Bank Indonesia

-

DATABASE (639)

-

ARTICLES (299)

Tokopedia is an Indonesian e-commerce marketplace, which in 2017 become the most popular site of its kind in Indonesia. Through partnerships with fintech companies, it has added new features that enable customers to buy gold and mutual funds. Besides foreign e-commerce marketplaces such as Lazada, Tokopedia’s closest rival is B2C/C2C marketplace Bukalapak, another Indonesian unicorn.

Tokopedia is an Indonesian e-commerce marketplace, which in 2017 become the most popular site of its kind in Indonesia. Through partnerships with fintech companies, it has added new features that enable customers to buy gold and mutual funds. Besides foreign e-commerce marketplaces such as Lazada, Tokopedia’s closest rival is B2C/C2C marketplace Bukalapak, another Indonesian unicorn.

Kingfisher is a privately owned, and independently managed financial services firm active for nearly three decades. The firm was established in Charlotte in the US in 1989 and acquired by WealthTrust, LLC in 2004. In 2009, it returned to operate as an independent investment adviser under the name of Kingfisher Capital, LLC and purchased all outstanding ownership interest from WealthTrust LLC. Kingfisher has supported affluent families, professionals, business owners, and institutions through financial advisory, smart investments and personalized client service.The firm is currently led by managing partners and co-founders Alexander Miles and H K Hallett. Prior to founding Kingfisher, Miles worked at WealthTrust Advisors, the Myers Limited Partnerships and Lehman Brothers in New York. Hallett worked for Trust Company Bank of Georgia and Peoples Bank of North Carolina before joining Carolina Securities Corporation, where he co-managed the Charlotte office.

Kingfisher is a privately owned, and independently managed financial services firm active for nearly three decades. The firm was established in Charlotte in the US in 1989 and acquired by WealthTrust, LLC in 2004. In 2009, it returned to operate as an independent investment adviser under the name of Kingfisher Capital, LLC and purchased all outstanding ownership interest from WealthTrust LLC. Kingfisher has supported affluent families, professionals, business owners, and institutions through financial advisory, smart investments and personalized client service.The firm is currently led by managing partners and co-founders Alexander Miles and H K Hallett. Prior to founding Kingfisher, Miles worked at WealthTrust Advisors, the Myers Limited Partnerships and Lehman Brothers in New York. Hallett worked for Trust Company Bank of Georgia and Peoples Bank of North Carolina before joining Carolina Securities Corporation, where he co-managed the Charlotte office.

Launched in 2014, Convergence Ventures (formerly Convergence Accel) is a venture fund focused on investing in Indonesia. The fund is led by Donald Wihardja and ex-Rocket Internet man Adrian Li. Li is also the co-founder of Qraved, one of Indonesia's leading food social networking startup.

Launched in 2014, Convergence Ventures (formerly Convergence Accel) is a venture fund focused on investing in Indonesia. The fund is led by Donald Wihardja and ex-Rocket Internet man Adrian Li. Li is also the co-founder of Qraved, one of Indonesia's leading food social networking startup.

Founded by tech entrepreneur and investor Teruhide ("Teru") Sato, Tokyo-headquartered Beenos is a seed accelerator and investor in startups from fast-growing countries such as India, Indonesia and Turkey, as well as Japan and the United States. Beenos typically invests between US$100,000 and US$3 million.

Founded by tech entrepreneur and investor Teruhide ("Teru") Sato, Tokyo-headquartered Beenos is a seed accelerator and investor in startups from fast-growing countries such as India, Indonesia and Turkey, as well as Japan and the United States. Beenos typically invests between US$100,000 and US$3 million.

Investment banker Miguel Haupt is a managing partner at London-based investment company Opinmaco. He was previously the MD at both Morgan Stanley and Deutsche Bank in Zurich. As an angel investor, his only disclosed investment to date is the seed round of Spanish femtech WOOM in 2018.

Investment banker Miguel Haupt is a managing partner at London-based investment company Opinmaco. He was previously the MD at both Morgan Stanley and Deutsche Bank in Zurich. As an angel investor, his only disclosed investment to date is the seed round of Spanish femtech WOOM in 2018.

Founder and CEO of Hero Entertainment

Ying, who invented the concept of mobile game publishing, is often referred to as the Father of Mobile Esports in China. In 1999, he dropped out of East China Normal University three months after matriculating to start his first business venture. In 2006, Ying worked at Standard Chartered Bank. In 2008, he started a mobile game distributing business, later acquired by the V1 Group. Ying became president of China Mobile Games and Entertainment Group, a subsidiary of V1, in 2013. In 2015, he founded Hero Entertainment.

Ying, who invented the concept of mobile game publishing, is often referred to as the Father of Mobile Esports in China. In 1999, he dropped out of East China Normal University three months after matriculating to start his first business venture. In 2006, Ying worked at Standard Chartered Bank. In 2008, he started a mobile game distributing business, later acquired by the V1 Group. Ying became president of China Mobile Games and Entertainment Group, a subsidiary of V1, in 2013. In 2015, he founded Hero Entertainment.

Co-founder of Coinffeine

Alvaro Polo Valdenebro is a co-founder of Coinffeine, a decentralized P2P bitcoin exchange platform and the first cryptocurrency project to be backed by a bank, Bankinter. Today he is Principal Software Development Engineer at Cabify. He has previously held positions as a Software Engineer at JobandTalent and in the R&D department of Telefonica. Valdenebro has also been a professor at Rey Juan Carlos University, teaching subjects including Networking, Distributed Software Architectures, Distributed Multimedia Services, Operating Systems and Foundations of Programming.

Alvaro Polo Valdenebro is a co-founder of Coinffeine, a decentralized P2P bitcoin exchange platform and the first cryptocurrency project to be backed by a bank, Bankinter. Today he is Principal Software Development Engineer at Cabify. He has previously held positions as a Software Engineer at JobandTalent and in the R&D department of Telefonica. Valdenebro has also been a professor at Rey Juan Carlos University, teaching subjects including Networking, Distributed Software Architectures, Distributed Multimedia Services, Operating Systems and Foundations of Programming.

Co-founder of Coinffeine

Sebastián Ortega is a Computer Science Engineer and co-founder of Coinffeine, a P2P bitcoin exchange platform and the first cyrptocurrency project to be backed a bank, Bankinter.Currently he works as a Data Engineer at Letgo. From 2011 to 2014 he worked in R&D for Telefonica, and has also worked as a Data Engineer at JobandTalent.According to his LinkedIn profile, Ortega hosts a software development podcast and publishes a tech and coding blog in his free time.

Sebastián Ortega is a Computer Science Engineer and co-founder of Coinffeine, a P2P bitcoin exchange platform and the first cyrptocurrency project to be backed a bank, Bankinter.Currently he works as a Data Engineer at Letgo. From 2011 to 2014 he worked in R&D for Telefonica, and has also worked as a Data Engineer at JobandTalent.According to his LinkedIn profile, Ortega hosts a software development podcast and publishes a tech and coding blog in his free time.

Co-founder, CEO & CFO Spain of Nutrinsect

Jose Vidal Obón is the Spanish-born co-founder, CEO and CFO for Spain of Italo-Spanish insect protein manufacturer Nutrinsect, where he has worked since 2016. He is also on the Spanish board of insurance company AXA. Prior to Nutrinsect, he worked for six years as manager of Madrid-based insurance company Crédito y Caución and for two years as supervisor at Italian bank Banca Mediolanum. Vidal is an economics graduate.

Jose Vidal Obón is the Spanish-born co-founder, CEO and CFO for Spain of Italo-Spanish insect protein manufacturer Nutrinsect, where he has worked since 2016. He is also on the Spanish board of insurance company AXA. Prior to Nutrinsect, he worked for six years as manager of Madrid-based insurance company Crédito y Caución and for two years as supervisor at Italian bank Banca Mediolanum. Vidal is an economics graduate.

Mari Elka Pangestu is the first female Chinese Indonesian to hold a cabinet position. She was the Minister of Trade from 2004 to 2011 and the Minister of Tourism from 2011 to 2014. She holds a doctorate in Economics from the University of California, USA. Returning to academia at the University of Indonesia, the professor is also part of the Indonesian network of angel investors ANGIN.

Mari Elka Pangestu is the first female Chinese Indonesian to hold a cabinet position. She was the Minister of Trade from 2004 to 2011 and the Minister of Tourism from 2011 to 2014. She holds a doctorate in Economics from the University of California, USA. Returning to academia at the University of Indonesia, the professor is also part of the Indonesian network of angel investors ANGIN.

Singtel Innov8 is the venture arm of Singapore-based telecommunications company Singtel. It invests in companies that can potentially bolster Singtel's own capabilities in communications technologies, media services and customer experience. Innov8 has invested in companies at home and abroad, including in Indonesia, China, the USA and Israel. It has made exits through the sale of its portfolio companies (Viki and Tempo.AI) and via IPOs.

Singtel Innov8 is the venture arm of Singapore-based telecommunications company Singtel. It invests in companies that can potentially bolster Singtel's own capabilities in communications technologies, media services and customer experience. Innov8 has invested in companies at home and abroad, including in Indonesia, China, the USA and Israel. It has made exits through the sale of its portfolio companies (Viki and Tempo.AI) and via IPOs.

Rentracks is an adtech company from Japan, listed in the “Mothers” (Market of the High-Growth and Emerging Stocks) board of the Tokyo Stock Exchange. The company provides consultancy services for web development (for SEO, SEM, and other ad purposes) and Internet-based ads. Rentracks also has a network of affiliate companies in various Asian countries, including China, India, Indonesia, and the Philippines.

Rentracks is an adtech company from Japan, listed in the “Mothers” (Market of the High-Growth and Emerging Stocks) board of the Tokyo Stock Exchange. The company provides consultancy services for web development (for SEO, SEM, and other ad purposes) and Internet-based ads. Rentracks also has a network of affiliate companies in various Asian countries, including China, India, Indonesia, and the Philippines.

Astra International is an Indonesian conglomerate most famous for its automotive importing and related businesses, although it has subsidiaries in finance, agri-business and property as well. The holding company, PT Astra International Tbk., is listed in the Indonesian stock exchange. Its investments so far have been focused in Indonesia. Companies like Gojek, Sayurbox, and Halodoc have become part of Astra’s portfolio.

Astra International is an Indonesian conglomerate most famous for its automotive importing and related businesses, although it has subsidiaries in finance, agri-business and property as well. The holding company, PT Astra International Tbk., is listed in the Indonesian stock exchange. Its investments so far have been focused in Indonesia. Companies like Gojek, Sayurbox, and Halodoc have become part of Astra’s portfolio.

UOB Venture Management is a private equity firm backed by the United Overseas Bank (UOB). It invests in growing companies at their expansion stages, with special focus on the Southeast Asia and China markets. Its portfolio is diverse, ranging from food and health companies to petrochemicals and tech businesses like Giosis (which operates e-commerce site Qoo10) and AI-powered marketing service startup Appier.

UOB Venture Management is a private equity firm backed by the United Overseas Bank (UOB). It invests in growing companies at their expansion stages, with special focus on the Southeast Asia and China markets. Its portfolio is diverse, ranging from food and health companies to petrochemicals and tech businesses like Giosis (which operates e-commerce site Qoo10) and AI-powered marketing service startup Appier.

Founded in Shanghai in May 2015, CICC Zhide specializes in investment consultation, equity investment and management. The company is a subsidiary of CICC Capital that was established in 1995. The China International Capital Corporation (CICC) is China's first joint venture bank, with its HQ in Beijing. CICC was listed on the Hong Kong Stock Exchange in 2015.

Founded in Shanghai in May 2015, CICC Zhide specializes in investment consultation, equity investment and management. The company is a subsidiary of CICC Capital that was established in 1995. The China International Capital Corporation (CICC) is China's first joint venture bank, with its HQ in Beijing. CICC was listed on the Hong Kong Stock Exchange in 2015.

No bank account? In Indonesia, you can still shop online

Indonesian startups are racing to serve the millions of consumers that banks haven’t reached. Here’s a look at some of the leading players, their innovations and how they have redefined the market

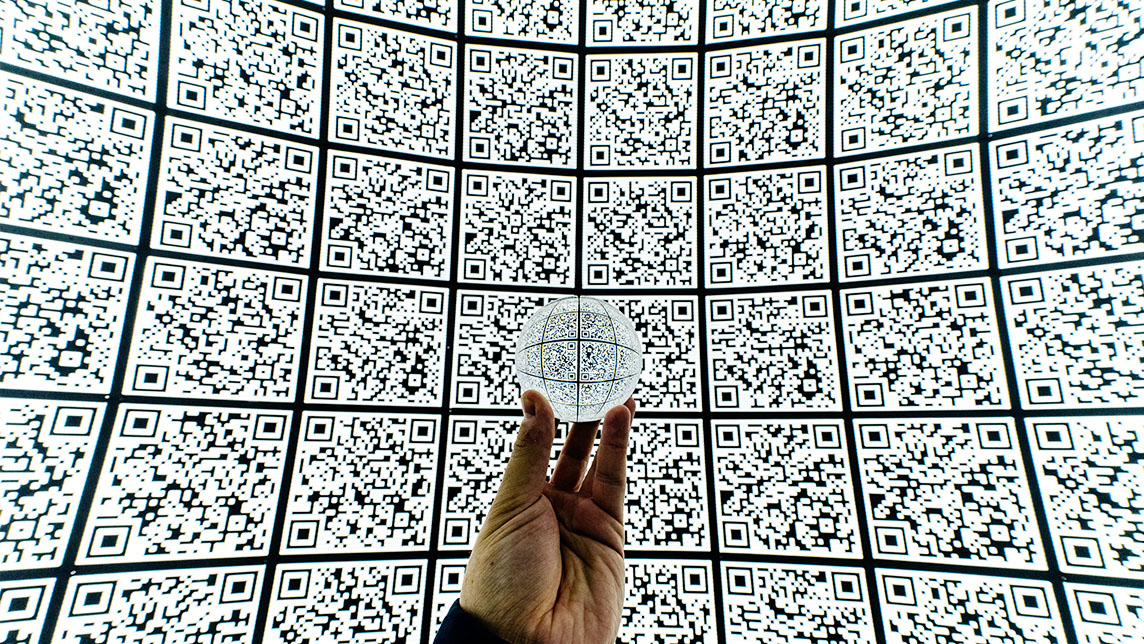

With universal QR code, Indonesia achieves e-payment harmony

The move to standardize Indonesia's QR code is expected to unify the country's cashless payments system and lift tens of thousands of small merchants into the payments mainstream

P2P financing platform Investree raises Series C, with $23.5m in first tranche

Indonesia's Investree closes key funding amid Covid-19 crisis; is applying for licenses in Thailand and the Philippines in regional expansion

QRIS: Will the new QR code standard rewrite Indonesia’s e-payments scene?

Enabling interoperability, the QRIS seeks to level the playing field until now dominated by GoPay and OVO – disruption that could go beyond the e-wallets scene

Gojek acquires Indonesian POS startup Moka, gains greater share of SME fintech market

Deal reportedly worth $120m will add Moka's network of over 30,000 merchants to Gojek's reach

Investing in Indonesia: The fintech companies driving a new influx of capital

With 66% of Indonesians not owning a bank account, fintech startups have come up with myriad innovative products to entice a new generation of retail investors

MSMB: From university research to agritech ecosystem

The Indonesian startup is moving beyond sensors to build technologies for livestock tracking and fish farming

Indonesian state enterprises launch e-wallet LinkAja, competing with Go-Pay and OVO

Even with a wider range of services and extensive state backing, LinkAja faces a tough battle

Gradana: P2P lending for more accessible home ownership in Indonesia

Gradana wants to create an ecosystem where developers, agents, landlords, buyers and lenders benefit one another through interconnected financing

ZendMoney: Putting cash back into the pockets of Indonesian migrant workers

ZendMoney's unique remittance concept has already helped 90,000 migrant workers send money back home

Indonesian P2P lending platform Investree expands to the Philippines

With local partner Filinvest Development Corporation, Investree Philippines will support the country’s SMEs with its lending-based crowdfunding platform

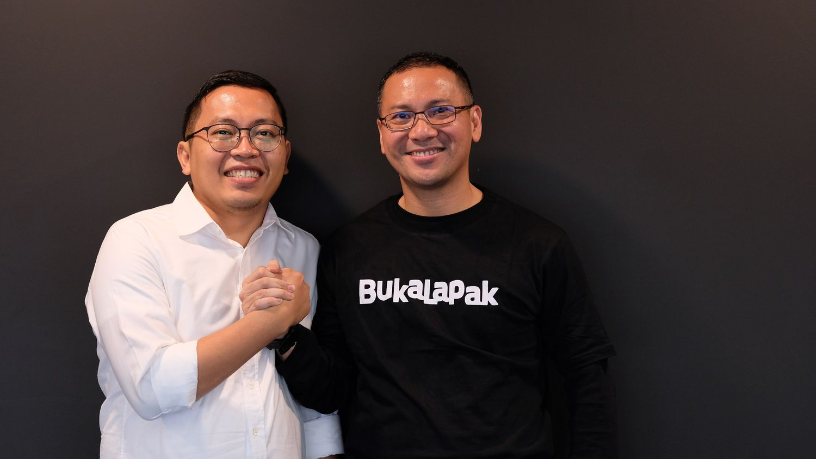

Bukalapak CEO Achmad Zaky steps down, ex-banker Rachmat Kaimuddin to take over

Rumors of a leadership change first surfaced in August as the Indonesian unicorn and its co-founder got a bad press

Payfazz aims to be Indonesia's first on-demand financial services company

Handling transactions averaging over IDR 1tn monthly, Payfazz hopes to bring the benefits of banking to all Indonesians

UPDATE: Indonesian mPOS startup Cashlez raises IDR 85bn from IPO in May

Cashlez is the first fintech company to list on the Indonesia Stock Exchange; will spend over 60% of proceeds to acquire payments company in toll road market

Crowde-funding Indonesia's fields

Agritech startup Crowde offers retail investors direct access to Indonesia’s US$25 billion agricultural sector, transforming the way traditional farmers fund, run and grow their businesses

Sorry, we couldn’t find any matches for“Bank Indonesia”.