Mental health

-

DATABASE (144)

-

ARTICLES (198)

Ataria Ventures is an early stage fund that offers predominantly Latin American investors and corporations access to technology startups in Israel and Silicon Valley. It has invested in more than 30 startups across a variety of industries and sectors, including Artificial Intelligence, Big Data, Virtual Reality, foodtech, agritech, consumer, and health.

Ataria Ventures is an early stage fund that offers predominantly Latin American investors and corporations access to technology startups in Israel and Silicon Valley. It has invested in more than 30 startups across a variety of industries and sectors, including Artificial Intelligence, Big Data, Virtual Reality, foodtech, agritech, consumer, and health.

UNIQA Ventures is the venture capital arm of the UNIQA Group, a leading insurance entity headquartered in Austria and operating also across Central and Eastern Europe. With about 40 companies in 18 countries, the UNIQA group serves about 15.5 million customers. UNIQA Ventures' investment focus is in insurtech, fintech and digital health care.

UNIQA Ventures is the venture capital arm of the UNIQA Group, a leading insurance entity headquartered in Austria and operating also across Central and Eastern Europe. With about 40 companies in 18 countries, the UNIQA group serves about 15.5 million customers. UNIQA Ventures' investment focus is in insurtech, fintech and digital health care.

Co-founder and CTO of Qlapa

Fransiskus Xaverius is an experienced software engineer. He worked as an intern at RIM and Google during his Computer Science degree course at the University of Washington, USA. After graduating in 2011, he worked as a software engineer at various American tech companies, including the online game firm Zynga, Castlight Health and Homejoy. He returned to Indonesia after leaving Homejoy in 2015 to co-found Qlapa, an online marketplace for handmade products.

Fransiskus Xaverius is an experienced software engineer. He worked as an intern at RIM and Google during his Computer Science degree course at the University of Washington, USA. After graduating in 2011, he worked as a software engineer at various American tech companies, including the online game firm Zynga, Castlight Health and Homejoy. He returned to Indonesia after leaving Homejoy in 2015 to co-found Qlapa, an online marketplace for handmade products.

Co-founder and CEO of Gorry Holdings

Inspired by his own weight loss experience, former business consultant William Susilo founded the Gorry Holdings group of health and wellness startups: GorryGourmet, GorryWell and Helopt. Before becoming an entrepreneur, William worked for Accenture and Sinar Mas Land between 2012 and 2016, while also spending time at CT Corp, the holding company of a major Indonesian conglomerate. William graduated with a bachelor's in accounting from the University of Indonesia.

Inspired by his own weight loss experience, former business consultant William Susilo founded the Gorry Holdings group of health and wellness startups: GorryGourmet, GorryWell and Helopt. Before becoming an entrepreneur, William worked for Accenture and Sinar Mas Land between 2012 and 2016, while also spending time at CT Corp, the holding company of a major Indonesian conglomerate. William graduated with a bachelor's in accounting from the University of Indonesia.

Co-Founder and COO of Lemonilo

Harvard graduate Johannes Ardiant earned his bachelor’s degree in Computing from the National University of Singapore. He also pursued a Master’s in Public Policy at Harvard. In 2015 he became the co-founder and COO of healthcare services platform Konsula, which pivoted into health food startup Lemonilo in 2017. Currently, he heads Lemonilo’s product, engineering, data, design and operations.

Harvard graduate Johannes Ardiant earned his bachelor’s degree in Computing from the National University of Singapore. He also pursued a Master’s in Public Policy at Harvard. In 2015 he became the co-founder and COO of healthcare services platform Konsula, which pivoted into health food startup Lemonilo in 2017. Currently, he heads Lemonilo’s product, engineering, data, design and operations.

Founded in 2012, ClearVue Partners focuses on the consumer sector, e.g., new retail, lifestyle, health and wellness and digital consumption. ClearVue Partners typically invests US$10–50 million in growth-stage startups. Investment deals are spearheaded by a team with experience in the US and Greater China and an advisory group of recognized businessmen from the consumer industry. Its headquarters is in Shanghai.

Founded in 2012, ClearVue Partners focuses on the consumer sector, e.g., new retail, lifestyle, health and wellness and digital consumption. ClearVue Partners typically invests US$10–50 million in growth-stage startups. Investment deals are spearheaded by a team with experience in the US and Greater China and an advisory group of recognized businessmen from the consumer industry. Its headquarters is in Shanghai.

AddVenture is a Russian VC fund investing internationally. The firm has US$120m under management, participating in funding rounds with an investment range between US$1m and US$10m. The firm’s portfolio comprises 23 investments and five exits.AddVenture's investment criteria focus on local services, marketplaces, SaaS, food-tech and health-tech startups.

AddVenture is a Russian VC fund investing internationally. The firm has US$120m under management, participating in funding rounds with an investment range between US$1m and US$10m. The firm’s portfolio comprises 23 investments and five exits.AddVenture's investment criteria focus on local services, marketplaces, SaaS, food-tech and health-tech startups.

Co-founder of Findster, Co-founder and CTO of SWORD Health

Getting access to a computer in his elementary school piqued Márcio Colunas’s interest in informatics. This led to a degree in Computer and Telematics Engineering at the University of Aveiro, where he carried out research and development in biomedical systems. His work was integral to his career, having co-founded SWORD Health, a technology company disrupting medical-physical rehabilitation. Born in 1987, Colunas is also a co-founder of Findster Technologies, the company behind the Findster Duo GPS pet tracker.

Getting access to a computer in his elementary school piqued Márcio Colunas’s interest in informatics. This led to a degree in Computer and Telematics Engineering at the University of Aveiro, where he carried out research and development in biomedical systems. His work was integral to his career, having co-founded SWORD Health, a technology company disrupting medical-physical rehabilitation. Born in 1987, Colunas is also a co-founder of Findster Technologies, the company behind the Findster Duo GPS pet tracker.

UOB Venture Management is a private equity firm backed by the United Overseas Bank (UOB). It invests in growing companies at their expansion stages, with special focus on the Southeast Asia and China markets. Its portfolio is diverse, ranging from food and health companies to petrochemicals and tech businesses like Giosis (which operates e-commerce site Qoo10) and AI-powered marketing service startup Appier.

UOB Venture Management is a private equity firm backed by the United Overseas Bank (UOB). It invests in growing companies at their expansion stages, with special focus on the Southeast Asia and China markets. Its portfolio is diverse, ranging from food and health companies to petrochemicals and tech businesses like Giosis (which operates e-commerce site Qoo10) and AI-powered marketing service startup Appier.

Spring Fund was founded in Beijing in May 2015 with RMB 300m initial funding. Its cornerstone investors include government guidance funds and Chunyu Mobile Health. Spring Fund mainly invests in the early stages of mobile healthtechs and startups with focus on intelligent hardware, smart assistance, online diagnosis, chronic disease management, cross-border healthcare, rural areas and the elderly population.

Spring Fund was founded in Beijing in May 2015 with RMB 300m initial funding. Its cornerstone investors include government guidance funds and Chunyu Mobile Health. Spring Fund mainly invests in the early stages of mobile healthtechs and startups with focus on intelligent hardware, smart assistance, online diagnosis, chronic disease management, cross-border healthcare, rural areas and the elderly population.

SEEDS Capital is the investment arm of Enterprise Singapore supporting locally based startups that have innovative technologies and global market potential. Sectors of focus include advanced manufacturing & engineering, health & biomedical sciences, urban sustainability & solutions, fintech, artificial intelligence and agritech. SEEDS currently works with more than 500 deep tech startups, and over 40 incubators, accelerators and venture capital firms.

SEEDS Capital is the investment arm of Enterprise Singapore supporting locally based startups that have innovative technologies and global market potential. Sectors of focus include advanced manufacturing & engineering, health & biomedical sciences, urban sustainability & solutions, fintech, artificial intelligence and agritech. SEEDS currently works with more than 500 deep tech startups, and over 40 incubators, accelerators and venture capital firms.

Co-founder and CMO of Paprika

Indra Halim graduated in 2003 with a degree in Business and IT from RMIT University in Australia. He has been an investor in Medan’s Gelato Bar since 2010. As a co-founder of health food startup Lesssalt and food information website kulinermedan, Indra has extensive experience in the culinary world. He was also CFO for three years at Benah.in, a now-defunct social media website for SMEs. In 2015, he joined Paprika as a co-founder and CMO but left the company in 2016.

Indra Halim graduated in 2003 with a degree in Business and IT from RMIT University in Australia. He has been an investor in Medan’s Gelato Bar since 2010. As a co-founder of health food startup Lesssalt and food information website kulinermedan, Indra has extensive experience in the culinary world. He was also CFO for three years at Benah.in, a now-defunct social media website for SMEs. In 2015, he joined Paprika as a co-founder and CMO but left the company in 2016.

BStartup is an initiative of Sabadell Bank that supports innovation and entrepreneurship in Spain. It focuses mainly on tech and digital ecosystems and has recently launched a new program BStartup Health to invest in the healthtech sector. The BStartup10 program allocates €1 million annually to support the seed and early-stage of development of 10 startups. The Sabadell Venture Capital provides Series A and Series B funding.

BStartup is an initiative of Sabadell Bank that supports innovation and entrepreneurship in Spain. It focuses mainly on tech and digital ecosystems and has recently launched a new program BStartup Health to invest in the healthtech sector. The BStartup10 program allocates €1 million annually to support the seed and early-stage of development of 10 startups. The Sabadell Venture Capital provides Series A and Series B funding.

Established in Shenzhen in 2007, Share Capital has invested in over 100 companies. Some of its portfolio companies – e.g., NavInfo, Perfect World and BGI – have gone public. Its investment team of nearly 50 members manages more than RMB 6 billion worth of assets. Share Capital has set up a healthcare fund of RMB 1.5 billion and invested in over 70 health-related projects.

Established in Shenzhen in 2007, Share Capital has invested in over 100 companies. Some of its portfolio companies – e.g., NavInfo, Perfect World and BGI – have gone public. Its investment team of nearly 50 members manages more than RMB 6 billion worth of assets. Share Capital has set up a healthcare fund of RMB 1.5 billion and invested in over 70 health-related projects.

Ship2B is an accelerator and investor for social impact startups and spin-offs. It acts principally in three sectors: health tech, social tech for vulnerable groups and climate technology. It also fosters networking alliances between startups and large companies, and has a network of high-level mentors available to assist startups.To date, Ship2B has invested €40m in 146 startups and spin-offs.

Ship2B is an accelerator and investor for social impact startups and spin-offs. It acts principally in three sectors: health tech, social tech for vulnerable groups and climate technology. It also fosters networking alliances between startups and large companies, and has a network of high-level mentors available to assist startups.To date, Ship2B has invested €40m in 146 startups and spin-offs.

Aimentia: Pioneering mental health AI SaaS seeks to improve diagnosis as demand surges

Barcelona-based Aimentia supports the oft-overlooked mental health segment through digitalization and analytics, going beyond therapy platforms

Mental health services platform Ibunda wants to keep expanding its reach

Since its founding in 2015, the Indonesian startup Ibunda has provided psychological consultations to over 200,000 clients

Mindtera: Building mental resilience through bite-sized lessons

Mindtera wants to nip mental health issues in the bud by equipping working adults with skills to navigate work challenges and personal relationships, using their phones

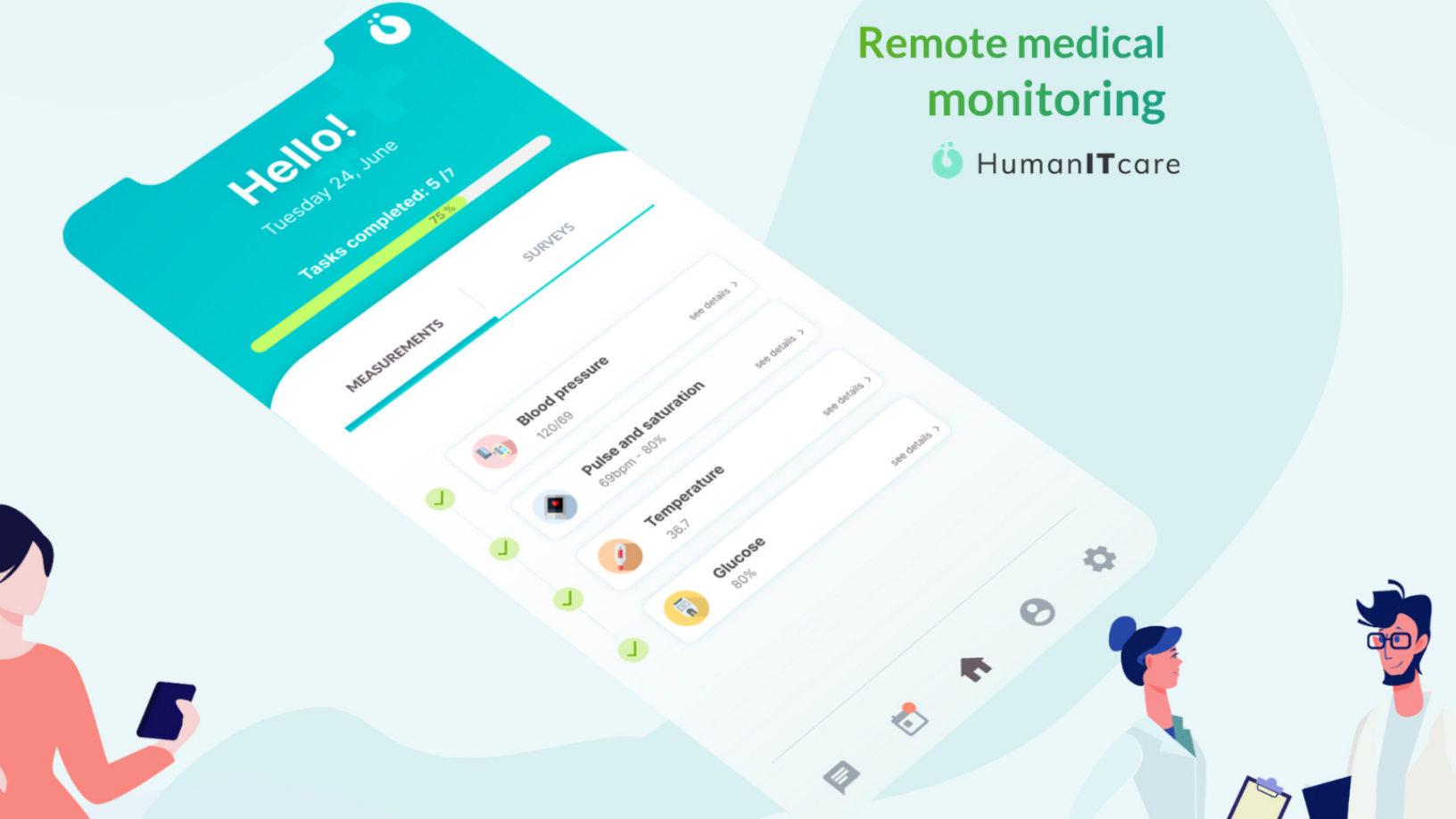

HumanITcare: The first real-time symptom tracker for mental illness patients

FollowHealth’s HumanITcare app combines wearables, analytics and AI to monitor and improve outcomes for sufferers of depression, schizophrenia, alcoholism and more

TherapyChat: Using AI to scale and improve accuracy in mental health treatment

Business for the Spanish startup has surged ninefold since Covid-19, with the company expanding to the UK and Italy

Gorry Holdings: Promoting staff wellness in Indonesia

The healthtech startup wants companies to understand how healthy employees can translate into good business

Choose from over 10,000 mental health therapists at Yidianling

Startup's 24/7 services will include AI-powered chatbots to help more Chinese cope with mental health issues, amid lack of therapists

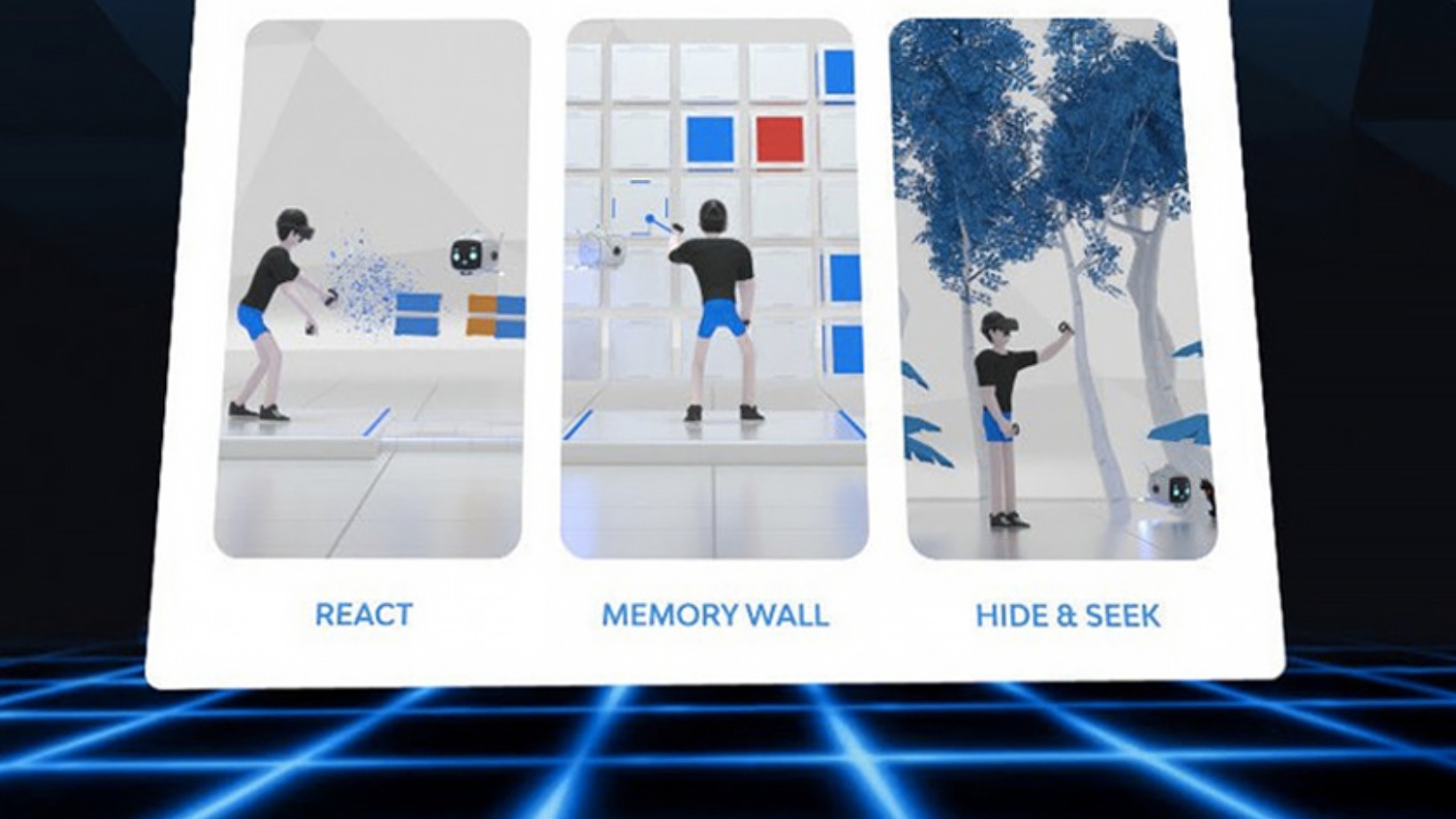

Virtuleap's VR games provide a mental workout, boosting brain health

Used by the AARP and Veteran's Health Administration in the US, Virtuleap’s games with AI-enabled assessment work to improve cognition and to counter degenerative diseases such as Alzheimer's

Accelerating Asia bets on unicorn wave from MSME digitalization, logistics

The investor-accelerator’s sixth batch will start accepting applications in December, with greater ESG focus and a pledge to donate 1% of profit on investments to charity

Benergy: A new app to track gut health with smart data

The Benergy app allows results to be shared with doctors to facilitate diagnosis and includes swap tests

China's WeDoctor offers free coronavirus consultations globally in English and Chinese

WeDoctor lets anyone in the world send queries to doctors who fought to save lives in China's most affected Covid-19 districts, and now helping people overseas to stay safe during the pandemic

Startups join the fight in China's coronavirus crisis

Chinese startups have discovered their technologies can play a major role in the nationwide efforts to battle the coronavirus epidemic

HumanITcare: Covid-19 spurs demand for telemedicine across Spain and beyond

The startup’s revenue is expected to exceed €10m by 2024 due to rapid digital transformation of healthcare services and a growing market for AI-powered medtechs

AlphaBeats: a 10-minute music playlist to de-stress your brain using biofeedback

With the exclusive rights to Philips’s neurofeedback technology, Alphabeats has developed an app to offer and enhance relaxation using a person’s favorite music

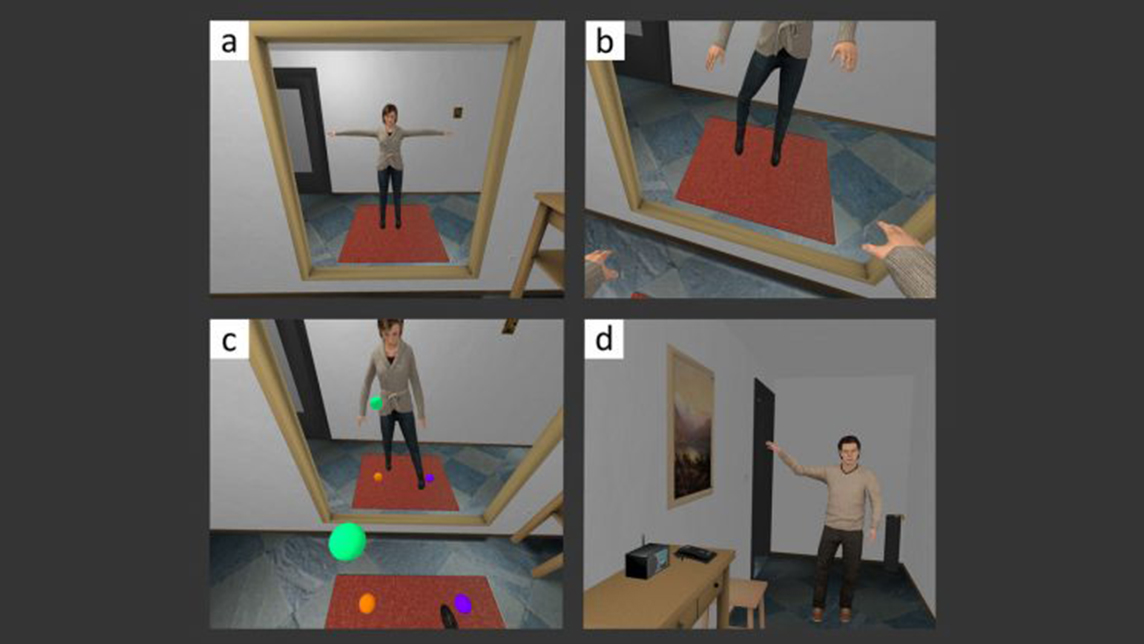

Virtual Bodyworks: VR psychotherapy to reduce crime and health issues

Applications created by the Barcelona-based startup could be used to track and influence human behavior

Sorry, we couldn’t find any matches for“Mental health”.