Bayer Growth Ventures

-

DATABASE (425)

-

ARTICLES (466)

The Mirae Asset Financial Group started in 1997 with Mirae Asset Global Investment and Mirae Asset Capital. The group's business interests focus on asset and wealth management, investments, and insurance. It has also invested in a range of companies, from logistics firm Shadowfax to AmazeVR. In 2018, it established a joint venture with Naver Corporation, one of South Korea's leading tech companies, and set up the Asia Growth Fund with $940m committed to VC investing in the region. The joint venture has backed Southeast Asian ride-hailing giant Grab, Indonesian e-commerce platform Bukalapak, and Singapore-based credit scoring firm FinAccel.

The Mirae Asset Financial Group started in 1997 with Mirae Asset Global Investment and Mirae Asset Capital. The group's business interests focus on asset and wealth management, investments, and insurance. It has also invested in a range of companies, from logistics firm Shadowfax to AmazeVR. In 2018, it established a joint venture with Naver Corporation, one of South Korea's leading tech companies, and set up the Asia Growth Fund with $940m committed to VC investing in the region. The joint venture has backed Southeast Asian ride-hailing giant Grab, Indonesian e-commerce platform Bukalapak, and Singapore-based credit scoring firm FinAccel.

The IESE BAN was formed in 2003 by a group of angel investors and entrepreneurs bringing together both alumni and non-alumni of the IESE Business School. It creates and manages deal flow for investors while establishing synergies and collaboration among the network's members. It counts on more than 250 active investors financing technology startups in Madrid and Barcelona. To-date, IESE BAN has invested more than €50m in over 220 startups. It is also part of ACCIÓ’s Network of Private Investors, which fosters technology innovation and startups’ growth in Catalonia.

The IESE BAN was formed in 2003 by a group of angel investors and entrepreneurs bringing together both alumni and non-alumni of the IESE Business School. It creates and manages deal flow for investors while establishing synergies and collaboration among the network's members. It counts on more than 250 active investors financing technology startups in Madrid and Barcelona. To-date, IESE BAN has invested more than €50m in over 220 startups. It is also part of ACCIÓ’s Network of Private Investors, which fosters technology innovation and startups’ growth in Catalonia.

General Atlantic was founded in 1980 as the investment arm of Atlantic Philanthropies, and claims to be the pioneer in growth equity. The US-based company has presence all over the world, including in Indonesia, UK, China, Mexico, and Singapore. As of August 2019, it manages US$35b in assets from global investors. Some major companies that were part of GA's portfolio includes Facebook, Alibaba, Meituan, Saxo Bank, and SEA. Edtech startup Ruangguru is GA's second investment in Indonesia; the first is MAP Boga Adiperkasa, a major F&B and lifestyle conglomerate.

General Atlantic was founded in 1980 as the investment arm of Atlantic Philanthropies, and claims to be the pioneer in growth equity. The US-based company has presence all over the world, including in Indonesia, UK, China, Mexico, and Singapore. As of August 2019, it manages US$35b in assets from global investors. Some major companies that were part of GA's portfolio includes Facebook, Alibaba, Meituan, Saxo Bank, and SEA. Edtech startup Ruangguru is GA's second investment in Indonesia; the first is MAP Boga Adiperkasa, a major F&B and lifestyle conglomerate.

CareCapital, with offices in Hong Kong and Shangai, is a leading investor in the global oral and dental industry. The firm’s operations span clinical and education, consumers product, orthodontics, digital equipment, SaaS, distribution, and industry-specific services. Its team comprises industry experts such as dental entrepreneurs, managers, and practitioners, healthcare investors; the company’s portfolio includes companies based in North America with revenues of RMB 5bn, Europe RMB 1.5bn, and Asia RMB 3.5bn. In June 2020, the company signed strategic partnerships with SINOCERA and Hillhouse Capital to work closely in the development and growth of dental restoration.

CareCapital, with offices in Hong Kong and Shangai, is a leading investor in the global oral and dental industry. The firm’s operations span clinical and education, consumers product, orthodontics, digital equipment, SaaS, distribution, and industry-specific services. Its team comprises industry experts such as dental entrepreneurs, managers, and practitioners, healthcare investors; the company’s portfolio includes companies based in North America with revenues of RMB 5bn, Europe RMB 1.5bn, and Asia RMB 3.5bn. In June 2020, the company signed strategic partnerships with SINOCERA and Hillhouse Capital to work closely in the development and growth of dental restoration.

Founded in 2013 by board chairman of Longfor Properties Wu Yajun, Wu Capital conducts multistages investments and focuses on TMT, healthcare, fintech, consumption, culture and entertainment sectors. It has also co-founded Cloud Angel Fund with China Broadband Capital, Sequoia Capital China, Northern Light Venture Capital and GSR Ventures.

Founded in 2013 by board chairman of Longfor Properties Wu Yajun, Wu Capital conducts multistages investments and focuses on TMT, healthcare, fintech, consumption, culture and entertainment sectors. It has also co-founded Cloud Angel Fund with China Broadband Capital, Sequoia Capital China, Northern Light Venture Capital and GSR Ventures.

Established in 2015, KLab Venture Partners (KVP) is the investment arm of Japanese online game developer KLab. It is the successor of KLab’s previous investment subsidiary, KLab Ventures that had invested in various internet startups before closing in January 2017. KVP provides funding, resources and networking support to early stage startups.

Established in 2015, KLab Venture Partners (KVP) is the investment arm of Japanese online game developer KLab. It is the successor of KLab’s previous investment subsidiary, KLab Ventures that had invested in various internet startups before closing in January 2017. KVP provides funding, resources and networking support to early stage startups.

Founded by Xiaomi founder Lei Jun and former GIC executive Koh Tuck Lye (or Xu Dalai), Shunwei Capital invests in early- and growth-stage startups in the internet technology and high-tech sectors. It has about US$750 million in capital under management.

Founded by Xiaomi founder Lei Jun and former GIC executive Koh Tuck Lye (or Xu Dalai), Shunwei Capital invests in early- and growth-stage startups in the internet technology and high-tech sectors. It has about US$750 million in capital under management.

Founded in Silicon Valley in 2000 by Kate Mitchell and Rory O'Driscoll, Scale Venture Partners invests in 75% early revenue and 25% growth stage companies, with an average initial investment of US$8 million. It's mainly interested in startups that disrupt the workplace and it usually invests between US$5-25 million per funding round. It has invested in more than 200 companies to date and was the lead investor in more than 80 investments. Scale has managed 62 exits to date including DocuSign, Box, HubSpot, Exact Target and Realm. Its recent investments include in Keep Truckin, Pantheon and PubNub's Series D rounds.

Founded in Silicon Valley in 2000 by Kate Mitchell and Rory O'Driscoll, Scale Venture Partners invests in 75% early revenue and 25% growth stage companies, with an average initial investment of US$8 million. It's mainly interested in startups that disrupt the workplace and it usually invests between US$5-25 million per funding round. It has invested in more than 200 companies to date and was the lead investor in more than 80 investments. Scale has managed 62 exits to date including DocuSign, Box, HubSpot, Exact Target and Realm. Its recent investments include in Keep Truckin, Pantheon and PubNub's Series D rounds.

Design to Improve Life Fund (The INDEX Project)

The Index Project, known by its motto “Design to Improve Life”, is a Copenhagen-based non-profit organization under the patronage of the Crown Prince and Princess of Denmark and supported by the Danish Ministry of Business and Growth.Founded in 2002, The Index Project organizes the biennial Index Award, one of the world's biggest design award. A diverse range of designs are selected through each Index Award cycle. It also backs projects with good causes through investment vehicle, Design to Improve Life Fund that has stakes in 11 solutions, ranging from seed to Series B+.

The Index Project, known by its motto “Design to Improve Life”, is a Copenhagen-based non-profit organization under the patronage of the Crown Prince and Princess of Denmark and supported by the Danish Ministry of Business and Growth.Founded in 2002, The Index Project organizes the biennial Index Award, one of the world's biggest design award. A diverse range of designs are selected through each Index Award cycle. It also backs projects with good causes through investment vehicle, Design to Improve Life Fund that has stakes in 11 solutions, ranging from seed to Series B+.

Founded in Connecticut in 2014, Oak has a total of $3.3bn assets under management, the overwhelming majority within healthcare and fintech, and invests at all stages of growth. Approximately one third of its portfolio companies that currently number 55, seek re-investment from the VC. It has managed eight exits to date and has a special interest in investing in women in tech.Its most recent investments have included in Canadian unicorn the startup financing fintech Clearco that raised $100m in its April 2021 Series C round, and, the same month, in US virtual healthcare platform Firefly Health’s $40m Series B round.

Founded in Connecticut in 2014, Oak has a total of $3.3bn assets under management, the overwhelming majority within healthcare and fintech, and invests at all stages of growth. Approximately one third of its portfolio companies that currently number 55, seek re-investment from the VC. It has managed eight exits to date and has a special interest in investing in women in tech.Its most recent investments have included in Canadian unicorn the startup financing fintech Clearco that raised $100m in its April 2021 Series C round, and, the same month, in US virtual healthcare platform Firefly Health’s $40m Series B round.

Nickleby Capital is a London-based VC firm that focuses on three main areas: (1) investment capital for companies in the scale-up phase, Series A, Series B, and buyouts, (2) advisory services leveraging proprietary tech, researches and industry network, to accelerate PLCs and private companies' growth, and (3) real estate, advising on commercial and residential properties globally. The firm’s investors are mostly family offices and serial entrepreneurs that have built market-leading companies. The Nickleby Capital’s team is founded by a team of alumni from Goldman Sachs, Rothschild, BDO and Korn Ferry.

Nickleby Capital is a London-based VC firm that focuses on three main areas: (1) investment capital for companies in the scale-up phase, Series A, Series B, and buyouts, (2) advisory services leveraging proprietary tech, researches and industry network, to accelerate PLCs and private companies' growth, and (3) real estate, advising on commercial and residential properties globally. The firm’s investors are mostly family offices and serial entrepreneurs that have built market-leading companies. The Nickleby Capital’s team is founded by a team of alumni from Goldman Sachs, Rothschild, BDO and Korn Ferry.

Founded in 2010 and based in Lisbon, eggNEST is a seed capital fund targeting Portuguese startups in the fields of digital marketing and software engineering. eggNEST is partnered with VC firms such as Caixa Capital and Portugal Ventures, as well as accelerators such as Startup Lisboa and Startup Braga, to build the country’s startup ecosystem.

Founded in 2010 and based in Lisbon, eggNEST is a seed capital fund targeting Portuguese startups in the fields of digital marketing and software engineering. eggNEST is partnered with VC firms such as Caixa Capital and Portugal Ventures, as well as accelerators such as Startup Lisboa and Startup Braga, to build the country’s startup ecosystem.

A prolific investor, Eddy Chan has been involved in venture investments for US companies like Paypal, SpaceX, and Palantir, as well as Indonesian ones like coworking space EV Hive (now CoHive), BeliMobilGue (used car marketplace) and Kata.ai (chatbot builder). He is also the founding partner of Intudo Ventures, an "Indonesia-only" VC firm.

A prolific investor, Eddy Chan has been involved in venture investments for US companies like Paypal, SpaceX, and Palantir, as well as Indonesian ones like coworking space EV Hive (now CoHive), BeliMobilGue (used car marketplace) and Kata.ai (chatbot builder). He is also the founding partner of Intudo Ventures, an "Indonesia-only" VC firm.

Senior Scientific Advisor and co-founder of The Not Company (NotCo)

Pablo Zamora is a biotechnologist from the University of Santiago, where he worked as a professor and research scientist until 2008. In 2009, he started his postdoctoral research on Mexico’s maize genetics at UC Davis Life Science Innovation Center. He worked there as a senior scientist and associate until 2014. In 2015, he was appointed the center’s Chief Science Officer based in Chile, a position he was in till January 2018.From 2013–2015, he also worked on various plant and microbe genomics projects as a senior scientist in Mars Advanced Research Institute. He was also an editor from 2012–2017 at the Journal of Technology Management & Innovation and worked at the non-profit PIPRA from 2010–2018 as international alliance manager in Sacramento, University of California.In 2015, he co-founded The Not Company (NotCo) based in Santiago. He was appointed CSO in February 2018, a role he led until March 2020, when he left the company to focus on a new project, AptaBuilder, a $60m program that promotes R&D for Chilean technology-based ventures. Zamora still consults as NotCo’s senior scientific advisor.

Pablo Zamora is a biotechnologist from the University of Santiago, where he worked as a professor and research scientist until 2008. In 2009, he started his postdoctoral research on Mexico’s maize genetics at UC Davis Life Science Innovation Center. He worked there as a senior scientist and associate until 2014. In 2015, he was appointed the center’s Chief Science Officer based in Chile, a position he was in till January 2018.From 2013–2015, he also worked on various plant and microbe genomics projects as a senior scientist in Mars Advanced Research Institute. He was also an editor from 2012–2017 at the Journal of Technology Management & Innovation and worked at the non-profit PIPRA from 2010–2018 as international alliance manager in Sacramento, University of California.In 2015, he co-founded The Not Company (NotCo) based in Santiago. He was appointed CSO in February 2018, a role he led until March 2020, when he left the company to focus on a new project, AptaBuilder, a $60m program that promotes R&D for Chilean technology-based ventures. Zamora still consults as NotCo’s senior scientific advisor.

CEO and co-founder of Xendit

Moses Lo comes from an entrepreneurial family, his father acquired a failing business in Australia and turned it into a successful company. The family business inspired Lo to start his own fashion business in Australia after graduating in finance and commerce at the University of New South Wales in 2010.Lo initially gained work experience as an analyst in 2008 as part of his undergraduate finance and commerce programs in Australia. In 2011, he became an associate at the Boston Consulting Group in Australia. After two years, he was promoted to senior associate but left BCG in 2013 to focus on his menswear ventures until 2014.Lo decided to get first-hand tech startup experience in the Silicon Valley, working at Amazon while completing an MBA program at the University of California, Berkeley. In 2015, he decided to established a P2P payments platform Xendit in Indonesia. The platform has since pivoted into a payment gateway service and became a unicorn in 2021, with Lo as CEO based in California and Jakarta. He was also featured in Forbes’ 30 Under 30 list for Asian figures in finance and venture capital in 2016.

Moses Lo comes from an entrepreneurial family, his father acquired a failing business in Australia and turned it into a successful company. The family business inspired Lo to start his own fashion business in Australia after graduating in finance and commerce at the University of New South Wales in 2010.Lo initially gained work experience as an analyst in 2008 as part of his undergraduate finance and commerce programs in Australia. In 2011, he became an associate at the Boston Consulting Group in Australia. After two years, he was promoted to senior associate but left BCG in 2013 to focus on his menswear ventures until 2014.Lo decided to get first-hand tech startup experience in the Silicon Valley, working at Amazon while completing an MBA program at the University of California, Berkeley. In 2015, he decided to established a P2P payments platform Xendit in Indonesia. The platform has since pivoted into a payment gateway service and became a unicorn in 2021, with Lo as CEO based in California and Jakarta. He was also featured in Forbes’ 30 Under 30 list for Asian figures in finance and venture capital in 2016.

Bayer Growth Ventures' Paimun Amini: Invest in tech for smarter, more sustainable farming

Corporate venture capital showed up in abundance at Smart Agrifood Malaga, where CompassList spoke with Paimun Amini, Director of Venture Investments for Bayer Growth Ventures (BGV)

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

Future Food Asia: Temasek, Continental Grain on investing in agrifood in Singapore and China

The two heavyweight investors discuss opportunities, needs and how agrifood startups can scale in Asian markets

In-store robots and online doctors serve customers 24/7 at Dingdang Medicine Express

Dingdang also offers cheaper medicines and 28-minute home delivery, thanks to its innovative logistics and partnership models

Xtrem Biotech, an agritech startup from Granada, seeks global expansion

With its research roots in the University of Granada, Xtrem Biotech was named one of the world's most innovative agtech spin-offs by accelerator TERRA Food & AgTech

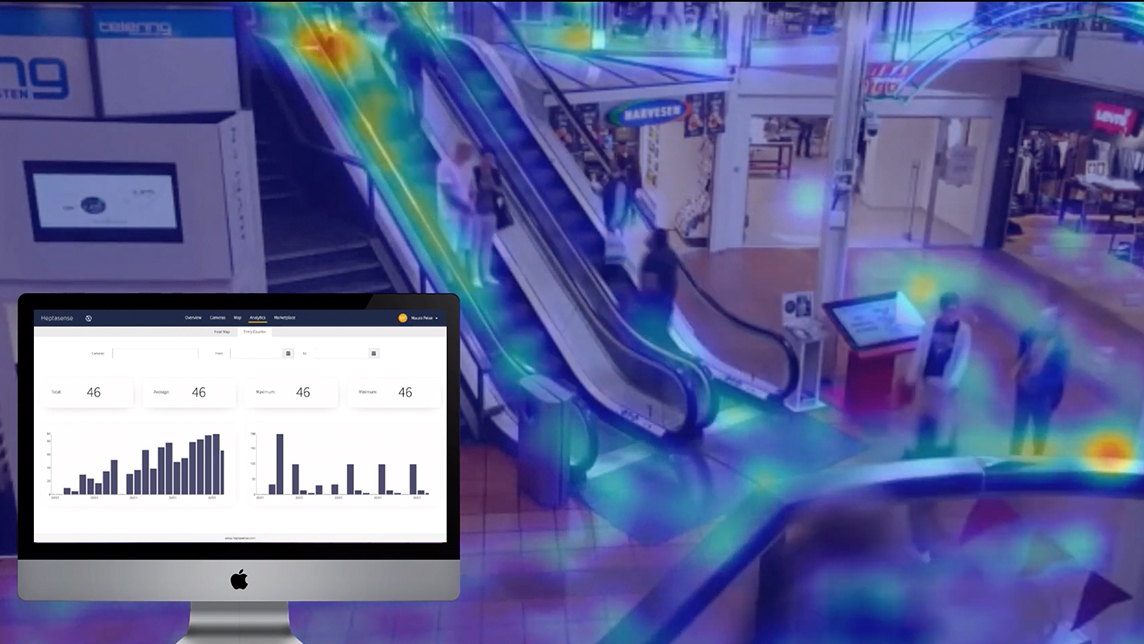

Heptasense wins trust at a time of (lax) global surveillance

There may be some 700 million surveillance cameras running worldwide in today's age of global security threats, yet 98% of them are unmonitored. A Lisbon-based startup is promising real-time response and greater reliability in security tech

Amid Covid-19, contactless smart mailbox startup Mayordomo eyes €75m revenue by 2024

Mayordomo's Smart Point app-locker system helps consumers get the best deals online while minimizing CO2 emissions from multiple vendors’ last-mile deliveries

Backed by pharmas, doctors, medtech startup DyCare is expanding fast across Europe

Its remote musculoskeletal rehabilitation and monitoring system sets to improve rehabilitation outcomes in an overtaxed sector

Housfy leads growth in Spanish proptech

The real estate platform helps clients sell their property without the astronomical agency fees

New Ventures Innovation: Prasetiya Mulya University takes on student entrepreneurship

To prepare a new generation of startup founders, Prasetiya Mulya University combines theoretical education with real-life exposure to the startup world

Beatriz González: Seaya Ventures head and Spanish tech VC trailblazer

From Cabify to Glovo, the only woman to head a Spanish VC firm has backed some of the country’s most successful startups to date

eShop Ventures: A costly spending spree to create the Spanish Amazon

Behind the downfall of one of Spain's most promising startups

Intudo Ventures: Grooming returning overseas talent for an Indonesia-only bet

Combining the experience and networks of foreign-educated Indonesians with local distribution channels, Intudo’s hyperlocal strategy has attracted $200m in managed assets

TroopTravel: Growth opportunities in Big Data corporate travel analytics

International award-winner TroopTravel wants to be the ultimate choice for global travellers.

Science4you cancels IPO amid market jitters, foresees slower growth

Portugal's largest toymaker will continue to focus on international markets, digital boost

Sorry, we couldn’t find any matches for“Bayer Growth Ventures”.