Bank Indonesia

-

DATABASE (639)

-

ARTICLES (299)

Tim Hart is an investor and consultant at Charlotte Street Capital, focusing on early stage and general tech businesses. He became a non-executive director at Nixplay and Creedon Technologies Limited in 2017. He joined the advisory board of Chorus Intelligence Ltd in 2016. He has acquired a wide range of finance and trading experience since 1989 when he started work as a junior trader at James Capel. He has also served as VP at Robert Fleming, a director at Merrill Lynch and MD of Deutsche Bank.

Tim Hart is an investor and consultant at Charlotte Street Capital, focusing on early stage and general tech businesses. He became a non-executive director at Nixplay and Creedon Technologies Limited in 2017. He joined the advisory board of Chorus Intelligence Ltd in 2016. He has acquired a wide range of finance and trading experience since 1989 when he started work as a junior trader at James Capel. He has also served as VP at Robert Fleming, a director at Merrill Lynch and MD of Deutsche Bank.

Founded in 2017 by the ex-CEO of Credit Suisse bank Gaël de Boissard, 2B Capital is venture capital firm based in London. Its first investment in CrowdProcess Inc and the startup's James risk management platform was as part of a US$2.7-million seed funding in August 2017. The VC primarily invests in fintech and structured credit and mezzanine lending to the new lenders and challenger banks.

Founded in 2017 by the ex-CEO of Credit Suisse bank Gaël de Boissard, 2B Capital is venture capital firm based in London. Its first investment in CrowdProcess Inc and the startup's James risk management platform was as part of a US$2.7-million seed funding in August 2017. The VC primarily invests in fintech and structured credit and mezzanine lending to the new lenders and challenger banks.

Not-for-profit social impact investor, Rabo Foundation, is a subsidiary of Rabobank based in the Netherlands. The bank specializes in sustainability-oriented banking, food and agriculture financing.Founded in Utrecht in 1974, Rabo Foundation actively invests in the Netherlands and 22 emerging markets across Africa, Asia and Latin America. It mainly focuses on funding for social enterprises, especially savings and credit cooperatives and producer organizations for smallholder farmers. It currently has investments in 26 startups including participation in AgroCenta’s $790,000 seed round in January 2021. Rabo has also pumped in $500,000 in Dutch fintech Geldfit.nl, a debt prevention and counseling app service.

Not-for-profit social impact investor, Rabo Foundation, is a subsidiary of Rabobank based in the Netherlands. The bank specializes in sustainability-oriented banking, food and agriculture financing.Founded in Utrecht in 1974, Rabo Foundation actively invests in the Netherlands and 22 emerging markets across Africa, Asia and Latin America. It mainly focuses on funding for social enterprises, especially savings and credit cooperatives and producer organizations for smallholder farmers. It currently has investments in 26 startups including participation in AgroCenta’s $790,000 seed round in January 2021. Rabo has also pumped in $500,000 in Dutch fintech Geldfit.nl, a debt prevention and counseling app service.

Danish asset management company Maj Invest was established in 2005. Based in Copenhagen, it is owned by the management, employees and Danish institutional investors, PKA, Realdania and PBU. Its main businesses are in asset management and private equity. It recently ventured into the financial services sector with Maj Bank.In 2009, Maj Invest launched into international private equity activities, with offices in Singapore, Indonesia’s Jakarta,Vietnam’s Ho Chi Minh City and Lima in Peru. Its Maj Invest Equity Southeast Asia II K/S, worth US$90 million, is still looking for new investment opportunities in the region.

Danish asset management company Maj Invest was established in 2005. Based in Copenhagen, it is owned by the management, employees and Danish institutional investors, PKA, Realdania and PBU. Its main businesses are in asset management and private equity. It recently ventured into the financial services sector with Maj Bank.In 2009, Maj Invest launched into international private equity activities, with offices in Singapore, Indonesia’s Jakarta,Vietnam’s Ho Chi Minh City and Lima in Peru. Its Maj Invest Equity Southeast Asia II K/S, worth US$90 million, is still looking for new investment opportunities in the region.

Co-founder of Sleekr

Dirman Suharno is a veteran web designer who founded his own web design studio, Harnods, in 2004 where he focused on serving Internet startup clients in Indonesia, Singapore and the USA. In 2014, he joined Suwandi Soh as a co-founder and designer at Sleekr, a web-based HR platform.Dirman holds a bachelor’s degree in Visual Communication from Universitas Tarumanagara, Indonesia.

Dirman Suharno is a veteran web designer who founded his own web design studio, Harnods, in 2004 where he focused on serving Internet startup clients in Indonesia, Singapore and the USA. In 2014, he joined Suwandi Soh as a co-founder and designer at Sleekr, a web-based HR platform.Dirman holds a bachelor’s degree in Visual Communication from Universitas Tarumanagara, Indonesia.

Co-founder and Brand Manager of Bobobox

Ahmad Qois started developing an idea for a capsule hotel that was to become Bobobox in 2017. While still studying for his Communications Management degree at Universitas Islam Bandung, Indonesia, he also co-founded DAPP Indonesia, a Bandung-based men’s fashion brand. He also briefly worked for Mengundang, a startup that produces customized wedding invitation websites.

Ahmad Qois started developing an idea for a capsule hotel that was to become Bobobox in 2017. While still studying for his Communications Management degree at Universitas Islam Bandung, Indonesia, he also co-founded DAPP Indonesia, a Bandung-based men’s fashion brand. He also briefly worked for Mengundang, a startup that produces customized wedding invitation websites.

Co-founder and CEO of Goola

Kevin Susanto was famous in Indonesia for singing children's Christian songs. After graduating from Macquarie University in Australia with a master's in Commerce (Finance), he returned to Indonesia in 2015 to become president director at petrochemical firm PT Multi Globalindo Sukses Pratama. In 2018, he became the co-founder and CEO of Goola that seeks to modernize the traditional Indonesian drinks sector.

Kevin Susanto was famous in Indonesia for singing children's Christian songs. After graduating from Macquarie University in Australia with a master's in Commerce (Finance), he returned to Indonesia in 2015 to become president director at petrochemical firm PT Multi Globalindo Sukses Pratama. In 2018, he became the co-founder and CEO of Goola that seeks to modernize the traditional Indonesian drinks sector.

Co-Founder and CEO of Lemonilo

Harvard Law graduate Shinta Nurfauzia earned her bachelor's degree in law at Universitas Indonesia. After working as a banking and finance associate at Allen & Overy Indonesia, and as a law associate at Lubis, Santosa & Maramis, Nurfauzia received the prestigious Indonesia Endowment Fund For Education Scholarship to Harvard Law School. Post-Harvard, Nurfauzia worked as a consultant to the Indonesian government sustainability program (REDD+) before founding the healthcare platform Konsula. She started her first business at 14 years old, a pancake business, and then a luxury bag reseller business.After Konsula pivoted to health food company Lemonilo, Nurfauzia remained at the company. She is currently Lemonilo’s co-CEO, sharing the role with Ronald Wijaya.

Harvard Law graduate Shinta Nurfauzia earned her bachelor's degree in law at Universitas Indonesia. After working as a banking and finance associate at Allen & Overy Indonesia, and as a law associate at Lubis, Santosa & Maramis, Nurfauzia received the prestigious Indonesia Endowment Fund For Education Scholarship to Harvard Law School. Post-Harvard, Nurfauzia worked as a consultant to the Indonesian government sustainability program (REDD+) before founding the healthcare platform Konsula. She started her first business at 14 years old, a pancake business, and then a luxury bag reseller business.After Konsula pivoted to health food company Lemonilo, Nurfauzia remained at the company. She is currently Lemonilo’s co-CEO, sharing the role with Ronald Wijaya.

Founded in 2012 in Washington DC, Accion Venture Lab is a seed-stage investor in fintech for the underserved. Venture Lab is part of Accion, a not-for-profit global organization that works with financial service providers to deliver affordable solutions for unbanked and underbanked communities worldwide.Its portfolio includes 44 startups from 17 countries, ranging from Chile to Indonesia. Seed-stage startups normally get $500,000 funding per company. Investments in December 2020 included participation in the $1.5m seed round of Argentinian software development tech Henry and a financing round for Indonesian micro-credit fintech Pintech.

Founded in 2012 in Washington DC, Accion Venture Lab is a seed-stage investor in fintech for the underserved. Venture Lab is part of Accion, a not-for-profit global organization that works with financial service providers to deliver affordable solutions for unbanked and underbanked communities worldwide.Its portfolio includes 44 startups from 17 countries, ranging from Chile to Indonesia. Seed-stage startups normally get $500,000 funding per company. Investments in December 2020 included participation in the $1.5m seed round of Argentinian software development tech Henry and a financing round for Indonesian micro-credit fintech Pintech.

Co-founder and CTO of DanaDidik

Januar Sudharsono is a veteran IT project manager and consultant with over 10 years of experience. After graduating from Universitas Advent Indonesia in 2006, he worked as an IT assistant manager at Nextnation Network, a Malaysian mobile content provider. He left in 2009 to become an IT consultant for Seven Music Indonesia, a recording label. He co-founded student loan crowdfunding platform DanaDidik in 2015 and became the company’s CTO.

Januar Sudharsono is a veteran IT project manager and consultant with over 10 years of experience. After graduating from Universitas Advent Indonesia in 2006, he worked as an IT assistant manager at Nextnation Network, a Malaysian mobile content provider. He left in 2009 to become an IT consultant for Seven Music Indonesia, a recording label. He co-founded student loan crowdfunding platform DanaDidik in 2015 and became the company’s CTO.

Founder and CEO of Ku Ka

Titonius Karto is a former real estate investor who lived in the United States for 15 years. He established Ku Ka, an online marketplace for quality local products, after returning to Indonesia. Titonius holds a Master of Global Management degree from the Thunderbird School of Global Management at Arizona State University.

Titonius Karto is a former real estate investor who lived in the United States for 15 years. He established Ku Ka, an online marketplace for quality local products, after returning to Indonesia. Titonius holds a Master of Global Management degree from the Thunderbird School of Global Management at Arizona State University.

Co-founder and Chief of Product of Medigo

Faizal Rahman Hakim is a UI/UX designer and current Chief of Product at Medigo Indonesia. Before graduating with a bachelor's degree in Computer Science from Universitas Indonesia in 2013, Faizal joined Flipbox, the mobile app development subsidiary of digital agency Definite, where he was Flipbox's Head of Design. He later joined Definite's former CEO Harya Bimo to establish Medigo, a platform for outpatient management at hospitals and clinics.

Faizal Rahman Hakim is a UI/UX designer and current Chief of Product at Medigo Indonesia. Before graduating with a bachelor's degree in Computer Science from Universitas Indonesia in 2013, Faizal joined Flipbox, the mobile app development subsidiary of digital agency Definite, where he was Flipbox's Head of Design. He later joined Definite's former CEO Harya Bimo to establish Medigo, a platform for outpatient management at hospitals and clinics.

Co-founder, CEO of Virtuleap

Amir Bozorgzadeh is the Canadian-Iranian CEO and co-founder of Virtuleap, a Portugal-based cognition training and assessment VR startup, where he has worked since 2018. He also writes regularly about tech for websites such as VentureBeat and CrunchBase .He was previously based in Dubai, where he co-founded two startups: Gameguise, a gaming publisher and developer, and Time Dirham, the Middle East’s first circular economy time bank. He was also managing partner at digital marketing agency Conovi and a consultant at digital media agencies Massive Media and BizX, both based in Dubai. He additionally worked at YouGov in business development in his decade-long Dubai residence. Bozorgzadeh’s first posts were in project and account management in Vancouver, where he also studied Management at its Sauder School of Business. He holds a first degree in Liberal Studies from Toronto’s York University and also studied the Executive Leadership Program at Amsterdam’s THINK- School of Creative Leadership.

Amir Bozorgzadeh is the Canadian-Iranian CEO and co-founder of Virtuleap, a Portugal-based cognition training and assessment VR startup, where he has worked since 2018. He also writes regularly about tech for websites such as VentureBeat and CrunchBase .He was previously based in Dubai, where he co-founded two startups: Gameguise, a gaming publisher and developer, and Time Dirham, the Middle East’s first circular economy time bank. He was also managing partner at digital marketing agency Conovi and a consultant at digital media agencies Massive Media and BizX, both based in Dubai. He additionally worked at YouGov in business development in his decade-long Dubai residence. Bozorgzadeh’s first posts were in project and account management in Vancouver, where he also studied Management at its Sauder School of Business. He holds a first degree in Liberal Studies from Toronto’s York University and also studied the Executive Leadership Program at Amsterdam’s THINK- School of Creative Leadership.

CEO and co-founder of Biel Glasses

Jaume Puig Adamuz is co-founder and CEO of Biel Glasses, a medtech developing smart glasses for people with low vision. Prior to founding the startup in 2017, he was a pre-sales and product manager at cloud services company MediaCloud, and was the Workplace Transformation Governance Manager in the Government of Catalonia's education department, where he was in charge of its digital transformation.In total, he has over 25 years' experience as a manager in various technology companies, including British Telecom, Deustche Bank, Telefónica and Tiscali. Puig also previously founded two companies, Mobbiz Communication, a mobile marketing services company, where he worked from 2003 to 2013, and Fleet Control Systems, one of the first commercial radio and GPS fleet location and management systems, where he worked from 1995 to 1998.Puig holds a master's degree in Business Administration from the University of Ramon Llull in Barcelona.

Jaume Puig Adamuz is co-founder and CEO of Biel Glasses, a medtech developing smart glasses for people with low vision. Prior to founding the startup in 2017, he was a pre-sales and product manager at cloud services company MediaCloud, and was the Workplace Transformation Governance Manager in the Government of Catalonia's education department, where he was in charge of its digital transformation.In total, he has over 25 years' experience as a manager in various technology companies, including British Telecom, Deustche Bank, Telefónica and Tiscali. Puig also previously founded two companies, Mobbiz Communication, a mobile marketing services company, where he worked from 2003 to 2013, and Fleet Control Systems, one of the first commercial radio and GPS fleet location and management systems, where he worked from 1995 to 1998.Puig holds a master's degree in Business Administration from the University of Ramon Llull in Barcelona.

Juan Jose Juste Ortega is an economist with a long career in the banking and financial sector. He held executive roles in multiple banks such as Lloyds Banking Group and Citi, and was Director of Chase and Société Générale in Madrid. For over 10 years, he worked as general subdirector in Caja Madrid. Concurrently, he was CEO and Executive President of the CIFI, a non-bank institution experienced in financing infrastructure and energy in Latin America and the Caribbean. From 2015 to 2018, Juste Ortega was Director of Read Madrid football clubHe is currently diversifying his investments by backing Spanish tech startups.

Juan Jose Juste Ortega is an economist with a long career in the banking and financial sector. He held executive roles in multiple banks such as Lloyds Banking Group and Citi, and was Director of Chase and Société Générale in Madrid. For over 10 years, he worked as general subdirector in Caja Madrid. Concurrently, he was CEO and Executive President of the CIFI, a non-bank institution experienced in financing infrastructure and energy in Latin America and the Caribbean. From 2015 to 2018, Juste Ortega was Director of Read Madrid football clubHe is currently diversifying his investments by backing Spanish tech startups.

No bank account? In Indonesia, you can still shop online

Indonesian startups are racing to serve the millions of consumers that banks haven’t reached. Here’s a look at some of the leading players, their innovations and how they have redefined the market

With universal QR code, Indonesia achieves e-payment harmony

The move to standardize Indonesia's QR code is expected to unify the country's cashless payments system and lift tens of thousands of small merchants into the payments mainstream

P2P financing platform Investree raises Series C, with $23.5m in first tranche

Indonesia's Investree closes key funding amid Covid-19 crisis; is applying for licenses in Thailand and the Philippines in regional expansion

QRIS: Will the new QR code standard rewrite Indonesia’s e-payments scene?

Enabling interoperability, the QRIS seeks to level the playing field until now dominated by GoPay and OVO – disruption that could go beyond the e-wallets scene

Gojek acquires Indonesian POS startup Moka, gains greater share of SME fintech market

Deal reportedly worth $120m will add Moka's network of over 30,000 merchants to Gojek's reach

Investing in Indonesia: The fintech companies driving a new influx of capital

With 66% of Indonesians not owning a bank account, fintech startups have come up with myriad innovative products to entice a new generation of retail investors

MSMB: From university research to agritech ecosystem

The Indonesian startup is moving beyond sensors to build technologies for livestock tracking and fish farming

Indonesian state enterprises launch e-wallet LinkAja, competing with Go-Pay and OVO

Even with a wider range of services and extensive state backing, LinkAja faces a tough battle

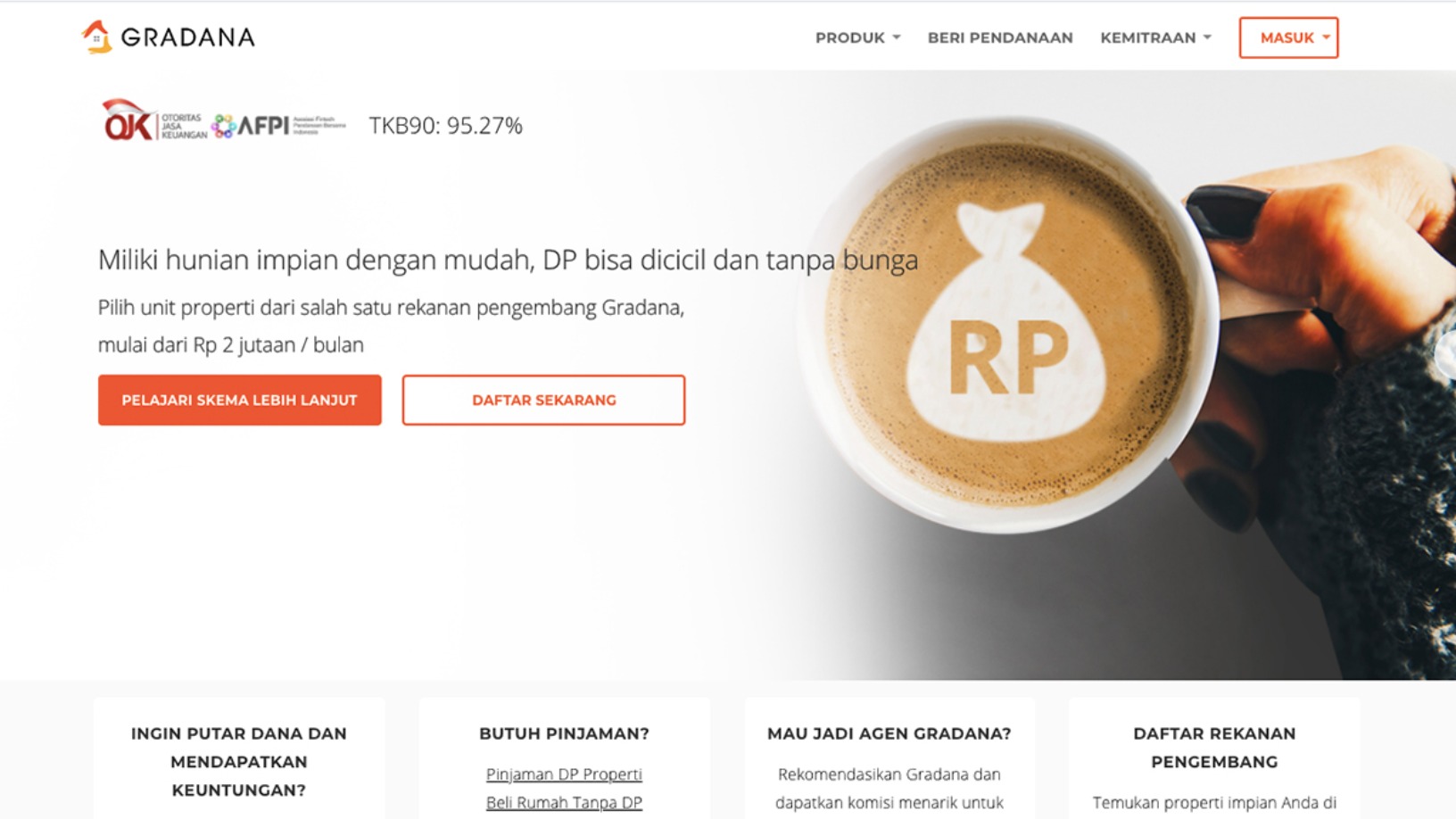

Gradana: P2P lending for more accessible home ownership in Indonesia

Gradana wants to create an ecosystem where developers, agents, landlords, buyers and lenders benefit one another through interconnected financing

ZendMoney: Putting cash back into the pockets of Indonesian migrant workers

ZendMoney's unique remittance concept has already helped 90,000 migrant workers send money back home

Indonesian P2P lending platform Investree expands to the Philippines

With local partner Filinvest Development Corporation, Investree Philippines will support the country’s SMEs with its lending-based crowdfunding platform

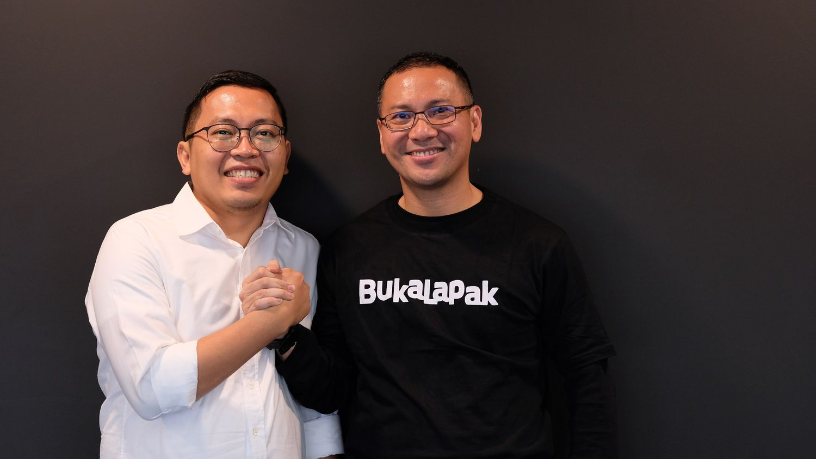

Bukalapak CEO Achmad Zaky steps down, ex-banker Rachmat Kaimuddin to take over

Rumors of a leadership change first surfaced in August as the Indonesian unicorn and its co-founder got a bad press

Payfazz aims to be Indonesia's first on-demand financial services company

Handling transactions averaging over IDR 1tn monthly, Payfazz hopes to bring the benefits of banking to all Indonesians

UPDATE: Indonesian mPOS startup Cashlez raises IDR 85bn from IPO in May

Cashlez is the first fintech company to list on the Indonesia Stock Exchange; will spend over 60% of proceeds to acquire payments company in toll road market

Crowde-funding Indonesia's fields

Agritech startup Crowde offers retail investors direct access to Indonesia’s US$25 billion agricultural sector, transforming the way traditional farmers fund, run and grow their businesses

Sorry, we couldn’t find any matches for“Bank Indonesia”.