cultured meat

-

DATABASE (40)

-

ARTICLES (76)

Founded in 1813 as a small grain-trading firm in Arlon, France (now Belgium), Continental Grain Company (CGC) is now headquartered in New York. It has operations in 10 countries and employs over 13,500 people worldwide. Business activities include animal feeds, aquaculture and meat production.Besides interests in the food, agribusiness and commodities sectors, CGC also manages different asset classes like private equity, listed securities and venture capital. Its investment portfolio includes more than 30 food and agribusiness companies, ranging from early-stage ventures to established market leaders across the US, China and Latin America.CGC Asia mainly invests in feed milling, animal husbandry, meat production and processing businesses in the region. Direct investments are made through Continental Capital Limited in China, focusing on high‐growth food and agribusiness firms.

Founded in 1813 as a small grain-trading firm in Arlon, France (now Belgium), Continental Grain Company (CGC) is now headquartered in New York. It has operations in 10 countries and employs over 13,500 people worldwide. Business activities include animal feeds, aquaculture and meat production.Besides interests in the food, agribusiness and commodities sectors, CGC also manages different asset classes like private equity, listed securities and venture capital. Its investment portfolio includes more than 30 food and agribusiness companies, ranging from early-stage ventures to established market leaders across the US, China and Latin America.CGC Asia mainly invests in feed milling, animal husbandry, meat production and processing businesses in the region. Direct investments are made through Continental Capital Limited in China, focusing on high‐growth food and agribusiness firms.

Advanced sous-vide aseptic packaging (ASAP) technology extending the shelf-life of food to two years without refrigeration, preservatives or chemicals, potentially disrupting cold chain logistics

Advanced sous-vide aseptic packaging (ASAP) technology extending the shelf-life of food to two years without refrigeration, preservatives or chemicals, potentially disrupting cold chain logistics

Co-founder, CEO of Foods for Tomorrow / Heura Foods

Marc Coloma is the co-founder and CEO of Spanish plant-based meat startup, Foods for Tomorrow, where he has worked since 2017. Earlier, he spent two years at the local government business promotion organization Barcelona Activa's Entrepreneur's With Ideas training program, where Food for Tomorrow’s business and Heura foods product ideas were conceived. Coloma's background includes stints at a Catalonian animal charity and Doctors Without Borders (MSF) in project work and fundraising respectively, and as COO of a catering company. A committed vegan and environmentalist, Coloma was named on Forbes list of 100 Most Creative People in Business in July 2019.

Marc Coloma is the co-founder and CEO of Spanish plant-based meat startup, Foods for Tomorrow, where he has worked since 2017. Earlier, he spent two years at the local government business promotion organization Barcelona Activa's Entrepreneur's With Ideas training program, where Food for Tomorrow’s business and Heura foods product ideas were conceived. Coloma's background includes stints at a Catalonian animal charity and Doctors Without Borders (MSF) in project work and fundraising respectively, and as COO of a catering company. A committed vegan and environmentalist, Coloma was named on Forbes list of 100 Most Creative People in Business in July 2019.

Co-founder, Chief Social Movement Officer of Foods for Tomorrow / Heura Foods

Bernat Añaños Martínez is co-founder and Chief Social Movement Officer of Spanish plant-based meat startup, Foods for Tomorrow, where he has worked since 2017. He was previously CMO and Chief Growth Officer. A committed vegan and environmentalist, Añaños, worked briefly in China's EventBank, the first smart event management cloud platform, and in the European Parliament's press office in Brussels. Añaños has a first degree in Advertising and Public Relations from the University of Barcelona, a master’s in Corporate Communication and Public Relations from the UK’s Leeds University and a postgraduate qualification in Digital Marketing from the Autonomous University of Barcelona.He has volunteered at various NGOs for about 13 years.

Bernat Añaños Martínez is co-founder and Chief Social Movement Officer of Spanish plant-based meat startup, Foods for Tomorrow, where he has worked since 2017. He was previously CMO and Chief Growth Officer. A committed vegan and environmentalist, Añaños, worked briefly in China's EventBank, the first smart event management cloud platform, and in the European Parliament's press office in Brussels. Añaños has a first degree in Advertising and Public Relations from the University of Barcelona, a master’s in Corporate Communication and Public Relations from the UK’s Leeds University and a postgraduate qualification in Digital Marketing from the Autonomous University of Barcelona.He has volunteered at various NGOs for about 13 years.

The biotech will expand its popular range of organic and probiotic treats for dogs and cats with cell-based pet food, planned for launch in 2022.

The biotech will expand its popular range of organic and probiotic treats for dogs and cats with cell-based pet food, planned for launch in 2022.

Lever VC was founded in 2018 by Nick Cooney, an early investor of Beyond Meat and Memphis Meats. He is also the co-founder of Good Food Institute. Lever has currently invested in 14 startups from the US, Europe, Asia and Latin America.Focused on investments in early-stage alternative protein companies, the firm announced the first close of its Lever VC Fund I in August 2020, with its fourth close at $46m in April 2021. The final close will be completed by June 2021. Investors in the fund include NFL and NBA athletes, British nobility, food businesses, alt-protein companies and family offices as limited partners.In June 2020, Lever launched a $28m joint investment fund and accelerator to invest in Chinese plant-based and cell-cultivated meat and dairy companies. The Lever China Alternative Protein Fund will invest RMB 40m in alt-protein companies in mainland China over the next four years.

Lever VC was founded in 2018 by Nick Cooney, an early investor of Beyond Meat and Memphis Meats. He is also the co-founder of Good Food Institute. Lever has currently invested in 14 startups from the US, Europe, Asia and Latin America.Focused on investments in early-stage alternative protein companies, the firm announced the first close of its Lever VC Fund I in August 2020, with its fourth close at $46m in April 2021. The final close will be completed by June 2021. Investors in the fund include NFL and NBA athletes, British nobility, food businesses, alt-protein companies and family offices as limited partners.In June 2020, Lever launched a $28m joint investment fund and accelerator to invest in Chinese plant-based and cell-cultivated meat and dairy companies. The Lever China Alternative Protein Fund will invest RMB 40m in alt-protein companies in mainland China over the next four years.

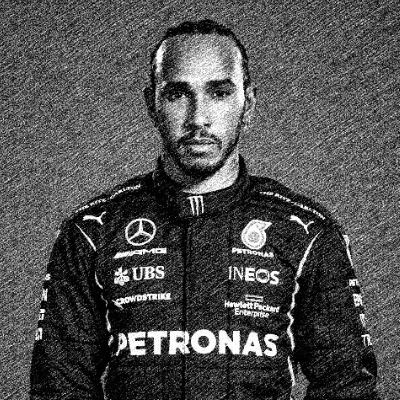

The British F1 racing driver and five-time FIA Formula One World Champion Lewis Hamilton has started to promote veganism and sustainable lifestyles, investing in several technology startups that develop solutions in that field.In 2019 he launched Neat Meat, the British vegan fast casual chain, in collaboration with The Cream Group, UNICEF Ambassadors and early investor in Beyond Meat Tommaso Chiabra. More recently he participated in a Series D funding round backing NotCo, the first Chilean unicorn selling plant-based food and beverage products across Latin America and the US.Hamilton is actively fighting to promote sustainable and eco-friendly practices across industries. In 2019 he also pushed Mercedes-Benz to discuss the possibility of including animal-free interiors in their cars. On that he said: I want to be part of a system that is going to help heal the world and do something positive for the future.”

The British F1 racing driver and five-time FIA Formula One World Champion Lewis Hamilton has started to promote veganism and sustainable lifestyles, investing in several technology startups that develop solutions in that field.In 2019 he launched Neat Meat, the British vegan fast casual chain, in collaboration with The Cream Group, UNICEF Ambassadors and early investor in Beyond Meat Tommaso Chiabra. More recently he participated in a Series D funding round backing NotCo, the first Chilean unicorn selling plant-based food and beverage products across Latin America and the US.Hamilton is actively fighting to promote sustainable and eco-friendly practices across industries. In 2019 he also pushed Mercedes-Benz to discuss the possibility of including animal-free interiors in their cars. On that he said: I want to be part of a system that is going to help heal the world and do something positive for the future.”

Horizons Ventures is a Hong Kong-based venture capital firm that manages the personal investments of Li Ka-shing, one of Hong Kong’s richest businessmen. Horizons’ investments cover a wide range of tech, media, and telecommunications companies. Standouts include artificial intelligence company DeepMind (acquired by Google in 2014), plant-based meat replacement makers Impossible Foods, and video conferencing software Zoom. It has also backed consumer-facing businesses like Atomo Coffee in Australia, Kopi Kenangan in Indonesia, and US-based distilled spirits company Endless West.

Horizons Ventures is a Hong Kong-based venture capital firm that manages the personal investments of Li Ka-shing, one of Hong Kong’s richest businessmen. Horizons’ investments cover a wide range of tech, media, and telecommunications companies. Standouts include artificial intelligence company DeepMind (acquired by Google in 2014), plant-based meat replacement makers Impossible Foods, and video conferencing software Zoom. It has also backed consumer-facing businesses like Atomo Coffee in Australia, Kopi Kenangan in Indonesia, and US-based distilled spirits company Endless West.

New York-based Humboldt Fund invests in startups with the potential to solve critical issues of our time across the areas of food production, healthcare, energy, and construction and manufacturing materials. It currently has 14 companies in its portfolio. Its most recent investments include in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech, and in the February 2021 $16m seed round of US biotech Cellino Biotech.

New York-based Humboldt Fund invests in startups with the potential to solve critical issues of our time across the areas of food production, healthcare, energy, and construction and manufacturing materials. It currently has 14 companies in its portfolio. Its most recent investments include in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech, and in the February 2021 $16m seed round of US biotech Cellino Biotech.

Serena Ventures is a venture capital investment firm founded by professional tennis player and businesswoman Serena Williams. The company focuses on early-stage companies founded by young, diverse teams. Since it was founded in 2014, it has invested in more than 30 companies with a cumulative market cap of $12b. Coffee brand Kopi Kenangan is its first investment in the Indonesian market. Serena Ventures has invested in notable companies like plant-based meat maker Impossible Foods, cryptocurrency exchange Coinbase, as well as Serena Williams’ own fashion label, S by Serena.

Serena Ventures is a venture capital investment firm founded by professional tennis player and businesswoman Serena Williams. The company focuses on early-stage companies founded by young, diverse teams. Since it was founded in 2014, it has invested in more than 30 companies with a cumulative market cap of $12b. Coffee brand Kopi Kenangan is its first investment in the Indonesian market. Serena Ventures has invested in notable companies like plant-based meat maker Impossible Foods, cryptocurrency exchange Coinbase, as well as Serena Williams’ own fashion label, S by Serena.

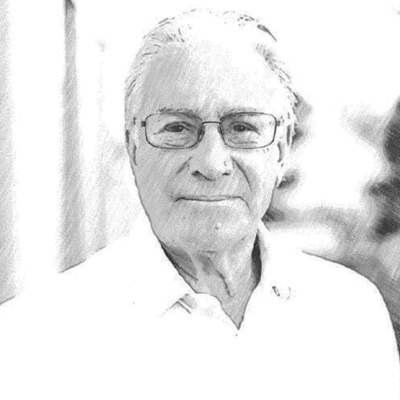

Jeffrey Leiden is a physician and scientist of more than 40 years, who is currently the executive chairman of US-based multinational biotech company Vertex Pharmaceuticals. Leiden is also the chairman of Casana, a remote healthcare platform and the chairman of Tmunity, a biotech dedicated to T-cell research. In March 2021, he participated as an angel investor in the $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Jeffrey Leiden is a physician and scientist of more than 40 years, who is currently the executive chairman of US-based multinational biotech company Vertex Pharmaceuticals. Leiden is also the chairman of Casana, a remote healthcare platform and the chairman of Tmunity, a biotech dedicated to T-cell research. In March 2021, he participated as an angel investor in the $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Founded in 2016, Berlin-based investor BlueYard invests in startups aiming to tackle the planet’s greatest challenges. It typically makes $1m–3m as an initial investment and has no geographical bias. Its most recent investments include in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech and in the February 2021 $4m seed round of Next Matter, a German Open Source automation tool for operations teams.

Founded in 2016, Berlin-based investor BlueYard invests in startups aiming to tackle the planet’s greatest challenges. It typically makes $1m–3m as an initial investment and has no geographical bias. Its most recent investments include in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech and in the February 2021 $4m seed round of Next Matter, a German Open Source automation tool for operations teams.

Founded in 2018, Kale United is a Stockholm-based ethical investor with an overriding interest in plant-based technologies. It raises funds from crowd campaigns and currently has a portfolio of 30 companies, mostly Swedish alternative meat startups. It had crowdfunded €1.34m by April 2020 for its portfolio of companies from three separate campaigns. It also has a portfolio of plant-based public shares and features a team of vegan expert investors and business leaders. Its founder, Måns Ullerstam, owns a third of the company. He is also CEO of local vegetarian food producer startup Astrid och Aporna.

Founded in 2018, Kale United is a Stockholm-based ethical investor with an overriding interest in plant-based technologies. It raises funds from crowd campaigns and currently has a portfolio of 30 companies, mostly Swedish alternative meat startups. It had crowdfunded €1.34m by April 2020 for its portfolio of companies from three separate campaigns. It also has a portfolio of plant-based public shares and features a team of vegan expert investors and business leaders. Its founder, Måns Ullerstam, owns a third of the company. He is also CEO of local vegetarian food producer startup Astrid och Aporna.

Rick Klausner is an award-winning scientist, former executive director of the Bill & Melinda Gates Foundation and an entrepreneur. Cell and molecular biologist Klausner was also director of the US National Cancer Institute from 1999-2001 and currently serves as CEO at biotech Lyell Immunopharma working with cell-based technology. He has also co-founded three US healthcare startups to date, Juno Therapeutics in 2013, MindStrong Health in 2014 and GRAIL in 2015. In 2021, he participated as an investor in the $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Rick Klausner is an award-winning scientist, former executive director of the Bill & Melinda Gates Foundation and an entrepreneur. Cell and molecular biologist Klausner was also director of the US National Cancer Institute from 1999-2001 and currently serves as CEO at biotech Lyell Immunopharma working with cell-based technology. He has also co-founded three US healthcare startups to date, Juno Therapeutics in 2013, MindStrong Health in 2014 and GRAIL in 2015. In 2021, he participated as an investor in the $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Taavet Hinrikus is the Estonian-born co-founder and CEO of money transfer platform and unicorn TransferWise (now called Wise). He was formerly Skype’s Director of Strategy and is a prolific angel investor across sectors and technologies, with investments in around 30 startups to date. His most recent investments include in the April 2021 $11m Series A round of automatic contract negotiator PACTUM and in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

Taavet Hinrikus is the Estonian-born co-founder and CEO of money transfer platform and unicorn TransferWise (now called Wise). He was formerly Skype’s Director of Strategy and is a prolific angel investor across sectors and technologies, with investments in around 30 startups to date. His most recent investments include in the April 2021 $11m Series A round of automatic contract negotiator PACTUM and in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech.

China a “positive environment” for uptake of cultured meat, researcher tells Future Food Asia

But for interested cultured meat companies, China-based Chloe Dempsey suggests it would be better to wait, observe and learn more about the market before trying to tap its massive potential

Because Animals: Pioneering cultured meat for pets

The biotech startup is disrupting the pet food processing industry with cell-based food to minimize environmental “pawprints” and promote animal welfare

Meatable: Cell-based meat startup secures $47m Series A for scalable technology

The Dutch startup offers a pioneering technology for quickly scaling cell-based meat production while eliminating the need for animal-derived growth media

Meatable joins Royal DSM to create growth media specific for cell-based meat tech

The R&D between the biotech startup and fellow Dutch nutrition conglomerate could help scale and drive the commercial viability of lab-grown meat

Future Food Asia 2021: Long road ahead for the clean meat industry

Crucial basic research is still needed to ensure the safety, quality, and production efficiency of lab-grown meat. Concerted public and private sector efforts will accelerate progress

Singapore, the place to start and grow a cellular agriculture startup

A country that imports over 90% of its food supply, Singapore has turned to foodtech, including cellular agriculture, to safeguard food security, supported by proactive regulators

Dao Foods unfazed by China tech crackdown, says alternative proteins aligned with state goals

Impact investor Dao Foods expects government support for alternative proteins to come, as it announces second batch of startups, diversifying into fermentation and cell-based proteins

New Food Invest: Growing an alternative protein business in Asia

With more than 4bn people, Asia presents unique opportunities and challenges to alternative protein startups. Four leading entrepreneurs shared their experiences at the recent New Food Invest conference

Do plant-based meat alternatives stand a chance in China, the world's largest meat consumer?

Major food brands and foodtech startups are trying to build their following in a nascent market forecast to grow to nearly $12bn worth by 2023

Cubiq Foods: Bioreactor farms producing the food of tomorrow

Growing appetite for meat alternatives expected to fuel demand for Cubiq’s low calorie, Omega 3-enriched lab-grown fats

Big Idea Ventures Founder Andrew D Ive: Asia will lead cell-based meat innovation

In a wide-ranging interview, the managing general partner of the US- and Singapore-based foodtech investor also expounds on his goal to extend sustainability to the rest of the food sector, combining good returns with doing good

SWITCH Singapore: Alternative protein sure to take off in Asia, with Singapore as innovation hotbed

In an in-depth discussion, food industry experts say products made with alternative protein in hybrid forms could offer the fastest route to commercialization

Dao Foods: Grooming and betting on China's rising alternative protein startups

How can businesses involve Chinese consumers in the environmental cause, even if it isn’t a priority for them? For that, the impact investor-incubator Dao Foods has got its philosophy-led strategy figured out

Biomilq: Creating cell-based mothers’ milk in a lab

With the aim of helping women struggling to breastfeed, Bill Gates-backed Biomilq is disrupting the $45bn baby formula industry developing lab-grown breast milk from mammary epithelial cells

New Food Invest: Plant-based cheese, the next investment boom?

With alt-protein startups experiencing a global funding boom, industry experts and investors share their views about emerging trends in diverse food sectors

Sorry, we couldn’t find any matches for“cultured meat”.