EV Growth

-

DATABASE (171)

-

ARTICLES (388)

LGT Venture Philanthropy is an independent charitable foundation that supports organizations and companies which implement solutions that contribute to the achievement of sustainable development goals. It strives to improve the quality of life of disadvantaged people, contribute to healthy ecosystems and build resilient, inclusive and prosperous communities. LGT supports the growth of innovative social organizations by providing them with a tailored combination of growth capital, access to business skills, management know-how and strategic advice.

LGT Venture Philanthropy is an independent charitable foundation that supports organizations and companies which implement solutions that contribute to the achievement of sustainable development goals. It strives to improve the quality of life of disadvantaged people, contribute to healthy ecosystems and build resilient, inclusive and prosperous communities. LGT supports the growth of innovative social organizations by providing them with a tailored combination of growth capital, access to business skills, management know-how and strategic advice.

Founded by John Ball in 2000, Steamboat Ventures is Disney’s venture capital subsidiary. They invest in early through growth stage companies with specialization in digital media and consumer technology.

Founded by John Ball in 2000, Steamboat Ventures is Disney’s venture capital subsidiary. They invest in early through growth stage companies with specialization in digital media and consumer technology.

Chief Growth Officer and co-founder of Kobo360

After graduating in business administration at the University of Michigan-Dearborn in 2013, Ife Oyedele II stayed on at the university to obtain a master’s in information technology in 2016.While studying in Michigan, Oyedele met up with Obi Ozor and the two friends started an e-commerce venture to sell diapers and baby soap from the US to customers in Nigeria. Ozor later moved to Philadelphia to continue his studies at Wharton School.Still at university, he gained work experience in business intelligence at Michigan consultancy firm CFI Group for about three years. He has also conducted some research for pharma group iLabs and completed stints in business analysis and quality assurance at various companies. In May 2014, he joined General Fuels company in Detroit and worked as a business manager for almost two years.In 2016, Ozor and Oyedele co-founded Uber-style logistics platform Kobo360 in Nigeria. Oyedele was CTO at Kobo360 until 2020 when he became the company’s Chief Growth Officer.

After graduating in business administration at the University of Michigan-Dearborn in 2013, Ife Oyedele II stayed on at the university to obtain a master’s in information technology in 2016.While studying in Michigan, Oyedele met up with Obi Ozor and the two friends started an e-commerce venture to sell diapers and baby soap from the US to customers in Nigeria. Ozor later moved to Philadelphia to continue his studies at Wharton School.Still at university, he gained work experience in business intelligence at Michigan consultancy firm CFI Group for about three years. He has also conducted some research for pharma group iLabs and completed stints in business analysis and quality assurance at various companies. In May 2014, he joined General Fuels company in Detroit and worked as a business manager for almost two years.In 2016, Ozor and Oyedele co-founded Uber-style logistics platform Kobo360 in Nigeria. Oyedele was CTO at Kobo360 until 2020 when he became the company’s Chief Growth Officer.

Changce Investment was established in Guangzhou in May 2015. With more than RMB 1 billion under management, the firm invests mainly in unlisted high-growth companies in the IoT sector.

Changce Investment was established in Guangzhou in May 2015. With more than RMB 1 billion under management, the firm invests mainly in unlisted high-growth companies in the IoT sector.

One of the earliest PE firms in China focusing on growth-stage investment in high-tech companies. With RMB 20 billion under management, Tsing-yuan Captial has invested in 170+ companies.

One of the earliest PE firms in China focusing on growth-stage investment in high-tech companies. With RMB 20 billion under management, Tsing-yuan Captial has invested in 170+ companies.

CICC Jiatai Fund (RMB M&A Fund) is managed by the private equity department of China International Capital Corporation Limited (CICC). It focuses on industrial consolidation, growth enterprise and cross-border investment opportunities.

CICC Jiatai Fund (RMB M&A Fund) is managed by the private equity department of China International Capital Corporation Limited (CICC). It focuses on industrial consolidation, growth enterprise and cross-border investment opportunities.

Korelya Capital is a Paris-based VC firm that backs startups during their growth stage, focusing on cross-border investments between Asia and Europe. The firm's investment portfolio of €200m includes unicorns like Glovo and GetYourGuide.

Korelya Capital is a Paris-based VC firm that backs startups during their growth stage, focusing on cross-border investments between Asia and Europe. The firm's investment portfolio of €200m includes unicorns like Glovo and GetYourGuide.

Started in 2008 by Joe Zhou (Zhou Zhixiong), one of the founders of Kleiner Perkins Caufield & Byers' China fund, Keytone Ventures primarily invests in high-growth companies in the cleantech, media, hi-tech and consumer sectors.

Started in 2008 by Joe Zhou (Zhou Zhixiong), one of the founders of Kleiner Perkins Caufield & Byers' China fund, Keytone Ventures primarily invests in high-growth companies in the cleantech, media, hi-tech and consumer sectors.

Co-founder of NPAW

Otto Christof Wüst Acedo is co-founder and COO at social media advertising firm Adsmurai while serving as advisor to The Real Plaza, an online platform for cross-border real estate transactions. He is also co-founder and the former CEO of NPAW, where he was responsible for new business generation developing and strategic relationships with customers and partners during the startup's growth phase. NPAW's funding round with Axon Partners Group was completed during his tenure as CEO. Wüst read Telecommunications Engineering at the Polytechnic University of Catalonia, has studied at Duke University and holds a MSc. in Computer Science from Pompeu Fabra University.

Otto Christof Wüst Acedo is co-founder and COO at social media advertising firm Adsmurai while serving as advisor to The Real Plaza, an online platform for cross-border real estate transactions. He is also co-founder and the former CEO of NPAW, where he was responsible for new business generation developing and strategic relationships with customers and partners during the startup's growth phase. NPAW's funding round with Axon Partners Group was completed during his tenure as CEO. Wüst read Telecommunications Engineering at the Polytechnic University of Catalonia, has studied at Duke University and holds a MSc. in Computer Science from Pompeu Fabra University.

Light-Up Capital (Dianliang Fund)

Founded in 2013 by Long Wei, a co-founder of Dianping, Light-Up Capital (also known as Dianliang Fund) focuses on companies in early through growth stage with specialization in robotics, artificial intelligence, mobile internet and mobile healthcare.

Founded in 2013 by Long Wei, a co-founder of Dianping, Light-Up Capital (also known as Dianliang Fund) focuses on companies in early through growth stage with specialization in robotics, artificial intelligence, mobile internet and mobile healthcare.

Founded in 2014, Frankfurt-based CommerzVentures operates as the VC arm of Commerzbank AG. The firm invests mainly in early- and growth-stage startups from Series A onward. Its portfolio features fintech companies such as PayKey and Marqeta.

Founded in 2014, Frankfurt-based CommerzVentures operates as the VC arm of Commerzbank AG. The firm invests mainly in early- and growth-stage startups from Series A onward. Its portfolio features fintech companies such as PayKey and Marqeta.

Established in 2006, Qiming Venture Partners is a leading venture capital firm in China with more than RMB 10 billion under management. They invest in early through growth stage companies within the internet and consumer ("intersumer"), healthcare, clean technology sectors.

Established in 2006, Qiming Venture Partners is a leading venture capital firm in China with more than RMB 10 billion under management. They invest in early through growth stage companies within the internet and consumer ("intersumer"), healthcare, clean technology sectors.

A Boston-based VC founded in 1984 with an impressive investment history, currently totaling US$9.5 billion. With offices in Boston, Menlo Park, California and London, Summit Partners has invested in more than 460 companies in technology, healthcare, life sciences and other high-growth industries, including as lead investor in 77 companies. It has seen 192 exits to date. Recent major investments include as lead investor in Red Points' Series C round and in Markforged's Series D round.The company also provides services, such as, recruitment of senior executives and board members and Peak Performance Groups to help companies’ identify and execute growth initiatives and operational efficiency.

A Boston-based VC founded in 1984 with an impressive investment history, currently totaling US$9.5 billion. With offices in Boston, Menlo Park, California and London, Summit Partners has invested in more than 460 companies in technology, healthcare, life sciences and other high-growth industries, including as lead investor in 77 companies. It has seen 192 exits to date. Recent major investments include as lead investor in Red Points' Series C round and in Markforged's Series D round.The company also provides services, such as, recruitment of senior executives and board members and Peak Performance Groups to help companies’ identify and execute growth initiatives and operational efficiency.

Sofina began in 1898 as Société Financière de Transport et d’Entreprises Industrielles, an engineering conglomerate in Belgium. In the late 1960s, Sofina changed course to become an investment company. As a holding company, its major investments lie in the consumer goods, energy, and distribution sectors, with stakes in companies like Danone and communications satellite operator SES. It has also been involved in various venture capital investment activities, both as an LP to other VCs and as a VC itself, running the Sofina Growth portfolio. The Sofina Growth portfolio spans a wide range of sectors and geographies, from China to Southeast Asia, with investments in notable companies like Zilingo, Byju’s and Kopi Kenangan.

Sofina began in 1898 as Société Financière de Transport et d’Entreprises Industrielles, an engineering conglomerate in Belgium. In the late 1960s, Sofina changed course to become an investment company. As a holding company, its major investments lie in the consumer goods, energy, and distribution sectors, with stakes in companies like Danone and communications satellite operator SES. It has also been involved in various venture capital investment activities, both as an LP to other VCs and as a VC itself, running the Sofina Growth portfolio. The Sofina Growth portfolio spans a wide range of sectors and geographies, from China to Southeast Asia, with investments in notable companies like Zilingo, Byju’s and Kopi Kenangan.

Known as one of the “big four” VC firms investing in early and growth stages in London, Europe-focused Balderton Capital was one of the early backers of today’s unicorns such as Revolut, Yoox, MySQL, CityMapper and Betfair. To date, Balderton Capital has made over 250 investments since its founding in 2000 and raised over $4bn across nine funds to date. In 2018, it launched the first fund to acquire equity from existing shareholders in European startups. The firm also focuses on Series A investments through its $400m fund Balderton VII launched in 2019. In June 2021, Balderton Capital launched its first growth fund with $680m under management.

Known as one of the “big four” VC firms investing in early and growth stages in London, Europe-focused Balderton Capital was one of the early backers of today’s unicorns such as Revolut, Yoox, MySQL, CityMapper and Betfair. To date, Balderton Capital has made over 250 investments since its founding in 2000 and raised over $4bn across nine funds to date. In 2018, it launched the first fund to acquire equity from existing shareholders in European startups. The firm also focuses on Series A investments through its $400m fund Balderton VII launched in 2019. In June 2021, Balderton Capital launched its first growth fund with $680m under management.

Subsidy cut has dented sales, but China's EV manufacturers need better products to win over buyers

Eliminating subsidies is a painful must for the sustainability of China’s electric vehicle industry

SWITCH Singapore: Xpeng expects strong China EV growth after 3Q rebound, launches overseas expansion

Welcoming foreign player entry as potential boost to EV adoption, Xpeng President Brian Gu also notes attractiveness of overseas markets, especially Europe

Chinese EV startups feel the heat as Tesla slashes prices, market subsidies ending

Tesla's recent price cuts and upcoming Shanghai plant for producing cheaper cars are increasing pressure on its Chinese rivals

Europe ramps up development of local EV battery sector in race to zero emissions

Startups, automakers jostle or unite to ride the fast-growing EV battery market, as the EU pumps billions into developing its own value chain, to cut reliance on imports

Wallbox’s bumper funding boosts Spain’s EV charging sector

Wallbox’s generic EV charging systems are sold in 40 countries, including the US and China; attracting major backers like Seaya Ventures, Spanish utility Iberdrola and US VC Endeavor

Kryha: Enabling big businesses' green practices with blockchain

Kryha’s blockchain systems help companies trace the movement and transformation of resources among multiple stakeholders without exposing sensitive information

Supercharging and battery swap in race to cut EV charging times in China

Supercharging can slash EV charging times but has technological challenges. Hence battery swapping is on the rise in China, with state support

Li Bin: Aiming for more than a Chinese copy of Tesla

Good at making and investing money, he founded two companies that went on to list on the NYSE and invested in over 40 startups

Behind Indonesia's recent EV push

EV prices in Indonesia are still high and there are concerns about infrastructure, but serious policymaking and private sector support can boost consumer adoption

EV maker Xpeng Motors partners Didi to offer car rentals and better charging services

Besides working with China's largest ride-hailing platform, Xpeng Motors has also connected to the charging networks of EV maker NIO and TELD, China's biggest EV charging network

Plug-it and Drive-it with Wallbox’s EV quick chargers

Created by an ex-Tesla engineer, these generic chargers are fast and easy to use – just like recharging mobile phones

Mass production and delivery delays – common challenges facing China EV startups

As Tesla postponed delivery yet again, its Chinese rivals are scrambling too

This EV maker caters to young consumers by making driving easier and more fun

Amongst all the players in China’s EV market, Xpeng Motors still stands out

Place to Plug: Symbiosis in scaling with the electric vehicle sector

Launched commercially just five months ago, EV-charging infrastructure platform Place to Plug has already attracted attention from investors in Silicon Valley and Asia

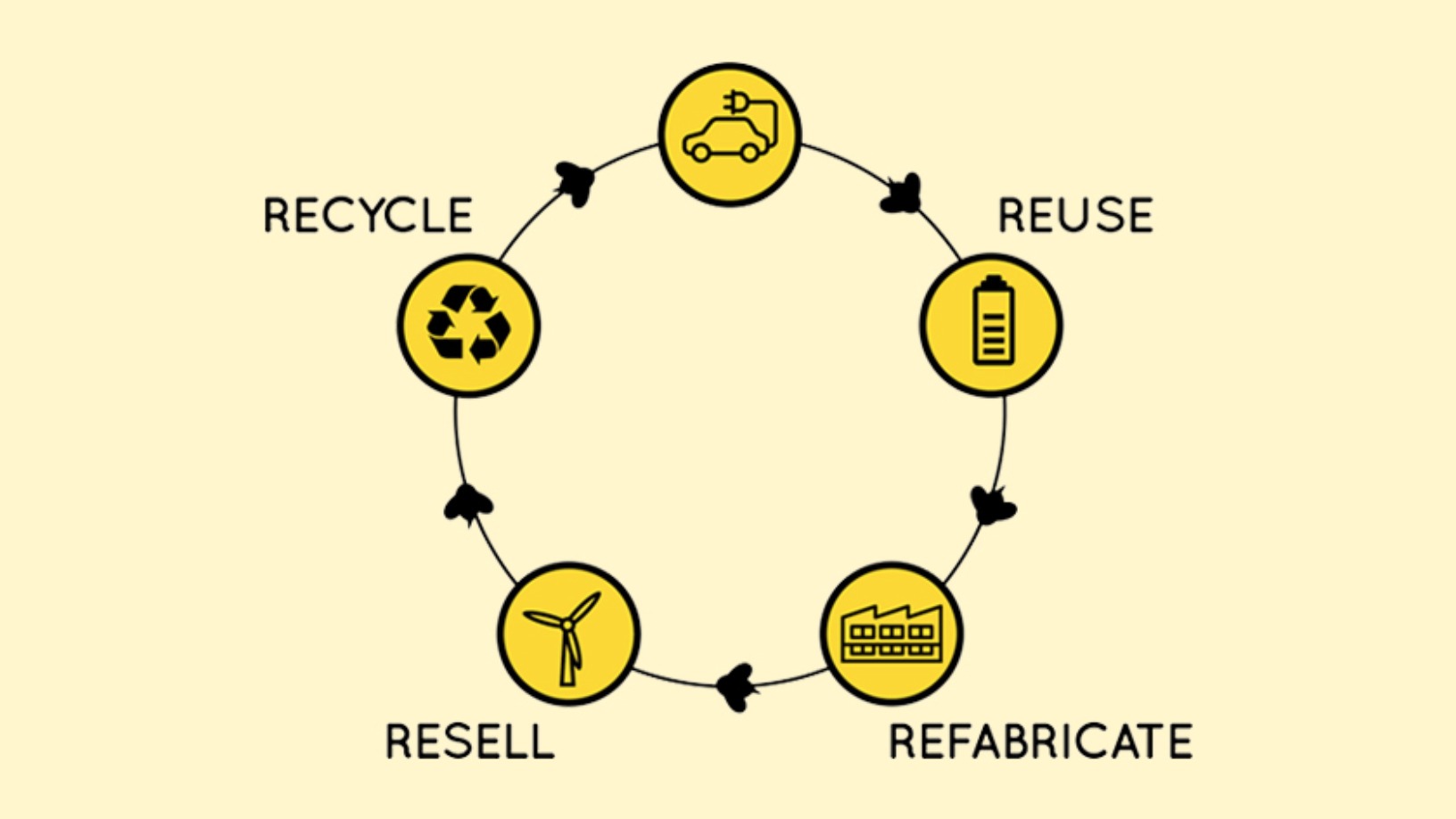

BeePlanet Factory: Recycling EV batteries as a sustainable, profitable business

With 4kWh–200kWh residential and industrial battery packs, the Pamplona-based startup wants to scale its energy storage solutions in the agri-food sector, camping sites and mountain huts

Sorry, we couldn’t find any matches for“EV Growth”.