Food deliveries have become a source of comfort, and even a lifeline, for many people stuck at home owing to Covid-19 pandemic lockdowns. The fleets of gig workers who make these deliveries, however, are stretched thin and exposed to a greater risk of accidents or Covid-19 infection. Singapore-based insurtech startup Igloo, formerly known as Axinan, has launched new products to protect such gig workers from the financial risks related to these hazards.

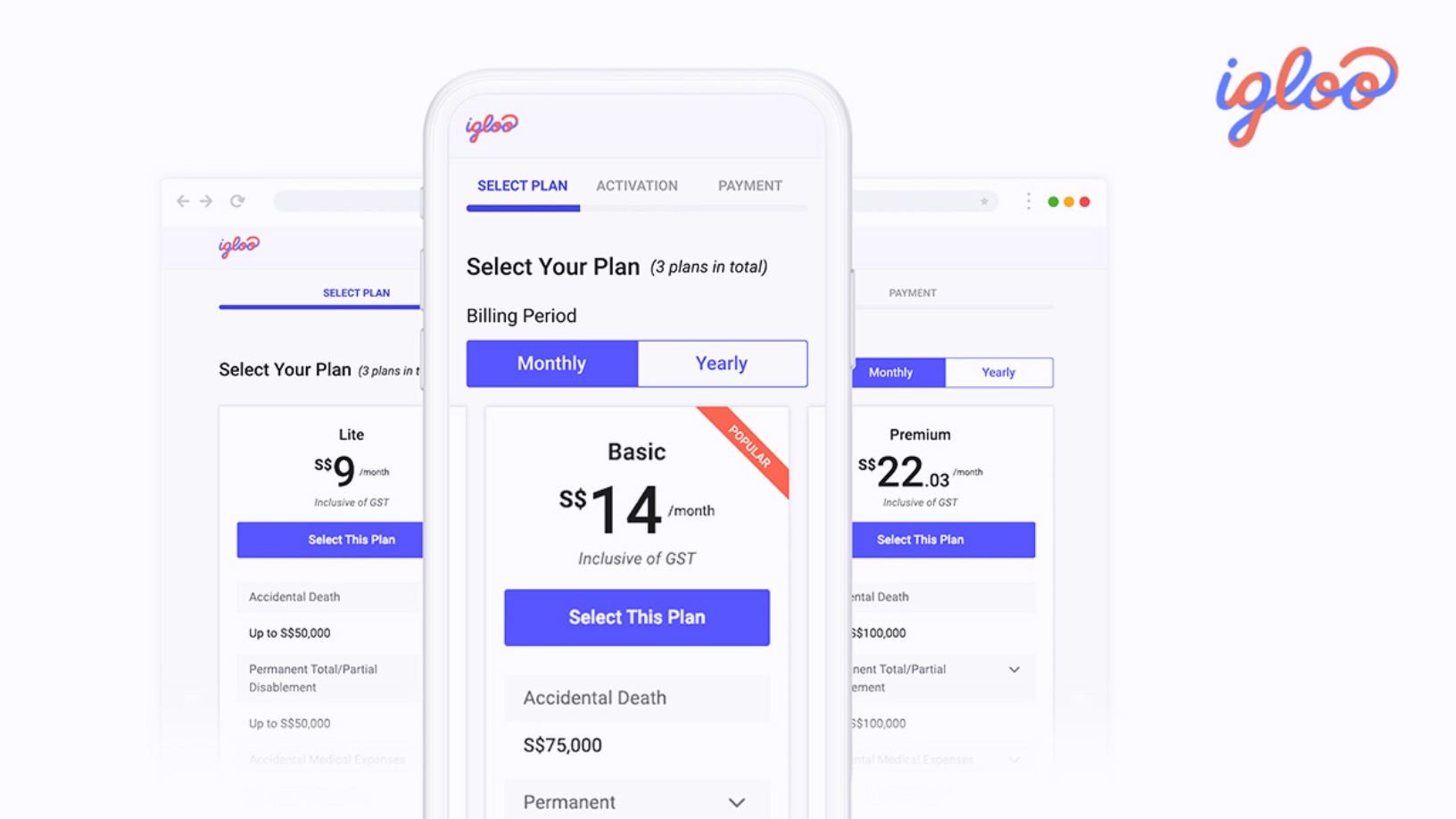

Working with insurers such as MSIG and Cigna, Igloo is providing a bundle of insurance products for Foodpanda delivery riders in Thailand and Singapore. Called PandaCare in Singapore, the bundle includes coverage for accidental death, disability, mobile phone damage and hospitalization funds. Foodpanda riders in Singapore can pay as little as S$9 ($1=S$1.35) monthly to access insurance coverage benefits through PandaCare.

“During the Covid-19 pandemic, we’ve noticed that the riders’ working hours have increased and that they also run the risk of getting infected,” Igloo Chief Commercial Officer Raunak Mehta told CompassList in an online interview. “We try to address the costs associated with Covid-19 diagnosis, hospitalization and loss of income.”

Founded in 2016 by ex-Grab CTO Wei Zhu, Igloo started out creating microinsurance products for e-commerce deliveries, capitalizing on the growth of online shopping in Southeast Asia. The company has since expanded its range of products and partnerships to include accident-coverage products such as PandaCare, automotive insurance in Thailand, and even natural disaster coverage in the Philippines.

The startup is currently in talks to raise more funds to extend its “presence and expertise” wherever it is currently active. “Over the next six months, we will grow our team twofold, with a focus on scaling and consolidating the country, engineering and insurance teams,” Mehta said.

Data-guided product development

Just on August 29, Singapore Prime Minister Lee Hsien Loong said he was "especially concerned" about the plight of delivery riders who work with online platforms like Foodpanda, Grab and Deliveroo, and earn “modest incomes.” Because these gig-economy workers don’t have employment contracts, they lack basic work protections such as workplace injury compensation and pension contributions, and face economic insecurity, he said.

Igloo’s goal is to help fill the $134bn underinsurance gap in Asia by offering affordable, easy to understand and accessible products through the digital platforms that Asians engage with. “For a push-based industry such as insurance, demand is developed through increased awareness," Mehta said. “Making insurance easy to understand will help to increase insurance penetration.”

For its partnership with Foodpanda, Igloo collected and studied data on the drivers’ vehicle types, the routes taken to reach the destination, delivery schedules and the number of accidents in which the driver had been involved. By determining the risk undertaken by drivers during their work, Igloo and MSIG are able to provide customized insurance coverage at lower premiums, focusing on the key risks and relevant products while removing the more fringe benefits.

Such an approach can also be used to improve existing insurance products such as automotive insurance. In Thailand, Igloo uses a device attached to the vehicle to collect data on speed, distance, trip duration and areas visited. This data is used to learn about the driver’s behavior and to assign an individual risk score, which in turn determines the insurance premium payments.

The usage-based insurance system, which monitors how the driver controls their vehicle, benefits both the driver and the insurance company. “When you’re being monitored, you start behaving better, your risk score improves and you get charged a lower premium,” Mehta said. “The insurance company also benefits because there are fewer accidents and therefore fewer claims.”

Mehta added that Igloo is able to provide granular, focused products because of its use of big data, a broad range of industry expertise and the flexibility that comes with being a startup.

“Can big insurance companies come up with the products we do? Of course, because ultimately it’s humans who make these products. But as you grow bigger [as a company], you have less room to be disruptive and you have to move steadily,” Mehta said.

“Moving in uncharted waters is something that these companies generally don’t want to do and this is where Igloo comes in.”

Adding value and impact

As an insurtech startup, Igloo connects insurers with a broader range of clients, whether through developing new products or through digitizing the sales of existing ones. Mehta said that Igloo’s services also benefit the platforms that offer these products, whether they are e-commerce companies offering delivery insurance or logistics companies providing their gig workers with accident coverage.

“[For companies employing gig workers], this is a way to show their workers that they are welcomed,” Mehta said. “It’s not just a platform that pays you for work, but it also gives you peace of mind.”

In the case of gig workers, providing peace of mind does not stop at insurance coverage for the workers themselves. Mehta said that Foodpanda Singapore drivers could purchase insurance products for their family members through PandaCare. “This is one way we are trying to make a positive impact in society,” he said.

Mehta revealed that Igloo is currently looking for partners to develop social insurance products, which will provide families with financial support if they lose their main source of income. “While Southeast Asia’s middle-class is steadily becoming more affluent, there is still little social protection available to help those breadwinners who lose their jobs or fall sick.”

Expanding in Southeast Asia

While Mehta declined to comment on Igloo’s profitability, he shared that Igloo’s revenue has grown tenfold since 2019, and the company is “on track to achieve its goal of facilitating 5% of general insurance premium over the next five years.” The company earns revenue by facilitating the transactions between insurers and clients, although the specific rates and mechanisms vary between use cases and contracts.

Igloo has raised $16m in funding so far, with the most recent round being an $8.2m extension to its Series A round in April 2020. To reach a broader segment of Southeast Asia’s middle-income households, Igloo is developing new products that can be accessed through digital platforms. One is a credit insurance product, which Mehta said would be launched in at least one country in the region within the next six months.

“People take credit facilities from banks and other financial institutions to carry out their daily activities, and there is an opportunity to protect them against default risks in the event of unemployment, death or disability,” he said.

Igloo will also explore opportunities to work with MSMEs, which employ the majority of the population in Southeast Asia. “Many MSMEs are under financial stress, but they still have to take care of their employees," he said. “I hope we can deliver a product that can help these organizations, which have not been able to provide the kinds of employee benefits that larger companies can.”