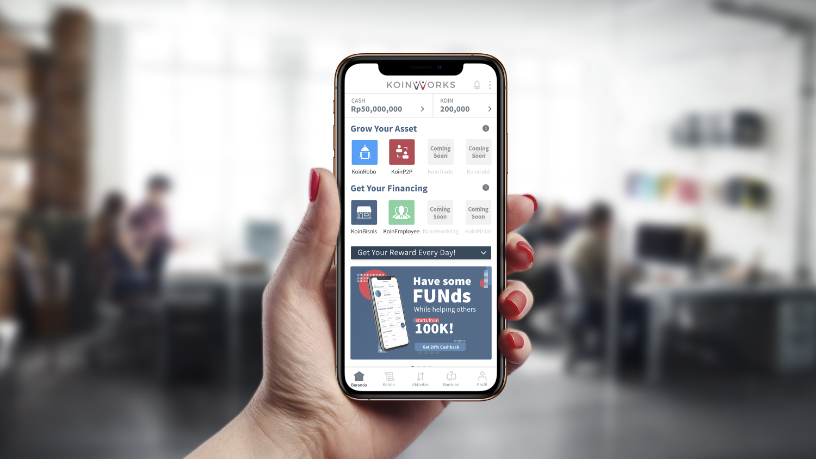

Amid Covid-19, Indonesian P2P lender KoinWorks raises $20m in convertible note funding

Backed by Quona Capital, EV Growth and other investors, KoinWorks plans to disburse more loans amid greater uncertainty and default risk

Sorry, we couldn’t find any matches for“crop protection”.