EDP Ventures

-

DATABASE (301)

-

ARTICLES (215)

Toro Ventures is a VC fund based in Monterrey, Mexico, with offices in San Francisco. Led by entrepreneurs Elsa Treviño and Tuto Assad, the fund helps tech startups raise seed capital as well as build a network of family offices and business angels interested in investment opportunities in the Latin American tech ecosystem.Toro Ventures also supports big companies looking to innovate by connecting them with startups from relevant industry verticals. In December 2018, it made its biggest investment to date: €2 million in Spain's BEWE. Established in December 2016, the company has invested in nine startups, to date.

Toro Ventures is a VC fund based in Monterrey, Mexico, with offices in San Francisco. Led by entrepreneurs Elsa Treviño and Tuto Assad, the fund helps tech startups raise seed capital as well as build a network of family offices and business angels interested in investment opportunities in the Latin American tech ecosystem.Toro Ventures also supports big companies looking to innovate by connecting them with startups from relevant industry verticals. In December 2018, it made its biggest investment to date: €2 million in Spain's BEWE. Established in December 2016, the company has invested in nine startups, to date.

Total Energy Ventures is a corporate venture capital arm of French multinational energy company Total. Headquartered in Paris with offices in San Francisco, its investment focus is in startups committed to reducing CO2 emissions through groundbreaking technologies and innovative models applied to clean-tech and sustainable energy, transport and waste management.Total Energy Ventures invests mainly by acquiring minority stakes in backed companies. The company has invested a total of US$200 million in more than 30 companies, with three exits to date. Recent investments include in Peg and Sunfire's Series C rounds and in Tado's Series F round that raised US$50 million.

Total Energy Ventures is a corporate venture capital arm of French multinational energy company Total. Headquartered in Paris with offices in San Francisco, its investment focus is in startups committed to reducing CO2 emissions through groundbreaking technologies and innovative models applied to clean-tech and sustainable energy, transport and waste management.Total Energy Ventures invests mainly by acquiring minority stakes in backed companies. The company has invested a total of US$200 million in more than 30 companies, with three exits to date. Recent investments include in Peg and Sunfire's Series C rounds and in Tado's Series F round that raised US$50 million.

Founded in 2009, Finnish VC Lifeline Ventures has invested in over 100 early-stage startups, with investments ranging from €100,000 to €2m. Focusing mainly on local tech startups, the VC has 71 tech and non-tech companies in its portfolio.Recent investments in April 2021 include the $100m Series C round of Finnish wellness ring and app Oura Health and the $6.2m seed round of Finnish cleantech Carbo Culture. One of Lifeline’s VC partners, Timo Ahopelto, is an advisor at student-led VC Wave Ventures that also participated in the investment round of Carbo Culture.

Founded in 2009, Finnish VC Lifeline Ventures has invested in over 100 early-stage startups, with investments ranging from €100,000 to €2m. Focusing mainly on local tech startups, the VC has 71 tech and non-tech companies in its portfolio.Recent investments in April 2021 include the $100m Series C round of Finnish wellness ring and app Oura Health and the $6.2m seed round of Finnish cleantech Carbo Culture. One of Lifeline’s VC partners, Timo Ahopelto, is an advisor at student-led VC Wave Ventures that also participated in the investment round of Carbo Culture.

Started in 2008 by Joe Zhou (Zhou Zhixiong), one of the founders of Kleiner Perkins Caufield & Byers' China fund, Keytone Ventures primarily invests in high-growth companies in the cleantech, media, hi-tech and consumer sectors.

Started in 2008 by Joe Zhou (Zhou Zhixiong), one of the founders of Kleiner Perkins Caufield & Byers' China fund, Keytone Ventures primarily invests in high-growth companies in the cleantech, media, hi-tech and consumer sectors.

The venture capital arm of media conglomerate Hearst Corporation, Hearst Ventures made its first investment in 1995 and now conducts all stage investments, with focuses on media and technology startups mainly in the US, China and Europe.

The venture capital arm of media conglomerate Hearst Corporation, Hearst Ventures made its first investment in 1995 and now conducts all stage investments, with focuses on media and technology startups mainly in the US, China and Europe.

Eminence Ventures was founded in 2017 by former senior executives from Tencent Holdings and Ctrip.com, a Chinese travel services provider. The firm invests mainly in product- and technology-driven startups in the enterprise software and cloud computing fields.

Eminence Ventures was founded in 2017 by former senior executives from Tencent Holdings and Ctrip.com, a Chinese travel services provider. The firm invests mainly in product- and technology-driven startups in the enterprise software and cloud computing fields.

Closed Loop Ventures is an early-stage investment fund focused on the development of the circular economy.

Closed Loop Ventures is an early-stage investment fund focused on the development of the circular economy.

MDI Ventures is the venture capital arm of Telkom, Indonesia’s state-owned telco. It aims to invest in disruptive and innovative companies in the online, media, and mobile internet space. It also supports fledgling startups through Indigo, an incubator and accelerator program.

MDI Ventures is the venture capital arm of Telkom, Indonesia’s state-owned telco. It aims to invest in disruptive and innovative companies in the online, media, and mobile internet space. It also supports fledgling startups through Indigo, an incubator and accelerator program.

Founded in 2018, Agaeti Ventures is an Indonesia-focused VC that participates at the pre-Series A and Series A levels. Agaeti's portfolio includes smart retail kiosk startup Warung Pintar, delivery coffee chain Fore Coffee and Bangladeshi transportation firm Pathao.

Founded in 2018, Agaeti Ventures is an Indonesia-focused VC that participates at the pre-Series A and Series A levels. Agaeti's portfolio includes smart retail kiosk startup Warung Pintar, delivery coffee chain Fore Coffee and Bangladeshi transportation firm Pathao.

Based in San Francisco, Slow Ventures was founded in 2011 by an early Facebook employee David Morin, who helped to build the Facebook Platform and Facebook Connect. Slow Ventures is no longer known as the “Facebook Alumni Fund”.Today, the VC is a generalist fund, investing in diverse sectors worldwide, ranging from digital health to enterprise solutions. The firm has backed unicorn startups in the US like Postmates, Nextdoor, AngelList and Evernote. A fourth fundraising round has been launched for two new funds totaling $220m: seed funding of $165m and $55m for a follow-up round. Its last funding round closed at $145m in 2016.

Based in San Francisco, Slow Ventures was founded in 2011 by an early Facebook employee David Morin, who helped to build the Facebook Platform and Facebook Connect. Slow Ventures is no longer known as the “Facebook Alumni Fund”.Today, the VC is a generalist fund, investing in diverse sectors worldwide, ranging from digital health to enterprise solutions. The firm has backed unicorn startups in the US like Postmates, Nextdoor, AngelList and Evernote. A fourth fundraising round has been launched for two new funds totaling $220m: seed funding of $165m and $55m for a follow-up round. Its last funding round closed at $145m in 2016.

RMKB Ventures is a hands-on venture firm investing in seed stage digital companies in Indonesia. Managing partner Kevin Sutantyo is a veteran entrepreneur in the US and in Indonesia. He recently became a venture partner at Sovereign’s Capital, also an investor in Printerous.

RMKB Ventures is a hands-on venture firm investing in seed stage digital companies in Indonesia. Managing partner Kevin Sutantyo is a veteran entrepreneur in the US and in Indonesia. He recently became a venture partner at Sovereign’s Capital, also an investor in Printerous.

Founded in 2010, East Ventures is a venture capital firm with offices in Indonesia, Japan and USA. Today, the company has invested in over 150 companies across Asia, mainly Southeast Asia and Japan, and the USA. Its ticket size ranges from US$100,000 to US$500,000.

Founded in 2010, East Ventures is a venture capital firm with offices in Indonesia, Japan and USA. Today, the company has invested in over 150 companies across Asia, mainly Southeast Asia and Japan, and the USA. Its ticket size ranges from US$100,000 to US$500,000.

A government-backed firm, Portugal Ventures is the country's most active VC. It invests exclusively in Portugal-based or initiated startups. There are currently over 100 companies in its portfolio, predominantly from the engineering, tourism, manufacturing and life sciences sectors. Established in 2012, Portugal Ventures focuses on MVP-ready projects and invests from €300,000 to €1.5m in the projects it selects for funding. The firm has managed eight exits to date. It most recently invested in the €1m seed round of conversational games developer Doppio Games and in the €2m seed round of remote access security company Fyde.

A government-backed firm, Portugal Ventures is the country's most active VC. It invests exclusively in Portugal-based or initiated startups. There are currently over 100 companies in its portfolio, predominantly from the engineering, tourism, manufacturing and life sciences sectors. Established in 2012, Portugal Ventures focuses on MVP-ready projects and invests from €300,000 to €1.5m in the projects it selects for funding. The firm has managed eight exits to date. It most recently invested in the €1m seed round of conversational games developer Doppio Games and in the €2m seed round of remote access security company Fyde.

Based in Berlin, Cherry Ventures was founded in 2012 to invest in startups across diverse sectors mainly in Europe including non-tech enterprises. With offices in London, Paris and Stockholm, the VC has invested in 53 startups and managed 12 exits. Initial investments range from €300,000 to €5m.In June 2019, a third fund “Cherry Ventures III” with €175m funding was launched to focus on providing seed funding for B2B and B2C startups. Recent investments in 2021 include the $6.2m seed round of Finnish cleantech Carbo Culture in April. The VC also acquired a stake in the $1.9m seed round of US Cloud-based product notification inbox, MagicBell, one of a handful of non-European startups in its portfolio.

Based in Berlin, Cherry Ventures was founded in 2012 to invest in startups across diverse sectors mainly in Europe including non-tech enterprises. With offices in London, Paris and Stockholm, the VC has invested in 53 startups and managed 12 exits. Initial investments range from €300,000 to €5m.In June 2019, a third fund “Cherry Ventures III” with €175m funding was launched to focus on providing seed funding for B2B and B2C startups. Recent investments in 2021 include the $6.2m seed round of Finnish cleantech Carbo Culture in April. The VC also acquired a stake in the $1.9m seed round of US Cloud-based product notification inbox, MagicBell, one of a handful of non-European startups in its portfolio.

Headquartered in San Francisco, Golden Gate Ventures aims to connect the startup ecosystem in Southeast Asia with Silicon Valley. It was established in 2011.

Headquartered in San Francisco, Golden Gate Ventures aims to connect the startup ecosystem in Southeast Asia with Silicon Valley. It was established in 2011.

Harnessing its innovative startups, Portugal builds a better cleantech ecosystem

With help from government and private-sector initiatives, Portuguese cleantech startups are playing an ever-increasing role in helping the country meet its energy challenges while cutting harmful greenhouse gases

Jungle.ai: Tapping data and AI to prevent outages and breakdowns

Forewarned is forearmed. Performance predictions by Jungle.ai can help save billions of dollars and hours of frustration caused by sudden power failures

Wallbox’s bumper funding boosts Spain’s EV charging sector

Wallbox’s generic EV charging systems are sold in 40 countries, including the US and China; attracting major backers like Seaya Ventures, Spanish utility Iberdrola and US VC Endeavor

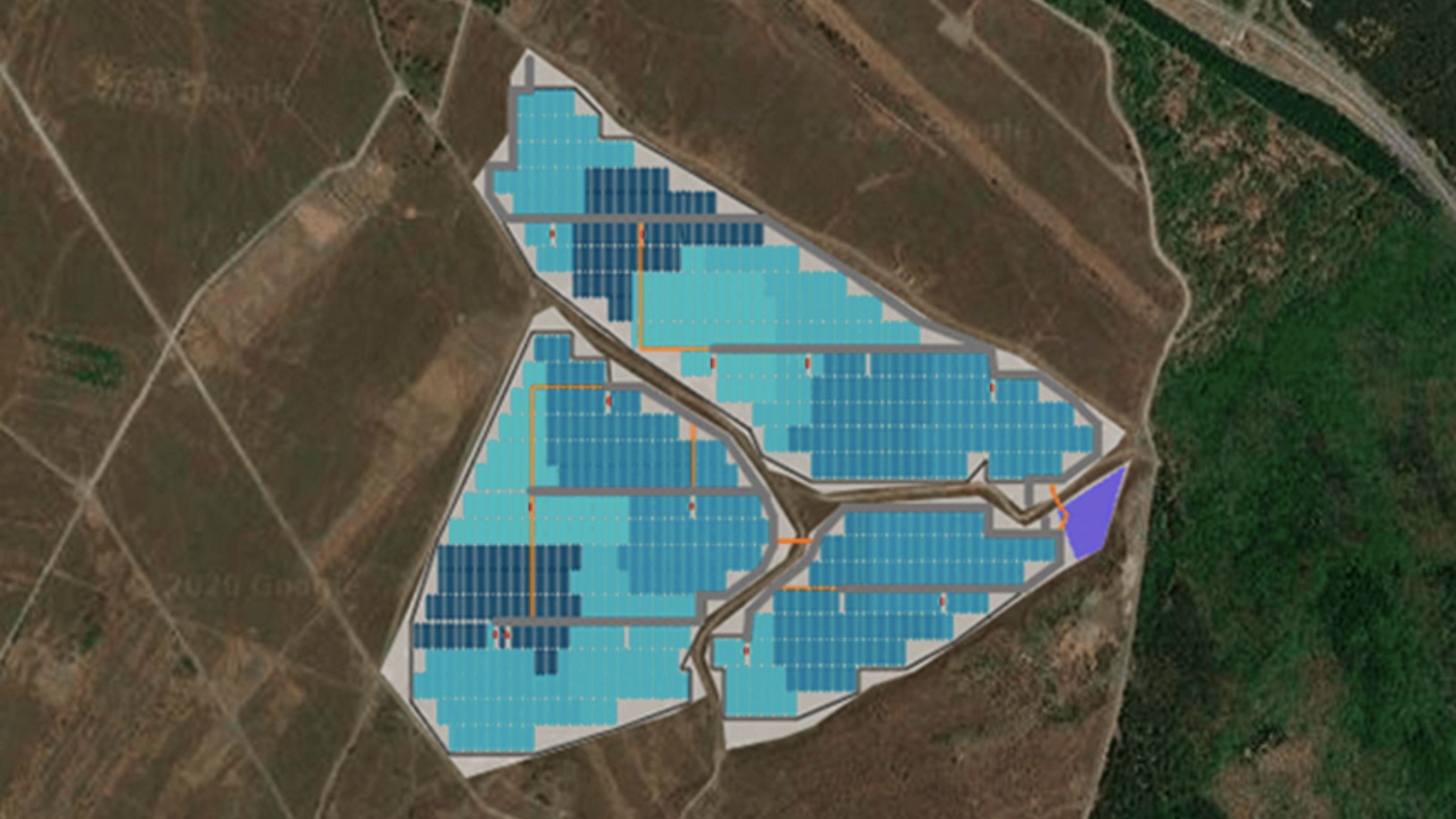

RatedPower: Creating solar power plant designs in minutes

The Spanish startup is helping solar plants expand exponentially worldwide and revolutionizing the sector with its automated software

HypeLabs wins bumper US$3m seed funding to democratize connectivity

HypeLab's P2P mesh networking technology enables everyone to communicate within their own networks without needing internet, in cities, remote villages and even in disaster zones

X1 Wind's PivotBuoy: Innovative floating platform to help scale offshore wind energy

With a downwind turbine on its patented single point mooring system, Spanish startup X1 Wind aims to disrupt the market with light, cheaper and easy to install offshore platforms

New Ventures Innovation: Prasetiya Mulya University takes on student entrepreneurship

To prepare a new generation of startup founders, Prasetiya Mulya University combines theoretical education with real-life exposure to the startup world

Beatriz González: Seaya Ventures head and Spanish tech VC trailblazer

From Cabify to Glovo, the only woman to head a Spanish VC firm has backed some of the country’s most successful startups to date

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

eShop Ventures: A costly spending spree to create the Spanish Amazon

Behind the downfall of one of Spain's most promising startups

Intudo Ventures: Grooming returning overseas talent for an Indonesia-only bet

Combining the experience and networks of foreign-educated Indonesians with local distribution channels, Intudo’s hyperlocal strategy has attracted $200m in managed assets

Alpha JWC Ventures bets on Indonesian fintech, analytics startups for big impact

A commitment to mentoring and supporting its portfolio companies also lies at the core of its business

Early Charm Ventures: Taking research from the labs to the real world

Instead of investing money, the venture studio gets hands-on, co-running companies with top scientists and their cutting-edge research

Bayer Growth Ventures' Paimun Amini: Invest in tech for smarter, more sustainable farming

Corporate venture capital showed up in abundance at Smart Agrifood Malaga, where CompassList spoke with Paimun Amini, Director of Venture Investments for Bayer Growth Ventures (BGV)

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

Sorry, we couldn’t find any matches for“EDP Ventures”.