Materials

This function is exclusive for Premium subscribers

-

DATABASE (25)

-

ARTICLES (42)

BayWa Venture GmbH is a subsidiary company of BayWa AG, the German agriculture, energy and construction conglomerate.Putting digitalization at the core of its agriculture strategy, the company is looking to expand its core business into digital services within the existing businesses. It is investigating new digital business models and stand-alone concepts through collaboration with emerging startups focusing on cutting-edge technologies in the agrifood tech space.BayWa started to invest in startups in 2012 mainly focused on online customer management, services and sales platforms. In 2015, the company purchased Farm Facts, a German farm management SaaS and in 2017 invested in Abundant Robotics, a US-based automated harvest company. One of the firms’ most recent investments has been Evja, an Italian startup developing precision farming hardware based on advanced agronomic models and machine learning technology.

BayWa Venture GmbH is a subsidiary company of BayWa AG, the German agriculture, energy and construction conglomerate.Putting digitalization at the core of its agriculture strategy, the company is looking to expand its core business into digital services within the existing businesses. It is investigating new digital business models and stand-alone concepts through collaboration with emerging startups focusing on cutting-edge technologies in the agrifood tech space.BayWa started to invest in startups in 2012 mainly focused on online customer management, services and sales platforms. In 2015, the company purchased Farm Facts, a German farm management SaaS and in 2017 invested in Abundant Robotics, a US-based automated harvest company. One of the firms’ most recent investments has been Evja, an Italian startup developing precision farming hardware based on advanced agronomic models and machine learning technology.

Beyond Investing is a Geneva-based firm investing in early-stage venture capital and equity growth startups mainly in European developed markets. With average investments of €200,000, the firm’s core investment strategy focuses on sustainability with an investment period lasting 5–10 years.The impact investor targets innovative startups involved in vegan, cruelty-free and plant-based alternatives; biotechnologies, foodtech, new materials, clothing and lifestyle sectors. Successful portfolio foodtechs include Mosa Meat, BlueNalu and Shiok Meats.With a team of vegan finance professionals in the US and Europe, Beyond Investing listed the first US Vegan Climate ETF (VEGN) on the New York Stock Exchange in September 2019. The ETF tracks Beyond Investing’s US Vegan Climate Index which covers an index of 495 of the largest-capitalization companies in the US stock market. The ethical investment option aims to exclude stocks in companies with activities that are not aligned with its vegan-themed, cruelty-free and fossil-fuel-free investing ethos.

Beyond Investing is a Geneva-based firm investing in early-stage venture capital and equity growth startups mainly in European developed markets. With average investments of €200,000, the firm’s core investment strategy focuses on sustainability with an investment period lasting 5–10 years.The impact investor targets innovative startups involved in vegan, cruelty-free and plant-based alternatives; biotechnologies, foodtech, new materials, clothing and lifestyle sectors. Successful portfolio foodtechs include Mosa Meat, BlueNalu and Shiok Meats.With a team of vegan finance professionals in the US and Europe, Beyond Investing listed the first US Vegan Climate ETF (VEGN) on the New York Stock Exchange in September 2019. The ETF tracks Beyond Investing’s US Vegan Climate Index which covers an index of 495 of the largest-capitalization companies in the US stock market. The ethical investment option aims to exclude stocks in companies with activities that are not aligned with its vegan-themed, cruelty-free and fossil-fuel-free investing ethos.

Since 2005, Demeter Partners has been one of the major VC and private equity funds supporting technology companies in developing solutions for ecological and energy transitions. The firm typically invests €1m–€30m in early and growth stages of startups. With assets worth over €1bn under management, its portfolio in 2019 was estimated to have cut 4.3m tons of CO2 with 575 GWh of clean energy produced. In 2021, Demeter was named the “Best Sustainable Equity investor” by a panel of former Fortune 500 individuals, global experts and industry leaders to recognize Demeter’s commitment to the UN’s SDG and ESG strategy.

Since 2005, Demeter Partners has been one of the major VC and private equity funds supporting technology companies in developing solutions for ecological and energy transitions. The firm typically invests €1m–€30m in early and growth stages of startups. With assets worth over €1bn under management, its portfolio in 2019 was estimated to have cut 4.3m tons of CO2 with 575 GWh of clean energy produced. In 2021, Demeter was named the “Best Sustainable Equity investor” by a panel of former Fortune 500 individuals, global experts and industry leaders to recognize Demeter’s commitment to the UN’s SDG and ESG strategy.

Mohit Goel is one of India’s youngest real estate tycoons and an angel investor. He appeared as one of a panel of potential investors on the India reality TV show The Vault, which features start-ups pitching their business ideas to angel investors in order to seek funding. Goel is CEO of Omaxe, a real estate firm based in New Delhi. As the second-generation head of the company, he was credited for structural changes aimed at turning the firm around amidst challenging market conditions and introducing fresh concepts and customer-centric ideas to strengthen the business. Goel is also the north zone head of CREDAI Youth Wing, an industry body bringing together the next generation of leaders in India’s real estate and property developer market. In 2014, he was named Young Male Entrepreneur of the Year at the Infra & Realty Sutra Awards and also received the Young Achiever’s Award at ABP News’ Real Estate Awards.

Mohit Goel is one of India’s youngest real estate tycoons and an angel investor. He appeared as one of a panel of potential investors on the India reality TV show The Vault, which features start-ups pitching their business ideas to angel investors in order to seek funding. Goel is CEO of Omaxe, a real estate firm based in New Delhi. As the second-generation head of the company, he was credited for structural changes aimed at turning the firm around amidst challenging market conditions and introducing fresh concepts and customer-centric ideas to strengthen the business. Goel is also the north zone head of CREDAI Youth Wing, an industry body bringing together the next generation of leaders in India’s real estate and property developer market. In 2014, he was named Young Male Entrepreneur of the Year at the Infra & Realty Sutra Awards and also received the Young Achiever’s Award at ABP News’ Real Estate Awards.

Aquiti Gestion is a 20-year old capital investment company focused on supporting startups in the seed and Series A stage in the Nouvelle-Aquitaine region of France’s southwest. It counts more than 200 companies in its portfolio and some €200m under management. It has three offices and 18 staff.

Aquiti Gestion is a 20-year old capital investment company focused on supporting startups in the seed and Series A stage in the Nouvelle-Aquitaine region of France’s southwest. It counts more than 200 companies in its portfolio and some €200m under management. It has three offices and 18 staff.

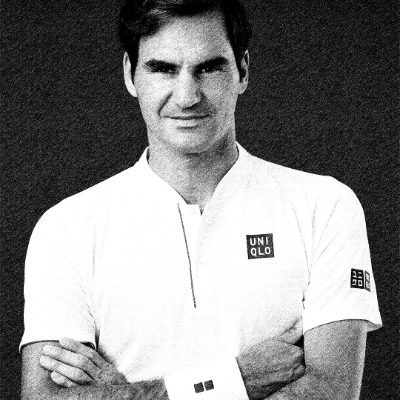

Roger Federer, the Swiss 20-times Grand Slam tennis champion, has turned into an angel investor while planning his professional life beyond and after his tennis sports career.In 2019, he invested in On, the Swiss running shoe manufacturer for an undisclosed funding amount. Federer currently has no formal role in the company but he’s actively involved in its R&D and product development. “I feel like I can give input on any of the lines, the shoes, anything moving forward. I can give my opinion on anything and On can either take it or leave it. I feel like [with] a major brand like Nike, that's literally impossible. It just wouldn't work,” he has said.More recently, Federer participated in a Series D funding round backing the first Chilean unicorn NotCo, which sells plant-based food and beverage products across Latin America and the US.

Roger Federer, the Swiss 20-times Grand Slam tennis champion, has turned into an angel investor while planning his professional life beyond and after his tennis sports career.In 2019, he invested in On, the Swiss running shoe manufacturer for an undisclosed funding amount. Federer currently has no formal role in the company but he’s actively involved in its R&D and product development. “I feel like I can give input on any of the lines, the shoes, anything moving forward. I can give my opinion on anything and On can either take it or leave it. I feel like [with] a major brand like Nike, that's literally impossible. It just wouldn't work,” he has said.More recently, Federer participated in a Series D funding round backing the first Chilean unicorn NotCo, which sells plant-based food and beverage products across Latin America and the US.

Future Positive Capital is a Paris-based VC with a second office in London. Its investments cover deep-technology companies applying AI, biotechnology, synthetic biology, as well as robotics. Co-funded in 2016 by ex-Index Ventures associate Sofia Hmich along with Alexandre Terrien and Michael Rosen; it has made 18 investments to date. In 2019 Future Positive raised over $57m pan-European impact investment fund, claiming that most European VCs are continuing to staying focused on sectors, such as consumer, fintech, and marketing, or web and mobile technologies. Future Positive’s belief is that there is instead, a long-tail of investment opportunities to back businesses that actually tackle “the world’s most pressing problems”.Through this fund, it will back throughout Seed and Series A stages, with the possibility to follow up on Series B investing between around €300,000 and €5m. Since then the company has backed startups in the like of BioBeats, an AI company focused on preventative mental health, cell-based startup Meatable, and more recently NotCo, the Chilean unicorn disrupting the food and beverage sector with AI-enabled plant-based products.The team counts on an extensive network of mentors, innovators, impact angel investors and entrepreneurs such as F1 pilots Nico Rosberg, the MD of Alibaba France Sebastien Badault, the Omid Ashtari the President of Citymapper amongst others.

Future Positive Capital is a Paris-based VC with a second office in London. Its investments cover deep-technology companies applying AI, biotechnology, synthetic biology, as well as robotics. Co-funded in 2016 by ex-Index Ventures associate Sofia Hmich along with Alexandre Terrien and Michael Rosen; it has made 18 investments to date. In 2019 Future Positive raised over $57m pan-European impact investment fund, claiming that most European VCs are continuing to staying focused on sectors, such as consumer, fintech, and marketing, or web and mobile technologies. Future Positive’s belief is that there is instead, a long-tail of investment opportunities to back businesses that actually tackle “the world’s most pressing problems”.Through this fund, it will back throughout Seed and Series A stages, with the possibility to follow up on Series B investing between around €300,000 and €5m. Since then the company has backed startups in the like of BioBeats, an AI company focused on preventative mental health, cell-based startup Meatable, and more recently NotCo, the Chilean unicorn disrupting the food and beverage sector with AI-enabled plant-based products.The team counts on an extensive network of mentors, innovators, impact angel investors and entrepreneurs such as F1 pilots Nico Rosberg, the MD of Alibaba France Sebastien Badault, the Omid Ashtari the President of Citymapper amongst others.

Cambridge Enterprise Venture Partners

A Cambridge-based investor, founded in 2006, that exists to support spin-off companies created at the city’s university with an emphasis on social impact. It currently has 57 companies in its portfolio, almost entirely in the areas of life and physical sciences, which have, in total, raised over £2bn in further investment and grant funding.Its most recent investments include in the June 2021 £3m seed round of Gallium Nitride semiconductor engineering company Porotech and in the January 2021 $20m Series A round of quantum computing innovators Riverlane.

A Cambridge-based investor, founded in 2006, that exists to support spin-off companies created at the city’s university with an emphasis on social impact. It currently has 57 companies in its portfolio, almost entirely in the areas of life and physical sciences, which have, in total, raised over £2bn in further investment and grant funding.Its most recent investments include in the June 2021 £3m seed round of Gallium Nitride semiconductor engineering company Porotech and in the January 2021 $20m Series A round of quantum computing innovators Riverlane.

Founded in London in 2009, Parkwalk is a specialist investor in deeptech spin-offs created at UK universities. Parkwalk currently has over £375m of assets under management and has invested in over 100 companies to date, emanating from the universities in Oxford, Cambridge, Imperial and Bristol, becoming the UK’s most active VC outside London. It currently has 143 portfolio companies, Its recent investments include the $17m May 2021 Series A round of cell therapy medtech Mogrify and in the April 2021 £1.9m seed round of HexagonFab, a medtech producing analytical lab instruments.

Founded in London in 2009, Parkwalk is a specialist investor in deeptech spin-offs created at UK universities. Parkwalk currently has over £375m of assets under management and has invested in over 100 companies to date, emanating from the universities in Oxford, Cambridge, Imperial and Bristol, becoming the UK’s most active VC outside London. It currently has 143 portfolio companies, Its recent investments include the $17m May 2021 Series A round of cell therapy medtech Mogrify and in the April 2021 £1.9m seed round of HexagonFab, a medtech producing analytical lab instruments.

Royal Golden Eagle (RGE) is an industrial group owned by Indonesian tycoon Sukanto Tanoto. It employs 60,000 people worldwide with assets worth over $20bn. Tanoto started his business empire in 1967 as a supplier of spare parts to oil and construction companies in Indonesia. He went on to invest in oil palm plantations in 1979. Since 1985, his group companies have been managing 30,000 acres of oil palm trees each year across a total land area of 160,000 hectares.Headquartered in Singapore, RGE has interests in diverse sectors like paper palm oil, viscose, asset management, real estate, construction and energy. RGE owns the world’s largest viscose producer Sateri, Asia Pacific Rayon and energy firm Pacific Oil & Gas. It is also the owner of the Asia Pacific Resources International Holdings Limited (APRIL), one of the world’s largest pulp and paper mills. The Rainforest Action Network and other NGOs like Greenpeace and the WWF have put considerable pressure on the RGE group’s unsustainable operations such as the destruction of rainforests by APRIL. In 2019, RGE announced plans to invest $200m in cellulosic textile fiber research and development over a period of 10 years. Projects will include the scaling up of proven clean technology in fiber manufacturing, bringing pilot-scale production to commercial scale and R&D in emerging frontier solutions.

Royal Golden Eagle (RGE) is an industrial group owned by Indonesian tycoon Sukanto Tanoto. It employs 60,000 people worldwide with assets worth over $20bn. Tanoto started his business empire in 1967 as a supplier of spare parts to oil and construction companies in Indonesia. He went on to invest in oil palm plantations in 1979. Since 1985, his group companies have been managing 30,000 acres of oil palm trees each year across a total land area of 160,000 hectares.Headquartered in Singapore, RGE has interests in diverse sectors like paper palm oil, viscose, asset management, real estate, construction and energy. RGE owns the world’s largest viscose producer Sateri, Asia Pacific Rayon and energy firm Pacific Oil & Gas. It is also the owner of the Asia Pacific Resources International Holdings Limited (APRIL), one of the world’s largest pulp and paper mills. The Rainforest Action Network and other NGOs like Greenpeace and the WWF have put considerable pressure on the RGE group’s unsustainable operations such as the destruction of rainforests by APRIL. In 2019, RGE announced plans to invest $200m in cellulosic textile fiber research and development over a period of 10 years. Projects will include the scaling up of proven clean technology in fiber manufacturing, bringing pilot-scale production to commercial scale and R&D in emerging frontier solutions.

- 1

- 2

Forget solar panels and batteries, Bioo wants to scale soil bioelectricity generation

Improving on NASA’s microbial fuel cell tech, Bioo hopes to boost crop efficiency and transform the way urbanites live, in future green cities powered by plants

Sequoia China Seed Fund: Growing an era of deep-tech startups

Managing Partner Neil Shen wants to help deep-tech and enterprise tech startups get investments more easily, across quantum computing, semiconductors, synthetic biology and more

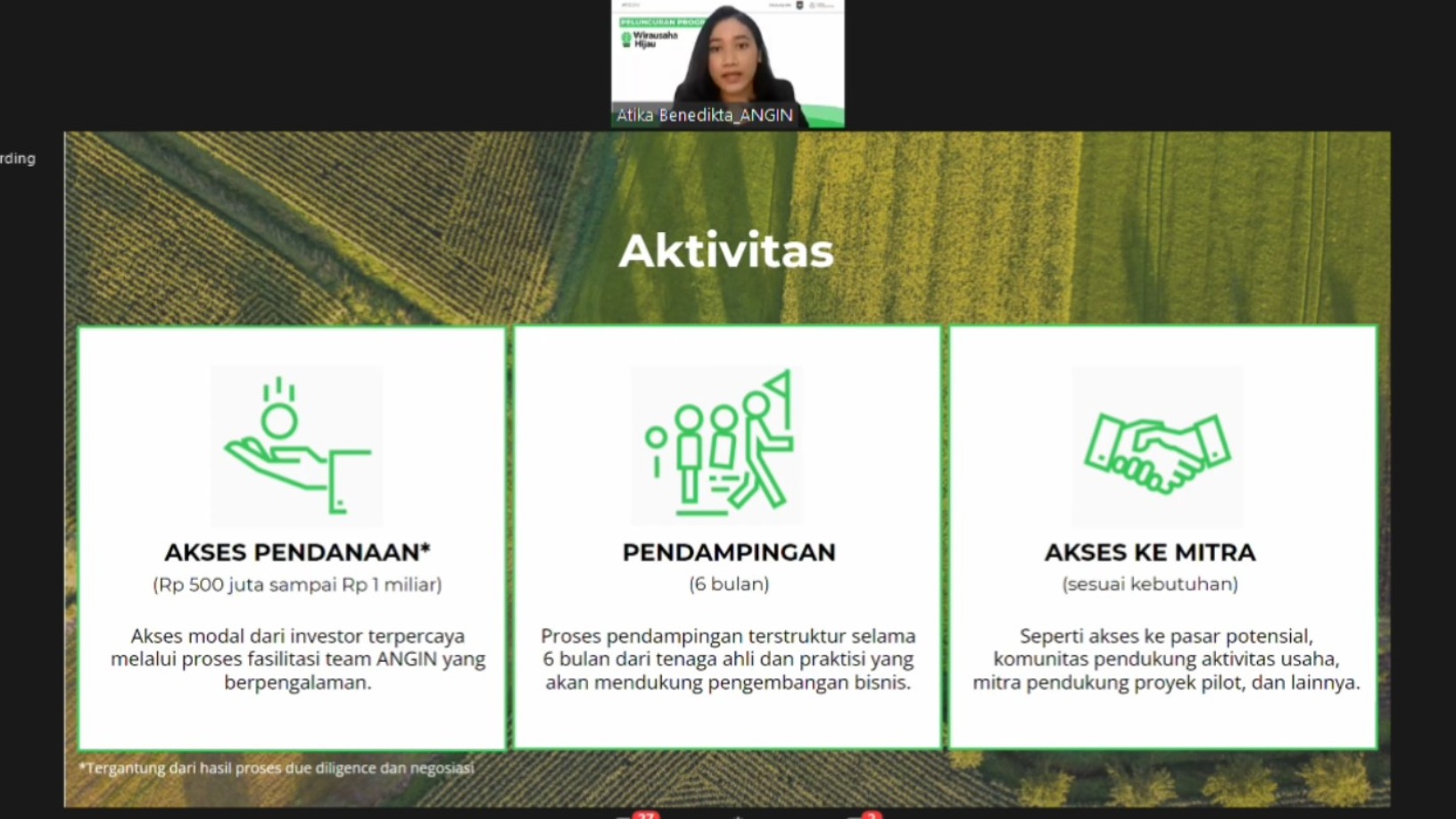

Indonesian angel investor network ANGIN launches agrifood incubator

Program targets ESG investment and builds on the strong potential of Indonesia’s agriculture sector, which kept growing despite the Covid-19 pandemic

Beyond Leather Materials: Turning apples into alt-leather for sustainable fashion

Through its Leap brand, the Danish startup cuts food waste by turning apples junked in cider factories into affordable vegan leather for the $100bn leather market

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

Infinited Fiber: Producing biofibers for fashion to move toward circular economy

Supported by H&M, Adidas and textile manufacturers, Infinited Fiber is helping the world’s second most polluting industry go greener by turning industrial waste into regenerated biomaterials

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

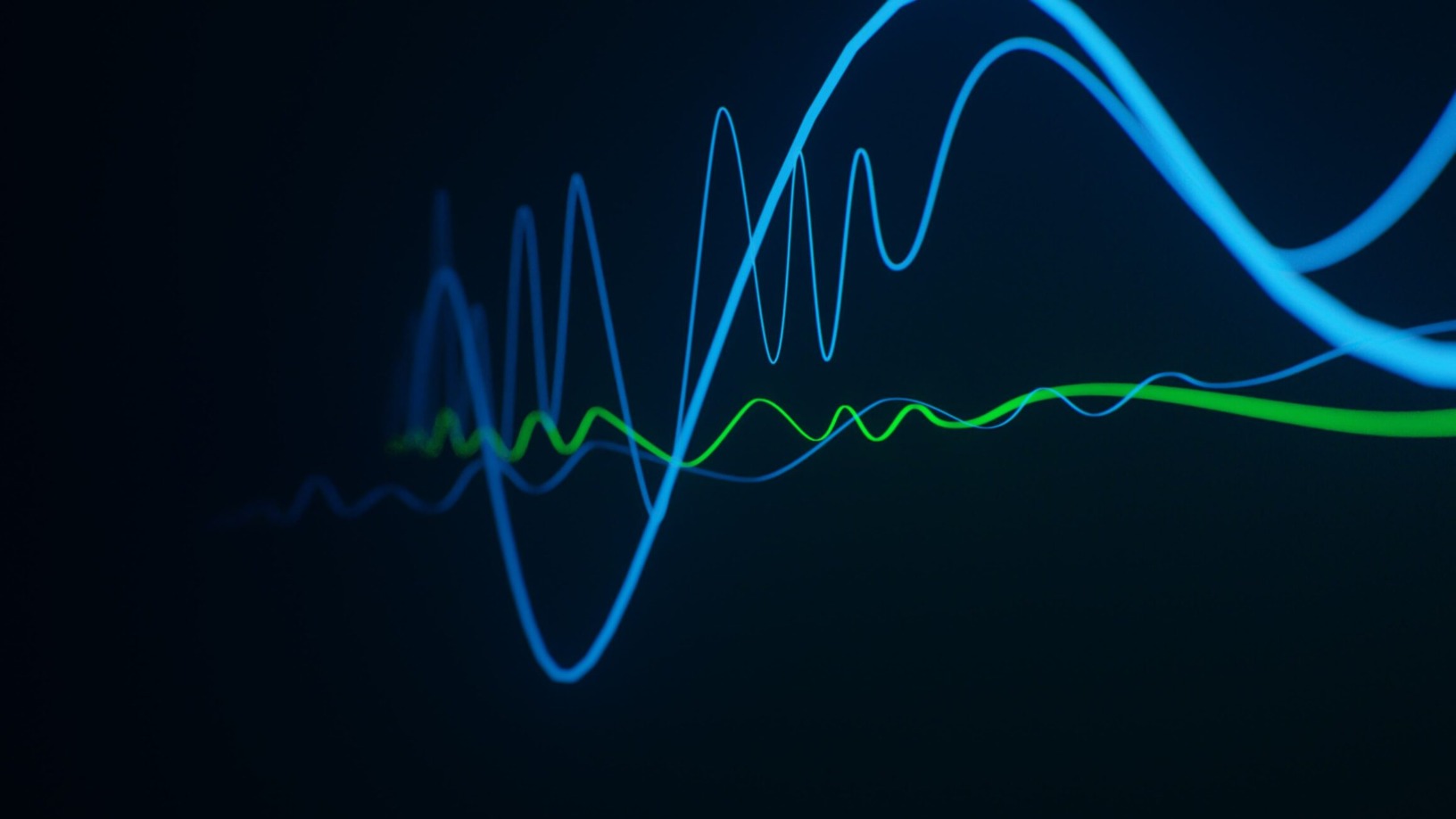

Viezo: Vibration energy harvesting to power sensors and IoT devices

Disrupting the battery market, Viezo’s proprietary technology, PolyFilm, can also boost operational efficiency and slash maintenance costs of sensors and IoT devices

Xampla: Making strong, low-cost biodegradable plastic from peas

Inspired by the strength of spider silk, the Cambridge University spinoff has produced a plant-based, completely compostable alternative to microplastics

Petit Pli: Origami-inspired clothes that still fit, even after the body has grown

Founded by a young aeronautical engineer, Petit Pli produces stylish, sustainable pleated garments made from recycled plastic that expand up to seven sizes

Want to cut plastic packaging? Notpla's edible seaweed sachets are an option

From its edible whiskey “bubbles” to biodegradable Teflon-free container liners, Notpla seeks to replace single-use plastic and help food companies boost their green credentials

Qorium: Lab-grown premium leather for the future of luxury

The Dutch biotech startup co-founded by cell-based meat pioneer Mark Post is targeting the luxury goods market with its “clean leather” sheets made from cultivating bovine skin cells, and plans to raise up to €100m

Bygen: Turning waste into activated carbon

Australian startup Bygen is offering agribusinesses more reasons to upcycle waste sustainably into a lucrative product with its eco-friendly process to make activated carbon

Botree Cycling: Recovering critical metals from end-of-life batteries

The Beijing-based startup helps clients dismantle and recycle spent lithium batteries on-site, recovering over 90% of rare metals and reducing demand for mineral resources

Oceanium: Supporting sustainable seaweed farming

Scottish startup Oceanium has developed a proprietary biorefinery and processing model to create seaweed-based compostable materials, alt-protein ingredients and nutraceuticals for use across industry verticals

Search instead for portugal, b2b, hospitality