Amid a suspension of travel and face-to-face meetings because of Covid-19, Singapore-based VC firm KK Fund has partnered GK-Plug and Play, the Indonesian branch of the global incubator and VC, to set up online meetings between Indonesian startups and VC firms.

Dubbed “Meet your Match,” the program is also being run in Thailand, Vietnam, Singapore, Malaysia and Taiwan. Overall response has been “overwhelming,” KK Fund wrote in an email, responding to queries from CompassList. More than 200 startups have signed up as of April 13. The meetings will end April 17, with the exception of Thailand, where the program first started and finished on April 10.

More than 80 investors, including EV Growth, MDI Ventures, Monk's Hill Ventures, Patamar Capital and Sequoia Capital have signed up.

“We felt that startups should not be deterred from meeting investors and vice versa because of the virus,” KK Fund said, adding that it's open to expanding Meet Your Match to other ecosystems.

“Investors are still open to meeting startups in this climate. Yes, they are more cautious, but this and the virus does not change the fact that there are still promising startups out there.”

KK Fund has invested in Indonesian companies like furniture marketplace Fabelio and recruitment platform Urbanhire, as well as other regional startups like logistics firm The Lorry and employee benefits management company Venteny.

GK-Plug and Play is the Indonesian joint venture between Plug and Play and Indonesian investment firm Gan Konsulindo. Their program has supported various early stage startups such as community waste management company Gringgo, data analytics firm Datanest, and last-mile logistics company RaRa, which on April 7 raised $1.2m from 500 Startups and AngelCentral.

“The startups and investors will have meaningful conversations once they engage each other,” KK Fund said about the online meetings.

Startups sign up their interest on a Google form and indicate which investors they want to connect with. The list is sent to the investors, who will also indicate their interest. If there is a match, KK Fund and GK-Plug and Play will arrange for an online meeting.

KK Fund first announced the collaboration in a Medium post last week. KK Fund's General Partner and founder Koichi Saito said that startups should not stop talking to investors despite the current tough market conditions. “Startups should be perfectly ready for fundraising when the market momentum changes again,” he said.

Despite the global economic slowdown, the Covid-19 pandemic, and the departure from ambitious funding rounds after 2019, new funding rounds are still closed in Indonesia.

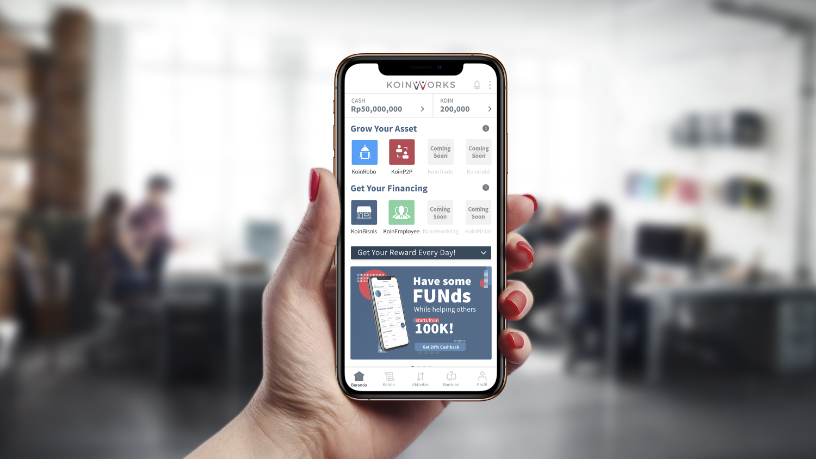

In the past two weeks, two local P2P lending platforms, Investree and KoinWorks, announced funding rounds in the $20m range. On April 14, logistics startup Kargo Technologies announced that they raised $31m in funding, while also setting up a $1m relief fund to help truck drivers survive during the pandemic.

Antler, a global VC participating in Meet your Match, is looking for startups that seek to solve Covid-19 challenges. The VC will be accepting applications until April 15. According to the company’s website, selected startups will receive a $100,000 investment and the opportunity to join an Antler program closest to their location, “with most modules being remote.”

However, most VCs are reporting difficult fundraising conditions. In Australia, M8 Ventures is going into “sleep mode” as it is difficult to get backers to participate in their $10m fund, its founding partner Alan Jones said in a blog post.

Jones wrote: “The biggest issue right now is the pandemic cutting the guts out of not just the tech startup industry but the global economy… We can’t ask potential investors to invest in a seed-stage venture fund right now when we wouldn’t consider doing so ourselves.”

In Indonesia, growth-stage VC Indogen Capital has also had to put their first close plans on hold. The company had initially planned to make a $10m close as part of their $50m fund in March.

“We’re hoping things can settle down by May, which would only mean a short delay to our [fundraising] work,” Indogen Capital's Managing Partner Chandra Firmanto said in an interview. “Currently there are no problems on the deal-sourcing side, but fundraising can be difficult when the LP’s country is on lockdown.”