EV Growth

-

DATABASE (171)

-

ARTICLES (388)

Since 2005, Demeter Partners has been one of the major VC and private equity funds supporting technology companies in developing solutions for ecological and energy transitions. The firm typically invests €1m–€30m in early and growth stages of startups. With assets worth over €1bn under management, its portfolio in 2019 was estimated to have cut 4.3m tons of CO2 with 575 GWh of clean energy produced. In 2021, Demeter was named the “Best Sustainable Equity investor” by a panel of former Fortune 500 individuals, global experts and industry leaders to recognize Demeter’s commitment to the UN’s SDG and ESG strategy.

Since 2005, Demeter Partners has been one of the major VC and private equity funds supporting technology companies in developing solutions for ecological and energy transitions. The firm typically invests €1m–€30m in early and growth stages of startups. With assets worth over €1bn under management, its portfolio in 2019 was estimated to have cut 4.3m tons of CO2 with 575 GWh of clean energy produced. In 2021, Demeter was named the “Best Sustainable Equity investor” by a panel of former Fortune 500 individuals, global experts and industry leaders to recognize Demeter’s commitment to the UN’s SDG and ESG strategy.

Founded in 1999 in Santiago de Compostela, XesGalicia SGEIC SA is 100% owned by the Galician Institute for Economic Promotion (Igape). The VC supports Spanish startups through seed funding, early ventures and growth capital investments. It usually invests between €60,000 and €200,000 in each enterprise, with temporary acquisition of minority stakes. The firm focuses on the biotech, telecommunications, energy and environment sectors. In 2014, it was involved in the creation of the Galician Network of Business Angels to facilitate the collaboration of private and public fund investors to nurture innovative projects and applications of new technologies.

Founded in 1999 in Santiago de Compostela, XesGalicia SGEIC SA is 100% owned by the Galician Institute for Economic Promotion (Igape). The VC supports Spanish startups through seed funding, early ventures and growth capital investments. It usually invests between €60,000 and €200,000 in each enterprise, with temporary acquisition of minority stakes. The firm focuses on the biotech, telecommunications, energy and environment sectors. In 2014, it was involved in the creation of the Galician Network of Business Angels to facilitate the collaboration of private and public fund investors to nurture innovative projects and applications of new technologies.

Rodolfo Lomascolo is a serial entrepreneur with a strong technical foundation in the software, e-commerce and energy sector. He has more than 25 years of experience in C-level positions and is one of the pioneers who fostered the early growth of the tech ecosystem in Spain. For over 14 years, Lomascolo was CEO of the Internet Publishing Services Certification Authority (ipsCA) that was eventually acquired by the STS Group, of which he was subsequently vice-president of International Business Development, growing the company's revenue from zero to €30m in three years. In 2015, he became co-founder and CEO of Pervasive Technologies, a company that deploys big data, machine learning and IoT for digital innovation.

Rodolfo Lomascolo is a serial entrepreneur with a strong technical foundation in the software, e-commerce and energy sector. He has more than 25 years of experience in C-level positions and is one of the pioneers who fostered the early growth of the tech ecosystem in Spain. For over 14 years, Lomascolo was CEO of the Internet Publishing Services Certification Authority (ipsCA) that was eventually acquired by the STS Group, of which he was subsequently vice-president of International Business Development, growing the company's revenue from zero to €30m in three years. In 2015, he became co-founder and CEO of Pervasive Technologies, a company that deploys big data, machine learning and IoT for digital innovation.

One of the earliest and independent VC firms in China, Chengwei Capital was founded in Shanghai in 1999. It’s also the first and only evergreen fund in China.With Yale University Endowment as its largest investor, the VC limited partners also include institutional investors from around the world. With a portfolio of about 30 companies, the firm mainly invests in manufacturing, consumer goods, education, internet and petroleum & natural gas.In 2012, Chengwei and China Europe International Business School (CEIBS) jointly launched the $100m CEIBS-Chengwei Venture Capital Fund to invest in early- and growth-stage companies founded or managed by CEIBS alumni. The VC also seeks to support entrepreneurs to build sustainable businesses over a long period of time, acting as their long-term business partner.

One of the earliest and independent VC firms in China, Chengwei Capital was founded in Shanghai in 1999. It’s also the first and only evergreen fund in China.With Yale University Endowment as its largest investor, the VC limited partners also include institutional investors from around the world. With a portfolio of about 30 companies, the firm mainly invests in manufacturing, consumer goods, education, internet and petroleum & natural gas.In 2012, Chengwei and China Europe International Business School (CEIBS) jointly launched the $100m CEIBS-Chengwei Venture Capital Fund to invest in early- and growth-stage companies founded or managed by CEIBS alumni. The VC also seeks to support entrepreneurs to build sustainable businesses over a long period of time, acting as their long-term business partner.

ICONIQ Capital is a private investment management company that is known for serving a wide variety of famous clients, including Facebook’s Mark Zuckerberg and Sheryl Sandberg, Twitter founder Jack Dorsey and Asian billionaire Li Ka-shing, among other Silicon Valley elites and world-famous billionaires. The company is led by Divesh Makan, Chad Boeding and Michael Anders, who were coworkers at Goldman Sachs and joined Morgan Stanley together before establishing ICONIQ in 2011.The investment company is a mix of family office and venture capital, with specialized verticals in tech startup investing, real estate, and impact investments. Its VC arm, ICONIQ Growth, manages over $9b in capital commitments, and has invested into companies like stock brokerage app Robinhood, short-term accommodation startup Airbnb, and online signature company DocuSign.

ICONIQ Capital is a private investment management company that is known for serving a wide variety of famous clients, including Facebook’s Mark Zuckerberg and Sheryl Sandberg, Twitter founder Jack Dorsey and Asian billionaire Li Ka-shing, among other Silicon Valley elites and world-famous billionaires. The company is led by Divesh Makan, Chad Boeding and Michael Anders, who were coworkers at Goldman Sachs and joined Morgan Stanley together before establishing ICONIQ in 2011.The investment company is a mix of family office and venture capital, with specialized verticals in tech startup investing, real estate, and impact investments. Its VC arm, ICONIQ Growth, manages over $9b in capital commitments, and has invested into companies like stock brokerage app Robinhood, short-term accommodation startup Airbnb, and online signature company DocuSign.

Founded in 1813 as a small grain-trading firm in Arlon, France (now Belgium), Continental Grain Company (CGC) is now headquartered in New York. It has operations in 10 countries and employs over 13,500 people worldwide. Business activities include animal feeds, aquaculture and meat production.Besides interests in the food, agribusiness and commodities sectors, CGC also manages different asset classes like private equity, listed securities and venture capital. Its investment portfolio includes more than 30 food and agribusiness companies, ranging from early-stage ventures to established market leaders across the US, China and Latin America.CGC Asia mainly invests in feed milling, animal husbandry, meat production and processing businesses in the region. Direct investments are made through Continental Capital Limited in China, focusing on high‐growth food and agribusiness firms.

Founded in 1813 as a small grain-trading firm in Arlon, France (now Belgium), Continental Grain Company (CGC) is now headquartered in New York. It has operations in 10 countries and employs over 13,500 people worldwide. Business activities include animal feeds, aquaculture and meat production.Besides interests in the food, agribusiness and commodities sectors, CGC also manages different asset classes like private equity, listed securities and venture capital. Its investment portfolio includes more than 30 food and agribusiness companies, ranging from early-stage ventures to established market leaders across the US, China and Latin America.CGC Asia mainly invests in feed milling, animal husbandry, meat production and processing businesses in the region. Direct investments are made through Continental Capital Limited in China, focusing on high‐growth food and agribusiness firms.

Scottish Enterprise, a public arm of the Scottish Government, facilitates investments and economic growth of businesses in the eastern, central, and southern areas of Scotland. Led by Chairman Bob Keiller, Scottish Enterprise fulfills the objectives of the Scottish Government. It employs 1,100 staff across 14 offices in the UK and 33 overseas.Founded in 1975 as the Scottish Development Agency (SDA), it changed into Scottish Enterprise in 1991. Its operative structure was initially formed by Local Enterprise Companies (LECs) with boards led by local entrepreneurs. Since 2000, former limited companies have become wholly-owned subsidiaries of the Scottish Enterprise.Based on its performance report for 2017–2018, Scottish Enterprise has helped portfolio companies with £315m in R&D funds and secured capital investment of £215m.

Scottish Enterprise, a public arm of the Scottish Government, facilitates investments and economic growth of businesses in the eastern, central, and southern areas of Scotland. Led by Chairman Bob Keiller, Scottish Enterprise fulfills the objectives of the Scottish Government. It employs 1,100 staff across 14 offices in the UK and 33 overseas.Founded in 1975 as the Scottish Development Agency (SDA), it changed into Scottish Enterprise in 1991. Its operative structure was initially formed by Local Enterprise Companies (LECs) with boards led by local entrepreneurs. Since 2000, former limited companies have become wholly-owned subsidiaries of the Scottish Enterprise.Based on its performance report for 2017–2018, Scottish Enterprise has helped portfolio companies with £315m in R&D funds and secured capital investment of £215m.

The Craftory is a London-based investment house with a satellite office in San Francisco. Founded in 2018 by retail and media industry veterans Ernesto Schmitt and Ellio Leoni Sceti, the firm has made seven investments in various consumer goods brands. Sceti is also the chairman of London-based family VC firm LSG Holdings, with his brother Patrick as the MD.The Craftory’s $375m fund specializes in building a new investment house of consumer brands, hence its name from the words, “craft" and “factory.” It mainly offers permanent and growth capital to consumer packaged goods (CPG) brands. The Craftory supports CPG challenger brands to help them to grow from “craft” businesses to sustainable, mass CPG brands, offering consumers better choices for everyday products.

The Craftory is a London-based investment house with a satellite office in San Francisco. Founded in 2018 by retail and media industry veterans Ernesto Schmitt and Ellio Leoni Sceti, the firm has made seven investments in various consumer goods brands. Sceti is also the chairman of London-based family VC firm LSG Holdings, with his brother Patrick as the MD.The Craftory’s $375m fund specializes in building a new investment house of consumer brands, hence its name from the words, “craft" and “factory.” It mainly offers permanent and growth capital to consumer packaged goods (CPG) brands. The Craftory supports CPG challenger brands to help them to grow from “craft” businesses to sustainable, mass CPG brands, offering consumers better choices for everyday products.

Crevisse Partners is a South Korean investor and venture builder with an impact focus. Its name stands for “Creative, Visionary and Social Entrepreneurs”. Originally incorporated in 2004, Crevisse claims to be the first impact investor in Korea, even before such terms became commonplace. The company strives to develop businesses in sectors “where the market principle wasn’t working”.Crevisse has internally incubated a number of companies in South Korea, such as reusable drinking cup company BringYourCup, sustainable forestry firm Forest Trust, and fundraising service DONUS. Crevisse Ventures is the company’s dedicated VC arm that manages a $20m fund and a number of blended finance funds through collaborations with government agencies and financial institutions. In particular, Crevisse Ventures focuses on startups that solve problems in four major areas: urban communities; climate and energy; education and welfare; as well as jobs and economic growth.

Crevisse Partners is a South Korean investor and venture builder with an impact focus. Its name stands for “Creative, Visionary and Social Entrepreneurs”. Originally incorporated in 2004, Crevisse claims to be the first impact investor in Korea, even before such terms became commonplace. The company strives to develop businesses in sectors “where the market principle wasn’t working”.Crevisse has internally incubated a number of companies in South Korea, such as reusable drinking cup company BringYourCup, sustainable forestry firm Forest Trust, and fundraising service DONUS. Crevisse Ventures is the company’s dedicated VC arm that manages a $20m fund and a number of blended finance funds through collaborations with government agencies and financial institutions. In particular, Crevisse Ventures focuses on startups that solve problems in four major areas: urban communities; climate and energy; education and welfare; as well as jobs and economic growth.

London-based Sustainability Ventures is one of the UK’s leading early-stage investors in Cleantech. It comprises a group of successful entrepreneurs with a track record in building and investing in high-growth start-ups. It has created Europe’s largest ecosystem for cleantech and sustainability startups, as a business founder and investor, provider of accelerator and support services and provider of shared workspaces. Active since 2011, Sustainability Ventures has raised £250m in total equity funds to date. Its focus is on agritech and food, building technology, circular economy, future energy and mobility. It has established 10 companies, invested in 30 and supported the development of over 250 more enterprises as of 2021 and aims to develop 1,000 sustainable startups by 2025.

London-based Sustainability Ventures is one of the UK’s leading early-stage investors in Cleantech. It comprises a group of successful entrepreneurs with a track record in building and investing in high-growth start-ups. It has created Europe’s largest ecosystem for cleantech and sustainability startups, as a business founder and investor, provider of accelerator and support services and provider of shared workspaces. Active since 2011, Sustainability Ventures has raised £250m in total equity funds to date. Its focus is on agritech and food, building technology, circular economy, future energy and mobility. It has established 10 companies, invested in 30 and supported the development of over 250 more enterprises as of 2021 and aims to develop 1,000 sustainable startups by 2025.

Verizon Ventures is the venture capital arm of Verizon Communications, the US's largest wireless provider, established in 2000. It invests from Series A to IPO. Verizon Ventures has made more than 100 investments to date and managed 20 exits, including healthcare diagnostics company NantHealth and P2P video content service Streamroot. Recent investments include holographic lighting technology company Light Field Lab's US$28m Series A round and AI-powered mass transportation technology company Optibus's US$40m Series B round.

Verizon Ventures is the venture capital arm of Verizon Communications, the US's largest wireless provider, established in 2000. It invests from Series A to IPO. Verizon Ventures has made more than 100 investments to date and managed 20 exits, including healthcare diagnostics company NantHealth and P2P video content service Streamroot. Recent investments include holographic lighting technology company Light Field Lab's US$28m Series A round and AI-powered mass transportation technology company Optibus's US$40m Series B round.

Silicon Valley-based Almaz Capital was co-founded in 2008 as a bridge VC fund by Alexander Galitsky, a serial techpreneur and former senior executive at the Soviet Space Agency and Defense Industry. Almaz also has an office in Berlin and partners with interests in the UK, Poland and Ukraine. The global fund has invested in over 30 startups and managed 15 exits within its portfolio.Recent investments in 2021 include co-leading the $54m Series B round of Refurbed with Evli Growth Partners in August. Almaz was also the lead investor for the $6m funding round for US-based precision audio software Sonarworks in July.

Silicon Valley-based Almaz Capital was co-founded in 2008 as a bridge VC fund by Alexander Galitsky, a serial techpreneur and former senior executive at the Soviet Space Agency and Defense Industry. Almaz also has an office in Berlin and partners with interests in the UK, Poland and Ukraine. The global fund has invested in over 30 startups and managed 15 exits within its portfolio.Recent investments in 2021 include co-leading the $54m Series B round of Refurbed with Evli Growth Partners in August. Almaz was also the lead investor for the $6m funding round for US-based precision audio software Sonarworks in July.

Kaszek Ventures is an Argentinian VC co-founded in 2011 by Hernan Kazah and Nicolas Szekasy, both hailing from Latin America’s e-commerce success story MercadoLibre. Starting with $95m, the VC made its first investment in Brazilian fintech, Nubank. The VC now has over 159 investments and has managed 21 exits. It mainly focuses on B2C solutions, mobile, healthcare technology, retail and media.The most recent Kaszek investment is in Latin America’s leading crypto platform Bitso, co-leading Bitso’s $62m Series B round with QED Investors. Managing partner Szekasy has also joined Bitso’s board. Existing shareholders Coinbase Ventures and Pantera Capital joined the Bitso round.In 2019, Kaszek raised two new funds securing a total of $600m to invest in later-growth stage companies to tap into Latin America’s rapidly maturing tech ecosystems. The rollout of 4G has also helped to speed up the adoption of new technologies across the region, according to Kazah.

Kaszek Ventures is an Argentinian VC co-founded in 2011 by Hernan Kazah and Nicolas Szekasy, both hailing from Latin America’s e-commerce success story MercadoLibre. Starting with $95m, the VC made its first investment in Brazilian fintech, Nubank. The VC now has over 159 investments and has managed 21 exits. It mainly focuses on B2C solutions, mobile, healthcare technology, retail and media.The most recent Kaszek investment is in Latin America’s leading crypto platform Bitso, co-leading Bitso’s $62m Series B round with QED Investors. Managing partner Szekasy has also joined Bitso’s board. Existing shareholders Coinbase Ventures and Pantera Capital joined the Bitso round.In 2019, Kaszek raised two new funds securing a total of $600m to invest in later-growth stage companies to tap into Latin America’s rapidly maturing tech ecosystems. The rollout of 4G has also helped to speed up the adoption of new technologies across the region, according to Kazah.

Beyond Investing is a Geneva-based firm investing in early-stage venture capital and equity growth startups mainly in European developed markets. With average investments of €200,000, the firm’s core investment strategy focuses on sustainability with an investment period lasting 5–10 years.The impact investor targets innovative startups involved in vegan, cruelty-free and plant-based alternatives; biotechnologies, foodtech, new materials, clothing and lifestyle sectors. Successful portfolio foodtechs include Mosa Meat, BlueNalu and Shiok Meats.With a team of vegan finance professionals in the US and Europe, Beyond Investing listed the first US Vegan Climate ETF (VEGN) on the New York Stock Exchange in September 2019. The ETF tracks Beyond Investing’s US Vegan Climate Index which covers an index of 495 of the largest-capitalization companies in the US stock market. The ethical investment option aims to exclude stocks in companies with activities that are not aligned with its vegan-themed, cruelty-free and fossil-fuel-free investing ethos.

Beyond Investing is a Geneva-based firm investing in early-stage venture capital and equity growth startups mainly in European developed markets. With average investments of €200,000, the firm’s core investment strategy focuses on sustainability with an investment period lasting 5–10 years.The impact investor targets innovative startups involved in vegan, cruelty-free and plant-based alternatives; biotechnologies, foodtech, new materials, clothing and lifestyle sectors. Successful portfolio foodtechs include Mosa Meat, BlueNalu and Shiok Meats.With a team of vegan finance professionals in the US and Europe, Beyond Investing listed the first US Vegan Climate ETF (VEGN) on the New York Stock Exchange in September 2019. The ETF tracks Beyond Investing’s US Vegan Climate Index which covers an index of 495 of the largest-capitalization companies in the US stock market. The ethical investment option aims to exclude stocks in companies with activities that are not aligned with its vegan-themed, cruelty-free and fossil-fuel-free investing ethos.

Founded in London in 1998, Kreos Capital is a pioneer growth debt provider. Kreos has completed over 630 deals worth over €3bn in pan-European countries and Israel. The Kreos Capital Group of companies and various funds are regulated by the Jersey Financial Services Commission.Kreos currently has 102 companies in its portfolio and has managed over 200 exits. Investee Riskified, an Israeli e-commerce fraud protection company, was listed on the NYSE at a $3.3bn valuation in August 2021. Kreos also joined recent investments in 2021 including the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed and the €9.5m round of Berlin-based HRtech expertlead.

Founded in London in 1998, Kreos Capital is a pioneer growth debt provider. Kreos has completed over 630 deals worth over €3bn in pan-European countries and Israel. The Kreos Capital Group of companies and various funds are regulated by the Jersey Financial Services Commission.Kreos currently has 102 companies in its portfolio and has managed over 200 exits. Investee Riskified, an Israeli e-commerce fraud protection company, was listed on the NYSE at a $3.3bn valuation in August 2021. Kreos also joined recent investments in 2021 including the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed and the €9.5m round of Berlin-based HRtech expertlead.

Subsidy cut has dented sales, but China's EV manufacturers need better products to win over buyers

Eliminating subsidies is a painful must for the sustainability of China’s electric vehicle industry

SWITCH Singapore: Xpeng expects strong China EV growth after 3Q rebound, launches overseas expansion

Welcoming foreign player entry as potential boost to EV adoption, Xpeng President Brian Gu also notes attractiveness of overseas markets, especially Europe

Chinese EV startups feel the heat as Tesla slashes prices, market subsidies ending

Tesla's recent price cuts and upcoming Shanghai plant for producing cheaper cars are increasing pressure on its Chinese rivals

Europe ramps up development of local EV battery sector in race to zero emissions

Startups, automakers jostle or unite to ride the fast-growing EV battery market, as the EU pumps billions into developing its own value chain, to cut reliance on imports

Wallbox’s bumper funding boosts Spain’s EV charging sector

Wallbox’s generic EV charging systems are sold in 40 countries, including the US and China; attracting major backers like Seaya Ventures, Spanish utility Iberdrola and US VC Endeavor

Kryha: Enabling big businesses' green practices with blockchain

Kryha’s blockchain systems help companies trace the movement and transformation of resources among multiple stakeholders without exposing sensitive information

Supercharging and battery swap in race to cut EV charging times in China

Supercharging can slash EV charging times but has technological challenges. Hence battery swapping is on the rise in China, with state support

Li Bin: Aiming for more than a Chinese copy of Tesla

Good at making and investing money, he founded two companies that went on to list on the NYSE and invested in over 40 startups

Behind Indonesia's recent EV push

EV prices in Indonesia are still high and there are concerns about infrastructure, but serious policymaking and private sector support can boost consumer adoption

EV maker Xpeng Motors partners Didi to offer car rentals and better charging services

Besides working with China's largest ride-hailing platform, Xpeng Motors has also connected to the charging networks of EV maker NIO and TELD, China's biggest EV charging network

Plug-it and Drive-it with Wallbox’s EV quick chargers

Created by an ex-Tesla engineer, these generic chargers are fast and easy to use – just like recharging mobile phones

Mass production and delivery delays – common challenges facing China EV startups

As Tesla postponed delivery yet again, its Chinese rivals are scrambling too

This EV maker caters to young consumers by making driving easier and more fun

Amongst all the players in China’s EV market, Xpeng Motors still stands out

Place to Plug: Symbiosis in scaling with the electric vehicle sector

Launched commercially just five months ago, EV-charging infrastructure platform Place to Plug has already attracted attention from investors in Silicon Valley and Asia

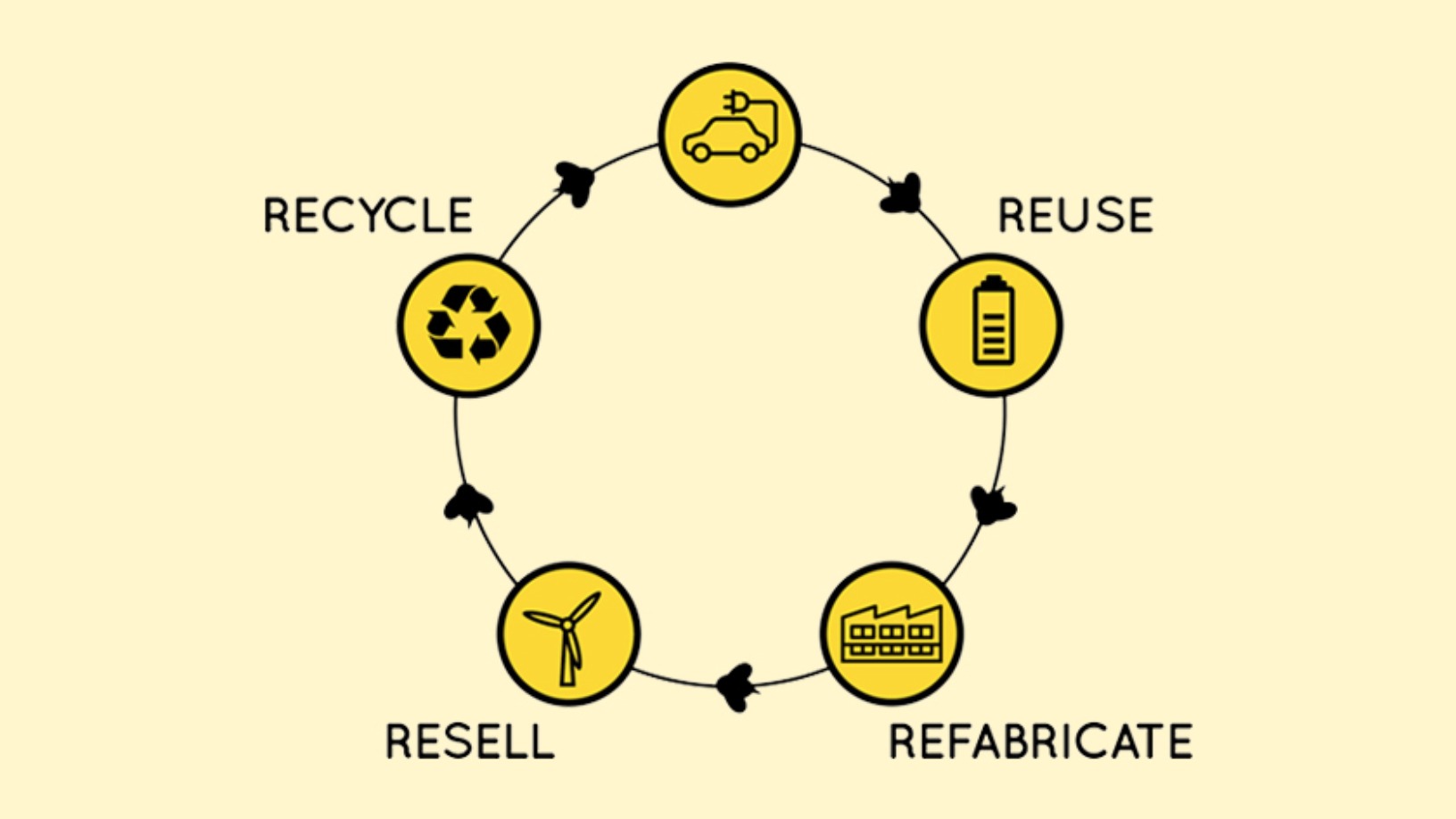

BeePlanet Factory: Recycling EV batteries as a sustainable, profitable business

With 4kWh–200kWh residential and industrial battery packs, the Pamplona-based startup wants to scale its energy storage solutions in the agri-food sector, camping sites and mountain huts

Sorry, we couldn’t find any matches for“EV Growth”.