China, the world’s largest smartphone market with over 1bn users, also has a rampant market of fake users — a big headache for app developers who pay for marketing but fail to get results beyond the initial bump in app store rankings. Digital Union, a Beijing-based cybersecurity startup, has been helping them detect such fraud since 2014.

Fake users are part of the wider online fraud of click farming, a $50bn industry in China, according to investigations by the South China Morning Post in 2018. Click fraud works by artificially boosting the standing of an app or website by paying for increased clicks on paid advertising links, increased downloads, or increased likes or followers on social media.

Click farms often consist of large groups of workers hired to do the clicking, in India, Thailand and the Philippines, for instance. But in China, the farms have a more automated process, where thousands of phones with phone cards are linked together, rows after rows, and controlled by a computer and the worker operating it.

“There are several ways to trick the app developer into believing there is a new user,” said Digital Union co-founder Zhang Yuping, who was the mobile security chief at Baidu, with over 15 years of experience in cybersecurity. For one, fraudsters could directly mislead the developer by using a simulator or emulator, or by changing a dominant feature of a device, e.g., the phone number, International Mobile Equipment Identity (IMEI) or the IP address. That goes into creating fake app downloads and user registrations.

As a result, "some 70% of the marketing costs spent by app developers go to waste,” said Yang Cong’an, Digital Union’s CEO and co-founder, who comes from over 20 years of working in the internet sector.

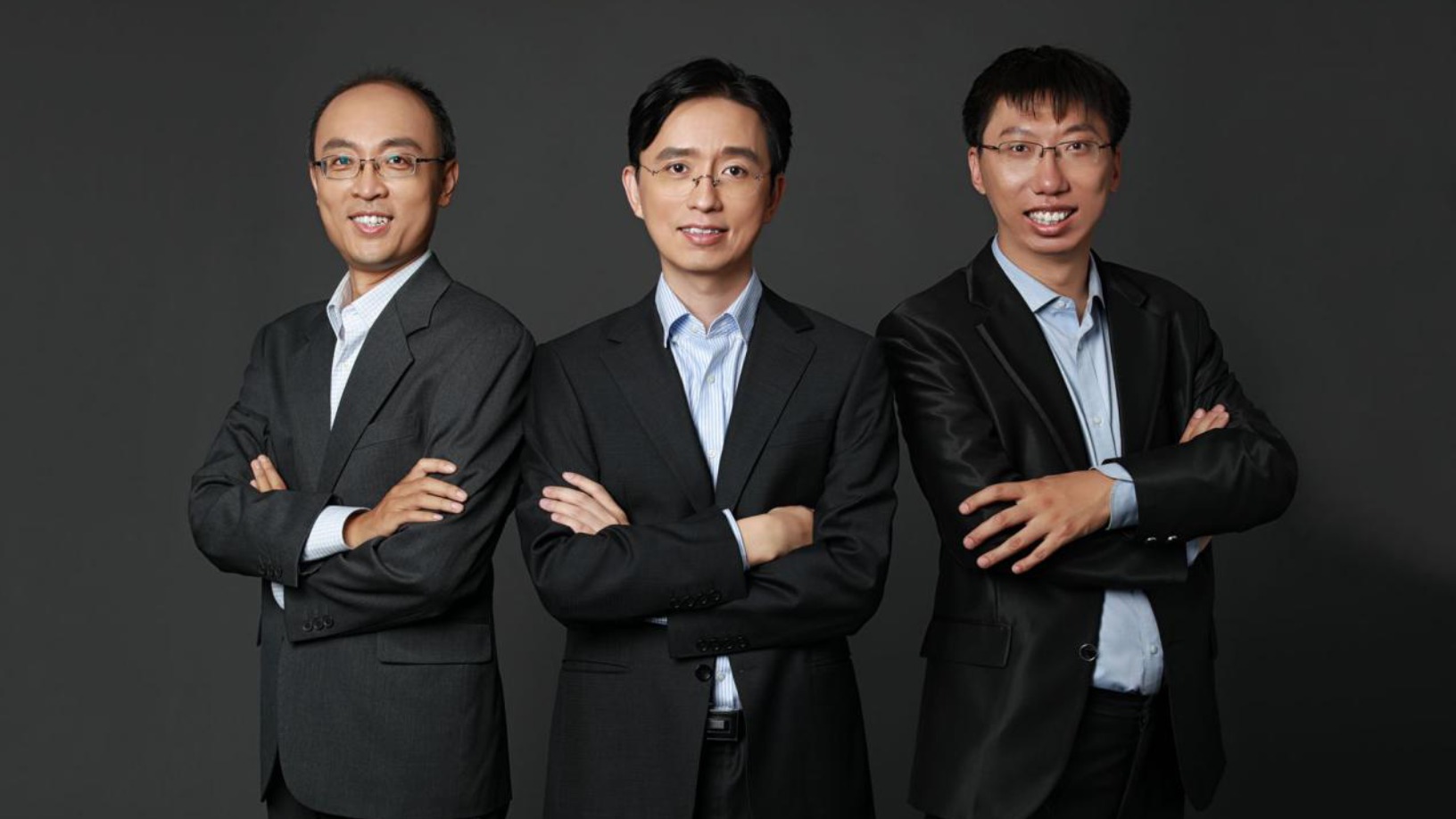

Sensing the market would want a solution to this, Yang and Zhang teamed up with another IT specialist, Liu Jingjing who used to work at Kingsoft and LKM, to found Digital Union in 2014.

Digital IDs for smartphones

Their solution was to give each phone containing the downloaded app in question a unique digital ID, created based on a complex management system of attributes, including the phone’s sensors, phone user behavior and parameters, and usage historical data, said Yang. Once such a digital ID is generated and embedded in the app, it can’t be altered. From the digital ID alone, the app developer can tell whether the app download was by a real person, or by an emulator.

Yang said it took his team one year to turn their prototype into the final product, mainly because of the technical sophistication of the fraudsters.

“People may not be aware that many of the fraudsters have master's degrees and studied abroad,” said co-founder Liu. “Even now, we have to upgrade our main computer program every 14 days. In an extreme case, we would have 20 upgrades within one day.”

So far, the company has embedded its unique IDs into a slew of apps, including Airbnb, Weibo, Zhihu and Yingke, on over 800m phones. It charges the app companies an annual fee, varying according to their needs.

It last raised RMB 24m in Series A+ funding in May 2018, with total funding raised so far of about RMB 80m. Investors of Digital Union include Star VC, Galaxy Internet and the Haidian District government of Beijing.

App developers’ unease

For Zhang and his team, their challenge includes convincing app developers to use their tool, especially those who realized they had wasted money on marketing and promotion.

“Every developer knows that its app user number is inflated, but some just don’t want to find out how inflated it is,” Yang said.

“For those companies raising Series C or Series D funding, finding out how many of their users are fake could ruin their credibility and their image in the eyes of investors.”

Some app developers are also worried that the algorithms of solutions such as Digital Union could backfire, since there is a risk, however slim, of exposing their users’ data to a third-party company. Also, tech giants like Apple already have their own tools and algorithms to combat click farming.

To stay competitive in the sector, Digital Union is expanding its services to video sharing apps, social media paid promotion, and anti-web-crawl on content platforms. Potentially, its tool could also be used for risk management by online financial services.

“Our vision is for Digital Union to truly become an industry standard and become recognized widely, the way Visa is for the banking sector,” said Liu.