Swanlaab Venture Factory

-

DATABASE (450)

-

ARTICLES (256)

Capitana Venture Partners is a venture fund headquartered in Madrid with a presence across Spain, Germany, Italy and UK. The firm backs technology startups at their seed and early stage phase, investing between €200,000 and €500,000. Capitana's team comprises eight business angels and advisors with experience in corporate finance, investment banking and capital market financing.

Capitana Venture Partners is a venture fund headquartered in Madrid with a presence across Spain, Germany, Italy and UK. The firm backs technology startups at their seed and early stage phase, investing between €200,000 and €500,000. Capitana's team comprises eight business angels and advisors with experience in corporate finance, investment banking and capital market financing.

Wei Venture Capital is a VC fund jointly launched in November 2010 by Sina Corporation, Sequoia Capital China, IDG Capital, Sinovation Ventures, YF Capital and DFJ Dragon Fund. Sina contributed half of Wei's RMB 200m fund, with the other five partners contributing RMB 20m each. The fund is managed by Beijing Weimeng Innovation Venture Capital Management Co Ltd.

Wei Venture Capital is a VC fund jointly launched in November 2010 by Sina Corporation, Sequoia Capital China, IDG Capital, Sinovation Ventures, YF Capital and DFJ Dragon Fund. Sina contributed half of Wei's RMB 200m fund, with the other five partners contributing RMB 20m each. The fund is managed by Beijing Weimeng Innovation Venture Capital Management Co Ltd.

Zhejiang Jinke Venture Capital

Founded in 2000, Zhejiang Jinke Venture Capital is a private venture capital enterprise. It specializes in capital investment, capital management, real estate investment and startup investment.

Founded in 2000, Zhejiang Jinke Venture Capital is a private venture capital enterprise. It specializes in capital investment, capital management, real estate investment and startup investment.

Mount Venture Capital is an early-stage investment firm focusing on the mobile Internet, consumer Internet, big data, and cloud computing sectors.

Mount Venture Capital is an early-stage investment firm focusing on the mobile Internet, consumer Internet, big data, and cloud computing sectors.

Insight Venture Partners is a US venture capital and private equity firm, headquartered in New York and founded in 1995. It holds over US$20 billion in assets under management, invested in more than 300 companies in 65 countries and has completed more than 200 mergers and acquisitions for its portfolio companies and 84 exits. It specializes in growth-round investments at all levels and has raised more than US$7.6 billion to invest in both minority and majority transactions.

Insight Venture Partners is a US venture capital and private equity firm, headquartered in New York and founded in 1995. It holds over US$20 billion in assets under management, invested in more than 300 companies in 65 countries and has completed more than 200 mergers and acquisitions for its portfolio companies and 84 exits. It specializes in growth-round investments at all levels and has raised more than US$7.6 billion to invest in both minority and majority transactions.

Headquartered in Silicon Valley, Lightspeed Venture Partners is an early-stage VC firm that focuses on the enterprise and consumer sectors. Over the past two decades, the firm has backed more than 300 companies globally. It currently has over US$4bn in committed capital. The firm invests mainly in the US, Israel, India and China. It also works in collaboration with Lightspeed China Partners, a China-focused venture capital firm, to make investments in China.

Headquartered in Silicon Valley, Lightspeed Venture Partners is an early-stage VC firm that focuses on the enterprise and consumer sectors. Over the past two decades, the firm has backed more than 300 companies globally. It currently has over US$4bn in committed capital. The firm invests mainly in the US, Israel, India and China. It also works in collaboration with Lightspeed China Partners, a China-focused venture capital firm, to make investments in China.

Co-Founder and CEO of Sale Stock

Born in 1982, Lingga Madu holds a degree in Informatics, Multimedia and Web Development from Kristen Duta Wacana University and an MBA from Gadjah Mada University. He has professional experience as a web developer, user experience designer, financial planner, wealth manager and university lecturer. Before launching Sale Stock, he had worked at PT. Desain Sarana Intermatra, Money for Wealth Financial Services, IMAJIKU Web Developer and J-Factory Event Organizer.

Born in 1982, Lingga Madu holds a degree in Informatics, Multimedia and Web Development from Kristen Duta Wacana University and an MBA from Gadjah Mada University. He has professional experience as a web developer, user experience designer, financial planner, wealth manager and university lecturer. Before launching Sale Stock, he had worked at PT. Desain Sarana Intermatra, Money for Wealth Financial Services, IMAJIKU Web Developer and J-Factory Event Organizer.

Founder and CEO of Pinduoduo

Founder and CEO of Pinduoduo. Serial entrepreneur. The son of a factory worker, Huang received his BSc from Zhejiang University and his MSc from the University of Wisconsin-Madison, both in Computer Science. Upon the advice of a billionaire entrepreneur, he decided to join Google instead of Microsoft and, as a result, became financially independent within three years. Huang left Google in 2007. Before founding Pinduoduo, he started two other companies, both of which were profitable but failed to gain prestige. Looking to achieve renown, Huang started Pinduoduo in 2015.

Founder and CEO of Pinduoduo. Serial entrepreneur. The son of a factory worker, Huang received his BSc from Zhejiang University and his MSc from the University of Wisconsin-Madison, both in Computer Science. Upon the advice of a billionaire entrepreneur, he decided to join Google instead of Microsoft and, as a result, became financially independent within three years. Huang left Google in 2007. Before founding Pinduoduo, he started two other companies, both of which were profitable but failed to gain prestige. Looking to achieve renown, Huang started Pinduoduo in 2015.

Co-founder and CEO of Beonprice

Rubén Sánchez Martín majored in Computer Engineering at the University of Salamanca and has an MBA from the European Business School in Madrid. In 2017, he joined the Endeavor Scaling Entrepreneurial Ventures program with Harvard Business School.Based in Salamanca, he is the founding partner of Socio that has been operating two women-only fitness centers Curves since 2006. In 2009, he established Chocolat Factory. While running the businesses, Sánchez had been working at IT group GPM Innovación since 1998. He left GPM and closed down his chocolate delicatessen in 2012 to focus on Beonprice as co-founder and CEO.

Rubén Sánchez Martín majored in Computer Engineering at the University of Salamanca and has an MBA from the European Business School in Madrid. In 2017, he joined the Endeavor Scaling Entrepreneurial Ventures program with Harvard Business School.Based in Salamanca, he is the founding partner of Socio that has been operating two women-only fitness centers Curves since 2006. In 2009, he established Chocolat Factory. While running the businesses, Sánchez had been working at IT group GPM Innovación since 1998. He left GPM and closed down his chocolate delicatessen in 2012 to focus on Beonprice as co-founder and CEO.

Former CFO and Sales specialist of Atomian

García Ruiz, co-founder and CFO of Atomian until 2015, is an industrial engineering graduate from the Polytechnic University of Catalonia, where he is now an associate professor. García Ruiz also works as a business professor in the Chemical Institute of Sarria. He has a background in finance (Account Manager at WorkMeter, Tempos 21 and AIS Aplicaciones de Inteligencia Artificial) and sales (Commercial Manager at proceedit "the BPM process' factory" and Office Manager at Lleidanetworks Serveis Telemàtics, S.L., Hyperion Solutions, and Saari) and is an experienced executive in the IT and Telco industries with international exposure.

García Ruiz, co-founder and CFO of Atomian until 2015, is an industrial engineering graduate from the Polytechnic University of Catalonia, where he is now an associate professor. García Ruiz also works as a business professor in the Chemical Institute of Sarria. He has a background in finance (Account Manager at WorkMeter, Tempos 21 and AIS Aplicaciones de Inteligencia Artificial) and sales (Commercial Manager at proceedit "the BPM process' factory" and Office Manager at Lleidanetworks Serveis Telemàtics, S.L., Hyperion Solutions, and Saari) and is an experienced executive in the IT and Telco industries with international exposure.

Established in 1985, venture capital firm DFJ has invested in more than 300 companies throughout the world. Its core funds have raised US$4 billion to date.

Established in 1985, venture capital firm DFJ has invested in more than 300 companies throughout the world. Its core funds have raised US$4 billion to date.

Zhangjiang Torch Venture Capital

Founded as the investment arm of Spinnotec, a state-owned venture capital firm, in November 2008, Zhangjiang Torch Venture Capital is a state-owned financial investment company. It invests primarily in early-stage tech startups.

Founded as the investment arm of Spinnotec, a state-owned venture capital firm, in November 2008, Zhangjiang Torch Venture Capital is a state-owned financial investment company. It invests primarily in early-stage tech startups.

Founded in 1999, Armilar Venture Partners, previously Espirito Santo Ventures (E.S. Ventures), has made over 40 investments and currently manages five funds valued over €200 million. It covers Europe and the United States.

Founded in 1999, Armilar Venture Partners, previously Espirito Santo Ventures (E.S. Ventures), has made over 40 investments and currently manages five funds valued over €200 million. It covers Europe and the United States.

Cambrian Venture Capital was founded in Shanghai in 2016 and focuses on early-stage investments. It has invested in over 80 startups in edtech, B2B, internet and consumer sectors.

Cambrian Venture Capital was founded in Shanghai in 2016 and focuses on early-stage investments. It has invested in over 80 startups in edtech, B2B, internet and consumer sectors.

Swanlaab Venture Factory: €40 million funding chest to give power to the people

The female co-founder of Swanlaab Venture Factory believes that diversity enriches decision-making and drives performance. CompassList recently caught up with Verónica Trapa Díaz-Obregón to find out what's in store for Spain's first Israeli-backed VC fund

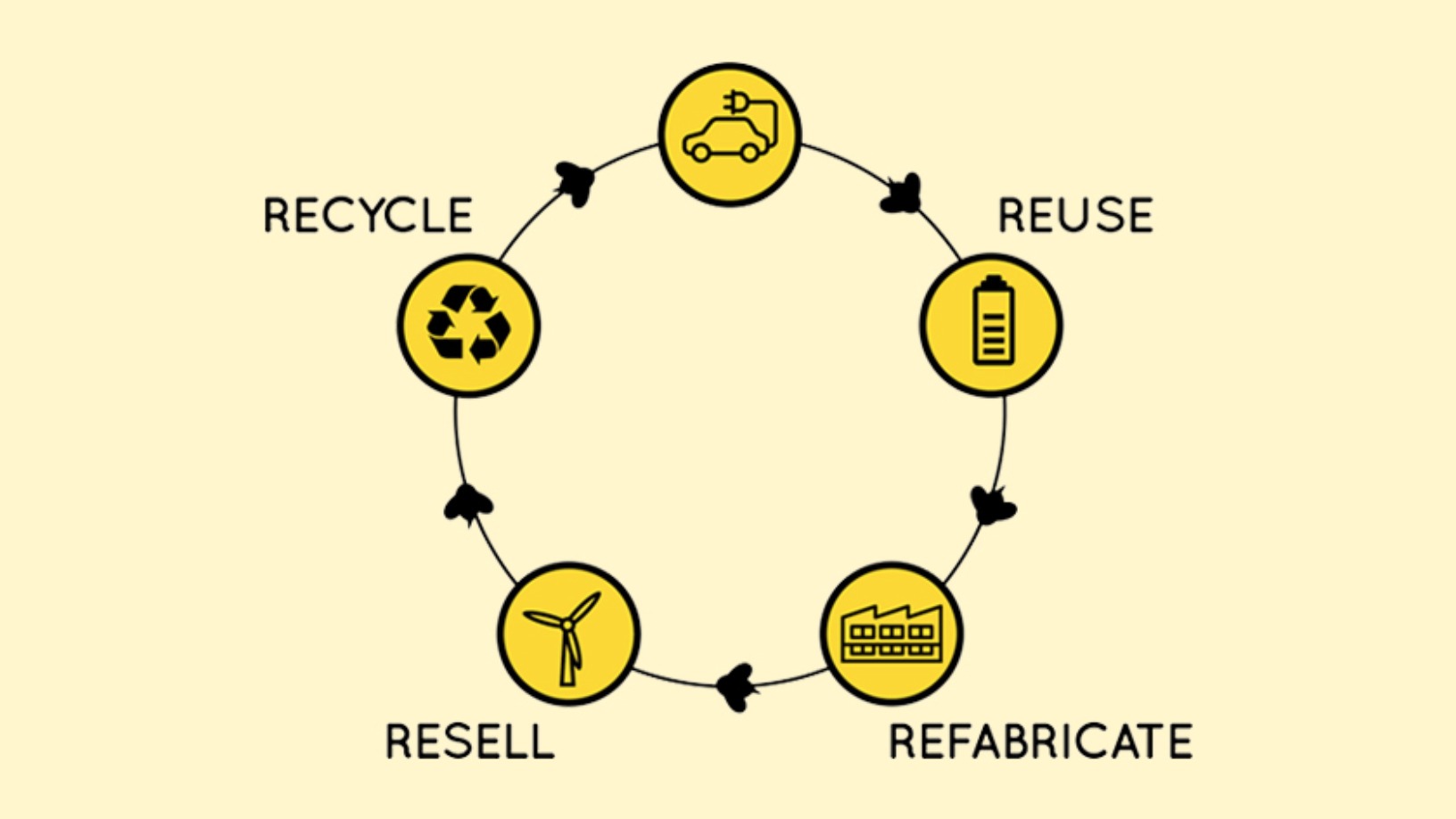

BeePlanet Factory: Recycling EV batteries as a sustainable, profitable business

With 4kWh–200kWh residential and industrial battery packs, the Pamplona-based startup wants to scale its energy storage solutions in the agri-food sector, camping sites and mountain huts

Faraday Venture Partners’ MP Gonzalo Tradacete: “We are actively looking for startups”

Amid the Covid-19 slump, Faraday Venture Partners' CIO and MP shares his expectations for startup investments and favored sectors, the measures his firm has taken so far to help investees ride out the crisis, and more.

Bluepha to boost PHA bioplastics production with $30m fresh funding

The Beijing-based startup aims to produce 10,000 tons of PHA bioplastic a year and build a SynBio community through its STEM education spinoff, Bluepha Lab

String Bio: Asia's first startup to harness methane gas for protein production

Using bacteria to turn the harmful greenhouse gas into a purer form of protein, String Bio is raising Series B funding to scale production

Waste management startup Magalarva aims for profitability with new factory, B2B services

Partnerships with supermarkets and waste transporters provide Magalarva with new revenue streams and sources of production input as the company ramps up its manufacturing activities

Qorium: Lab-grown premium leather for the future of luxury

The Dutch biotech startup co-founded by cell-based meat pioneer Mark Post is targeting the luxury goods market with its “clean leather” sheets made from cultivating bovine skin cells, and plans to raise up to €100m

Linptech: Smart home devices powered by movement

The first in China to tap kinetic energy to control smart home devices, Linptech has seen its wireless, battery-free products used in smart homes, and even at the Tokyo Olympics

Solatom plans overseas expansion with backing from energy giants, impact investor

With a US patent in hand, the Valencian startup is banking on international sales of its concentrated solar power modules, targeting €1m in revenue by end-2021

COMY Energy: Closing the plastic waste loop with chemical recycling

The Chinese startup transforms plastic wastes to virgin-quality recycled products without releasing toxic gas or pollution and is attracting interest from petrochemical giants and waste management companies

In-store robots and online doctors serve customers 24/7 at Dingdang Medicine Express

Dingdang also offers cheaper medicines and 28-minute home delivery, thanks to its innovative logistics and partnership models

4YFN: Investment booms across Europe during pandemic

Speaking at the recent 4YFN conference, prolific European startup investor Mattias Ljungman provided a highly optimistic assessment of the continent's current ecosystem strength and climate for seed funding

Mycorena: Fungi-based vegan protein challenging traditional plant-based ingredients

Award-winning Swedish biotech startup is scaling production of mycoprotein to become a key player in the emerging market for functional proteins

Future Food Asia 2021: Long road ahead for the clean meat industry

Crucial basic research is still needed to ensure the safety, quality, and production efficiency of lab-grown meat. Concerted public and private sector efforts will accelerate progress

Qairos Energies: Mass producing green hydrogen from industrial hemp

The French startup is seeking a €19m Series B round to produce industrial quantities of green hydrogen and is planning a “circular economy” partnership with local farmers

Sorry, we couldn’t find any matches for“Swanlaab Venture Factory”.