Social Innovation Fund

-

DATABASE (689)

-

ARTICLES (523)

Former technical development lead and co-founder of Graviky Labs

Nitesh Kadyan (also known as Nitesh Kumar) is a computer scientist, robotics engineer, inventor, maker and hacker. He was one of the three co-founders of Graviky Labs, a startup producing ink from captured carbon emissions. He worked at Graviky Labs from 2016–2018, during which he led its hardware development and prototyping. Currently, he works as a senior creative technologist at Lowe's Innovation Labs India.Kadyan holds a degree in computer science from the International Institute of Information Technology, Bangalore and did a research stint on AI and robotics at Freie University, Berlin. His background includes expertise in machine learning and embedded systems. Kadyan’s past projects include self-driving model cars, autonomous smart wheelchairs, an augmented reality interface for laser cutting, as well as machines that sketch and draw. He also founded a startup that does 3D printing in nearly any material, from plastic and metallic clay to chocolate, playdoh and fabric, and which was incubated at MIT Global Startup Labs 2014.Kadyan was named one of Foreign Policy magazine’s Top 100 Global Thinkers in 2016. He is a recipient of the Campus Diaries 25 Under 25 award, and is a two-time speaker at TEDx.

Nitesh Kadyan (also known as Nitesh Kumar) is a computer scientist, robotics engineer, inventor, maker and hacker. He was one of the three co-founders of Graviky Labs, a startup producing ink from captured carbon emissions. He worked at Graviky Labs from 2016–2018, during which he led its hardware development and prototyping. Currently, he works as a senior creative technologist at Lowe's Innovation Labs India.Kadyan holds a degree in computer science from the International Institute of Information Technology, Bangalore and did a research stint on AI and robotics at Freie University, Berlin. His background includes expertise in machine learning and embedded systems. Kadyan’s past projects include self-driving model cars, autonomous smart wheelchairs, an augmented reality interface for laser cutting, as well as machines that sketch and draw. He also founded a startup that does 3D printing in nearly any material, from plastic and metallic clay to chocolate, playdoh and fabric, and which was incubated at MIT Global Startup Labs 2014.Kadyan was named one of Foreign Policy magazine’s Top 100 Global Thinkers in 2016. He is a recipient of the Campus Diaries 25 Under 25 award, and is a two-time speaker at TEDx.

Founded in 1996, LB Investment (formerly LG Venture Investment) is supported by LG, the Korean conglomerate, and developing into a private equity fund investment company. It focuses on venture investments in Korea and China, and investments in medium and large companies.

Founded in 1996, LB Investment (formerly LG Venture Investment) is supported by LG, the Korean conglomerate, and developing into a private equity fund investment company. It focuses on venture investments in Korea and China, and investments in medium and large companies.

Founded in 2015, iResearch Capital is an investment fund of iResearch Group, one of the first consulting companies on internet research and analytics in China. It focuses on investment in marketing, big data, corporate services and new media companies.

Founded in 2015, iResearch Capital is an investment fund of iResearch Group, one of the first consulting companies on internet research and analytics in China. It focuses on investment in marketing, big data, corporate services and new media companies.

Founded by Wu Shichun in 2014, Plum Ventures is an internet-focused angel fund managing three RMB funds. Plum Ventures is listed among the top 10 angel investment firms in China, with each investment of RMB 2 million to 5 million.

Founded by Wu Shichun in 2014, Plum Ventures is an internet-focused angel fund managing three RMB funds. Plum Ventures is listed among the top 10 angel investment firms in China, with each investment of RMB 2 million to 5 million.

Divine Capital was founded in Shanghai in 2009. The private equity fund manages total assets of RMB 3bn and mainly invests in consumer services, manufacturing, clean technology and mid-sized startups. Divine Capital has completed 20 investment deals to date.

Divine Capital was founded in Shanghai in 2009. The private equity fund manages total assets of RMB 3bn and mainly invests in consumer services, manufacturing, clean technology and mid-sized startups. Divine Capital has completed 20 investment deals to date.

Founded in 2016, BHCP is an equity investment fund under BOC International. The wholly-owned subsidiary of Bank of China offers investment banking and securities brokerage services. It mainly invests in companies at a later stage, usually after Series C round.

Founded in 2016, BHCP is an equity investment fund under BOC International. The wholly-owned subsidiary of Bank of China offers investment banking and securities brokerage services. It mainly invests in companies at a later stage, usually after Series C round.

Qatar Investment Authority (QIA) is Qatar's sovereign wealth fund. QIA was founded by the State of Qatar in 2005 with the aim to strengthen the country's economy. Headquartered in Doha, QIA invests globally and manages total assets worth nearly $300bn.

Qatar Investment Authority (QIA) is Qatar's sovereign wealth fund. QIA was founded by the State of Qatar in 2005 with the aim to strengthen the country's economy. Headquartered in Doha, QIA invests globally and manages total assets worth nearly $300bn.

Baidu Ventures (BV) was launched as an AI-investment arm of online search and internet conglomerate Baidu in September 2016. It has regional headquarters in Beijing and Silicon Valley. With a phase-I fund of US$200m, it focuses on early-stage AI-startups.In San Francisco, BV's non-strategic fund focuses on the AI and robotics sectors providing pre-seed to Series B funding. Headed by Saman Farid as partner since November 2017, the US team manages investments in over 70 startups including Airmap, Covariant.ai, Atomwise, 8i and Subtle Medical.

Baidu Ventures (BV) was launched as an AI-investment arm of online search and internet conglomerate Baidu in September 2016. It has regional headquarters in Beijing and Silicon Valley. With a phase-I fund of US$200m, it focuses on early-stage AI-startups.In San Francisco, BV's non-strategic fund focuses on the AI and robotics sectors providing pre-seed to Series B funding. Headed by Saman Farid as partner since November 2017, the US team manages investments in over 70 startups including Airmap, Covariant.ai, Atomwise, 8i and Subtle Medical.

Founded in 2013, Sino-Ocean Capital is the investment arm of the Chinese real estate developer Sino-Ocean Group. It mainly invests in the sectors of big data, healthcare, logistics, environmental protection, real estate and finance. It currently manages RMB 50bn worth assets and $700m US dollar funds. The limited partners include insurance companies, large-sized enterprises and sovereign wealth funds.In 2019, Sino-Ocean Capital launched a RMB 3-5bn fund to acquire logistics properties and planned to invest RMB 48bn in logistics over the next five years. It also on the track to raise $1.5bn for its latest real estate fund to invest in offices in Beijing.

Founded in 2013, Sino-Ocean Capital is the investment arm of the Chinese real estate developer Sino-Ocean Group. It mainly invests in the sectors of big data, healthcare, logistics, environmental protection, real estate and finance. It currently manages RMB 50bn worth assets and $700m US dollar funds. The limited partners include insurance companies, large-sized enterprises and sovereign wealth funds.In 2019, Sino-Ocean Capital launched a RMB 3-5bn fund to acquire logistics properties and planned to invest RMB 48bn in logistics over the next five years. It also on the track to raise $1.5bn for its latest real estate fund to invest in offices in Beijing.

Based in San Francisco, Slow Ventures was founded in 2011 by an early Facebook employee David Morin, who helped to build the Facebook Platform and Facebook Connect. Slow Ventures is no longer known as the “Facebook Alumni Fund”.Today, the VC is a generalist fund, investing in diverse sectors worldwide, ranging from digital health to enterprise solutions. The firm has backed unicorn startups in the US like Postmates, Nextdoor, AngelList and Evernote. A fourth fundraising round has been launched for two new funds totaling $220m: seed funding of $165m and $55m for a follow-up round. Its last funding round closed at $145m in 2016.

Based in San Francisco, Slow Ventures was founded in 2011 by an early Facebook employee David Morin, who helped to build the Facebook Platform and Facebook Connect. Slow Ventures is no longer known as the “Facebook Alumni Fund”.Today, the VC is a generalist fund, investing in diverse sectors worldwide, ranging from digital health to enterprise solutions. The firm has backed unicorn startups in the US like Postmates, Nextdoor, AngelList and Evernote. A fourth fundraising round has been launched for two new funds totaling $220m: seed funding of $165m and $55m for a follow-up round. Its last funding round closed at $145m in 2016.

Mayfield Fund is one of Silicon Valley's oldest venture capital firms. Founded by Wally Davis and Thomas J Davis Jr in 1969, the VC is based in Menlo Park, California.Current investments include CRISPR-focused companies like Mammoth Biosciences and biotech startup iLoF,l which is focused on creating a digital library of optical fingerprints for non-invasive patient screening, early diagnostics and personalized medical treatments.. With a total of $2.5bn assets under management, the firm focuses mainly on early-stage to growth-stage investments. The VC has also backed startups like Marketo, Lyft and SolarCity. Most of Mayfield’s exits took place during the 2008 financial crisis and through subsequent funds.In April 2020, amid the Covid-19 pandemic, Mayfield announced two new funds which raised $750m in total. Mayfield XVI will invest in early-stage companies, while Mayfield Select II will focus on growth-stage companies outside its portfolio. The company said last year that it has raised a similar size fund every four years and has invested in 30 companies per fund. It primarily leads Series A investments.

Mayfield Fund is one of Silicon Valley's oldest venture capital firms. Founded by Wally Davis and Thomas J Davis Jr in 1969, the VC is based in Menlo Park, California.Current investments include CRISPR-focused companies like Mammoth Biosciences and biotech startup iLoF,l which is focused on creating a digital library of optical fingerprints for non-invasive patient screening, early diagnostics and personalized medical treatments.. With a total of $2.5bn assets under management, the firm focuses mainly on early-stage to growth-stage investments. The VC has also backed startups like Marketo, Lyft and SolarCity. Most of Mayfield’s exits took place during the 2008 financial crisis and through subsequent funds.In April 2020, amid the Covid-19 pandemic, Mayfield announced two new funds which raised $750m in total. Mayfield XVI will invest in early-stage companies, while Mayfield Select II will focus on growth-stage companies outside its portfolio. The company said last year that it has raised a similar size fund every four years and has invested in 30 companies per fund. It primarily leads Series A investments.

Founded by Finnish serial entrepreneur and angel investor Riku Asikainen, Helsinki-based Evli Growth Partners invest across market segments, with typical initial stakes of €3m–5m at Series A and B funding stages. The VC is currently building up a total fund of €200m to focus on investments in later-stage growth companies Europe. The first fund, EGP Fund I Ky, was launched in December 2018 and closed at €60m in November 2019. New funds will be set up every two years until 2028.EGP currently has seven companies in its portfolio. In 2021, Evli was co-lead investor for the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August, and investor lead in the €22m Series C round of Polish customized furniture design platform Tylko in March.

Founded by Finnish serial entrepreneur and angel investor Riku Asikainen, Helsinki-based Evli Growth Partners invest across market segments, with typical initial stakes of €3m–5m at Series A and B funding stages. The VC is currently building up a total fund of €200m to focus on investments in later-stage growth companies Europe. The first fund, EGP Fund I Ky, was launched in December 2018 and closed at €60m in November 2019. New funds will be set up every two years until 2028.EGP currently has seven companies in its portfolio. In 2021, Evli was co-lead investor for the $54m Series B round of Austrian refurbished electronics goods marketplace Refurbed in August, and investor lead in the €22m Series C round of Polish customized furniture design platform Tylko in March.

Guangdong China Science & Merchants Capital Management

Founded in 2009, Guangdong China Science & Merchants Capital Management is a subsidiary of China Science & Merchants Investment (Fund) Management, with the support of the Guangdong government. It invests in pre-IPO companies, regional leading enterprises and fast-growing innovative startups.

Founded in 2009, Guangdong China Science & Merchants Capital Management is a subsidiary of China Science & Merchants Investment (Fund) Management, with the support of the Guangdong government. It invests in pre-IPO companies, regional leading enterprises and fast-growing innovative startups.

The Graduate Syndicate is led by Harvard Business School senior lecturer Jeff Bussgang. The fund primarily invests in startups founded by Harvard graduates, particularly HBS alumni. It is linked to Flybridge Capital Partners, where Jeff Bussgang has served as a general partner since 2003.

The Graduate Syndicate is led by Harvard Business School senior lecturer Jeff Bussgang. The fund primarily invests in startups founded by Harvard graduates, particularly HBS alumni. It is linked to Flybridge Capital Partners, where Jeff Bussgang has served as a general partner since 2003.

Founded in 2013 by BYD co-founder Yang Longzhong, Hui Capital focuses on new energy, new materials, electronic information technology and artificial intelligence. It plays a role as the administrator of the National Development and Reform Commission’s emerging industry venture capital fund.

Founded in 2013 by BYD co-founder Yang Longzhong, Hui Capital focuses on new energy, new materials, electronic information technology and artificial intelligence. It plays a role as the administrator of the National Development and Reform Commission’s emerging industry venture capital fund.

Portugal pumps up to €60m into new initiatives to avert backslide in startup ecosystem

Government funding to ensure the strategically important and social impact startups don't fail, post-Covid

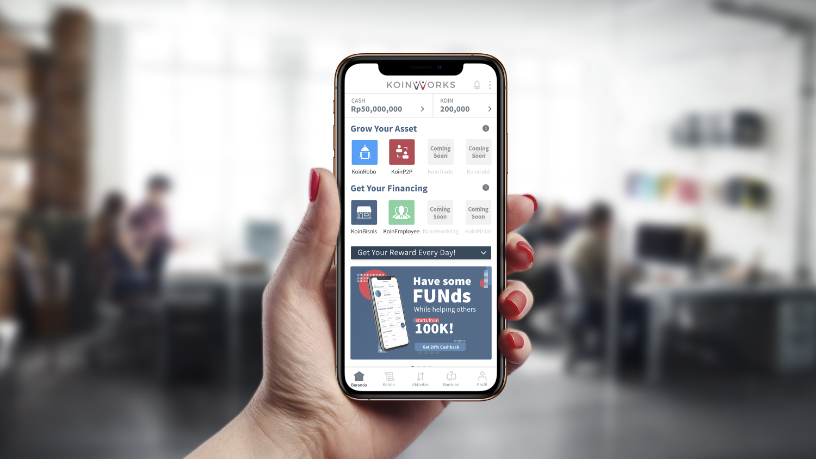

Amid Covid-19, Indonesian P2P lender KoinWorks raises $20m in convertible note funding

Backed by Quona Capital, EV Growth and other investors, KoinWorks plans to disburse more loans amid greater uncertainty and default risk

Good Startup: Alt-protein products can be better than real meat

The investor of Eat Just, Ripple Foods and more expects its portfolio companies will exit in the next four to six years, mostly through acquisition

Bluepha to boost PHA bioplastics production with $30m fresh funding

The Beijing-based startup aims to produce 10,000 tons of PHA bioplastic a year and build a SynBio community through its STEM education spinoff, Bluepha Lab

Sequoia China Seed Fund: Growing an era of deep-tech startups

Managing Partner Neil Shen wants to help deep-tech and enterprise tech startups get investments more easily, across quantum computing, semiconductors, synthetic biology and more

New sectors, strategies come into play as investors respond to China's Big Tech curbs

Amid the crackdown on China’s tech giants, some investors are sussing out less risky sectors, while heavyweights like BlackRock and Fidelity stay in for the long haul

Raising $50m second fund, Indogen Capital seeks more international partners and exits

Cooperation is key to Indogen's investment thesis, as it looks to help more foreign VCs and their portfolio startups find success in Southeast Asia's biggest market

Carlos Melo Brito: Driving force behind Porto's innovation boom

The professor has overseen the creation and growth of the University of Porto-based UPTEC incubator, birthplace of many of Portugal's most successful startups

Taronga Ventures takes RealTechX to Singapore; plans Japan, US growth

The Australian proptech investor to focus on ESG in its acceleration program, including women under-representation and site safety

Women entrepreneurs get ahead faster in Portugal

Still a long way to go for equality, but female founders in Portugal have made significant headstarts as tech innovators

Portugal's health & medtech startups: Taking innovation and disruption to heart

Backed by local and foreign money, Portugal’s healthcare and medical technology startups are hungry to go global

New Ventures Innovation: Prasetiya Mulya University takes on student entrepreneurship

To prepare a new generation of startup founders, Prasetiya Mulya University combines theoretical education with real-life exposure to the startup world

Animal AgTech Innovation Summit 2021: Experts discuss post-pandemic priorities

The pandemic not only put digital tech in everyone’s hands, it also forced thinking about collecting meaningful data and moving it on-demand to both producers and decision makers

Spain’s 100% renewable energy goal: How its startup ecosystem is rising to the challenge

Energy majors and public entities are backing renewable energy startups in the country's bet on the Green Economy

Animal AgTech Innovation Summit 2021: Future of aquaculture in the US

With the US Importing over 85% of its seafood, industry experts examine how and why the country should develop a sustainable aquaculture industry

Sorry, we couldn’t find any matches for“Social Innovation Fund”.