Madrid7R Circular Economy

-

DATABASE (43)

-

ARTICLES (176)

Co-founder and CEO of Cakap by Squline

Tomy Yunus is co-founder and CEO of Cakap (formerly known as Squline). He graduated from Universitas Bina Nusantara with a bachelor's in Computer Engineering in 2009, after which he pursued further education in China, graduating with a master's in Chinese Economy from Renmin University. While attending Chinese lessons at the Beijing Language and Culture Center, Tomy met future Squline co-founder Yohan Limerta. After working for two years in China, including a short stint as project lead at Pactera, Tomy returned to Indonesia in 2013 to establish Squline, an online language learning platform.

Tomy Yunus is co-founder and CEO of Cakap (formerly known as Squline). He graduated from Universitas Bina Nusantara with a bachelor's in Computer Engineering in 2009, after which he pursued further education in China, graduating with a master's in Chinese Economy from Renmin University. While attending Chinese lessons at the Beijing Language and Culture Center, Tomy met future Squline co-founder Yohan Limerta. After working for two years in China, including a short stint as project lead at Pactera, Tomy returned to Indonesia in 2013 to establish Squline, an online language learning platform.

Junrun Capital was founded in 2009 in Ningbo, Zhejiang province. It's the largest private equity fund in Ningbo and specializes in M&A, equity and venture capital investments. So far, it has successfully exited seven deals out of a total of 21. Junrun has investment managers and researchers with backgrounds in science and technology. It has offices in Hangzhou, Shanghai, Shenzhen and the US. The company mainly seeks investment opportunities in sustainable materials, cleantech, agriculture, manufacture, biotechnology and the dotcom economy.

Junrun Capital was founded in 2009 in Ningbo, Zhejiang province. It's the largest private equity fund in Ningbo and specializes in M&A, equity and venture capital investments. So far, it has successfully exited seven deals out of a total of 21. Junrun has investment managers and researchers with backgrounds in science and technology. It has offices in Hangzhou, Shanghai, Shenzhen and the US. The company mainly seeks investment opportunities in sustainable materials, cleantech, agriculture, manufacture, biotechnology and the dotcom economy.

Fidelity China Special Situations PLC

Founded in 2010, Fidelity China Special Situations PLC (FCSS) is managed by Dale Nicholls who has worked at Fidelity International since 1996. Listed on the FTSE 250 Index, FCSS is said to be the UK’s largest China-focused investment trust with access to Fidelity's investment research resources and investment licenses in China.Focusing on companies that are most likely to benefit from China’s growth and changing economy, FCSS has invested in over 100 businesses in the country. Besides technology, it is also seeking opportunities in the consumer space and healthcare.

Founded in 2010, Fidelity China Special Situations PLC (FCSS) is managed by Dale Nicholls who has worked at Fidelity International since 1996. Listed on the FTSE 250 Index, FCSS is said to be the UK’s largest China-focused investment trust with access to Fidelity's investment research resources and investment licenses in China.Focusing on companies that are most likely to benefit from China’s growth and changing economy, FCSS has invested in over 100 businesses in the country. Besides technology, it is also seeking opportunities in the consumer space and healthcare.

Co-founder and COO of Otobro

Mathew F Jones joined Otobro Pte Ltd in 2016 as co-founder and COO. Otobro was acquired by the C88 Group in March 2017. Mathew is also the commissioner of PT Superior Coach, a representative office in Jakarta. Mathew has worked in Indonesia for over 11 years. He joined PT Selaras Nusa Abadi as general manager in 2003 and became the managing director and Dealer Council chairman of the company from 2005 until 2015. He has a bachelor’s in Political Economy of Industrial Societies from the University of California Berkeley, USA.

Mathew F Jones joined Otobro Pte Ltd in 2016 as co-founder and COO. Otobro was acquired by the C88 Group in March 2017. Mathew is also the commissioner of PT Superior Coach, a representative office in Jakarta. Mathew has worked in Indonesia for over 11 years. He joined PT Selaras Nusa Abadi as general manager in 2003 and became the managing director and Dealer Council chairman of the company from 2005 until 2015. He has a bachelor’s in Political Economy of Industrial Societies from the University of California Berkeley, USA.

Co-founder and CEO of Halofina

Adjie Wicaksana graduated from the Bandung Institute of Technology (ITB) with a degree in Industrial Engineering. He also holds a master's in Social Entrepreneurship from the University of Southern California. Wicaksana is active in the Social Organization Center for Innovation and Community Development, the Indonesian Youth Student Association in the United States (Permias) Los Angeles and the Global Shapers Community - World Economic Forum. He is also a facilitator, specializing in business financial management, for BEKRAF's (Indonesia's Creative Economy Agency) Creative SME Finance Class Training Series. Wicaksana started Halofina with Eko Pratomo in 2017.

Adjie Wicaksana graduated from the Bandung Institute of Technology (ITB) with a degree in Industrial Engineering. He also holds a master's in Social Entrepreneurship from the University of Southern California. Wicaksana is active in the Social Organization Center for Innovation and Community Development, the Indonesian Youth Student Association in the United States (Permias) Los Angeles and the Global Shapers Community - World Economic Forum. He is also a facilitator, specializing in business financial management, for BEKRAF's (Indonesia's Creative Economy Agency) Creative SME Finance Class Training Series. Wicaksana started Halofina with Eko Pratomo in 2017.

Based in Sofia, BrightCap ventures is an early-stage VC supported by the European Investment Fund and Ministry of Economy of Bulgaria. Founded in 2018, the company has invested in seven startups based in various countries across market verticals. To date, it has managed one exit for London-based Cloudpipes, a cloud integration as a service manager.Its most recent investments include co-leading a post-seed round with Begin Capital to raise €2m for Spanish femtech Woom and a funding round for Enview, a 3D geospacial analytics company based in the US.

Based in Sofia, BrightCap ventures is an early-stage VC supported by the European Investment Fund and Ministry of Economy of Bulgaria. Founded in 2018, the company has invested in seven startups based in various countries across market verticals. To date, it has managed one exit for London-based Cloudpipes, a cloud integration as a service manager.Its most recent investments include co-leading a post-seed round with Begin Capital to raise €2m for Spanish femtech Woom and a funding round for Enview, a 3D geospacial analytics company based in the US.

Greater Bay Area Homeland Development Fund

With the aim of supporting Hong Kong to develop into a world-class tech innovation center and cooperating with Guangdong and Macau enterprises to support the development of the Guangdong-Hong Kong-Macao Greater Bay Area, large-sized mainland enterprises operating in Hong Kong, Hong Kong companies, mainland private firms and new economy enterprises initiated Greater Bay Area Homeland Development Fund in 2018. With a total capital volume of over HK$100bn, it is managed by Greater Bay Area Homeland Investments. The fund will also provide help to enterprises in the Greater Bay Area to export products to overseas markets.

With the aim of supporting Hong Kong to develop into a world-class tech innovation center and cooperating with Guangdong and Macau enterprises to support the development of the Guangdong-Hong Kong-Macao Greater Bay Area, large-sized mainland enterprises operating in Hong Kong, Hong Kong companies, mainland private firms and new economy enterprises initiated Greater Bay Area Homeland Development Fund in 2018. With a total capital volume of over HK$100bn, it is managed by Greater Bay Area Homeland Investments. The fund will also provide help to enterprises in the Greater Bay Area to export products to overseas markets.

CEO and Co-founder of Nusantics

Self-styled “bio-based economy enabler”, Sharlini Eriza Putri has held various industrial engineering roles since graduating in 2009 with a bachelor's in Chemical Engineering from Institut Teknologi Bandung. She joined Nestle as a management trainee and later became a process engineer until 2013. She left Nestle to read a master's in Sustainable Energy (Mechanical Engineering) at Imperial College London. In 2015, she started an independent consultancy for sustainable energy in Jakarta.In 2016, she became the head of center of excellence for the sugar industry conglomerate Samora Group. In 2019, she set up Nusantics to sell skincare products with natural ingredients. In 2020, Putri left Samora to work full-time at Nusantics as CEO.

Self-styled “bio-based economy enabler”, Sharlini Eriza Putri has held various industrial engineering roles since graduating in 2009 with a bachelor's in Chemical Engineering from Institut Teknologi Bandung. She joined Nestle as a management trainee and later became a process engineer until 2013. She left Nestle to read a master's in Sustainable Energy (Mechanical Engineering) at Imperial College London. In 2015, she started an independent consultancy for sustainable energy in Jakarta.In 2016, she became the head of center of excellence for the sugar industry conglomerate Samora Group. In 2019, she set up Nusantics to sell skincare products with natural ingredients. In 2020, Putri left Samora to work full-time at Nusantics as CEO.

Portuguese serial entrepreneur and angel investor, Carlos Oliveira is formerly the Secretary of State for Entrepreneurship, Competitiveness and Innovation in Portugal. He is also one of the 15 members of the European Commission's high-level group of innovators tasked with the creation of the European Innovation Council.In 2000, Oliveira founded a mobile services startup MobiComp and worked as its CEO until 2008 when he sold the company to Microsoft. He has also founded and invested in several startups, including StudentFinance fintech's €1.15m seed round. He is currently the executive president of the José Neves Foundation, set up by Farfetch founder José Neves to invest and transform Portugal into a knowledge economy.

Portuguese serial entrepreneur and angel investor, Carlos Oliveira is formerly the Secretary of State for Entrepreneurship, Competitiveness and Innovation in Portugal. He is also one of the 15 members of the European Commission's high-level group of innovators tasked with the creation of the European Innovation Council.In 2000, Oliveira founded a mobile services startup MobiComp and worked as its CEO until 2008 when he sold the company to Microsoft. He has also founded and invested in several startups, including StudentFinance fintech's €1.15m seed round. He is currently the executive president of the José Neves Foundation, set up by Farfetch founder José Neves to invest and transform Portugal into a knowledge economy.

Based in Brussels, Astanor Ventures is an impact investor specializing in foodtech, agritech and blue ocean economy with focus on the environment and sustainability. Founded in 2017 by Eric Archambeau and George Coelho, Astanor has invested in more than 20 startups in Europe and the US. Archambeau and Coelho launched Balderton Capital in Europe and were early investors in Spotify, Betfair and LoveFilm.Astanor invests according to the principles for responsible investment (PRI), prioritizing technology-led solutions that connect the value chain, innovate on nutrition and accelerate regenerative agriculture. In November 2020, the firm closed fundraising for its $325m Global Impact Fund focused on food and agriculture technology that comply with the UN’s 17 sustainable development goals (SDGs).

Based in Brussels, Astanor Ventures is an impact investor specializing in foodtech, agritech and blue ocean economy with focus on the environment and sustainability. Founded in 2017 by Eric Archambeau and George Coelho, Astanor has invested in more than 20 startups in Europe and the US. Archambeau and Coelho launched Balderton Capital in Europe and were early investors in Spotify, Betfair and LoveFilm.Astanor invests according to the principles for responsible investment (PRI), prioritizing technology-led solutions that connect the value chain, innovate on nutrition and accelerate regenerative agriculture. In November 2020, the firm closed fundraising for its $325m Global Impact Fund focused on food and agriculture technology that comply with the UN’s 17 sustainable development goals (SDGs).

Zhongguancun Longmen Investment

Investing in hi-tech IT, advanced manufacturing and biotechnology sectors – key pillars of China’s innovation-focused economy since 2017 – the Beijing government-backed Beijing Zhongguancun Longmen Investment manages about RMB 10bn via its first fund of the same name. The firm is founded and led by Xu Jinghong, former Chairman of Tsinghua Holdings, the investment and tech/R&D transfer arm of China’s most prestigious science and research university, whose R&D capacity was ranked in the third place of China’s top 500 enterprises in 2018. The LPs of the fund include social security funds, Beijing’s municipal government and the Haidian District government. Its portfolio enterprises are generally ranked in the top three of their respective industries. Among them, Qi An Xin Technology, which is listed in Shanghai and one of China’s biggest cybersecurity companies; Joy Wing Mao, one of China’s major fruits supply chain companies. In October of 2020, it invested RMB 100m into Beijing Immunochina Pharmaceutical, which develops innovative gene and cell therapies for curing malignant tumors. Longmen also provides mentoring and other expertise and support to its investee startups, especially those that plan to seek public listing.

Investing in hi-tech IT, advanced manufacturing and biotechnology sectors – key pillars of China’s innovation-focused economy since 2017 – the Beijing government-backed Beijing Zhongguancun Longmen Investment manages about RMB 10bn via its first fund of the same name. The firm is founded and led by Xu Jinghong, former Chairman of Tsinghua Holdings, the investment and tech/R&D transfer arm of China’s most prestigious science and research university, whose R&D capacity was ranked in the third place of China’s top 500 enterprises in 2018. The LPs of the fund include social security funds, Beijing’s municipal government and the Haidian District government. Its portfolio enterprises are generally ranked in the top three of their respective industries. Among them, Qi An Xin Technology, which is listed in Shanghai and one of China’s biggest cybersecurity companies; Joy Wing Mao, one of China’s major fruits supply chain companies. In October of 2020, it invested RMB 100m into Beijing Immunochina Pharmaceutical, which develops innovative gene and cell therapies for curing malignant tumors. Longmen also provides mentoring and other expertise and support to its investee startups, especially those that plan to seek public listing.

Co-CEO and co-founder of Pula

Dutch-born Rosa Goslinga has spent most of her career working in Africa and speaks five languages, including Swahili. She graduated in business, economics and international development at the University of Amsterdam in 2004. She also completed a master’s in political economy of development at the School for Oriental and African Studies (SOAS) in London in 2005.In 2006, she worked as an economist at the Ministry of Agriculture and Animal Resources in Rwanda where she realized there was an urgent need for small-scale farming insurance to protect the local farmers’ livelihoods against natural hazards.In 2008, she joined Syngenta Foundation for Sustainable Agriculture (SFSA) in Kenya, where she initiated a pilot Kilimo Salama in Nairobi as program director. The program was a success, starting with 185 farmers taking up index insurance and growing to be the largest in Africa with over 185,000 participants. Goslinga also met and started working with Thomas Njeru, the lead actuary for UAP Insurance for the Kilimo project.In 2013, with investors backing her project, she developed and patented a system and method for providing a site-related weather insurance contract. She left SFSA in 2014 and went on to set up Kenya’s pioneering insurtech Pula with Njeru as co-founder in 2015.Both are now co-CEOs of the Nairobi-based startup, education and helping over 4m small-scale farmers to protect their livelihoods from environmental hazards with tailor-made micro-finance and insurance products.

Dutch-born Rosa Goslinga has spent most of her career working in Africa and speaks five languages, including Swahili. She graduated in business, economics and international development at the University of Amsterdam in 2004. She also completed a master’s in political economy of development at the School for Oriental and African Studies (SOAS) in London in 2005.In 2006, she worked as an economist at the Ministry of Agriculture and Animal Resources in Rwanda where she realized there was an urgent need for small-scale farming insurance to protect the local farmers’ livelihoods against natural hazards.In 2008, she joined Syngenta Foundation for Sustainable Agriculture (SFSA) in Kenya, where she initiated a pilot Kilimo Salama in Nairobi as program director. The program was a success, starting with 185 farmers taking up index insurance and growing to be the largest in Africa with over 185,000 participants. Goslinga also met and started working with Thomas Njeru, the lead actuary for UAP Insurance for the Kilimo project.In 2013, with investors backing her project, she developed and patented a system and method for providing a site-related weather insurance contract. She left SFSA in 2014 and went on to set up Kenya’s pioneering insurtech Pula with Njeru as co-founder in 2015.Both are now co-CEOs of the Nairobi-based startup, education and helping over 4m small-scale farmers to protect their livelihoods from environmental hazards with tailor-made micro-finance and insurance products.

Co-CEO, co-founder of Psquared

Argentinian native Nicolas Araujo Müller is co-CEO and co-founder at Psquared, Spain’s first flexible workplace management and design company for hybrid workspaces. He has worked there since its foundation in April 2018, originally as part of startup hub CoBuilder, and is now its CFO. He is also a part-time advisor and investor at startup development agency We Are Grit, since its launch in 2020.Earlier, Araujo was CFO and co-founder at digital talent agency Bandit, for two years, until 2017. Before that, he held the same roles at his previous Barcelona-based startup, Nubelo, another tech recruitment agency for freelancers, between 2012 and 2016, when it was acquired by Freelancer.com. In 2016, Araujo was a visiting professor at the Autonomous University of Barcelona on digital economy.His first startup was Work At Home in Argentina, where he was a co-founder for two years from 2011–13, for which he won local innovation prizes. Prior to this, Araujo held various management consultancy roles, working in business analysis and research at Ernst & Young, Standard & Poor’s and Accenture, from 2008–2012, and completed a stint at the US embassy in Buenos Aires. He is also a founding member of Argentina’s entrepreneur organization, ASEA, established in 2013. Araujo holds a degree in economics from CEMA University, Buenos Aires and a qualification from Harvard University in negotiation. In 2017 and 2013, Araujo was named in Forbes Argentina’s 30 Promesas list of young entrepreneurs.

Argentinian native Nicolas Araujo Müller is co-CEO and co-founder at Psquared, Spain’s first flexible workplace management and design company for hybrid workspaces. He has worked there since its foundation in April 2018, originally as part of startup hub CoBuilder, and is now its CFO. He is also a part-time advisor and investor at startup development agency We Are Grit, since its launch in 2020.Earlier, Araujo was CFO and co-founder at digital talent agency Bandit, for two years, until 2017. Before that, he held the same roles at his previous Barcelona-based startup, Nubelo, another tech recruitment agency for freelancers, between 2012 and 2016, when it was acquired by Freelancer.com. In 2016, Araujo was a visiting professor at the Autonomous University of Barcelona on digital economy.His first startup was Work At Home in Argentina, where he was a co-founder for two years from 2011–13, for which he won local innovation prizes. Prior to this, Araujo held various management consultancy roles, working in business analysis and research at Ernst & Young, Standard & Poor’s and Accenture, from 2008–2012, and completed a stint at the US embassy in Buenos Aires. He is also a founding member of Argentina’s entrepreneur organization, ASEA, established in 2013. Araujo holds a degree in economics from CEMA University, Buenos Aires and a qualification from Harvard University in negotiation. In 2017 and 2013, Araujo was named in Forbes Argentina’s 30 Promesas list of young entrepreneurs.

Circular economy: Discarded goods get a new lease of life in Spain

From e-chargers inside phone booths, recycling chatbots to refurbished stadium seats from Atlético Madrid, the offbeat magic of the circular economy is fast becoming a lucrative business in Spain

SWITCH Singapore: Embracing a circular economy, the whys and the hows

Its benefits for the environment aside, going circular could also lead to new economic growth, better public health and higher value-add employment, experts say

ADBioplastics primed to help EU manufacturers transition to circular economy

ADBioplastics has developed a biodegradable and compostable bioplastic additive for use in food packaging and is seeking up to €5m in funding

RecyGlo, Myanmar's first circular economy waste management system, targets regional growth

Turning trash into cash, Yangon-based recycling pioneer RecyGlo wants to extend its zero-waste circular economy model to the rest of Southeast Asia

Futuralga: Circular economy model to turn seaweed into biodegradable plastic alternative

A Cádiz-based young startup is winning accolades for its eco-friendly bioplastic made from seaweed washed ashore

Infinited Fiber: Producing biofibers for fashion to move toward circular economy

Supported by H&M, Adidas and textile manufacturers, Infinited Fiber is helping the world’s second most polluting industry go greener by turning industrial waste into regenerated biomaterials

MIWA Technologies: Reducing food waste and packaging with smart refill vending system

MIWA’s solution lets consumers buy exact refill quantities in personalized containers, eradicating need for single-use plastics throughout the supply chain

Biomede: Harnessing plants’ natural attributes to decontaminate soil

The Lyon-based startup says using plants to remove harmful metals from the earth is a sustainable, cost-effective green alternative to decontaminate soil in agricultural or urban environments

Huidu Environmental: Creating a circular economy to ease online retail's parcel waste woes

China's billion-dollar courier industry finds much-needed solution in Huidu's eco-friendly, low-cost boxes and smart recycling system

Rheaply: Pioneering B2B asset reuse through technology

Through its SaaS platform, this Chicago-based startup finds success in the under-served corporate second-hand market, essential to any successful circular economy, recently landing $8m Series A

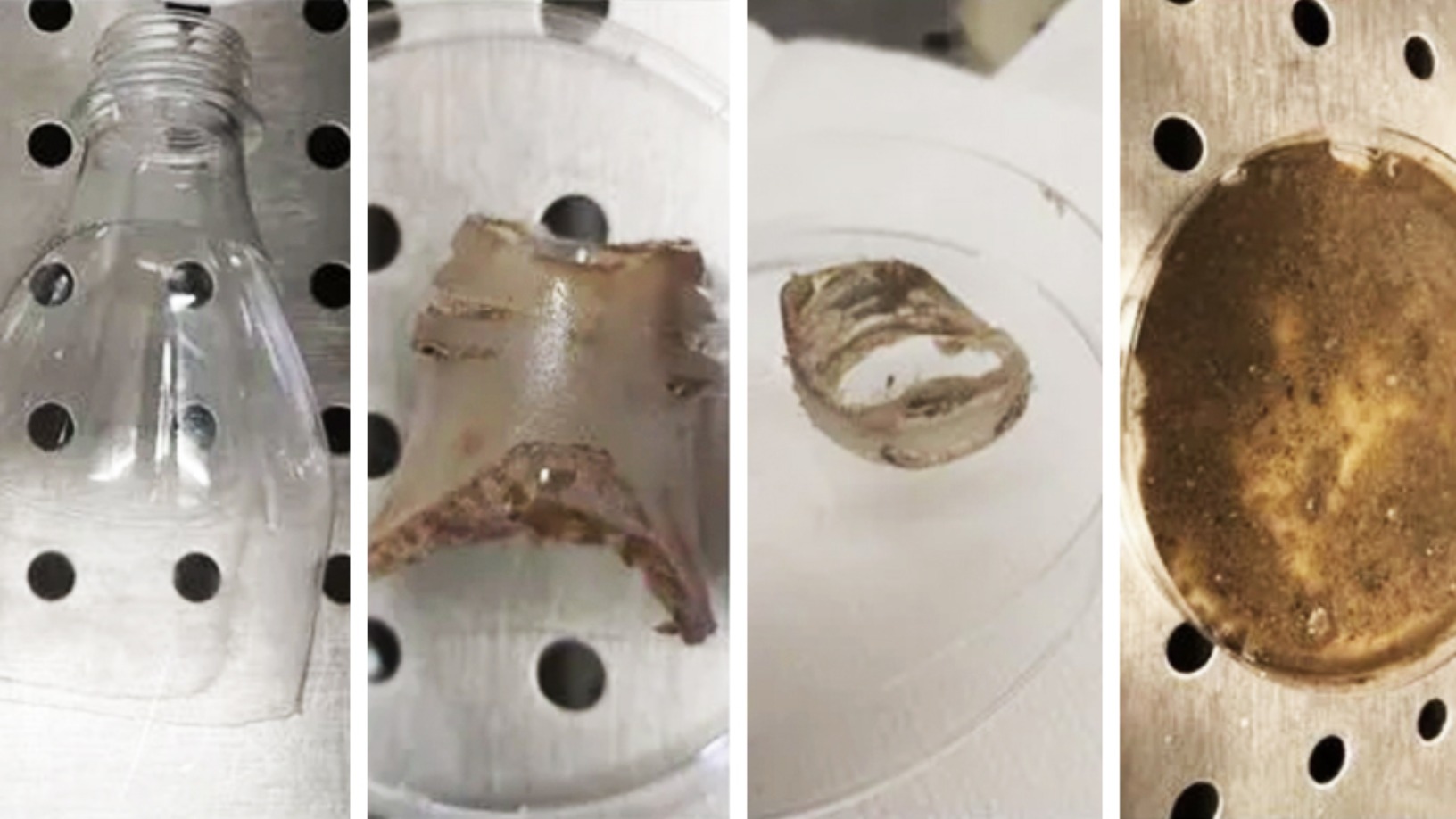

Poliloop: Tackling pollution crisis with plastic-eating bacteria for industrial use

Hungarian biotech Poliloop is closing $2m seed funding for “bacteria cocktail” that breaks down plastic into organic waste quickly, enabling more affordable and eco-friendly waste management

Wondaswim recycles dumped fishing nets to make sustainable swimwear, reduce ocean pollution

Lisbon-based startup by German co-founders creates sustainable swimwear for all body sizes, targeted at millennials

Kryha: Enabling big businesses' green practices with blockchain

Kryha’s blockchain systems help companies trace the movement and transformation of resources among multiple stakeholders without exposing sensitive information

Qairos Energies: Mass producing green hydrogen from industrial hemp

The French startup is seeking a €19m Series B round to produce industrial quantities of green hydrogen and is planning a “circular economy” partnership with local farmers

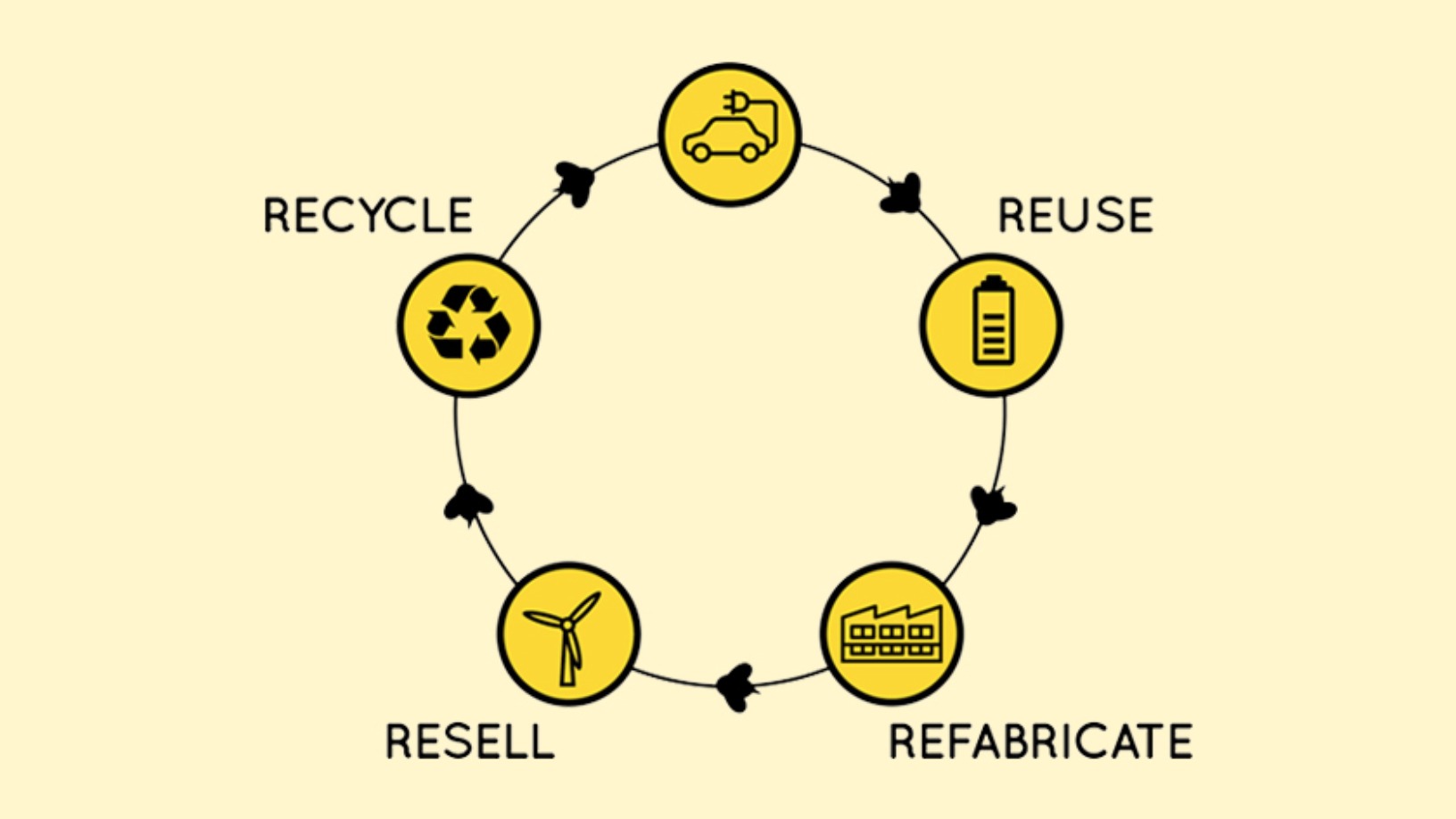

BeePlanet Factory: Recycling EV batteries as a sustainable, profitable business

With 4kWh–200kWh residential and industrial battery packs, the Pamplona-based startup wants to scale its energy storage solutions in the agri-food sector, camping sites and mountain huts

Sorry, we couldn’t find any matches for“Madrid7R Circular Economy”.