Crowdfunding

This function is exclusive for Premium subscribers

-

DATABASE (17)

-

ARTICLES (27)

Indonesian agritech pioneer Crowde has battled competition to stay ahead by pivoting from crowdfunding farming projects to channeling institutional lenders’ funds into agricultural loans.

Indonesian agritech pioneer Crowde has battled competition to stay ahead by pivoting from crowdfunding farming projects to channeling institutional lenders’ funds into agricultural loans.

Stylish garments created using materials technology, which can expand across seven sizes and last for years, offering a sustainable alternative to the heavy-polluting fashion industry.

Stylish garments created using materials technology, which can expand across seven sizes and last for years, offering a sustainable alternative to the heavy-polluting fashion industry.

MIT Media Lab spin-off Graviky Labs turns air pollution into carbon-negative inks with diverse applications, from industrial printing to marker pens.

MIT Media Lab spin-off Graviky Labs turns air pollution into carbon-negative inks with diverse applications, from industrial printing to marker pens.

Through crowdfunding, Chinese insurtech firm Waterdrop makes treatment for critical diseases accessible to the majority of China's population who have no commercial health insurance.

Through crowdfunding, Chinese insurtech firm Waterdrop makes treatment for critical diseases accessible to the majority of China's population who have no commercial health insurance.

The first equity crowdfunding company to be licensed in Indonesia, Santara started locally in Yogyakarta to help SMEs in Indonesia, attract investors and raise capital.

The first equity crowdfunding company to be licensed in Indonesia, Santara started locally in Yogyakarta to help SMEs in Indonesia, attract investors and raise capital.

Indonesia's newly-licensed equity crowdfunding platform CrowdDana empowers people to invest in real estate and ease shortage of affordable housing.

Indonesia's newly-licensed equity crowdfunding platform CrowdDana empowers people to invest in real estate and ease shortage of affordable housing.

Indonesia's first crowdfunding platform for musicians of all genres, where the artist-fan relationship can flourish in creative, exciting and mutually beneficial ways.

Indonesia's first crowdfunding platform for musicians of all genres, where the artist-fan relationship can flourish in creative, exciting and mutually beneficial ways.

Pioneering crowdfunding company lets individuals invest as little as €500 in renewable energy projects, previously open only to energy companies and financial entities.

Pioneering crowdfunding company lets individuals invest as little as €500 in renewable energy projects, previously open only to energy companies and financial entities.

Not enough capital to start your own business? You can own a share of Indonesia's most popular franchises through Bizhare's equity crowdfunding platform.

Not enough capital to start your own business? You can own a share of Indonesia's most popular franchises through Bizhare's equity crowdfunding platform.

Growpal’s investment crowdfunding platform offers investors the opportunity to participate in one of the world’s top aquaculture and fishery export markets.

Growpal’s investment crowdfunding platform offers investors the opportunity to participate in one of the world’s top aquaculture and fishery export markets.

Konserku makes dreams come true - the fan club concerts crowdfunding platform brings in niche performers and reduces financial risks for music promoters.

Konserku makes dreams come true - the fan club concerts crowdfunding platform brings in niche performers and reduces financial risks for music promoters.

Backed by Lyft CEO and the Rothschilds trust, regulated equity crowdfunding platform Seedrs opens startup investing–usually exclusive to VCs and the super rich–to retail investors.

Backed by Lyft CEO and the Rothschilds trust, regulated equity crowdfunding platform Seedrs opens startup investing–usually exclusive to VCs and the super rich–to retail investors.

A record IDR 3 billion fundraiser has transformed social activist startup Kitabisa into a popular crowdfunding hub, with transparency and accountability as its corporate mantra.

A record IDR 3 billion fundraiser has transformed social activist startup Kitabisa into a popular crowdfunding hub, with transparency and accountability as its corporate mantra.

- 1

- 2

Daniel Oliver: Building a "Facebook" for investments in biotech startups

The biologist and crowdfunding expert has pioneered the growth of Spanish biotech startups, providing access to early-stage investments, with support from scientific experts worldwide

Bizhare equity crowdfunding attracts over 50,000 retail investors, starts secondary trading

A partner of the Indonesia Central Securities Depository, Bizhare also lowered minimum investment amounts, implemented scripless trading and handpicked businesses on its platform

Indonesian P2P lending platform Investree expands to the Philippines

With local partner Filinvest Development Corporation, Investree Philippines will support the country’s SMEs with its lending-based crowdfunding platform

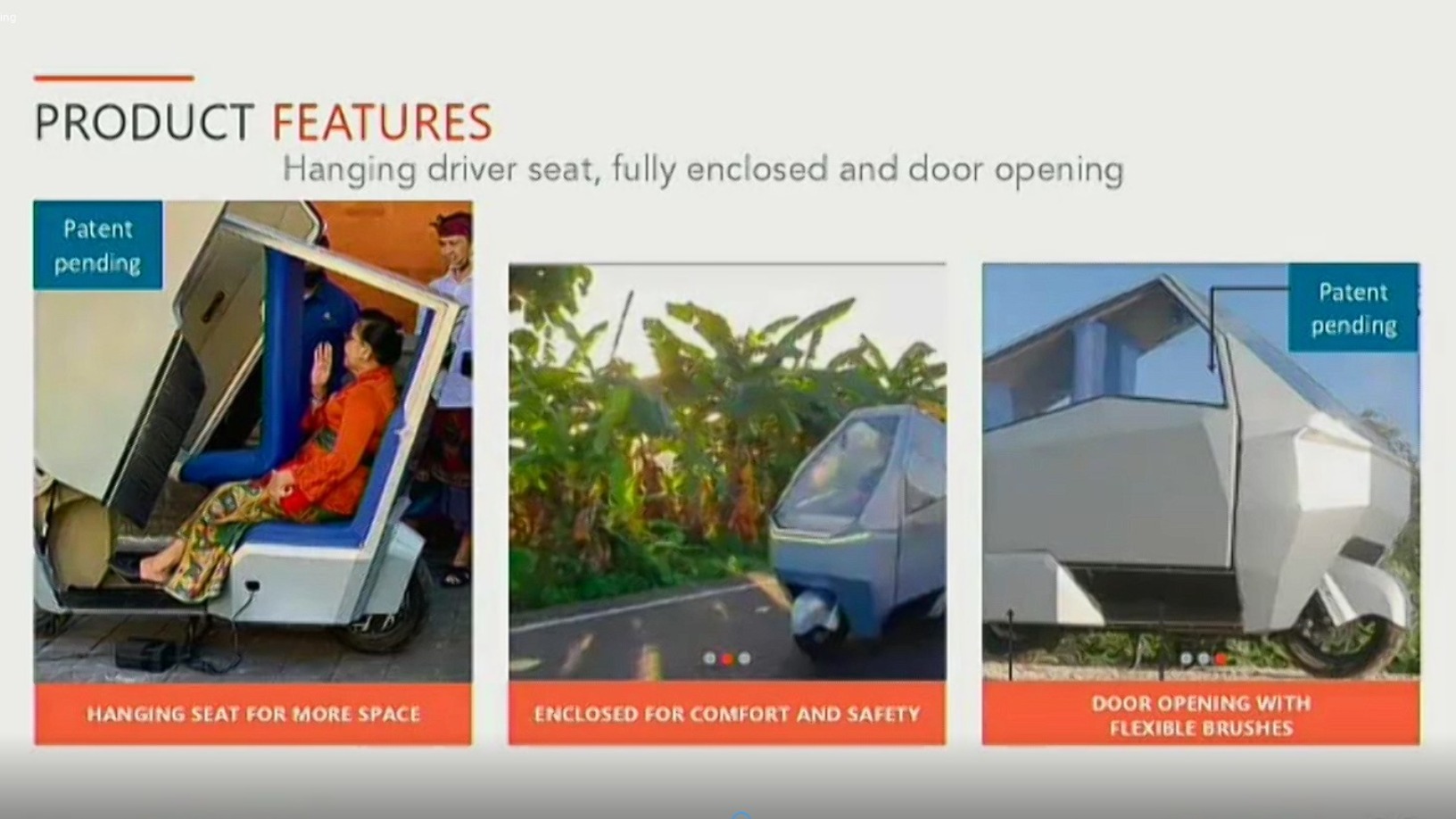

HighPitch 2020: Hydroponics, EV startups PanenBali and Manouv represent Denpasar chapter

Renewable energy and sustainability focuses impress investors, who also caution startups about competitors from outside their region

In depth: The business ecosystems China’s tech giants and unicorns build

Startups could accept to join Alibaba, Tencent or other tech giants in their ecosystems and scale quickly. Or they could say no and keep their independence. But do they really have a choice?

China’s online mutual aid market: A new battleground for tech giants and startups

Startups spotted the opportunity and tech giants too have entered a market seen tripling by 2025. But profitability is still in doubt amid regulatory uncertainty

ClimateTrade: Using blockchain to spur climate change action that can make a difference

ClimateTrade is a decentralized carbon trading platform that democratizes the financing of SDG initiatives and provides traceability of carbon credit purchases and emission offsets

Kolase: Crowdfunding platform for Indonesian musicians

Started by music industry veterans, Kolase sees a promising online market in contemporary music fandom

Bizhare: Focusing on crowdfunding quality franchises

Bizhare aims to democratize funding for franchisees, making it easier for budding entrepreneurs to go into business

Santara: Sharia-inspired equity crowdfunding for Indonesia's MSMEs

With strong links to local business communities, Santara has big ambitions to become a household name in equity crowdfunding

CrowdDana: Taking the equity crowdfunding hype into the real estate sector

Beginning with boarding house projects, CrowdDana's new business model aims to more efficiently connect Indonesian SMEs needing funding with a growing pool of investors

In Indonesia, equity crowdfunding is gaining in popularity among SMEs, challenging P2P lending

Equity crowdfunding platforms are offering new approaches to SME financing in Indonesia, with more players entering the market

Agritech from Myanmar to Indonesia and beyond: Interview with Jefry Pratama, UMG Idealab

UMG, the Myanmar-based conglomerate, looks to Indonesia for investment and inspiration, with agritech and drones among its focuses

Waterdrop: Using crowdfunding and social media to disrupt health insurance

Insurtech startup Waterdrop helps families in China who cannot afford medical treatment to raise money via online mutual aid and crowdfunding, while selling insurance plans too

2gether: The world's first crypto-collaborative financial platform

Banking on the opportunities afforded by blockchain, 2gether is owned by its customers who get commission-free financial services in euros and cryptocurrency

- 1

- 2