The startup cut its teeth in last-mile food delivery as early as 2016. Four years on, logistical solutions provider Mox has swiftly pivoted to the e-commerce market, a switch accelerated by the recent Covid-19 lockdown in Spain.

The Seville-based startup was just beginning to diversify into e-commerce and grocery delivery before the pandemic. As more people turned to online shopping during the nearly three-month lockdown, Mox went from deriving 90% of its business from takeout deliveries and 10% from parcel deliveries in December 2019, to about a 50-50 weightage between the two in May.

“We hadn’t planned to go from doing 90% food delivery to 40%, 50% in less than four months. Everything speeded up during Covid-19, which is what has made this possible,” Mox co-founder and CMO Tom Horsey said in an interview with CompassList.

With over 1,200 riders operating across 52 cities in Spain, Mox is the only instant-delivery last-mile operator with such a wide national network, utilizing a cellular model that serves mini urban hubs with a delivery range limited to 1–2 km. The company’s new e-commerce-focused business has already secured key clients like traditional last-mile delivery operators Seur and Paack.

"We’ve been working very hard and the team has been excellent. We are coming out [of this pandemic] stronger than we were before,” said Horsey.

To consolidate its expansion across the new segments and prepare for its launch in Italy, Mox, which used to be called Mission Box, is raising €8.2m in new funding. The company had aimed to finalize the funding round by July, but its rapid growth and traction across verticals since the pandemic has extended its runway. It closed a €3m investment round led by VAS Ventures, the early-stage investment fund of serial entrepreneur and angel investor Martín Varsavsky, in November 2019.

“We’ve got several parties that are interested. Some semi-institutional investors are already in, like Just Eat and Martín Varsavsky," he said, but "everybody is waiting for a leading investor.”

Riding the turbulence

During the pandemic, Mox saw a 70% drop in food delivery orders as restaurants were closing their doors and people were not ordering food because of concerns about the safety of consuming food prepared by others. As a result, the company had to furlough 60% of its staff, putting them on “expediente de regulación temporal de empleo” (ERTE). Unlike food delivery platforms like Glovo and Uber Eats, Mox contracts its riders as full-time employees.

Even before Covid-19, Mox – whose other co-founders were Gregorio López Martos, CEO, Global; and Antonio Valenzuela, CEO, New Business – had found operating in the food delivery sector increasingly challenging.

“We had realized that food delivery is a very complicated business – from the logistical point of view, almost impossible to optimize,” Horsey said.

“Most of the time, the delivery time is actually [dependent] on restaurants, and not the rider. In a perfect world, the order will come in, the restaurant will prepare [the food], the rider will turn up, and soon after he arrived at the pick-up point, the customer will get the order… In this way, the delivery time will be something like 20–25 minutes. But that never happens" in real life.

The inefficiency of point to-point food delivery, from one restaurant to one customer, is another issue. "Unless you are working with a very high concentration of demand, which in effect means McDonald, KFC and maybe few others, you don’t have multiple drop-off points. You are also dealing with customers that are hungry in a very short window of delivery and also at specific times.

“Compare that to [e-commerce] parcel delivery, where deliveries are managed throughout the day and riders are given a route … delivering multiple packages to multiple points.”

Such foresight paid off. Although Mox saw its revenue drop between March and April, the company was back on track by May with its new verticals. "Over the last two months, we’ve been able to turn the overall situation around,” Horsey said.

He recalled that the company was running pilots with three customers, specifically for grocery-delivery services. When these companies suddenly experienced a boom in demand during the lockdown, Mox had to also quickly figure out grocery delivery solutions that would suit this new vertical.

Horsey said: “We started to test grocery deliveries with different fleets of vehicles based on the weight and type of products to be transported. We got bicycles, tricycles, electric three-wheel motorbikes, cars and vans."

In the last few months, he witnessed industries rapidly digitizing, noting that restaurants, in particular, had to pivot to offering food delivery out of necessity or risk closing down as they would not have been able to sustain their business otherwise. “We started to grow [our business] significantly with individual restaurants – more than what we did previously."

Agile fit

During the lockdown, Mox managed to close several deals by banking on its greatest assets: technology and lean methodologies. “We cut our teeth on food delivery and so, to a certain extent, everything else comes quite easy for us because we learned in a very difficult market,” said Horsey. “We are not a one-size-fits-all type of solution; we work white label, we do technological integrations and we are happy to use third-party software – that’s not common at all in logistics.”

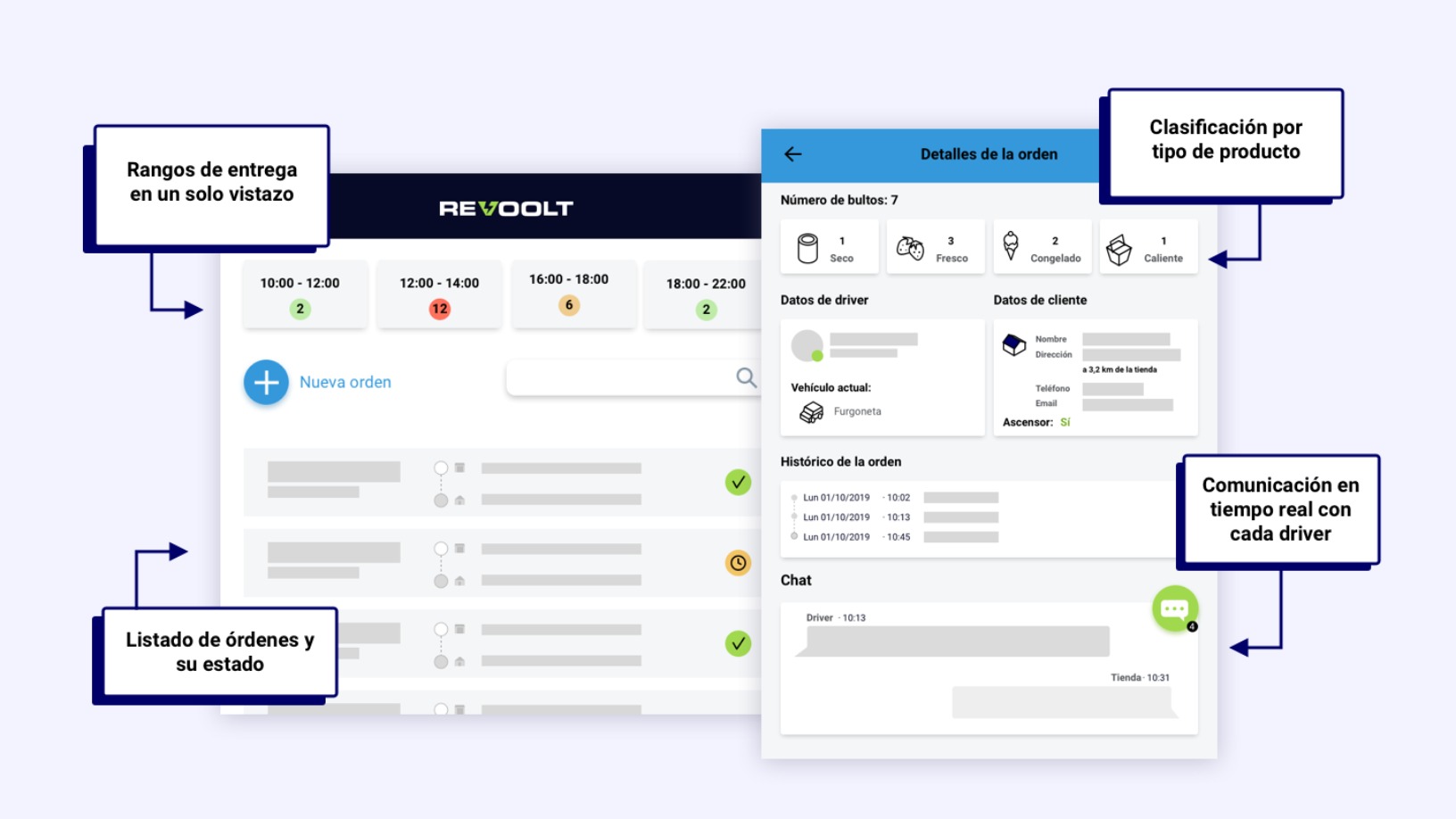

“Most of our business is purely operations, but we’d like to think of ourselves as a technology player. We build our native technology, we have our own algorithms and we are constantly thinking about how we can improve through the use of technology.”

To demonstrate its potential as a technological partner, Mox agreed to help one of its major new customers solve a logistical problem across 10 cities amid the lockdown even though it was only for a two-week trial.

“All of this comes down to agility, we wanted to prove we are capable of doing so," Horsey said. The customer’s problem was "obviously quite complicated to resolve and probably not profitable in itself because of the work involved in getting set up. But if we prove that we can resolve it in days, then hopefully next time you face a problem like this, you will come to us and there will be a long-term relationship.”

Blockchain contracts

Since its launch, the startup’s revenue has grown from €300,000 in 2017 to €2.8m in 2018 and €8.9m in 2019. This year, Mox aims to break even with a revenue of €30m, by focusing on a pioneering technology it has created, integrating blockchain and AI to create white-label solutions for last-mile delivery verticals. A white label product or service is one created by a company to be packaged and sold by other companies under their own brand names.

This involves a blockchain system of smart contracts that automatically track specific key performance indicators of the service-level agreement (SLA) it has with customers. Examples of key performance indicators that customers might want to track include the time taken for an order request to be accepted by a delivery driver, the time taken by the driver to collect the order and the time taken to deliver the order to its end point. “Wherever there is a trust issue, smart contracts help, and there is always a trust issue in this business,” said Horsey.

Since every order can be tracked, Mox can charge the customer per delivery and it can even charge extra if its drivers outperform the SLA. Horsey said, “If we can charge [our customers] on a per-delivery basis, then we can also pay our drivers on a per-delivery basis instantly. For example, we can a pay drivers a fixed amount per delivery and, on top of that, add an extra bonus per delivery performed, say, five minutes earlier.”

More new tech solutions are on the way. “There will be more and more a necessity to integrate orders in a common interface as orders are coming through multiple sources, like WhatsApp, email, websites. There are lot of solutions but not the type of solutions that the store owner is comfortable with, so there’s a whole chain that has to be improved,” said Horsey.