Unlike most westerners who get to know meat alternatives from the Impossible Burger or Beyond Sausages, many Chinese are getting to know them from mooncakes or steamboat -- largely because of a local startup called Zhenmeat.

Since it was founded in May 2019, Zhenmeat, which translates to "precious meat” in English, has created several meat alternatives tailored to Chinese tastebuds. It made its first splash during the Mid-Autumn festival last year, four months after its founding, when 3,000 boxes of mooncakes made with plant-based meat stuffing sold out in six days. At the same time, the company was working with dim sum franchise Jindingxuan to develop BBQ pork buns and Sichuan noodles with its ground meat. In June 2020, it released meat alternatives of fried pork fillet and crayfish for steamboat meals.

Spurred by the success of Impossible Foods and Beyond Meat, Zhenmeat is among the few new-generation plant-based meat startups that have emerged in China over the last year or so, targeting the more affluent and health-conscious consumers. Zhenmeat is seeking $2m funding this year to finance its expansion in the fast-growing market. Of that total, it has secured “a few hundred thousand US dollars” from Big Idea Ventures, a New York-based venture capital firm, according to Vince Lyu, CEO and founder of Zhenmeat.

Zhenmeat’s local competitors Starfield and Hey Maet aren’t lagging behind. In August, Hey Maet raised seed funding of about RMB 10m and Starfield raised Series A funding, with a total funding so far of over $10m. Then there is Hong Kong-based OmniPork, which launched its products in franchised retail stores in the same period.

A panacea for China

Lyu majored in materials science and protein properties at the University of Illinois at Urbana-Champaign in the US. In 2014, he founded a startup Fuchouzhe to produce protein bars, targeting fitness enthusiasts for a healthier nutrition boost. He has even higher hopes for Zhenmeat.

“Meat is one of the most important staples in the Chinese diet. However, the meat industry has many problems," said Lyu. ”The average meat consumption per person in China is increasing every year, while natural disasters and the spread of African swine flu have affected the meat supply."

Data shows China may face a meat deficit of 38m tons in 2030. "If plant-based meat can make up 5% of this, the market size will reach over RMB 100bn," said Lyu.

Plant-based meat also caters to the healthier diet trend in China, especially among young people. According to several 2019 reports by Meituan, one of China's biggest food delivery companies, the number of “light food” orders offering low calories, low fat and high fiber almost doubled year on year and the number of vendors who sold light food increased 58%. About 62% of people who order light food were born in the 1990s and 26% were born in the ’80s. The two age groups have a combined population of 400m in China.

“One of our main target groups is young people,” said Zhou Qiyu, Zhenmeat's COO. "They have a natural curiosity for new concepts and things, especially when the idea of plant-based meat is futuristic with a sense of tech."

According to data from Tmall, Alibaba's e-shopping website, the majority of plant-based meat buyers include young people who embrace new things, and those with high education and high income, who value quality.

Growing concern about meat safety due to the African swine flu and Covid-19 crises is also attracting Chinese consumers to plant-based food. Pork consumption in China, the world’s largest, fell by about 25% in 2019 and is expected to decline a further 10% to 15% this year. Consumers and food processors have shied away from the meat amid the local swine flu outbreak that decimated 55% of China’s pig population in 2019 from 440m normally, estimated agri-focused Rabobank. Euromonitor forecasts that China's meat substitute industry will reach $11.9bn by 2023.

Old concept, new opportunities

China has a long history of using bean protein as a substitute for meat. Tofu is one example whose history can be traced back over 700 years.

Most common is “surou," or mock meat made of wheat gluten, beans and mushrooms, which visually resembles real meat while tasting like bean food. They are popular among Chinese vegetarians or Buddhists, though production is often small scale and the processing method is still traditional: surou tastes nothing like real meat.

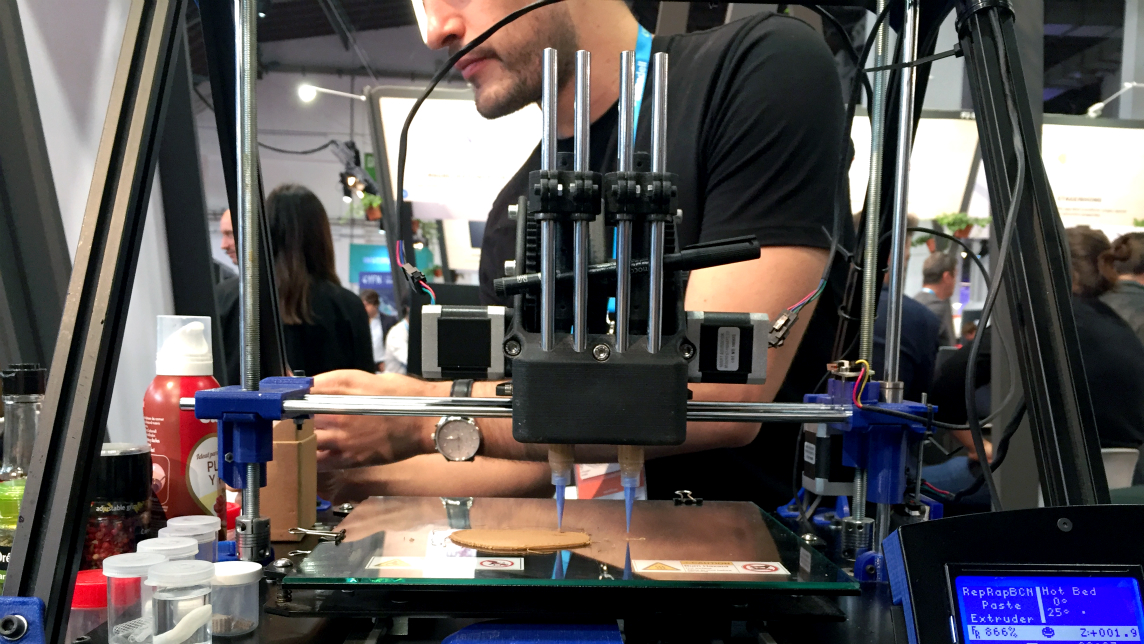

Applying current technologies in food processing, principally thermoextrusion, Zhenmeat uses pea as its main raw material for the protein, similar to Beyond Meat and Impossible Foods. In China, the pea protein is a byproduct of another Chinese product: fensi, a noodle-like food made out of starch. This reduces the cost of pea protein and, according to Lyu, allows Zhenmeat's products to cost less than those of its overseas rivals. For example, Zhenmeat's ground beef substitute is no more expensive than real beef, while that of Beyond Meat is 15–20% higher.

In addition to lower cost, Zhenmeat also provides more forms of meat substitute than its western counterparts. While US food startups focus on producing meat patties and steaks – the most common meat forms in western cooking – Zhenmeat aims to develop sliced, cubed and shredded meat to meet the demands of China’s diverse cuisine.

"Global brands are not familiar with Chinese cuisine, which gives domestic companies some advantages," Lyu said, noting that Zhenmeat is partnering with local restaurants and factories for new products.

The company has also planned to develop fresh ground meat, steak, meat sauce and meat jerkies. It is focusing on attracting franchised restaurants with broad customer bases to promote its products more effectively.

Head-to-head in an emerging market

Despite its initial success in promoting plant-based meat in the Chinese market, Zhenmeat expects a tough battle ahead with bigger foreign brands and local players all in the same space. Beyond Meat has announced plans to set up factories in Zhejiang, making it the first foreign company to do so. These factories are planning to produce plant-based meat, including chicken, beef, and pork within months. Impossible Foods is also looking for partners in China to take a share of the market.

Older Chinese food companies like Jinzi Ham and MYS Group are also in the fray. Jinzi Ham in October 2019 announced a plant-based meat product it developed with Danisco (China) Investment, a unit of DuPont, that was cholesterol-free and contained no animal hormones or antibiotics. The company also sold 1,000 beef-flavoured artificial patties in an online sales event that year, and said it is able to produce five tons of plant-based meat products a day, Xinhua reported. MYS also said in October it was conducting research into creating plant-based meat.

To retain its competitiveness, Lyu said Zhenmeat will further improve its recipes with more R&D investment and equipment while increasing its production.

Until now, Zhenmeat has been working with more than 10 food companies of substantial strength. Among them are Shuangta Food, a listed corporate champion in the fensi industry, and Whole Perfect Food, one of the largest long-standing vegetarian food manufacturers.

“In three years, we would like to lower the retail price of our products below that of real meat,” said Lyu. "That's what the industry is aiming at."