High Pitch 2020

-

DATABASE (284)

-

ARTICLES (593)

China’s first developer of self-driving robots, Zhen Robotics aims to revolutionize last-mile delivery.

China’s first developer of self-driving robots, Zhen Robotics aims to revolutionize last-mile delivery.

Providing privacy, peace and quiet in public areas through intelligent, noise-proof and comfortable private cabins, including luxury sleeping pods, meeting rooms and phone booths.

Providing privacy, peace and quiet in public areas through intelligent, noise-proof and comfortable private cabins, including luxury sleeping pods, meeting rooms and phone booths.

Foods for Tomorrow / Heura Foods

Sold at 2,000+ outlets in four continents, the Heura brand comprises sustainably produced, nutritious, plant-based vegan products that mimic both chicken and beef.

Sold at 2,000+ outlets in four continents, the Heura brand comprises sustainably produced, nutritious, plant-based vegan products that mimic both chicken and beef.

TreeFrog Therapeutics’ C-Stem technology mass-produces high-quality pluripotent stem cells in a 3D environment that mimics the way cells grow in the human body.

TreeFrog Therapeutics’ C-Stem technology mass-produces high-quality pluripotent stem cells in a 3D environment that mimics the way cells grow in the human body.

NovoNutients uses CO2 and other emissions to produce cost-effective and environmentally-friendly protein-rich fish feed, a circular solution to aquaculture's fishmeal supply problem.

NovoNutients uses CO2 and other emissions to produce cost-effective and environmentally-friendly protein-rich fish feed, a circular solution to aquaculture's fishmeal supply problem.

Fides Capital is a private investment group aimed at tech-based B2B startups with scalable business models and products or services already in the market.Fides Capital is part of a larger group Perennius, comprising investment professionals with a focus on financial products, real estate and high growth companies. Success stories funded include Masmovil that has grown into the fourth largest telephone operator in Spain.

Fides Capital is a private investment group aimed at tech-based B2B startups with scalable business models and products or services already in the market.Fides Capital is part of a larger group Perennius, comprising investment professionals with a focus on financial products, real estate and high growth companies. Success stories funded include Masmovil that has grown into the fourth largest telephone operator in Spain.

Founded in 2017, Rekanext Capital Partners Pte Ltd is an early-stage VC firm based in Singapore and Jakarta. The VC focuses on scaling high potential startups in Southeast Asia to expand regionally by providing expertise, industry experience and networks. Its diverse investment portfolio includes agri-crowdfunding platform iGrow, chat and customer service developer Qiscus and architecture-focused VR Collab that has operations in Singapore and China.

Founded in 2017, Rekanext Capital Partners Pte Ltd is an early-stage VC firm based in Singapore and Jakarta. The VC focuses on scaling high potential startups in Southeast Asia to expand regionally by providing expertise, industry experience and networks. Its diverse investment portfolio includes agri-crowdfunding platform iGrow, chat and customer service developer Qiscus and architecture-focused VR Collab that has operations in Singapore and China.

Sony is a Japanese multinational conglomerate established in 1946. It has a high number of acquisitions, investing in more than 20 tech startups and companies manufacturing technology products. It also has a seed investment fund, Seed Acceleration Program, launched in April 2014 to promote ideas that are beyond existing business categories and develop them for commercialization.

Sony is a Japanese multinational conglomerate established in 1946. It has a high number of acquisitions, investing in more than 20 tech startups and companies manufacturing technology products. It also has a seed investment fund, Seed Acceleration Program, launched in April 2014 to promote ideas that are beyond existing business categories and develop them for commercialization.

Ship2B is an accelerator and investor for social impact startups and spin-offs. It acts principally in three sectors: health tech, social tech for vulnerable groups and climate technology. It also fosters networking alliances between startups and large companies, and has a network of high-level mentors available to assist startups.To date, Ship2B has invested €40m in 146 startups and spin-offs.

Ship2B is an accelerator and investor for social impact startups and spin-offs. It acts principally in three sectors: health tech, social tech for vulnerable groups and climate technology. It also fosters networking alliances between startups and large companies, and has a network of high-level mentors available to assist startups.To date, Ship2B has invested €40m in 146 startups and spin-offs.

Endeavor Catalyst is part of the global investment company Endeavor. Launched in 2012 and based in New York, it supports the equity funding efforts of Endeavour entrepreneurs with third party investors. Its portfolio investments had a total capital value of over US$100 million and it specializes in mid-stage investments across sectors and different countries, with significant investment in transportation startups to date. In 2020, it participated in the second €12m part of the €23m Series A round of EV charging hardware startup, Wallbox, with an undisclosed investment. Other recent investments in 2020 include in the US$40m Series D round of Egyptian healthtech Vezeeta and in the undisclosed seed round of Turkish fintech Figopara.

Endeavor Catalyst is part of the global investment company Endeavor. Launched in 2012 and based in New York, it supports the equity funding efforts of Endeavour entrepreneurs with third party investors. Its portfolio investments had a total capital value of over US$100 million and it specializes in mid-stage investments across sectors and different countries, with significant investment in transportation startups to date. In 2020, it participated in the second €12m part of the €23m Series A round of EV charging hardware startup, Wallbox, with an undisclosed investment. Other recent investments in 2020 include in the US$40m Series D round of Egyptian healthtech Vezeeta and in the undisclosed seed round of Turkish fintech Figopara.

Swanlaab Venture Factory is a Spanish-Israeli VC fund founded in 2013 in Israel and in 2017 in Madrid, whose first investment fund totalled €40 million. Within Spain, its portfolio has 11 startups across different B2B verticals. Each startup selected for investment during investment rounds of €2–3 million, receives funds of €500,000 to €1.5 million.Swanlaab's Israeli backer Giza Venture Capital has already achieved more than 40 successful exits and is ranked amongst the top funds worldwide, investing over $600 million since 1992.Its most recent investments include in edtech and multimedia content platform Odilo’s July 2020 $10m undisclosed round and in the €3.5m Series A investment round of sales tech Sales Layer in May 2020.

Swanlaab Venture Factory is a Spanish-Israeli VC fund founded in 2013 in Israel and in 2017 in Madrid, whose first investment fund totalled €40 million. Within Spain, its portfolio has 11 startups across different B2B verticals. Each startup selected for investment during investment rounds of €2–3 million, receives funds of €500,000 to €1.5 million.Swanlaab's Israeli backer Giza Venture Capital has already achieved more than 40 successful exits and is ranked amongst the top funds worldwide, investing over $600 million since 1992.Its most recent investments include in edtech and multimedia content platform Odilo’s July 2020 $10m undisclosed round and in the €3.5m Series A investment round of sales tech Sales Layer in May 2020.

Vesalius Biocapital III is a €70 million fund that invests in medtech, e-health initiatives and drug development in Europe. It was launched in 2017 by Luxembourg-based Vesalius Biocapital, a life sciences venture capital firm founded in 2007. Preceding Vesalius Biocapital III were Vesalius Biocapital I, with €76 million under management and Vesalius Biocapital II, which has €78 million invested; both funds have 11 portfolio companies each.Its recent investments include in Portuguese home physiotherapy tech solution SWORD Health's 2021 $25m Series B and in the 2020 $9m second phase of its Series A round as well as in the 2020 €22m Series B round of German biotech Topas Therapeutics.

Vesalius Biocapital III is a €70 million fund that invests in medtech, e-health initiatives and drug development in Europe. It was launched in 2017 by Luxembourg-based Vesalius Biocapital, a life sciences venture capital firm founded in 2007. Preceding Vesalius Biocapital III were Vesalius Biocapital I, with €76 million under management and Vesalius Biocapital II, which has €78 million invested; both funds have 11 portfolio companies each.Its recent investments include in Portuguese home physiotherapy tech solution SWORD Health's 2021 $25m Series B and in the 2020 $9m second phase of its Series A round as well as in the 2020 €22m Series B round of German biotech Topas Therapeutics.

Founded in 2012, Purple Orange’s objective is to support the transition away from animals in the food chain, supporting early-stage food and biotech companies across the globe with a focus on alternative proteins and cellular agriculture. It currently has 12 startups from different nations in its portfolio. Its most recently disclosed investments have been in the December 2020 pre-seed round of Chinese cultured meat startup CellX and in the November 2020 $500,000 pre-seed round of Swedish plant-based food vending startup VEAT.

Founded in 2012, Purple Orange’s objective is to support the transition away from animals in the food chain, supporting early-stage food and biotech companies across the globe with a focus on alternative proteins and cellular agriculture. It currently has 12 startups from different nations in its portfolio. Its most recently disclosed investments have been in the December 2020 pre-seed round of Chinese cultured meat startup CellX and in the November 2020 $500,000 pre-seed round of Swedish plant-based food vending startup VEAT.

Founder and CEO of Geoblink

Ex-McKinsey consultant and Amadeus engineer Jaime Laulhé lived in New York, Paris and Hong Kong before returning to his native Madrid to work at McKinsey, where he spent two years. He holds degrees in IT Engineering from Madrid Polytechnic University and in Telecommunications Engineering from ENSIMAG in France, and an MBA from the University of Chicago and a master's in Mathematics from Institut Fourier, France.In New York and Hong Kong, he spent several years working in High Frequency Trading tech at Société Générale. He is founder and CEO of Geoblink, developing location tech AI solutions for retail, real estate and FMCG sectors.

Ex-McKinsey consultant and Amadeus engineer Jaime Laulhé lived in New York, Paris and Hong Kong before returning to his native Madrid to work at McKinsey, where he spent two years. He holds degrees in IT Engineering from Madrid Polytechnic University and in Telecommunications Engineering from ENSIMAG in France, and an MBA from the University of Chicago and a master's in Mathematics from Institut Fourier, France.In New York and Hong Kong, he spent several years working in High Frequency Trading tech at Société Générale. He is founder and CEO of Geoblink, developing location tech AI solutions for retail, real estate and FMCG sectors.

Profitable Estay has built a leading brand in online booking of short-term luxury home rentals and services for travelers; with property management, upgrading for homeowners.

Profitable Estay has built a leading brand in online booking of short-term luxury home rentals and services for travelers; with property management, upgrading for homeowners.

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

HighPitch: E-grocery marketplace Pasar20 and healthcare edtech Appskep top the Medan chapter

Representing Sumatra’s startup ecosystem in the national finals later in November, Pasar20 and Appskep have ambitious expansion plans in store

HighPitch 2020: Event ticketing and legal tech startups come up tops in Jakarta chapter

VC judges favored Goers’s strong pivot amid Covid and HAKITA’s outstanding pitch

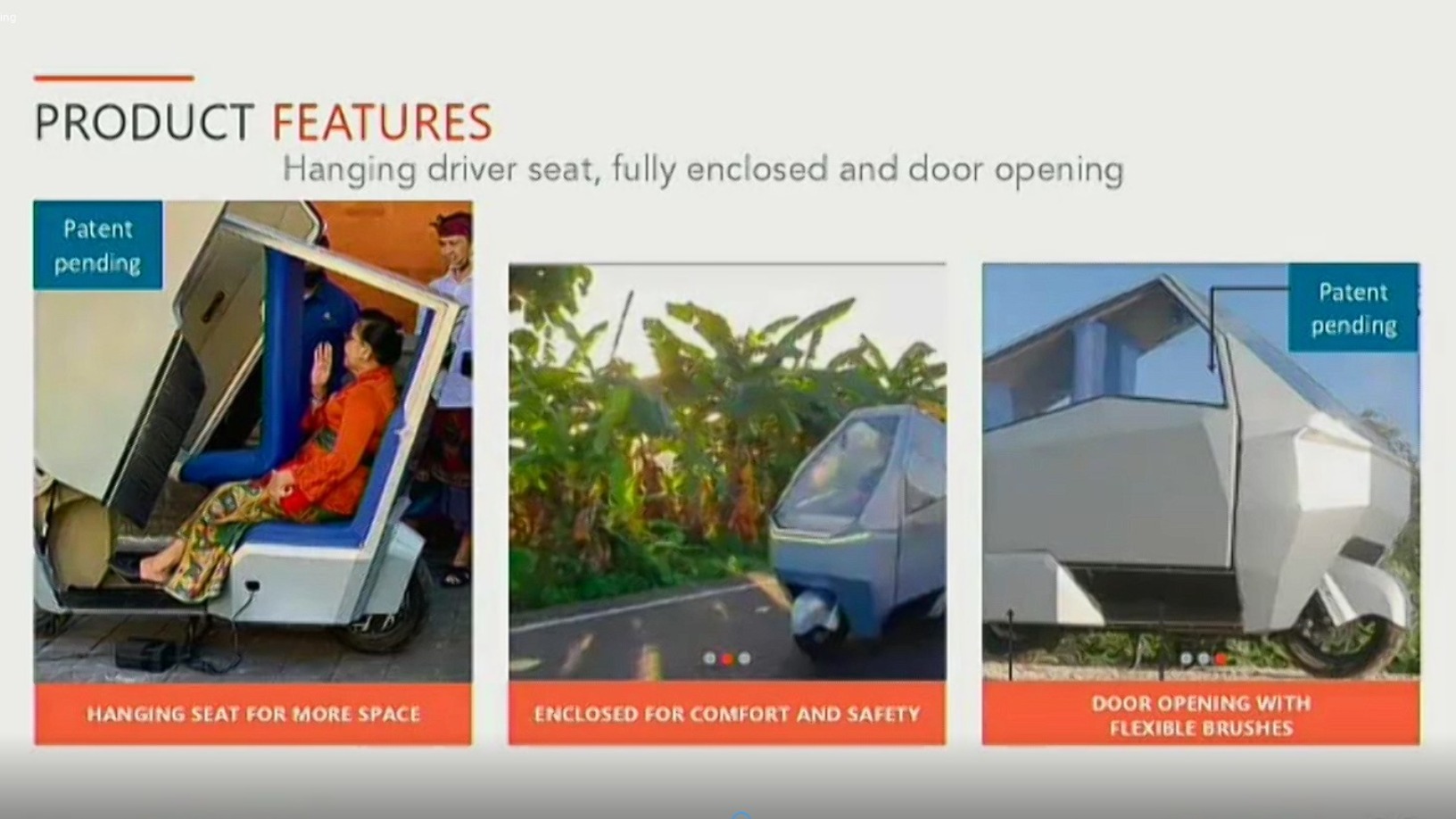

HighPitch 2020: Hydroponics, EV startups PanenBali and Manouv represent Denpasar chapter

Renewable energy and sustainability focuses impress investors, who also caution startups about competitors from outside their region

Coronavirus: Portuguese startups pitch in as nation battles pandemic

More than 120 startups join the #tech4COVID19 initiative, offering the public free medical help, meals for the vulnerable, online education and more

HighPitch 2020: Goers wins Indonesia's national startup competition

Event ticketing startup Goers gains new revenue streams with pivot to helping leisure spots go online; hotel SaaS Izy and on-demand medical testing service CekLab also in top three

In Portugal tourism tech gets disrupted, in time for post-Covid-19 era

As Portugal reopens to tourists early next month, the sector is banking on a new generation of tourism tech startups to enable safety and reassure visitors

HighPitch 2020: In conversation with top winners and UMG Idealab head Kiwi Aliwarga

Goers, Izy and CekLab demonstrated quick thinking when adapting their businesses to the pandemic, a capability they will need to stay competitive post-Covid

Indonesia's HighPitch 2020: VC investors on Medan startups, deal-sourcing during Covid

Healthcare-focused edtech Appskep and e-grocer Pasar20 win regional pitch competition for Sumatra; judging VCs share their new perspectives gained on local problems and startups from outside Greater Jakarta, and more

HighPitch 2020: Yogyakarta chapter won by on-demand lab testing and solar cell startups

Judges lauded the variety of ideas, but said startups could improve their presentations and clearly state the problems they are solving

HighPitch 2020: Waste management play Octopus, digital concierge service Izy win Makassar battle

Both startups have scored strong traction despite the weight of Covid-19; they are also expanding and keen to explore new opportunities

Future Food Asia 2021: Impact assessments – getting the metrics right

Common impact measures are useful but each situation requires specific, sometimes subjective considerations. The priority is to gauge if the impact has led to positive changes

Buy Yourself GO: Relieving the pressure in high-demand retail

Buy Yourself's patented self-checkout technology specifically targets peak sales periods for bricks-and-mortars and requires no prior download of software

Xu Jinghong: Champion of young entrepreneurs and high-tech startups

Under Xu Jinghong’s leadership, Tsinghua Holdings grew its assets sevenfold and incubated over 10,000 businesses. In his new role as VC investor, Xu wants to nurture startups into future global leaders

Citibeats, a social trends monitoring tool for governments and businesses, wins €1.4m funding

Citibeats tracks and analyzes what the public is saying online in any language; wants to boost its presence in LatAm and Asia

Sorry, we couldn’t find any matches for“High Pitch 2020”.