EV Growth

-

DATABASE (171)

-

ARTICLES (388)

Co-founder and CEO of Tiantian Xuenong

While working on his master's in Software Engineering at Sun Yat-sen University, Zhao founded an ebook-sharing site that gained over 200,000 users in one year. After graduating, he worked as a developer at telecom equipment maker Huawei from 2008 to 2015. In 2012, Zhao created yunweipai.com, China's first nonprofit online community to provide IT maintenance advice. In 2015, he resigned from Huawei and launched Makebang, a software crowdsourcing platform. Recognizing the limited growth potential of the industry, Zhao sold Makebang in 2017. In 2017, he co-founded Tiantian Xuenong with Yan Zitong, a friend from university, and became its CEO.

While working on his master's in Software Engineering at Sun Yat-sen University, Zhao founded an ebook-sharing site that gained over 200,000 users in one year. After graduating, he worked as a developer at telecom equipment maker Huawei from 2008 to 2015. In 2012, Zhao created yunweipai.com, China's first nonprofit online community to provide IT maintenance advice. In 2015, he resigned from Huawei and launched Makebang, a software crowdsourcing platform. Recognizing the limited growth potential of the industry, Zhao sold Makebang in 2017. In 2017, he co-founded Tiantian Xuenong with Yan Zitong, a friend from university, and became its CEO.

TurtleTree Labs will license its technology for creating natural ingredients found in human milk to dairy and infant formula companies to produce full-composition liquid milk.

TurtleTree Labs will license its technology for creating natural ingredients found in human milk to dairy and infant formula companies to produce full-composition liquid milk.

Endeavor Catalyst is part of the global investment company Endeavor. Launched in 2012 and based in New York, it supports the equity funding efforts of Endeavour entrepreneurs with third party investors. Its portfolio investments had a total capital value of over US$100 million and it specializes in mid-stage investments across sectors and different countries, with significant investment in transportation startups to date. In 2020, it participated in the second €12m part of the €23m Series A round of EV charging hardware startup, Wallbox, with an undisclosed investment. Other recent investments in 2020 include in the US$40m Series D round of Egyptian healthtech Vezeeta and in the undisclosed seed round of Turkish fintech Figopara.

Endeavor Catalyst is part of the global investment company Endeavor. Launched in 2012 and based in New York, it supports the equity funding efforts of Endeavour entrepreneurs with third party investors. Its portfolio investments had a total capital value of over US$100 million and it specializes in mid-stage investments across sectors and different countries, with significant investment in transportation startups to date. In 2020, it participated in the second €12m part of the €23m Series A round of EV charging hardware startup, Wallbox, with an undisclosed investment. Other recent investments in 2020 include in the US$40m Series D round of Egyptian healthtech Vezeeta and in the undisclosed seed round of Turkish fintech Figopara.

Co-founder, Chief Social Movement Officer of Foods for Tomorrow / Heura Foods

Bernat Añaños Martínez is co-founder and Chief Social Movement Officer of Spanish plant-based meat startup, Foods for Tomorrow, where he has worked since 2017. He was previously CMO and Chief Growth Officer. A committed vegan and environmentalist, Añaños, worked briefly in China's EventBank, the first smart event management cloud platform, and in the European Parliament's press office in Brussels. Añaños has a first degree in Advertising and Public Relations from the University of Barcelona, a master’s in Corporate Communication and Public Relations from the UK’s Leeds University and a postgraduate qualification in Digital Marketing from the Autonomous University of Barcelona.He has volunteered at various NGOs for about 13 years.

Bernat Añaños Martínez is co-founder and Chief Social Movement Officer of Spanish plant-based meat startup, Foods for Tomorrow, where he has worked since 2017. He was previously CMO and Chief Growth Officer. A committed vegan and environmentalist, Añaños, worked briefly in China's EventBank, the first smart event management cloud platform, and in the European Parliament's press office in Brussels. Añaños has a first degree in Advertising and Public Relations from the University of Barcelona, a master’s in Corporate Communication and Public Relations from the UK’s Leeds University and a postgraduate qualification in Digital Marketing from the Autonomous University of Barcelona.He has volunteered at various NGOs for about 13 years.

Aspex Management was founded in 2018 by Hermes Li Ho Kei who was previously the executive MD and Head of Asia Equities at Och-Ziff Capital Management, aka OZ Management. Prior to joining OZ in 2011 Li worked at Goldman, Sachs & Co in Hong Kong.The London School of Economics graduate is now the chief investment officer at Aspex. The Hong Kong firm focuses on equity investments in Pan-Asia, specializing in sectors with long-term market growth potential and companies undergoing structural changes.Aspex led the $64m funding round for South Korean fintech unicorn Toss in August 2019. The P2P money transfer service platform Toss is created by Viva Republica backed by PayPal. Other participants in the round included existing Toss investors Kleiner Perkins, Altos Ventures, Singapore's GIC, Sequoia Capital China, Goodwater Capital and Bessemer Venture Partners.In May 2020, Aspex also invested in another startup Market Kurly, a grocery-delivery service provider that became South Korea’s latest unicorn via the Series E funding round that secured $328m led by DST Global. In July, Aspex also joined the $900m Series C+ funding round of Xpeng Motors, Tesla’s EV rival in China.

Aspex Management was founded in 2018 by Hermes Li Ho Kei who was previously the executive MD and Head of Asia Equities at Och-Ziff Capital Management, aka OZ Management. Prior to joining OZ in 2011 Li worked at Goldman, Sachs & Co in Hong Kong.The London School of Economics graduate is now the chief investment officer at Aspex. The Hong Kong firm focuses on equity investments in Pan-Asia, specializing in sectors with long-term market growth potential and companies undergoing structural changes.Aspex led the $64m funding round for South Korean fintech unicorn Toss in August 2019. The P2P money transfer service platform Toss is created by Viva Republica backed by PayPal. Other participants in the round included existing Toss investors Kleiner Perkins, Altos Ventures, Singapore's GIC, Sequoia Capital China, Goodwater Capital and Bessemer Venture Partners.In May 2020, Aspex also invested in another startup Market Kurly, a grocery-delivery service provider that became South Korea’s latest unicorn via the Series E funding round that secured $328m led by DST Global. In July, Aspex also joined the $900m Series C+ funding round of Xpeng Motors, Tesla’s EV rival in China.

CEO and co-founder of Scoobic Urban Mobility

Jose María Gómez Marquez started his business career as CEO at Roder Spain from 1986–1994, manufacturing materials used in Expo 1992 in Seville. From 1998–2005, Gómez worked in business development for Climocubierta indoor swimming pool materials company in Seville. Since 1998, Gómez has also been running F1/MotoGP equipment supply company AMG Services as CEO and founder.He completed a master’s in business management in 2006 at San Telmo International Institute in Seville and became the managing partner of Seville-based engineering design company Arquingenia.In 2015, he co-founded Spanish mobility startup Scoobic Urban Mobility and became the CEO of the country’s first three-wheeled EV last-mile delivery logistics provider. He is also CEO of Passion Motorbike Factory.Between 2011 and 2015, Gómez was a director at Morocco-based EURoma Network, a transnational EU organization contributing to the promotion of social inclusion, equal opportunities and the fight against discrimination of the Roma community.

Jose María Gómez Marquez started his business career as CEO at Roder Spain from 1986–1994, manufacturing materials used in Expo 1992 in Seville. From 1998–2005, Gómez worked in business development for Climocubierta indoor swimming pool materials company in Seville. Since 1998, Gómez has also been running F1/MotoGP equipment supply company AMG Services as CEO and founder.He completed a master’s in business management in 2006 at San Telmo International Institute in Seville and became the managing partner of Seville-based engineering design company Arquingenia.In 2015, he co-founded Spanish mobility startup Scoobic Urban Mobility and became the CEO of the country’s first three-wheeled EV last-mile delivery logistics provider. He is also CEO of Passion Motorbike Factory.Between 2011 and 2015, Gómez was a director at Morocco-based EURoma Network, a transnational EU organization contributing to the promotion of social inclusion, equal opportunities and the fight against discrimination of the Roma community.

Founder and Chairman of Secoo

Aka the “luxury maniac”, Richard Li Rixue was named to the “Top Ten Venture Pioneers in China in 2014” list by Fortune.With his beginnings in selling domestic appliances as early as 1998, Li started a domestic appliance website in 2007. This first startup failed, but he found an opportunity in secondhand goods as friends complained of unwanted gifts and unused things being a waste of space and money. In 2008, he established Secoo, a secondhand goods business that soon grew into a luxury consignment, then pure luxury, online-to-offline empire, fueled by the dizzying growth of high-end consumption in China. Today, Li is Chairman of Secoo.

Aka the “luxury maniac”, Richard Li Rixue was named to the “Top Ten Venture Pioneers in China in 2014” list by Fortune.With his beginnings in selling domestic appliances as early as 1998, Li started a domestic appliance website in 2007. This first startup failed, but he found an opportunity in secondhand goods as friends complained of unwanted gifts and unused things being a waste of space and money. In 2008, he established Secoo, a secondhand goods business that soon grew into a luxury consignment, then pure luxury, online-to-offline empire, fueled by the dizzying growth of high-end consumption in China. Today, Li is Chairman of Secoo.

Formerly Fidelity Growth Partners, the renamed Eight Roads Ventures is the investment arm of Fidelity International Limited. In China for over 20 years, it counts among its successful investments/exits Alibaba, WuXi PharmaTech, AsiaInfo and iSoftStone. It focuses on early- and growth-stage companies across eight broad sectors.

Formerly Fidelity Growth Partners, the renamed Eight Roads Ventures is the investment arm of Fidelity International Limited. In China for over 20 years, it counts among its successful investments/exits Alibaba, WuXi PharmaTech, AsiaInfo and iSoftStone. It focuses on early- and growth-stage companies across eight broad sectors.

US-French private equity company L Catterton is based in Greenwich, USA, with 17 offices around the world and over $28bn of equity capital. It mostly invests in the consumer industry as well as real estate and technology startups.Founded in 1989 and currently led by co-CEOs Michael Chu and Scott Dahnke, in 2016, L Catterton partnered with the LVMH Group and Groupe Arnault combining Catterton's operations with LVMH and Groupe Arnault's real estate and private equity operations across Europe Asia, and North America. The partnership formed the largest global consumer-focused private equity firm yet the 31st largest private equity firm in the world. L Catterton holds majority stakes in companies like Birkenstock, Crystal Jade, Bliss, John Hardy amongst others; it also invests in technology startups in their growth and hyper-growth phases. Most notable investments include Aleph Farms, ClassPass, and more recently the plant-based products manufacturer NotCo. Its latest growth fund, L Catterton Growth IV, targets an investment range of $10m–$75m in North America and Europe.

US-French private equity company L Catterton is based in Greenwich, USA, with 17 offices around the world and over $28bn of equity capital. It mostly invests in the consumer industry as well as real estate and technology startups.Founded in 1989 and currently led by co-CEOs Michael Chu and Scott Dahnke, in 2016, L Catterton partnered with the LVMH Group and Groupe Arnault combining Catterton's operations with LVMH and Groupe Arnault's real estate and private equity operations across Europe Asia, and North America. The partnership formed the largest global consumer-focused private equity firm yet the 31st largest private equity firm in the world. L Catterton holds majority stakes in companies like Birkenstock, Crystal Jade, Bliss, John Hardy amongst others; it also invests in technology startups in their growth and hyper-growth phases. Most notable investments include Aleph Farms, ClassPass, and more recently the plant-based products manufacturer NotCo. Its latest growth fund, L Catterton Growth IV, targets an investment range of $10m–$75m in North America and Europe.

CEO and co-founder of Singrow

With a PhD in molecular biology from NUS, Bao Shengjie, CEO and co-founder of Singrow, is a plant physiology expert who has been focusing his research for more than six years on expediting growth and improving yields. He grew up in Ningbo, a coastal city of China’s eastern Zhejiang Province. In 2011, he graduated from esteemed Zhejiang University with a bachelor's degree. He also studied bioinformatics at North Carolina State University, followed by studies at NUS. Since 2017, he has been an NUS research fellow. Strawberry has his favourite fruit since childhood. After moving to Singapore, he found that strawberries from the local supermarket were nothing close to those he had been eating for years. That sparked his study into the problem of Singapore’s local strawberry market, which in turn caused him to explore the urban farming industry with his plant physiology and molecular biology knowledge. Besides founding Singrow, he is the breeder of the company’s signature White Crystal Strawberry and invented the Fast Cultivation Method.

With a PhD in molecular biology from NUS, Bao Shengjie, CEO and co-founder of Singrow, is a plant physiology expert who has been focusing his research for more than six years on expediting growth and improving yields. He grew up in Ningbo, a coastal city of China’s eastern Zhejiang Province. In 2011, he graduated from esteemed Zhejiang University with a bachelor's degree. He also studied bioinformatics at North Carolina State University, followed by studies at NUS. Since 2017, he has been an NUS research fellow. Strawberry has his favourite fruit since childhood. After moving to Singapore, he found that strawberries from the local supermarket were nothing close to those he had been eating for years. That sparked his study into the problem of Singapore’s local strawberry market, which in turn caused him to explore the urban farming industry with his plant physiology and molecular biology knowledge. Besides founding Singrow, he is the breeder of the company’s signature White Crystal Strawberry and invented the Fast Cultivation Method.

Founded in 2016, Seekdource invests in startups in the fields of artificial intelligence, intelligent robotics and big data that have the potential for sustainable growth.

Founded in 2016, Seekdource invests in startups in the fields of artificial intelligence, intelligent robotics and big data that have the potential for sustainable growth.

Bpifrance Large Venture is the growth equity arm of French state investor Bpifrance. It is a €1bn VC fund focused on high-growth, capital-intensive, innovative tech and life sciences companies that have already raised capital. It invests minority stakes of at least €10m as well as co-invests alongside current or new investors in rounds of at least about €20m. It has invested €600m to date and currently has 34 portfolio companies, including 18 listed ones.

Bpifrance Large Venture is the growth equity arm of French state investor Bpifrance. It is a €1bn VC fund focused on high-growth, capital-intensive, innovative tech and life sciences companies that have already raised capital. It invests minority stakes of at least €10m as well as co-invests alongside current or new investors in rounds of at least about €20m. It has invested €600m to date and currently has 34 portfolio companies, including 18 listed ones.

Cheers Capital Partners is a PE investment firm focusing on early- and growth-stage investment in internet, IT, culture & media and consumption & retail sectors.

Cheers Capital Partners is a PE investment firm focusing on early- and growth-stage investment in internet, IT, culture & media and consumption & retail sectors.

Mountain Partners is a global company builder that has managed more than 90 investments in IT-based startups. Mountain Partners supports companies from incubation to growth stages to go global.

Mountain Partners is a global company builder that has managed more than 90 investments in IT-based startups. Mountain Partners supports companies from incubation to growth stages to go global.

Subsidy cut has dented sales, but China's EV manufacturers need better products to win over buyers

Eliminating subsidies is a painful must for the sustainability of China’s electric vehicle industry

SWITCH Singapore: Xpeng expects strong China EV growth after 3Q rebound, launches overseas expansion

Welcoming foreign player entry as potential boost to EV adoption, Xpeng President Brian Gu also notes attractiveness of overseas markets, especially Europe

Chinese EV startups feel the heat as Tesla slashes prices, market subsidies ending

Tesla's recent price cuts and upcoming Shanghai plant for producing cheaper cars are increasing pressure on its Chinese rivals

Europe ramps up development of local EV battery sector in race to zero emissions

Startups, automakers jostle or unite to ride the fast-growing EV battery market, as the EU pumps billions into developing its own value chain, to cut reliance on imports

Wallbox’s bumper funding boosts Spain’s EV charging sector

Wallbox’s generic EV charging systems are sold in 40 countries, including the US and China; attracting major backers like Seaya Ventures, Spanish utility Iberdrola and US VC Endeavor

Kryha: Enabling big businesses' green practices with blockchain

Kryha’s blockchain systems help companies trace the movement and transformation of resources among multiple stakeholders without exposing sensitive information

Supercharging and battery swap in race to cut EV charging times in China

Supercharging can slash EV charging times but has technological challenges. Hence battery swapping is on the rise in China, with state support

Li Bin: Aiming for more than a Chinese copy of Tesla

Good at making and investing money, he founded two companies that went on to list on the NYSE and invested in over 40 startups

Behind Indonesia's recent EV push

EV prices in Indonesia are still high and there are concerns about infrastructure, but serious policymaking and private sector support can boost consumer adoption

EV maker Xpeng Motors partners Didi to offer car rentals and better charging services

Besides working with China's largest ride-hailing platform, Xpeng Motors has also connected to the charging networks of EV maker NIO and TELD, China's biggest EV charging network

Plug-it and Drive-it with Wallbox’s EV quick chargers

Created by an ex-Tesla engineer, these generic chargers are fast and easy to use – just like recharging mobile phones

Mass production and delivery delays – common challenges facing China EV startups

As Tesla postponed delivery yet again, its Chinese rivals are scrambling too

This EV maker caters to young consumers by making driving easier and more fun

Amongst all the players in China’s EV market, Xpeng Motors still stands out

Place to Plug: Symbiosis in scaling with the electric vehicle sector

Launched commercially just five months ago, EV-charging infrastructure platform Place to Plug has already attracted attention from investors in Silicon Valley and Asia

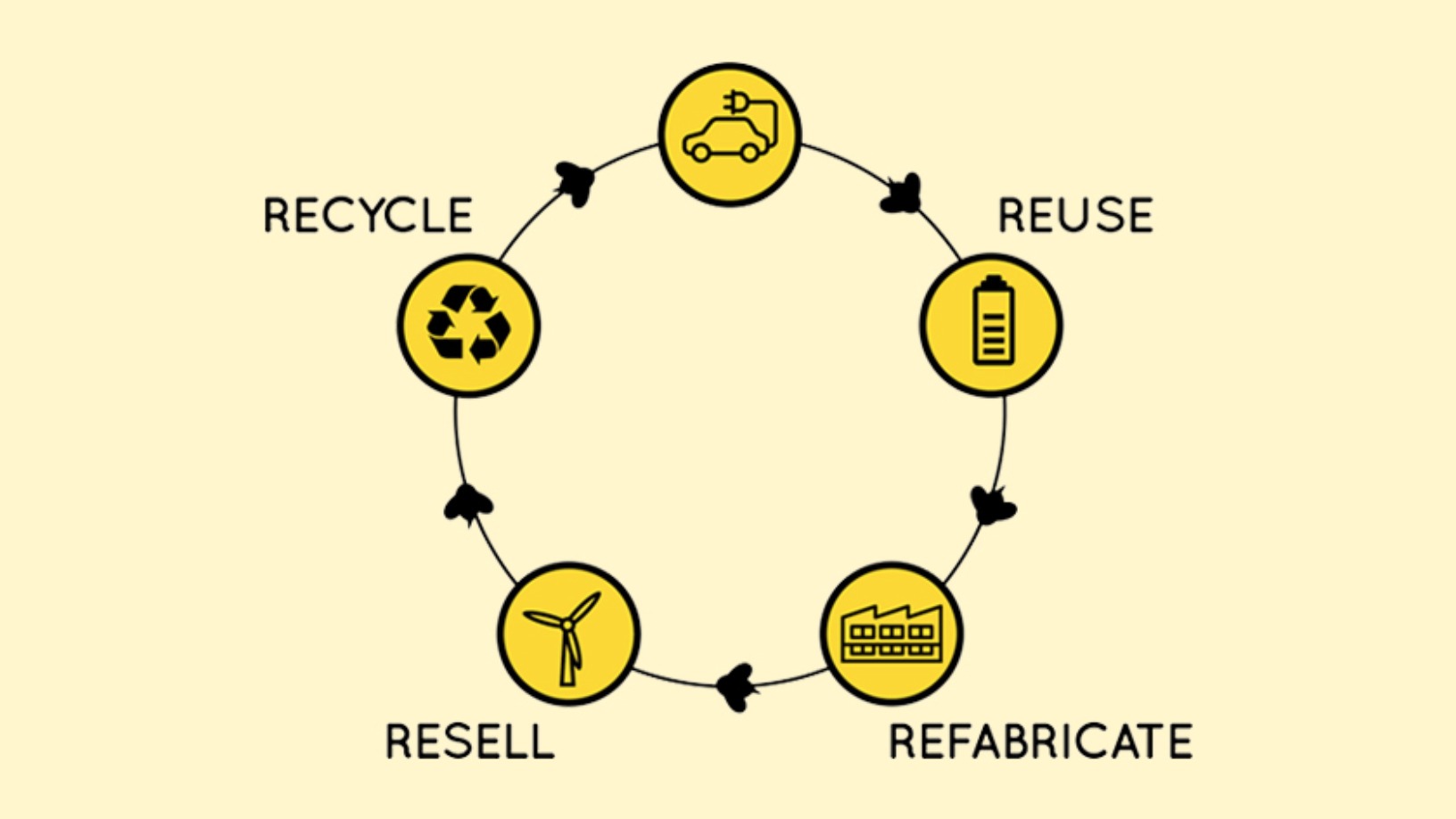

BeePlanet Factory: Recycling EV batteries as a sustainable, profitable business

With 4kWh–200kWh residential and industrial battery packs, the Pamplona-based startup wants to scale its energy storage solutions in the agri-food sector, camping sites and mountain huts

Sorry, we couldn’t find any matches for“EV Growth”.