Bank Indonesia

-

DATABASE (639)

-

ARTICLES (299)

Co-founder and CTO of Karta

Jeff Hendrata co-founded motorcycle-mounted billboard firm Karta in 2016. He started his first company, digital media agency Brit-e2, in 2012 after graduating from Universitas Bina Nusantara with a bachelor's degree in Computer Science. Between 2012 and 2015, Jeff acted as Brit-e's CEO, overseeing projects with major clients, including Indonesia's fourth largest bank, CIMB Niaga and consumer products group Orang Tua. He remains an advisor to Brit-e after Karta was established.

Jeff Hendrata co-founded motorcycle-mounted billboard firm Karta in 2016. He started his first company, digital media agency Brit-e2, in 2012 after graduating from Universitas Bina Nusantara with a bachelor's degree in Computer Science. Between 2012 and 2015, Jeff acted as Brit-e's CEO, overseeing projects with major clients, including Indonesia's fourth largest bank, CIMB Niaga and consumer products group Orang Tua. He remains an advisor to Brit-e after Karta was established.

Founder and CEO of MSParis of MSParis

With an educational background in finance and business, Xu spent seven years working in investment banking upon graduating from Columbia University in 2005. She worked at Deutsche Bank and Macquarie Capital in Hong Kong, where she helped major Chinese e-commerce companies such as Vipshop, Moonbasa and Alibaba with their overseas IPOs, among other financial needs. She is a CFA Charterholder. Xu founded Shanghai Qiansong Internet Technology Co., Ltd., the parent company of MSParis, in 2014.

With an educational background in finance and business, Xu spent seven years working in investment banking upon graduating from Columbia University in 2005. She worked at Deutsche Bank and Macquarie Capital in Hong Kong, where she helped major Chinese e-commerce companies such as Vipshop, Moonbasa and Alibaba with their overseas IPOs, among other financial needs. She is a CFA Charterholder. Xu founded Shanghai Qiansong Internet Technology Co., Ltd., the parent company of MSParis, in 2014.

Private equity fund and incubator Balancop Ventures Ltd was founded in 2009 by Herman Wang who is based in Shanghai, China. Balancop will also establish and invest in its own stable of startups, including a telematics service company in China, GM’s Onstar and Toyota’s G-book. Balancop also has offices in Hong Kong and Indonesia.

Private equity fund and incubator Balancop Ventures Ltd was founded in 2009 by Herman Wang who is based in Shanghai, China. Balancop will also establish and invest in its own stable of startups, including a telematics service company in China, GM’s Onstar and Toyota’s G-book. Balancop also has offices in Hong Kong and Indonesia.

A prolific investor, Eddy Chan has been involved in venture investments for US companies like Paypal, SpaceX, and Palantir, as well as Indonesian ones like coworking space EV Hive (now CoHive), BeliMobilGue (used car marketplace) and Kata.ai (chatbot builder). He is also the founding partner of Intudo Ventures, an "Indonesia-only" VC firm.

A prolific investor, Eddy Chan has been involved in venture investments for US companies like Paypal, SpaceX, and Palantir, as well as Indonesian ones like coworking space EV Hive (now CoHive), BeliMobilGue (used car marketplace) and Kata.ai (chatbot builder). He is also the founding partner of Intudo Ventures, an "Indonesia-only" VC firm.

Heritas Capital Management began as an investment/fund management arm of IMC Group, a diversified conglomerate in Singapore. It became a Capital Management Services firm in 2013, and according to its website it manages over SGD 250m in assets. In Indonesia, it has backed telemedicine startup Alodokter and healthy catering company Gorry Holdings.

Heritas Capital Management began as an investment/fund management arm of IMC Group, a diversified conglomerate in Singapore. It became a Capital Management Services firm in 2013, and according to its website it manages over SGD 250m in assets. In Indonesia, it has backed telemedicine startup Alodokter and healthy catering company Gorry Holdings.

Pioneering AI SaaS combining virtual clinic and database for mental health professionals enables quicker diagnoses, with up to 90% accuracy.

Pioneering AI SaaS combining virtual clinic and database for mental health professionals enables quicker diagnoses, with up to 90% accuracy.

A veteran businessman, Diono Nurjadin is the president and CEO of Cardig Aero Services that is also a logistics partner of Kargo.co.id. He worked for Peregrine Securities in Singapore before returning to Indonesia in 1994. He was also the chairman of the now-defunct Mandala Airlines. Diono is a member of ANGIN, a network of Indonesian angel investors.

A veteran businessman, Diono Nurjadin is the president and CEO of Cardig Aero Services that is also a logistics partner of Kargo.co.id. He worked for Peregrine Securities in Singapore before returning to Indonesia in 1994. He was also the chairman of the now-defunct Mandala Airlines. Diono is a member of ANGIN, a network of Indonesian angel investors.

Beenext is a new venture fund started by Beenos founder and former CEO Teruhide “Teru” Sato. The fund describes itself as a “partnership of the founders, by the founders, for the founders”; bringing their wealth of global experience and capital backing to support promising entrepreneurs. Beenext has invested in nine countries, including India, Singapore and Indonesia.

Beenext is a new venture fund started by Beenos founder and former CEO Teruhide “Teru” Sato. The fund describes itself as a “partnership of the founders, by the founders, for the founders”; bringing their wealth of global experience and capital backing to support promising entrepreneurs. Beenext has invested in nine countries, including India, Singapore and Indonesia.

VIAEight is an advertising company in Indonesia, specializing in custom neon-box advertising boards and other modes of out-of-home advertising. Its products include car decals and train advertisements to neon boxes mounted on motorcycles. In November 2018, the company produced a projection mapping attraction to mark Lazada Indonesia's Singles Day online shopping discount event.

VIAEight is an advertising company in Indonesia, specializing in custom neon-box advertising boards and other modes of out-of-home advertising. Its products include car decals and train advertisements to neon boxes mounted on motorcycles. In November 2018, the company produced a projection mapping attraction to mark Lazada Indonesia's Singles Day online shopping discount event.

Mahanusa Capital is a financial services company founded by Daniel Budiman. The firm provides investment banking and brokerage services through its subsidiaries, Mahanusa Securities and Magna Finance. It also manages major property assets in Indonesia, including the Pacific Place mall in Jakarta. Mahanusa Capital has invested in digital signature startup PrivyID and local event discovery app Goers.

Mahanusa Capital is a financial services company founded by Daniel Budiman. The firm provides investment banking and brokerage services through its subsidiaries, Mahanusa Securities and Magna Finance. It also manages major property assets in Indonesia, including the Pacific Place mall in Jakarta. Mahanusa Capital has invested in digital signature startup PrivyID and local event discovery app Goers.

Head of Customer Success and co-founder of Blox

Carlos Ricci Ricci has an MBA in marketing from Minas Gerais Catholic Pontifical University and an MBA in business finance from the Getulio Vargas Foundation.He has worked in banking for over 30 years, including more than 14 years in sales and risk management at Banco Fidis. He also worked as an account manager at ABN AMRO bank for over 16 years. He is now the co-founder and Head of Customer Success of edtech startup Blox.

Carlos Ricci Ricci has an MBA in marketing from Minas Gerais Catholic Pontifical University and an MBA in business finance from the Getulio Vargas Foundation.He has worked in banking for over 30 years, including more than 14 years in sales and risk management at Banco Fidis. He also worked as an account manager at ABN AMRO bank for over 16 years. He is now the co-founder and Head of Customer Success of edtech startup Blox.

Lippo Digital Ventures was the corporate venture arm of Indonesian conglomerate Lippo Group, founded by Indonesian billionaire and banker Mochtar Riady. In 2015, the company reincarnated as Venturra Capital, a US$150 million fund focusing on technology firms in Indonesia and Southeast Asia.

Lippo Digital Ventures was the corporate venture arm of Indonesian conglomerate Lippo Group, founded by Indonesian billionaire and banker Mochtar Riady. In 2015, the company reincarnated as Venturra Capital, a US$150 million fund focusing on technology firms in Indonesia and Southeast Asia.

Mitsubishi UFJ Financial Group

Japan's largest financial institution, the Mitsubishi UFJ Financial Group (MUFG) runs the country's flagship MUFG Bank. As part of the Mitsubishi Group, MUFG also has subsidiaries specializing in finance, securities and investments. Its investment in Indonesia's fast-growing Gojek is part of MUFG's expansion plans to enter the financial services market in Southeast-Asia.

Japan's largest financial institution, the Mitsubishi UFJ Financial Group (MUFG) runs the country's flagship MUFG Bank. As part of the Mitsubishi Group, MUFG also has subsidiaries specializing in finance, securities and investments. Its investment in Indonesia's fast-growing Gojek is part of MUFG's expansion plans to enter the financial services market in Southeast-Asia.

Aavishkaar (‘invention’ in Hindi) was founded in 2001 as an early stage investor to help build sustainable enterprises in India’s underserved regions. Its VC portfolio, valued at over US$ 155 million, covers key industry sectors including sanitation, healthcare, agriculture and technology. Its Aavishkaar Frontier Fund was created in 2015 to invest in South and Southeast Asian countries like Indonesia, Pakistan and Bangladesh.

Aavishkaar (‘invention’ in Hindi) was founded in 2001 as an early stage investor to help build sustainable enterprises in India’s underserved regions. Its VC portfolio, valued at over US$ 155 million, covers key industry sectors including sanitation, healthcare, agriculture and technology. Its Aavishkaar Frontier Fund was created in 2015 to invest in South and Southeast Asian countries like Indonesia, Pakistan and Bangladesh.

Kinara is a venture capital fund based in Indonesia. Established in 2011, it focuses on impact investments that include supporting inclusive economy initiatives and eco-friendly ventures such as Greeneration. Kinara has been managing Indonesia’s first business impact acceleration program that has produced 11 enterprises in the food security sector since 2016. Other priority sectors are microfinance, clean tech, agriculture and fisheries.

Kinara is a venture capital fund based in Indonesia. Established in 2011, it focuses on impact investments that include supporting inclusive economy initiatives and eco-friendly ventures such as Greeneration. Kinara has been managing Indonesia’s first business impact acceleration program that has produced 11 enterprises in the food security sector since 2016. Other priority sectors are microfinance, clean tech, agriculture and fisheries.

No bank account? In Indonesia, you can still shop online

Indonesian startups are racing to serve the millions of consumers that banks haven’t reached. Here’s a look at some of the leading players, their innovations and how they have redefined the market

With universal QR code, Indonesia achieves e-payment harmony

The move to standardize Indonesia's QR code is expected to unify the country's cashless payments system and lift tens of thousands of small merchants into the payments mainstream

P2P financing platform Investree raises Series C, with $23.5m in first tranche

Indonesia's Investree closes key funding amid Covid-19 crisis; is applying for licenses in Thailand and the Philippines in regional expansion

QRIS: Will the new QR code standard rewrite Indonesia’s e-payments scene?

Enabling interoperability, the QRIS seeks to level the playing field until now dominated by GoPay and OVO – disruption that could go beyond the e-wallets scene

Gojek acquires Indonesian POS startup Moka, gains greater share of SME fintech market

Deal reportedly worth $120m will add Moka's network of over 30,000 merchants to Gojek's reach

Investing in Indonesia: The fintech companies driving a new influx of capital

With 66% of Indonesians not owning a bank account, fintech startups have come up with myriad innovative products to entice a new generation of retail investors

MSMB: From university research to agritech ecosystem

The Indonesian startup is moving beyond sensors to build technologies for livestock tracking and fish farming

Indonesian state enterprises launch e-wallet LinkAja, competing with Go-Pay and OVO

Even with a wider range of services and extensive state backing, LinkAja faces a tough battle

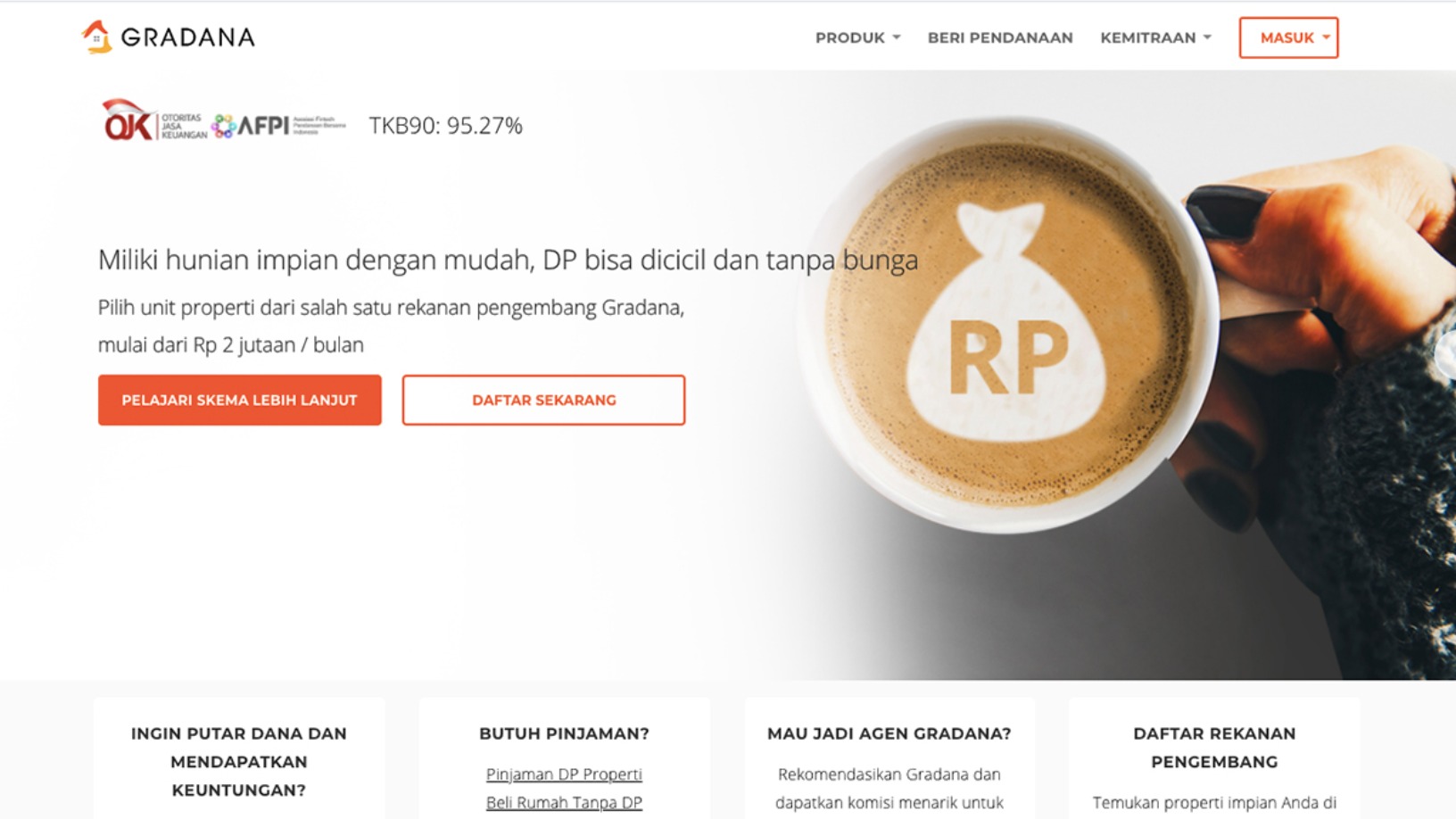

Gradana: P2P lending for more accessible home ownership in Indonesia

Gradana wants to create an ecosystem where developers, agents, landlords, buyers and lenders benefit one another through interconnected financing

ZendMoney: Putting cash back into the pockets of Indonesian migrant workers

ZendMoney's unique remittance concept has already helped 90,000 migrant workers send money back home

Indonesian P2P lending platform Investree expands to the Philippines

With local partner Filinvest Development Corporation, Investree Philippines will support the country’s SMEs with its lending-based crowdfunding platform

Bukalapak CEO Achmad Zaky steps down, ex-banker Rachmat Kaimuddin to take over

Rumors of a leadership change first surfaced in August as the Indonesian unicorn and its co-founder got a bad press

Payfazz aims to be Indonesia's first on-demand financial services company

Handling transactions averaging over IDR 1tn monthly, Payfazz hopes to bring the benefits of banking to all Indonesians

UPDATE: Indonesian mPOS startup Cashlez raises IDR 85bn from IPO in May

Cashlez is the first fintech company to list on the Indonesia Stock Exchange; will spend over 60% of proceeds to acquire payments company in toll road market

Crowde-funding Indonesia's fields

Agritech startup Crowde offers retail investors direct access to Indonesia’s US$25 billion agricultural sector, transforming the way traditional farmers fund, run and grow their businesses

Sorry, we couldn’t find any matches for“Bank Indonesia”.