Panoply City

-

DATABASE (62)

-

ARTICLES (179)

CEO, founder of TherapyChat

Alessandro De Sario is CEO and founder of mental health startup TherapyChat, Spain’s number one online psychotherapy platform founded in 2016. He also works for TherapyChat’s investor, the Spanish VC and startup developer Next Chance Group, on other startups in their portfolio, such as the discount aggregator app Billionhands.Prior to starting TherapyChat, De Sario spent just over three years working in different food delivery entities associated with German VC and startup incubator Rocket Internet. He oversaw the development and launch of Rocket Internet’s food delivery operations in Latin America before these entities were sold to JustEat and Delivery Hero. He was also Head of Logistics at La Nevera Roja in Spain, which was later acquired by Delivery Hero. Before these roles, De Sario spent two years in investment banking and mergers and acquisitions at HSBC in London.De Sario holds three master’s degrees: one in management from ESCP Business School; one in science from City University, London; and one in business administration from the University of Turin, Italy. He lectures part-time on International Food and Beverage Management at ESCP Business School in Turin, Italy.

Alessandro De Sario is CEO and founder of mental health startup TherapyChat, Spain’s number one online psychotherapy platform founded in 2016. He also works for TherapyChat’s investor, the Spanish VC and startup developer Next Chance Group, on other startups in their portfolio, such as the discount aggregator app Billionhands.Prior to starting TherapyChat, De Sario spent just over three years working in different food delivery entities associated with German VC and startup incubator Rocket Internet. He oversaw the development and launch of Rocket Internet’s food delivery operations in Latin America before these entities were sold to JustEat and Delivery Hero. He was also Head of Logistics at La Nevera Roja in Spain, which was later acquired by Delivery Hero. Before these roles, De Sario spent two years in investment banking and mergers and acquisitions at HSBC in London.De Sario holds three master’s degrees: one in management from ESCP Business School; one in science from City University, London; and one in business administration from the University of Turin, Italy. He lectures part-time on International Food and Beverage Management at ESCP Business School in Turin, Italy.

Based in New York City, Lerer Hippeau mainly invests in seed and early-stage startups based in the US. Founded in 2010 by managing partners Kenneth Lerer, Ben Lerer and Eric Hippeau, the VC operates several funds offering initial investments of $1m per startup. Kenneth Lerer is the co-founder of Huffington Post and longtime chairman of BuzzFeed. Hippeau was the CEO of Huffington Post and ex-managing partner of Softbank Capital that invested in Huffington Post.Its 400+ startups also get support for business growth by tapping into tech ecosystems like New York, San Francisco and Los Angeles. Its 80+ exits include Giphy (GIF) that was acquired by Facebook and home-fitness studio Mirror acquired by Lululemon. However, the IPO by portfolio company Bed-in-a-box online retailer Casper was below market expectations. The loss-making e-commerce unicorn went public at $12 a share in February 2020, closing at $13.50 on its first day out, for a market capitalization of less than half the $1.1 billion Casper was valued at in a private funding round in 2019.

Based in New York City, Lerer Hippeau mainly invests in seed and early-stage startups based in the US. Founded in 2010 by managing partners Kenneth Lerer, Ben Lerer and Eric Hippeau, the VC operates several funds offering initial investments of $1m per startup. Kenneth Lerer is the co-founder of Huffington Post and longtime chairman of BuzzFeed. Hippeau was the CEO of Huffington Post and ex-managing partner of Softbank Capital that invested in Huffington Post.Its 400+ startups also get support for business growth by tapping into tech ecosystems like New York, San Francisco and Los Angeles. Its 80+ exits include Giphy (GIF) that was acquired by Facebook and home-fitness studio Mirror acquired by Lululemon. However, the IPO by portfolio company Bed-in-a-box online retailer Casper was below market expectations. The loss-making e-commerce unicorn went public at $12 a share in February 2020, closing at $13.50 on its first day out, for a market capitalization of less than half the $1.1 billion Casper was valued at in a private funding round in 2019.

Chic by Choice: From Forbes' 30 Under 30 to insolvency

Lack of cashflow was the main reason for the demise of Chic by Choice, Europe's leading luxury dress rental e-store

Turning Singapore into an Edible Garden City

Urban agriculture startup Edible Garden City embraces new tech for intensive, space-saving farming while staying true to its community-driven values

Jakarta Smart City seeks startup solutions for life in post-Covid “new normal”

From collaborative working to cyberbullying, these startups will soon work with Indonesia’s first smart city agency

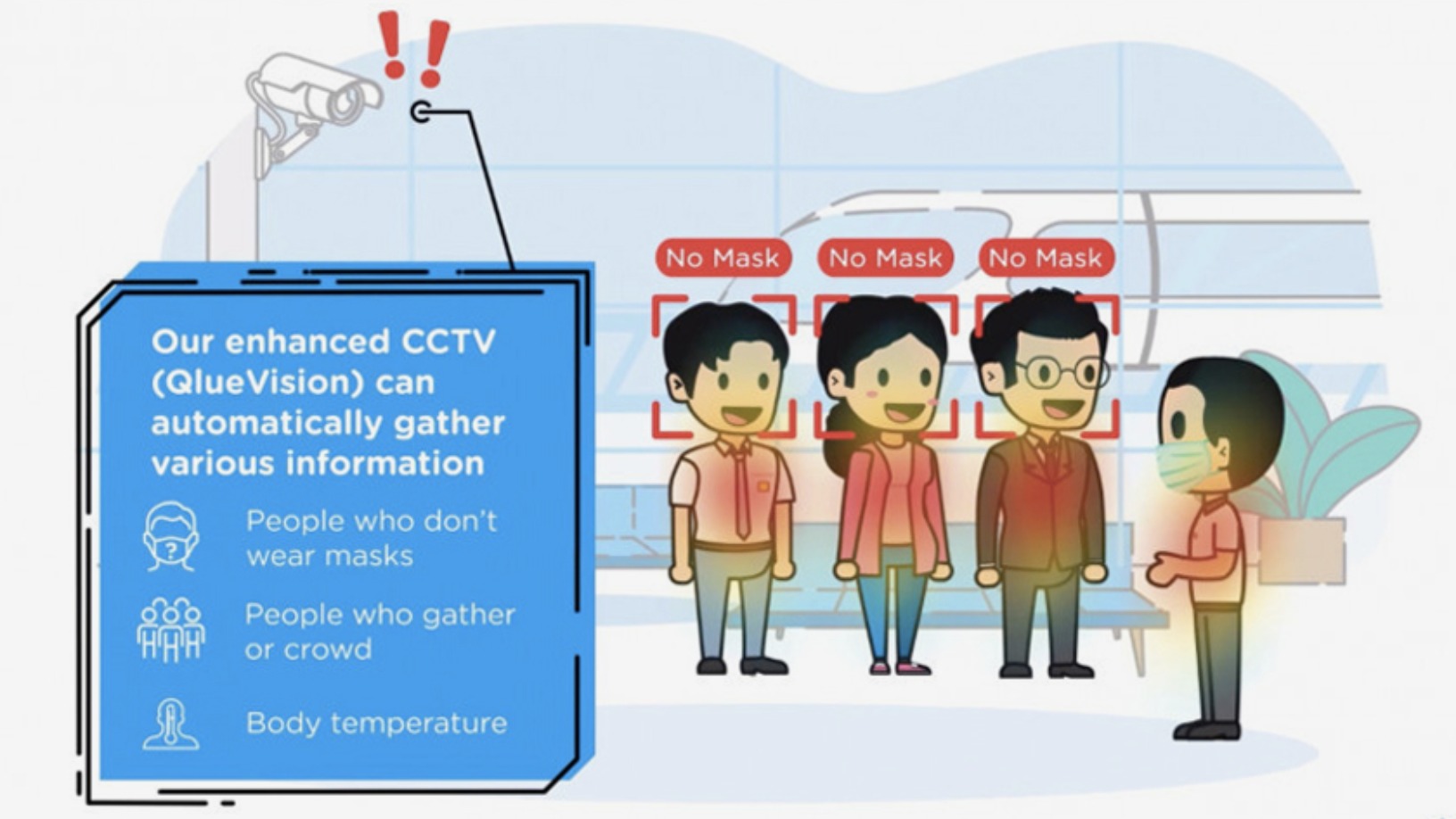

Interview with Qlue CEO: "We didn't know what a smart city should look like"

Co-founder and CEO of Qlue, Indonesia's largest "smart city" company, Rama Raditya explains how citizen involvement – not high-tech – is the true innovation of smart cities and the agent for change; plus how his startup has grown from partnering governments to businesses, and more

Indonesian smart city tech leader Qlue thrives amid Covid-19 with thermal scanner and B2G refocus

Plans to tilt its client portfolio toward B2B work are delayed as Qlue returns to its B2G roots

Interview with Qlue CEO, part II: Smart cities in Indonesia and beyond

Continuing from the first part of an interview, Qlue CEO Rama Raditya discusses trends, achievements and challenges in smart city development

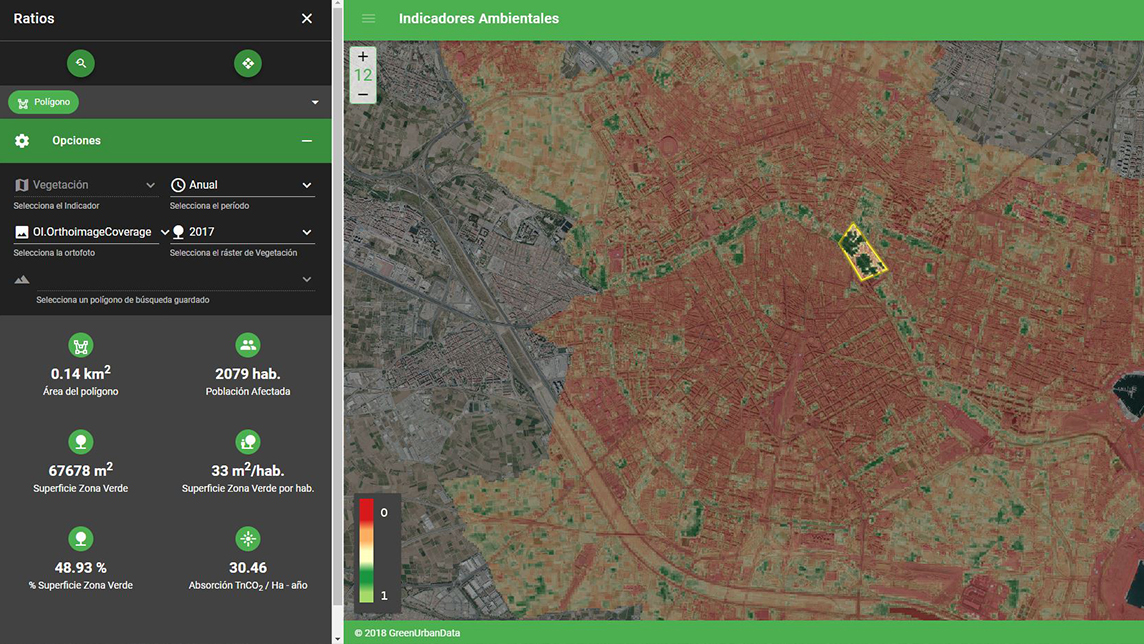

Green Urban Data: Empowering cities to mitigate climate change

The Valencia-based startup is the first to mitigate urban temperature increases and provide healthy travel route suggestions using AI and big data

EXCLUSIVE: Qlue raising Series B funding, "confident" of turning profitable in 2020

Qlue is also targeting more enterprise clients as it expands overseas and improved accountability and management practices

Vadecity: Stop bicycle theft with an intelligent bike-parking system

The Barcelona-based startup wants more people to bike by offering flexible, affordable parking with its Vadebike solution

Nodeflux: Automating computer vision analysis for the smart cities of tomorrow

Indonesia's first facial recognition tech company aims to become a central player in Jakarta's smart city push

Omniflow gets €2 million boost for its solar-, wind-powered IoT street lights

Thanks to Portugal's Omniflow, renewable energy street lamps doubling up as Wi-Fi hotspots, e-chargers and traffic monitors may soon be ubiquitous street furniture in tomorrow's smart cities

Zhongzheng Information: Big data and fully integrated services for smart office buildings

Joining the Microsoft for Startups program will boost Zhongzheng's R&D and business expansion in China

Doinn: Impeccable housekeeping for lucrative holiday rentals

With its tech tools, better working conditions and 5-star ratings, the Portuguese startup now wants to expand to Southeast Asia and get Series A funding

Bettair's air pollution monitoring system for cities promises over 90% accuracy

Combining smart sensors, AI and machine learning, Barcelona-based Bettair has developed a unique, affordable PaaS to accurately measure pollution levels in urban areas

Agricool: Growing fresh strawberries in shipping containers

Paris-based Agricool grows fresh produce in urban aeroponics farms within shipping containers for sale at downtown supermarkets, aims to supply more large cities by 2030

Sorry, we couldn’t find any matches for“Panoply City”.