B2B

This function is exclusive for Premium subscribers

-

DATABASE (366)

-

ARTICLES (399)

This healthcare service gathers via the cloud global public and private medical resources, centered on medical images and online consultation achieving lower cost, greater efficiency.

This healthcare service gathers via the cloud global public and private medical resources, centered on medical images and online consultation achieving lower cost, greater efficiency.

Talk to your plants. Habibi Garden ensures crops are nourished at optimum levels by hi-tech sensors, automatic pumps and analytics.

Talk to your plants. Habibi Garden ensures crops are nourished at optimum levels by hi-tech sensors, automatic pumps and analytics.

Jala’s hi-tech sensors will boost Indonesia’s seafood output by helping the fishery industry to operate more efficiently with accurate real-time data analytics.

Jala’s hi-tech sensors will boost Indonesia’s seafood output by helping the fishery industry to operate more efficiently with accurate real-time data analytics.

Pawoon enables SMEs to automate POS and business transactions to create a real-time data kitchen through its cloud-based mobile technology.

Pawoon enables SMEs to automate POS and business transactions to create a real-time data kitchen through its cloud-based mobile technology.

Agritech platform 8villages helps farmers to become business-savvy and reap more profit by connecting directly to suppliers, customers and public stakeholders.

Agritech platform 8villages helps farmers to become business-savvy and reap more profit by connecting directly to suppliers, customers and public stakeholders.

Automated feeder systems from eFishery will help fish and shrimp farmers to operate more profitably by providing feeding data and training to eliminate wastage.

Automated feeder systems from eFishery will help fish and shrimp farmers to operate more profitably by providing feeding data and training to eliminate wastage.

Botika creates bespoke AI chatbots that respond in Bahasa Indonesia to help businesses to engage more effectively with local consumers at every transaction level.

Botika creates bespoke AI chatbots that respond in Bahasa Indonesia to help businesses to engage more effectively with local consumers at every transaction level.

Logistics “Uber” startup Kargo.co.id makes shipping easy and safe by offering on-demand logistics services to optimize productivity for transport operators.

Logistics “Uber” startup Kargo.co.id makes shipping easy and safe by offering on-demand logistics services to optimize productivity for transport operators.

Market leader Tuhu offers quality tires, auto aftermarket services and much more–at low prices, 24-hour online ordering and installation at its nationwide partner garages.

Market leader Tuhu offers quality tires, auto aftermarket services and much more–at low prices, 24-hour online ordering and installation at its nationwide partner garages.

The world’s first sharing platform for farm drone technology, Farm Friend is already eyeing a yet bigger role: as a comprehensive, one-stop agritech services provider.

The world’s first sharing platform for farm drone technology, Farm Friend is already eyeing a yet bigger role: as a comprehensive, one-stop agritech services provider.

The first online HR services platform to help China SMEs meet their complex social security processing needs –so they save time and money, minimize errors.

The first online HR services platform to help China SMEs meet their complex social security processing needs –so they save time and money, minimize errors.

Fast like the wind, Mr Feng’s army of mobile-technology-enabled “courier-warriors” provide reliable on-demand intracity delivery for individuals and businesses; and is Hangzhou’s No. 1 player.

Fast like the wind, Mr Feng’s army of mobile-technology-enabled “courier-warriors” provide reliable on-demand intracity delivery for individuals and businesses; and is Hangzhou’s No. 1 player.

Xhockware reduces supermarket shopping checkout times to under one minute, so retailers increase inventory turnover and customer satisfaction. Zero capital investment needed.

Xhockware reduces supermarket shopping checkout times to under one minute, so retailers increase inventory turnover and customer satisfaction. Zero capital investment needed.

Cogo: Tech that helps you cut your real-time carbon footprint through daily choices

Currently operating in New Zealand, Australia and the UK, Cogo is raising $20m to bring its emissions tracking technology to companies and consumers in Asia, Europe and the US

SWITCH Singapore 2021: Driving renewable energy impact through better business models

Startups need to communicate the business benefits of green solutions to their customers, rather than just pitching the hi-tech

Indonesia's aquaculture startup eFishery eyes 1m farmer users in region

Bandung-based eFishery has diversified to fish sales and loan services, seeking to replicate its success in 10 countries in Southeast and South Asia, starting with Thailand

Yali Bio: Recreating a juicy steak in plant-based alternatives

Founded by the former head of Impossible Foods’ pilot plant, this Bay Area genomics and foodtech startup is one of the first to engineer a better fat for plant-based meat

BeeHero: Agritech for bee health and better crop pollination

Combining AI, smart sensors and the world’s largest bee database, BeeHero accurately predicts disorders in colonies, helping beekeepers reduce the mortality rate of bees vital for crop pollination

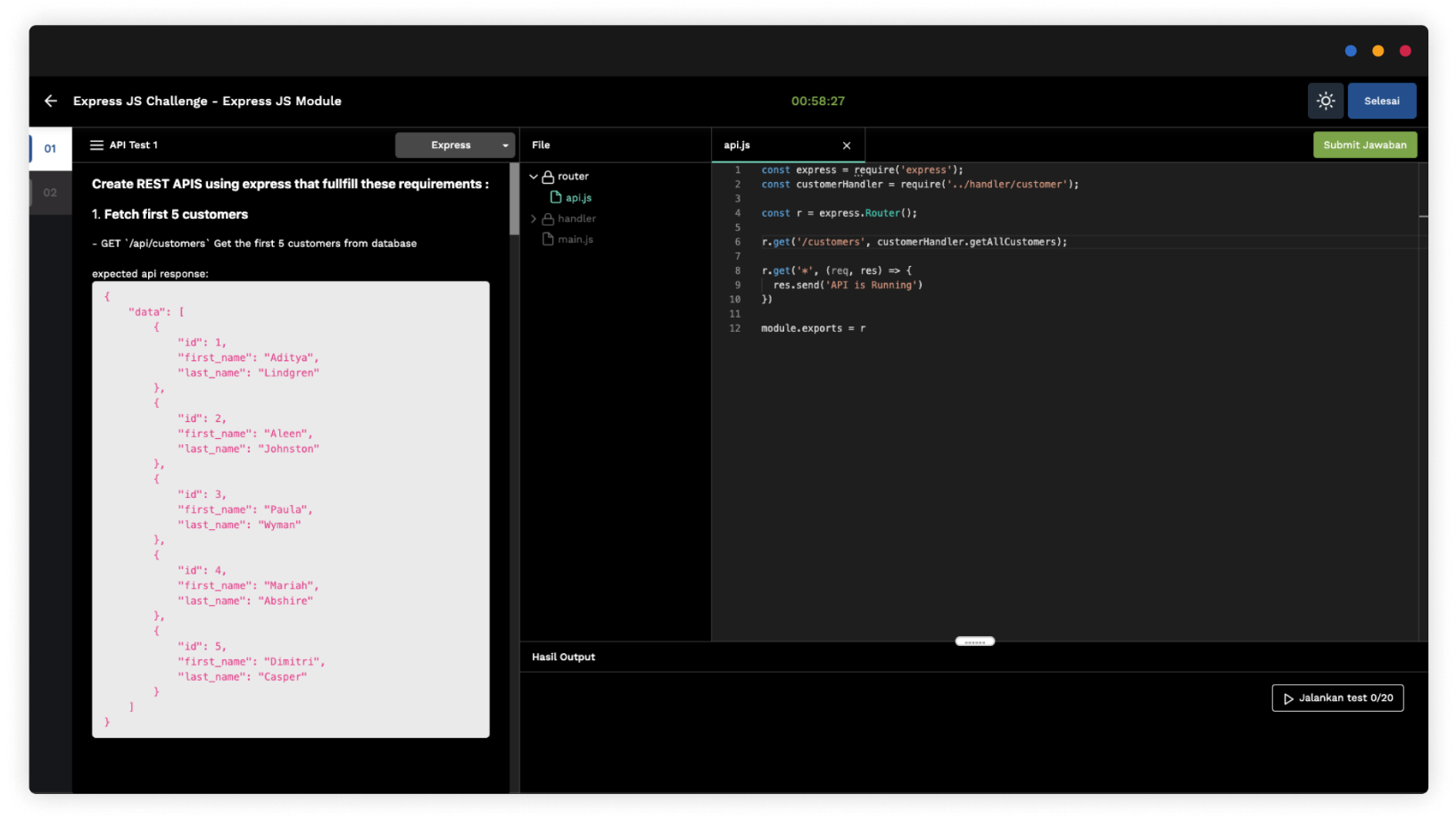

Algobash: SaaS for more effective IT hiring in Indonesia

With its remote assessment and automated interview platform, Algobash seeks faster, fairer and more inclusive recruitment and training of coders, to support tech growth in Indonesia

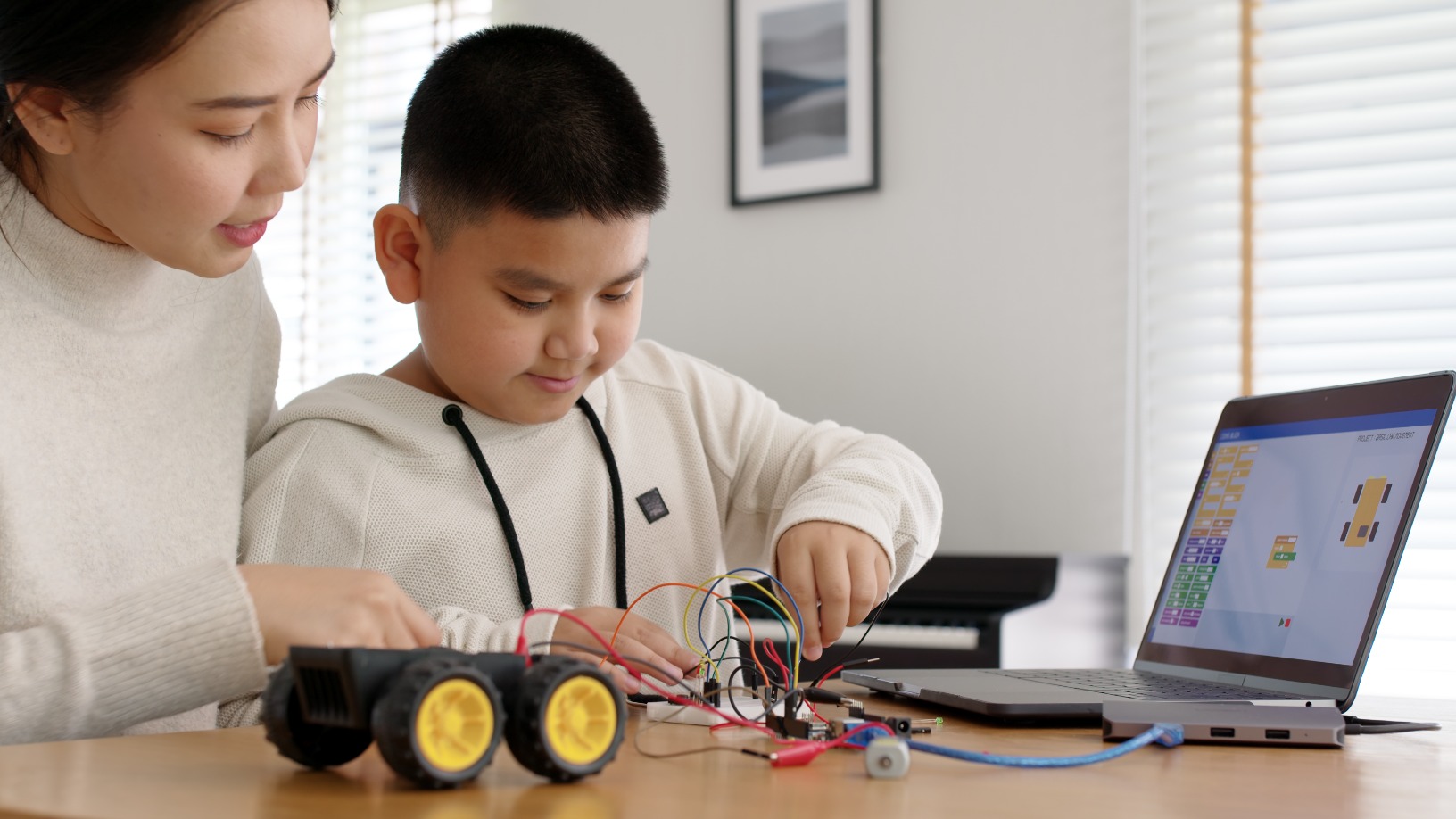

China edtech companies pivot to survive private tutoring crackdown

AI adaptive personalized learning is the bright star, attracting investors and corporates

QOA: Gourmet guilt-free chocolate, without the cocoa

Munich-based QOA transforms industrial food waste into vegan chocolate, enabling consumers to avoid the sustainability and ethical issues of cocoa production

Forget solar panels and batteries, Bioo wants to scale soil bioelectricity generation

Improving on NASA’s microbial fuel cell tech, Bioo hopes to boost crop efficiency and transform the way urbanites live, in future green cities powered by plants

Southeast Asian startups to keep riding digitalization, IPO boom, investors say

O2O business models and growing interest in ESG are also key themes, as regional startups gain $4.4bn of funding in first half of 2021

Verkor: Accelerating low‑carbon battery production in France

French startup Verkor aims to raise up to €1.3bn by the end of next year to finance its first Gigafactory producing sustainable lithium-ion batteries for the European market

South Summit 2021: Key insights on going from startup to scaleup in Spain

Company culture, talent acquisition and ecosystem support are top-of-mind for Voicemod’s Jaime Bosch and Jobandtalent’s Juan Urdiales in scaling startups up from zero to hero

Intudo Ventures: Grooming returning overseas talent for an Indonesia-only bet

Combining the experience and networks of foreign-educated Indonesians with local distribution channels, Intudo’s hyperlocal strategy has attracted $200m in managed assets

Smart Agrifood 2021: SVG Ventures's Hartnett, Land O'Lakes's Bekele on disruption in agrifood chain

How US farming cooperative Land O'Lakes and leading CPG brands are working with famers and tech firms to overcome agritech challenges, transform the whole value chain

Smart Agrifood Summit 2021: A global innovation ecosystem is needed to catch up with other sectors

Investors from SVG Ventures/THRIVE, Pinduoduo and others agree that players must join forces to boost agrifood tech investment, internationally and across the value chain