Fintech

This function is exclusive for Premium subscribers

-

DATABASE (313)

-

ARTICLES (110)

Xendit, an all-purpose payment gateway and management platform for SMEs and startups in Southeast Asia, becomes a unicorn after expansion into the Philippines.

Xendit, an all-purpose payment gateway and management platform for SMEs and startups in Southeast Asia, becomes a unicorn after expansion into the Philippines.

Cobee automates and extends flexibility in compensation and benefits management to meal vouchers, childcare, healthcare, etc., helping firms increase their average employee benefits uptake fourfold.

Cobee automates and extends flexibility in compensation and benefits management to meal vouchers, childcare, healthcare, etc., helping firms increase their average employee benefits uptake fourfold.

Indonesia’s first unicorn, ride-hailing startup Gojek has merged with Tokopedia to compete against regional giants Grab and Sea Group to develop the best super-app.

Indonesia’s first unicorn, ride-hailing startup Gojek has merged with Tokopedia to compete against regional giants Grab and Sea Group to develop the best super-app.

Amartha’s business co-op for unbanked entrepreneurs has pivoted into Indonesia’s fastest-growing P2P lending fintech for women, with over 800% growth in loans issued.

Amartha’s business co-op for unbanked entrepreneurs has pivoted into Indonesia’s fastest-growing P2P lending fintech for women, with over 800% growth in loans issued.

Empowering Ghanaian subsistence farmers, especially women, via apps boosting sales via direct links to buyers, cutting out intermediaries, and offering e-payments, micro-credits and insurance.

Empowering Ghanaian subsistence farmers, especially women, via apps boosting sales via direct links to buyers, cutting out intermediaries, and offering e-payments, micro-credits and insurance.

Feedzai is a powerful cloud-based AI tool detecting e-commerce fraud in real-time among trillions of dollars of transactions by the world’s largest corporates.

Feedzai is a powerful cloud-based AI tool detecting e-commerce fraud in real-time among trillions of dollars of transactions by the world’s largest corporates.

Using big data and predictive risk analysis, Pula is helping 4.4m farmers to boost yields, get insurance to protect their livelihoods against environmental hazards.

Using big data and predictive risk analysis, Pula is helping 4.4m farmers to boost yields, get insurance to protect their livelihoods against environmental hazards.

Ajaib’s online wealth management tool brings personalized mutual fund investing to the masses, potentially mobilizing billions of investable assets across Southeast Asia.

Ajaib’s online wealth management tool brings personalized mutual fund investing to the masses, potentially mobilizing billions of investable assets across Southeast Asia.

Unlocking the potential of pan-African commerce, on-demand logistics platform Kobo360 is scaling its trucking network across borders to speed up deliveries and reduce transportation costs.

Unlocking the potential of pan-African commerce, on-demand logistics platform Kobo360 is scaling its trucking network across borders to speed up deliveries and reduce transportation costs.

The first equity crowdfunding company to be licensed in Indonesia, Santara started locally in Yogyakarta to help SMEs in Indonesia, attract investors and raise capital.

The first equity crowdfunding company to be licensed in Indonesia, Santara started locally in Yogyakarta to help SMEs in Indonesia, attract investors and raise capital.

Pioneering insurtech leverages AI to tailor offers to SMEs and the self-employed, with monthly payments and no commission.

Pioneering insurtech leverages AI to tailor offers to SMEs and the self-employed, with monthly payments and no commission.

Indonesia's newly-licensed equity crowdfunding platform CrowdDana empowers people to invest in real estate and ease shortage of affordable housing.

Indonesia's newly-licensed equity crowdfunding platform CrowdDana empowers people to invest in real estate and ease shortage of affordable housing.

Cogo: Tech that helps you cut your real-time carbon footprint through daily choices

Currently operating in New Zealand, Australia and the UK, Cogo is raising $20m to bring its emissions tracking technology to companies and consumers in Asia, Europe and the US

Southeast Asian startups to keep riding digitalization, IPO boom, investors say

O2O business models and growing interest in ESG are also key themes, as regional startups gain $4.4bn of funding in first half of 2021

Intudo Ventures: Grooming returning overseas talent for an Indonesia-only bet

Combining the experience and networks of foreign-educated Indonesians with local distribution channels, Intudo’s hyperlocal strategy has attracted $200m in managed assets

MioTech: Early mover in China ESG data and analytics for investing, corporate reporting

Hong Kong-based fintech uses AI technologies to monitor ESG data and risks in real time, turn unstructured data into reliable insights

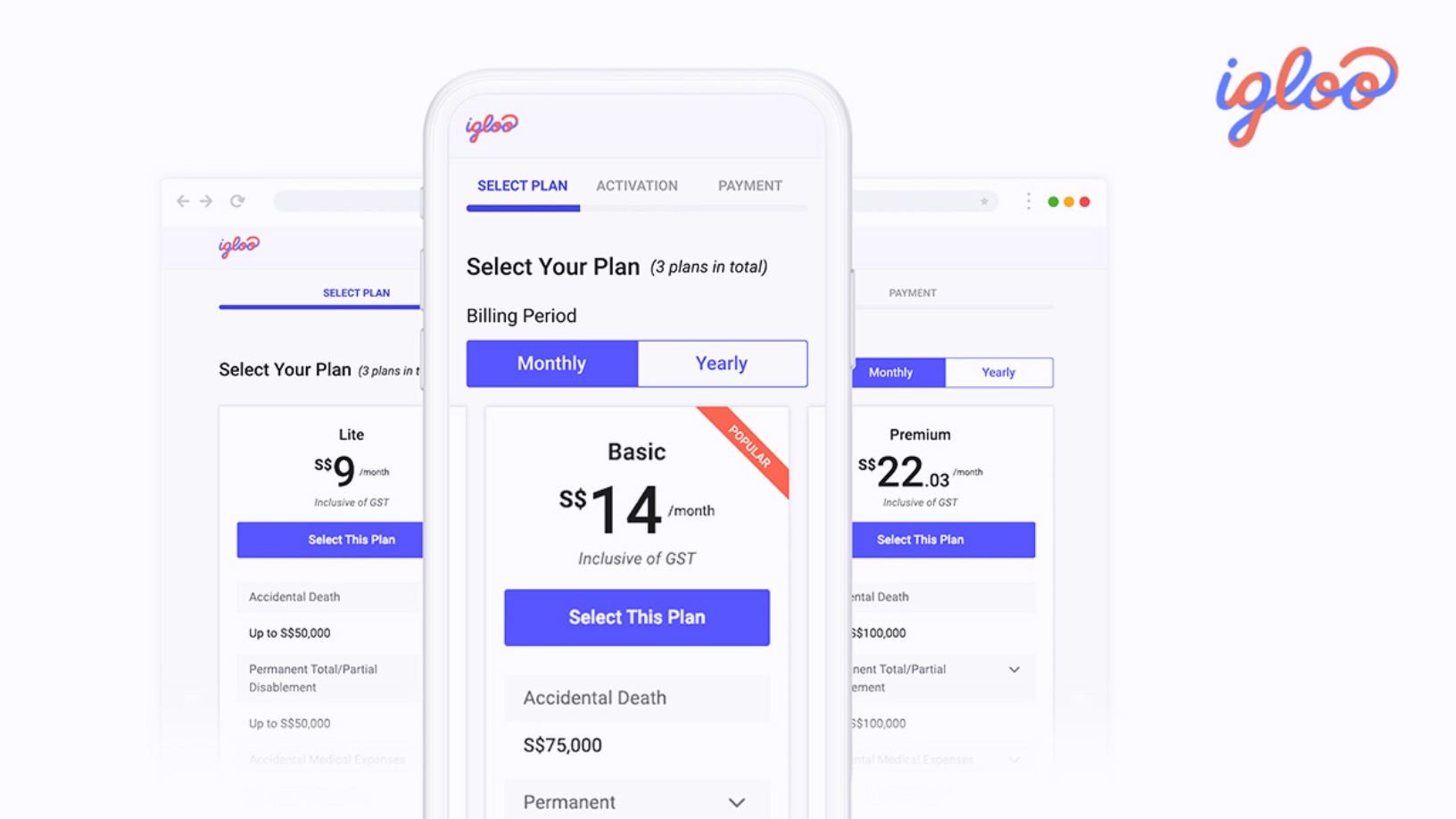

From delivery riders to MSMEs, Igloo aims to make insurance more accessible

Expanding from its origins in e-commerce insurance, Igloo seeks growth in credit insurance and income protection for middle-income groups in Southeast Asia

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Gigacover: Providing a financial safety net for gig workers

Gigacover is eyeing multi-billion-dollar opportunities in income and healthcare protection and financial services for the 150m self-employed workers in Southeast Asia, about half of whom are underbanked

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

Future Food Asia 2021: Regenerative agriculture in Asia

The unique challenges facing regenerative agriculture in Asia require solutions different from those in the West, presenting opportunities for microfinancing and impact investment

AgroCenta: Providing market access and credit to African smallholder farmers

AgroCenta’s platforms empower Ghanaian subsistence farmers, especially women, boosting productivity and sales with e-payments, micro-credits and insurance, and direct connections to buyers, cutting out the intermediaries

Gojek and Tokopedia merge to form GoTo

The new entity, now Indonesia’s largest tech group, plans to go public in Indonesia and the US, targeting a $40bn valuation

Accelerating Asia's Amra Naidoo: We’re at an inflection point in Southeast Asia

Accelerating Asia’s co-founder Amra Naidoo reveals how the program adapts its curriculum to meet startups’ needs and the challenges accelerator programs face during the pandemic

Indonesian insurtech Qoala survives pandemic with new partners and products

Acquisition of Thai insurtech FairDee to spearhead expansion into Southeast Asia, building on earlier entry into Malaysia and Vietnam and a Covid-19 travel insurance product at home

Pula: Pioneering insurtech helps to improve Africa's food security

With Kenyan insurtech Pula’s micro-insurance products, millions of farmers no longer have to bear the full risk of losses from natural disasters and crop failures

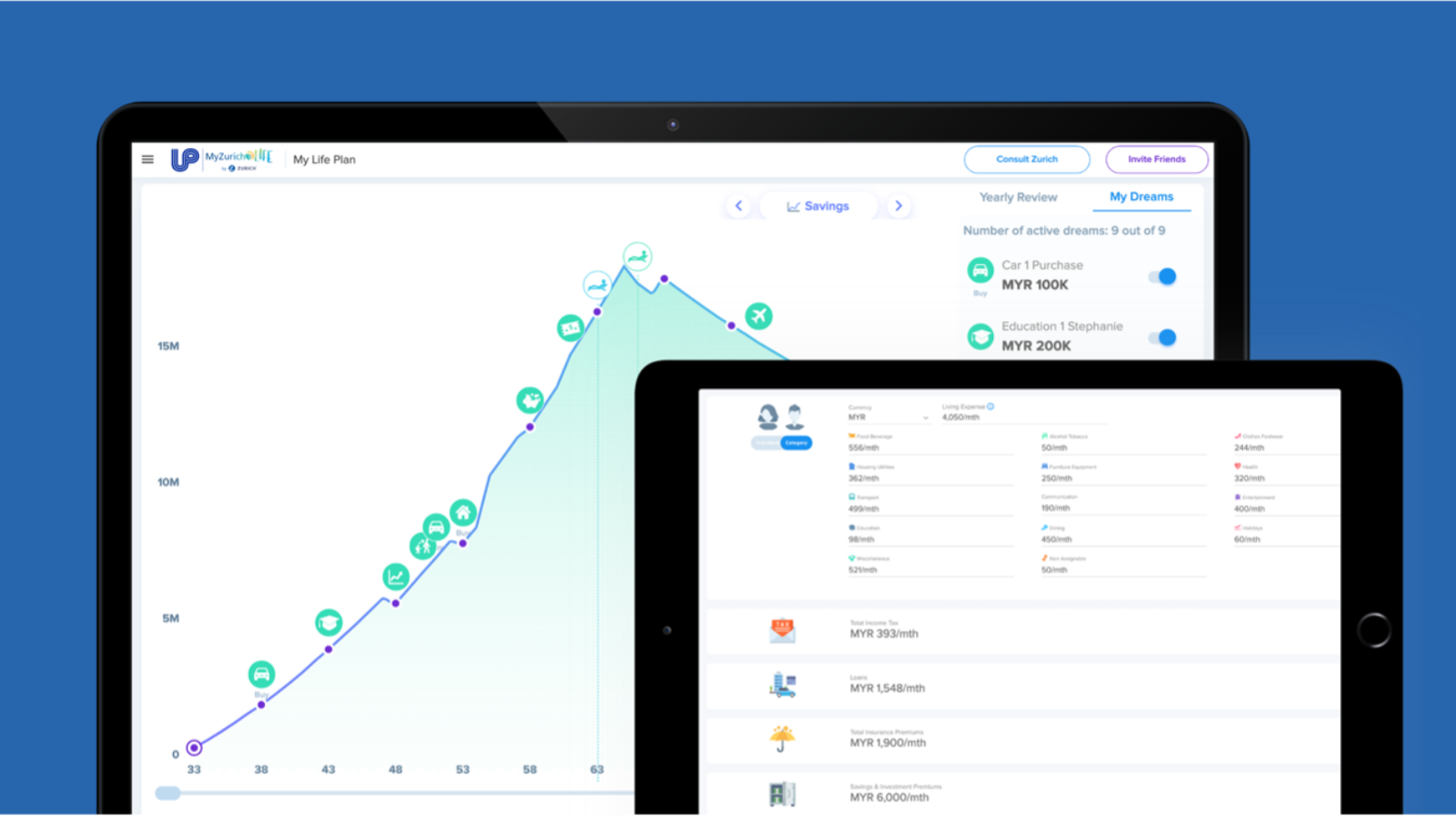

BetterTradeOff: Taking the pain out of financial planning

The Singapore-based startup’s user numbers rose sharply during Covid-19. It wants to raise $11.5m by year-end, is planning a launch in Australia and is eyeing the US market