High Pitch 2020

-

DATABASE (284)

-

ARTICLES (593)

UBS is a Switzerland-based financial institution providing banking, wealth management, and securities services. Originally established in 1862 as the Bank in Winterthur, it is the largest Swiss banking institution. UBS engages in venture capital activities as part of its investment banking services. In 2020, UBS began a partnership with venture capital firm Anthemis to launch UBS Next, a $200m fund that will invest in fintech and other tech startups.

UBS is a Switzerland-based financial institution providing banking, wealth management, and securities services. Originally established in 1862 as the Bank in Winterthur, it is the largest Swiss banking institution. UBS engages in venture capital activities as part of its investment banking services. In 2020, UBS began a partnership with venture capital firm Anthemis to launch UBS Next, a $200m fund that will invest in fintech and other tech startups.

A Boston-based VC founded in 1984 with an impressive investment history, currently totaling US$9.5 billion. With offices in Boston, Menlo Park, California and London, Summit Partners has invested in more than 460 companies in technology, healthcare, life sciences and other high-growth industries, including as lead investor in 77 companies. It has seen 192 exits to date. Recent major investments include as lead investor in Red Points' Series C round and in Markforged's Series D round.The company also provides services, such as, recruitment of senior executives and board members and Peak Performance Groups to help companies’ identify and execute growth initiatives and operational efficiency.

A Boston-based VC founded in 1984 with an impressive investment history, currently totaling US$9.5 billion. With offices in Boston, Menlo Park, California and London, Summit Partners has invested in more than 460 companies in technology, healthcare, life sciences and other high-growth industries, including as lead investor in 77 companies. It has seen 192 exits to date. Recent major investments include as lead investor in Red Points' Series C round and in Markforged's Series D round.The company also provides services, such as, recruitment of senior executives and board members and Peak Performance Groups to help companies’ identify and execute growth initiatives and operational efficiency.

Portuguese serial entrepreneur and angel investor, Carlos Oliveira is formerly the Secretary of State for Entrepreneurship, Competitiveness and Innovation in Portugal. He is also one of the 15 members of the European Commission's high-level group of innovators tasked with the creation of the European Innovation Council.In 2000, Oliveira founded a mobile services startup MobiComp and worked as its CEO until 2008 when he sold the company to Microsoft. He has also founded and invested in several startups, including StudentFinance fintech's €1.15m seed round. He is currently the executive president of the José Neves Foundation, set up by Farfetch founder José Neves to invest and transform Portugal into a knowledge economy.

Portuguese serial entrepreneur and angel investor, Carlos Oliveira is formerly the Secretary of State for Entrepreneurship, Competitiveness and Innovation in Portugal. He is also one of the 15 members of the European Commission's high-level group of innovators tasked with the creation of the European Innovation Council.In 2000, Oliveira founded a mobile services startup MobiComp and worked as its CEO until 2008 when he sold the company to Microsoft. He has also founded and invested in several startups, including StudentFinance fintech's €1.15m seed round. He is currently the executive president of the José Neves Foundation, set up by Farfetch founder José Neves to invest and transform Portugal into a knowledge economy.

Formerly known as Guangdong Technology Venture Capital Group, Technology Financial Group is a state-owned firm based in Guangzhou. It has a subsidiary in Guangdong province and has set up nine offices in other provinces across China. Technology Financial Group began investing in companies when it was founded in 1992, and it has assets under management of RMB 50bn. With a focus on VC investment, it also provides financial services such as asset management.The firm invests mainly in the high-end equipment manufacturing; new-generation information technology; new material; art, entertainment and media; consumption; biotech and pharmacy; energy and environmental protection; and automotive sectors.

Formerly known as Guangdong Technology Venture Capital Group, Technology Financial Group is a state-owned firm based in Guangzhou. It has a subsidiary in Guangdong province and has set up nine offices in other provinces across China. Technology Financial Group began investing in companies when it was founded in 1992, and it has assets under management of RMB 50bn. With a focus on VC investment, it also provides financial services such as asset management.The firm invests mainly in the high-end equipment manufacturing; new-generation information technology; new material; art, entertainment and media; consumption; biotech and pharmacy; energy and environmental protection; and automotive sectors.

Founded in 2002, Bluesail was initially known as a manufacturer of PVC gloves, with an annual capacity of tens of billions of pairs at its peak. At the end of 2012, it began to expand into more health-related areas.In 2018, it acquired a 93.37% stake in Biosensors International Group that specializes in developing, manufacturing and licensing technologies for use in interventional cardiology procedures and critical care. The two companies were merged and Bluesail began to produce more high-end medical consumables. In 2019, the company and senior executives invested in CH Biomedical to collaborate in the development of innovative medical devices for sale in China and overseas.

Founded in 2002, Bluesail was initially known as a manufacturer of PVC gloves, with an annual capacity of tens of billions of pairs at its peak. At the end of 2012, it began to expand into more health-related areas.In 2018, it acquired a 93.37% stake in Biosensors International Group that specializes in developing, manufacturing and licensing technologies for use in interventional cardiology procedures and critical care. The two companies were merged and Bluesail began to produce more high-end medical consumables. In 2019, the company and senior executives invested in CH Biomedical to collaborate in the development of innovative medical devices for sale in China and overseas.

Senior Scientific Advisor and co-founder of The Not Company (NotCo)

Pablo Zamora is a biotechnologist from the University of Santiago, where he worked as a professor and research scientist until 2008. In 2009, he started his postdoctoral research on Mexico’s maize genetics at UC Davis Life Science Innovation Center. He worked there as a senior scientist and associate until 2014. In 2015, he was appointed the center’s Chief Science Officer based in Chile, a position he was in till January 2018.From 2013–2015, he also worked on various plant and microbe genomics projects as a senior scientist in Mars Advanced Research Institute. He was also an editor from 2012–2017 at the Journal of Technology Management & Innovation and worked at the non-profit PIPRA from 2010–2018 as international alliance manager in Sacramento, University of California.In 2015, he co-founded The Not Company (NotCo) based in Santiago. He was appointed CSO in February 2018, a role he led until March 2020, when he left the company to focus on a new project, AptaBuilder, a $60m program that promotes R&D for Chilean technology-based ventures. Zamora still consults as NotCo’s senior scientific advisor.

Pablo Zamora is a biotechnologist from the University of Santiago, where he worked as a professor and research scientist until 2008. In 2009, he started his postdoctoral research on Mexico’s maize genetics at UC Davis Life Science Innovation Center. He worked there as a senior scientist and associate until 2014. In 2015, he was appointed the center’s Chief Science Officer based in Chile, a position he was in till January 2018.From 2013–2015, he also worked on various plant and microbe genomics projects as a senior scientist in Mars Advanced Research Institute. He was also an editor from 2012–2017 at the Journal of Technology Management & Innovation and worked at the non-profit PIPRA from 2010–2018 as international alliance manager in Sacramento, University of California.In 2015, he co-founded The Not Company (NotCo) based in Santiago. He was appointed CSO in February 2018, a role he led until March 2020, when he left the company to focus on a new project, AptaBuilder, a $60m program that promotes R&D for Chilean technology-based ventures. Zamora still consults as NotCo’s senior scientific advisor.

Founded in 2018, Oslo-based Katapult Ocean is the first investor focused entirely on oceantech and related startups. The VC also operates a three-month accelerator and has invested in 32 startups from 17 countries worldwide.The VC typically invests at the seed or pre-seed level but in July 2020 it completed its first Series A round of $8.5m investment in Chilean social enterprise Betterfly. Other recent investments include the pre-seed rounds of US foodtech GreenCover and Dutch offshore solar tech SolarDuck.

Founded in 2018, Oslo-based Katapult Ocean is the first investor focused entirely on oceantech and related startups. The VC also operates a three-month accelerator and has invested in 32 startups from 17 countries worldwide.The VC typically invests at the seed or pre-seed level but in July 2020 it completed its first Series A round of $8.5m investment in Chilean social enterprise Betterfly. Other recent investments include the pre-seed rounds of US foodtech GreenCover and Dutch offshore solar tech SolarDuck.

Nigerian investment bank and investor CardinalStone Partners was founded in 2008. It invests in enterprises with the potential to transform diverse sectors deemed to be strategic to the development of the economies in Nigeria, Ghana and other West African countries.The VC also reviews potential investments in relation to their ESG impact. CardinalStone currently has six companies in its portfolio including Nigerian gym chain i-Fitness and Nigerian fintech Appzone. In 2020, it raised $50m for a new private equity fund, CardinalStone Capital Advisers Growth Fund.

Nigerian investment bank and investor CardinalStone Partners was founded in 2008. It invests in enterprises with the potential to transform diverse sectors deemed to be strategic to the development of the economies in Nigeria, Ghana and other West African countries.The VC also reviews potential investments in relation to their ESG impact. CardinalStone currently has six companies in its portfolio including Nigerian gym chain i-Fitness and Nigerian fintech Appzone. In 2020, it raised $50m for a new private equity fund, CardinalStone Capital Advisers Growth Fund.

Founded in 1904, Duke Energy is a North Carolina-based utilities company that has the objective of zero methane emissions by 2030. It occasianally invests in US tech startups looking to offset greenhouse gas emissions and has invested in four startups to date. Its most recent investments were in the $50m 2020 Series C round of SOURCE Global (formerly Zero Mass Water), the premier off-grid drinking water production tech using solar-powered panels, and in the 2019 $5m round of energy management software producer Phoenix ET.

Founded in 1904, Duke Energy is a North Carolina-based utilities company that has the objective of zero methane emissions by 2030. It occasianally invests in US tech startups looking to offset greenhouse gas emissions and has invested in four startups to date. Its most recent investments were in the $50m 2020 Series C round of SOURCE Global (formerly Zero Mass Water), the premier off-grid drinking water production tech using solar-powered panels, and in the 2019 $5m round of energy management software producer Phoenix ET.

Founded in 2016 in Boulder, Colorado, Blackhorn specializes in startup investment in potential game-changers for industry, including construction – its top priority for investment – manufacturing, healthcare, agriculture, transportation, water and energy. It has no geographical bias and currently has 48 companies in its portfolio with two acquisitions to date. Its most recent investments include in the undisclosed $8m round of US medtech Cytovale in January 2021 and in the $20.5m December 2020 Series A round of employees compensation fintech Foresight Risk, based in Silicon Valley.

Founded in 2016 in Boulder, Colorado, Blackhorn specializes in startup investment in potential game-changers for industry, including construction – its top priority for investment – manufacturing, healthcare, agriculture, transportation, water and energy. It has no geographical bias and currently has 48 companies in its portfolio with two acquisitions to date. Its most recent investments include in the undisclosed $8m round of US medtech Cytovale in January 2021 and in the $20.5m December 2020 Series A round of employees compensation fintech Foresight Risk, based in Silicon Valley.

Based in Frankfurt, GreenTec Capital Partners is a German social impact investor that focuses on supporting African tech and non-tech startups. The VC plans to increase its investment portfolio to a total of 400 enterprises by 2023. Its current stake in 20 startups is estimated to be €32.5m. In 2020, GreenTec joined the pre-seed round of Nigerian online food cooperative Principally and seed round of Freshbag, a farmers’ marketplace in Cameroon. Recent investments also include AgroCenta’s seed funding in January 2021.

Based in Frankfurt, GreenTec Capital Partners is a German social impact investor that focuses on supporting African tech and non-tech startups. The VC plans to increase its investment portfolio to a total of 400 enterprises by 2023. Its current stake in 20 startups is estimated to be €32.5m. In 2020, GreenTec joined the pre-seed round of Nigerian online food cooperative Principally and seed round of Freshbag, a farmers’ marketplace in Cameroon. Recent investments also include AgroCenta’s seed funding in January 2021.

Facebook is a social networking platform founded by Mark Zuckerberg and partners in 2004. It is listed on the NASDAQ exchange under ticker code FB. Throughout its development it has acquired various complementary social media and networking services, such as Instagram and WhatsApp.As an investor, Facebook has invested in a wide range of companies. It invested in and later acquired virtual reality headset developers Oculus, and also invested in e-commerce enabler Meesho. In 2020, it joined Google, Tencent and other major tech investors as an investor in Gojek.

Facebook is a social networking platform founded by Mark Zuckerberg and partners in 2004. It is listed on the NASDAQ exchange under ticker code FB. Throughout its development it has acquired various complementary social media and networking services, such as Instagram and WhatsApp.As an investor, Facebook has invested in a wide range of companies. It invested in and later acquired virtual reality headset developers Oculus, and also invested in e-commerce enabler Meesho. In 2020, it joined Google, Tencent and other major tech investors as an investor in Gojek.

Elevation China Capital (ECC) is an equity investment firm, with offices in Shenzhen, Shanghai and Silicon Valley. Founded in Beijing in June 2010 by managing partner Man Li, the VC focuses on investments in early-stage and high-growth stage tech companies.In August 2019, Shenzen's IGTech became its most recent investment as part of a seed funding worth RMB 10m. The Guangdong company provides intelligent manufacturing solutions to help digitize the production process to improve safety, efficiency and quality using advance data management technology.

Elevation China Capital (ECC) is an equity investment firm, with offices in Shenzhen, Shanghai and Silicon Valley. Founded in Beijing in June 2010 by managing partner Man Li, the VC focuses on investments in early-stage and high-growth stage tech companies.In August 2019, Shenzen's IGTech became its most recent investment as part of a seed funding worth RMB 10m. The Guangdong company provides intelligent manufacturing solutions to help digitize the production process to improve safety, efficiency and quality using advance data management technology.

With a special interest in enterprise tech, Silicon Valley-based Omega Venture Partners has 25 startups in its portfolio and, to date, has invested from pre-seed to Series E stages. It has managed eight exits to date. Its most recent investments were in the 2020 $55m Series B round of US-based small business management platform ZenBusiness and in the February 2021 $50m Series B round of US voice transcription software Otter.ai. The investor boasts an extensive network of major corporations as advisors and partners including Google, Microsoft, Amazon, IBM, SAP and CitiGroup.

With a special interest in enterprise tech, Silicon Valley-based Omega Venture Partners has 25 startups in its portfolio and, to date, has invested from pre-seed to Series E stages. It has managed eight exits to date. Its most recent investments were in the 2020 $55m Series B round of US-based small business management platform ZenBusiness and in the February 2021 $50m Series B round of US voice transcription software Otter.ai. The investor boasts an extensive network of major corporations as advisors and partners including Google, Microsoft, Amazon, IBM, SAP and CitiGroup.

Founded in 2011, London-based Agronomics Limited’s principal investing interest is in environmentally-friendly alternatives to the traditional production of meat, wherever they may be located. There are currently 17 companies in its portfolio, all of them in the cellular-based or plant-based protein category and sustainable food production.Its most recent declared investments have been in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech, and in the December 2020 undisclosed pre-seed round of Chinese cellular foodtech CellX.

Founded in 2011, London-based Agronomics Limited’s principal investing interest is in environmentally-friendly alternatives to the traditional production of meat, wherever they may be located. There are currently 17 companies in its portfolio, all of them in the cellular-based or plant-based protein category and sustainable food production.Its most recent declared investments have been in the March 2021 $48m Series A round of Dutch cell-based meat startup Meatable which leverages pluripotent stem cells for the first time in foodtech, and in the December 2020 undisclosed pre-seed round of Chinese cellular foodtech CellX.

Indonesia launches national pitch competition HighPitch 2020 to re-energize its startup ecosystem

With 43 VC investors so far joining as judges and mentors, HighPitch 2020 aims to reconnect investors with young startups across the country amid Covid-19

HighPitch: E-grocery marketplace Pasar20 and healthcare edtech Appskep top the Medan chapter

Representing Sumatra’s startup ecosystem in the national finals later in November, Pasar20 and Appskep have ambitious expansion plans in store

HighPitch 2020: Event ticketing and legal tech startups come up tops in Jakarta chapter

VC judges favored Goers’s strong pivot amid Covid and HAKITA’s outstanding pitch

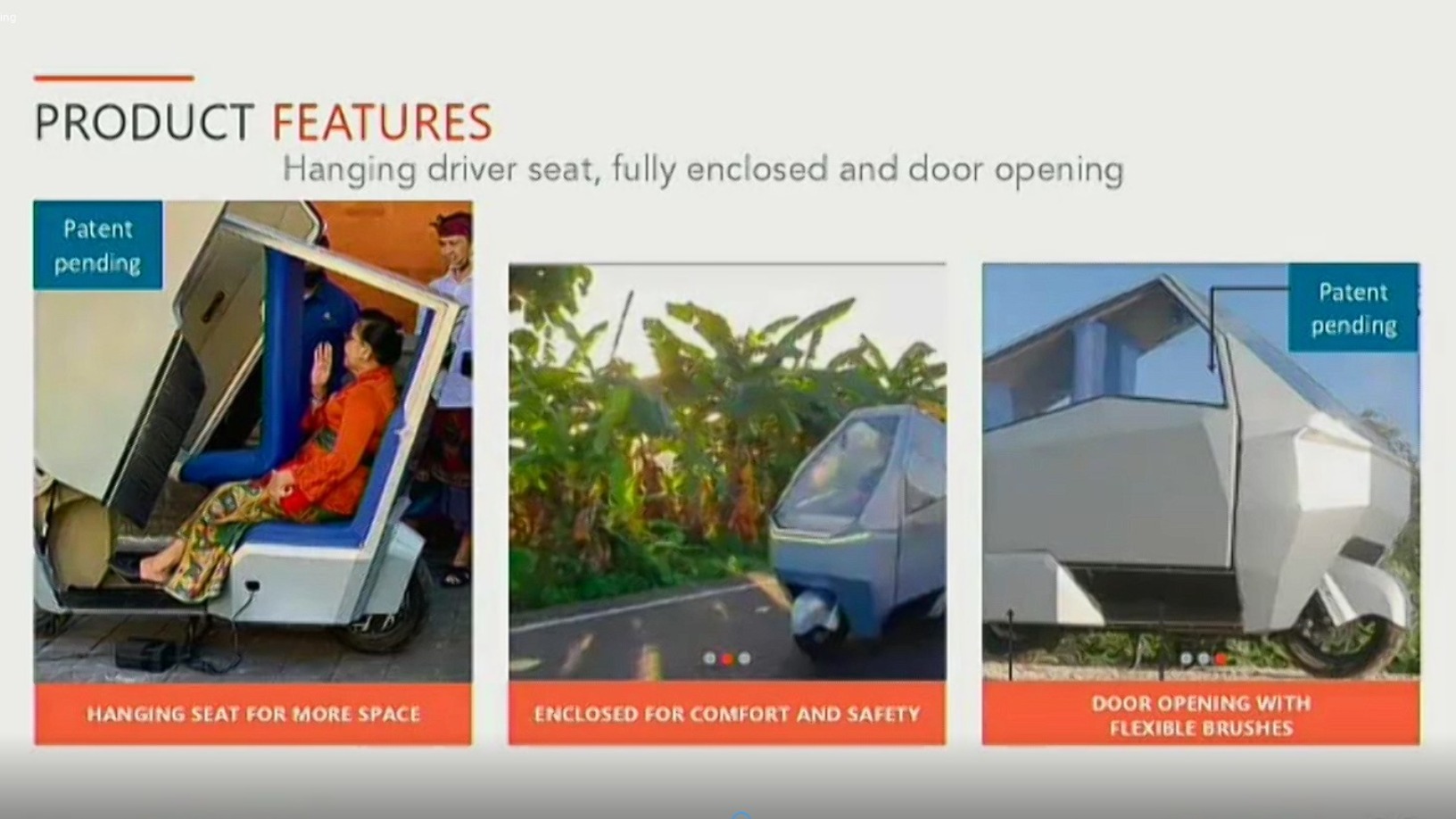

HighPitch 2020: Hydroponics, EV startups PanenBali and Manouv represent Denpasar chapter

Renewable energy and sustainability focuses impress investors, who also caution startups about competitors from outside their region

Coronavirus: Portuguese startups pitch in as nation battles pandemic

More than 120 startups join the #tech4COVID19 initiative, offering the public free medical help, meals for the vulnerable, online education and more

HighPitch 2020: Goers wins Indonesia's national startup competition

Event ticketing startup Goers gains new revenue streams with pivot to helping leisure spots go online; hotel SaaS Izy and on-demand medical testing service CekLab also in top three

In Portugal tourism tech gets disrupted, in time for post-Covid-19 era

As Portugal reopens to tourists early next month, the sector is banking on a new generation of tourism tech startups to enable safety and reassure visitors

HighPitch 2020: In conversation with top winners and UMG Idealab head Kiwi Aliwarga

Goers, Izy and CekLab demonstrated quick thinking when adapting their businesses to the pandemic, a capability they will need to stay competitive post-Covid

Indonesia's HighPitch 2020: VC investors on Medan startups, deal-sourcing during Covid

Healthcare-focused edtech Appskep and e-grocer Pasar20 win regional pitch competition for Sumatra; judging VCs share their new perspectives gained on local problems and startups from outside Greater Jakarta, and more

HighPitch 2020: Yogyakarta chapter won by on-demand lab testing and solar cell startups

Judges lauded the variety of ideas, but said startups could improve their presentations and clearly state the problems they are solving

HighPitch 2020: Waste management play Octopus, digital concierge service Izy win Makassar battle

Both startups have scored strong traction despite the weight of Covid-19; they are also expanding and keen to explore new opportunities

Future Food Asia 2021: Impact assessments – getting the metrics right

Common impact measures are useful but each situation requires specific, sometimes subjective considerations. The priority is to gauge if the impact has led to positive changes

Buy Yourself GO: Relieving the pressure in high-demand retail

Buy Yourself's patented self-checkout technology specifically targets peak sales periods for bricks-and-mortars and requires no prior download of software

Xu Jinghong: Champion of young entrepreneurs and high-tech startups

Under Xu Jinghong’s leadership, Tsinghua Holdings grew its assets sevenfold and incubated over 10,000 businesses. In his new role as VC investor, Xu wants to nurture startups into future global leaders

Citibeats, a social trends monitoring tool for governments and businesses, wins €1.4m funding

Citibeats tracks and analyzes what the public is saying online in any language; wants to boost its presence in LatAm and Asia

Sorry, we couldn’t find any matches for“High Pitch 2020”.