Personal Finance

This function is exclusive for Premium subscribers

-

DATABASE (16)

-

ARTICLES (21)

Cobee automates and extends flexibility in compensation and benefits management to meal vouchers, childcare, healthcare, etc., helping firms increase their average employee benefits uptake fourfold.

Cobee automates and extends flexibility in compensation and benefits management to meal vouchers, childcare, healthcare, etc., helping firms increase their average employee benefits uptake fourfold.

Ajaib’s online wealth management tool brings personalized mutual fund investing to the masses, potentially mobilizing billions of investable assets across Southeast Asia.

Ajaib’s online wealth management tool brings personalized mutual fund investing to the masses, potentially mobilizing billions of investable assets across Southeast Asia.

Indonesia's newly-licensed equity crowdfunding platform CrowdDana empowers people to invest in real estate and ease shortage of affordable housing.

Indonesia's newly-licensed equity crowdfunding platform CrowdDana empowers people to invest in real estate and ease shortage of affordable housing.

With plans to expand across Europe, StudentFinance uses AI-powered screening platform to recruit and train students to plug the skills gaps in fast-growing tech sectors.

With plans to expand across Europe, StudentFinance uses AI-powered screening platform to recruit and train students to plug the skills gaps in fast-growing tech sectors.

Micro-investing app, aimed at half of the world's millennials without retirement plans, rounds up users' card purchases to the nearest euro, saving the difference.

Micro-investing app, aimed at half of the world's millennials without retirement plans, rounds up users' card purchases to the nearest euro, saving the difference.

With 10m users worldwide, Fumi's trading platform Webull offers punters the best of Bloomberg, Interactive Brokers and Charles Schwab.

With 10m users worldwide, Fumi's trading platform Webull offers punters the best of Bloomberg, Interactive Brokers and Charles Schwab.

Focused on helping young professionals learn to manage their finances, Halofina is a mobile app that gives users investment recommendations and portfolio tracking.

Focused on helping young professionals learn to manage their finances, Halofina is a mobile app that gives users investment recommendations and portfolio tracking.

Having consistently iterated and improved its technology, Quipu now has a strong position in Spain's HR sector; gaining traction in new markets is next.

Having consistently iterated and improved its technology, Quipu now has a strong position in Spain's HR sector; gaining traction in new markets is next.

Need cash fast? JULO's AI-based proprietary credit-scoring system offers quick approvals for short-term microloans via its smartphone app.

Need cash fast? JULO's AI-based proprietary credit-scoring system offers quick approvals for short-term microloans via its smartphone app.

Mastercard, established in 1966, has made 12 acquisitions to date and has a special interest in secure payment systems and different technologies associated with their implementation. It has a special interest in secure payment systems and different technologies associated with their implementation. Since launch in early 2014, MasterCard Start Path, the company’s effort to support innovative early stage startups around the world, has partnered with over 40 startups across the globe in areas including biometrics, big data, wearable technology, beacons, B2B payments, and logistics.

Mastercard, established in 1966, has made 12 acquisitions to date and has a special interest in secure payment systems and different technologies associated with their implementation. It has a special interest in secure payment systems and different technologies associated with their implementation. Since launch in early 2014, MasterCard Start Path, the company’s effort to support innovative early stage startups around the world, has partnered with over 40 startups across the globe in areas including biometrics, big data, wearable technology, beacons, B2B payments, and logistics.

Indexa Capital is Spain's first automated investment manager offering index funds. Its operations are based on passive investment management. The firm's objective is to offer diversified and transparent investments with commissions that are 80% lower than those charged by the financial sector. This is achieved through index funds investments and a machine that automatically assigns clients a portfolio from the available options, based on criteria such as the client's age, income and risk aversion, promising returns that are 3% higher than the average returns offered by banks and funds.The company was founded in 2015 by Unai Ansejo Barra, François Derbaix and Ramón Blanco, all of whom have extensive experience in the digital and investments ecosystems.

Indexa Capital is Spain's first automated investment manager offering index funds. Its operations are based on passive investment management. The firm's objective is to offer diversified and transparent investments with commissions that are 80% lower than those charged by the financial sector. This is achieved through index funds investments and a machine that automatically assigns clients a portfolio from the available options, based on criteria such as the client's age, income and risk aversion, promising returns that are 3% higher than the average returns offered by banks and funds.The company was founded in 2015 by Unai Ansejo Barra, François Derbaix and Ramón Blanco, all of whom have extensive experience in the digital and investments ecosystems.

Based in UK, Will Neale is a prolific angel and early-stage investor with interests in over a dozen startups from the pre-seed to Series B stages. The tech consultant had previously worked as a manager at Accenture for six years.In 2006, Neale founded mobile payments and processing startup Fonix Mobile. He also created Grabyo, a cloud-based video production, editing and distribution platform in 2013.

Based in UK, Will Neale is a prolific angel and early-stage investor with interests in over a dozen startups from the pre-seed to Series B stages. The tech consultant had previously worked as a manager at Accenture for six years.In 2006, Neale founded mobile payments and processing startup Fonix Mobile. He also created Grabyo, a cloud-based video production, editing and distribution platform in 2013.

Founded in 2019 in Silicon Valley, Concrete Rose is focused on diversity by investing in under-represented founders and companies serving under-represented consumers at the early-stage and across market segments. It currently has 14 companies in its portfolio and its most recent investments in January 2021 include the $3.5m seed round of inclusive car insurer Loop and in the $17.1m seed round of HR analytics software Syndio

Founded in 2019 in Silicon Valley, Concrete Rose is focused on diversity by investing in under-represented founders and companies serving under-represented consumers at the early-stage and across market segments. It currently has 14 companies in its portfolio and its most recent investments in January 2021 include the $3.5m seed round of inclusive car insurer Loop and in the $17.1m seed round of HR analytics software Syndio

Founded in 2012 in Washington DC, Accion Venture Lab is a seed-stage investor in fintech for the underserved. Venture Lab is part of Accion, a not-for-profit global organization that works with financial service providers to deliver affordable solutions for unbanked and underbanked communities worldwide.Its portfolio includes 44 startups from 17 countries, ranging from Chile to Indonesia. Seed-stage startups normally get $500,000 funding per company. Investments in December 2020 included participation in the $1.5m seed round of Argentinian software development tech Henry and a financing round for Indonesian micro-credit fintech Pintech.

Founded in 2012 in Washington DC, Accion Venture Lab is a seed-stage investor in fintech for the underserved. Venture Lab is part of Accion, a not-for-profit global organization that works with financial service providers to deliver affordable solutions for unbanked and underbanked communities worldwide.Its portfolio includes 44 startups from 17 countries, ranging from Chile to Indonesia. Seed-stage startups normally get $500,000 funding per company. Investments in December 2020 included participation in the $1.5m seed round of Argentinian software development tech Henry and a financing round for Indonesian micro-credit fintech Pintech.

- 1

- 2

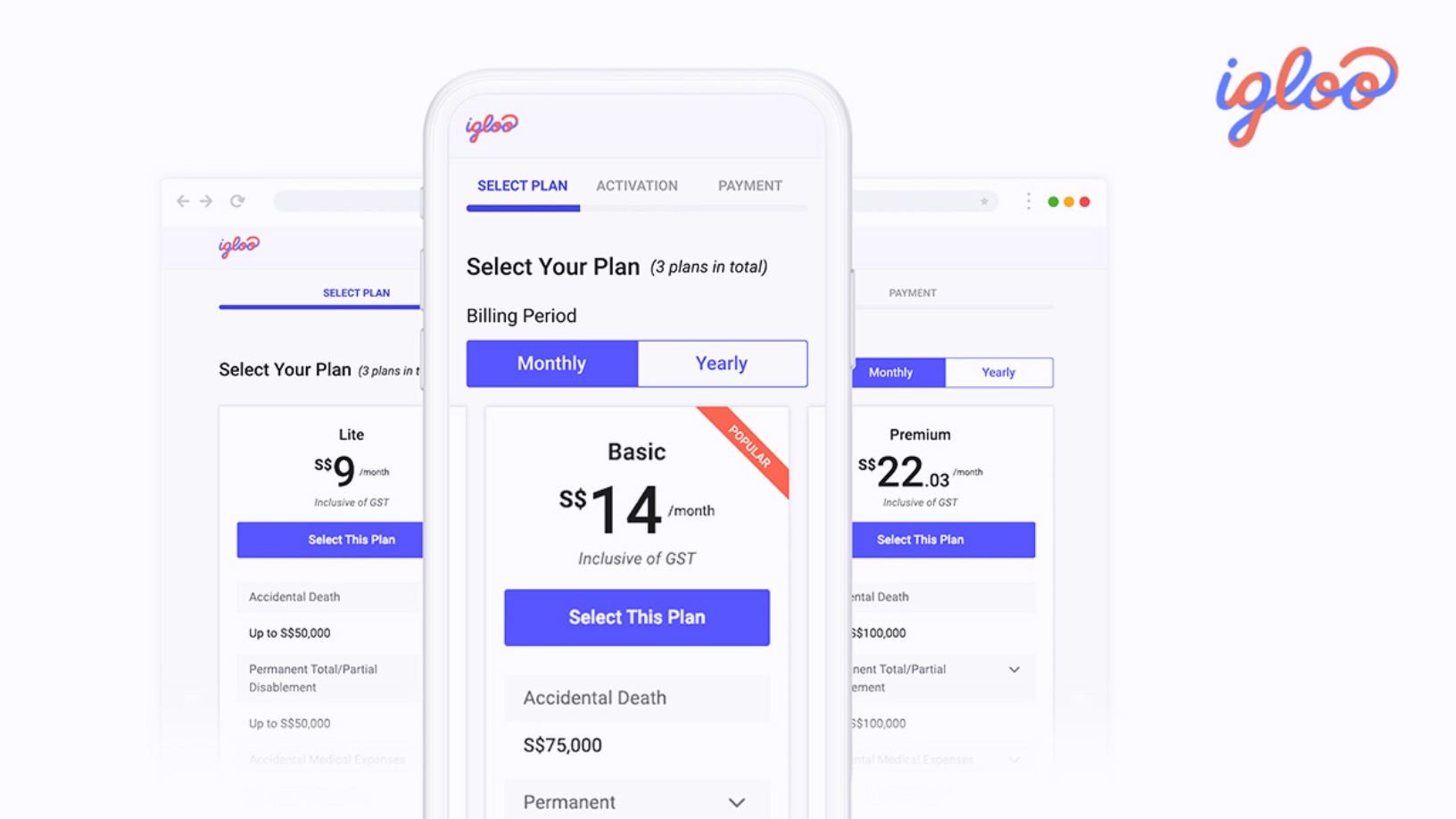

From delivery riders to MSMEs, Igloo aims to make insurance more accessible

Expanding from its origins in e-commerce insurance, Igloo seeks growth in credit insurance and income protection for middle-income groups in Southeast Asia

AgroCenta: Providing market access and credit to African smallholder farmers

AgroCenta’s platforms empower Ghanaian subsistence farmers, especially women, boosting productivity and sales with e-payments, micro-credits and insurance, and direct connections to buyers, cutting out the intermediaries

Indonesian insurtech Qoala survives pandemic with new partners and products

Acquisition of Thai insurtech FairDee to spearhead expansion into Southeast Asia, building on earlier entry into Malaysia and Vietnam and a Covid-19 travel insurance product at home

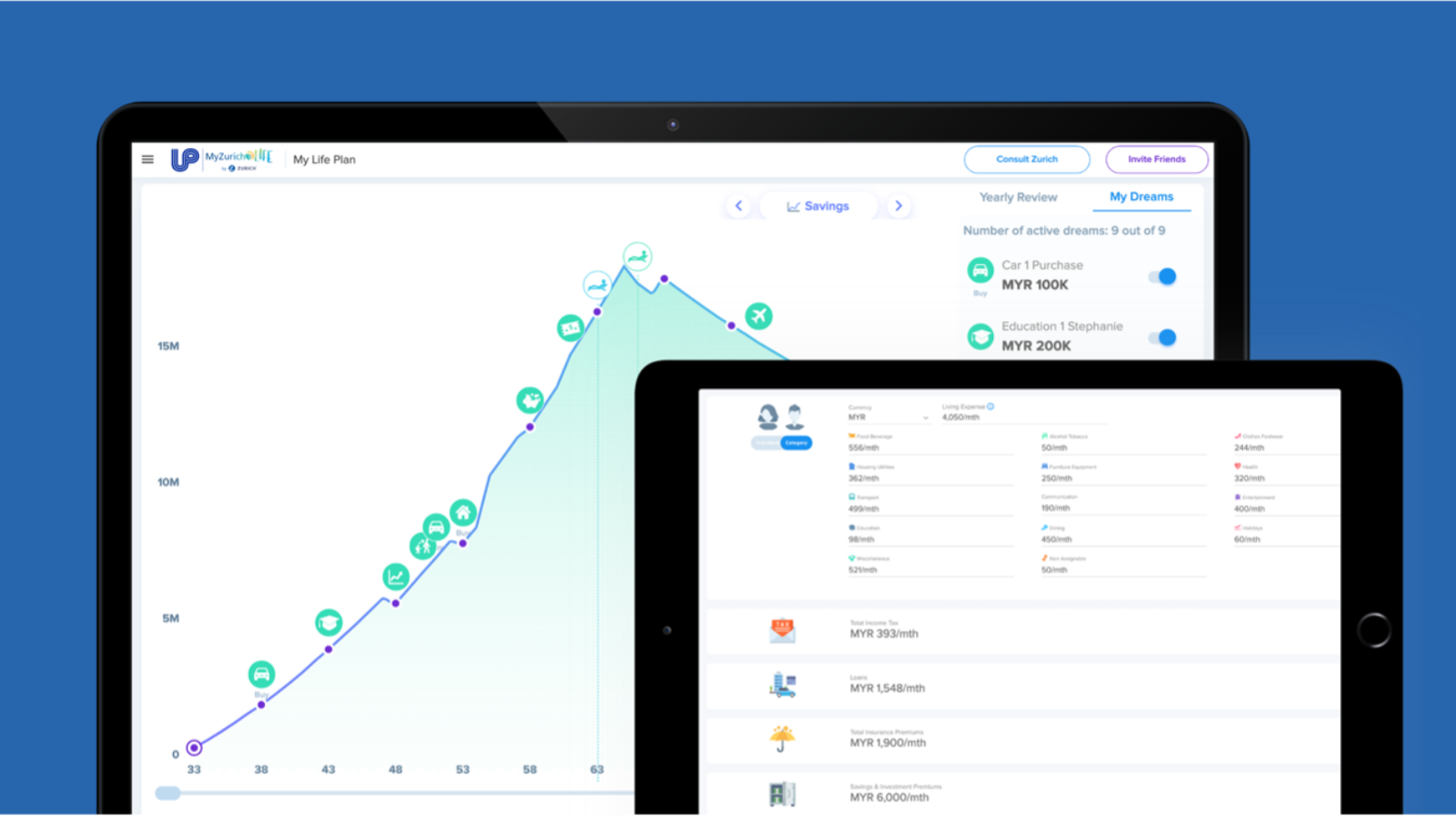

BetterTradeOff: Taking the pain out of financial planning

The Singapore-based startup’s user numbers rose sharply during Covid-19. It wants to raise $11.5m by year-end, is planning a launch in Australia and is eyeing the US market

Indonesian fintechs plug payday gaps, help workers stay away from loan sharks

Cash advance or “earned wage access” programs, already popular employee benefits in the US and Europe, are attracting investors and diverse clients in Indonesia

In depth: The business ecosystems China’s tech giants and unicorns build

Startups could accept to join Alibaba, Tencent or other tech giants in their ecosystems and scale quickly. Or they could say no and keep their independence. But do they really have a choice?

Ajaib targets millennials with easy-to-use investment app

Y Combinator alumnus Ajaib recently acquired a local brokerage to add stock trading to its products

Cobee: On-demand staff payroll and benefits in an app and card

Backed by Speedinvest, Target Global and Encomenda, Cobee's employee-focused HR SaaS is redefining staff benefits management and beyond

Fresh from $13.5m Series A, Indonesian insurtech Qoala takes the long view amid Covid-19

Backed by capital from VCs like Sequoia Capital India, Qoala wants to grow its income channels, team and partnerships as others hold back

StudentFinance: AI screening software matches students to IT courses and jobs

StudentFinance also offers "Study now, pay later" model, making IT courses financially accessible while helping companies overcome skilled tech talent shortage

Alipay opens its platform to speed up digitalization of Chinese service providers amid Covid-19

As Alipay continues to battle WeChat for super-app supremacy, it's created a stronghold in China’s services industry, where 80% of businesses still operate under brick-and-mortar models

Spanish startups and investors rethink strategies as Covid-19 hits funding, valuations

Investors and startups in Spain say most funding has stalled, and share their strategies and advice for coping with the downturn

QRIS: Will the new QR code standard rewrite Indonesia’s e-payments scene?

Enabling interoperability, the QRIS seeks to level the playing field until now dominated by GoPay and OVO – disruption that could go beyond the e-wallets scene

Coinscrap: Digital piggy banks for millennials

Smart savings app helps young consumers save and invest every cent of spare change by rounding up payments for purchases

E-wallet LinkAja gets access to Indonesia's Civil Registry for user data checks

Move allows more than 2,000 public and private entities to verify user data against government records, but the public has raised privacy and security concerns

- 1

- 2