Ghana

-

DATABASE (7)

-

ARTICLES (8)

CTO and co-founder of AgroCenta (Holdings)

Michael Ocansey graduated in accounting and IT from Regent University of Science and Technology in Dansoman, Ghana. From 2005 to 2010, Ocansey worked as a lead web developer at Ghanaian digital development agency Esoko in Accra, where he met business development executive Francis Obirikorang. Ocansey also worked as a contract web developer for software developer Origo in San Diego for two years until 2013.In 2015, Ocansey and Obirikorang co-founded Swappaholics Holdings in British Virgin Islands. He worked for one year as CTO for the online marketplace that allows users to “barter” or exchange products, skills and services.In January 2016, Ocansey and Obirikorang established AgroCenta (Holdings) Limited in Mauritius. The agritech startup set up its first office in Accra to provide an e-commerce platform, supply-chain and fintech services to smallholder farmers in Ghana.

Michael Ocansey graduated in accounting and IT from Regent University of Science and Technology in Dansoman, Ghana. From 2005 to 2010, Ocansey worked as a lead web developer at Ghanaian digital development agency Esoko in Accra, where he met business development executive Francis Obirikorang. Ocansey also worked as a contract web developer for software developer Origo in San Diego for two years until 2013.In 2015, Ocansey and Obirikorang co-founded Swappaholics Holdings in British Virgin Islands. He worked for one year as CTO for the online marketplace that allows users to “barter” or exchange products, skills and services.In January 2016, Ocansey and Obirikorang established AgroCenta (Holdings) Limited in Mauritius. The agritech startup set up its first office in Accra to provide an e-commerce platform, supply-chain and fintech services to smallholder farmers in Ghana.

CEO and co-founder of AgroCenta (Holdings)

Francis Obirikorang completed a bachelor’s degree in materials engineering in 2006 at Kwame Nkrumah University of Science and Technology (KNUST) in Kumasi, Ghana.In 2008, Obirikorang started work as a technical writer at Esoko, a Ghanaian digital development agency in Accra, where he met web developer Michael Ocansey. Obirikorang left Esoko in 2010 and became lead technical writer for Corenett, a transactions processing management company. In 2013, he worked at digital advertising agency TXT Ghana as a business analyst until 2015.In January 2015, Obirikorang and Ocansey established their first startup Swappaholics Holdings in the British Virgin Islands. In 2016, the two friends also co-founded AgroCenta (Holdings) Limited in Mauritius with Obirikorang as CEO and Ocansey as CTO. Ocansey left the Swappaholics in 2016 to focus on building AgroCenta.Obirikorang still runs both companies as CEO and joined the global entrepreneur community Startup Grind in 2016 as chapter director of Kumasi, Ghana’s second-largest city.

Francis Obirikorang completed a bachelor’s degree in materials engineering in 2006 at Kwame Nkrumah University of Science and Technology (KNUST) in Kumasi, Ghana.In 2008, Obirikorang started work as a technical writer at Esoko, a Ghanaian digital development agency in Accra, where he met web developer Michael Ocansey. Obirikorang left Esoko in 2010 and became lead technical writer for Corenett, a transactions processing management company. In 2013, he worked at digital advertising agency TXT Ghana as a business analyst until 2015.In January 2015, Obirikorang and Ocansey established their first startup Swappaholics Holdings in the British Virgin Islands. In 2016, the two friends also co-founded AgroCenta (Holdings) Limited in Mauritius with Obirikorang as CEO and Ocansey as CTO. Ocansey left the Swappaholics in 2016 to focus on building AgroCenta.Obirikorang still runs both companies as CEO and joined the global entrepreneur community Startup Grind in 2016 as chapter director of Kumasi, Ghana’s second-largest city.

Empowering Ghanaian subsistence farmers, especially women, via apps boosting sales via direct links to buyers, cutting out intermediaries, and offering e-payments, micro-credits and insurance.

Empowering Ghanaian subsistence farmers, especially women, via apps boosting sales via direct links to buyers, cutting out intermediaries, and offering e-payments, micro-credits and insurance.

Nigerian investment bank and investor CardinalStone Partners was founded in 2008. It invests in enterprises with the potential to transform diverse sectors deemed to be strategic to the development of the economies in Nigeria, Ghana and other West African countries.The VC also reviews potential investments in relation to their ESG impact. CardinalStone currently has six companies in its portfolio including Nigerian gym chain i-Fitness and Nigerian fintech Appzone. In 2020, it raised $50m for a new private equity fund, CardinalStone Capital Advisers Growth Fund.

Nigerian investment bank and investor CardinalStone Partners was founded in 2008. It invests in enterprises with the potential to transform diverse sectors deemed to be strategic to the development of the economies in Nigeria, Ghana and other West African countries.The VC also reviews potential investments in relation to their ESG impact. CardinalStone currently has six companies in its portfolio including Nigerian gym chain i-Fitness and Nigerian fintech Appzone. In 2020, it raised $50m for a new private equity fund, CardinalStone Capital Advisers Growth Fund.

Norfund is the sovereign investment fund of Norway, established by the parliament in 1997 and owned by the Ministry of Foreign Affairs. The company has committed NOK 28.4bn in investments into 170 projects in developing countries as of 2020. Norfund has regional offices in Thailand, Costa Rica, Kenya, Mozambique and Ghana to support its activities in Asia, Africa and Latin America. In Asia, its core investment targets are Indonesia, Cambodia, Laos, Vietnam, Myanmar, Bangladesh and Sri Lanka. Norfund primarily invests in three key areas: clean energy, agriculture and fintech. The fund has invested in solar power projects and various food companies in India and various African countries. In Asia, Norfund has invested in Amartha, an Indonesian P2P lending fintech company providing loans to women-led microbusinesses. Norfund also invests in other venture funds, such as Southeast Asia-focused Openspace Ventures Fund III, to expand and diversify their portfolio.

Norfund is the sovereign investment fund of Norway, established by the parliament in 1997 and owned by the Ministry of Foreign Affairs. The company has committed NOK 28.4bn in investments into 170 projects in developing countries as of 2020. Norfund has regional offices in Thailand, Costa Rica, Kenya, Mozambique and Ghana to support its activities in Asia, Africa and Latin America. In Asia, its core investment targets are Indonesia, Cambodia, Laos, Vietnam, Myanmar, Bangladesh and Sri Lanka. Norfund primarily invests in three key areas: clean energy, agriculture and fintech. The fund has invested in solar power projects and various food companies in India and various African countries. In Asia, Norfund has invested in Amartha, an Indonesian P2P lending fintech company providing loans to women-led microbusinesses. Norfund also invests in other venture funds, such as Southeast Asia-focused Openspace Ventures Fund III, to expand and diversify their portfolio.

Investisseurs & Partenaires (I&P)

Set up in 2002 by Patrice Hoppenot 15 years after he founded European investment fund BC Partners, Investisseurs & Partenaires (I&P) is an impact investor seeking to help SMEs prosper in Africa and create sustainable jobs and income there. With about €210m raised to date, I&P finances SMEs, startups and regional investment funds in Africa through equity participation and loans, as well as through microfinance institutions. Its I&P Acceleration Technologies focuses on digital startups with €2.5m of funding to be invested in 10–15 startups in 2020–2023. To date, I&P has supported more than 100 capital-funded companies and 20 companies benefiting from subsidized acceleration programs. I&P has about 100 staff based in Paris, Washington D.C. and in seven African offices (Burkina Faso, Cameroon, Côte d'Ivoire, Ghana, Madagascar, Niger and Senegal).

Set up in 2002 by Patrice Hoppenot 15 years after he founded European investment fund BC Partners, Investisseurs & Partenaires (I&P) is an impact investor seeking to help SMEs prosper in Africa and create sustainable jobs and income there. With about €210m raised to date, I&P finances SMEs, startups and regional investment funds in Africa through equity participation and loans, as well as through microfinance institutions. Its I&P Acceleration Technologies focuses on digital startups with €2.5m of funding to be invested in 10–15 startups in 2020–2023. To date, I&P has supported more than 100 capital-funded companies and 20 companies benefiting from subsidized acceleration programs. I&P has about 100 staff based in Paris, Washington D.C. and in seven African offices (Burkina Faso, Cameroon, Côte d'Ivoire, Ghana, Madagascar, Niger and Senegal).

LeapFrog Investments is an impact-focused investor, managing over $1.6bn in assets mainly investing in Africa and Asia. Its “profit with purpose” has led to investments in startups that provide healthcare, financial services and insurance for low-income consumers. Since it was founded in 2007, LeapFrog has attracted funds from Prudential, AXA, Swiss Re and Omidyar Network, becoming the first impact investor in the world to reach the $1bn milestone. It’s headquartered in South Africa and Singapore.LeapFrog is best known for its investments in the insurance sector. One of the most prominent companies in its portfolio is BIMA, the mobile-based insurance provider that has provided coverage in Ghana, Bangladesh, Cambodia and many other countries. In 2020, LeapFrog invested in Indonesian startup PasarPolis, which is a broker for a wide range of microinsurance products. In the healthcare and biotechnology sectors, LeapFrog has funded Indian genetic diagnostics company MedGenome, as well as Goodlife Pharmacy, a Kenyan company providing access to affordable medicine in the East African country.

LeapFrog Investments is an impact-focused investor, managing over $1.6bn in assets mainly investing in Africa and Asia. Its “profit with purpose” has led to investments in startups that provide healthcare, financial services and insurance for low-income consumers. Since it was founded in 2007, LeapFrog has attracted funds from Prudential, AXA, Swiss Re and Omidyar Network, becoming the first impact investor in the world to reach the $1bn milestone. It’s headquartered in South Africa and Singapore.LeapFrog is best known for its investments in the insurance sector. One of the most prominent companies in its portfolio is BIMA, the mobile-based insurance provider that has provided coverage in Ghana, Bangladesh, Cambodia and many other countries. In 2020, LeapFrog invested in Indonesian startup PasarPolis, which is a broker for a wide range of microinsurance products. In the healthcare and biotechnology sectors, LeapFrog has funded Indian genetic diagnostics company MedGenome, as well as Goodlife Pharmacy, a Kenyan company providing access to affordable medicine in the East African country.

AgroCenta: Providing market access and credit to African smallholder farmers

AgroCenta’s platforms empower Ghanaian subsistence farmers, especially women, boosting productivity and sales with e-payments, micro-credits and insurance, and direct connections to buyers, cutting out the intermediaries

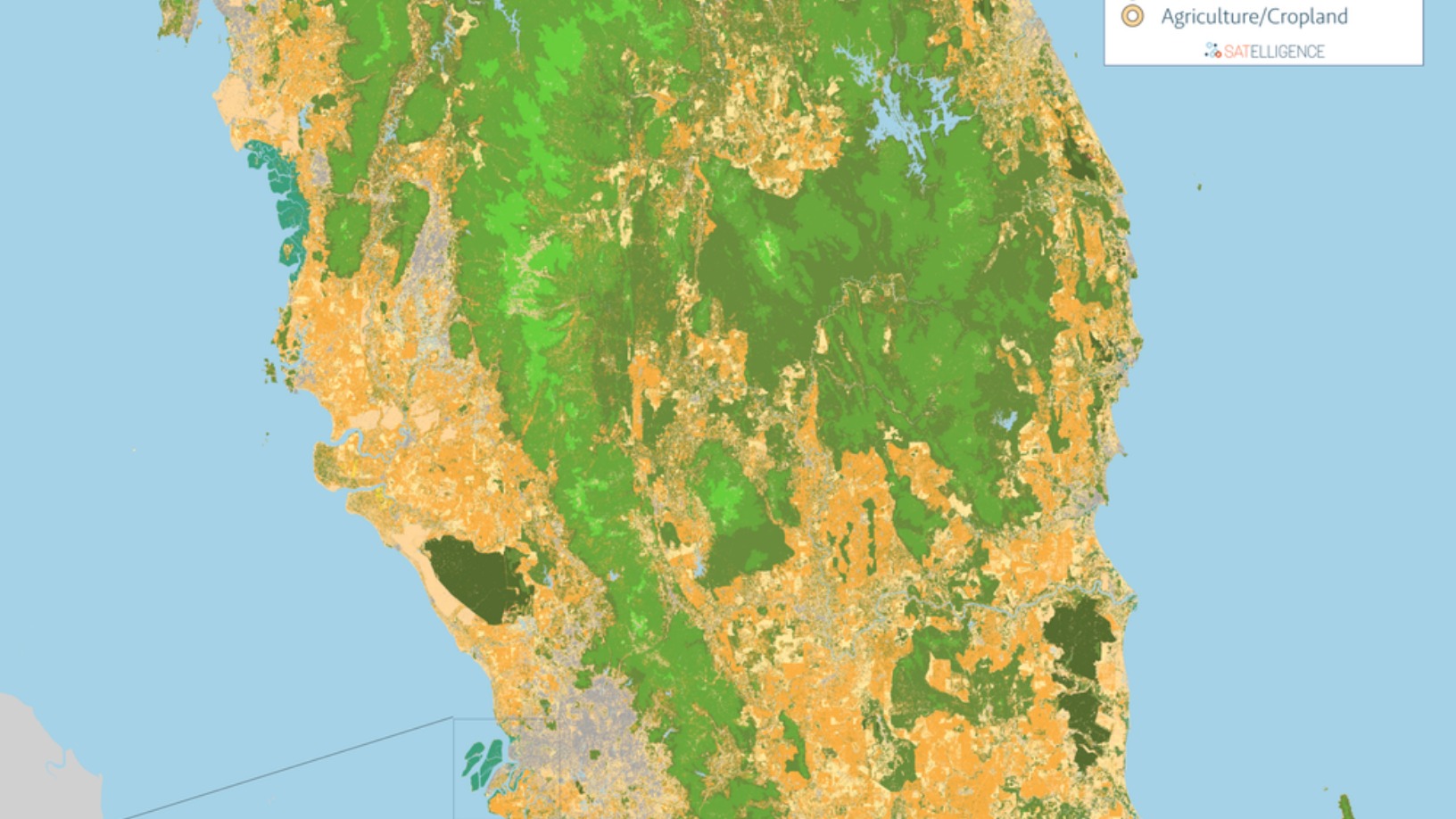

Satelligence: Satellite data and AI helping corporate giants source commodities more sustainably

Satelligence monitors environmental risks across 6bn hectares of mostly tropical forest for high-profile clients such as Pepsico, Nestlé and Unilever

Lota Digital: Disrupting fishing in Portugal for a sustainable future

The “digital fish market” app helps fishermen compete in a market dominated by large players

Women entrepreneurs get ahead faster in Portugal

Still a long way to go for equality, but female founders in Portugal have made significant headstarts as tech innovators

Pula: Pioneering insurtech helps to improve Africa's food security

With Kenyan insurtech Pula’s micro-insurance products, millions of farmers no longer have to bear the full risk of losses from natural disasters and crop failures

Lalibela Global-Networks: A mission to digitalize, move Africa's healthcare system to the cloud

This year’s Web Summit winner, Lalibela Global-Networks, is digitalizing Africa’s paper-based healthcare system in a low-cost, low-code way to save lives and make healthcare affordable

Kobo360: Nigeria's Uber-style logistics startup turns pan-African dream into reality

Riding on Africa’s new free trade deal, Kobo360 aims to be the continent’s next unicorn by digitalizing logistics ops to transport goods quickly, reliably and more cheaply

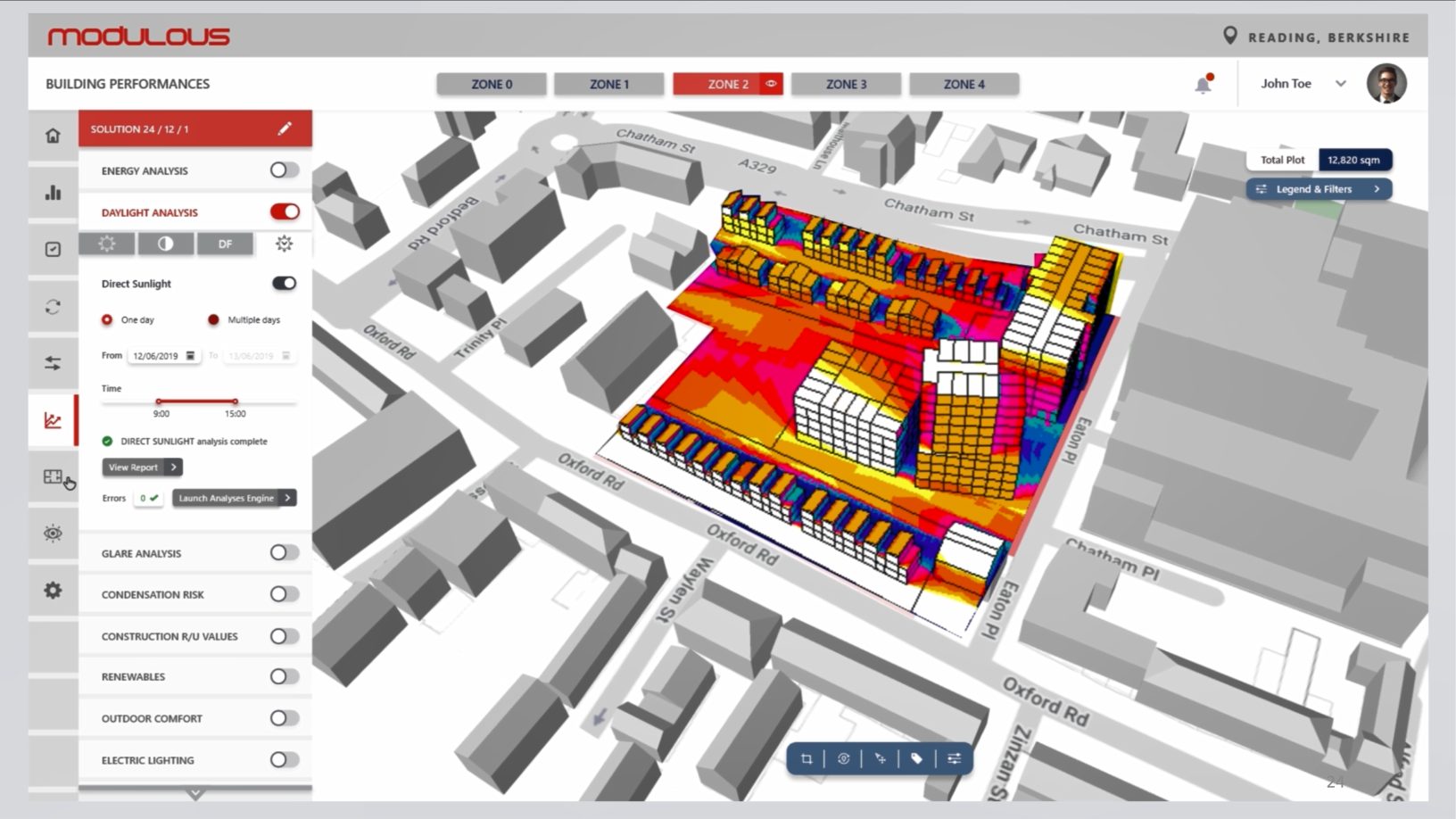

Modulous: End-to-end construction tech to (finally) disrupt the building sector value chain

Construction is among the most lucrative but least disrupted industries globally. UK-based Modulous aims to change this

Sorry, we couldn’t find any matches for“Ghana”.