Cybersecurity

This function is exclusive for Premium subscribers

-

DATABASE (46)

-

ARTICLES (19)

Feedzai is a powerful cloud-based AI tool detecting e-commerce fraud in real-time among trillions of dollars of transactions by the world’s largest corporates.

Feedzai is a powerful cloud-based AI tool detecting e-commerce fraud in real-time among trillions of dollars of transactions by the world’s largest corporates.

EverSafe Online (Threat Hunter)

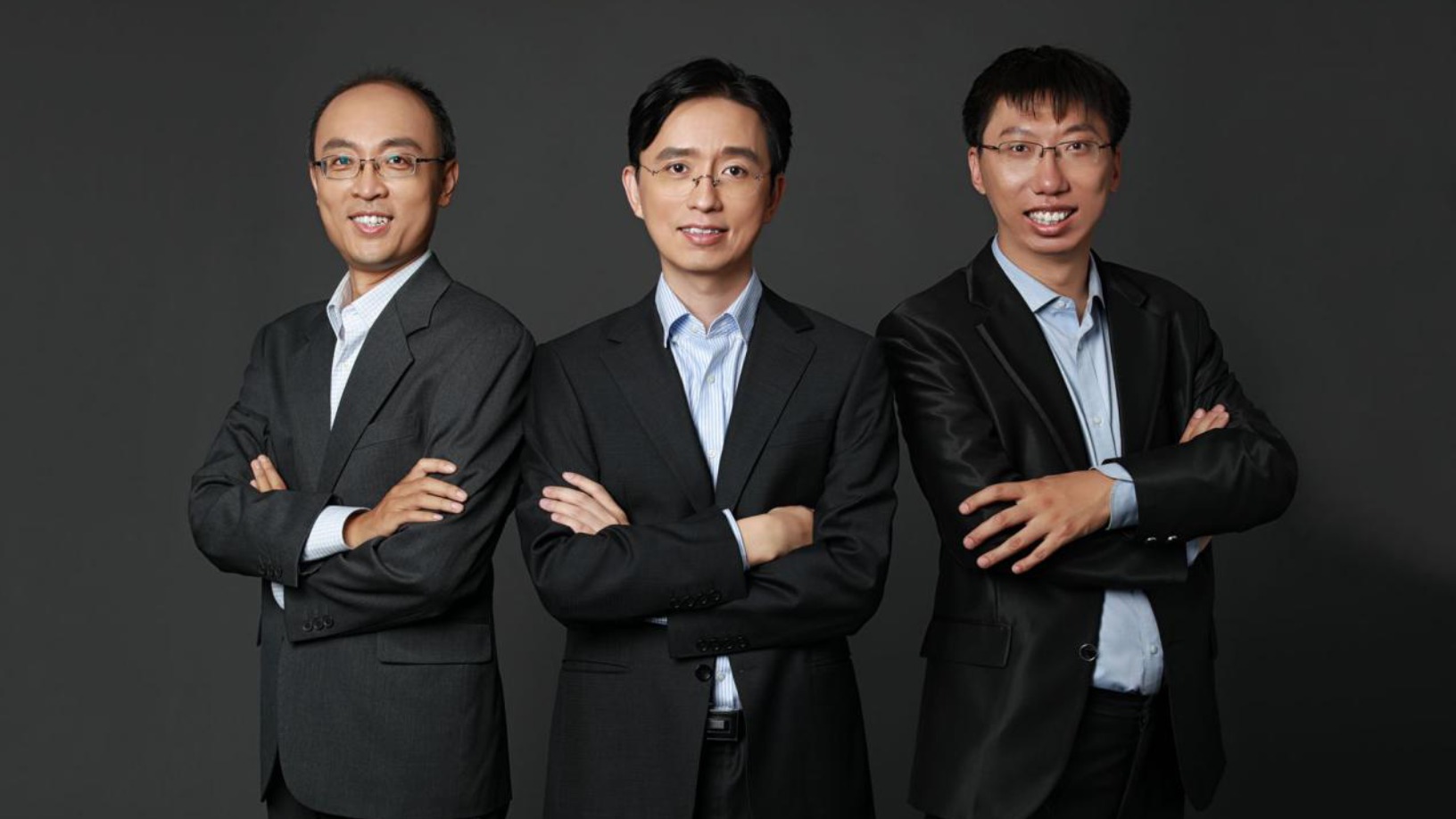

Shenzhen's cybersecurity startup can detect malicious threats well in advance, with 99% accuracy.

Shenzhen's cybersecurity startup can detect malicious threats well in advance, with 99% accuracy.

CraiditX uses AI technology and data mining to provide financial institutions with information on risk management, marketing and customer service.

CraiditX uses AI technology and data mining to provide financial institutions with information on risk management, marketing and customer service.

Ecertic's EADTrust-approved digital identity solutions ensure companies who digitize their business processes also adhere to the latest local regulations.

Ecertic's EADTrust-approved digital identity solutions ensure companies who digitize their business processes also adhere to the latest local regulations.

Geetest’s behavior-based authentication technology better protects websites from attacks and makes it easier for clients to verify web visitors.

Geetest’s behavior-based authentication technology better protects websites from attacks and makes it easier for clients to verify web visitors.

Alias Robotics keeps robots and their components safe with automatically-updating hi-tech immunity chips, compatible with most robotics software, that use bio-inspired AI.

Alias Robotics keeps robots and their components safe with automatically-updating hi-tech immunity chips, compatible with most robotics software, that use bio-inspired AI.

A spellchecker that supports 28 programming languages, Codacy optimizes development efforts, saves hours of work and improves cybersecurity through automated code review.

A spellchecker that supports 28 programming languages, Codacy optimizes development efforts, saves hours of work and improves cybersecurity through automated code review.

Trusted by internet finance firms, China’s largest e-contracting and e-signature platform allows for faster and more secure transactions at a lower cost.

Trusted by internet finance firms, China’s largest e-contracting and e-signature platform allows for faster and more secure transactions at a lower cost.

The hassle of remembering passwords is a thing of the past thanks to Secken, China’s only biometric authentication company offering safe and easy Internet logins.

The hassle of remembering passwords is a thing of the past thanks to Secken, China’s only biometric authentication company offering safe and easy Internet logins.

The venture capital arm of Cisco was established in 1993 in San Francisco and currently has a US$2bn active portfolio. Each year, it invests between US$200-300m from Series A rounds to later investment stages. Cisco Investments has more than 120 companies in its portfolio. It has managed multiple exits and acquisitions, most recently by purchasing customer analytics technology CloudCherry for an undisclosed sum in August 2019. Cisco Investment's recent portfolio investments include healthcare platform Luma Health's US$16m Series B round and big data cybersecurity startup Exabeam's US$75m Series E round.

The venture capital arm of Cisco was established in 1993 in San Francisco and currently has a US$2bn active portfolio. Each year, it invests between US$200-300m from Series A rounds to later investment stages. Cisco Investments has more than 120 companies in its portfolio. It has managed multiple exits and acquisitions, most recently by purchasing customer analytics technology CloudCherry for an undisclosed sum in August 2019. Cisco Investment's recent portfolio investments include healthcare platform Luma Health's US$16m Series B round and big data cybersecurity startup Exabeam's US$75m Series E round.

Caffeinated Capital is a San Francisco-based venture capital firm founded by Raymond Tonsing, founded in 2009. Since 2016, it has launched three funds, investing a total US$242 million in 60 companies, including five as the lead investor. It has seen a number of prominent exits including Parse, WePay and Appurify and was the lead investor in Series B rounds for Sapho and Airtable, besides MemSQL's Series C funding. Its recent investments include in Opendoor's Series E round and in Triplebyte's Series B and SentiLink's Series A rounds. Healthcare, fintech and cryptosecurity are key investment areas.

Caffeinated Capital is a San Francisco-based venture capital firm founded by Raymond Tonsing, founded in 2009. Since 2016, it has launched three funds, investing a total US$242 million in 60 companies, including five as the lead investor. It has seen a number of prominent exits including Parse, WePay and Appurify and was the lead investor in Series B rounds for Sapho and Airtable, besides MemSQL's Series C funding. Its recent investments include in Opendoor's Series E round and in Triplebyte's Series B and SentiLink's Series A rounds. Healthcare, fintech and cryptosecurity are key investment areas.

Founded in 2006 and renamed in 2010, Floodgate Fund is a venture capital firm focused on early-stage investment in technology sectors.

Founded in 2006 and renamed in 2010, Floodgate Fund is a venture capital firm focused on early-stage investment in technology sectors.

Frontline Ventures is a London-based VC firm that typically invests in early-stage B2B companies with the bulk of funding going toward European companies seeking a U.S. expansion. The current Fund II, worth €60 million, closed in 2016 and they are looking to make investments of between €200,000 and €3 million each.

Frontline Ventures is a London-based VC firm that typically invests in early-stage B2B companies with the bulk of funding going toward European companies seeking a U.S. expansion. The current Fund II, worth €60 million, closed in 2016 and they are looking to make investments of between €200,000 and €3 million each.

Bonsai VC invests in Spanish startups with global ambitions and mobile-focused business models. The founders and managers, including Javier Cebrián Monereo, Javier Cebrián Sagarriga, Luis González Buendía and Rafael Gutierrez de Calderón; own approximately 60% of the VC share capital.

Bonsai VC invests in Spanish startups with global ambitions and mobile-focused business models. The founders and managers, including Javier Cebrián Monereo, Javier Cebrián Sagarriga, Luis González Buendía and Rafael Gutierrez de Calderón; own approximately 60% of the VC share capital.

Finch Capital is formerly known as Orange Growth Capital. Operating from their offices in Amsterdam, London and Singapore, they invest in European and Southeast Asian early-stage companies that have already generated revenue. They are "thematic investors", focusing on enabling technological innovation for the finance services sector.

Finch Capital is formerly known as Orange Growth Capital. Operating from their offices in Amsterdam, London and Singapore, they invest in European and Southeast Asian early-stage companies that have already generated revenue. They are "thematic investors", focusing on enabling technological innovation for the finance services sector.

SWITCH Singapore 2021: How to harness the power of the deep tech ecosystem

Investor Jason Illian of Koch Disruptive Technologies talks talent, scaling for deep tech startups, and why longer gestation periods and mid-course pivots don’t have to be deal breakers

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Xu Jinghong: Champion of young entrepreneurs and high-tech startups

Under Xu Jinghong’s leadership, Tsinghua Holdings grew its assets sevenfold and incubated over 10,000 businesses. In his new role as VC investor, Xu wants to nurture startups into future global leaders

Digital Union: Fighting fake users in China's mobile app industry

The Beijing-based cybersecurity startup is helping developers spot fake app downloads, so their ad money don’t go to waste

Data integration platform Onna accelerates growth with Covid-19 boost

Corporates use up to 80 different apps in their workflows. Slack- and Dropbox-backed Onna is a central platform integrating all that fragmented data, giving companies greater control

NoMorePass: Free app for safe, easy password retrieval across platforms

NoMorePass is a password storage solution that employs military-grade encryption to guard against hackers and data leaks, rendering cloud-based password managers obsolete

Fintech startup Xendit launches aid program for Indonesian businesses amid Covid-19 crisis

Xendit is helping more SMEs go online by waiving transaction fees for its digital payments solution for the first month

Spanish startups protest the lack of relevant aid, compared with other EU countries; investors warn of “disastrous” new foreign investment restriction

EverSafe Online: Pre-empting cyber attacks so companies avoid huge losses

Making cybersecurity affordable for SMEs, Shenzhen-based Eversafe Online launches China's first business intelligence search engine to track, pre-empt cyber attacks

Vottun: The "WordPress for blockchain" seeks US expansion, investors

Seeking Series A funding this year, the agnostic SaaS opens blockchain's wealth of possibilities to businesses unfamiliar with the technology

After insurtech and fintech, Newralers applies AI to winemaking

Newralers expects strong demand for its disruptive AI solutions that test the cognitive value of information, with clients from listed companies to SMEs

This startup aims to be the DocuSign of China

Having captured a third of a largely untapped domestic e-contracting market, Shangshangqian looks to gain a greater foothold at home and abroad

Ecertic Digital Solutions: A Spanish leader in online ID verification

The Spanish biometric tech startup offers online ID verification and tracked document solutions in a US$10 billion market set to double by 2022

Geetest provides an easy and fun way to secure websites and apps

This startup’s behavior-based verification process takes less than a second to finish, but that’s all the time it needs to distinguish a human from a robot

Billin offers unlimited free e-invoicing services to SMEs and freelancers

Offering automated online invoice generating, sharing, tracking and payments, the Spanish fintech wants to become the billing Dropbox for businesses worldwide

- 1

- 2