Energy & Cleantech

This function is exclusive for Premium subscribers

-

DATABASE (190)

-

ARTICLES (84)

Schneider Electric is a Europe-based company primarily providing energy management and automation solutions for homes, commercial and industrial-scale properties. The company was originally named Schneider & Cie, founded in 1836 as a metal and weaponry, but between 1975 and 1999 began to refocus towards the electrical industry. The company was renamed Schneider Electric in 1999.Schneider’s technologies focus on managing energy use and conserving energy through a combination of hardware and software. Consequently, Schneider’s investments into startups revolve around the energy sector, with companies like solar power management service Xurya, battery manufacturer Verkor, and building management SaaS Clockworks Analytics as part of their portfolio.

Schneider Electric is a Europe-based company primarily providing energy management and automation solutions for homes, commercial and industrial-scale properties. The company was originally named Schneider & Cie, founded in 1836 as a metal and weaponry, but between 1975 and 1999 began to refocus towards the electrical industry. The company was renamed Schneider Electric in 1999.Schneider’s technologies focus on managing energy use and conserving energy through a combination of hardware and software. Consequently, Schneider’s investments into startups revolve around the energy sector, with companies like solar power management service Xurya, battery manufacturer Verkor, and building management SaaS Clockworks Analytics as part of their portfolio.

Crevisse Partners is a South Korean investor and venture builder with an impact focus. Its name stands for “Creative, Visionary and Social Entrepreneurs”. Originally incorporated in 2004, Crevisse claims to be the first impact investor in Korea, even before such terms became commonplace. The company strives to develop businesses in sectors “where the market principle wasn’t working”.Crevisse has internally incubated a number of companies in South Korea, such as reusable drinking cup company BringYourCup, sustainable forestry firm Forest Trust, and fundraising service DONUS. Crevisse Ventures is the company’s dedicated VC arm that manages a $20m fund and a number of blended finance funds through collaborations with government agencies and financial institutions. In particular, Crevisse Ventures focuses on startups that solve problems in four major areas: urban communities; climate and energy; education and welfare; as well as jobs and economic growth.

Crevisse Partners is a South Korean investor and venture builder with an impact focus. Its name stands for “Creative, Visionary and Social Entrepreneurs”. Originally incorporated in 2004, Crevisse claims to be the first impact investor in Korea, even before such terms became commonplace. The company strives to develop businesses in sectors “where the market principle wasn’t working”.Crevisse has internally incubated a number of companies in South Korea, such as reusable drinking cup company BringYourCup, sustainable forestry firm Forest Trust, and fundraising service DONUS. Crevisse Ventures is the company’s dedicated VC arm that manages a $20m fund and a number of blended finance funds through collaborations with government agencies and financial institutions. In particular, Crevisse Ventures focuses on startups that solve problems in four major areas: urban communities; climate and energy; education and welfare; as well as jobs and economic growth.

New Energy Nexus is a US-based investor and startup support organization that focuses on the clean energy sector. The company was originally known as the California Clean Energy Fund (CalCEF) and has invested in SolarCentury and Tesla Motors. Since 2015, New Energy Nexus has been working with international partners like GIZ (the German agency for international development) and IKEA Foundation to promote renewables and smart energy worldwide. In 2018, New Energy Nexus launched its Southeast Asian operations by establishing offices in Indonesia and Thailand.New Energy Nexus supports startups through incubator and accelerator programs, hackathons, public talks, grants and equity investments. So far, it has invested in four Indonesian startups, including B2B rooftop solar service provider Xurya and solar equipment marketplace BLUE, and distributed nearly $50,000 in grants.

New Energy Nexus is a US-based investor and startup support organization that focuses on the clean energy sector. The company was originally known as the California Clean Energy Fund (CalCEF) and has invested in SolarCentury and Tesla Motors. Since 2015, New Energy Nexus has been working with international partners like GIZ (the German agency for international development) and IKEA Foundation to promote renewables and smart energy worldwide. In 2018, New Energy Nexus launched its Southeast Asian operations by establishing offices in Indonesia and Thailand.New Energy Nexus supports startups through incubator and accelerator programs, hackathons, public talks, grants and equity investments. So far, it has invested in four Indonesian startups, including B2B rooftop solar service provider Xurya and solar equipment marketplace BLUE, and distributed nearly $50,000 in grants.

London-based Sustainability Ventures is one of the UK’s leading early-stage investors in Cleantech. It comprises a group of successful entrepreneurs with a track record in building and investing in high-growth start-ups. It has created Europe’s largest ecosystem for cleantech and sustainability startups, as a business founder and investor, provider of accelerator and support services and provider of shared workspaces. Active since 2011, Sustainability Ventures has raised £250m in total equity funds to date. Its focus is on agritech and food, building technology, circular economy, future energy and mobility. It has established 10 companies, invested in 30 and supported the development of over 250 more enterprises as of 2021 and aims to develop 1,000 sustainable startups by 2025.

London-based Sustainability Ventures is one of the UK’s leading early-stage investors in Cleantech. It comprises a group of successful entrepreneurs with a track record in building and investing in high-growth start-ups. It has created Europe’s largest ecosystem for cleantech and sustainability startups, as a business founder and investor, provider of accelerator and support services and provider of shared workspaces. Active since 2011, Sustainability Ventures has raised £250m in total equity funds to date. Its focus is on agritech and food, building technology, circular economy, future energy and mobility. It has established 10 companies, invested in 30 and supported the development of over 250 more enterprises as of 2021 and aims to develop 1,000 sustainable startups by 2025.

Founded in London in 2009, Parkwalk is a specialist investor in deeptech spin-offs created at UK universities. Parkwalk currently has over £375m of assets under management and has invested in over 100 companies to date, emanating from the universities in Oxford, Cambridge, Imperial and Bristol, becoming the UK’s most active VC outside London. It currently has 143 portfolio companies, Its recent investments include the $17m May 2021 Series A round of cell therapy medtech Mogrify and in the April 2021 £1.9m seed round of HexagonFab, a medtech producing analytical lab instruments.

Founded in London in 2009, Parkwalk is a specialist investor in deeptech spin-offs created at UK universities. Parkwalk currently has over £375m of assets under management and has invested in over 100 companies to date, emanating from the universities in Oxford, Cambridge, Imperial and Bristol, becoming the UK’s most active VC outside London. It currently has 143 portfolio companies, Its recent investments include the $17m May 2021 Series A round of cell therapy medtech Mogrify and in the April 2021 £1.9m seed round of HexagonFab, a medtech producing analytical lab instruments.

Founded in 2017 in Hong Kong, Happiness Capital invests in seed to growth stage companies in the US, Europe, Israel, and China, with a focus on issues affecting global happiness within the areas of citizen trust, food, health, climate change, and reduced inequalities. It hosts its own annual contest, the Super Happiness Challenge , a global open innovation contest to fund individuals and startups with ideas and new products or services that tapped into unmet needs to achieve happiness, with a possible $1m in total investment on offer. The VC currently has 37 startups in its portfolio, around half of which are in foodtech and agtech. Its most recent investments include leading the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions, and co-leading the $29m February 2021 Series A round of Israeli 3D printed alt-meat startup Redefine Meat.

Founded in 2017 in Hong Kong, Happiness Capital invests in seed to growth stage companies in the US, Europe, Israel, and China, with a focus on issues affecting global happiness within the areas of citizen trust, food, health, climate change, and reduced inequalities. It hosts its own annual contest, the Super Happiness Challenge , a global open innovation contest to fund individuals and startups with ideas and new products or services that tapped into unmet needs to achieve happiness, with a possible $1m in total investment on offer. The VC currently has 37 startups in its portfolio, around half of which are in foodtech and agtech. Its most recent investments include leading the $4.7m July 2021 seed funding round of NovoNutrients, the US-based biotech producer of alt-protein from fermentation using CO2 and other emissions, and co-leading the $29m February 2021 Series A round of Israeli 3D printed alt-meat startup Redefine Meat.

Stanford Graduate School of Business

Launched in 2015, the Stanford GSB Impact Fund invests globally in innovators and tech startups whether connected with the university or not and within the area of social impact in seven market segments: education, energy and the environment, fintech, food and agriculture, justice, healthcare, and urban development. The university-owned fund invests from the pre-seed to Series A rounds and makes investments mostly from January to April. It currently has 11 startups in its portfolio.

Launched in 2015, the Stanford GSB Impact Fund invests globally in innovators and tech startups whether connected with the university or not and within the area of social impact in seven market segments: education, energy and the environment, fintech, food and agriculture, justice, healthcare, and urban development. The university-owned fund invests from the pre-seed to Series A rounds and makes investments mostly from January to April. It currently has 11 startups in its portfolio.

Royal Golden Eagle (RGE) is an industrial group owned by Indonesian tycoon Sukanto Tanoto. It employs 60,000 people worldwide with assets worth over $20bn. Tanoto started his business empire in 1967 as a supplier of spare parts to oil and construction companies in Indonesia. He went on to invest in oil palm plantations in 1979. Since 1985, his group companies have been managing 30,000 acres of oil palm trees each year across a total land area of 160,000 hectares.Headquartered in Singapore, RGE has interests in diverse sectors like paper palm oil, viscose, asset management, real estate, construction and energy. RGE owns the world’s largest viscose producer Sateri, Asia Pacific Rayon and energy firm Pacific Oil & Gas. It is also the owner of the Asia Pacific Resources International Holdings Limited (APRIL), one of the world’s largest pulp and paper mills. The Rainforest Action Network and other NGOs like Greenpeace and the WWF have put considerable pressure on the RGE group’s unsustainable operations such as the destruction of rainforests by APRIL. In 2019, RGE announced plans to invest $200m in cellulosic textile fiber research and development over a period of 10 years. Projects will include the scaling up of proven clean technology in fiber manufacturing, bringing pilot-scale production to commercial scale and R&D in emerging frontier solutions.

Royal Golden Eagle (RGE) is an industrial group owned by Indonesian tycoon Sukanto Tanoto. It employs 60,000 people worldwide with assets worth over $20bn. Tanoto started his business empire in 1967 as a supplier of spare parts to oil and construction companies in Indonesia. He went on to invest in oil palm plantations in 1979. Since 1985, his group companies have been managing 30,000 acres of oil palm trees each year across a total land area of 160,000 hectares.Headquartered in Singapore, RGE has interests in diverse sectors like paper palm oil, viscose, asset management, real estate, construction and energy. RGE owns the world’s largest viscose producer Sateri, Asia Pacific Rayon and energy firm Pacific Oil & Gas. It is also the owner of the Asia Pacific Resources International Holdings Limited (APRIL), one of the world’s largest pulp and paper mills. The Rainforest Action Network and other NGOs like Greenpeace and the WWF have put considerable pressure on the RGE group’s unsustainable operations such as the destruction of rainforests by APRIL. In 2019, RGE announced plans to invest $200m in cellulosic textile fiber research and development over a period of 10 years. Projects will include the scaling up of proven clean technology in fiber manufacturing, bringing pilot-scale production to commercial scale and R&D in emerging frontier solutions.

Fortum Oyj is a Finnish state-owned energy company operating power plants and co-generation plants across the nation. Listed on the NASDAQ OMX Helsinki stock exchange, Fortum is reputed to be Finland’s biggest company in terms of revenue generated in 2020.It is also Europe's third-largest producer of carbon-free electricity and the second-largest producer of nuclear power. Ranked as the fifth largest heat producer globally, Fortum supplies electricity and heating directly to consumers in Finland, Germany, Central Europe, the UK and the Nordic countries.Fortum invested in Finnish cleantech Infinited Fiber, taking up a 4% stake in 2019, to complement the energy company’s biorefining value chain and to improve resource efficiency. The cleantech investee aims to license its biodegradable fiber technology to help industry partners to manufacture innovative materials from textile and industrial waste.

Fortum Oyj is a Finnish state-owned energy company operating power plants and co-generation plants across the nation. Listed on the NASDAQ OMX Helsinki stock exchange, Fortum is reputed to be Finland’s biggest company in terms of revenue generated in 2020.It is also Europe's third-largest producer of carbon-free electricity and the second-largest producer of nuclear power. Ranked as the fifth largest heat producer globally, Fortum supplies electricity and heating directly to consumers in Finland, Germany, Central Europe, the UK and the Nordic countries.Fortum invested in Finnish cleantech Infinited Fiber, taking up a 4% stake in 2019, to complement the energy company’s biorefining value chain and to improve resource efficiency. The cleantech investee aims to license its biodegradable fiber technology to help industry partners to manufacture innovative materials from textile and industrial waste.

Founded in Amsterdam in 2011, Rockstart is a global accelerator-VC focusing on sustainability startups across market segments. Rockstart also runs specialist programs like agrifood in Copenhagen, healthcare in the Dutch town of Nijmegen and also in emerging tech in Bogota, Colombia. It specializes in developing business relationships for portfolio startups with global corporates such as Maersk, Shell and the Dutch Ministry of Health. Rockstart has invested in more than 250 startups, valued at €750m in total.Launched in 2019, Rockstart’s €22m agrifood fund secured investment partners including Vaekstfonden’s Green Future Fund and global dairy cooperative Arla Foods. It has invested in 20 food enterprises like Swiss zero-waste supermarket Lyfa and Danish alt-leather startup Beyond Leather Materials in 2021. Rockstart’s energy fund recently invested in the €730,000 pre-seed round of Danish carbon sequestration corporate marketplace, Klimate, in September 2021. Exits include Wercker, iClinic, Brincr and 3D Hubs.

Founded in Amsterdam in 2011, Rockstart is a global accelerator-VC focusing on sustainability startups across market segments. Rockstart also runs specialist programs like agrifood in Copenhagen, healthcare in the Dutch town of Nijmegen and also in emerging tech in Bogota, Colombia. It specializes in developing business relationships for portfolio startups with global corporates such as Maersk, Shell and the Dutch Ministry of Health. Rockstart has invested in more than 250 startups, valued at €750m in total.Launched in 2019, Rockstart’s €22m agrifood fund secured investment partners including Vaekstfonden’s Green Future Fund and global dairy cooperative Arla Foods. It has invested in 20 food enterprises like Swiss zero-waste supermarket Lyfa and Danish alt-leather startup Beyond Leather Materials in 2021. Rockstart’s energy fund recently invested in the €730,000 pre-seed round of Danish carbon sequestration corporate marketplace, Klimate, in September 2021. Exits include Wercker, iClinic, Brincr and 3D Hubs.

Europe ramps up development of local EV battery sector in race to zero emissions

Startups, automakers jostle or unite to ride the fast-growing EV battery market, as the EU pumps billions into developing its own value chain, to cut reliance on imports

SWITCH Singapore 2021: Driving renewable energy impact through better business models

Startups need to communicate the business benefits of green solutions to their customers, rather than just pitching the hi-tech

SWITCH Singapore 2021: Tapping the $1tn sustainability market in Southeast Asia

Falling costs and simplified deployment of sustainability solutions will help boost adoption, especially in underprivileged communities

SWITCH Singapore 2021: How startups, corporates and government can co-create smart cities

The next generation of adaptive spaces will harness big data, deep tech and analytics to respond intelligently to both changing environments and human needs, says an expert panel

Forget solar panels and batteries, Bioo wants to scale soil bioelectricity generation

Improving on NASA’s microbial fuel cell tech, Bioo hopes to boost crop efficiency and transform the way urbanites live, in future green cities powered by plants

Verkor: Accelerating low‑carbon battery production in France

French startup Verkor aims to raise up to €1.3bn by the end of next year to finance its first Gigafactory producing sustainable lithium-ion batteries for the European market

Indonesian angel investor network ANGIN launches agrifood incubator

Program targets ESG investment and builds on the strong potential of Indonesia’s agriculture sector, which kept growing despite the Covid-19 pandemic

Beyond Leather Materials: Turning apples into alt-leather for sustainable fashion

Through its Leap brand, the Danish startup cuts food waste by turning apples junked in cider factories into affordable vegan leather for the $100bn leather market

Bound4Blue’s aeronautical tech propels first sustainable shipping vessel in the Pacific

Winning €5m fresh funding, Bound4Blue also scores with its EC-backed pilot, the first of its kind, offering new possibilities to cargo vessels seeking sustainable transportation

Linptech: Smart home devices powered by movement

The first in China to tap kinetic energy to control smart home devices, Linptech has seen its wireless, battery-free products used in smart homes, and even at the Tokyo Olympics

NovoNutrients: Tackling the dual problems of CO2 emissions and over-fishing

The first to transform CO2 to fish food, NovoNutrients is trialing with industry giants Skretting and Chevron, and will soon raise Series A funding

Sequoia Capital China holds steady with investments in healthcare, biotech and green economy

China’s most active investor increases bets on sectors beyond the consumer internet and edtech recently hurt by regulatory clampdown

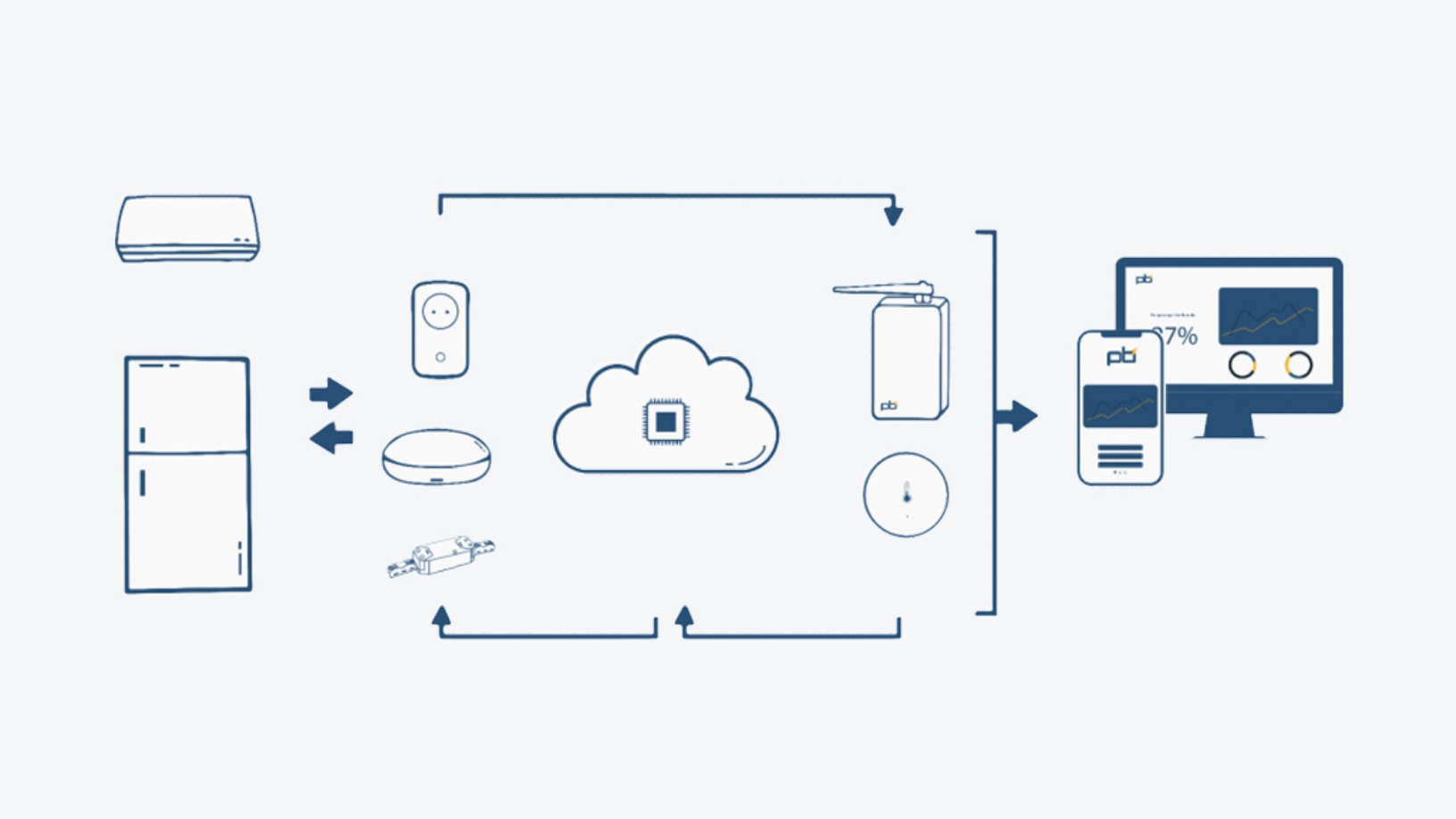

Powerbrain: Saving energy and cutting emissions for SMEs, with none of the fuss

Already profitable within a year of running, Powerbrain is raising funds to protect its IPs and enter new verticals in Indonesia’s energy management business

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Viezo: Vibration energy harvesting to power sensors and IoT devices

Disrupting the battery market, Viezo’s proprietary technology, PolyFilm, can also boost operational efficiency and slash maintenance costs of sensors and IoT devices