Golden Gate Ventures

-

DATABASE (303)

-

ARTICLES (221)

Headquartered in San Francisco, Golden Gate Ventures aims to connect the startup ecosystem in Southeast Asia with Silicon Valley. It was established in 2011.

Headquartered in San Francisco, Golden Gate Ventures aims to connect the startup ecosystem in Southeast Asia with Silicon Valley. It was established in 2011.

Based in Singapore, Golden Equator Capital manages investment funds in real estate, currency and technology businesses. Its Technology and Innovation Fund has backed various up-and-coming Southeast Asian startups, such as the internship job board Glints, dating app Paktor and affordable fashion marketplace Sale Stock. Golden Equator also provides industry expertise, mentoring and other supporting services to the companies in its investment portfolio.

Based in Singapore, Golden Equator Capital manages investment funds in real estate, currency and technology businesses. Its Technology and Innovation Fund has backed various up-and-coming Southeast Asian startups, such as the internship job board Glints, dating app Paktor and affordable fashion marketplace Sale Stock. Golden Equator also provides industry expertise, mentoring and other supporting services to the companies in its investment portfolio.

Warren Shaeffer is the co-founder of online video community Vidme. He was also COO of SocialEngine, co-founded by Vidme co-founder Alex Benzer. He had also worked at Golden Gate Capital and JPMorgan. Shaeffer received his bachelor’s degree in Government from Harvard University and was a Detur Book Prize recipient.

Warren Shaeffer is the co-founder of online video community Vidme. He was also COO of SocialEngine, co-founded by Vidme co-founder Alex Benzer. He had also worked at Golden Gate Capital and JPMorgan. Shaeffer received his bachelor’s degree in Government from Harvard University and was a Detur Book Prize recipient.

Co-Founder and CEO of Zhuazhua

Former Tencent engineer in mobile payments Yang Dengfeng is a pet lover who has struggled with the same problems faced by many pet owners – especially every time he has to bathe his 50kg golden retriever.

Former Tencent engineer in mobile payments Yang Dengfeng is a pet lover who has struggled with the same problems faced by many pet owners – especially every time he has to bathe his 50kg golden retriever.

Loket aims to join the big league in the region’s events management industry by developing innovative hi-tech ticketing software and Big Data services.

Loket aims to join the big league in the region’s events management industry by developing innovative hi-tech ticketing software and Big Data services.

Shanghai Dingfeng Asset Management focuses on the management of securities investment and equity investment. With an AUM exceeding RMB 10 billion, the company is led by a group of core partners including Zhang Gao, Li Linjun, Wang Xiaogang, Liu Cheng, Chen Zhengxu and Wang Shaoyan. To date it has won 11 Golden Bull Awards and 50 others, including 2013 Forbes China Best Hedge Fund and 2014 Morningstar China Hedge Fund.

Shanghai Dingfeng Asset Management focuses on the management of securities investment and equity investment. With an AUM exceeding RMB 10 billion, the company is led by a group of core partners including Zhang Gao, Li Linjun, Wang Xiaogang, Liu Cheng, Chen Zhengxu and Wang Shaoyan. To date it has won 11 Golden Bull Awards and 50 others, including 2013 Forbes China Best Hedge Fund and 2014 Morningstar China Hedge Fund.

Openspace Ventures (formerly NSI Ventures)

Originally formed in 2014 as NSI Ventures, Openspace Ventures makes investments in technology companies based in Southeast Asia. Led by Shane Chesson and Hian Goh, Openspace Ventures used to be a part of Northstar Group, a private equity firm primarily invested in the financial services, retail, energy and telecom sectors. In 2018, Chesson and Goh took NSI Ventures independent and rebranded it as Openspace Ventures. They still maintain links with Northstar, with Northstar managing partner Patrick Goh becoming senior advisor to Openspace.

Originally formed in 2014 as NSI Ventures, Openspace Ventures makes investments in technology companies based in Southeast Asia. Led by Shane Chesson and Hian Goh, Openspace Ventures used to be a part of Northstar Group, a private equity firm primarily invested in the financial services, retail, energy and telecom sectors. In 2018, Chesson and Goh took NSI Ventures independent and rebranded it as Openspace Ventures. They still maintain links with Northstar, with Northstar managing partner Patrick Goh becoming senior advisor to Openspace.

Prosperity7 Ventures is the $1bn diversified VC fund of Aramco Ventures, a subsidiary of Aramco, the world's leading integrated energy and chemicals company. The fund's name derives from “Prosperity Well", the 7th oil well drilled in Saudi Arabia and the first to strike oil. Prosperity7 Ventures invests globally, focusing on highly scalable startups in the US and China.

Prosperity7 Ventures is the $1bn diversified VC fund of Aramco Ventures, a subsidiary of Aramco, the world's leading integrated energy and chemicals company. The fund's name derives from “Prosperity Well", the 7th oil well drilled in Saudi Arabia and the first to strike oil. Prosperity7 Ventures invests globally, focusing on highly scalable startups in the US and China.

SC Ventures is the venture capital arm of Standard Chartered Bank. The company serves as a platform from which Standard Chartered can identify innovative technologies in banking and financial services, and invest in the companies that build these technologies and business models. Besides investments, SC Ventures also operates an accelerator program named eXellerator and an internal venture builder unit. As an investor, SC Ventures focuses on Series B+ rounds, with each investment at the $1-5m range.

SC Ventures is the venture capital arm of Standard Chartered Bank. The company serves as a platform from which Standard Chartered can identify innovative technologies in banking and financial services, and invest in the companies that build these technologies and business models. Besides investments, SC Ventures also operates an accelerator program named eXellerator and an internal venture builder unit. As an investor, SC Ventures focuses on Series B+ rounds, with each investment at the $1-5m range.

Founded by Wu Shichun in 2014, Plum Ventures is an internet-focused angel fund managing three RMB funds. Plum Ventures is listed among the top 10 angel investment firms in China, with each investment of RMB 2 million to 5 million.

Founded by Wu Shichun in 2014, Plum Ventures is an internet-focused angel fund managing three RMB funds. Plum Ventures is listed among the top 10 angel investment firms in China, with each investment of RMB 2 million to 5 million.

Founded in 2011, Atom Ventures is a venture capital firm focused on early-stage investments in internet and mobile startups. Atom Ventures was named “the Most Active Angel Investor in 2016” and “The Top 30 Angel Investors in China”.

Founded in 2011, Atom Ventures is a venture capital firm focused on early-stage investments in internet and mobile startups. Atom Ventures was named “the Most Active Angel Investor in 2016” and “The Top 30 Angel Investors in China”.

Samsung Venture Investment, or Samsung Ventures, is the VC investment arm of South Korean diversified conglomerate Samsung Group. It is a separate entity from Samsung NEXT.Samsung Ventures primarily invests in semiconductors, telecommunications tech, software and internet companies, as well as biotechnology and medical companies. The VC is built to support new innovations that can lead to further improvements in Samsung’s existing businesses, which includes smartphones, home appliances, and components like OLED panels and Li-ion batteries.Samsung Ventures has invested in healthcare and wellness tech companies like Indonesia’s telehealth service Alodokter, posture correction device makers Posture360, and Noom, an app for dieting and exercise. In the sensors front, Samsung Ventures has invested in Sense Photonics, a startup creating 3D computer vision based on lidar for industrial and automotive (self-driving) purposes. Besides these companies, Samsung Ventures has also invested in insurtech companies and even gaming companies, such as Pokémon Go developer Niantic.

Samsung Venture Investment, or Samsung Ventures, is the VC investment arm of South Korean diversified conglomerate Samsung Group. It is a separate entity from Samsung NEXT.Samsung Ventures primarily invests in semiconductors, telecommunications tech, software and internet companies, as well as biotechnology and medical companies. The VC is built to support new innovations that can lead to further improvements in Samsung’s existing businesses, which includes smartphones, home appliances, and components like OLED panels and Li-ion batteries.Samsung Ventures has invested in healthcare and wellness tech companies like Indonesia’s telehealth service Alodokter, posture correction device makers Posture360, and Noom, an app for dieting and exercise. In the sensors front, Samsung Ventures has invested in Sense Photonics, a startup creating 3D computer vision based on lidar for industrial and automotive (self-driving) purposes. Besides these companies, Samsung Ventures has also invested in insurtech companies and even gaming companies, such as Pokémon Go developer Niantic.

Co-founded by Angel Asin, Yago Perrin and Yago Arbeloa in 2000, Viriditas Ventures is an angel investment firm that provides funds for tech startups in the IT related sector. Viriditas Ventures invests in early-stage startups and helps entrepreneurs get to the next funding stage.

Co-founded by Angel Asin, Yago Perrin and Yago Arbeloa in 2000, Viriditas Ventures is an angel investment firm that provides funds for tech startups in the IT related sector. Viriditas Ventures invests in early-stage startups and helps entrepreneurs get to the next funding stage.

BW Ventures was established in February 2015 by Xu Min. The firm has offices in Beijing and Shanghai. BW Ventures' angel investments usually range from RMB 500,000 to 1,500,000.

BW Ventures was established in February 2015 by Xu Min. The firm has offices in Beijing and Shanghai. BW Ventures' angel investments usually range from RMB 500,000 to 1,500,000.

Anthill Ventures is an accelerator VC firm that provides early stage investments and support services for pre-Series A startups to facilitate rapid growth based on a proprietary “Scalability Quotient” score. Based on 108 parameters, the SQ score is used by Anthill Ventures to evaluate a startup’s potential for quick scalability.

Anthill Ventures is an accelerator VC firm that provides early stage investments and support services for pre-Series A startups to facilitate rapid growth based on a proprietary “Scalability Quotient” score. Based on 108 parameters, the SQ score is used by Anthill Ventures to evaluate a startup’s potential for quick scalability.

Raising $50m second fund, Indogen Capital seeks more international partners and exits

Cooperation is key to Indogen's investment thesis, as it looks to help more foreign VCs and their portfolio startups find success in Southeast Asia's biggest market

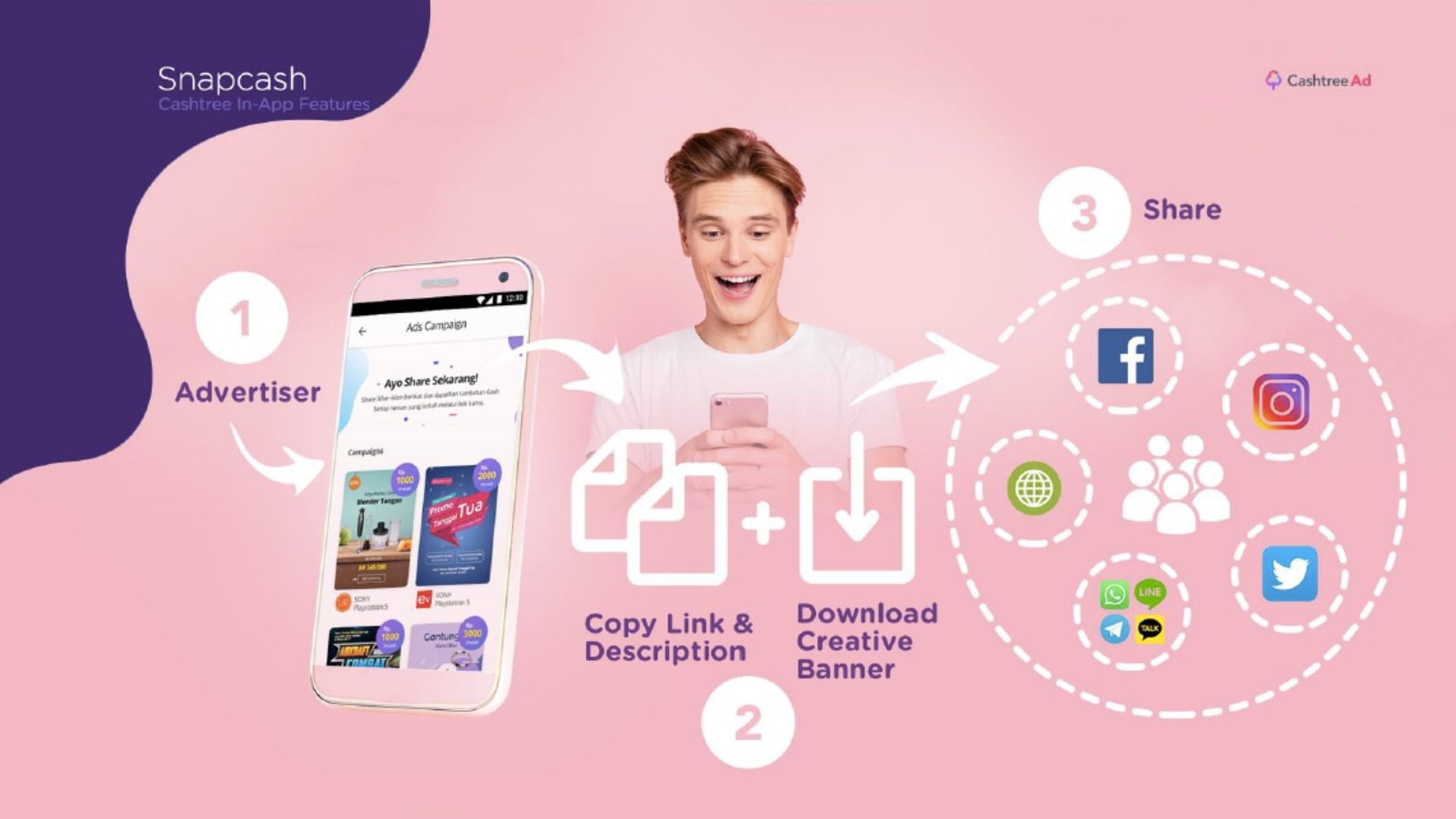

Cashtree combines locksreen ads and rewards-based marketing to help businesses go viral

The Indonesian mobile advertising platform encourages users to share ads on social media and WhatsApp so they go viral

Jesús Encinar: The Man Behind Idealista and 11870.com

Entrepreneur, angel investor and down-to-earth idealist

Indonesia's Rata offers customized aligners for quicker teeth straightening

Founded by two dentists, Alpha JWC Ventures-backed Rata seeks to offer an affordable alternative to conventional braces by tapping AI in orthodontics

FMCG supply chain solution KlikDaily simplifies life for mom-and-pop stores in Indonesia

KlikDaily, which raised Series A funding this week, is helping small businesses streamline supply of FMCG and reduce prices by eliminating several links in the supply chain

Billin offers unlimited free e-invoicing services to SMEs and freelancers

Offering automated online invoice generating, sharing, tracking and payments, the Spanish fintech wants to become the billing Dropbox for businesses worldwide

Haoqipei: Connecting China's vast B2B auto parts market

Haoqipei not only connects buyers and sellers with a B2B trading platform, it also uses big data to build trust and relationships in a highly fragmented market

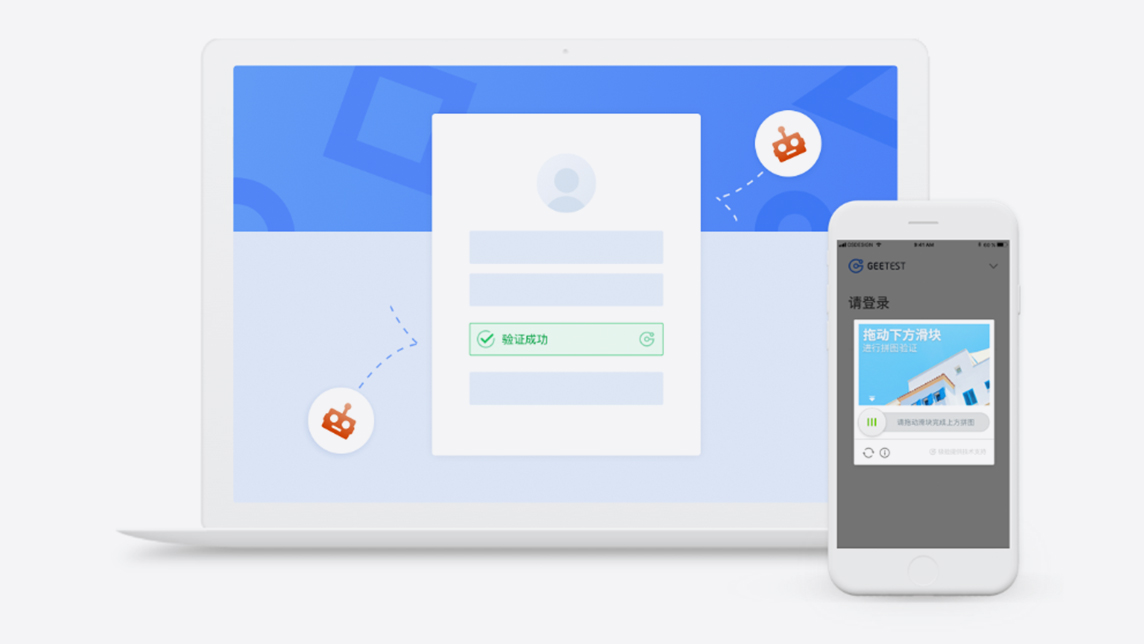

Geetest provides an easy and fun way to secure websites and apps

This startup’s behavior-based verification process takes less than a second to finish, but that’s all the time it needs to distinguish a human from a robot

Ruangguru cracks business model as it reaches 13 million student users

Holding pole position as Indonesia's popular tutoring services app, Ruangguru is revving up to expand into the lucrative corporate training sector

Indonesia agritech startup HARA goes on the blockchain

What began as a way to help farmers make data-driven decisions has unexpectedly expanded into blockchain. How does HARA plan to use this technology to improve outcomes in agriculture?

As AI assistant market heats up, Sherpa zooms in on smart autos, smart homes

Spanish AI assistant startup Sherpa launches Sherpa Platform, a new set of APIs for smart cars, phones and home devices

Neurafarm: Putting an AI plant doctor in farmers' hands

This startup is riding on Indonesia’s urban farming trend with its planting kit and an AI-powered app that identifies plant diseases from photos of unhealthy leaves

Mindtera: Building mental resilience through bite-sized lessons

Mindtera wants to nip mental health issues in the bud by equipping working adults with skills to navigate work challenges and personal relationships, using their phones

TheVentures founders launch Singapore VC to drive deals in Southeast Asia

The Korean Viki co-founders return to Singapore as venture builders and investors, offering South Korean partnerships and “CTO-as-a-service” in Southeast Asia

Insights on tech and the Indonesian diaspora in Silicon Valley

Navigating the different diaspora communities, one tech event at a time

Sorry, we couldn’t find any matches for“Golden Gate Ventures”.