Energy & Cleantech

This function is exclusive for Premium subscribers

-

DATABASE (190)

-

ARTICLES (84)

Owned by French investment group Eurazeo, Idinvest Partners was founded in 1997 in Paris, France, as AGF Private Equity and operated as part of German multinational Allianz until 2010, when it became an independent entity. With additional offices in Madrid, Frankfurt, Shanghai and Dubai, Idinvest manages €8bn in assets and has invested in around 4,000 companies, with 75 exits. It specializes in private equity and venture capital financing of European small and mid-size startups and has been named Best Private Equity Team by Deloitte in its 2012 Technology Fast 50 Awards. The company was acquired by Eurazeo in April 2018.

Owned by French investment group Eurazeo, Idinvest Partners was founded in 1997 in Paris, France, as AGF Private Equity and operated as part of German multinational Allianz until 2010, when it became an independent entity. With additional offices in Madrid, Frankfurt, Shanghai and Dubai, Idinvest manages €8bn in assets and has invested in around 4,000 companies, with 75 exits. It specializes in private equity and venture capital financing of European small and mid-size startups and has been named Best Private Equity Team by Deloitte in its 2012 Technology Fast 50 Awards. The company was acquired by Eurazeo in April 2018.

Established in Shenzhen in 2007, Share Capital has invested in over 100 companies. Some of its portfolio companies – e.g., NavInfo, Perfect World and BGI – have gone public. Its investment team of nearly 50 members manages more than RMB 6 billion worth of assets. Share Capital has set up a healthcare fund of RMB 1.5 billion and invested in over 70 health-related projects.

Established in Shenzhen in 2007, Share Capital has invested in over 100 companies. Some of its portfolio companies – e.g., NavInfo, Perfect World and BGI – have gone public. Its investment team of nearly 50 members manages more than RMB 6 billion worth of assets. Share Capital has set up a healthcare fund of RMB 1.5 billion and invested in over 70 health-related projects.

EDP Ventures is the VC arm of EDP, or Energias de Portugal, a global energy company based in Portugal. It invests in early-stage startups both Portuguese and from other nations across varied sectors and is a promoter of renewable energies.

EDP Ventures is the VC arm of EDP, or Energias de Portugal, a global energy company based in Portugal. It invests in early-stage startups both Portuguese and from other nations across varied sectors and is a promoter of renewable energies.

Tianjin Venture Capital was co-founded by Tianjin Municipal Science & Technology Commission and Tianjin Municipal Finance Bureau in 2003. It invests mainly in the sectors of advanced manufacturing, TMT, energy conservation & environmental protection, healthcare and consumer services. The firm manages RMB 8bn in capital. Of the 100+ tech startups in which the firm has invested, nearly 10 have gone public in China.

Tianjin Venture Capital was co-founded by Tianjin Municipal Science & Technology Commission and Tianjin Municipal Finance Bureau in 2003. It invests mainly in the sectors of advanced manufacturing, TMT, energy conservation & environmental protection, healthcare and consumer services. The firm manages RMB 8bn in capital. Of the 100+ tech startups in which the firm has invested, nearly 10 have gone public in China.

Norway-based Katapult Accelerator focuses on technology-based startups targeting environmental and societal causes. Katapult's three-month accelerator program offers training and mentorship opportunities across a range of technologies including AI, blockchain and IoT, along with access to funding and investors. The company has recently teamed up with New York's ERA accelerator to help Katapult's startups expand to the US.

Norway-based Katapult Accelerator focuses on technology-based startups targeting environmental and societal causes. Katapult's three-month accelerator program offers training and mentorship opportunities across a range of technologies including AI, blockchain and IoT, along with access to funding and investors. The company has recently teamed up with New York's ERA accelerator to help Katapult's startups expand to the US.

Climate-KIC is an initiative supported by the European Institute of Innovation and Technology (EIT), whose focus is to create and support a community of entrepreneurs and mentors that jointly develop and produce innovative ideas facilitating the transition to a zero-carbon economy. Climate-KIC has launched various initiatives and acceleration programs across Europe targeted at growing startups that are tackling climate change, providing them with structure, assistance, mentoring and seed funding to develop low-carbon products and services.

Climate-KIC is an initiative supported by the European Institute of Innovation and Technology (EIT), whose focus is to create and support a community of entrepreneurs and mentors that jointly develop and produce innovative ideas facilitating the transition to a zero-carbon economy. Climate-KIC has launched various initiatives and acceleration programs across Europe targeted at growing startups that are tackling climate change, providing them with structure, assistance, mentoring and seed funding to develop low-carbon products and services.

Green Innovations is an impact fund that invests in large-scale projects addressing global sustainability challenges, focusing on the agriculture, biotechnology, education, energy, housing and water sectors. It is headed by Angola-based Portuguese businessman Jorge Marques, and linked to Israeli group Mitrelli. Green Innovations took control of Biocant, Portugal’s biggest biotech park, in a privatization move in 2017–2018. Green Innovations's stable of companies includes Green Biotech, created to invest in biotechnology in Portugal, and Green Services Innovations, linked to the exploration of phosphates in Congo.Its recent investments include in the June 2021 $85m Series C round and February 2021 $25m Series B of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution.

Green Innovations is an impact fund that invests in large-scale projects addressing global sustainability challenges, focusing on the agriculture, biotechnology, education, energy, housing and water sectors. It is headed by Angola-based Portuguese businessman Jorge Marques, and linked to Israeli group Mitrelli. Green Innovations took control of Biocant, Portugal’s biggest biotech park, in a privatization move in 2017–2018. Green Innovations's stable of companies includes Green Biotech, created to invest in biotechnology in Portugal, and Green Services Innovations, linked to the exploration of phosphates in Congo.Its recent investments include in the June 2021 $85m Series C round and February 2021 $25m Series B of Portuguese home physiotherapy tech solution SWORD Health, the world’s fastest-growing musculoskeletal solution.

The municipal government of Wuhan launched Wuhan S&T Angel Venture Fund in September 2013. With RMB 300 million under management, the fund is operated by Wuhan S&T Angel Venture Fund Management Co., Ltd. It invests mainly in the information technology, new materials, advanced equipment manufacturing, biomedicine, new energy, automotive, energy conservation, environmental protection and modern agriculture fields.

The municipal government of Wuhan launched Wuhan S&T Angel Venture Fund in September 2013. With RMB 300 million under management, the fund is operated by Wuhan S&T Angel Venture Fund Management Co., Ltd. It invests mainly in the information technology, new materials, advanced equipment manufacturing, biomedicine, new energy, automotive, energy conservation, environmental protection and modern agriculture fields.

NUMA is a Paris-based innovation hub with offices in New York, Berlin, Moscow, Barcelona, Mexico City, Casablanca in Morocco and Bengalaru, India. Supported by its 130 staff members, the company runs training and startup acceleration programs globally. To date, 300 startups have participated in NUMA's acceleration program, which was developed in partnership with the City of Paris. To date, NUMA has seen 17 exits from its investments.

NUMA is a Paris-based innovation hub with offices in New York, Berlin, Moscow, Barcelona, Mexico City, Casablanca in Morocco and Bengalaru, India. Supported by its 130 staff members, the company runs training and startup acceleration programs globally. To date, 300 startups have participated in NUMA's acceleration program, which was developed in partnership with the City of Paris. To date, NUMA has seen 17 exits from its investments.

Shenzhen Sihai VC Co., Ltd (Qianhai)

Founded in 2016, Shenzhen Sihai VC Co., Ltd (Qianhai) is fully controlled by Shenzhenshi Qianhai Sihaihengtong Equity Investment Ltd. The company manages multiple RMB funds, which have invested a total of RMB 1.5 billion primarily in the TMT, environmental protection, energy conservation, medtech, new materials and consumption sectors.

Founded in 2016, Shenzhen Sihai VC Co., Ltd (Qianhai) is fully controlled by Shenzhenshi Qianhai Sihaihengtong Equity Investment Ltd. The company manages multiple RMB funds, which have invested a total of RMB 1.5 billion primarily in the TMT, environmental protection, energy conservation, medtech, new materials and consumption sectors.

Unreasonable Capital is a US-based venture capital firm. It focuses on early to mid-stage startups in emerging markets that address social and environmental challenges. The firm does not lead investments on its own, participating only when a local entity participates in financing. Its portfolio includes Nigerian fintech firm Paga, Indonesian automated fish feeder maker eFishery and solar power system producer BuffaloGrid.

Unreasonable Capital is a US-based venture capital firm. It focuses on early to mid-stage startups in emerging markets that address social and environmental challenges. The firm does not lead investments on its own, participating only when a local entity participates in financing. Its portfolio includes Nigerian fintech firm Paga, Indonesian automated fish feeder maker eFishery and solar power system producer BuffaloGrid.

Lisbon-based venture capital and private equity firm, HCapital Partners focuses on energy, mobility and smart technologies in Portugal and Spain. HCapital typically invests between €500,000 and €2.5m per funding round. Its New Ideas fund is directed toward scalable startups. The firm was founded in 2014.

Lisbon-based venture capital and private equity firm, HCapital Partners focuses on energy, mobility and smart technologies in Portugal and Spain. HCapital typically invests between €500,000 and €2.5m per funding round. Its New Ideas fund is directed toward scalable startups. The firm was founded in 2014.

EIT InnoEnergy, an initiative of the European Institute of Innovation and Technology (EI), offers startup entrepreneurs support in growing and scaling their businesses. It focuses on innovative clean-tech projects, offering mentorships and industry expertise through seed funding and an accelerator program. The network consists of 15 European clean-tech venture capitalists and 15 research institutes. To date, it has supported over 200 European startups working on initiatives aimed at boosting the prevalence of sustainable energy in the market.

EIT InnoEnergy, an initiative of the European Institute of Innovation and Technology (EI), offers startup entrepreneurs support in growing and scaling their businesses. It focuses on innovative clean-tech projects, offering mentorships and industry expertise through seed funding and an accelerator program. The network consists of 15 European clean-tech venture capitalists and 15 research institutes. To date, it has supported over 200 European startups working on initiatives aimed at boosting the prevalence of sustainable energy in the market.

Volkswagen Group China is a division of German automobile manufacturer Volkswagen Group. Volkswagen Group China produces, sells and services cars, engines and transmission systems, as well as other parts and components. It runs more than 2,000 authorized dealerships and has 360,000 dealers on staff. Volkswagen Group China and its joint-venture companies plan to invest €15 billion by 2020 in developing autonomous and new energy vehicles.

Volkswagen Group China is a division of German automobile manufacturer Volkswagen Group. Volkswagen Group China produces, sells and services cars, engines and transmission systems, as well as other parts and components. It runs more than 2,000 authorized dealerships and has 360,000 dealers on staff. Volkswagen Group China and its joint-venture companies plan to invest €15 billion by 2020 in developing autonomous and new energy vehicles.

Founded in Shanghai in 2002, Pre IPO is a private equity investor targeting pre-IPO startups in China. It specializes in sectors like consumer products, medicine, edtech, eco-friendly technology, advanced manufacturing and agriculture. The firm also participates in M&A ventures and risk investments in high-tech, new media and IT.

Founded in Shanghai in 2002, Pre IPO is a private equity investor targeting pre-IPO startups in China. It specializes in sectors like consumer products, medicine, edtech, eco-friendly technology, advanced manufacturing and agriculture. The firm also participates in M&A ventures and risk investments in high-tech, new media and IT.

Europe ramps up development of local EV battery sector in race to zero emissions

Startups, automakers jostle or unite to ride the fast-growing EV battery market, as the EU pumps billions into developing its own value chain, to cut reliance on imports

SWITCH Singapore 2021: Driving renewable energy impact through better business models

Startups need to communicate the business benefits of green solutions to their customers, rather than just pitching the hi-tech

SWITCH Singapore 2021: Tapping the $1tn sustainability market in Southeast Asia

Falling costs and simplified deployment of sustainability solutions will help boost adoption, especially in underprivileged communities

SWITCH Singapore 2021: How startups, corporates and government can co-create smart cities

The next generation of adaptive spaces will harness big data, deep tech and analytics to respond intelligently to both changing environments and human needs, says an expert panel

Forget solar panels and batteries, Bioo wants to scale soil bioelectricity generation

Improving on NASA’s microbial fuel cell tech, Bioo hopes to boost crop efficiency and transform the way urbanites live, in future green cities powered by plants

Verkor: Accelerating low‑carbon battery production in France

French startup Verkor aims to raise up to €1.3bn by the end of next year to finance its first Gigafactory producing sustainable lithium-ion batteries for the European market

Indonesian angel investor network ANGIN launches agrifood incubator

Program targets ESG investment and builds on the strong potential of Indonesia’s agriculture sector, which kept growing despite the Covid-19 pandemic

Beyond Leather Materials: Turning apples into alt-leather for sustainable fashion

Through its Leap brand, the Danish startup cuts food waste by turning apples junked in cider factories into affordable vegan leather for the $100bn leather market

Bound4Blue’s aeronautical tech propels first sustainable shipping vessel in the Pacific

Winning €5m fresh funding, Bound4Blue also scores with its EC-backed pilot, the first of its kind, offering new possibilities to cargo vessels seeking sustainable transportation

Linptech: Smart home devices powered by movement

The first in China to tap kinetic energy to control smart home devices, Linptech has seen its wireless, battery-free products used in smart homes, and even at the Tokyo Olympics

NovoNutrients: Tackling the dual problems of CO2 emissions and over-fishing

The first to transform CO2 to fish food, NovoNutrients is trialing with industry giants Skretting and Chevron, and will soon raise Series A funding

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

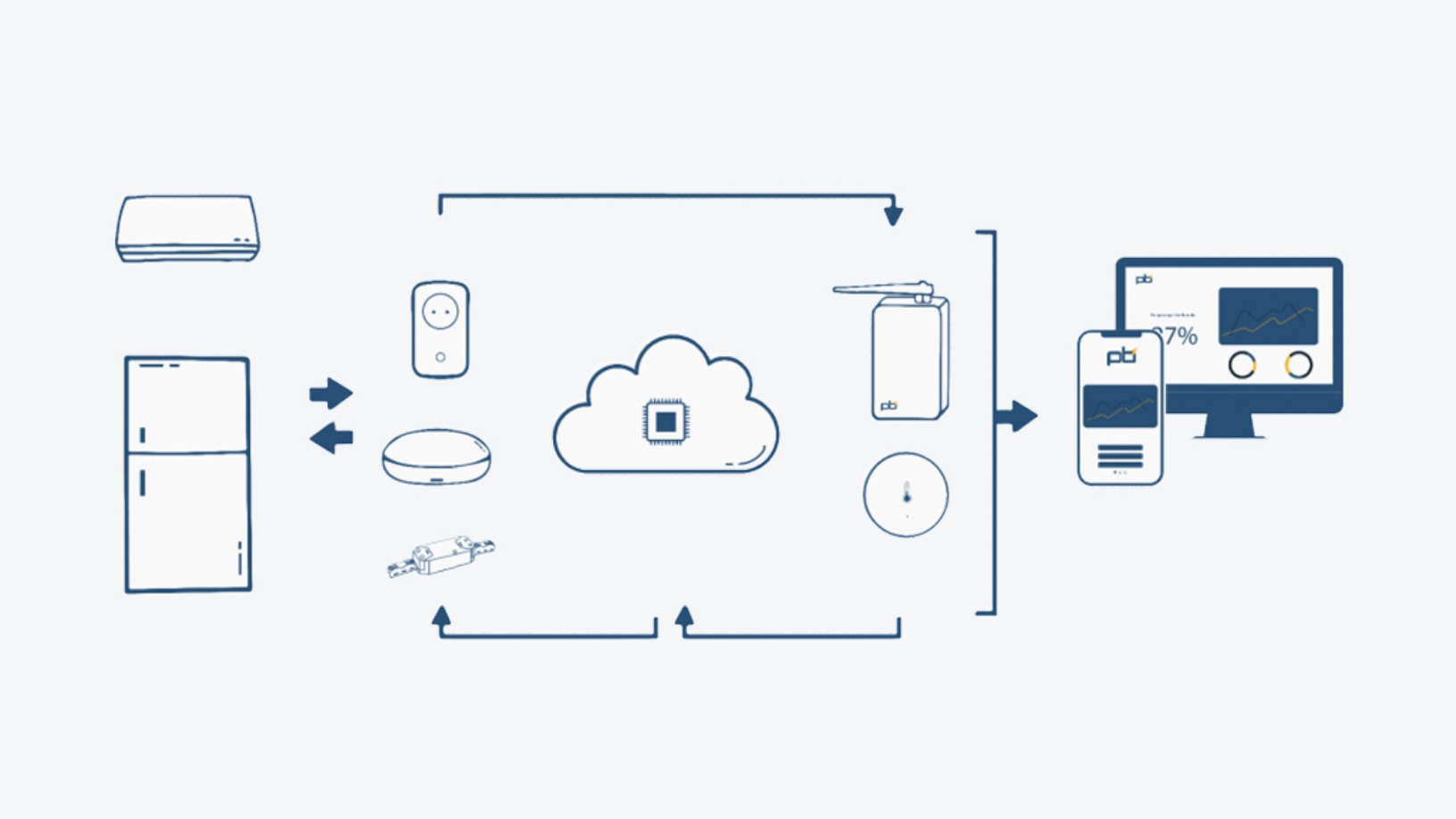

Powerbrain: Saving energy and cutting emissions for SMEs, with none of the fuss

Already profitable within a year of running, Powerbrain is raising funds to protect its IPs and enter new verticals in Indonesia’s energy management business

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Viezo: Vibration energy harvesting to power sensors and IoT devices

Disrupting the battery market, Viezo’s proprietary technology, PolyFilm, can also boost operational efficiency and slash maintenance costs of sensors and IoT devices