Swanlaab Venture Factory

-

DATABASE (450)

-

ARTICLES (256)

Established in Shanghai in 2014, Wuqiong Venture Capital is an early-stage investment firm, having backed more than 10 startups in China including Beautysite, CeCelife and Orange-social.

Established in Shanghai in 2014, Wuqiong Venture Capital is an early-stage investment firm, having backed more than 10 startups in China including Beautysite, CeCelife and Orange-social.

Leaguer Venture Capital was founded by Leaguer Group in 1999 as a wholly-owned subsidiary, responsible for incubating and investing in high-tech startups. It mainly invests in early- and mid-stage tech startups.

Leaguer Venture Capital was founded by Leaguer Group in 1999 as a wholly-owned subsidiary, responsible for incubating and investing in high-tech startups. It mainly invests in early- and mid-stage tech startups.

China Venture Capital was initiated by the China National Democratic Construction Association Committee in 2000. It focuses on technology SMEs with independent intellectual property rights, investing RMB 5 million to RMB 100 million in each project.

China Venture Capital was initiated by the China National Democratic Construction Association Committee in 2000. It focuses on technology SMEs with independent intellectual property rights, investing RMB 5 million to RMB 100 million in each project.

Everest Venture Capital was founded in Beijing in July 2010. By May 2019, it had invested in 80 companies in many different sectors, including, artificial intelligence, media, healthcare, robotics, automobile and edtech.

Everest Venture Capital was founded in Beijing in July 2010. By May 2019, it had invested in 80 companies in many different sectors, including, artificial intelligence, media, healthcare, robotics, automobile and edtech.

The Craftory is a London-based investment house with a satellite office in San Francisco. Founded in 2018 by retail and media industry veterans Ernesto Schmitt and Ellio Leoni Sceti, the firm has made seven investments in various consumer goods brands. Sceti is also the chairman of London-based family VC firm LSG Holdings, with his brother Patrick as the MD.The Craftory’s $375m fund specializes in building a new investment house of consumer brands, hence its name from the words, “craft" and “factory.” It mainly offers permanent and growth capital to consumer packaged goods (CPG) brands. The Craftory supports CPG challenger brands to help them to grow from “craft” businesses to sustainable, mass CPG brands, offering consumers better choices for everyday products.

The Craftory is a London-based investment house with a satellite office in San Francisco. Founded in 2018 by retail and media industry veterans Ernesto Schmitt and Ellio Leoni Sceti, the firm has made seven investments in various consumer goods brands. Sceti is also the chairman of London-based family VC firm LSG Holdings, with his brother Patrick as the MD.The Craftory’s $375m fund specializes in building a new investment house of consumer brands, hence its name from the words, “craft" and “factory.” It mainly offers permanent and growth capital to consumer packaged goods (CPG) brands. The Craftory supports CPG challenger brands to help them to grow from “craft” businesses to sustainable, mass CPG brands, offering consumers better choices for everyday products.

CTO and co-founder of Scoobic Urban Mobility

Pablo Marfil Serrano graduated in industrial design engineering and product development at Nebrija University in Madrid in 2014. He has worked in industrial design, product development and branding for Madrid-based companies, including AECOM and Steelcase.In 2010, he became a member of the competitive Mini racing team Nebrija Motorsport. In 2012, Marfil founded his own agency Marfil Design & Consulting. He also co-founded Scoobic Urban Mobility in 2015 and became the Spanish mobility startup's CTO and business development manager. He is also a founding member and partner of Passion Motorbike Factory.

Pablo Marfil Serrano graduated in industrial design engineering and product development at Nebrija University in Madrid in 2014. He has worked in industrial design, product development and branding for Madrid-based companies, including AECOM and Steelcase.In 2010, he became a member of the competitive Mini racing team Nebrija Motorsport. In 2012, Marfil founded his own agency Marfil Design & Consulting. He also co-founded Scoobic Urban Mobility in 2015 and became the Spanish mobility startup's CTO and business development manager. He is also a founding member and partner of Passion Motorbike Factory.

PowerCloud Venture Capital was founded in 2014 by UAV manufacturer PowerVision Group, Innovation Angel Funds and Beijing Jiaxun Feihong Electrical Co., Ltd. It invests mainly in early-stage startups in the robotics, drone, artificial intelligence and big data sectors.

PowerCloud Venture Capital was founded in 2014 by UAV manufacturer PowerVision Group, Innovation Angel Funds and Beijing Jiaxun Feihong Electrical Co., Ltd. It invests mainly in early-stage startups in the robotics, drone, artificial intelligence and big data sectors.

Founded in 2012 in Washington DC, Accion Venture Lab is a seed-stage investor in fintech for the underserved. Venture Lab is part of Accion, a not-for-profit global organization that works with financial service providers to deliver affordable solutions for unbanked and underbanked communities worldwide.Its portfolio includes 44 startups from 17 countries, ranging from Chile to Indonesia. Seed-stage startups normally get $500,000 funding per company. Investments in December 2020 included participation in the $1.5m seed round of Argentinian software development tech Henry and a financing round for Indonesian micro-credit fintech Pintech.

Founded in 2012 in Washington DC, Accion Venture Lab is a seed-stage investor in fintech for the underserved. Venture Lab is part of Accion, a not-for-profit global organization that works with financial service providers to deliver affordable solutions for unbanked and underbanked communities worldwide.Its portfolio includes 44 startups from 17 countries, ranging from Chile to Indonesia. Seed-stage startups normally get $500,000 funding per company. Investments in December 2020 included participation in the $1.5m seed round of Argentinian software development tech Henry and a financing round for Indonesian micro-credit fintech Pintech.

Changsha Lugu Venture Capital was founded in December 2007. The VC manages total assets worth RMB 300m and mainly invests in the internet and technology sectors. As a state-owned company, Changsha Lugu Venture Capital also provides free office facilities and funding of RMB200,000 for talented startups in Changsha.

Changsha Lugu Venture Capital was founded in December 2007. The VC manages total assets worth RMB 300m and mainly invests in the internet and technology sectors. As a state-owned company, Changsha Lugu Venture Capital also provides free office facilities and funding of RMB200,000 for talented startups in Changsha.

Silicon Valley-based Bessemer Venture Partners is one of the largest startup investors in the world, with US$5.4bn invested across five funds, the most recent raised in August 2018. Founded in 1911, the VC has five US offices as well as premises in India and Israel. It invests starting from seed and Series A level, sticking with portfolio companies through later-stage investments. Bessemer Venture Partners has invested in over 880 startups and managed more than 120 exits to date. Recent investments include Korean fintech Toss's US$64m Series F, US accounting unicorn ScaleFactor's US$60m Series C and fintech Mambu's Series C.

Silicon Valley-based Bessemer Venture Partners is one of the largest startup investors in the world, with US$5.4bn invested across five funds, the most recent raised in August 2018. Founded in 1911, the VC has five US offices as well as premises in India and Israel. It invests starting from seed and Series A level, sticking with portfolio companies through later-stage investments. Bessemer Venture Partners has invested in over 880 startups and managed more than 120 exits to date. Recent investments include Korean fintech Toss's US$64m Series F, US accounting unicorn ScaleFactor's US$60m Series C and fintech Mambu's Series C.

Established in 2015, KLab Venture Partners (KVP) is the investment arm of Japanese online game developer KLab. It is the successor of KLab’s previous investment subsidiary, KLab Ventures that had invested in various internet startups before closing in January 2017. KVP provides funding, resources and networking support to early stage startups.

Established in 2015, KLab Venture Partners (KVP) is the investment arm of Japanese online game developer KLab. It is the successor of KLab’s previous investment subsidiary, KLab Ventures that had invested in various internet startups before closing in January 2017. KVP provides funding, resources and networking support to early stage startups.

Gemboom Venture Capital was founded in Shenzhen in 2016 and mainly invests in early-stage startups from angel to Series A rounds. It specializes in high-tech, industrial upgrades and consumables. The VC invests primarily in big cities like Beijing, Shanghai, Guangzhou, Shenzhen, Hangzhou and Chengdu.

Gemboom Venture Capital was founded in Shenzhen in 2016 and mainly invests in early-stage startups from angel to Series A rounds. It specializes in high-tech, industrial upgrades and consumables. The VC invests primarily in big cities like Beijing, Shanghai, Guangzhou, Shenzhen, Hangzhou and Chengdu.

SWAN Venture Fund is a group of Seattle angel investors established in 2015. It leads in early seed rounds and tends to be the first major outside investment to a startup, ranging from US$200,000 – US$1.2 million. Besides tech startups, it also invests in companies producing innovative commercial products.

SWAN Venture Fund is a group of Seattle angel investors established in 2015. It leads in early seed rounds and tends to be the first major outside investment to a startup, ranging from US$200,000 – US$1.2 million. Besides tech startups, it also invests in companies producing innovative commercial products.

Antai Venture Builder is co-founded by Miguel Vicente, named “the magician of startups” by the El País newspaper. Its other co-founder is also a well-known serial entrepreneur and publicist Gerard Olivé who has interests focusing on digital businesses. He is one of the most iconic names in the Barcelona startup ecosystem.

Antai Venture Builder is co-founded by Miguel Vicente, named “the magician of startups” by the El País newspaper. Its other co-founder is also a well-known serial entrepreneur and publicist Gerard Olivé who has interests focusing on digital businesses. He is one of the most iconic names in the Barcelona startup ecosystem.

Yueyin Venture Capital was founded in 2015 in Beijing. It manages total assets worth US$300m, with investments in 22 companies. The VC focuses mainly in the healthcare, pharmaceutical and biotech sectors.

Yueyin Venture Capital was founded in 2015 in Beijing. It manages total assets worth US$300m, with investments in 22 companies. The VC focuses mainly in the healthcare, pharmaceutical and biotech sectors.

Swanlaab Venture Factory: €40 million funding chest to give power to the people

The female co-founder of Swanlaab Venture Factory believes that diversity enriches decision-making and drives performance. CompassList recently caught up with Verónica Trapa Díaz-Obregón to find out what's in store for Spain's first Israeli-backed VC fund

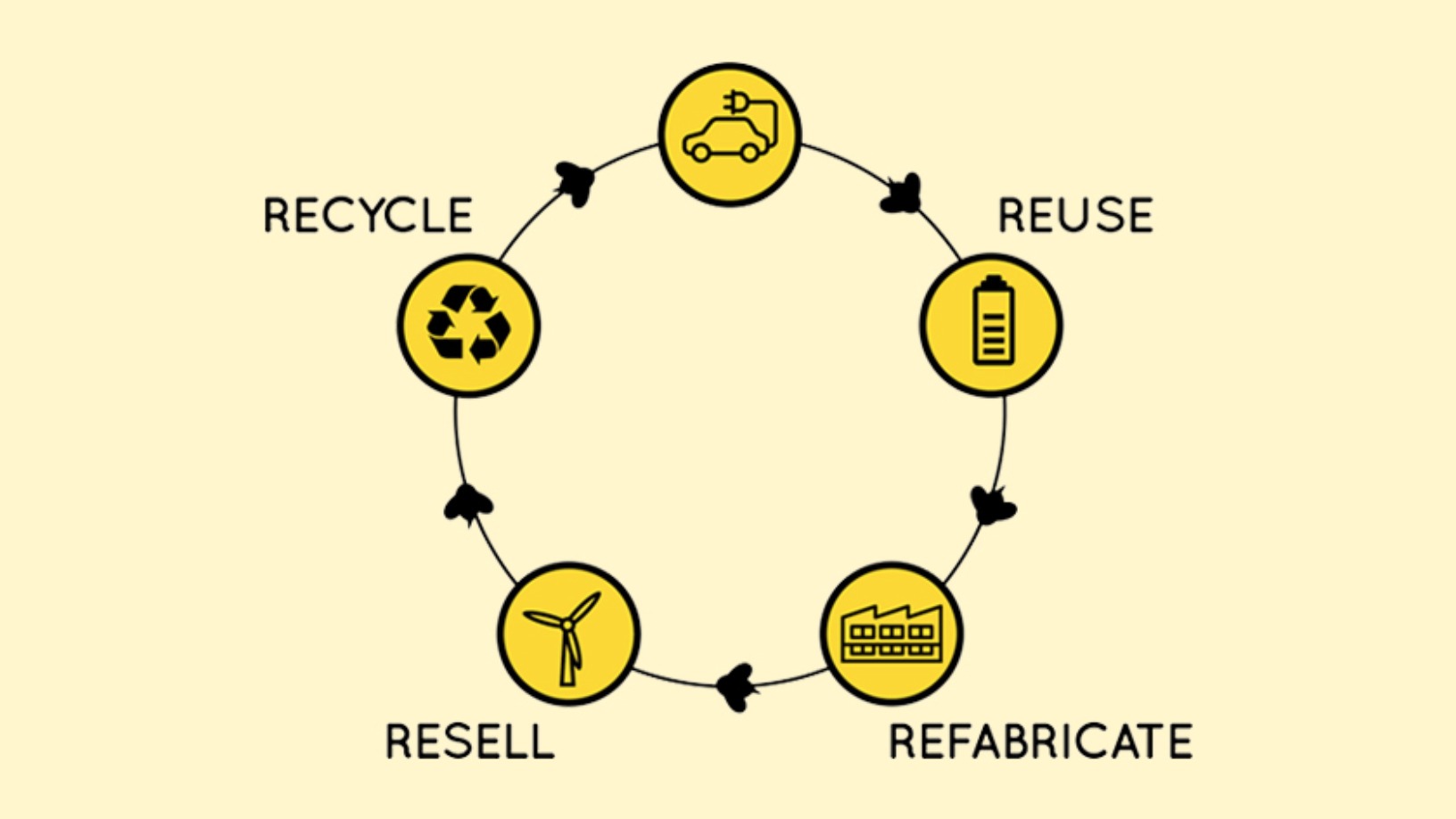

BeePlanet Factory: Recycling EV batteries as a sustainable, profitable business

With 4kWh–200kWh residential and industrial battery packs, the Pamplona-based startup wants to scale its energy storage solutions in the agri-food sector, camping sites and mountain huts

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Bluepha to boost PHA bioplastics production with $30m fresh funding

The Beijing-based startup aims to produce 10,000 tons of PHA bioplastic a year and build a SynBio community through its STEM education spinoff, Bluepha Lab

String Bio: Asia's first startup to harness methane gas for protein production

Using bacteria to turn the harmful greenhouse gas into a purer form of protein, String Bio is raising Series B funding to scale production

Waste management startup Magalarva aims for profitability with new factory, B2B services

Partnerships with supermarkets and waste transporters provide Magalarva with new revenue streams and sources of production input as the company ramps up its manufacturing activities

Qorium: Lab-grown premium leather for the future of luxury

The Dutch biotech startup co-founded by cell-based meat pioneer Mark Post is targeting the luxury goods market with its “clean leather” sheets made from cultivating bovine skin cells, and plans to raise up to €100m

Linptech: Smart home devices powered by movement

The first in China to tap kinetic energy to control smart home devices, Linptech has seen its wireless, battery-free products used in smart homes, and even at the Tokyo Olympics

Solatom plans overseas expansion with backing from energy giants, impact investor

With a US patent in hand, the Valencian startup is banking on international sales of its concentrated solar power modules, targeting €1m in revenue by end-2021

COMY Energy: Closing the plastic waste loop with chemical recycling

The Chinese startup transforms plastic wastes to virgin-quality recycled products without releasing toxic gas or pollution and is attracting interest from petrochemical giants and waste management companies

In-store robots and online doctors serve customers 24/7 at Dingdang Medicine Express

Dingdang also offers cheaper medicines and 28-minute home delivery, thanks to its innovative logistics and partnership models

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

Mycorena: Fungi-based vegan protein challenging traditional plant-based ingredients

Award-winning Swedish biotech startup is scaling production of mycoprotein to become a key player in the emerging market for functional proteins

Future Food Asia 2021: Long road ahead for the clean meat industry

Crucial basic research is still needed to ensure the safety, quality, and production efficiency of lab-grown meat. Concerted public and private sector efforts will accelerate progress

Qairos Energies: Mass producing green hydrogen from industrial hemp

The French startup is seeking a €19m Series B round to produce industrial quantities of green hydrogen and is planning a “circular economy” partnership with local farmers

Sorry, we couldn’t find any matches for“Swanlaab Venture Factory”.