With so much information out there about climate change and sustainable lifestyles, the average consumer might have trouble figuring out how they can start making a difference. New Zealand startup Cogo wants to help simplify that, starting with small changes to what one can do and buy.

Currently available in the UK, the Cogo app categorizes banking transactions and gives users an estimate of how much each purchase or activity contributes to their total carbon emissions. The app then suggests what they could do to reduce their carbon footprint through actions such as composting, buying produce from local farms, and switching to a more eco-friendly utilities provider. Cogo also links users to carbon-offsetting initiatives to compensate for their emissions.

“We can measure the carbon footprint of every activity where you spend your dollar,” Cogo COO Christina Bellis told CompassList in an online interview. Through collaborations with accredited institutions, Cogo estimates the emissions related to different types of activities.

For example, Bellis said, buying new clothes made from virgin materials would be associated with a different emissions factor from getting secondhand outfits or clothes made from recycled materials. “These emission factors are included in our API, and we complete the data [using] some questions to deduce your carbon emissions.”

The startup currently has 60 employees, mostly based in New Zealand, Australia and the UK. Bellis said that Cogo’s current $20m fundraise will be used for expansion, mainly to optimize the organizational structure for growth and expand the team to 200 employees across global operations. The startup has raised nearly NZ$11m to date.

Cogo also provides white-label and API products to companies, such as UK bank NatWest and Australia’s Commonwealth Bank. In a pilot involving NatWest customers, users were able to reduce their carbon footprint by an average of 11kg per month. The company estimates that if the behavior were to be replicated across NatWest’s 8m app users, it would save 1bn of CO2 emissions per year, “equivalent to planting 17m trees.”

Small changes, big impact

Bellis describes Cogo’s model as one that encourages climate action through “ethical nudges,” or suggestions that spark small changes in behavior, or positive reinforcement to strengthen lifestyle behaviors that benefit the environment.

“For example, the app can give a nudge saying, ‘We noticed that you spent this much on petrol today. Did you know that by switching to an electric vehicle, you can reduce your carbon emissions by this amount?’” she said. “Or maybe you can get encouraged to compost your food waste, and the app can send you information on how to start.”

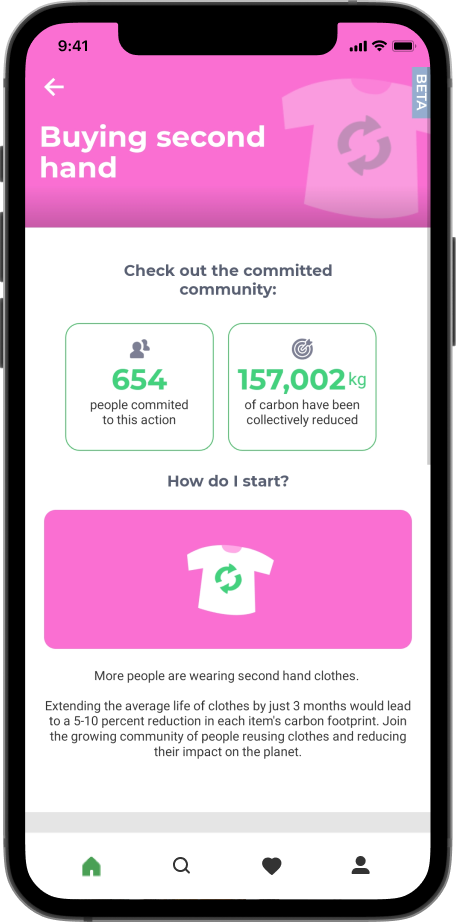

While Cogo’s app doesn’t give users physical rewards or cash incentives, it encourages eco-friendly behavior with positive feedback. Users can also see if others in their community have adopted the same sustainable changes that they have, as well as the collective impact of these efforts. “Having peers that are doing the same thing, and seeing how your collective action reduces carbon footprint, can reinforce your good behavior,” Bellis said.

Besides offering white-label and API products, Cogo is also developing products to help SMEs and other organizations examine their carbon footprint, by applying the same principles it uses in its consumer-facing app. Such organizations can then reduce and compensate their carbon footprint, and even aim for net-zero certification.

“You can only reach one consumer at a time [with a consumer-facing app],” Bellis said, “but if you partner with a business with 8m customers, that means we can affect 8m people in one go, and therefore we can reach our goal of changing the world much faster.”

Fueled by open banking

Cogo’s origins date back to 2010, when founder Ben Gleisner started Conscious Consumers as part of his work for a charitable trust. Each time a Conscious Consumers user scanned a QR code, they would get information on businesses that were accredited for socially conscious and environmentally sustainable practices, such as paying employees fair living wages and composting organic waste.

“The businesses would get accredited every year, and [Conscious Consumers would then help] users find the businesses in [their] vicinity that matched [their] values,” Bellis said.

In 2016, Gleisner relocated to the UK. He initially planned to bring Conscious Consumers there, but ended up modifying the concept to focus on the user’s own actions and environmental impact. Conscious Consumers was then rebranded as Cogo.

Cogo’s consumer-facing app is currently available only in the UK. Bellis said this is due to the UK having a more robust open banking infrastructure compared with other countries, including the company’s native New Zealand. Outside of the UK, Cogo’s focus is on large-scale partnerships with financial institutions.

“Having open banking so prevalent in the UK has helped us push our business strategy forward,” Bellis said. “In New Zealand, we don’t yet have that platform, which makes it difficult for people to link their bank data to an external app.”

Providers like Cogo do not actually store any banking credentials on their platform. But even so, Bellis says she still sees many customers who are understandably concerned about the security of their data. “For a lot of people, there’s that uncertainty about who they’re giving [their bank] credentials to, even though [they’re] not actually putting them into our app — rather, the data would go through a trusted third party.”

However, while the UK’s open banking framework has certainly helped the company grow, Bellis said Cogo isn’t limited to such frameworks, especially when it comes to expanding to other markets.

“There are other types of data [besides bank transactions] that can be used to enable customers to get their emissions data. So if open banking is not available in a country, we can use other types of data and categorizations,” she said.

International expansion plans

While Cogo’s consumer app is free to use, businesses that want to be featured on the Cogo platform pay an annual fee. The startup also earns revenue from SaaS subscriptions from bank partners that use its white-label products and API. Bellis said that while the company earns “significant” revenue, it isn't yet profitable as it is "still investing everything back into the business.”

Moving ahead, the company is eyeing expansion to markets in Europe and Oceania, including Australia, where Cogo has already set up an office. According to Bellis, Cogo has also signed confidentiality agreements with companies in Japan and Hong Kong to explore partnerships in these countries.

“We also have people on the ground in North America to check the lay of the land and develop a strategy for that market,” she added.

The same care goes into building the Cogo team. “Just as you might replicate your software, we want to be able to replicate our team, so we can be consistent with our offering,” Bellis said. “We want to ensure we have all the right onboarding process and training.”