cell-based meat

-

DATABASE (857)

-

ARTICLES (608)

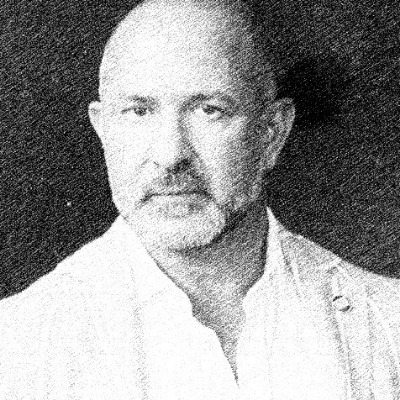

Albert Domingo is a Spanish entrepreneur and investor. He is the founder and CEO NexTReT, which was established in 1992 to provide IT systems and infrastructure services. Domingo is also an active business angel, backing startups as a partner investor in Barcelona-based venture builder Itnig's network, which has seen two exits, Gym For Less and Playfulbet. He studied computer engineering and also management development at the IESE Business School in Barcelona.

Albert Domingo is a Spanish entrepreneur and investor. He is the founder and CEO NexTReT, which was established in 1992 to provide IT systems and infrastructure services. Domingo is also an active business angel, backing startups as a partner investor in Barcelona-based venture builder Itnig's network, which has seen two exits, Gym For Less and Playfulbet. He studied computer engineering and also management development at the IESE Business School in Barcelona.

Haibang Fund was created in 2011 by Haibang Venture based in Hangzhou. Haibang Fund manages total assets worth US$360m with investments in 60 companies, four of which have gone public. Started by a group of overseas returnees and experienced investors, the VC focuses on startups founded by returnees from overseas.

Haibang Fund was created in 2011 by Haibang Venture based in Hangzhou. Haibang Fund manages total assets worth US$360m with investments in 60 companies, four of which have gone public. Started by a group of overseas returnees and experienced investors, the VC focuses on startups founded by returnees from overseas.

PadeInvest is involved in early-stage investments to accelerate the growth of Spanish startups. The angel investor consortium was named the Best Business Angels Network of 2013 by the Spanish Association of Business Angels (AEBAN).Based in Madrid, PadeInvest was established in 2010 by 35 IESE Business School students from the PADE’10 program for investment activities of tech startups. Its network comprises professionals in business management across multiple industry sectors.

PadeInvest is involved in early-stage investments to accelerate the growth of Spanish startups. The angel investor consortium was named the Best Business Angels Network of 2013 by the Spanish Association of Business Angels (AEBAN).Based in Madrid, PadeInvest was established in 2010 by 35 IESE Business School students from the PADE’10 program for investment activities of tech startups. Its network comprises professionals in business management across multiple industry sectors.

Farben Consulting is a Portuguese real estate investor and consultancy based in Torres Novas and established in 1996. It has no website and has not disclosed any information about its business. In 2014 and 2015, Farben invested €1.5m for an equity stake of 98% in CoolFarm. The agtech became insolvent in October 2018 when Farben decided to stop supporting the startup due to lack of sales and market potential for B2B indoor farming solutions.

Farben Consulting is a Portuguese real estate investor and consultancy based in Torres Novas and established in 1996. It has no website and has not disclosed any information about its business. In 2014 and 2015, Farben invested €1.5m for an equity stake of 98% in CoolFarm. The agtech became insolvent in October 2018 when Farben decided to stop supporting the startup due to lack of sales and market potential for B2B indoor farming solutions.

BAN madri+d is a network of angel investors specializing in finding and backing technology-based startups in their seed stage of development and also headquartered in Madrid .With over 116 active investors, the institution aims to establish a competitive entrepreneurial ecosystem through collaboration with business experts, research centers and public institutions.To date, BAN madri+d has already invested (directly and indirectly) more than €70,000 across 480 projects.

BAN madri+d is a network of angel investors specializing in finding and backing technology-based startups in their seed stage of development and also headquartered in Madrid .With over 116 active investors, the institution aims to establish a competitive entrepreneurial ecosystem through collaboration with business experts, research centers and public institutions.To date, BAN madri+d has already invested (directly and indirectly) more than €70,000 across 480 projects.

Based in San Francisco, SV Angel was founded in 2009 by Ron Conway, one of Silicon Valley’s super-angels. The firm was originally Conway’s personal investment vehicle that was later turned into a VC with initial investment capital of $10m from external investors.The firm typically invests in early-seed stage rounds, supporting portfolio companies in M&A, business development and financing. Investments include US unicorns like Dropbox, Slack, Pinterest and Airbnb.

Based in San Francisco, SV Angel was founded in 2009 by Ron Conway, one of Silicon Valley’s super-angels. The firm was originally Conway’s personal investment vehicle that was later turned into a VC with initial investment capital of $10m from external investors.The firm typically invests in early-seed stage rounds, supporting portfolio companies in M&A, business development and financing. Investments include US unicorns like Dropbox, Slack, Pinterest and Airbnb.

Established in 2017, Educapital invests in edtech, HR and training tech startups. The French VC has stakes in 19 companies, mostly based in Europe, including participation in the €5m Series B funding of French Supermood, a contractor’s workplace engagement tool.In the edtech space, Educapital has recently joined a R$1.7m seed investment round for Brazilian edtech Blox and a €10m Series B round for Preply, a Ukrainian edtech specializing in online language learning.

Established in 2017, Educapital invests in edtech, HR and training tech startups. The French VC has stakes in 19 companies, mostly based in Europe, including participation in the €5m Series B funding of French Supermood, a contractor’s workplace engagement tool.In the edtech space, Educapital has recently joined a R$1.7m seed investment round for Brazilian edtech Blox and a €10m Series B round for Preply, a Ukrainian edtech specializing in online language learning.

The Hague-based social impact investor invests in the areas of environment, economic inclusion, health and well-being and follows the socio-economic principles of the United Nation’s Global Social Development Goals. The VC was established in 2019 and to date has invested in four companies. Its most recent investments have been in agritech sustainability monitoring platform Satelligence’s $2.3m seed round and AI-powered sustainable recruiting platform Equalture’s €1m seed round.

The Hague-based social impact investor invests in the areas of environment, economic inclusion, health and well-being and follows the socio-economic principles of the United Nation’s Global Social Development Goals. The VC was established in 2019 and to date has invested in four companies. Its most recent investments have been in agritech sustainability monitoring platform Satelligence’s $2.3m seed round and AI-powered sustainable recruiting platform Equalture’s €1m seed round.

Based in New York, VectoIQ was formed in 2016 to fund startups in the smart mobility space. It is led by Steve Girsky, former vice-chairman of General Motors with more than 30 years in the automobile industry. Mary Chan is the managing partner, who also worked at GM as president of global connected consumer. The VC mainly invests in sectors relating to autonomous vehicles, connected car, smart mobility, MaaS, electrification and cybersecurity.

Based in New York, VectoIQ was formed in 2016 to fund startups in the smart mobility space. It is led by Steve Girsky, former vice-chairman of General Motors with more than 30 years in the automobile industry. Mary Chan is the managing partner, who also worked at GM as president of global connected consumer. The VC mainly invests in sectors relating to autonomous vehicles, connected car, smart mobility, MaaS, electrification and cybersecurity.

Founded in 2016, Paris-based Future Positive Capital invests in European startups in deep tech and biotechnology to solve major problems, with funding for only 20 portfolio startups. It has backed eight startups to date with its most recent investments being in the April 2021 undisclosed €5.2m funding round of French renewable energytech SWEETCH Energy and in the £7.9m Series A round of British ecosystem restoration technology Dendra Systems in September 2020.

Founded in 2016, Paris-based Future Positive Capital invests in European startups in deep tech and biotechnology to solve major problems, with funding for only 20 portfolio startups. It has backed eight startups to date with its most recent investments being in the April 2021 undisclosed €5.2m funding round of French renewable energytech SWEETCH Energy and in the £7.9m Series A round of British ecosystem restoration technology Dendra Systems in September 2020.

Launched in 2013, Japan’s Rakuten Capital is the corporate venture capital arm of conglomerate Rakuten. It manages a range of funds, such as the early-stage Rakuten Ventures, Rakuten Fintech Fund, and Rakuten Mobility Investments. Its portfolio covers a broad range of companies, including C2C e-commerce platform Carousell, ride-hailing unicorn Gojek, and video game vouchers platform CodaPay. Notable exits include the IPOs of US-based ride hailing company Lyft and image sharing site Pinterest.

Launched in 2013, Japan’s Rakuten Capital is the corporate venture capital arm of conglomerate Rakuten. It manages a range of funds, such as the early-stage Rakuten Ventures, Rakuten Fintech Fund, and Rakuten Mobility Investments. Its portfolio covers a broad range of companies, including C2C e-commerce platform Carousell, ride-hailing unicorn Gojek, and video game vouchers platform CodaPay. Notable exits include the IPOs of US-based ride hailing company Lyft and image sharing site Pinterest.

Ecertic's EADTrust-approved digital identity solutions ensure companies who digitize their business processes also adhere to the latest local regulations.

Ecertic's EADTrust-approved digital identity solutions ensure companies who digitize their business processes also adhere to the latest local regulations.

Co-founder, COO of Bodyswaps

Julien Denoël is the Belgian co-founder and COO of UK-based VR edtech for soft-skills training Bodyswaps, where he has worked since its founding in 2019. Prior to this, he was CEO and managing director at VR marketing agency Somewhere Else from 2016, before the agency pivoted to training and skills development and became the basis of Bodyswaps’ product offer. The agency had clients such as Adidas, for which Somewhere Else produced an interactive VR in-store promotional tool that was deployed in over 100 locations in China, Europe and the US and was nominated for a VR Award and an Immersive Perspective award. Denoël has also been a guest lecturer in VR and AR at INSEEC business school in London and Geneva since 2017. Prior to this, Denoël also co-founded another VR agency, Exheb, in 2014, where he worked for almost three years as VR Producer. He also worked in digital marketing for Quotient Technology, formerly Coupons.com for two years, and in business development and marketing at the WorldOne agency for the same amount of time. Denoël holds both a master’s and a bachelor’s degree from HEC Management School in Liege, Belgium, the former in Marketing and Organization, the latter in Management.

Julien Denoël is the Belgian co-founder and COO of UK-based VR edtech for soft-skills training Bodyswaps, where he has worked since its founding in 2019. Prior to this, he was CEO and managing director at VR marketing agency Somewhere Else from 2016, before the agency pivoted to training and skills development and became the basis of Bodyswaps’ product offer. The agency had clients such as Adidas, for which Somewhere Else produced an interactive VR in-store promotional tool that was deployed in over 100 locations in China, Europe and the US and was nominated for a VR Award and an Immersive Perspective award. Denoël has also been a guest lecturer in VR and AR at INSEEC business school in London and Geneva since 2017. Prior to this, Denoël also co-founded another VR agency, Exheb, in 2014, where he worked for almost three years as VR Producer. He also worked in digital marketing for Quotient Technology, formerly Coupons.com for two years, and in business development and marketing at the WorldOne agency for the same amount of time. Denoël holds both a master’s and a bachelor’s degree from HEC Management School in Liege, Belgium, the former in Marketing and Organization, the latter in Management.

CEO and co-founder of Xendit

Moses Lo comes from an entrepreneurial family, his father acquired a failing business in Australia and turned it into a successful company. The family business inspired Lo to start his own fashion business in Australia after graduating in finance and commerce at the University of New South Wales in 2010.Lo initially gained work experience as an analyst in 2008 as part of his undergraduate finance and commerce programs in Australia. In 2011, he became an associate at the Boston Consulting Group in Australia. After two years, he was promoted to senior associate but left BCG in 2013 to focus on his menswear ventures until 2014.Lo decided to get first-hand tech startup experience in the Silicon Valley, working at Amazon while completing an MBA program at the University of California, Berkeley. In 2015, he decided to established a P2P payments platform Xendit in Indonesia. The platform has since pivoted into a payment gateway service and became a unicorn in 2021, with Lo as CEO based in California and Jakarta. He was also featured in Forbes’ 30 Under 30 list for Asian figures in finance and venture capital in 2016.

Moses Lo comes from an entrepreneurial family, his father acquired a failing business in Australia and turned it into a successful company. The family business inspired Lo to start his own fashion business in Australia after graduating in finance and commerce at the University of New South Wales in 2010.Lo initially gained work experience as an analyst in 2008 as part of his undergraduate finance and commerce programs in Australia. In 2011, he became an associate at the Boston Consulting Group in Australia. After two years, he was promoted to senior associate but left BCG in 2013 to focus on his menswear ventures until 2014.Lo decided to get first-hand tech startup experience in the Silicon Valley, working at Amazon while completing an MBA program at the University of California, Berkeley. In 2015, he decided to established a P2P payments platform Xendit in Indonesia. The platform has since pivoted into a payment gateway service and became a unicorn in 2021, with Lo as CEO based in California and Jakarta. He was also featured in Forbes’ 30 Under 30 list for Asian figures in finance and venture capital in 2016.

Portuguese state investment company PME Investimentos is the country's most prolific tech investor. Founded in 1989 as a joint stock company, SULPEDIP was under the supervision of the Bank of Portugal and changed its name to PME in 1998. The main aim is to help local SMEs to access funding and financial management services to develop and expand internationally. PME has invested in hundreds of startups, both tech and non-tech focused, across market verticals. It also manages several funds, including 200M that was launched in 2016 to focus on investments in Portugal-based startups. The co-investment fund of €200m prioritizes startups based in the Northern, Central, Alentejo, Lisbon and Algarve regions. The fund matches up to 100% of the private investors’ commitment, subject to a minimum investment of €500,000 and a maximum of €5m. Recent investments include petfood e-commerce Barkyn's €1.1m seed round, €4.2m Series A of made-to-order designer Platforme and a €650,000 contribution in the second phase of healthy food service EatTasty's €1.75m seed round.

Portuguese state investment company PME Investimentos is the country's most prolific tech investor. Founded in 1989 as a joint stock company, SULPEDIP was under the supervision of the Bank of Portugal and changed its name to PME in 1998. The main aim is to help local SMEs to access funding and financial management services to develop and expand internationally. PME has invested in hundreds of startups, both tech and non-tech focused, across market verticals. It also manages several funds, including 200M that was launched in 2016 to focus on investments in Portugal-based startups. The co-investment fund of €200m prioritizes startups based in the Northern, Central, Alentejo, Lisbon and Algarve regions. The fund matches up to 100% of the private investors’ commitment, subject to a minimum investment of €500,000 and a maximum of €5m. Recent investments include petfood e-commerce Barkyn's €1.1m seed round, €4.2m Series A of made-to-order designer Platforme and a €650,000 contribution in the second phase of healthy food service EatTasty's €1.75m seed round.

Meatable: Cell-based meat startup secures $47m Series A for scalable technology

The Dutch startup offers a pioneering technology for quickly scaling cell-based meat production while eliminating the need for animal-derived growth media

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

Cocuus: Industrial-scale solutions to design and print food

This Spanish startup is pioneering industrial-scale 3D food printing using inkjet and laser technology that prints up to 30 times faster with eye-catching food designs

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

New Food Invest: Growing an alternative protein business in Asia

With more than 4bn people, Asia presents unique opportunities and challenges to alternative protein startups. Four leading entrepreneurs shared their experiences at the recent New Food Invest conference

Because Animals: Pioneering cultured meat for pets

The biotech startup is disrupting the pet food processing industry with cell-based food to minimize environmental “pawprints” and promote animal welfare

Future Food Asia 2021: Long road ahead for the clean meat industry

Crucial basic research is still needed to ensure the safety, quality, and production efficiency of lab-grown meat. Concerted public and private sector efforts will accelerate progress

Singapore, the place to start and grow a cellular agriculture startup

A country that imports over 90% of its food supply, Singapore has turned to foodtech, including cellular agriculture, to safeguard food security, supported by proactive regulators

Cubiq Foods: Bioreactor farms producing the food of tomorrow

Growing appetite for meat alternatives expected to fuel demand for Cubiq’s low calorie, Omega 3-enriched lab-grown fats

Good Startup: Alt-protein products can be better than real meat

The investor of Eat Just, Ripple Foods and more expects its portfolio companies will exit in the next four to six years, mostly through acquisition

SWITCH Singapore: Alternative protein sure to take off in Asia, with Singapore as innovation hotbed

In an in-depth discussion, food industry experts say products made with alternative protein in hybrid forms could offer the fastest route to commercialization

Dao Foods unfazed by China tech crackdown, says alternative proteins aligned with state goals

Impact investor Dao Foods expects government support for alternative proteins to come, as it announces second batch of startups, diversifying into fermentation and cell-based proteins

Grain Meat: Focusing on whole cut plant-based meat

With its proprietary fiber weaving technique and specially-designed machinery, Wuxi-based Grain Meat aims to replicate the texture and even the grain of real meat

Biomilq: Creating cell-based mothers’ milk in a lab

With the aim of helping women struggling to breastfeed, Bill Gates-backed Biomilq is disrupting the $45bn baby formula industry developing lab-grown breast milk from mammary epithelial cells

Qorium: Lab-grown premium leather for the future of luxury

The Dutch biotech startup co-founded by cell-based meat pioneer Mark Post is targeting the luxury goods market with its “clean leather” sheets made from cultivating bovine skin cells, and plans to raise up to €100m

Sorry, we couldn’t find any matches for“cell-based meat”.