Cell-based leather

-

DATABASE (856)

-

ARTICLES (601)

Based in Singapore, Antler is a venture capital firm that runs a global five-month venture building program. Aside from funding and company building, Antler matches founders and the talent they need prior to the start of the program. Antler's programs are run in Singapore, Stockholm, Sydney, Amsterdam and London. Antler was founded by former managing director of Zalora, Magnus Grimeland.

Based in Singapore, Antler is a venture capital firm that runs a global five-month venture building program. Aside from funding and company building, Antler matches founders and the talent they need prior to the start of the program. Antler's programs are run in Singapore, Stockholm, Sydney, Amsterdam and London. Antler was founded by former managing director of Zalora, Magnus Grimeland.

Agentes y Asesores Financieros

Agentes y Asesores Financieros is a Madrid-based small and medium enterprise (SME) founded in 2003 that has evolved from traditional legal and financial advice to one focused on real estate asset management and advisory services and management of financial investments. It is led by José Antonio Bautista Molero.

Agentes y Asesores Financieros is a Madrid-based small and medium enterprise (SME) founded in 2003 that has evolved from traditional legal and financial advice to one focused on real estate asset management and advisory services and management of financial investments. It is led by José Antonio Bautista Molero.

Spanish-born Felipe Navio has previously worked as a business analyst at McKinsey & Company. Since 2009, he has worked as the co-CEO and co-founder of UK-based employment site Jobandtalent.Navio and co-CEO Juan Urdiales are also angel investors, participating in the €1.15m seed round of fintech StudentFinance in 2019.

Spanish-born Felipe Navio has previously worked as a business analyst at McKinsey & Company. Since 2009, he has worked as the co-CEO and co-founder of UK-based employment site Jobandtalent.Navio and co-CEO Juan Urdiales are also angel investors, participating in the €1.15m seed round of fintech StudentFinance in 2019.

Investment banker Miguel Haupt is a managing partner at London-based investment company Opinmaco. He was previously the MD at both Morgan Stanley and Deutsche Bank in Zurich. As an angel investor, his only disclosed investment to date is the seed round of Spanish femtech WOOM in 2018.

Investment banker Miguel Haupt is a managing partner at London-based investment company Opinmaco. He was previously the MD at both Morgan Stanley and Deutsche Bank in Zurich. As an angel investor, his only disclosed investment to date is the seed round of Spanish femtech WOOM in 2018.

Zurich-based Übermorgen Ventures was founded in 2019 to invest in climate-change startups that focus on reducing greenhouse gas emissions. The VC has invested in five startups including recent participation in the €500,000 seed investment of German low-cost solar provider Sunvigo in January 2021 and the $6.2m seed round of Finnish biocarbon startup Carbo Culture in April.

Zurich-based Übermorgen Ventures was founded in 2019 to invest in climate-change startups that focus on reducing greenhouse gas emissions. The VC has invested in five startups including recent participation in the €500,000 seed investment of German low-cost solar provider Sunvigo in January 2021 and the $6.2m seed round of Finnish biocarbon startup Carbo Culture in April.

CCO and co-founder of Modulous Tech

Reimell Ragnauth is co-founder and Chief Commercial Officer at UK-based Modulous, the first end-to-end generative design and delivery solution for affordable, sustainable and modulized housing, where he has worked since 2019. He also works part-time as a strategic investor to data analysis company iaidō and is a non-executive chairman at construction insulation company PMP Manufacturing.Before Modulous, he was chief business development officer at gold fintech startup Glint for a year and established its US office. He previously worked as the managing director of Spiralite Ductwork in the area of building energy efficiency from 2010-17. Prior to this, all of his positions were in the finance and investment area: at 3i Group as Associated Director of Quoted Private Equity 2007-9; at the Electra Group as a senior associate of the EQMC Fund 2006-7; at consultancy Deloitte as an associate director of private equity transaction services 2004-6; at Orbis Investments 2001-4 working in investment analysis; and as Manager of Business Recovery Services at PwC in London 1996-2000. Ragnauth holds a Master’s in Law from Cambridge University.

Reimell Ragnauth is co-founder and Chief Commercial Officer at UK-based Modulous, the first end-to-end generative design and delivery solution for affordable, sustainable and modulized housing, where he has worked since 2019. He also works part-time as a strategic investor to data analysis company iaidō and is a non-executive chairman at construction insulation company PMP Manufacturing.Before Modulous, he was chief business development officer at gold fintech startup Glint for a year and established its US office. He previously worked as the managing director of Spiralite Ductwork in the area of building energy efficiency from 2010-17. Prior to this, all of his positions were in the finance and investment area: at 3i Group as Associated Director of Quoted Private Equity 2007-9; at the Electra Group as a senior associate of the EQMC Fund 2006-7; at consultancy Deloitte as an associate director of private equity transaction services 2004-6; at Orbis Investments 2001-4 working in investment analysis; and as Manager of Business Recovery Services at PwC in London 1996-2000. Ragnauth holds a Master’s in Law from Cambridge University.

CTO and co-founder of Carbo Culture

US native Christopher Carstens graduated in mechanical engineering in 2002 at the University of California, Berkeley. He started his career as a technology analyst at The Spark Group in San Francisco.In 2004, the engineer co-founded Solid Gas Technologies to build a methane hydrate production system. Carstens also founded Homeland Fuels to construct a bioreactor using ethanol. He exited both companies in 2006 and went to work at World Waste Technologies in California as project manager and engineer. In 2012, he started working at Graphene Technologies as R&D engineer.In 2013, he joined an innovation accelerator program at Singularity University where he met Finnish participant Henrietta Moon. They co-founded Finnish startup Carbo Culture in 2016 with Carstens as CTO based at the California plant.The serial entrepreneur and inventor also founded Hydrate Dynamics as CTO in 2015 to develop gas storage and transportation facilities using clathrate hydrates technology. In 2018, he was appointed by the US Department of Energy to be a member of the Methane Hydrate Advisory Committee until January 2020.

US native Christopher Carstens graduated in mechanical engineering in 2002 at the University of California, Berkeley. He started his career as a technology analyst at The Spark Group in San Francisco.In 2004, the engineer co-founded Solid Gas Technologies to build a methane hydrate production system. Carstens also founded Homeland Fuels to construct a bioreactor using ethanol. He exited both companies in 2006 and went to work at World Waste Technologies in California as project manager and engineer. In 2012, he started working at Graphene Technologies as R&D engineer.In 2013, he joined an innovation accelerator program at Singularity University where he met Finnish participant Henrietta Moon. They co-founded Finnish startup Carbo Culture in 2016 with Carstens as CTO based at the California plant.The serial entrepreneur and inventor also founded Hydrate Dynamics as CTO in 2015 to develop gas storage and transportation facilities using clathrate hydrates technology. In 2018, he was appointed by the US Department of Energy to be a member of the Methane Hydrate Advisory Committee until January 2020.

CEO and founder of Petit Pli

Ryan Mario Yasin is an engineer, designer and sustainable fashion entrepreneur based in London. Originally from Reykjavik, Iceland, Yasin graduated in aeronautical engineering at Imperial College London and has a master’s in global innovation design from the Royal College of Art. As a 23-year-old design student, Yasin founded materials technology startup Petit Pli, and developed the design for the company’s first product, a pleated garment that could expand up to seven sizes to last children through their first few years of life. Petit Pli now makes expandable pleated clothes for children and adults, using a fabric derived from recycled plastic and a structure inspired by origami, architecture and space satellites. Petit Pli products have won a number of prestigious awards, such as the UK James Dyson Award, Time Magazine’s best invention of 2020 and the Red Dot Product Design Award.Yasin has a strong interest in photography and in the interplay between art and engineering. In 2020, Yasin was included by Forbes in its 30 Under 30 list for Europe.

Ryan Mario Yasin is an engineer, designer and sustainable fashion entrepreneur based in London. Originally from Reykjavik, Iceland, Yasin graduated in aeronautical engineering at Imperial College London and has a master’s in global innovation design from the Royal College of Art. As a 23-year-old design student, Yasin founded materials technology startup Petit Pli, and developed the design for the company’s first product, a pleated garment that could expand up to seven sizes to last children through their first few years of life. Petit Pli now makes expandable pleated clothes for children and adults, using a fabric derived from recycled plastic and a structure inspired by origami, architecture and space satellites. Petit Pli products have won a number of prestigious awards, such as the UK James Dyson Award, Time Magazine’s best invention of 2020 and the Red Dot Product Design Award.Yasin has a strong interest in photography and in the interplay between art and engineering. In 2020, Yasin was included by Forbes in its 30 Under 30 list for Europe.

BayWa Venture GmbH is a subsidiary company of BayWa AG, the German agriculture, energy and construction conglomerate.Putting digitalization at the core of its agriculture strategy, the company is looking to expand its core business into digital services within the existing businesses. It is investigating new digital business models and stand-alone concepts through collaboration with emerging startups focusing on cutting-edge technologies in the agrifood tech space.BayWa started to invest in startups in 2012 mainly focused on online customer management, services and sales platforms. In 2015, the company purchased Farm Facts, a German farm management SaaS and in 2017 invested in Abundant Robotics, a US-based automated harvest company. One of the firms’ most recent investments has been Evja, an Italian startup developing precision farming hardware based on advanced agronomic models and machine learning technology.

BayWa Venture GmbH is a subsidiary company of BayWa AG, the German agriculture, energy and construction conglomerate.Putting digitalization at the core of its agriculture strategy, the company is looking to expand its core business into digital services within the existing businesses. It is investigating new digital business models and stand-alone concepts through collaboration with emerging startups focusing on cutting-edge technologies in the agrifood tech space.BayWa started to invest in startups in 2012 mainly focused on online customer management, services and sales platforms. In 2015, the company purchased Farm Facts, a German farm management SaaS and in 2017 invested in Abundant Robotics, a US-based automated harvest company. One of the firms’ most recent investments has been Evja, an Italian startup developing precision farming hardware based on advanced agronomic models and machine learning technology.

Based in San Mateo California, KBW Ventures was founded by HRH Prince Khaled bin Alwaleed bin Talal Al Saud. The asset management firm’s CEO is also the chairman of KBW Investments that was founded in 2013 in Dubai in the United Arab Emirates (UAE).KBW Ventures is part of the KBW Group and mainly invests in companies involved in sustainable food, artificial intelligence, blockchain technologies and fintech. In 2019, the VC had already invested in 24 companies in sectors like e-gaming, drones, e-commerce and plant-based proteins. Recently, it also increased its stakes in two Californian biotechs BlueNalu and TurtleTree Labs. The aim is to open up the Middle East markets to global tech companies.

Based in San Mateo California, KBW Ventures was founded by HRH Prince Khaled bin Alwaleed bin Talal Al Saud. The asset management firm’s CEO is also the chairman of KBW Investments that was founded in 2013 in Dubai in the United Arab Emirates (UAE).KBW Ventures is part of the KBW Group and mainly invests in companies involved in sustainable food, artificial intelligence, blockchain technologies and fintech. In 2019, the VC had already invested in 24 companies in sectors like e-gaming, drones, e-commerce and plant-based proteins. Recently, it also increased its stakes in two Californian biotechs BlueNalu and TurtleTree Labs. The aim is to open up the Middle East markets to global tech companies.

Based in the Netherlands, Prosus is a global investor in consumer tech and Internet companies. It is a subsidiary of South African tech investment company Naspers. In August 2021 the two companies completed a cross-holding agreement in which Naspers owns 57% of Prosus while Prosus owns 49% of Naspers. The two companies share a single board.Prosus is the largest shareholder in Chinese tech giant Tencent and Russian tech platform Mail.ru. Meanwhile, its venture division invests in a variety of fintech, food delivery, and other consumer tech companies. In Indonesia, it has invested in Bibit, a stock and mutual funds investment platform, as well as fishery trading and community development startup Aruna. It has also invested in edtech platforms like Indian executive learning platform Eruditus, and US-based coding education company SoloLearn.

Based in the Netherlands, Prosus is a global investor in consumer tech and Internet companies. It is a subsidiary of South African tech investment company Naspers. In August 2021 the two companies completed a cross-holding agreement in which Naspers owns 57% of Prosus while Prosus owns 49% of Naspers. The two companies share a single board.Prosus is the largest shareholder in Chinese tech giant Tencent and Russian tech platform Mail.ru. Meanwhile, its venture division invests in a variety of fintech, food delivery, and other consumer tech companies. In Indonesia, it has invested in Bibit, a stock and mutual funds investment platform, as well as fishery trading and community development startup Aruna. It has also invested in edtech platforms like Indian executive learning platform Eruditus, and US-based coding education company SoloLearn.

Silicon Valley-based Almaz Capital was co-founded in 2008 as a bridge VC fund by Alexander Galitsky, a serial techpreneur and former senior executive at the Soviet Space Agency and Defense Industry. Almaz also has an office in Berlin and partners with interests in the UK, Poland and Ukraine. The global fund has invested in over 30 startups and managed 15 exits within its portfolio.Recent investments in 2021 include co-leading the $54m Series B round of Refurbed with Evli Growth Partners in August. Almaz was also the lead investor for the $6m funding round for US-based precision audio software Sonarworks in July.

Silicon Valley-based Almaz Capital was co-founded in 2008 as a bridge VC fund by Alexander Galitsky, a serial techpreneur and former senior executive at the Soviet Space Agency and Defense Industry. Almaz also has an office in Berlin and partners with interests in the UK, Poland and Ukraine. The global fund has invested in over 30 startups and managed 15 exits within its portfolio.Recent investments in 2021 include co-leading the $54m Series B round of Refurbed with Evli Growth Partners in August. Almaz was also the lead investor for the $6m funding round for US-based precision audio software Sonarworks in July.

Omnes Capital is a Paris-based private equity firm founded within the French banking group Crédit Agricole in 1999. The firm has invested in over 450 businesses across various sectors, managing assets of valuations totalling over €3.4 billion.within the French banking group Crédit Agricole in 1999. The firm has invested in over 450 businesses across various sectors, managing assets of valuations totalling over €3.4 billion.

Omnes Capital is a Paris-based private equity firm founded within the French banking group Crédit Agricole in 1999. The firm has invested in over 450 businesses across various sectors, managing assets of valuations totalling over €3.4 billion.within the French banking group Crédit Agricole in 1999. The firm has invested in over 450 businesses across various sectors, managing assets of valuations totalling over €3.4 billion.

Augmentum Capital was formed in 2009 by Tim Levene and Richard Matthews, with the backing of RIT Capital Partners, the investment trust chaired by Lord Rothschild (whose family owns 18% of the trust). Based in London, the investment firm focuses on fast-growing fintech companies in the UK and Europe, typically supporting Series A and Series B funding rounds.

Augmentum Capital was formed in 2009 by Tim Levene and Richard Matthews, with the backing of RIT Capital Partners, the investment trust chaired by Lord Rothschild (whose family owns 18% of the trust). Based in London, the investment firm focuses on fast-growing fintech companies in the UK and Europe, typically supporting Series A and Series B funding rounds.

Avianta Capital is a private equity and venture capital firm helmed by Fernando Jamie-Fernández, who is also co-founder of the Madrid-based Bipi, a Spanish on-demand car rental app startup. Headquartered in San Pedro Garza Garcia, Mexico, Avianta Capital also has a satellite office in Madrid to facilitate cross-border investments and operations between Spain and Latin America.

Avianta Capital is a private equity and venture capital firm helmed by Fernando Jamie-Fernández, who is also co-founder of the Madrid-based Bipi, a Spanish on-demand car rental app startup. Headquartered in San Pedro Garza Garcia, Mexico, Avianta Capital also has a satellite office in Madrid to facilitate cross-border investments and operations between Spain and Latin America.

Qorium: Lab-grown premium leather for the future of luxury

The Dutch biotech startup co-founded by cell-based meat pioneer Mark Post is targeting the luxury goods market with its “clean leather” sheets made from cultivating bovine skin cells, and plans to raise up to €100m

Beyond Leather Materials: Turning apples into alt-leather for sustainable fashion

Through its Leap brand, the Danish startup cuts food waste by turning apples junked in cider factories into affordable vegan leather for the $100bn leather market

Eco-friendly vegan leather from recycled waste, made in Indonesia

In the battle for ethical consumer dollars, mass production of vegan leather by startups like Mycotech and Bell Society, could be the game-changer for the fashion industry

Biomilq: Creating cell-based mothers’ milk in a lab

With the aim of helping women struggling to breastfeed, Bill Gates-backed Biomilq is disrupting the $45bn baby formula industry developing lab-grown breast milk from mammary epithelial cells

Meatable: Cell-based meat startup secures $47m Series A for scalable technology

The Dutch startup offers a pioneering technology for quickly scaling cell-based meat production while eliminating the need for animal-derived growth media

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

TreeFrog Therapeutics: Mimicking how stem cells grow in the human body

The French biotech’s proprietory technology to cultivate pluripotent stem cells in a 3D environment can be scaled to mass-produce high-quality cells to treat diseases such as Parkinson’s

TurtleTree Labs: Creating sustainable mammalian milk alternatives from stem cells

Founder’s search for high-quality dairy milk led to the creation in a lab of naturally occurring ingredients found in human milk for supply to dairy milk and infant formula businesses

Cubiq Foods: Bioreactor farms producing the food of tomorrow

Growing appetite for meat alternatives expected to fuel demand for Cubiq’s low calorie, Omega 3-enriched lab-grown fats

Cocuus: Industrial-scale solutions to design and print food

This Spanish startup is pioneering industrial-scale 3D food printing using inkjet and laser technology that prints up to 30 times faster with eye-catching food designs

Indonesian local crafts marketplace Qlapa shuts down

Series A funding failed to keep startup afloat as business remains unprofitable, regional heavyweights close in

Singapore, the place to start and grow a cellular agriculture startup

A country that imports over 90% of its food supply, Singapore has turned to foodtech, including cellular agriculture, to safeguard food security, supported by proactive regulators

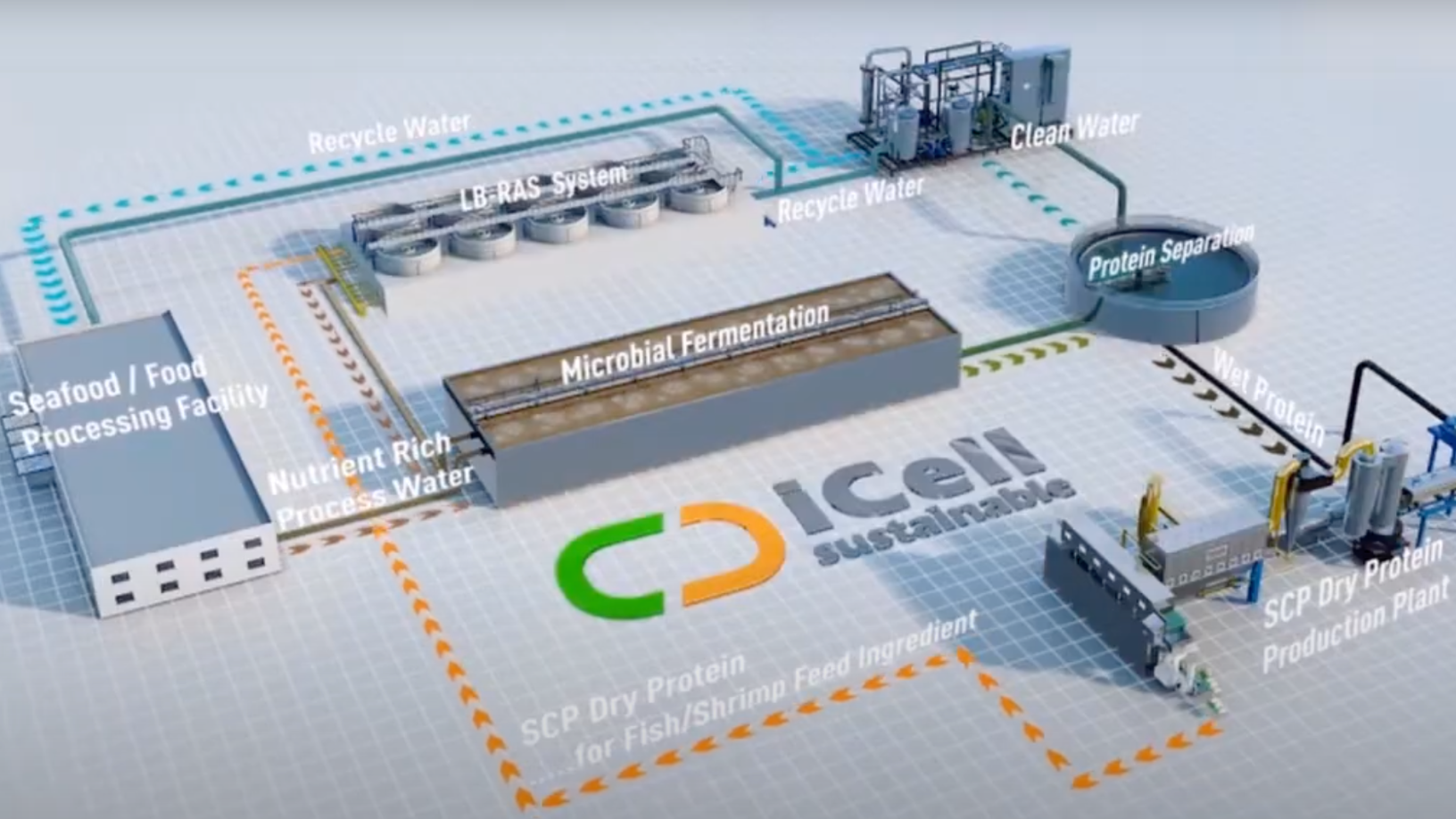

iCell: Upcycling nutrients from wastewater

Hong Kong-based iCell Sustainable Nutrition makes single-cell proteins with wastewater from food and beverage factories, generating revenue and purifying the water for safe discharge or reuse

Because Animals: Pioneering cultured meat for pets

The biotech startup is disrupting the pet food processing industry with cell-based food to minimize environmental “pawprints” and promote animal welfare

Sorry, we couldn’t find any matches for“Cell-based leather”.