MUFG Innovation Partners

-

DATABASE (365)

-

ARTICLES (473)

Founded in Sydney in 2004, Artesian Capital Management (Australia) Pty Ltd is a global alternative investment management firm specialized in public and private debt, venture capital and impact investment strategies. The VC was a spin-off from ANZ Banking Group’s capital markets business, backed by ANZ Private Equity. Artesian’s founding partners Jeremy Colless, Matthew Clunies-Ross and John McCartney bought ANZ’s stake in 2005.Today, Artesian has international offices in New York, London, Singapore, Jakarta and Shanghai. Its China VC Fund was launched in 2017 and the firm also has plans for a Southeast Asia VC Fund. The alternative investment firm currently manages multiple funds including Australian VC Fund 2, High Impact Green Debt Fund, GrainInnovate and Women Economic Empowerment Fund.

Founded in Sydney in 2004, Artesian Capital Management (Australia) Pty Ltd is a global alternative investment management firm specialized in public and private debt, venture capital and impact investment strategies. The VC was a spin-off from ANZ Banking Group’s capital markets business, backed by ANZ Private Equity. Artesian’s founding partners Jeremy Colless, Matthew Clunies-Ross and John McCartney bought ANZ’s stake in 2005.Today, Artesian has international offices in New York, London, Singapore, Jakarta and Shanghai. Its China VC Fund was launched in 2017 and the firm also has plans for a Southeast Asia VC Fund. The alternative investment firm currently manages multiple funds including Australian VC Fund 2, High Impact Green Debt Fund, GrainInnovate and Women Economic Empowerment Fund.

Co-CEO, co-founder of Psquared

Argentinian native Nicolas Araujo Müller is co-CEO and co-founder at Psquared, Spain’s first flexible workplace management and design company for hybrid workspaces. He has worked there since its foundation in April 2018, originally as part of startup hub CoBuilder, and is now its CFO. He is also a part-time advisor and investor at startup development agency We Are Grit, since its launch in 2020.Earlier, Araujo was CFO and co-founder at digital talent agency Bandit, for two years, until 2017. Before that, he held the same roles at his previous Barcelona-based startup, Nubelo, another tech recruitment agency for freelancers, between 2012 and 2016, when it was acquired by Freelancer.com. In 2016, Araujo was a visiting professor at the Autonomous University of Barcelona on digital economy.His first startup was Work At Home in Argentina, where he was a co-founder for two years from 2011–13, for which he won local innovation prizes. Prior to this, Araujo held various management consultancy roles, working in business analysis and research at Ernst & Young, Standard & Poor’s and Accenture, from 2008–2012, and completed a stint at the US embassy in Buenos Aires. He is also a founding member of Argentina’s entrepreneur organization, ASEA, established in 2013. Araujo holds a degree in economics from CEMA University, Buenos Aires and a qualification from Harvard University in negotiation. In 2017 and 2013, Araujo was named in Forbes Argentina’s 30 Promesas list of young entrepreneurs.

Argentinian native Nicolas Araujo Müller is co-CEO and co-founder at Psquared, Spain’s first flexible workplace management and design company for hybrid workspaces. He has worked there since its foundation in April 2018, originally as part of startup hub CoBuilder, and is now its CFO. He is also a part-time advisor and investor at startup development agency We Are Grit, since its launch in 2020.Earlier, Araujo was CFO and co-founder at digital talent agency Bandit, for two years, until 2017. Before that, he held the same roles at his previous Barcelona-based startup, Nubelo, another tech recruitment agency for freelancers, between 2012 and 2016, when it was acquired by Freelancer.com. In 2016, Araujo was a visiting professor at the Autonomous University of Barcelona on digital economy.His first startup was Work At Home in Argentina, where he was a co-founder for two years from 2011–13, for which he won local innovation prizes. Prior to this, Araujo held various management consultancy roles, working in business analysis and research at Ernst & Young, Standard & Poor’s and Accenture, from 2008–2012, and completed a stint at the US embassy in Buenos Aires. He is also a founding member of Argentina’s entrepreneur organization, ASEA, established in 2013. Araujo holds a degree in economics from CEMA University, Buenos Aires and a qualification from Harvard University in negotiation. In 2017 and 2013, Araujo was named in Forbes Argentina’s 30 Promesas list of young entrepreneurs.

Co-CEO and Co-founder of Notpla (formerly Skipping Rocks Lab)

Rodrigo García González graduated in Architecture at the Technical University of Madrid (ETSAM) in 2009 and also completed various PhD courses in advanced architecture at his alma mater.In 2006, the architect student joined an EU Asia-Link sustainable humane habitat program that included stints at the Centre for Environmental Planning and Technology (CEPT) University in India. He also won a SMILE scholarship to study industrial design at Pontificia Universidad Católica in Chile for one year. In 2011, he obtained a scholarship to study industrial design and business at Umeå Institute of Design in Sweden. In 2014, he completed two master’s programs in innovation design engineering run by London’s Imperial College and Royal College of Art.In July 2014, he co-founded Skipping Rocks Lab, that was later pivoted into Notpla, a UK-based startup that develops compostable and edible packaging materials made of seaweed and other plants.Since 2007, he has worked with various institutions in Europe, Latin America and the US including Cornell University, CEPT, Imperial College and Royal College of Art. In 2016, he became a senior lecturer for a degree program in product and furniture design at Kingston University.He has two patents for his work on structural and deployable systems. His designs have also been featured in prestigious art centers like the Cite de l'Architecture of Paris and the Venice Biennale of Architecture.Other projects include the Hop! suitcase that can follow the user by tracking the signal of the user’s mobile phone and Aer, an artificial cloud that can evaporate “drinkable” water from the sea. He also developed Zipizip, an architectural system that enables the construction of several floors of a building in a few hours.

Rodrigo García González graduated in Architecture at the Technical University of Madrid (ETSAM) in 2009 and also completed various PhD courses in advanced architecture at his alma mater.In 2006, the architect student joined an EU Asia-Link sustainable humane habitat program that included stints at the Centre for Environmental Planning and Technology (CEPT) University in India. He also won a SMILE scholarship to study industrial design at Pontificia Universidad Católica in Chile for one year. In 2011, he obtained a scholarship to study industrial design and business at Umeå Institute of Design in Sweden. In 2014, he completed two master’s programs in innovation design engineering run by London’s Imperial College and Royal College of Art.In July 2014, he co-founded Skipping Rocks Lab, that was later pivoted into Notpla, a UK-based startup that develops compostable and edible packaging materials made of seaweed and other plants.Since 2007, he has worked with various institutions in Europe, Latin America and the US including Cornell University, CEPT, Imperial College and Royal College of Art. In 2016, he became a senior lecturer for a degree program in product and furniture design at Kingston University.He has two patents for his work on structural and deployable systems. His designs have also been featured in prestigious art centers like the Cite de l'Architecture of Paris and the Venice Biennale of Architecture.Other projects include the Hop! suitcase that can follow the user by tracking the signal of the user’s mobile phone and Aer, an artificial cloud that can evaporate “drinkable” water from the sea. He also developed Zipizip, an architectural system that enables the construction of several floors of a building in a few hours.

Born in Shanghai in 1973, Zhang and his parents immigrated to the US in 1987. He received his bachelor’s in Neurobiology from the University of California, San Francisco in 1995 and his master’s in Biotechnology and Business from Northwestern University in 1999. Zhang worked at Salomon Smith Barney and ABN AMRO Capital from 1999–2001. He then served as managing director and head of China operations at venture capital firm WI Harper Group from 2002–2008. Zhang has since served as founding managing partner at Matrix Partners China.

Born in Shanghai in 1973, Zhang and his parents immigrated to the US in 1987. He received his bachelor’s in Neurobiology from the University of California, San Francisco in 1995 and his master’s in Biotechnology and Business from Northwestern University in 1999. Zhang worked at Salomon Smith Barney and ABN AMRO Capital from 1999–2001. He then served as managing director and head of China operations at venture capital firm WI Harper Group from 2002–2008. Zhang has since served as founding managing partner at Matrix Partners China.

Bo Shao graduated with a Harvard degree in Physics and Electrical Engineering in 1995 and worked at the Boston Consulting Group for almost two years until 1997. After obtaining an MBA from Harvard in 1999, he started EachNet in China. The e-commerce platform was acquired by eBay in 2003 for US$225m and Bo went on to other ventures like Babytree and Parent Lab Inc.Based in San Francisco, the angel investor became a founding partner of Matrix Partners China in 2008. He focuses on early-stage investments in the internet, e-commerce and new media sectors.

Bo Shao graduated with a Harvard degree in Physics and Electrical Engineering in 1995 and worked at the Boston Consulting Group for almost two years until 1997. After obtaining an MBA from Harvard in 1999, he started EachNet in China. The e-commerce platform was acquired by eBay in 2003 for US$225m and Bo went on to other ventures like Babytree and Parent Lab Inc.Based in San Francisco, the angel investor became a founding partner of Matrix Partners China in 2008. He focuses on early-stage investments in the internet, e-commerce and new media sectors.

Founded in 2013, Visionnaire Ventures is based in San Francisco and invests globally in innovative technologies in diverse sectors like AI and ML, digital health, Big Data, IoT, mobile and agriculture. The firm is managed by a team of serial entrepreneurs and executives involved in global internet, game and online media companies.The VC is co-founded by managing partners Taizo Son, Keith Nilsson and Susan Choe who also founded Katalyst Ventures. Son is the brother of SoftBank’s Masayoshi Son based in Japan. Taizo founded Gungho Online in 2002, a major online gaming company that became public-listed in 2005. With a vision to create a Silicon Valley-like venture eco-system in East Asia, he also founded MOVIDA JAPAN in 2009. He also founded Mistletoe Inc as CEO in 2013 to support entrepreneurs and provide startup ecosystem development activities.

Founded in 2013, Visionnaire Ventures is based in San Francisco and invests globally in innovative technologies in diverse sectors like AI and ML, digital health, Big Data, IoT, mobile and agriculture. The firm is managed by a team of serial entrepreneurs and executives involved in global internet, game and online media companies.The VC is co-founded by managing partners Taizo Son, Keith Nilsson and Susan Choe who also founded Katalyst Ventures. Son is the brother of SoftBank’s Masayoshi Son based in Japan. Taizo founded Gungho Online in 2002, a major online gaming company that became public-listed in 2005. With a vision to create a Silicon Valley-like venture eco-system in East Asia, he also founded MOVIDA JAPAN in 2009. He also founded Mistletoe Inc as CEO in 2013 to support entrepreneurs and provide startup ecosystem development activities.

Andrew McCollum is CEO of television streaming service Philo and was also one of its earliest investors. Prior to that, he was one of the co-founders of Facebook. He served as an entrepreneur in residence at two of Philo’s investors, the US-based VC firms New Enterprise Associates and Flybridge Partners, and is also an early-stage angel investor himself.His last disclosed investments were in 2015, in US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer, as well as in breastfeeding app Moxxly’s undisclosed seed round prior to it being acquired by Medela.

Andrew McCollum is CEO of television streaming service Philo and was also one of its earliest investors. Prior to that, he was one of the co-founders of Facebook. He served as an entrepreneur in residence at two of Philo’s investors, the US-based VC firms New Enterprise Associates and Flybridge Partners, and is also an early-stage angel investor himself.His last disclosed investments were in 2015, in US-based unicorn Diamond Foundry, the first certified carbon-neutral lab-produced diamond manufacturer, as well as in breastfeeding app Moxxly’s undisclosed seed round prior to it being acquired by Medela.

Kingfisher is a privately owned, and independently managed financial services firm active for nearly three decades. The firm was established in Charlotte in the US in 1989 and acquired by WealthTrust, LLC in 2004. In 2009, it returned to operate as an independent investment adviser under the name of Kingfisher Capital, LLC and purchased all outstanding ownership interest from WealthTrust LLC. Kingfisher has supported affluent families, professionals, business owners, and institutions through financial advisory, smart investments and personalized client service.The firm is currently led by managing partners and co-founders Alexander Miles and H K Hallett. Prior to founding Kingfisher, Miles worked at WealthTrust Advisors, the Myers Limited Partnerships and Lehman Brothers in New York. Hallett worked for Trust Company Bank of Georgia and Peoples Bank of North Carolina before joining Carolina Securities Corporation, where he co-managed the Charlotte office.

Kingfisher is a privately owned, and independently managed financial services firm active for nearly three decades. The firm was established in Charlotte in the US in 1989 and acquired by WealthTrust, LLC in 2004. In 2009, it returned to operate as an independent investment adviser under the name of Kingfisher Capital, LLC and purchased all outstanding ownership interest from WealthTrust LLC. Kingfisher has supported affluent families, professionals, business owners, and institutions through financial advisory, smart investments and personalized client service.The firm is currently led by managing partners and co-founders Alexander Miles and H K Hallett. Prior to founding Kingfisher, Miles worked at WealthTrust Advisors, the Myers Limited Partnerships and Lehman Brothers in New York. Hallett worked for Trust Company Bank of Georgia and Peoples Bank of North Carolina before joining Carolina Securities Corporation, where he co-managed the Charlotte office.

Currently based in the UK, Carlos González-Cadenas is a serial entrepreneur and business angel. In 2017, he became the CPO and CTO of GoCardless, one of the fintech partners of Billin. He founded Fogg in Barcelona in 2008 to build an advanced semantic search platform for the travel industry that was acquired by Scotland's Skyscanner in 2013. As CPO of Skyscanner in UK, he was able to scale the product development organization globally before the company was acquired by the Ctrip group for US$1.75 billion in November 2016. He was also part of Oberlo that was acquired by Shopify.

Currently based in the UK, Carlos González-Cadenas is a serial entrepreneur and business angel. In 2017, he became the CPO and CTO of GoCardless, one of the fintech partners of Billin. He founded Fogg in Barcelona in 2008 to build an advanced semantic search platform for the travel industry that was acquired by Scotland's Skyscanner in 2013. As CPO of Skyscanner in UK, he was able to scale the product development organization globally before the company was acquired by the Ctrip group for US$1.75 billion in November 2016. He was also part of Oberlo that was acquired by Shopify.

Lever VC was founded in 2018 by Nick Cooney, an early investor of Beyond Meat and Memphis Meats. He is also the co-founder of Good Food Institute. Lever has currently invested in 14 startups from the US, Europe, Asia and Latin America.Focused on investments in early-stage alternative protein companies, the firm announced the first close of its Lever VC Fund I in August 2020, with its fourth close at $46m in April 2021. The final close will be completed by June 2021. Investors in the fund include NFL and NBA athletes, British nobility, food businesses, alt-protein companies and family offices as limited partners.In June 2020, Lever launched a $28m joint investment fund and accelerator to invest in Chinese plant-based and cell-cultivated meat and dairy companies. The Lever China Alternative Protein Fund will invest RMB 40m in alt-protein companies in mainland China over the next four years.

Lever VC was founded in 2018 by Nick Cooney, an early investor of Beyond Meat and Memphis Meats. He is also the co-founder of Good Food Institute. Lever has currently invested in 14 startups from the US, Europe, Asia and Latin America.Focused on investments in early-stage alternative protein companies, the firm announced the first close of its Lever VC Fund I in August 2020, with its fourth close at $46m in April 2021. The final close will be completed by June 2021. Investors in the fund include NFL and NBA athletes, British nobility, food businesses, alt-protein companies and family offices as limited partners.In June 2020, Lever launched a $28m joint investment fund and accelerator to invest in Chinese plant-based and cell-cultivated meat and dairy companies. The Lever China Alternative Protein Fund will invest RMB 40m in alt-protein companies in mainland China over the next four years.

Entrepreneur First is a global entrepreneur incubator program and early-startup investor. The incubator is an intensive six-month program for founders and aspiring entrepreneurs to help them develop ideas that can go into building their own companies. The program is held in six cities around the world: Bangalore; Berlin, London, Paris, Singapore and Toronto (Canada).Participants do not need to have a startup or a specific business idea to participate, and those who have established their own companies can seek partners or co-founders at the program. Roughly 40-50% of the cohort reach the “Launch” phase, where the participants have established their own companies and received investments from Entrepreneur First and potentially other VCs. Entrepreneur First can invest in a startup built by program participants in exchange for 10% equity. The exact amount invested varies: £80,000 for the European programs; S$75,000 for the Singapore and Bangalore programs; and C$100,000 for the Canada program.

Entrepreneur First is a global entrepreneur incubator program and early-startup investor. The incubator is an intensive six-month program for founders and aspiring entrepreneurs to help them develop ideas that can go into building their own companies. The program is held in six cities around the world: Bangalore; Berlin, London, Paris, Singapore and Toronto (Canada).Participants do not need to have a startup or a specific business idea to participate, and those who have established their own companies can seek partners or co-founders at the program. Roughly 40-50% of the cohort reach the “Launch” phase, where the participants have established their own companies and received investments from Entrepreneur First and potentially other VCs. Entrepreneur First can invest in a startup built by program participants in exchange for 10% equity. The exact amount invested varies: £80,000 for the European programs; S$75,000 for the Singapore and Bangalore programs; and C$100,000 for the Canada program.

Fortum Oyj is a Finnish state-owned energy company operating power plants and co-generation plants across the nation. Listed on the NASDAQ OMX Helsinki stock exchange, Fortum is reputed to be Finland’s biggest company in terms of revenue generated in 2020.It is also Europe's third-largest producer of carbon-free electricity and the second-largest producer of nuclear power. Ranked as the fifth largest heat producer globally, Fortum supplies electricity and heating directly to consumers in Finland, Germany, Central Europe, the UK and the Nordic countries.Fortum invested in Finnish cleantech Infinited Fiber, taking up a 4% stake in 2019, to complement the energy company’s biorefining value chain and to improve resource efficiency. The cleantech investee aims to license its biodegradable fiber technology to help industry partners to manufacture innovative materials from textile and industrial waste.

Fortum Oyj is a Finnish state-owned energy company operating power plants and co-generation plants across the nation. Listed on the NASDAQ OMX Helsinki stock exchange, Fortum is reputed to be Finland’s biggest company in terms of revenue generated in 2020.It is also Europe's third-largest producer of carbon-free electricity and the second-largest producer of nuclear power. Ranked as the fifth largest heat producer globally, Fortum supplies electricity and heating directly to consumers in Finland, Germany, Central Europe, the UK and the Nordic countries.Fortum invested in Finnish cleantech Infinited Fiber, taking up a 4% stake in 2019, to complement the energy company’s biorefining value chain and to improve resource efficiency. The cleantech investee aims to license its biodegradable fiber technology to help industry partners to manufacture innovative materials from textile and industrial waste.

Founded in Amsterdam in 2011, Rockstart is a global accelerator-VC focusing on sustainability startups across market segments. Rockstart also runs specialist programs like agrifood in Copenhagen, healthcare in the Dutch town of Nijmegen and also in emerging tech in Bogota, Colombia. It specializes in developing business relationships for portfolio startups with global corporates such as Maersk, Shell and the Dutch Ministry of Health. Rockstart has invested in more than 250 startups, valued at €750m in total.Launched in 2019, Rockstart’s €22m agrifood fund secured investment partners including Vaekstfonden’s Green Future Fund and global dairy cooperative Arla Foods. It has invested in 20 food enterprises like Swiss zero-waste supermarket Lyfa and Danish alt-leather startup Beyond Leather Materials in 2021. Rockstart’s energy fund recently invested in the €730,000 pre-seed round of Danish carbon sequestration corporate marketplace, Klimate, in September 2021. Exits include Wercker, iClinic, Brincr and 3D Hubs.

Founded in Amsterdam in 2011, Rockstart is a global accelerator-VC focusing on sustainability startups across market segments. Rockstart also runs specialist programs like agrifood in Copenhagen, healthcare in the Dutch town of Nijmegen and also in emerging tech in Bogota, Colombia. It specializes in developing business relationships for portfolio startups with global corporates such as Maersk, Shell and the Dutch Ministry of Health. Rockstart has invested in more than 250 startups, valued at €750m in total.Launched in 2019, Rockstart’s €22m agrifood fund secured investment partners including Vaekstfonden’s Green Future Fund and global dairy cooperative Arla Foods. It has invested in 20 food enterprises like Swiss zero-waste supermarket Lyfa and Danish alt-leather startup Beyond Leather Materials in 2021. Rockstart’s energy fund recently invested in the €730,000 pre-seed round of Danish carbon sequestration corporate marketplace, Klimate, in September 2021. Exits include Wercker, iClinic, Brincr and 3D Hubs.

Investisseurs & Partenaires (I&P)

Set up in 2002 by Patrice Hoppenot 15 years after he founded European investment fund BC Partners, Investisseurs & Partenaires (I&P) is an impact investor seeking to help SMEs prosper in Africa and create sustainable jobs and income there. With about €210m raised to date, I&P finances SMEs, startups and regional investment funds in Africa through equity participation and loans, as well as through microfinance institutions. Its I&P Acceleration Technologies focuses on digital startups with €2.5m of funding to be invested in 10–15 startups in 2020–2023. To date, I&P has supported more than 100 capital-funded companies and 20 companies benefiting from subsidized acceleration programs. I&P has about 100 staff based in Paris, Washington D.C. and in seven African offices (Burkina Faso, Cameroon, Côte d'Ivoire, Ghana, Madagascar, Niger and Senegal).

Set up in 2002 by Patrice Hoppenot 15 years after he founded European investment fund BC Partners, Investisseurs & Partenaires (I&P) is an impact investor seeking to help SMEs prosper in Africa and create sustainable jobs and income there. With about €210m raised to date, I&P finances SMEs, startups and regional investment funds in Africa through equity participation and loans, as well as through microfinance institutions. Its I&P Acceleration Technologies focuses on digital startups with €2.5m of funding to be invested in 10–15 startups in 2020–2023. To date, I&P has supported more than 100 capital-funded companies and 20 companies benefiting from subsidized acceleration programs. I&P has about 100 staff based in Paris, Washington D.C. and in seven African offices (Burkina Faso, Cameroon, Côte d'Ivoire, Ghana, Madagascar, Niger and Senegal).

Fu was born in Jiangxi province in March 1978. In 2005, he led a team that created free antivirus software Qihoo 360 Security Guard. In 2008, he became vice president at Matrix Partners China. A year later, Fu became CEO and chairman of picture software firm Conew Image, which merged with Kingsoft Security in November 2010 to create Kingsoft Network. Fu has served as CEO of the merged company ever since, which, in March 2014, was renamed Cheetah Mobile. He is also founder and general partner at Purple Cow Startups.

Fu was born in Jiangxi province in March 1978. In 2005, he led a team that created free antivirus software Qihoo 360 Security Guard. In 2008, he became vice president at Matrix Partners China. A year later, Fu became CEO and chairman of picture software firm Conew Image, which merged with Kingsoft Security in November 2010 to create Kingsoft Network. Fu has served as CEO of the merged company ever since, which, in March 2014, was renamed Cheetah Mobile. He is also founder and general partner at Purple Cow Startups.

P2P financing platform Investree raises Series C, with $23.5m in first tranche

Indonesia's Investree closes key funding amid Covid-19 crisis; is applying for licenses in Thailand and the Philippines in regional expansion

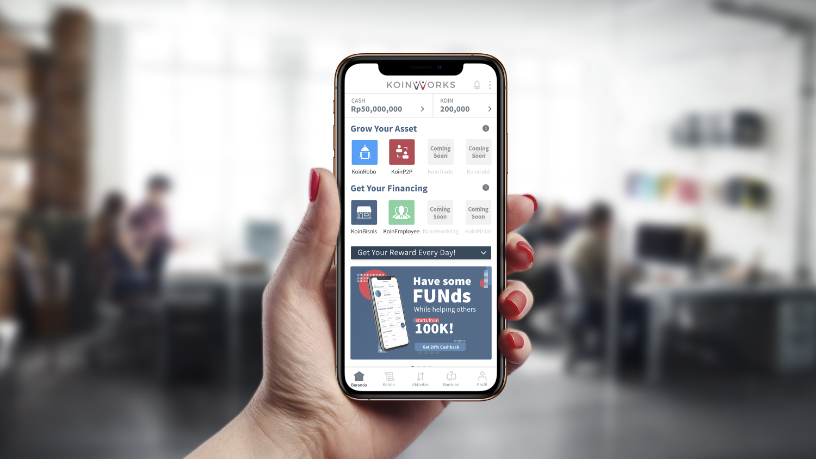

Amid Covid-19, Indonesian P2P lender KoinWorks raises $20m in convertible note funding

Backed by Quona Capital, EV Growth and other investors, KoinWorks plans to disburse more loans amid greater uncertainty and default risk

Raising $50m second fund, Indogen Capital seeks more international partners and exits

Cooperation is key to Indogen's investment thesis, as it looks to help more foreign VCs and their portfolio startups find success in Southeast Asia's biggest market

Shilling Capital Partners: Growing Portuguese tech businesses from seed

An early mover, the influential angel investing firm is accelerating local techs into Brazil and globally

Indonesian insurtech Qoala survives pandemic with new partners and products

Acquisition of Thai insurtech FairDee to spearhead expansion into Southeast Asia, building on earlier entry into Malaysia and Vietnam and a Covid-19 travel insurance product at home

Carlos Melo Brito: Driving force behind Porto's innovation boom

The professor has overseen the creation and growth of the University of Porto-based UPTEC incubator, birthplace of many of Portugal's most successful startups

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Portugal's health & medtech startups: Taking innovation and disruption to heart

Backed by local and foreign money, Portugal’s healthcare and medical technology startups are hungry to go global

New Ventures Innovation: Prasetiya Mulya University takes on student entrepreneurship

To prepare a new generation of startup founders, Prasetiya Mulya University combines theoretical education with real-life exposure to the startup world

Animal AgTech Innovation Summit 2021: Experts discuss post-pandemic priorities

The pandemic not only put digital tech in everyone’s hands, it also forced thinking about collecting meaningful data and moving it on-demand to both producers and decision makers

Animal AgTech Innovation Summit 2021: Future of aquaculture in the US

With the US Importing over 85% of its seafood, industry experts examine how and why the country should develop a sustainable aquaculture industry

EV maker Xpeng Motors partners Didi to offer car rentals and better charging services

Besides working with China's largest ride-hailing platform, Xpeng Motors has also connected to the charging networks of EV maker NIO and TELD, China's biggest EV charging network

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

SWITCH Singapore: Alternative protein sure to take off in Asia, with Singapore as innovation hotbed

In an in-depth discussion, food industry experts say products made with alternative protein in hybrid forms could offer the fastest route to commercialization

Smart Agrifood Summit 2021: A global innovation ecosystem is needed to catch up with other sectors

Investors from SVG Ventures/THRIVE, Pinduoduo and others agree that players must join forces to boost agrifood tech investment, internationally and across the value chain

Sorry, we couldn’t find any matches for“MUFG Innovation Partners”.