US’ Beyond Meat and Impossible Foods may be the biggest global names now for alternative proteins, but another brand is fast-rising – Heura – whose difference is not only its Spanish origins but also the environmental sustainability focus at the core of its identity.

Heura foods cover a range of soy-based products that mimic chicken or beef, from meatballs to spicy chunks that can be used in a variety of cuisines. Barcelona-based Foods for Tomorrow, the startup behind Heura, currently sells the products in nine countries across three continents in about 3,000 retail points, including supermarkets, restaurant chains, and online food, vegetarian and vegan stores.

“We are offering a product that aims to be the successor to meat, given that far less resources are required to obtain the same quantity of Heura as animal meat,” said Foods for Tomorrow CEO and co-founder Marc Coloma.

The company’s co-founders, both vegans and environmentalists, conceived their business idea in 2017 at a training program organized by a local government business promotion agency. Their goal? Environmental sustainability through a paradigm shift in eating habits. Last month, Foods for Tomorrow announced it would replace 80% of the 16 tons of plastic it was using with recycled cardboard, saving 12.85 tons of plastic waste.

“If there are more [plant-based protein] brands, it means we are doing things right and we are witnessing a tendency that is here to stay, not just a fashion,” said Bernat Añaños Martínez, Heura’s otherco-founder and Chief Social Movement Officer. “We see Foods for Tomorrow as having a leading role as the generation that will stop using animals to produce protein,” he said.

Low in calories, salt and fat

Despite the increasingly crowded meat substitute market, there is room for all, said Foods for Tomorrow. In Spain, Heura already enjoys widespread success, where it retails in some of the biggest food retailers and restaurant chains.

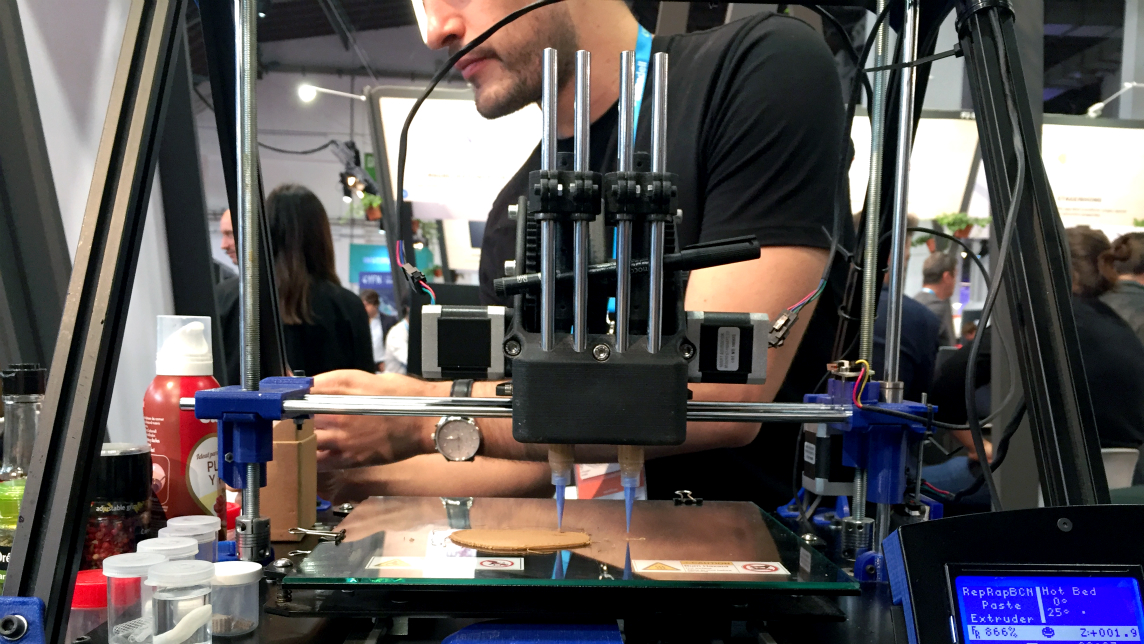

Unlike rival brands that produce lab-grown, plant-based proteins, the key ingredient Heura uses is unprocessed soy. Other ingredients include water, olive oil, salt, black pepper, chili, ginger, cardamom, mace and nuts. Vitamin B12 is also added. The concentrated soybean protein is mixed with filtered water to produce a mixture that is subjected to a process of wet extrusion.

Añaños calls this the “third generation of vegetable proteins” that replaces fermented products like tofu and tempeh produced by the process of dry extrusion. Using a screw system, the mixture is propelled through a die and simultaneously exposed to high temperatures to achieve the texture of meat, similar to meat-based sausages. Moisture is maintained, so unlike dry-extruded products, Heura’s products do not need to be cooked.

Not only are Heura products low in calories, salt and fat compared with many other meat substitutes, they are twice as high in protein compared with eggs, rich in fiber and iron, provide the nutritional benefits of vegetables; and are gluten-free.

“When we talk about the third generation of plant-based proteins, we refer to a new generation of wet extruded products which have fibrous textures and a complete structure, simplifying the ingredients because, with this process, it’s not necessary to add conservants or binding agents to agglutinate the product,” said Añaños.

Foods for Tomorrow says its products use 40 times less than the 20kg of cereals and pulses needed to produce 1kg of beef and also need 94% less water than for the same amount of beef. Its products will also save 1.1m chickens from slaughter in 2020, it added.

The company blames livestock for creating more greenhouse gases than emissions from all forms of transportation. The rearing of livestock, particularly those that need grazing land like cattle, sheep and goats, also uses over a quarter of the world's land, which is more than three-quarters of the area used for agriculture.

Major retailers on board

Foods for Tomorrow posted revenue of €2.5m in 2019, evenbefore several of its retail partnerships had takenoff. Major Spanish retailers stocking Heura products now include Carrefour,which, in December 2019, signed an agreement for the supply of Heura products to 53 of its hypermarkets. In the same month, it also partnered with Spain's main department store, El Corte Ingles, to supply 35 of its supermarkets.

Earlier partnerships included with Spain's main frozen food retailer La Sirena, with 120 stores; the supply of vegan dishes to Japanese-food restaurant chain Udon’s 56 outlets; and to Spain's main sandwich chain, Pans&Company, with more than 40 outlets.

Foods for Tomorrow began expanding overseas just one year after its 2017 launch. Today, it has a retail presence in France, Italy, the Netherlands and Portugal. It entered its first Asian markets, Hong Kong and Singapore, in December 2019; and the UK this month. It also has a small presence in Canada.

In April 2020, the startup entered Chile, its first Latin American market, where it is now supplying to more than half of Tottus's stores, the nation's largest supermarket chain with 70 outlets, and is set to do the same in Peru. It has signed a distribution agreement for Sweden, with Norway to follow, countries where it sees potential to convert meat-eaters into Heura consumers.

UK, the big test?

From this year, the global meat substitute market is forecast to grow at a CAGR of 15.1% to become worth $17.5bn by 2027. Among the companies attracting huge investments, Impossible Foods raised $200m in a Series G round just in August.

Foods for Tomorrow raised seed funding in a convertible note deal in May from New Capital Crop, the fund by New York-based foodtech VC Unovis. Its earlier backers include Kale Capital, the Swedish plant-based crowdfunded social investor, which will support Heura’s entry into the Scandinavian market; and the EIT-MassChallenge accelerator. The startup has almost 40 full-time staff in its Barcelona offices, double that of early 2019.

CEO Coloma has a background in project management and fundraising at a Catalonian animal charity and Doctors Without Borders (MSF) and as COO of a catering company. In July 2019, he was named to Forbes list of 100 Most Creative People in Business. Añaños worked briefly in China's EventBank, the first smart event management cloud platform, and in the European Parliament's press office. The pair are also involved in environmental initiatives such as a blockchain-based tracking system for agricultural waste.

Foods for Tomorrow’s recent entry into the UK, Europe's largest market for meat substitutes, could prove to be Heura's biggest test so far. UK prices for meat alternatives are significantly lower than Heura's products in Spanish supermarkets, in part due to the competition between several successful local players in the UK market, including Linda McCartney Foods

In contrast, countries like Spain and France have seen no significant competition until now and have higher prices for meat substitutes. Until last year, Lidl was the only major pan-European high street retailer to introduce its own range of alternative proteins.