Indonesian rentals booking and management platform Travelio announced on November 14 it had raised US$18m in Series B financing, in a round led by Pavilion Capital and Gobi Partners, with participation from existing unnamed investors.

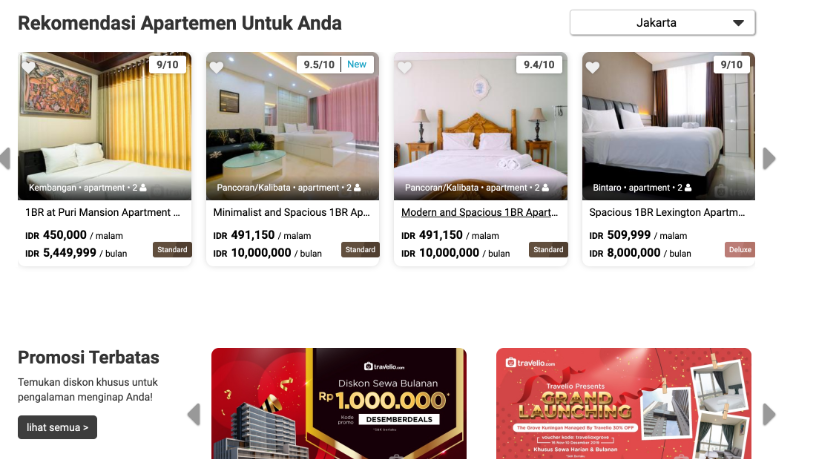

With its end-to-end property management services, Travelio provides a leasing service to apartment owners looking to earn additional income. The company manages everything from taking photographs and advertising, to installing electronic keys, maintenance, and receiving rental payments. It monetizes by taking a cut from the rental revenue.

Travelio manages more than 5,000 properties across six major Indonesian cities; it is seeking to expand its portfolio to 20,000 properties within the next year, according to TechCrunch, and plans to expand its offer to owners to include services such as interior design, financing, and restocking of daily necessities.

Seamless property leasing

Unlike Airbnb, Travelio handles guest check-in and check-out, regular cleaning and light maintenance. It also bills tenants additional fees for any damage caused to the property. Expenses for these services are included in the rental fees paid by the tenants, ensuring they don't incur surprise additional costs.

Travelio advertises its properties on both its own platform and on third-party property rental sites. On its own site, Travelio provides prospective guests an interactive virtual tour of the property, offering 360-degree views of the rooms.

The startup says it only earns money from a property when the homeowner does, taking 25–30% of the revenue earned from each unit. Income, expenses and property taxes are compiled in a monthly report, which is especially useful for owners with multiple rental properties.

Corporate backing

Travelio was established in 2015 after co-founder and CEO Hendry Rusli pitched the concept to the Suriadjaja family, which operates the publicly traded real estate development and property management conglomerate PT Surya Semesta Internusa (SSI). After the pitch, Christina Suriadjaja, with the support of her father SSI President Director Johannes Suriadjaja, decided to invest in the company, becoming a co-founder alongside Rusli and COO Christie Amanda. The company quickly attracted investors: by May 2018, it had raised total disclosed funding of US$6m in pre-Series A and Series A monies.

Initially Travelio helped owners of hotels, villas, and apartments find guests and tenants quickly. Occupancy in Indonesian hotels and villas often falls below 50% in off-peak seasons, partly due to poor advertising and lack of outreach.

In August 2018, it refocused the business on property management – specifically apartments – when it launched the “Travelio Property Management” division aimed at attracting landlords and property developers as clients. This business unit is now a crucial part of Travelio's core as it increasingly targets long-term tenants who lease for a month or more.

Mixing it with the majors

Over the past year, Travelio has been working with major property developers like Intiland and Waskita to lease units in their new development projects. The collaboration aims to attract investment-minded property owners who purchase apartments for lease, and Travelio introduced incentives such as waiving apartment service charges for 18 months to ease owner concerns about difficulty in finding tenants.

The partnerships also aims to increase occupancy rates. Harto Laksono, Director of Marketing at one of Intiland's subsidiaries, revealed that of the 295 units in the company's Surabaya Praxis project, only 40 were occupied. About 60% of buyers, he said, are investors. “We need to work on improving occupancy. One of the ways is to make it easier for owners to invest through their units [by leasing],” he added.

Travelio's competitors include property dealers and short-term or holiday rental accommodation aggregators like Traveloka, RedDoorz, OYO and Airy. It also has to compete with traditional real estate dealers in the long-term rental market, as well as online competitors like Singapore-based 99.co, which acquired the Indonesian property listing startup Urbanindo in 2018.