Sports Tech

This function is exclusive for Premium subscribers

-

DATABASE (33)

-

ARTICLES (10)

The first cycling helmet with a neck-protecting airbag activated by sensors and algorithm-refined software.

The first cycling helmet with a neck-protecting airbag activated by sensors and algorithm-refined software.

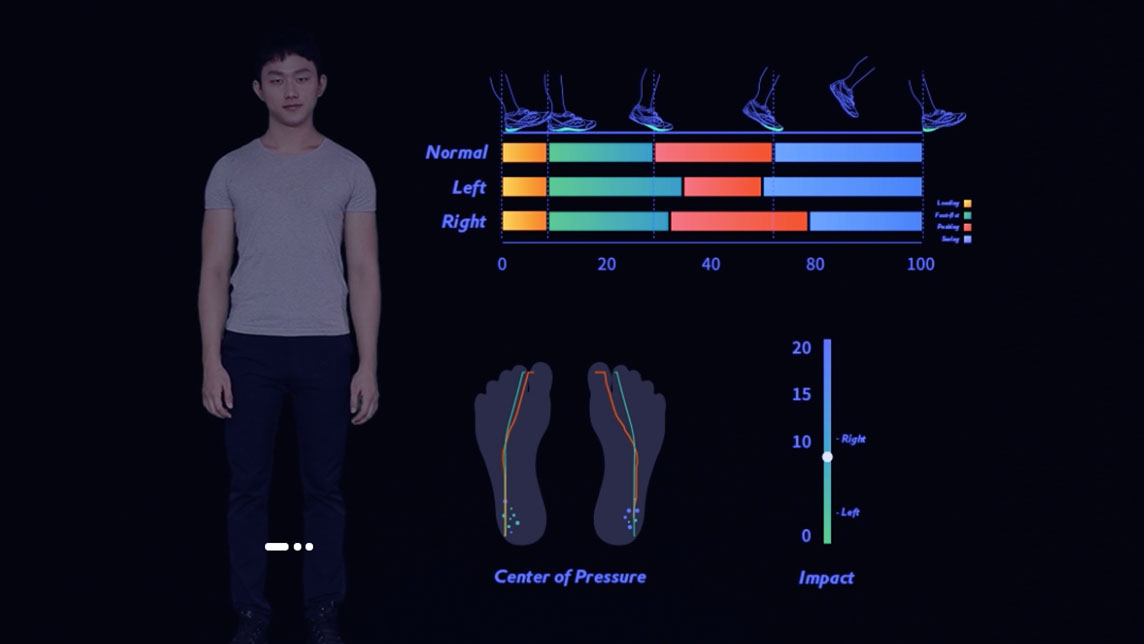

The gait data collected by Sennotech's smart insoles can help custom-make better shoes and orthotics, personalize training for athletes and improve rehabilitation treatment for patients.

The gait data collected by Sennotech's smart insoles can help custom-make better shoes and orthotics, personalize training for athletes and improve rehabilitation treatment for patients.

China's popular trading platform for branded trainers Poizon is gearing up for an IPO to become a one-stop marketplace for fashionistas.

China's popular trading platform for branded trainers Poizon is gearing up for an IPO to become a one-stop marketplace for fashionistas.

By providing shared fitness cabins available 24/7 for as little as RMB 10 an hour, ParkBox allows users to forgo expensive gym memberships.

By providing shared fitness cabins available 24/7 for as little as RMB 10 an hour, ParkBox allows users to forgo expensive gym memberships.

The future of golf: with accurate GPS distances for over 40,000 courses and connecting players across the world, Hole19 lets golfers play with anyone, anywhere.

The future of golf: with accurate GPS distances for over 40,000 courses and connecting players across the world, Hole19 lets golfers play with anyone, anywhere.

The independent VC arm of Legend Holdings, Legend Capital currently manages several USD funds and RMB funds with over RMB 26 billion in assets under management. It focuses on early- and expansion-stage investment and has invested in over 300 companies as of 2016, of which more than 40 were exited via IPO, and around 40 were exits through M&A.

The independent VC arm of Legend Holdings, Legend Capital currently manages several USD funds and RMB funds with over RMB 26 billion in assets under management. It focuses on early- and expansion-stage investment and has invested in over 300 companies as of 2016, of which more than 40 were exited via IPO, and around 40 were exits through M&A.

Founded in 2014, Desun Capital is the largest private investment firm in Sichuan province. With over RMB 1 billion under management, Desun conducts investments across all stages from seed/angel to IPO. It plans to go public in the next five years and become one of the most influential investment firms in China.

Founded in 2014, Desun Capital is the largest private investment firm in Sichuan province. With over RMB 1 billion under management, Desun conducts investments across all stages from seed/angel to IPO. It plans to go public in the next five years and become one of the most influential investment firms in China.

CRONUS was introduced into China by CEO Deng Yonghao in 2010.With 20-year experience of production and sales, it has a completed product line included from high-end professional bike to the general bike for daily life. For the moment now CRONUS in China, has opened nearly 200 stores or shop in shop. In 2014, CRONUS was listed on NEEQ (National Equities Exchange and Quotations). It is the first private-own bicycle company in China that joins capital market.

CRONUS was introduced into China by CEO Deng Yonghao in 2010.With 20-year experience of production and sales, it has a completed product line included from high-end professional bike to the general bike for daily life. For the moment now CRONUS in China, has opened nearly 200 stores or shop in shop. In 2014, CRONUS was listed on NEEQ (National Equities Exchange and Quotations). It is the first private-own bicycle company in China that joins capital market.

Vangoo Capital Partners was founded in 2008 in Hongkong as a wholly owned subsidiary of Ant Capital Partners. Ant Capital Partners completed localization in China by finishing management buy-out of Vangoo Capital Partners in 2011. Vangoo Capital Partners manages both US$ Fund and RMB funds. It focuses on the investment of medical, Internet, consumer products, high-tech, and new energy.

Vangoo Capital Partners was founded in 2008 in Hongkong as a wholly owned subsidiary of Ant Capital Partners. Ant Capital Partners completed localization in China by finishing management buy-out of Vangoo Capital Partners in 2011. Vangoo Capital Partners manages both US$ Fund and RMB funds. It focuses on the investment of medical, Internet, consumer products, high-tech, and new energy.

Founded in 2009, Whales Capital is a venture capital firm under Dazheng Group, one of China’s leading coffee making equipment supplier. Right now, Whales Capital manages three funds, including a cultural industries fund that it co-founded with Ximalaya.

Founded in 2009, Whales Capital is a venture capital firm under Dazheng Group, one of China’s leading coffee making equipment supplier. Right now, Whales Capital manages three funds, including a cultural industries fund that it co-founded with Ximalaya.

Founded in October 2014 in Hangzhou, Demonow Capital focuses on local early stage internet startups. In order to better serve startups and entrepreneurs, Demonow set up an incubator to provide early stage startups with professional services.

Founded in October 2014 in Hangzhou, Demonow Capital focuses on local early stage internet startups. In order to better serve startups and entrepreneurs, Demonow set up an incubator to provide early stage startups with professional services.

Established in 2007, Hongkun Yirun Investment is an investment management firm under Hongkun Group. It has invested in over 50 enterprises, more than 10 of which have been listed. Assets under management have exceeded RMB 10 billion. Hongkun Yirun Investment targets emerging industries and focuses on asset management, private equity investment, M&A and internet finance.

Established in 2007, Hongkun Yirun Investment is an investment management firm under Hongkun Group. It has invested in over 50 enterprises, more than 10 of which have been listed. Assets under management have exceeded RMB 10 billion. Hongkun Yirun Investment targets emerging industries and focuses on asset management, private equity investment, M&A and internet finance.

Founded in 1993, New Oriental is the largest provider of private educational services in China. Foreign language training and basic education currently make up its core business. New Oriental offers services in pre-school education, online education, vocational education, overseas study consulting, textbook publishing and education software R&D. New Oriental schools operate in 70 cities nationwide and in Toronto. As an institutional investor, the company has invested in over 40 startups, the vast majority of which are edtechs.

Founded in 1993, New Oriental is the largest provider of private educational services in China. Foreign language training and basic education currently make up its core business. New Oriental offers services in pre-school education, online education, vocational education, overseas study consulting, textbook publishing and education software R&D. New Oriental schools operate in 70 cities nationwide and in Toronto. As an institutional investor, the company has invested in over 40 startups, the vast majority of which are edtechs.

Tianxing Capital is a venture capital management company that was founded in 2012. It has invested in over 500 enterprises so far. Its investment focuses are media, healthcare, energy conservation, environmental protection, high-end manufacturing, etc.

Tianxing Capital is a venture capital management company that was founded in 2012. It has invested in over 500 enterprises so far. Its investment focuses are media, healthcare, energy conservation, environmental protection, high-end manufacturing, etc.

Sports directory and booking app STRONGBEE helps Indonesians to keep moving, even during Covid-19

Finding trainers, booking gym time and registering for marathons are just some of the activities available through the STRONGBEE app

Keep: Social fitness app bags $80m Series E as Covid-19 lockdown fuels demand for virtual gyms

Keep becomes China’s first sports tech unicorn as number of fitness app users in the country almost doubled to 89m amid home confinement and gym closures

Evix Safety's helmet with an airbag is a world-first for cycling safety

Evix Safety is launching a “smart” cycling helmet fitted with an airbag to prevent thousands of neck injuries from accidents

Spanish tech companies launch multi-project Covid-19 portal to help citizens and authorities

Startups including Glovo, CARTO and Cabify join forces with the likes of Google, Apple and IBM in the #StopCorona initiative to help Spain fight the pandemic

DGene : Star Wars-inspired 3D holograms made affordable for businesses

DGene's mobile-based VR/AR solution using integrated light field cuts the need for 3D modeling, useful for many sectors from retail marketing to conference calls

Foot Analytics: Turning pedestrian footfall into data for smart cities and retail

Applying sensors and proprietary algorithms to digitalize spaces, Foot Analytics gathers data and insights on customer behavior in retail spaces, stadia and airports

Sennotech offers affordable gait analysis on a mobile phone

Sennotech’s smart gait analysis system helps users choose comfy shoes, improve sports performance and foot health, and facilitate rehabilitation training

Genuine or fake? Sneakers resale platform Poizon tackles counterfeit issues

Gearing up for IPO in 2019 with just pre-A funding raised so far, fast-growing sneakers trading portal Poizon rides craze for branded sneakers and sneakerheads' willingness to pay

SoccerDream: World's first VR soccer training platform to launch in China, US

SoccerDream uses virtual reality to boost trainee players' performance on the field by 36% compared to their peers

In this shipping container, you can work out and save money

By eliminating the need to pay for an expensive gym membership, ParkBox is good news for gym buffs