2020

-

DATABASE (138)

-

ARTICLES (396)

Co-founder and CEO of Kopi Kenangan

Edward Tirtanata is best known for establishing Kopi Kenangan, the popular grab-and-go coffee chain. Prior to that, however, the finance and accounting graduate from Northeastern University, USA, had established Lewis & Carroll, a premium establishment serving artisanal tea. Unfortunately, the brand struggled to grow among Indonesia's budget-conscious youths, who preferred the cheaper bubble tea. Learning from the experience, he decided to eschew the Starbucks-style “third home” retail concept and opted for grab-and-go stalls that are cheaper to establish, but without abandoning the quality of the coffee served. The concept proved to be a hit, and Tirtanata's new venture became a nationwide sensation.Aside from his role as CEO of Kopi Kenangan, Tirtanata is getting more deeply involved in the F&B startup ecosystem. In February 2020, he joined Gojek and startup ecosystem builder Digitaraya in establishing Digitarasa, a new accelerator program for F&B businesses.

Edward Tirtanata is best known for establishing Kopi Kenangan, the popular grab-and-go coffee chain. Prior to that, however, the finance and accounting graduate from Northeastern University, USA, had established Lewis & Carroll, a premium establishment serving artisanal tea. Unfortunately, the brand struggled to grow among Indonesia's budget-conscious youths, who preferred the cheaper bubble tea. Learning from the experience, he decided to eschew the Starbucks-style “third home” retail concept and opted for grab-and-go stalls that are cheaper to establish, but without abandoning the quality of the coffee served. The concept proved to be a hit, and Tirtanata's new venture became a nationwide sensation.Aside from his role as CEO of Kopi Kenangan, Tirtanata is getting more deeply involved in the F&B startup ecosystem. In February 2020, he joined Gojek and startup ecosystem builder Digitaraya in establishing Digitarasa, a new accelerator program for F&B businesses.

Co-founder, CEO of Sea Water Analytics

Javier Colmenarejo is the Spanish co-founder and CEO of Sea Water Analytics, a tourism-focused data aggregator with user app to measure seawater quality. The technology has been in development since 2017, though the company was formally launched in Madrid in April 2020. He has spent more than 15 years as a civil engineer, working in hydraulic and water treatment systems. He currently works on smart city initiatives on the Adapting Cities to Change program in Madrid and he lectures in Big Data, IoT, Data Services and Business in two Madrid institutions. He works part-time at Sea Water Analytics' technical partner Talentum as a blockchain and IoT innovation manager.Colmenarejo holds four master's degrees: in Big Data and Business Analytics from Madrid's School of Industrial Organization (EIO); in Data Science and IoT from Madrid Institute of Things Institute; in Business Administration from The Power MBA; and in civil engineering from the Polytechnic University of Madrid.

Javier Colmenarejo is the Spanish co-founder and CEO of Sea Water Analytics, a tourism-focused data aggregator with user app to measure seawater quality. The technology has been in development since 2017, though the company was formally launched in Madrid in April 2020. He has spent more than 15 years as a civil engineer, working in hydraulic and water treatment systems. He currently works on smart city initiatives on the Adapting Cities to Change program in Madrid and he lectures in Big Data, IoT, Data Services and Business in two Madrid institutions. He works part-time at Sea Water Analytics' technical partner Talentum as a blockchain and IoT innovation manager.Colmenarejo holds four master's degrees: in Big Data and Business Analytics from Madrid's School of Industrial Organization (EIO); in Data Science and IoT from Madrid Institute of Things Institute; in Business Administration from The Power MBA; and in civil engineering from the Polytechnic University of Madrid.

CTO and co-founder of iLoF

Joana Paiva graduated in 2014 with a master’s in biomedical engineering at the University of Coimbra in Portugal. She went on to complete a PhD in physics at the University of Porto in 2019.In 2014, she also worked at INESC Technology and Science for almost five years while completing her PhD thesis: Intelligent Lab on Fiber tools for sensing single-cells and extracellular nano-vesicles. It was her research that led to the founding of medtech startup iLoF.In August 2019, she co-founded iLoF as CTO. The Oxford-Oporto-based startup enables personalized medicine through the use of AI and photonics to create optical fingerprints in a cloud-based library to collate disease biomarkers and biological profiles.Based in Porto, she is also a co-inventor with three patents and 29 scientific publications. She is one of Forbes 30 Under 30 for science and healthcare and was nominated for the EIT Woman Award 2020.

Joana Paiva graduated in 2014 with a master’s in biomedical engineering at the University of Coimbra in Portugal. She went on to complete a PhD in physics at the University of Porto in 2019.In 2014, she also worked at INESC Technology and Science for almost five years while completing her PhD thesis: Intelligent Lab on Fiber tools for sensing single-cells and extracellular nano-vesicles. It was her research that led to the founding of medtech startup iLoF.In August 2019, she co-founded iLoF as CTO. The Oxford-Oporto-based startup enables personalized medicine through the use of AI and photonics to create optical fingerprints in a cloud-based library to collate disease biomarkers and biological profiles.Based in Porto, she is also a co-inventor with three patents and 29 scientific publications. She is one of Forbes 30 Under 30 for science and healthcare and was nominated for the EIT Woman Award 2020.

CEO and co-founder of TurtleTree Labs

Cheese connoisseur, Lin Fengru, was unable to find milk that allowed her to make high-quality cheese. During her search around dairy farms in Asia, she realized that the poor quality of the milk was due to animal hygiene issues and the use of antibiotics and hormones on cows. The lack of quality dairy milk options inspired her to co-found TurtleTree Labs in January 2019 to create milk using stem cells.Lin graduated in information systems management and marketing in 2011 at Singapore Management University (SMU). In 2011, she joined Collis Asia as an account manager and left in 2014 to work at Salesforce in sales and business development. She joined Google Singapore in 2018 and worked as a territory account manager for Google Cloud Platform until June 2019. In 2020, she completed an MIT course in the science and business of biotechnology.

Cheese connoisseur, Lin Fengru, was unable to find milk that allowed her to make high-quality cheese. During her search around dairy farms in Asia, she realized that the poor quality of the milk was due to animal hygiene issues and the use of antibiotics and hormones on cows. The lack of quality dairy milk options inspired her to co-found TurtleTree Labs in January 2019 to create milk using stem cells.Lin graduated in information systems management and marketing in 2011 at Singapore Management University (SMU). In 2011, she joined Collis Asia as an account manager and left in 2014 to work at Salesforce in sales and business development. She joined Google Singapore in 2018 and worked as a territory account manager for Google Cloud Platform until June 2019. In 2020, she completed an MIT course in the science and business of biotechnology.

SoftBank announced its second Vision Fund of about $108bn in July 2019 to invest in technology startups across the world. SoftBank had originally planned to contribute $38bn to the new fund. However, its Vision Fund I was badly affected by the Covid-19 pandemic and losses resulting in lower valuations of its investments in Uber and WeWork.In February 2020, the Japanese conglomerate decided to inject more money into the Vision Fund II before raising new funds from other LPs. With $10bn committed to the second fund by the SoftBank Group, the new fund has now invested in 13 portfolio companies including co-leading the Series C round for XAG in November 2020.

SoftBank announced its second Vision Fund of about $108bn in July 2019 to invest in technology startups across the world. SoftBank had originally planned to contribute $38bn to the new fund. However, its Vision Fund I was badly affected by the Covid-19 pandemic and losses resulting in lower valuations of its investments in Uber and WeWork.In February 2020, the Japanese conglomerate decided to inject more money into the Vision Fund II before raising new funds from other LPs. With $10bn committed to the second fund by the SoftBank Group, the new fund has now invested in 13 portfolio companies including co-leading the Series C round for XAG in November 2020.

Founded in 2015, M25 is an early-stage VC based in Chicago, investing solely in companies headquartered in the US Midwest across tech sectors, almost exclusively at seed stage. It currently has 77 companies in its portfolio and has managed eight exits to date. Its most recent investments include in gaming monetization app Metafy’s $3m seed round in December 2020 and in the $2.7m seed round of mobile online store creation app CASHDROP in August 2020. It invests from $100,000 at the idea stage through to $25m per startup.Im sorry but I dont see that investing in 15 different sectors is actually a focus that is why I put General. it´s mosre like what sectors do they not invest in?

Founded in 2015, M25 is an early-stage VC based in Chicago, investing solely in companies headquartered in the US Midwest across tech sectors, almost exclusively at seed stage. It currently has 77 companies in its portfolio and has managed eight exits to date. Its most recent investments include in gaming monetization app Metafy’s $3m seed round in December 2020 and in the $2.7m seed round of mobile online store creation app CASHDROP in August 2020. It invests from $100,000 at the idea stage through to $25m per startup.Im sorry but I dont see that investing in 15 different sectors is actually a focus that is why I put General. it´s mosre like what sectors do they not invest in?

Based in Amsterdam, BC Begin Capital Limited was established in April 2019 by Alexey Menn as managing partner in Moscow. The VC has invested in five startups. In 2019, it invested in e-grocery food delivery service Samokat that was acquired by Mail.Ru Group.In February 2020, the international firm was lead investor for Finnish fashion marketplace Zadaa, raising €3.5m for its Series A round. Both Begin Capital and Bulgaria’s BrightCap Ventures were lead investors for Woom, raising €2m in May. The two investments are the biggest so far, compared to previous fundraisers for startups like Bulbshare in March 2020.

Based in Amsterdam, BC Begin Capital Limited was established in April 2019 by Alexey Menn as managing partner in Moscow. The VC has invested in five startups. In 2019, it invested in e-grocery food delivery service Samokat that was acquired by Mail.Ru Group.In February 2020, the international firm was lead investor for Finnish fashion marketplace Zadaa, raising €3.5m for its Series A round. Both Begin Capital and Bulgaria’s BrightCap Ventures were lead investors for Woom, raising €2m in May. The two investments are the biggest so far, compared to previous fundraisers for startups like Bulbshare in March 2020.

Established in 2015, Unovis Asset Management is a New York-based investor focussed on the alternative protein sector. It has raised two funds to date, the New Crop Capital Trust and The Alternative Protein Fund. It aims to transform the global food system by investing in solutions that facilitate sustained behavioral change and eliminate the consumption of animal protein products. It partners with entrepreneurs developing innovative plant-based and cultivated replacements to animal products, including meat, seafood, dairy and eggs. It currently has 33 companies in its portfolio and has managed three exits to date including Beyond Meat. Its recent investments include the undisclosed convertible note round of Spanish plant-based meat startup Foods for Tomorrow in May 2020 and in the $28m seed round of US plant-based startup Alpha Foods in February 2020.

Established in 2015, Unovis Asset Management is a New York-based investor focussed on the alternative protein sector. It has raised two funds to date, the New Crop Capital Trust and The Alternative Protein Fund. It aims to transform the global food system by investing in solutions that facilitate sustained behavioral change and eliminate the consumption of animal protein products. It partners with entrepreneurs developing innovative plant-based and cultivated replacements to animal products, including meat, seafood, dairy and eggs. It currently has 33 companies in its portfolio and has managed three exits to date including Beyond Meat. Its recent investments include the undisclosed convertible note round of Spanish plant-based meat startup Foods for Tomorrow in May 2020 and in the $28m seed round of US plant-based startup Alpha Foods in February 2020.

Launched in 2015 in Brussels, EIT Food was established by the not-for-profit European Institute of Innovation & Technology (EIT) and funded by the European Union as an investor and accelerator. Its aim is to support mainly European startups in foodtech areas ranging from traceability to alternative proteins, with sustainability a key deciding factor in the startups it backs from pre-seed to Series-B level. The organization currently has 55 startups in its portfolio, which raised more than €91m in investments in 2020. Its most recent investments include 700,000 Swiss francs (€637,000) in the seed round in January 2021 of Swiss biotech SwissDeCode, a company that applies DNA testing to food traceability. Another investment was the December 2020 €900,000 seed round of Spanish compostable-packaging tech Food Sourcing Specialists.

Launched in 2015 in Brussels, EIT Food was established by the not-for-profit European Institute of Innovation & Technology (EIT) and funded by the European Union as an investor and accelerator. Its aim is to support mainly European startups in foodtech areas ranging from traceability to alternative proteins, with sustainability a key deciding factor in the startups it backs from pre-seed to Series-B level. The organization currently has 55 startups in its portfolio, which raised more than €91m in investments in 2020. Its most recent investments include 700,000 Swiss francs (€637,000) in the seed round in January 2021 of Swiss biotech SwissDeCode, a company that applies DNA testing to food traceability. Another investment was the December 2020 €900,000 seed round of Spanish compostable-packaging tech Food Sourcing Specialists.

Co-CEO and Co-founder of Notpla (formerly Skipping Rocks Lab)

Currently based in London, French national Pierre Yves Paslier completed a master’s in materials science and engineering from INSA in Lyon in 2010. In 2012, he went on to complete a master’s in industrial and product design at the Royal College of Art in London. He also studied innovation design engineering at Imperial College.After graduating in 2014, Paslier and university alumnus Rodrigo García González co-founded Skipping Rocks Lab that was pivoted as Notpla in 2019. Both are co-CEOs of the UK-based startup that develops compostable and edible packaging material made of seaweed and other plants.Before becoming an entrepreneur, Paslier worked as a packaging engineer for L’Oréal from 2010 to 2012. He has been invited to speak at TEDx conferences in Athens and Warwick to share his experience and innovative projects in packaging and product design. In 2020, he became an industrial advisory board member at Imperial College London Dyson School of Design Engineering. In 2019, he also became a fellow of the Royal Academy of Engineering Enterprise Hub.

Currently based in London, French national Pierre Yves Paslier completed a master’s in materials science and engineering from INSA in Lyon in 2010. In 2012, he went on to complete a master’s in industrial and product design at the Royal College of Art in London. He also studied innovation design engineering at Imperial College.After graduating in 2014, Paslier and university alumnus Rodrigo García González co-founded Skipping Rocks Lab that was pivoted as Notpla in 2019. Both are co-CEOs of the UK-based startup that develops compostable and edible packaging material made of seaweed and other plants.Before becoming an entrepreneur, Paslier worked as a packaging engineer for L’Oréal from 2010 to 2012. He has been invited to speak at TEDx conferences in Athens and Warwick to share his experience and innovative projects in packaging and product design. In 2020, he became an industrial advisory board member at Imperial College London Dyson School of Design Engineering. In 2019, he also became a fellow of the Royal Academy of Engineering Enterprise Hub.

Lever VC was founded in 2018 by Nick Cooney, an early investor of Beyond Meat and Memphis Meats. He is also the co-founder of Good Food Institute. Lever has currently invested in 14 startups from the US, Europe, Asia and Latin America.Focused on investments in early-stage alternative protein companies, the firm announced the first close of its Lever VC Fund I in August 2020, with its fourth close at $46m in April 2021. The final close will be completed by June 2021. Investors in the fund include NFL and NBA athletes, British nobility, food businesses, alt-protein companies and family offices as limited partners.In June 2020, Lever launched a $28m joint investment fund and accelerator to invest in Chinese plant-based and cell-cultivated meat and dairy companies. The Lever China Alternative Protein Fund will invest RMB 40m in alt-protein companies in mainland China over the next four years.

Lever VC was founded in 2018 by Nick Cooney, an early investor of Beyond Meat and Memphis Meats. He is also the co-founder of Good Food Institute. Lever has currently invested in 14 startups from the US, Europe, Asia and Latin America.Focused on investments in early-stage alternative protein companies, the firm announced the first close of its Lever VC Fund I in August 2020, with its fourth close at $46m in April 2021. The final close will be completed by June 2021. Investors in the fund include NFL and NBA athletes, British nobility, food businesses, alt-protein companies and family offices as limited partners.In June 2020, Lever launched a $28m joint investment fund and accelerator to invest in Chinese plant-based and cell-cultivated meat and dairy companies. The Lever China Alternative Protein Fund will invest RMB 40m in alt-protein companies in mainland China over the next four years.

David Spector is the president and co-founder of the online lingerie company ThirdLove. A former partner at Sequioa Capital, he is a prolific angel investor with investments in around 30 startups across different geographies and market segments. Spector’s most recent disclosed investments are from 2020 and include participation in the $4.6m seed round of US fintech provider CapChase and in the $70m Series C round of US mobile marketing company Attentive.

David Spector is the president and co-founder of the online lingerie company ThirdLove. A former partner at Sequioa Capital, he is a prolific angel investor with investments in around 30 startups across different geographies and market segments. Spector’s most recent disclosed investments are from 2020 and include participation in the $4.6m seed round of US fintech provider CapChase and in the $70m Series C round of US mobile marketing company Attentive.

Founded in Nairobi in 2017, Chandaria Capital invests in African tech and non-tech startups across market segments. It currently has 13 companies in its portfolio. Recent investments include Kenyan diagnostics medtech startup Ilhara Health’s $3.8m Series A round in 2020 and $735,000 seed funding in 2019. The VC has also joined the seed investment round for Kenyan food and beverage startup Savannah Brand in 2019.

Founded in Nairobi in 2017, Chandaria Capital invests in African tech and non-tech startups across market segments. It currently has 13 companies in its portfolio. Recent investments include Kenyan diagnostics medtech startup Ilhara Health’s $3.8m Series A round in 2020 and $735,000 seed funding in 2019. The VC has also joined the seed investment round for Kenyan food and beverage startup Savannah Brand in 2019.

GoHub Ventures is the Valencia-based corporate venture capital arm of Global Omnium, a company specialised in water management. The firm invests in the seed and scale-up phases with a ticket size between €500,000 - €3m.The comnpany has so far invested €11m until 2020 and is mostly backing deep tech startups working in AI, big data, 3D, IoT and robotics and cybersecurity sectors.

GoHub Ventures is the Valencia-based corporate venture capital arm of Global Omnium, a company specialised in water management. The firm invests in the seed and scale-up phases with a ticket size between €500,000 - €3m.The comnpany has so far invested €11m until 2020 and is mostly backing deep tech startups working in AI, big data, 3D, IoT and robotics and cybersecurity sectors.

Xiaomi is one of the biggest mobile manufacturers in China and also actively invests in emerging startups. It had backed more than 300 companies as of March 2021, totaling RMB 32.3Bn in book value. Through such investments, the company has already built an ecosystem of the internet of things.

Xiaomi is one of the biggest mobile manufacturers in China and also actively invests in emerging startups. It had backed more than 300 companies as of March 2021, totaling RMB 32.3Bn in book value. Through such investments, the company has already built an ecosystem of the internet of things.

HighPitch 2020: Goers wins Indonesia's national startup competition

Event ticketing startup Goers gains new revenue streams with pivot to helping leisure spots go online; hotel SaaS Izy and on-demand medical testing service CekLab also in top three

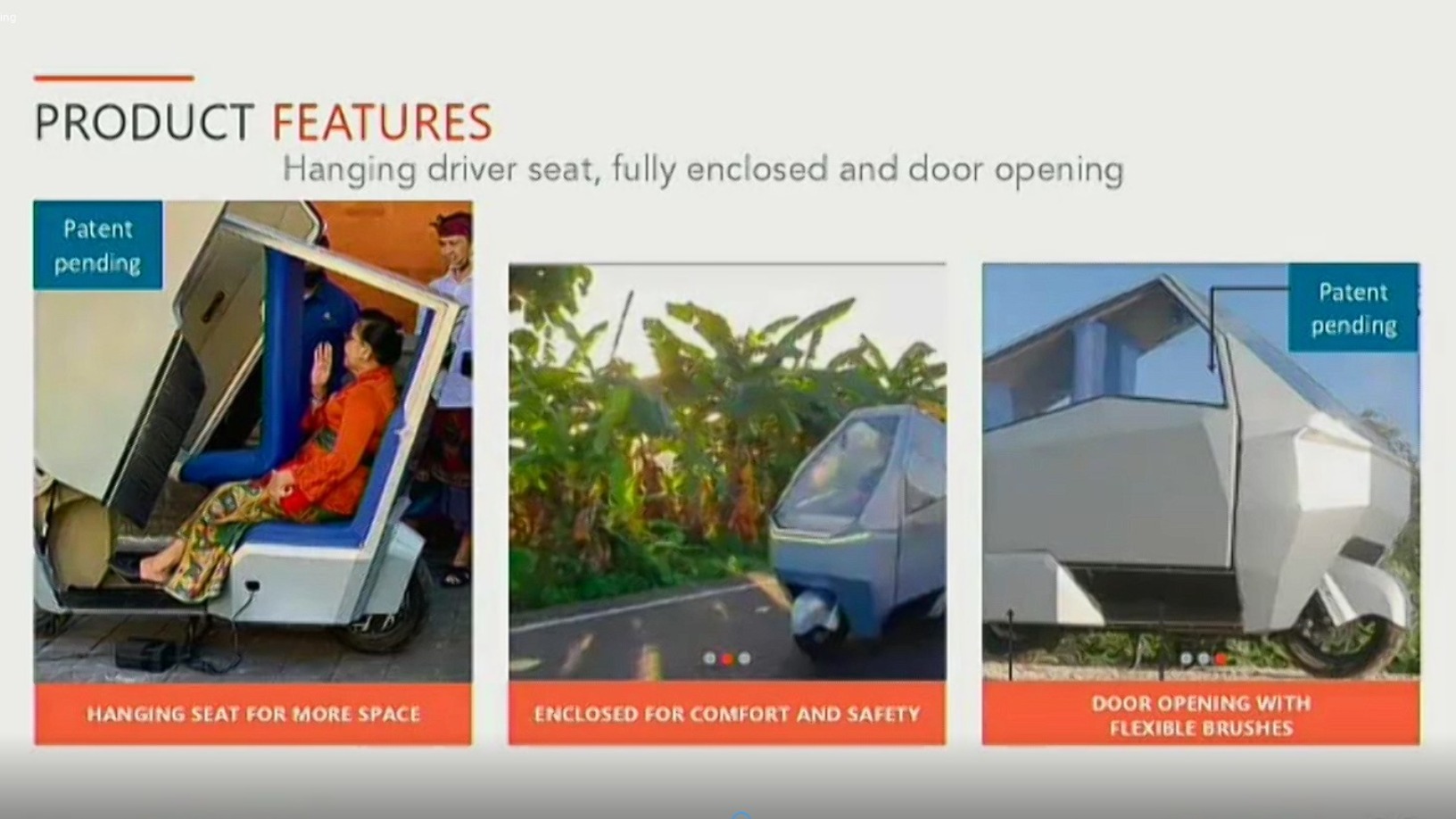

HighPitch 2020: Hydroponics, EV startups PanenBali and Manouv represent Denpasar chapter

Renewable energy and sustainability focuses impress investors, who also caution startups about competitors from outside their region

Alén Space: Nanosatellite company targets contracts of over €2 million by 2020

Alén Space seeks funding of €1.5 million to accelerate plans to win a share of the global market of 2,600 small satellites to be launched by 2023

EXCLUSIVE: Qlue raising Series B funding, "confident" of turning profitable in 2020

Qlue is also targeting more enterprise clients as it expands overseas and improved accountability and management practices

Indonesia's HighPitch 2020: VC investors on Medan startups, deal-sourcing during Covid

Healthcare-focused edtech Appskep and e-grocer Pasar20 win regional pitch competition for Sumatra; judging VCs share their new perspectives gained on local problems and startups from outside Greater Jakarta, and more

Indonesia 2020: Investors say opportunities still abound despite downturn risk, past year's flops

VCs weigh in on deal flows, valuations, the sectors they favor, and chances of more tech IPOs

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

HighPitch 2020: In conversation with top winners and UMG Idealab head Kiwi Aliwarga

Goers, Izy and CekLab demonstrated quick thinking when adapting their businesses to the pandemic, a capability they will need to stay competitive post-Covid

HighPitch 2020: Waste management play Octopus, digital concierge service Izy win Makassar battle

Both startups have scored strong traction despite the weight of Covid-19; they are also expanding and keen to explore new opportunities

After a Covid-led boom in 2020, what next for China's K-12 edtech?

Unicorns Yuanfudao and Zuoyebang raised more than $6bn combined last year as demand for online learning continues to grow, but some smaller players are running out of cash

HighPitch 2020: Event ticketing and legal tech startups come up tops in Jakarta chapter

VC judges favored Goers’s strong pivot amid Covid and HAKITA’s outstanding pitch

HighPitch 2020: Yogyakarta chapter won by on-demand lab testing and solar cell startups

Judges lauded the variety of ideas, but said startups could improve their presentations and clearly state the problems they are solving

“From a record year to a tragic year” – Investor Eneko Knorr on Spain’s 2020 startup funding

Startups should focus on profitability but for investors with leeway, there are still great opportunities, says Spanish angel investor Eneko Knorr. He shares his outlook, top picks and advice on riding out the Covid-19 crisis

Indonesian unicorn Traveloka aims for US listing via SPAC

The online travel aggregator reported revenue drops and layoffs in 2020 but became profitable late last year, led by recoveries in Vietnam and Thailand

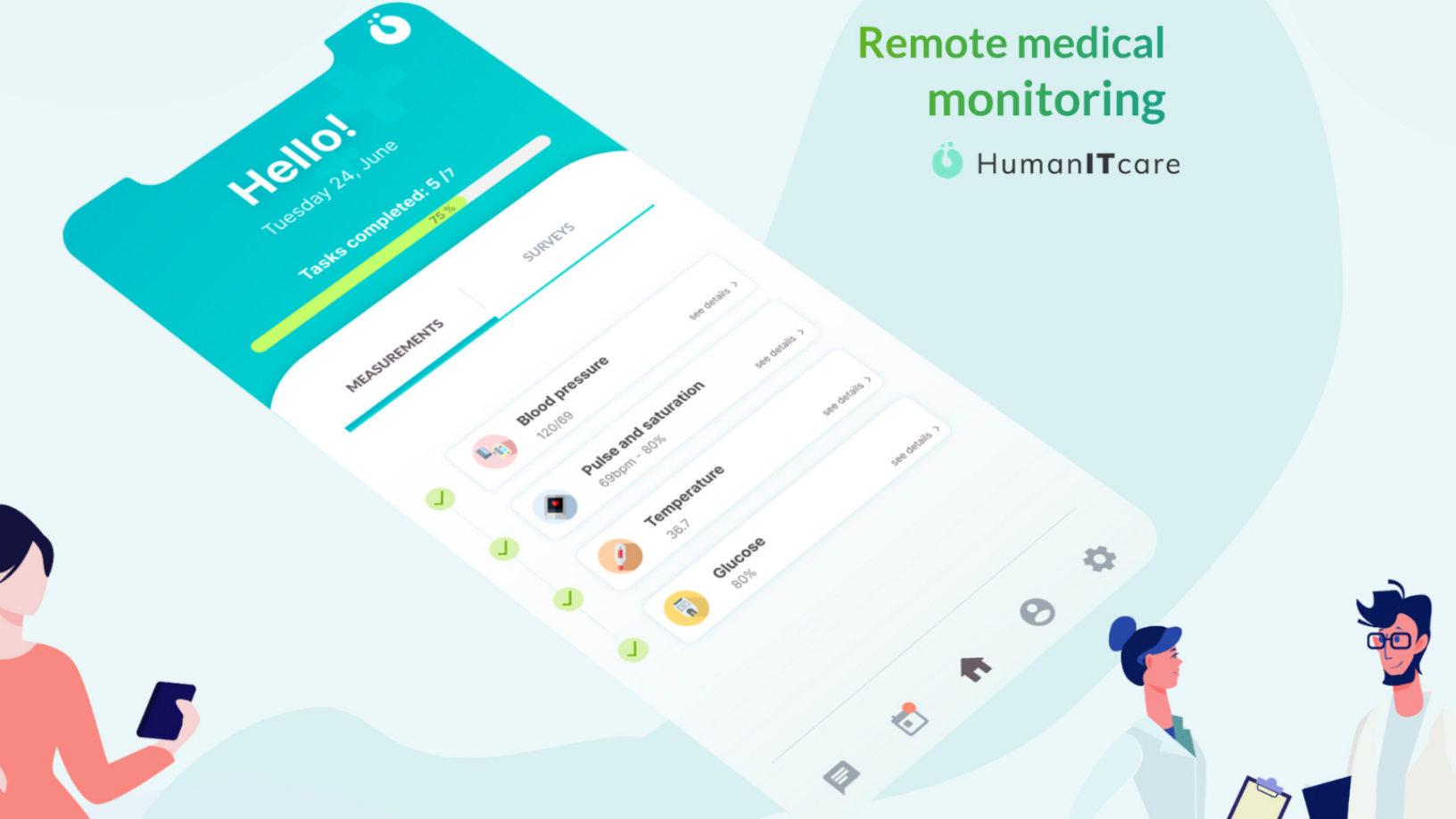

HumanITcare: Covid-19 spurs demand for telemedicine across Spain and beyond

The startup’s revenue is expected to exceed €10m by 2024 due to rapid digital transformation of healthcare services and a growing market for AI-powered medtechs

Sorry, we couldn’t find any matches for“2020”.