Circular Economy

This function is exclusive for Premium subscribers

-

DATABASE (35)

-

ARTICLES (50)

Social enterprise aims to help more coastal communities in Africa and Asia become micro-entrepreneurs, supplying blockchain-traceable “social plastic” for recycling to global brands.

Social enterprise aims to help more coastal communities in Africa and Asia become micro-entrepreneurs, supplying blockchain-traceable “social plastic” for recycling to global brands.

Beyond Leather Materials / Leap

Vegan leather made from apple waste is recyclable and biodegradable; produces 85% less CO2, uses 99% less water than leather; for sustainable textiles and fashion.

Vegan leather made from apple waste is recyclable and biodegradable; produces 85% less CO2, uses 99% less water than leather; for sustainable textiles and fashion.

Backed by €30m funding and orders from global brands, Finnish cleantech will build flagship factory to scale production of regenerated biodegradable microplastic-free textile fibers.

Backed by €30m funding and orders from global brands, Finnish cleantech will build flagship factory to scale production of regenerated biodegradable microplastic-free textile fibers.

MIWA expands eco-friendly smart vending services in Europe and the US, convenient pre-order and e-payment app for merchants and consumers to get real-time product information.

MIWA expands eco-friendly smart vending services in Europe and the US, convenient pre-order and e-payment app for merchants and consumers to get real-time product information.

Refurbed will expand Amazon-style refurbished electronics marketplace, with carbon-neutral plan to cut CO2 emissions and plant 1m trees in at-risk biodiversity hotspots worldwide.

Refurbed will expand Amazon-style refurbished electronics marketplace, with carbon-neutral plan to cut CO2 emissions and plant 1m trees in at-risk biodiversity hotspots worldwide.

Stylish garments created using materials technology, which can expand across seven sizes and last for years, offering a sustainable alternative to the heavy-polluting fashion industry.

Stylish garments created using materials technology, which can expand across seven sizes and last for years, offering a sustainable alternative to the heavy-polluting fashion industry.

Notpla (formerly Skipping Rocks Lab)

Compostable and edible seaweed-based packaging in a flexible product for many uses to replace polluting plastic, winning accolades from WIRED, Fortune and TIME.

Compostable and edible seaweed-based packaging in a flexible product for many uses to replace polluting plastic, winning accolades from WIRED, Fortune and TIME.

Bygen’s energy-efficient process for manufacturing activated carbon helps agribusinesses turn their biomass waste into a valuable industrial commodity.

Bygen’s energy-efficient process for manufacturing activated carbon helps agribusinesses turn their biomass waste into a valuable industrial commodity.

WWF-backed biotech Oceanium has developed a biorefinery that transforms seaweed into alt-proteins and compostable packaging that will soon be launched commercially.

WWF-backed biotech Oceanium has developed a biorefinery that transforms seaweed into alt-proteins and compostable packaging that will soon be launched commercially.

MIT Media Lab spin-off Graviky Labs turns air pollution into carbon-negative inks with diverse applications, from industrial printing to marker pens.

MIT Media Lab spin-off Graviky Labs turns air pollution into carbon-negative inks with diverse applications, from industrial printing to marker pens.

Cleantech to remove and convert biomass into stable, sustainable biochar, drawing down carbon for thousands of years.

Cleantech to remove and convert biomass into stable, sustainable biochar, drawing down carbon for thousands of years.

With a 55-tone capacity to produce fungi-based proteins annually, Mycorena’s Gothenburg facility will showcase its mycoprotein R&D and spur commercial expansion across Europe.

With a 55-tone capacity to produce fungi-based proteins annually, Mycorena’s Gothenburg facility will showcase its mycoprotein R&D and spur commercial expansion across Europe.

Organic waste-management circular tech producing raw bioplastic for versatile processing uses via its automated waste-processing hardware with garbage-eating cultivated bacteria.

Organic waste-management circular tech producing raw bioplastic for versatile processing uses via its automated waste-processing hardware with garbage-eating cultivated bacteria.

Oimo’s bioplastic products degrade in water within a month and are compatible with existing manufacturing machinery, allowing rapid replacement of single-use plastics.

Oimo’s bioplastic products degrade in water within a month and are compatible with existing manufacturing machinery, allowing rapid replacement of single-use plastics.

B2B asset reuse marketplace for local lending, exchange or sales, with the SaaS platform doubling up as company equipment register, while rewarding employee participation.

B2B asset reuse marketplace for local lending, exchange or sales, with the SaaS platform doubling up as company equipment register, while rewarding employee participation.

QOA: Gourmet guilt-free chocolate, without the cocoa

Munich-based QOA transforms industrial food waste into vegan chocolate, enabling consumers to avoid the sustainability and ethical issues of cocoa production

Beyond Leather Materials: Turning apples into alt-leather for sustainable fashion

Through its Leap brand, the Danish startup cuts food waste by turning apples junked in cider factories into affordable vegan leather for the $100bn leather market

Infinited Fiber: Producing biofibers for fashion to move toward circular economy

Supported by H&M, Adidas and textile manufacturers, Infinited Fiber is helping the world’s second most polluting industry go greener by turning industrial waste into regenerated biomaterials

MIWA Technologies: Reducing food waste and packaging with smart refill vending system

MIWA’s solution lets consumers buy exact refill quantities in personalized containers, eradicating need for single-use plastics throughout the supply chain

Refurbed: Electronics recycling marketplace gets $54m for EU consolidation, overseas expansion

Consumers can reduce their carbon footprints by shifting toward a circular economy, become carbon-neutral by planting one tree with every purchase from Refurbed

Petit Pli: Origami-inspired clothes that still fit, even after the body has grown

Founded by a young aeronautical engineer, Petit Pli produces stylish, sustainable pleated garments made from recycled plastic that expand up to seven sizes

Kryha: Enabling big businesses' green practices with blockchain

Kryha’s blockchain systems help companies trace the movement and transformation of resources among multiple stakeholders without exposing sensitive information

COMY Energy: Closing the plastic waste loop with chemical recycling

The Chinese startup transforms plastic wastes to virgin-quality recycled products without releasing toxic gas or pollution and is attracting interest from petrochemical giants and waste management companies

SWITCH Singapore: Sustainability startups see growing demand from corporates

Sophie’s BioNutrients, Ubiik and Intello Labs also note new trends in technology and supply chain arising from the Covid-19 pandemic, across the food, manufacturing and e-commerce sectors

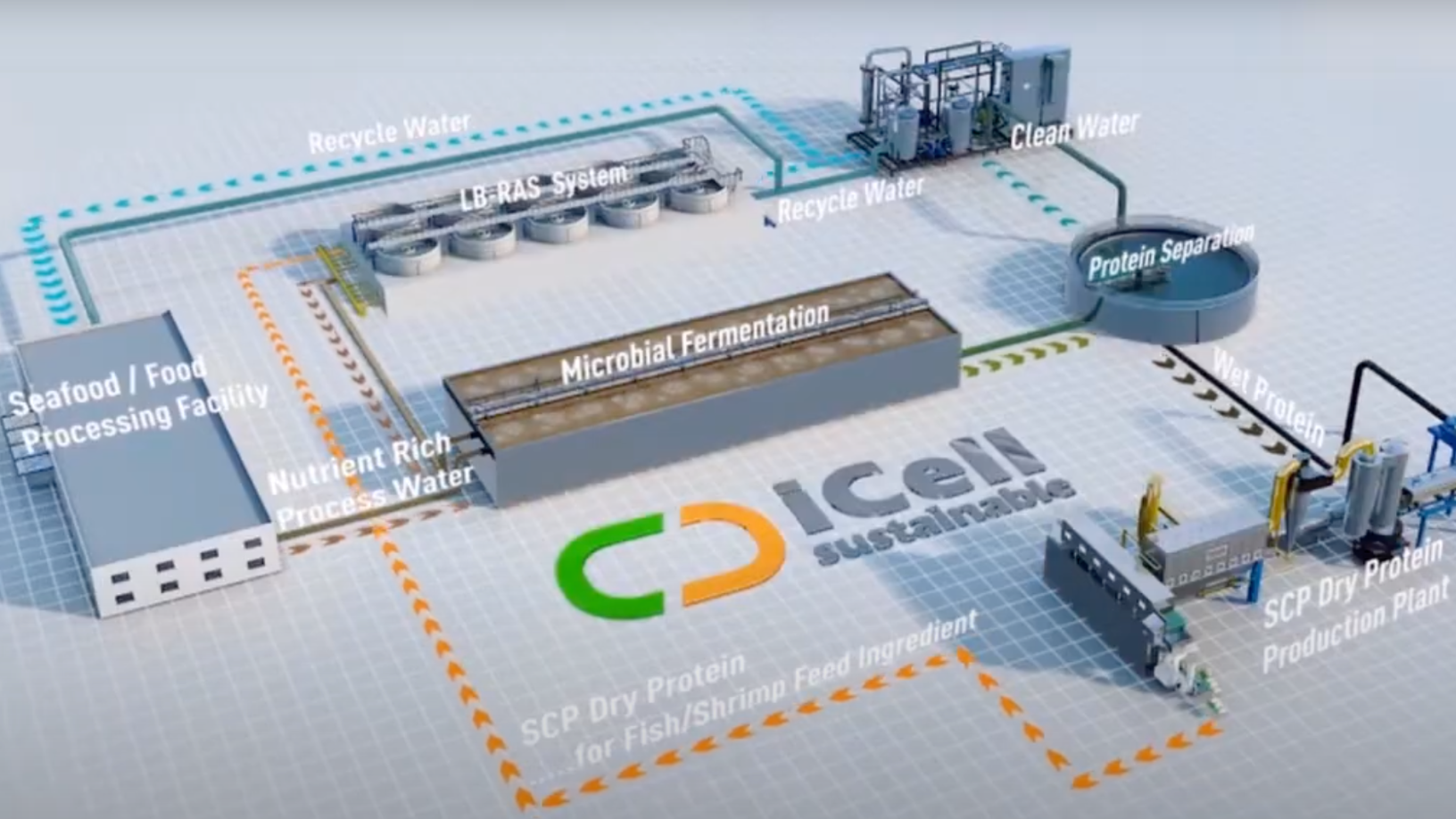

iCell: Upcycling nutrients from wastewater

Hong Kong-based iCell Sustainable Nutrition makes single-cell proteins with wastewater from food and beverage factories, generating revenue and purifying the water for safe discharge or reuse

Bygen: Turning waste into activated carbon

Australian startup Bygen is offering agribusinesses more reasons to upcycle waste sustainably into a lucrative product with its eco-friendly process to make activated carbon

Botree Cycling: Recovering critical metals from end-of-life batteries

The Beijing-based startup helps clients dismantle and recycle spent lithium batteries on-site, recovering over 90% of rare metals and reducing demand for mineral resources

Oceanium: Supporting sustainable seaweed farming

Scottish startup Oceanium has developed a proprietary biorefinery and processing model to create seaweed-based compostable materials, alt-protein ingredients and nutraceuticals for use across industry verticals

Future Food Asia 2021: Agrifood tech at an inflection point

Agrifood tech startups urged to harness consumer, investor and government feedback to create plentiful, nutritious food through sustainable means, but exercise caution when considering IPOs

Node: Fighting deforestation with fashionable footwear from agricultural waste

Using patented technology developed with Indonesia’s Ministry of Agriculture, Node turns farm waste and plant materials into biodegradable vegan footwear and shoe components to help fight deforestation.